MARKET OVERVIEW

The US Terracotta Cladding market, a dynamic and transformative sector within the construction industry, has gained substantial significance in recent years. Defined by the utilization of terracotta as a primary material for building facades, this market plays a pivotal role in shaping the architectural landscape of the nation. Terracotta, a type of fired clay, serves as a versatile and aesthetically appealing cladding solution that goes beyond mere functionality.

In architecture, the US Terracotta Cladding market emerges as a distinctive force, offering an alternative to conventional building materials. It represents an industry that seamlessly integrates tradition with modernity, blending the timeless appeal of terracotta with contemporary design principles. Architects and builders alike are increasingly drawn to the unique qualities of terracotta cladding, making it an integral component of innovative construction projects across the country.

The US Terracotta Cladding market finds its roots in the architectural pursuit of sustainability and durability. Terracotta, renowned for its resilience and environmental friendliness, aligns with the growing demand for eco-conscious construction practices. As the industry embraces sustainable building solutions, terracotta cladding emerges as a frontrunner, contributing to the reduction of environmental impact in the construction sector.

Moreover, the adaptability of terracotta as a cladding material allows for a diverse range of design possibilities. From classic to contemporary, the US Terracotta Cladding market accommodates an array of architectural styles, offering a visual richness that resonates with both tradition and innovation. This flexibility not only caters to the aesthetic preferences of architects and designers but also aligns with the diverse architectural heritage found throughout the United States.

The industry's growth is further fueled by the emphasis on energy efficiency and insulation in building design. Terracotta cladding acts as a natural insulator, regulating temperature and reducing energy consumption. This functional aspect positions terracotta as a sustainable choice that meets the evolving needs of the construction industry while contributing to the overall energy efficiency of buildings.

As the US Terracotta Cladding market continues to evolve, collaboration between manufacturers, architects, and builders becomes increasingly vital. This synergy fosters innovation in both design and production processes, ensuring that terracotta cladding remains at the forefront of architectural trends. The industry's success hinges on the ability to adapt to emerging challenges, such as changing regulatory standards and technological advancements, while maintaining a commitment to quality and sustainability.

The US Terracotta Cladding market is not merely a segment within the construction industry but a dynamic force shaping the architectural landscape of the nation. Its roots in sustainability, coupled with the aesthetic versatility of terracotta, position it as a unique and essential player in the ever evolving field of architecture and construction. As the industry forges ahead, the allure of terracotta cladding persists, leaving an indelible mark on the buildings that define the character of the United States.

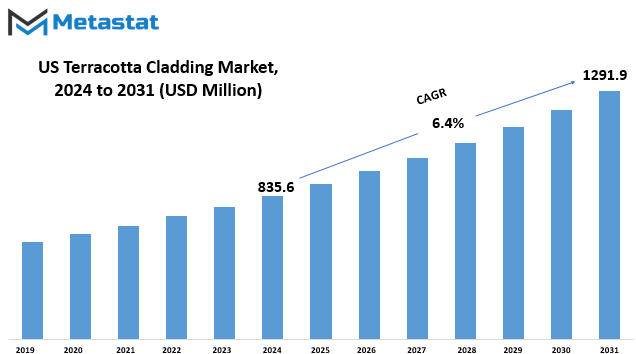

The US Terracotta Cladding market is estimated to reach $1291.9 Million by 2031; growing at a CAGR of 6.4% from 2024 to 2031.

GROWTH FACTORS

The US Terracotta Cladding market is influenced by various factors that shape its dynamics. One key driver is the growing emphasis on sustainable and energy-efficient building materials across the United States. As environmental consciousness continues to rise, there is a noticeable shift towards materials that contribute to energy efficiency and environmental sustainability in construction.

In addition to sustainability, there is a noteworthy increase in architectural and aesthetic preferences for natural and earthy building facades. This trend is driven by a desire for structures that seamlessly blend with their surroundings, reflecting a harmonious integration of architecture and nature. As a result, terracotta cladding, with its natural and earthy appeal, finds favor among those seeking both functionality and visual appeal in building design.

However, the market is not without its challenges. The high initial installation costs of terracotta cladding systems pose a significant restraint. While the long-term benefits of these systems are acknowledged, the upfront investment required can be a deterrent for some potential adopters. This financial barrier may slow down the widespread adoption of terracotta cladding in the construction industry.

Furthermore, the limited availability of skilled installers and maintenance expertise adds another layer of constraint. The intricate nature of terracotta cladding installation and maintenance demands specialized skills, and the scarcity of qualified professionals in this field can hinder the market's growth. Overcoming this limitation is crucial for unlocking the full potential of terracotta cladding in the construction sector.

Amidst these challenges, there lies an opportunity for market expansion. The rising demand for renovation and retrofitting projects in the United States creates a favorable environment for terracotta cladding. As aging structures undergo refurbishment, the need for innovative and visually appealing building materials becomes evident. Terracotta cladding, with its aesthetic charm and functional benefits, stands poised to cater to this rising demand for renovation and retrofitting projects.

The US Terracotta Cladding market is shaped by a delicate interplay of drivers, restraints, and opportunities. The emphasis on sustainable building materials and the aesthetic appeal of natural facades drives its growth, while challenges such as high installation costs and limited expertise present obstacles. However, the increasing demand for renovation projects provides a silver lining, offering a potential avenue for market expansion. The future trajectory of the market will likely be influenced by the industry's ability to address these challenges and capitalize on emerging opportunities.

MARKET SEGMENTATION

By Product Type

The US Terracotta Cladding market exhibits a diversified landscape, with various segments contributing significantly to its overall value. One notable dimension of this market is the categorization by product type. This classification plays a pivotal role in understanding the market dynamics and consumer preferences.

One of the primary components within this product-centric classification is Wall Tiles. In 2022, the Wall Tiles segment held a substantial value, amounting to 415.7 USD Million. This denotes the economic significance and popularity of wall tiles within the terracotta cladding domain. Wall tiles, often selected for their aesthetic appeal and functional attributes, have become integral elements in architectural and design considerations.

Another significant facet within the US Terracotta Cladding market is the Floor Tiles segment. Valued at 217.1 USD Million in 2022, floor tiles contribute significantly to the market’s overall worth. The demand for terracotta floor tiles reflects the consumer preference for not only visually appealing surfaces but also durable and versatile flooring options. This segment’s value underscores the substantial role floor tiles play in shaping the terracotta cladding market landscape.

In addition to wall and floor tiles, Roof Tiles constitute a noteworthy component in the product type segmentation. Although the exact market value for Roof Tiles in 2022 is not specified, it is an essential category within the broader terracotta cladding market. Roof tiles, valued for their durability and ability to withstand diverse weather conditions, hold a distinct place in both residential and commercial construction projects.

The segmentation by product type provides a nuanced perspective on consumer choices and industry trends. It highlights the diverse applications of terracotta cladding in different architectural elements, ranging from walls and floors to roofs. This multifaceted approach is instrumental in catering to the varied needs of consumers in the construction and design sectors.

As the market continues to evolve, these product-specific insights offer valuable information for stakeholders, architects, and developers. Understanding the distinct values associated with each segment aids in strategic decision-making, allowing businesses to align their offerings with prevailing market trends and consumer preferences.

The US Terracotta Cladding market’s segmentation by product type, encompassing Wall Tiles, Floor Tiles, and Roof Tiles, delineates the substantial contributions of these elements to the market's overall worth. This classification serves as a compass, guiding industry participants through the intricate landscape of consumer demands and preferences. It underscores the market’s adaptability to diverse applications within the realm of construction and design, providing a comprehensive view of the market’s dynamics.

By Application

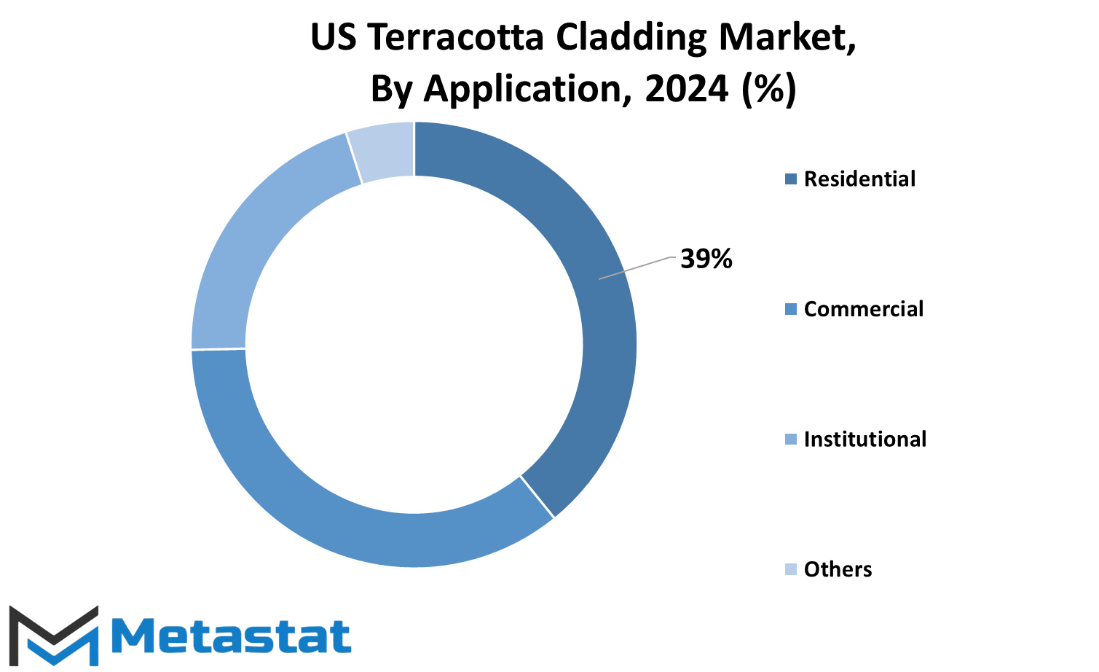

The US Terracotta Cladding market exhibits diversity in its applications, with a segmentation that categorizes its usage into Residential, Commercial, Institutional, and Others. This division by application sheds light on the varied contexts in which terracotta cladding finds its utility.

Residential applications stand out as a prominent facet of the US Terracotta Cladding market. In the housing realm, terracotta cladding serves as a protective shield and an aesthetic enhancer. Homeowners embrace this material for its durability and ability to seamlessly merge with diverse architectural styles, adding a touch of timeless charm to residential structures.

Moving beyond the confines of individual abodes, the Commercial application of terracotta cladding contributes significantly to the market’s dynamism. The material’s versatility becomes evident as it adorns the exteriors of various commercial establishments. Its durability proves essential in withstanding external elements, offering a robust protective layer while maintaining a visually appealing exterior.

Institutional spaces, too, benefit from the unique attributes of terracotta cladding. Whether it’s educational institutions, healthcare facilities, or government buildings, the application of terracotta cladding provides a balance between functionality and aesthetics. The material’s adaptability to different architectural requirements ensures that institutional structures not only stand resilient but also exude a refined visual appeal.

The umbrella category of Others encompasses a diverse range of applications that don’t neatly fit into the residential, commercial, or institutional classifications. This broad category speaks to the versatility of terracotta cladding, finding utility in areas that defy conventional categorization. From recreational spaces to public infrastructure projects, terracotta cladding’s adaptable nature allows it to integrate seamlessly into various projects, regardless of their specific purpose.

The market's segmentation into these distinct applications mirrors the practical considerations and preferences within each sector. For instance, residential users prioritize not only the protective aspects but also the aesthetic cohesion with their homes. Commercial entities, on the other hand, lean heavily on the durability and low maintenance requirements of terracotta cladding to ensure a long-lasting, cost-effective solution.

Institutional spaces demand a harmonious blend of functionality and visual appeal, a balance that terracotta cladding effortlessly achieves. The Others category, by virtue of its eclectic nature, highlights the adaptability of terracotta cladding in addressing a spectrum of project requirements beyond the conventional.

The segmentation of the US Terracotta Cladding market by application underscores the material’s versatility and widespread relevance. From residential structures seeking a harmonious blend of durability and aesthetics to commercial and institutional spaces prioritizing functionality, terracotta cladding emerges as a viable and adaptable choice. The inclusion of the ‘Others’ category further reinforces the broad spectrum of applications, showcasing the material’s ability to transcend conventional boundaries and cater to diverse project needs.

COMPETITIVE PLAYERS

The US Terracotta Cladding market boasts several influential players driving its dynamics. Among these, notable companies such as Terreal North America and M.F. Murray Companies, Inc. stand out as key contributors. These entities play a pivotal role in shaping the landscape of the Terracotta Cladding industry through their distinct market strategies and product offerings.

Terreal North America, a significant player in the field, brings a wealth of experience and expertise to the Terracotta Cladding market. With a focus on delivering high-quality solutions, the company has carved a niche for itself. Its commitment to innovation and customer satisfaction positions Terreal North America as a reliable choice for those seeking top-notch Terracotta Cladding products.

Similarly, M.F. Murray Companies, Inc. adds a layer of dynamism to the market. Known for its dedication to excellence, the company has established a strong presence in the Terracotta Cladding industry. M.F. Murray Companies, Inc. is recognized for its innovative approaches and a comprehensive range of offerings that cater to the diverse needs of clients. This player's influence extends beyond mere participation, actively shaping trends and standards within the Terracotta Cladding domain.

In a market driven by competition, these key players constantly strive to outperform their counterparts. The focus on product quality, reliability, and customer satisfaction sets the stage for a healthy competitive environment. Terreal North America and M.F. Murray Companies, Inc. engage in a continual quest to enhance their offerings, ensuring they remain at the forefront of industry advancements.

It's noteworthy that the competitive landscape isn't solely defined by individual prowess. Collaboration and strategic partnerships also play a pivotal role. These alliances enable key players to leverage each other's strengths, fostering a more robust and resilient industry ecosystem. In the US Terracotta Cladding market, Terreal North America and M.F. Murray Companies, Inc. navigate this dynamic landscape, adapting to emerging trends and customer preferences.

Market dynamics, however, are not static. External factors, such as economic shifts and technological advancements, contribute to the ever-changing nature of the Terracotta Cladding industry. Key players like Terreal North America and M.F. Murray Companies, Inc. must remain agile and responsive to these external influences. Adapting to market demands and staying attuned to the evolving needs of customers are crucial elements in sustaining a competitive edge.

The US Terracotta Cladding market is characterized by the active participation of key players like Terreal North America and M.F. Murray Companies, Inc. These companies shape the industry through their commitment to quality, innovation, and customer satisfaction. As the market continues to evolve, maintaining a competitive stance requires not only individual excellence but also an astute understanding of collaborative opportunities and responsiveness to external dynamics.

Terracotta Cladding Market Key Segments:

By Product Type

- Wall Tiles

- Floor Tiles

- Roof Tiles

By Application

- Residential

- Commercial

- Institutional

- Others

Key US Terracotta Cladding Industry Players

- Terreal North America

- M.F. Murray Companies, Inc.

- Pace Representatives, Inc.

- Shildan, Inc.

- Argeton

- Hunter Douglas N.V.

- Cladding Corp.

- Palagio USA Inc.

- Avenere Cladding LLC

- Boston Valley Terracotta

- ECO Cladding

- Telling Architectural Systems, LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252