MARKET OVERVIEW

The USA Cookware market and industry represent a vibrant sector catering to the multifarious culinary needs of homes and professionals alike. The space covers many products, such as pots, pans, bakeware, and specialty tools, all of which enhance the cooking experience. The ever-changing consumer preferences compel manufacturers to answer new trends that affect product innovation and distribution strategies.

A antiquity full of culinary innovations, culinary advances now characterize the changes in the greatest extent of cookware in the United States. Cookware demand in the United States reflects changes in lifestyle, dietary preferences, and advances in technology. The choice of material is of utmost concern: stainless steel, nonstick coating, cast iron, and ceramic are at the foremost. Each of these materials has different advantages for particular cooking techniques and consideration of consumer preferences. Traditional materials really get their role held; however, new technology offers modern advantages, innovations, and convenience.

The channels for retail and e-commerce act as paths along which cookware flows toward consumers. Brick-and-mortar stores provide a tactile experience where shoppers can feel quality and comfort before purchase. eCommerce, on the other hand, brings in convenience and ease to search for and compare a variety of products with all technical details and customer reviews. Subscription-based and direct marketing have also garnered significant consumer attention, which is a trend in itself.

Hop out with cooking enthusiasts for such a health and eco-friendliness concerned! Non-toxic eco-friendly cookware is ruling as buyers are considering products that resonate with their values. Certification and regulatory standards ensure product safety and compliance. Interest in high-quality cookware is further fueled by a growing home-cooking segment and food content through digital platforms that encourage both amateur and professional chefs to buy the best kitchenware they can afford.

Competition in the USA Cookware industry is overpowering because of the competition among established brands and emerging brands bringing in their innovation. Strategies today highlight quality, functionality, and style, while social media and blogger partnerships are helping to present the products to the consumers. Product differentiation remains the key, with brands developing proprietary benefits and features that help them stand out in an already crowded marketplace.

Innovative ideas will continue affecting cookware for the future in the United States. Smart kitchen technology integrates with cookware, offering temperature control, connectivity with mobile apps, and energy efficiency. Such innovations appeal to the tech-savvy segment that wants precision and ease in their cooking experience. At the same time, customization and modular systems give flexibility for smaller lifestyles and different cooking modalities.

Economic issues and supply chain tactics affect the performance of a given market. Fluctuations in the prices of raw materials, discrepancies in manufacturing capabilities, and global trade policies affect the pricing and availability of respective products. Domestic production and import competition balance out as two concepts for companies trying to balance cost efficiency versus guarantee of quality.

Future innovations continue to emphasize practicality and sustainable ideas, with consumers, as never before, driving demand. As far culinary trends keep changing, manufacturers of cookware will keep adjusting their products to respond to the needs of an ever-diversifying and very demanding audience. The USA Cookware market will, therefore, remain a central player in living rooms and professional kitchens, adjusting to new technological advancements and lifestyle changes in the years to come.

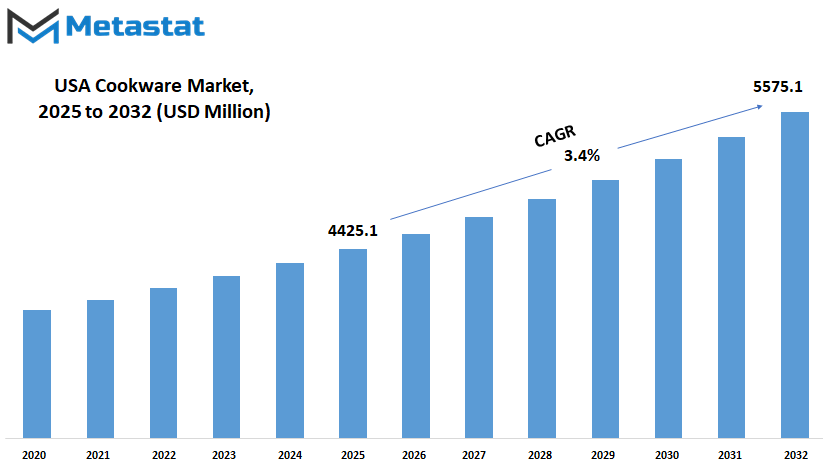

USA Cookware market is estimated to reach $5575.1 Million by 2032; growing at a CAGR of 3.4% from 2025 to 2032.

GROWTH FACTORS

The USA cookware market is poised for a revolution in the upcoming times due to various factors affecting the buying behavior of consumers and technologies adopted by the industry. With more people emphasizing cooking at home, the demand for quality and innovative cookware is on the rise. Lifestyle changes, rising interest in healthy eating, and technological advances in cookware materials are some of the major factors aiding such growth. Consumers are also becoming a lot choosier in what they want from kitchenware-and they want it to be durable, functional, and safe.

Of great influence on market growth is the behaviorial shift of consumers. The rise of social media and digital platforms has put cooking beyond mere necessity-a hobby and instrument of sharing-theatre binders nudge consumers into shells that can afford high-quality cookware of all kinds. Cooking programs, followed closely by online tutorials, have given consumers insight into the importance of using quality kitchen tools to keep their working environment safe; thus, the demand for non-stick pans, stainless steel pots, and eco-cookware is soaring.

Technological advancements are also cherished facets of the USA cookware market. Manufacturers are always busy designing new materials for more performance and sustainability. For instance, non-toxic and ceramic-coated cookware, with health and environmental considerations in mind, has gained popularity. Smart cookware is another emerging trend nowadays as it intertwines technology with kitchenware functions, thus assisting cooking precision and temperature control. Modern consumers increasingly demand such products. The more technology advances, the more innovative products the industry will witness, catering to versatile users’ demands.

However, some factors may inhibit the growth possibilities. One of these hindrances comes with the variation in the raw material pricing, which in turn affects the production cost and, subsequently, the pricing of cookware products. Besides, the escalating competition in manufacturing would exert pressure on prices and thereby commercialise the market to the detriment of smaller firms. Also, social concerns regarding the disposal of said non-biodegradable cookware materials are posing hurdles for companies who need to develop sustainable alternatives.

On the contrary, these hurdles present an opportunity for the market to rethink itself. Increasing popularity of eco-friendly products creates an avenue for manufacturers to create innovative and sustainable cookware alternatives. Companies that manufacture biodegradable materials and energy-efficient production will be most likely to attract conscious consumers. E-commerce is also booming and serves to expand cookware brands to target an extended audience with customized shopping experiences. Thus, the USA cookware market will steadily move forward with consumer demand in time-a demand for quality, sustainable models, and technological adroitminus.

MARKET SEGMENTATION

By Product Type

The USA Cookware market continues to thrive for several reasons, the number of users who fall into home cooking among materials innovation and different consumer preferences. They also grow aware of the quality and safety of the cookware people prefer to go for the durable and non-toxic ones. Technology is also improving and hence the manufacturers will definitely come up with better and more innovative designs that will enhance the effectiveness of cooking but keep it comfortable at the same time.

One of the major propelling factors of the USA Cookware market is increased demand for high-quality kitchen products. High-end consumers are ready to pay the right amount for durable, well-performing cooking tools. Such motivated health-centric buyers are also bound to look for products made with non-toxic materials, spiking demand for ceramic and stainless-steel cookware. And, of course, increasing popularity for home-cooked food as catalyzed by social media trends and the craving for healthy diets will also come into play in shaping this market. As more trials will be conducted at home, so will the demand increase for reliable cookware.

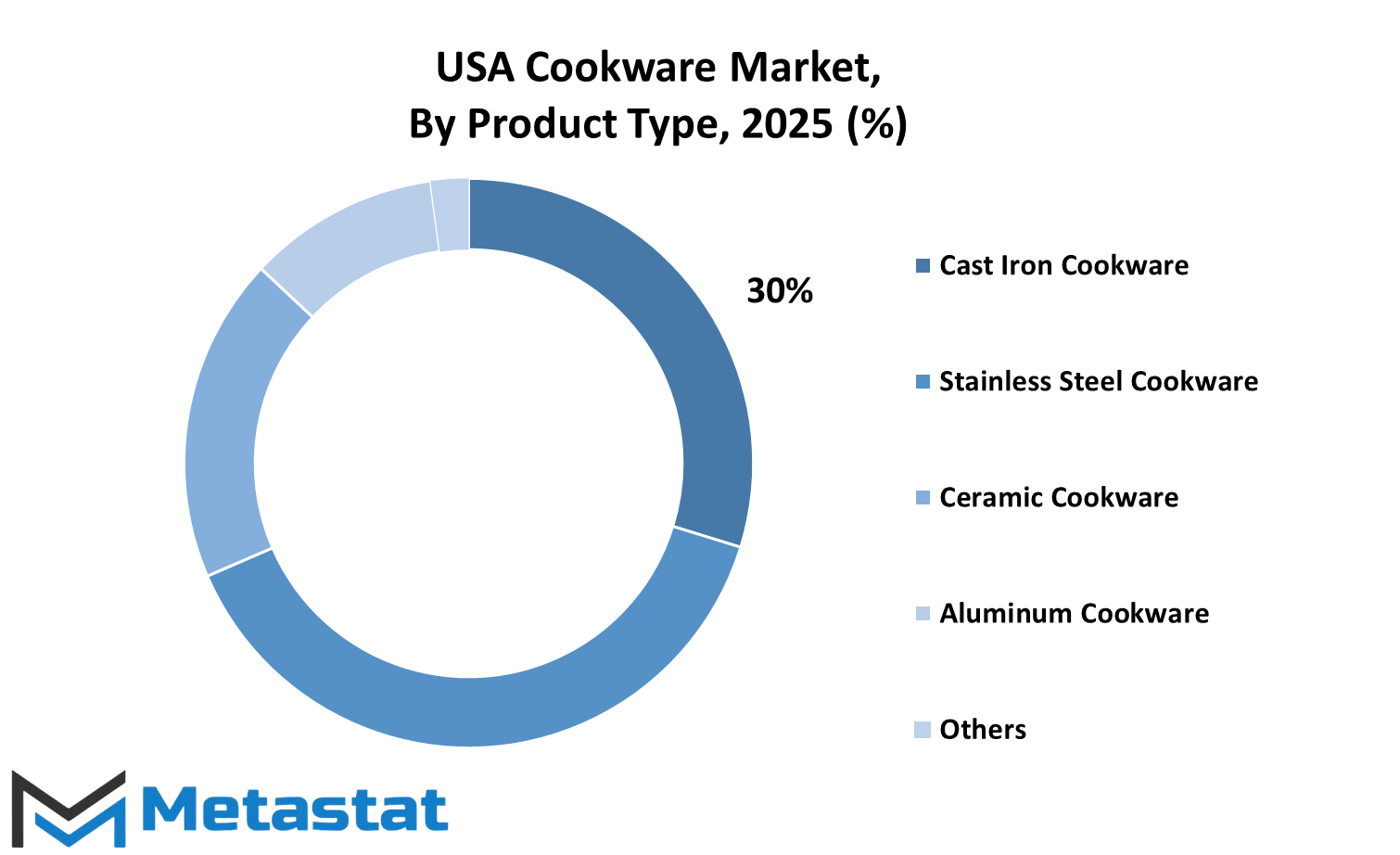

The US Cookware Market will continue to evolve with modern materials. Durable cast iron cookware has proved a quite all-time favorite since its good heat-retention ability makes it suitable for many cooking applications. Known for its characteristic of being a long-lasting, rust free cookware type, stainless steel has also earned its position among the preferred cookware types in most households. Given the fact that ceramic pots are free of chemicals and have non-stick qualities, they are now most actively embraced. Ideal cookware for a cooking process that is light yet efficient conductor of heat is aluminum pots. Other cookware types, such as copper and hybrid cookware, will continue to exist in the market since customers are looking for options that range from general to highly specialized.

Though growth prospects are bright, there are hindrances that would slow down the overall expansion of the USA Cookware market. Increased raw material prices, along with manufacturing costs, will lead to an end product being sold at a premium price, which some buyers might be reluctant to pay. Moreover, there are rising concerns regarding the environmental impacts of cookware production and disposal, which might also define consumer preference. Sustainability seems to be gaining grounds, with individuals likely to prefer durable and eco-friendly products over their cheaper alternatives.

But such shortage creates new opportunities. The development of sustainable cookware materials and energy-efficient production will attract consumers who rate both quality and environmental responsibility above all else. Smart cookware connects functionalities with digital features such as temperature control and cooking timers, establishing themselves as favorites among high-tech consumers. Innovation continues to change the industry; hence, the USA Cookware market will flourish at a steady pace and offer a wide choice of items to cater to the changing requirements of consumers.

By Distribution

The U.S. cookware market is undergoing fundamental changes owing to changing consumer habits and advancements in selling channels. The market, traditionally dominated by physical stores such as supermarkets and specialty shops, is also now experiencing a slow but sure and steady progression towards acceptance of online retailing platforms due to rising consumer confidence in online buying and its convenience.

In the recent past, online cookware sales saw tremendous gain. From 2024 to 2030, the online segment is projected to grow at a compounded annual growth rate (CAGR) of 7.7%. The boom has seen an influx of consumers who can easily compare products, are exposed to a wider spectrum of brands, and read customer product reviews before buying. This revolution in the cookware market was made possible by the rapid growth of e-commerce platforms, which found unending many kitchenware sites that made it easier for consumers to search specialized cookware that meets their culinary requirements.

Despite the boom in online retailing, there is still a significant part of the cookware market that sells offline. The online experience leaves most consumers wanting, desiring the feel of the cookware firsthand in order to assess quality, weight, and design. This sensory benchmark test is crucial for any personal product, particularly pots, pans, and bakeware. Another advantage of walking off with the goods is that customers appreciate this gratification.

As we go on, online and offline channel interaction will shape the future of the U.S. cookware market. Retailers make a greater effort now to develop an omnichannel approach in order for consumers to have a seamless browsing experience through physical stores and online presence. In reality, consumers might research products online and then go to a store to complete their purchase; conversely, they may examine in-store products and select them online for delivery to their home. This successful model for retailing takes into account all types of consumer preferences and makes use of the strengths of both channels.

Moreover, further technological developments are set to enhance the online shopping experience. VR and AR instruments can offer customers visualizations of how cookware items would look and fit into their kitchens, thus bridging the gap between online convenience and the longed-for tactile experience. AI for personalized recommendations can further maintain the connection by helping shoppers find products specifically fit for their cooking habits and preferences.

Overall, we could see evolution in the U.S. cookware market, with online retailers gaining traction alongside traditional offline stores. The evolved trends are closely tied to changing consumer behaviour, technological innovations, and the strategic interplay of multiple retail channels on their relative merit. In the meantime, online and offline platforms alike will play enmeshed and integral roles in facilitating various needs of consumers to keep them engaged with the cookware products that suit their culinary vocation.

By End User

The United States is witnessing explosive growth in its cookware market based on the changing consumer needs and preferences of people. This market is estimated to amount approximately USD 4.02 billion in 2023 and set to grow with a compound annual growth rate (CAGR) of 5.9% between 2024 and 2030.

People have shifted home cooking into the mainstream as a consequence of telecommuting and health-conscious behaviors. Increased spending on quality cookware has occurred due to the escalated amount of non-electric cookware and tableware by 33% starting from the first quarter of 2019 to early forecasting 2024, adjusting for inflation.

The market includes both residential and commercial sectors. The residential section is the leading one, accounting for more than 72% of the market share in 2023. This is due to rising home cooking interest and renovation of the kitchen space. The commercial sector otherwise includes hotels and restaurants, expected to grow at 6.5% CAGR during the forecast period. This is as a result of the expansion of the hospitality industry as well as the growing number of dining establishments.

Key materials preference is also changing. In 2023, stainless steel cookware owned the largest revenue share of 26.82%, because of its non-reactivity and durability. On the other hand, cast iron is steadily recreating more popularity, expected to record a CAGR growth of about 7.5%. Its versatility and exceptional heat-retaining properties add to its popularity.

Distribution channels have also adapted according to consumers' behavior and trends, with expectations of online sales growing at a CAGR of 7.7% from 2024 to 2030. This would bring forth a tech-savvy consumer base with convenience in access to numerous products and competitive prices through e-commerce channels.

Going forward, sustainability and health are set to dominate the market. Consumers are looking at more eco-friendly and non-toxic versions of cookware, like products with ceramic coating and enameled cast iron. This is anticipated as a result of rising awareness about environmental issues and desire for healthier cooking.

Overall, the U.S. cookware market is poised to develop on all fronts, fortified by changing lifestyles, material innovations, and the need for sustainability. The consumer-preferred shape of cookware directing the growth of both residential and commercial markets will be a solution for cookery durability, versatility, and friendliness to the ecosystem.

By Brand Preference

Brand preferences determine premium cookware companies, mid-tier, and value-for-money cookware companies in this segment. Traditionally, the premium brands are those associated with high-quality materials and excellent craftsmanship. Consumers purchasing high-end cookware generally value longevity and performance over time; they consider their cookware as an investment for life. The future would see premium brands embedding new smart technologies into its products, including smart temperature control and interfacing with other kitchen equipment. Thus, this innovation is to level up the cooking experience for an investment destination that willing to pay more for elite kitchenware.

Mid-tier brands sit in the balance of quality and price. They are more appealing to consumers who want sturdy cookware without the ‘premium price’ premium. For mid-tier brands, the future will probably see them incorporating some features common in the premium lines, such as non-stick coatings and ergonomic designs, but in a neat price-efficient manner. In this way, they can woo the wide audience looking for functionality and value.

Value-for-money brands target consumers who have limited budgets or those entering the cooking world who generally want simple and very user-friendly cookware. These brands focus on providing basic functional requirements without many ‘wanna-be’ features, thus appealing to many potential customers. In the future, in response to the increasing demand for sustainable foods, value-for-money brands could be moving toward the use of sustainable materials or eco-responsive manufacturing processes that do not elevate their pricing.

Many factors account for brand preferences. Economic conditions have a strong impact; good times would see consumers gravitating toward premium brands, while bad times would see people leaning more toward mid-tier or value-for-money options. Further, rising health consciousness and recent global developments have fostered increased demand for all cookware market segments.

Technological advances are also changing consumer expectations. The addition of smart features to cookware is no longer limited to premium brands; mid-priced brands and value-for-money manufacturers are starting to embrace technology to increase usability and win over tech-savvy consumers.

The USA cookware market, poised at a major change, still witnesses brand preference transformations alongside consumer needs and technological advancements. Premium brands would continue to innovatively define the path for quality. Mid-tier brands would give their best shot in accommodating features with affordability. Value-for-money-oriented brands would focus on convenience and sustainability. All these discussions are very important while understanding the cookware layout looking forward for stakeholders intending to maneuver and thrive in the near future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4425.1 million |

|

Market Size by 2032 |

$5575.1 Million |

|

Growth Rate from 2025 to 2032 |

3.4% |

|

Base Year |

2024 |

|

Regions Covered |

USA |

COMPETITIVE PLAYERS

The USA cookware market will remain fluid, responding to changing consumer taste and new technology. Companies are constantly striving to develop products that fit into the demands of the modern kitchen, with quality, durability, and efficiency in mind. The competition among the big players remains cutthroat, with brands working to create a space for themselves in the market through innovative materials and unique designs manufactured with state-of-the-art techniques.

Le Creuset, Lodge Cast Iron, Staub Cookware, and De Buyer have established themselves as reputable names in terms of reliable and high-quality products over the years. Meanwhile, new entrants, including Made In and Field Company, are creating a buzz by targeting a younger crowd looking for premium cookware at price points that don't break their wallets.

As technology advances, we expect to see more smart features integrated into cookware by manufacturers. There is a surge for convenience in cooking, and companies will thus be looking for ways to make cooking much easier, more convenient, and more accurate. Smart cookware that communicates with its user to adjust the degree of cooking heat or even send notifications might one day become an industry norm in our homes. Sustainability will also increase its footprint in shaping the industry. Customers have started to scrutinize the materials used in the cookware that they buy and how the production processes affect the environment. Eco-friendly materials and ethical manufacturers will, therefore, have a good chance of outshining their competitors.

Durable and high-performing, cast iron and stainless steel cookware are still preferred. Yet, a horizon of newer materials creating an interest for similar properties yet being lighter and low-maintenance is getting a boost. While Smithey Ironware and FINEX Cast Iron Cookware Co. are all about maintaining traditional craftsmanship through modern practices, allowing their products to appeal to design-conscious buyers, on a parallel path, All-Clad Metalcrafters, LLC and SharkNinja Operating, LLC are continuously launching high-performance cookware geared to meet the needs of professional chefs and home cooks alike.

The recent growth of e-commerce has seen brands concentrate their efforts on creating online platforms for direct-to-consumer sales with a personalized shopping experience. Social media imposes significant influence on the purchasing power of consumers since they rely on reviews and recommendations before making their choices. Limited editions and collaborations with chefs or influencers prove to be great customer pullers.

The USA cookware market will continue to adapt to new trends that ensure consumer enjoyment when purchasing products to facilitate their cooking. Emphasizing innovation and sustainability, along with consumer engagement, competition will remain the constant force driving the brands to push boundaries and redefine cookware, in the days ahead.

USA Cookware Market Key Segments:

By Product Type

- Cast Iron Cookware

- Stainless Steel Cookware

- Ceramic Cookware

- Aluminum Cookware

- Others

By Distribution Channel

- Online Retailers

- Offline Stores (Supermarkets, Specialty Stores)

By End User

- Residential

- Commercial (Hotels, Restaurants)

By Brand Preference

- Premium Brands

- Mid-Tier Brands

- Value-for-Money Brands

Key USA Cookware Industry Players

- Le Creuset

- Lodge Cast Iron

- Staub Cookware

- De Buyer

- FINEX Cast Iron Cookware Co.

- Made In

- Field Company

- Smithey Ironware

- All-Clad Metalcrafters, LLC

- SharkNinja Operating, LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252