MARKET OVERVIEW

The US Extended Warranty Market has begun to appear as one of the prime sectors in the overall popular insurance and consumer protection industry. That market is only gaining momentum since it has been offering specialized coverage, which further comprises consumer and business lines and is likely to remain in the foreseeable future. It is not only limited to covering mechanical failures or defects in products; it is set to go further in changing perceptions by the consumers of long-term value and security in relation to their purchases. Traditionally, it has been above covering electronics, appliances, and automobiles. But the broader transformations on the future are going to redefine its impacts and purposes.

As technology progresses and expectations shift among consumers, the US Extended Warranty market will grow into personalized coverage. While once the market turned away from a one-size-fits-all policy, businesses would begin offering options according to customer data, product type, and usage habits. Thus, providers may formulate plans that feel responsive and intuitive rather than rule-bound for consumers, giving them greater choice in the areas of their purchases they want to protect. These changes, along with advances in AI and analytics, will help insureds anticipate losses and dynamically adjust terms in ways that feel more real and pertinent.

Another characteristic that will push the market beyond boundaries is the emerging smart gadgets and connected ecosystems. With the intractability of homes and cars into digital systems, the scope of protection shall stretch to include software glitches, cybersecurity breaches, and network failures. This evolution would necessitate the providers to also insure not only the physical products but also the seamless function of interconnected platforms, thus making warranties a key component of the digital lifestyle.

Environmental sustainability will further stake out new grounds for the US Extended Warranty market. As consumers become increasingly aware of waste and the environmental costs of replacing products, warranties will work toward repairs and refurbishment rather than straight replacement. This eco-friendly angle will appeal to a new generation of consumers looking to responsibly prolong the lifespan of their purchase. Companies in the market will promote greener service networks and incentives for consumers choosing repair over replacement.

The convergence of warranty services with other financial products to include all products in their life cycle is also an imminent reality for the market. Buyers of electric vehicles, for example, will find warranties associated with maintenance and charging services, trade-in guarantees, and this type of bundling will value tight relations between warranty providers and consumers for longevity and engagement.

All these regulations will have further impacts on how the US Extended Warranty market works. The legislators may well soon come up with stricter compliance requirements for the protection of consumers from problematic contracts and hidden clauses. Thus, transparency will be the new centerpiece of warranty provision in the future to build trust between provider and client.

The overall US Extended Warranty market will, in the future, position itself as a very refined compact multifaceted service platform that will yield solutions to new consumer needs and problems. Beyond the protection of the consumers after purchase, it will act as an integral part of the whole ownership experience to enhance satisfaction and securities in ways that the modern-day market only begins to experiment with.

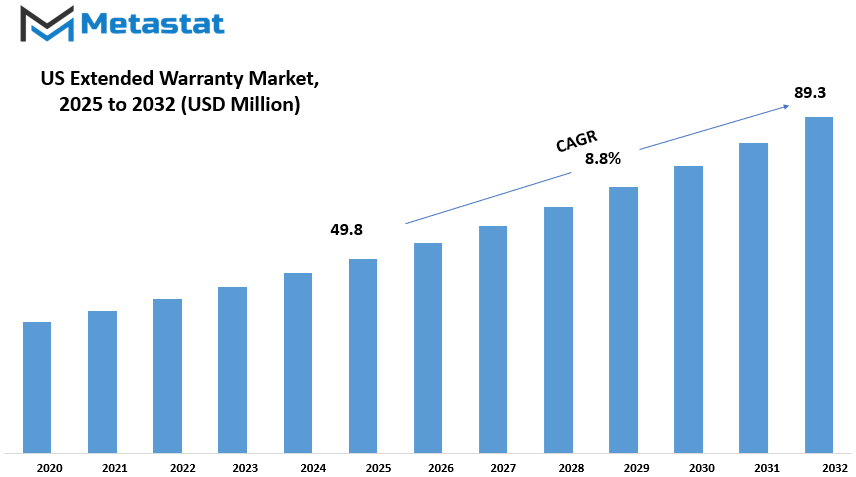

US Extended Warranty market is estimated to reach $89.3 Million by 2032; growing at a CAGR of 8.8% from 2025 to 2032.

GROWTH FACTORS

The US Extended Warranty Market has seen steady growth due to a few very strong demand-prompting factors. The increase in sales of consumer electronics is one of the primary contributors to the growth of this market. As more people decide to purchase gadgets like a smartphone, a laptop, or home appliances, the natural demand for their protection increases. An extended warranty serves as an assurance to the customer that, apart from the standard manufacturer warranty, the item would also be protected from damages in case of any unfortunate incidences. This is really beneficial for high-priced products. Besides this, another driving factor would be the greater awareness of consumers regarding product protection advantages. People are more cautious about protecting their purchases, and many are beginning to realize the advantage of having extra cover when there is an unexpected incident.

However, on the other hand, there are a few things that hinder the smooth progress of these markets. One of the very prominent ones is the high expense of these warranties. Most customers think twice about spending extra money after having already paid a lot for its product offerings. Some may reconsider spending this extra money on a warranty plan. Another hindering factor in the market is the negative connotation of extended warranties. Some buyers have been subjected to arduous claims procedures, have heard of them, or have just heard about the negative experiences, which cost them a lot of time and energy, and discourage potential buyers from purchasing extended warranties, even upon initial interest.

The landscape of the US Extended Warranty Market is therefore a mixture of opportunity and obstacles. The drastic rise in online shopping has been a boon for selling warranties. As eCommerce becomes the purchase medium, these businesses can easily offer warranty options to customers while general purchases are being completed. In a matter of a few clicks, it becomes convenient for a buyer to add a warranty to a purchase. An added novelty is in the injection of artificial intelligence and digital platforms in warranty. All of these, especially with AI, companies are doing claims and customer service their way, which means making it smooth and faster from the customer's perspective. Such improvement amps up customer satisfaction and further contributes to changing the stigma around extended warranties.

The US Extended Warranty Market has been growing and facing challenges at the same time. Rising demand for electronic appliances and better awareness among consumers are two factors boosting demand, but high costs and lengthy claims are working against it. However, new online sales channels and new digital tools are creating opportunities for the market to grow stronger in the years ahead.

MARKET SEGMENTATION

By Types

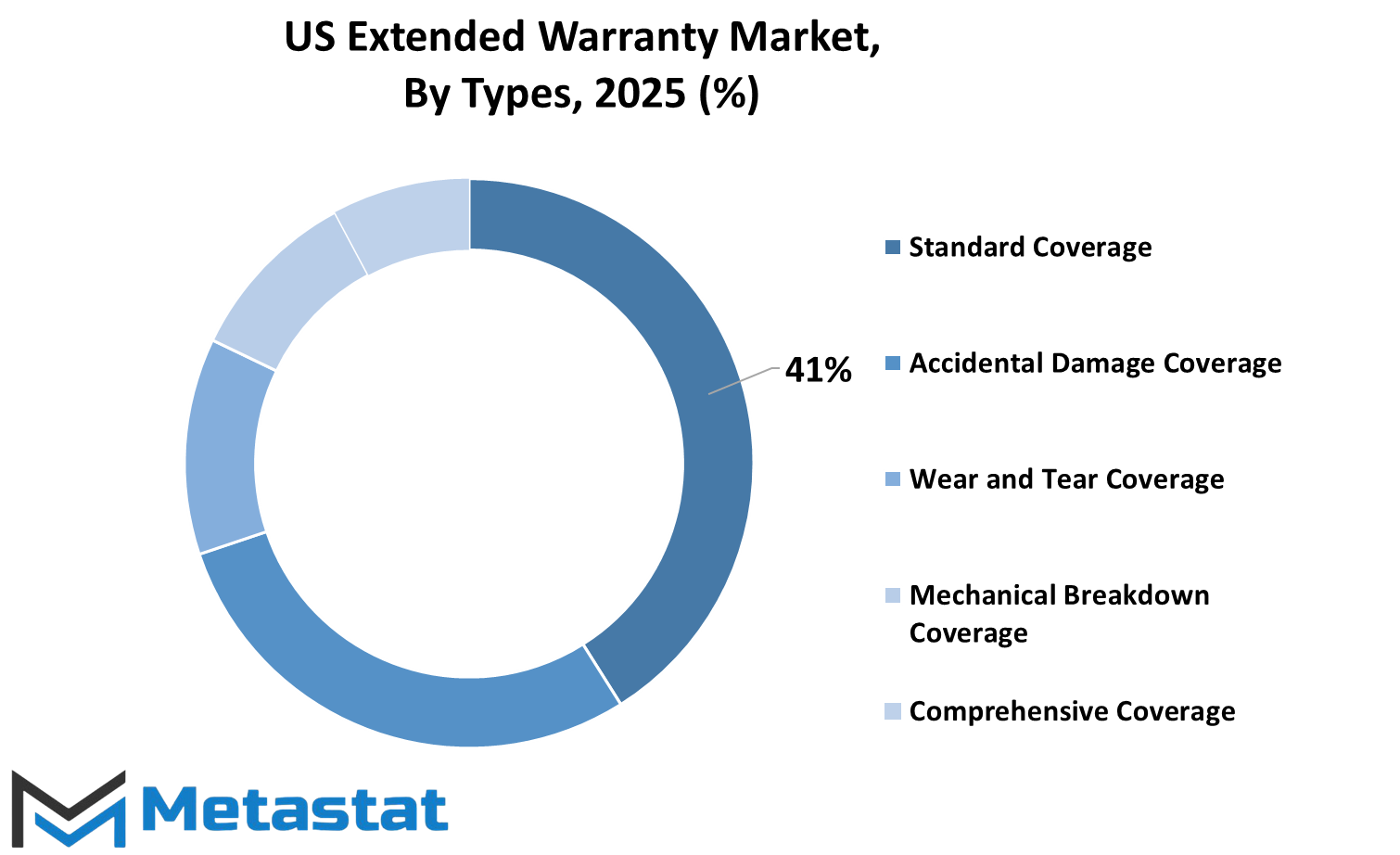

The US extended warranty markets have grown steadily during the last years. Now, they provided customers with options of protecting their purchases and provided peace of mind. An extended warranty is a service contract for repair or replacement costs beyond the original warranty from the manufacturer. Many consumers buy such plans because it spares them from unexpected costs when something goes wrong to the product after the expiration of the basic warranty. Companies can carry various types of extended warranties that serve different consumer companies.

It categorizes coverage types through which buyers can access diverse options. Standard Coverage is worth about $20.4 million. It includes products under its coverage from common problems that are likely to take place when the product is used normally. Accidental Damage Coverage is another popular type. This warranty is appropriate for those who are anxious about drops, spills, and other intervening accidents that could potentially damage the item. Beyond normal protection, this provision ensures that even accidents occurring unintentionally are covered as well, possibly saving the customer from costly repairs or replacement.

Very much equally important is Wear and Tear Coverage. In time, a product can wear down or lose its normal function due to regular usage. Such plans focus on the gradual damage that, by nature, takes place so that customers are not left standing with a broken product simply because it has aged or wore out through constant use. Mechanical Breakdown Coverage also plays an important role in the business. Such coverage extends to problems caused by internal mechanical failures that are mostly unpredictable and expensive to fix. These types of warranties can be a smart choice for those who want to keep their products going without worrying of something going wrong under mechanical breakdown.

Comprehensive Coverage provides the widest cover, as it comprises elements from all the other plans. It covers accidental damage, wear and tear, mechanical failures, etc. Best for anyone who seeks complete peace of mind and does not want to deal with the stress of wondering whether a particular issue is covered, this plan almost literally covers it all.

Basically, the extended warranty markets in the USA are all about fulfilling the varying needs of the customers. Types of coverage can be availed for different preferences so that one can choose to protect themselves as per availability. All products become more technologically advanced and expensive, thus extended warranties may continue to play a very important role for consumers in protecting their investments.

By Product Type

In the past tangent of a couple of years, the US extended warranty market has turned a lot of pages in terms of constant growth due to the rising consumer inclination towards product protection and peace of mind. This market has no restrictions; it covers almost every item available for use and divides them into several categories: consumer electronics, automobiles, home systems, furniture, etc., none of which can be overlooked to the overall growth of the market.

Consumer Electronics: A huge portion of the extended warranty market comprises consumer electronics-smartphones and laptops, household gadgets, etc. It's in reality that people buy everything in insurance because a very fast technological change requires big costs of repair or replacement. Thus, buyers enjoy extra security through extended warranties, and the demand is likely to continue increasing as more people are dependent on electronics in their lives.

Automobiles are among the most typical consumer goods for extended warranties. Cars tend to be a pretty hefty investment, and repairing them comes very pricey. These extended warranties provide protection for the car throughout the time its original warranty expires by covering anything from problems that arise from the engine to failure in operations of transmission or even in the electrical system. Newer advanced models are coming out with advanced features and technology; thus, the repair cost has increased so significantly with interest in the extended coverage.

Home systems such as heating and cooling units, plumbing, and electric systems also make up one of the important segments. These systems are required for comfort and safety because the repairs are often urgent and expensive. An extended warranty for these systems allows a homeowner to avoid sudden costs and keep his house running smoothly.

Furniture is the other product type that falls within the surface area of the market. Although furniture may seem least likely to require a warranty, it still covers damage or stains or structural problems. The more money invested in furniture, especially custom-made pieces, the more attractive a coverage becomes.

Besides groups such "goods", other depend upon extended protection. Other appliances or outdoor equipment, perhaps personal belongings that most people take great pride in. Without a doubt, this market will continue to grow though really consumers look for ways to protect their purchases through that gadget-extended warranty in the United States. Be it an electronic item, automobile, home system, or a piece of furniture-level, extended warranties will always offer a sense of security by assuring that all physical objects are in their place without unexpected costs on repairs.

Additional appliance, equipment outdoor or perhaps, there's even a personal belongings that are important to people. Without a doubt, that is a growing market, although really consumers look for ways of protecting their purchases through this gadget-extended warranty in the United States. Be it an electronic item, automobile, home system, or a piece of furniture-level, extended warranties will always offer a sense of security preventing costs of unexpected repair from which, everything really is in its place.

By Distribution Channel

The up-to-date and latest information regarding the status of extended warranty market in the United States has been recently evaluated, and it indicates that most consumers are in search of means to extend the protection coverage of their purchases beyond the time specified by the standard warranty. Extended warranties or guarantees refer to repairs or replacement of broken-down products after expiration of the original warranty. These appended warranties are normally purchased by customers for electronics, home appliances, cars, and even furniture to avoid unexpected repair costs. At the same time, several key and unique distribution channels will provide the market with the requirements in making these services very much within the reach of customers.

Retailers are one of the main channels through which extended warranties are sold. Consumers are often sold an extended warranty while at the point of checkout after buying a portable product within the store. It is often seen as more convenient than having to go home and tell them that they have a warranty for something they just purchased. Stores too really like selling warranties since such sales immediately add to the bottom line and do so in the context of relationship building with customers.

Manufacturers also play a major part in this market. Sometimes, the companies making the product give extended warranties directly to the purchaser. This appeals to a customer because they feel confident that the company knows its own product best and will keep trustworthy service. Manufacturer-backed warranties seem much more reliable, and people believe they are bound to get quality repairs or replacements when they need.

Insurance companies have also become major actors in the extended-warranty market. The insurance companies work with specialized plans that cover different types of products. Insurance-backed warranty plans may provide broader types of protection and may include additional services, such as something like 24-hour customer service. Some people prefer insurance companies because they feel these companies are experts in claim handling.

Online platforms have also simplified buying an extended warranty. Several websites allow consumers to compare various plans, read reviews, and buy a warranty from the comfort of their own homes. This has opened up more choices and made it so simple for customers to scour for a plan that suits their needs. The growth of e-commerce fueled the rapid growth of this channel.

Here are some alternative channels, like third-party service providers and financial institutions, offering extended warranties as a part of their provisions. Each of these channels contributes to making extended warranties accessible and offers customers the option to choose what feels right for them. As the demand for protection plans continues to rise, all of these channels will continue to play a vital role in the shaping of the future of the US extended warranty market.

By End-User

The US Extended Warranty market differs in various dimensions of buyers. One way of analyzing the market is to divide it into two main end-user groups: individuals and businesses. Both types buy according to particular needs and expectations of the buyer, which continues to evolve and grow in the market. While individuals tend to seek such policies for personal items, such as electronics, home appliances, or vehicles, businesses often have much different needs. Individuals normally purchase warranties to insure themselves against accident damage to a personal item after the warranty period ends. When the product malfunctions after the expiration of the standard warranty, these customers feel relieved that they won't have to deal with unanticipated costs for repairs. Hence, many people consider moving from pure rental to owning due to this layer of protection around important items.

Companies, on the other hand, have slightly different reasons for acquiring extended warranties. Companies usually have a lot of equipment, whether it be computers, machinery, or vehicles, and keeping everything in proper working condition becomes a driven need for the business, not convenience. Downtime on the repairs causes loss of income or delays, and that is why many think it a benefit in getting extended warranties. Such warranties aid managing the risk and better controlling maintenance cost.

The proliferation of advanced technologies entering everyday and business applications has helped promote interest in extended warranties. The moment a product becomes technologically advanced and sometimes costly to repair, people tend to state their need for protecting their investment. That much is true, whether families are protecting their new refrigerators or companies are insuring entire fleets of delivery vans: It is a secure sort of assurance.

Another game changer on the market was consumer awareness. Many consumers have become aware of what extended warranties cover and what is never covered, which means that they are more informed to make decisions. In addition, companies giving these warranties are attempting to build confidence by clearly defining their terms and providing reliable services.

In conclusion, both individuals and businesses searching for extra security for their valued belongings shape the U.S. Extended Warranty market. Each group has its rationale, but the end will always be the same: to lessen the blow financially of unforeseen repairs. With technology constantly moving forward and the public increasingly aware of its advantages, growth in extended warranty demands remains predictable.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$49.8 million |

|

Market Size by 2032 |

$89.3 Million |

|

Growth Rate from 2025 to 2032 |

8.8% |

|

Base Year |

2024 |

|

Regions Covered |

US |

REGIONAL ANALYSIS

The US Extended Warranty Market provides geographical segmentation into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. The market in North America includes the U.S., Canada, and Mexico. Europe is divided into the UK, Germany, France, Italy, and all others grouped as Rest of Europe. This classification is similar in the Asia-Pacific: it includes segmentation for India, China, Japan, South Korea, and Rest of Asia-Pacific covering other countries not specifically listed.

South America includes Brazil, Argentina, and other countries that fall under the category of Rest of South America. In the Middle East & Africa, the market is divided into three main divisions, namely, those of the Gulf Cooperation Council (GCC) countries, Egypt, South Africa, and the Rest of the Middle East & Africa, which, in turn, identifies other countries in the given areas.

These geographical divisions help in understanding the regional dynamics and trends within the US Extended Warranty market. This approach helps them to focus on these specific areas and tailor their product/service offerings to meet those specific needs, as each of these regions might have different demands or preferences for extended warranties. This segmentation also provides insights into the various levels of growth and responses to the increasing demand for extended warranty services across different regions.

Geographic divisions in the extended warranty industry are essential for strategic business considerations, marketing, and distribution. They allow a more accurate pinpoint of customer needs in each region, leading to the best possible approach to assist these needs in various corners of the world. These geographic divisions will become crucial in shaping the market strategies of the companies working in the US Extended Warranty market, given the continued growth and development of the sector.

In summary, the US Extended Warranty market is characterized by different geographical variations, with each region having unique features. In market segmentation, North America, Europe, Asia-Pacific, South America, and the Middle East & Africa allow companies to make decisions that will help them grow and succeed across diverse markets.

COMPETITIVE PLAYERS

The U.S. extended warranty market assumes a vital role by providing consumers with additional protection apart from the standard warranty provided by the manufacturers. This element gives customers peace of mind with some assurance should the product go bad after the regular warranty period. The trend toward requesting extended warranties has grown since consumers want to protect their investments, especially now that technology and appliances are fast becoming indispensable components of everyday life. These warranties are usually provided by independent third parties and come in various versions, including product protection plans and home appliance service contracts.

Several prominent players dominate the U.S. extended warranty market, each with unique services and solutions. There are certainly many but the major players include Asurion, LLC; SquareTrade, Inc.; American International Group, Inc. (AIG); and Toco Warranty Corp. These companies are established, with a fair share of warranty and insurance experience. For example, Asurion is said to be the leading name when it comes to insuring mobile phones, while SquareTrade protects electronics from smartphones to tablets and laptops. The startups are focusing on consumer-friendly hazard plans with various coverage options.

Assurant, Inc. and AmTrust Financial Services, Inc. are major players in the electronics and appliance warranty industry. More remarkably, Assurant has a very wide range of warranties tailored to the care of devices in different regions of the world. Similarly, AmTrust Financial Services provides various extended warranty options and enjoys a significant reputation in the financial and insurance industries.

CNA Financial Corporation is another player that offers warranties on appliances, electronics, and automobiles. Well-known as a reliable company in its field, it sells extended warranty products through its well-established financial services business. Other similar competitive entities include Warrantech, AKKO, LLC (Upsie), and Choice Home Warranty, and all have stepped into the competition pool with affordable and relatively easy access for consumers to warranties.

However, With all these features, services are being matured to make aptness ñ in every aspect-from differentiated types of plans to provisions for various basic household repairs or even coverage options specifically tailored for unique systems. In addition, more and more companies are likely to emerge as the extensions continue to grow in their market. As a result, more individualistic home warranty policies, which will cost-efficiently fit the budgets of the developing users, will become available.

Therefore, it seems the US extended warranty market comprises many large, existing firms offering diverse protection plans to their customers. The consumers-especially the ones-those who have come so close to totally dependent on their electronic appliances and modern electronics will use extensively more contracts in the longer run. Innovation and development would automatically be fueled in the market because of the increasing competition among the various companies having completely different kinds of services included in their plans.

US Extended Warranty Market Key Segments:

By Type

- Standard Coverage

- Accidental Damage Coverage

- Wear and Tear Coverage

- Mechanical Breakdown Coverage

- Comprehensive Coverage

By Product Type

- Consumer Electronics

- Automobiles

- Home Systems

- Furniture

- Others

By Distribution Channel

- Retailers

- Manufacturers

- Insurance Companies

- Online Platforms

- Others

By End-User

- Individuals

- Business

Key US Extended Warranty Industry Players

- Asurion, LLC

- SquareTrade, Inc.

- American International Group, Inc. (AIG)

- Toco Warranty Corp.

- Assurant, Inc.

- AmTrust Financial Services, Inc.

- CNA Financial Corporation

- Warrantech

- AKKO, LLC (Upsie)

- Choice Home Warranty

- Endurance Warranty Services, LLC

- Liberty Home Guard

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252