MARKET OVERVIEW

The us newborn screening technologies market will remain at the forefront of the healthcare diagnostics industry with its unique focus on early diagnosis of life-altering conditions in newborns. This specialized segment will not only determine public health policy but also redefine state medical protocols. With the capabilities of advancing technology, screening will include an ever-wider spectrum of metabolic, genetic, and endocrine disorders that heretofore were undetectable in the first few years of life.

The foundation for this market is greater than technical proficiency but is instead a complex interaction among regulation, clinical trials, and state-level mandates. Every state will have its own leeway in determining what to screen for, creating a disaggregated but heterogenous marketplace. This heterogeneity will prompt healthcare providers and diagnostic producers to create adaptable technology that satisfies national guidelines as well as neighborhood dictates. The requirement for rapid, accurate, and inexpensive solutions will remain an essential driver of the development of newer platforms, with special emphasis on minimizing false positives and time-to-result values.

In the near future, molecular testing will become the preferred method in the us newborn screening technologies market over traditional biochemical analysis. NGS and tandem mass spectrometry will provide more sensitive and personalized evaluations. Not only will these technologies make test sensitivity and specificity higher, but multiplexing for the simultaneous screening of multiple conditions will also be possible, improving clinical outcomes without adding to the complexity of the screening process.

Privacy concerns and ethical dilemmas will increase, especially with increasing genomic data collected and stored at birth. This will raise hot debates over data ownership rights, long-term storage, and parental consent. The us newborn screening technologies market will witness a shift in how laboratories approach bioinformatics infrastructure, with compliance with federal regulations while maintaining patient confidentiality. New models will be established to reconcile innovation with the ethical responsibility that comes with newborn health diagnostics.

Cooperation between private biotech firms, universities, and government laboratories will be a characteristic of the progress of the market. Such collaboration will finance research on advanced diagnostic kits and computer packages that read screening tests more accurately. Training programs for clinicians and parents will also be involved, so test results are interpreted and follow-up action is clearly defined.

As diagnostic processes are more and more influenced by artificial intelligence and automation, intelligent algorithms will be integrated with a view to effectively streamlining laboratory functions as well as results interpretation. Nevertheless, clinical supervision will not be eliminated. Instead, it will redefine the role of medical professionals towards verification and consultation, their expertise being more valuable in leading to further steps.

The us newborn screening technologies market will not evolve in isolation but in harmony with society need, technology potential, and the need for regulation. It will be a reflection of the nation's broader commitment to preventive medicine but will demand expert navigation through the scientific, legal, and moral worlds. By keeping its eyes firmly on patient care, this sector will establish new standards for what can be accomplished in early diagnosis.

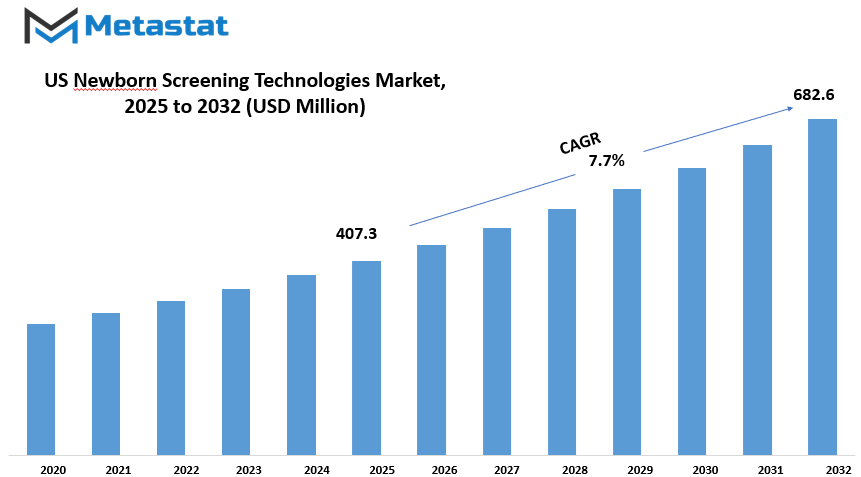

US newborn screening technologies market is estimated to reach $682.6 Million by 2032; growing at a CAGR of 7.7% from 2025 to 2032.

GROWTH FACTORS

The us newborn screening technologies market is driven by several key drivers that influence its opportunities, challenges, and growth. Government backing is one of the key drivers of the market. Federal mandates and payments are leading the way in propelling early detection initiatives. The initiatives target early identification of health issues in newborns to make it convenient to intervene in a timely fashion and enhance long-term results. Without such support, it would be much harder for states and healthcare providers to be able to achieve mass screening efforts that cover a wide variety of illnesses.

Technology is a major growth driver in this market, too. Technologies such as next-generation sequencing and point-of-care testing have transformed what is accessible with newborn screening. These technologies allow extra situations to be diagnosed more accurately and at higher charges. As those technology grow to be extra tremendous, they allow healthcare professionals to provide better care for newborns through figuring out ability scientific issues earlier.

Despite the promising growth, the marketplace still faces a few foremost challenges. One of the biggest among those problems is the fee of embracing new screening era. Equipment, education employees, and infrastructure improvements can be luxurious, and some localities or smaller health systems aren't in a position to pay for them. Such financial limitations hinder the introduction of improved screening methods in much of the country.

It also involves ethical and legal concerns that present challenges to expansion in the market. Informed consent issues, privacy of sensitive genetic data, and how parents might react to surprises present complexities to the process. These must be addressed sensitively to maintain trust of the families' and providers' and ensure that the screening process remains respectful and responsible.

At the same time, the marketplace also contains good potential for expansion. Perhaps one of the most promising is where genomic information is combined with screening information. By combining these two pieces of information, health professionals can offer more personalized care that is tailored to each baby's own set of genes. It can mean more personalized treatments as well as potentially better health outcomes.

Another promising answer is how telemedicine can make more screening accessible. Rural or resource-poor communities have computerized systems that allow healthcare professionals to give consultations and even some screening from a distance. This access bridge allows more families access to early detection regardless of where they are.

MARKET SEGMENTATION

By Type

The us newborn screening technologies market has been increasingly expanding due to rising demand for early diagnosis and treatment of congenital diseases. This market is critical in the sense that it detects health issues in newborn infants even before they show symptoms, allowing effective medical intervention. The screening technology uses different technologies to screen for numerous conditions that may not be immediately obvious at birth but can have long-lasting effects if not treated. Parents and healthcare providers both rely on the machines to ensure the health and welfare of infants are assured at the earliest phase of life.

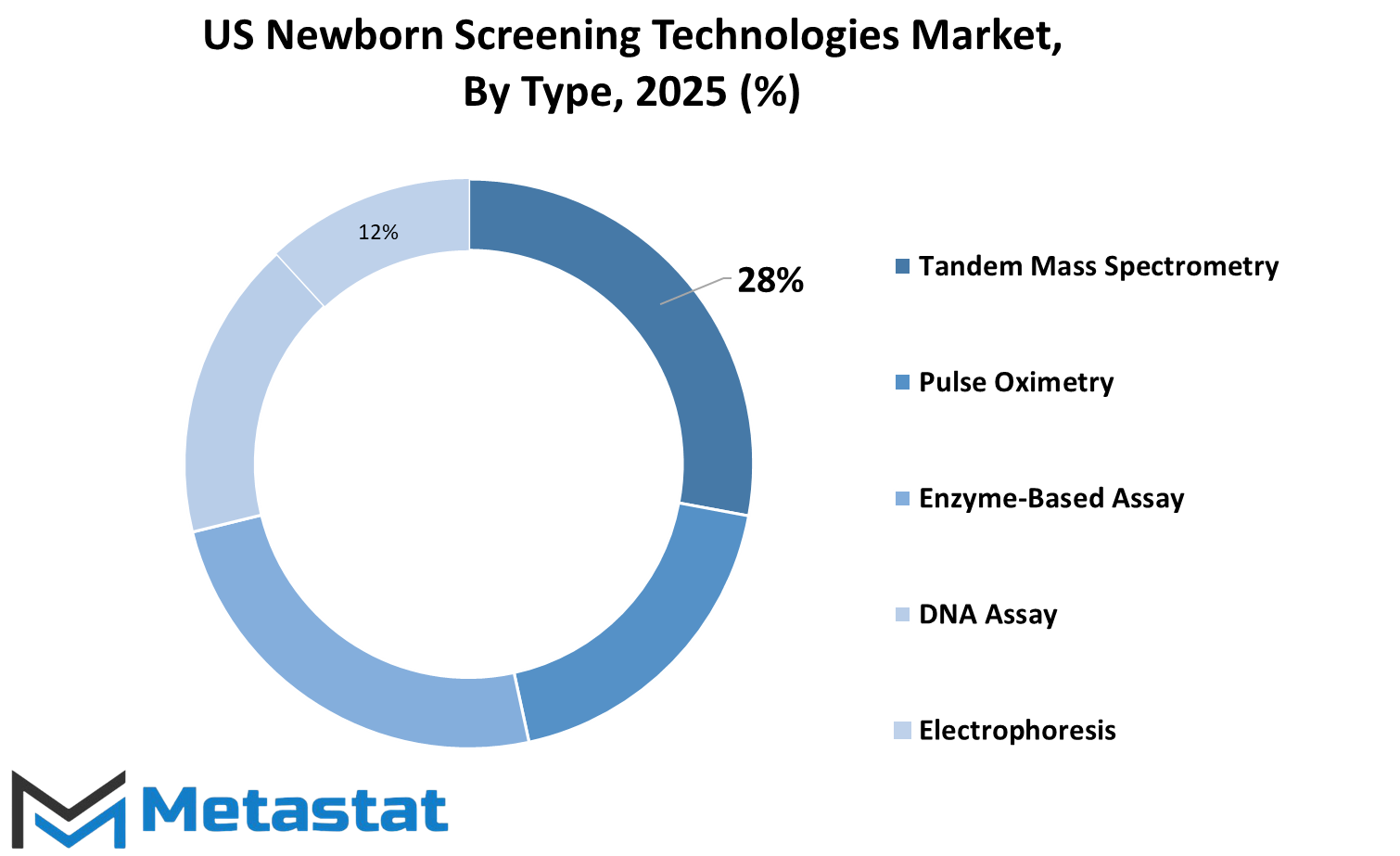

Among the technologies used in this area, Tandem Mass Spectrometry is the biggest, valued at $105.7 million. It plays a vital role in the identification of numerous metabolic and genetic disorders in one test. It is favored because it is accurate, and it also tests for multiple diseases simultaneously, hence it saves time and costs. The other commonly employed method is Pulse Oximetry. It measures the amount of oxygen in a baby's blood and is especially helpful to detect severe congenital heart diseases that would otherwise go unnoticed.

Enzyme-based assays are also commonly employed. These assays are used to detect enzyme deficiencies that could result in metabolic disorders. If these deficiencies are early on detected, then they can be treated promptly and the child's future can be enhanced. DNA screening, on the other hand, analyzes the baby's genetic code to detect mutations linked to some diseases. These are becoming more common as genetic testing is rendered less expensive and accessible. Electrophoresis is also one of the screens that are employed in screening and can be especially useful in the detection of blood diseases like sickle cell disease. It separates proteins in blood to detect abnormal proteins that may signal a health problem. Apart from these, other value-contributing technologies that yield complementary information or confirm results of initial tests are used.

Given the increased awareness among parents and physicians about the importance of newborn screening, the use of these technologies will keep rising. Public health initiatives and government appropriations are also driving this market. As the technology advances and more accurate machinery is the norm, early detection and treatment will become increasingly advanced, giving more newborns an even healthier start to life. The focus remains on increased coverage, greater test accuracy, and ensuring all newborns gain early screening benefit no matter where they are born.

By Application

The us newborn screening technologies market is the center of early diagnosis and treatment of various medical conditions in infants. Depending on the application, the market is divided into various important categories such as screening for metabolic disorders, screening for hormonal disorders, screening for hemoglobin disorders, screening for cystic fibrosis, screening for listening disorders, screening for significant heart disease (CCD), screening for CCD, and screening for transcendent diseases. All screenings detect diseases in a child's health, which can lead to a big difference in whether a child can live a healthy life.

Metabolic disorder screening is probably the most common and important. It detects problems in the way that the way a child's body processes food, it turns it into energy. Incidents such as phenylochetoneuria (PKU) and maple syrup urinary disease are abnormal but severe. Initial screening can prevent serious health issues, including brain damage. The hormonal disorder screening revolves around the detection of problems in the level of hormone. For example, congenital hypothyroidism, where the thyroid gland does not produce enough hormones, can be treated with hormone therapy if diagnosed early.

The hemoglobin disorder screening seek conditions within the blood, including sickle cell disease and thalassemia. Both these conditions affect the size and function of red blood cells and can cause complications such as pain, infection, or even organ damage. Screening at birth ensures proper care and follow -up. Screening for cystic fibrosis detects a condition that affects the lungs and intestines. If detected early, medication may be initiated that keeps symptoms under control and improves their quality of life.

Screening for hearing disorder is also a significant part of newborn screening. Hearing issues may not necessarily be obvious at first, but early screening will mean that babies born with hearing loss will be assisted soon, such as with hearing aids or therapy. Screening for CCHD detects serious heart defects that need to be fixed or treated soon after birth. Pulse oximetry, a simple procedure that is taking a blood oxygen reading, is generally applied to perform this test.

Lastly, infectious disease screening detects infections that potentially were passed from mother to infant at pregnancy time or delivery. They are not yet symptomatic but can cause severe problems if not treated. The technology used in these screenings improves and improves, allowing physicians to diagnose more conditions more correctly and rapidly. As more hospitals utilize these tests, more infants can be given the care they need right away.

By Assay Type

The us newborn screening technologies market zone is critical for early detection of sure illnesses in newborns, which allows their treatment in a timely way and guarantees better fitness. Through early infancy hassle identification, the generation enables medical doctors and parents to take vital measures to comprise or maybe save you extreme health complications. With a developing call for for early diagnosis, the market additionally needs superior and powerful screening technology. These technologies have the capacity to screen special conditions that are not right now sizeable at beginning however can cause intense headaches if undetected.

The market is categorised on the basis of assay kind into Specific Enzyme-Based Assays, Specific DNA Assays, Specific Mass Spectrometry Assays, and Others. Each of those categories provides a different take a look at approach that supports the detection of numerous fitness conditions. Specific Enzyme-Based Assays paintings through assessing the hobby of enzymes inside the frame, which could help in the detection of metabolic issues. These checks are in particular useful within the detection of illnesses where one unique enzyme is missing or running aberrantly. Specific DNA Assays attention on the genetic composition of the toddler, presenting help in figuring out inherited ailments via evaluation of the DNA for any mutations or changes. The method is beneficial in identifying conditions that are hereditary, hence an effective aid in preventive care.

Specific Mass Spectrometry Assays are used to measure a wide range of chemicals in the blood. This helps detect abnormal conditions through looking at the patterns in the metabolism of the baby. The ability of this procedure to test for more than one disorder at a time forms the speed and dependability of this technique. The "Others" category comprises newer or less commonly utilized testing technologies that also provide significant value to the screening process. These may be used in certain hospitals or research centers that are exploring more customized approaches to newborn treatment.

The steady progress in these kinds of assays has helped enhance newborn screening by increasing its precision and availability. With more states expanding their panel screens, the market will keep on expanding as hospitals and labs adopt newer and better technologies. Parents have more knowledge of the benefits of early screening, which is helping push demand for these technologies higher. In total, the us newborn screening technologies market will continue growing to offer more chances for babies to have a chance at healthier lives via early and correct testing.

By End User

The us newborn screening technologies market is targeted at the early diagnosis of certain medical conditions in newborns in order to provide timely treatment and better outcomes. The market is driven by the end users, which are primarily hospitals and clinical laboratories. These two institutions play a central role in the manner in which the newborn screening is done and the handling of test results.

Newborns first encounter hospitals, so they are an integral part of screening. Hospitals are where most births take place, and screening is typically performed within 24 to 48 hours of giving birth. Hospitals are also capable of performing these first screenings, and having a direct connection to the baby and parents allows quick communication and immediate response when needed. They are also equipped with the latest screening machines, trained medical staff, and proper blood sample storage and transportation methods. Hospitals are also responsible for informing the parents about the procedure and providing follow-up care if a test indicates an abnormality.

Clinical labs, however, make it easier by performing more sophisticated tests and analysis. Though the blood samples are drawn from hospitals, they typically send them to these labs for extensive testing. Clinical labs have high-tech equipment and skilled staff who specialize in screening for a wide range of disorders such as metabolic disorders, hormonal disorders, and genetic disorders. They strictly follow quality parameters so that the findings are authentic and accurate. The role of clinical laboratories is especially important when further testing must be performed in order to make a diagnosis or when further analysis is needed.

The clinical labs and hospitals work together with one another in a way that ensures the newborns receive their proper care as quickly as possible. They provide a mechanism together that helps identify potential health issues prior to the appearance of symptoms so that the treatments are performed at the right time, which can leave lifetime effects. Hospitals as well as the labs are evolving by using newer instruments and optimizing the process as the demand for quicker and better tests continues to grow.

The us newborn screening technologies market segmented by end user into clinical laboratories and hospitals helps understand how this process is conducted. They are both individual but corresponding activities that lead to the overall success of newborn health programs across the country. It is their combined collaboration that makes it possible for every baby born in the US to have a better chance at having a healthy start in life.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$407.3 million |

|

Market Size by 2032 |

$682.6 Million |

|

Growth Rate from 2025 to 2032 |

7.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

.

REGIONAL ANALYSIS

The us newborn screening technologies market is influenced by various regional segments that play a role in determining how the technology is developing worldwide. The market is split based on geography into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions is further segmented into individual countries in order to give a better idea of market trends, demands, and opportunities.

North America consists of the United States, Canada, and Mexico. In these, the United States is a pioneer in furthering newborn screening because it has an established healthcare system, robust research backing, and high levels of awareness. This nation is regularly in the vanguard of embracing new technology, which propels expansion and advancement in early diagnosis among newborns. Canada and Mexico are also making consistent progress, particularly with public health activities increasing and screening programs becoming more prominent.

The major markets in Europe are the UK, Germany, France, and Italy, and the Rest of Europe. Germany and the UK have made significant investments in healthcare, which positions them as significant drivers for the uptake of newborn screening devices. France and Italy also play a notable role, where the emphasis is placed on early detection of genetic and metabolic diseases. The rest of Europe follows suit, albeit with a lower rate of progress.

The Asia-Pacific region is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific. This region has excellent potential with a huge population and increased awareness towards early detection of disease. Japan and South Korea are technologically and in healthcare access more advanced, and this has enabled them to effectively implement screening programs. While this is happening, nations such as China and India are expanding their healthcare facilities and will probably be using newborn screening devices in an even wider manner in the foreseeable future.

South America consists of Brazil, Argentina, and the Rest of South America. Although here progress has been lagging behind other areas, there is increasing interest in enhancing healthcare services. In the region, Brazil is the leader, with a number of public health initiatives focusing on increasing access to newborn screening.

Finally, the Middle East & Africa area is divided into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa. Although there are still challenges in the areas of healthcare infrastructure, certain countries, particularly the Gulf nations, are putting tremendous efforts into enhancing maternal and child health. These activities will aid in the expansion of newborn screening technologies throughout the region.

COMPETITIVE PLAYERS

The us newborn screening technologies market is on an upward growth trajectory with an increasing number of healthcare professionals emphasizing early identification of severe conditions in infants. These technologies detect rare but curable disorders shortly after birth, providing infants with an improved possibility of healthy growth. Screening is usually performed in the initial few days of life, based on a tiny blood sample from the heel of the newborn. This quick process can catch conditions like metabolic, hormonal, or genetic disorders, which may not show symptoms right away but can cause severe health problems if left untreated.

Parents and physicians count on newborn screening to act quickly when necessary. Early detection not only enhances results but also conserves long-term health-care expenses by avoiding unnecessary complications. With the passage of time, the scope of medical conditions that can be screened has widened due to the development of technology and research. Laboratories now utilize more precise and efficient equipment for screening an increased number of disorders, and certain ones even add hearing and cardiac screening.

There are a number of companies that dominate this market. Some of the most prominent players are PerkinElmer, Inc., which is famous for its testing systems, and Bio-Rad Laboratories, Inc., whose products include instruments and software for precise screening. Natus Medical Incorporated specializes in neurodiagnostic and newborn care products. Baebies, Inc. creates innovative diagnostics for the early life period, and Masimo Corporation is well known for noninvasive monitoring solutions. Trivitron Healthcare and SCIEX aid with hardware that facilitates effective laboratory testing. RECIPE Chemicals + Instruments GmbH and Waters Corporation have a reputation for test reagents and equipment. Other notable mentions are CENTOGENE, Medtronic plc, DiaSorin S.p.A. (Luminex Corporation), Demant A/S (MAICO), F. Hoffmann-La Roche Ltd, and MP Biomedicals, each assisting various aspects of the screening process through innovation, research, or production.

As the public becomes more aware and regulations aid in the use of routine newborn screening, demand for better, faster, and more reliable screening equipment continues to grow. Increasingly, more states mandate testing for more conditions, and that boosts the industry. The work these companies do is vital not only for labs and hospitals but for families who rely on rapid answers during a stressful time. Thanks to continuous advances in screening technology, the future promises well for early treatment and diagnosis of newborn health conditions throughout the United States.

US Newborn Screening Technologies Market Key Segments:

By Type

- Tandem Mass Spectrometry

- Pulse Oximetry

- Enzyme-Based Assay

- DNA Assay

- Electrophoresis

- Other Technologies

By Application

- Metabolic Disorder Screening

- Hormonal Disorder Screening

- Hemoglobin Disorder Screening

- Cystic Fibrosis Screening

- Hearing Disorder Screening

- Critical Congenital Heart Disease (CCHD) Screening

- Infectious Disease Screening

By Assay Type

- Specific Enzyme-Based Assays

- Specific DNA Assays

- Specific Mass Spectrometry Assays

- Others

By End User

- Hospitals

- Clinical Laboratories

Key US Newborn Screening Technologies Industry Players

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Natus Medical Incorporated

- Baebies, Inc.

- Masimo Corporation

- Trivitron Healthcare

- SCIEX

- RECIPE Chemicals + Instruments GmbH

- Waters Corporation

- CENTOGENE

- Medtronic plc

- DiaSorin S.p.A. (Luminex Corporation)

- Demant A/S (MAICO)

- F. Hoffmann-La Roche Ltd

- MP Biomedicals

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

.jpg)

US: +1 3023308252

US: +1 3023308252