MARKET OVERVIEW

The US Dental Implantation Planning Software market is a dynamic and rapidly expanding sector that plays a crucial role in the dental industry. As technology continues to advance, the demand for sophisticated solutions in dental implant planning has become increasingly prominent. Dental implantation planning software serves as an essential tool for dental professionals, offering a comprehensive approach to designing and executing precise implant procedures.

In recent years, the US Dental Implantation Planning Software market has witnessed remarkable growth, driven by a confluence of factors. Advancements in imaging technologies, such as cone beam computed tomography (CBCT), have revolutionized the way dental professionals approach treatment planning. This, coupled with the growing prevalence of dental implant procedures, has fueled the need for advanced software solutions that facilitate accurate diagnosis and treatment.

One of the key features that distinguish the US Dental Implantation Planning Software market is the emphasis on user-friendly interfaces and intuitive functionalities. Software developers are keenly aware of the diverse skill sets among dental practitioners, and as a result, they are continuously refining their products to ensure accessibility for users with varying levels of technical expertise. This user-centric approach has contributed significantly to the widespread adoption of dental implantation planning software across diverse dental practices.

The integration of artificial intelligence (AI) has emerged as a noteworthy trend within the US Dental Implantation Planning Software market. AI algorithms enhance the precision of diagnostics by analyzing complex datasets from patient scans, aiding in the identification of optimal implant locations and configurations. This incorporation of AI not only streamlines the planning process but also contributes to the overall success and longevity of dental implant procedures.

Collaboration and interoperability are critical facets within the US Dental Implantation Planning Software market. Dental professionals often work within interdisciplinary teams, requiring seamless communication between software platforms and devices. Software developers recognize this need and are actively fostering interoperability to enhance the overall efficiency and coordination of dental implant procedures.

Security and compliance are paramount considerations in the US Dental Implantation Planning Software market. As these software solutions handle sensitive patient data, there is a heightened focus on ensuring robust cybersecurity measures and adherence to regulatory standards. Developers are investing in encryption technologies and strict compliance frameworks to safeguard patient information and maintain the trust of both dental professionals and their patients.

The US Dental Implantation Planning Software market stands at the forefront of innovation within the dental industry. With a commitment to user-friendly design, integration of AI, emphasis on collaboration, and a steadfast focus on security and compliance, this market is poised for continued growth. As technology continues to advance, the evolution of dental implantation planning software will play a pivotal role in shaping the future landscape of dental care in the United States.

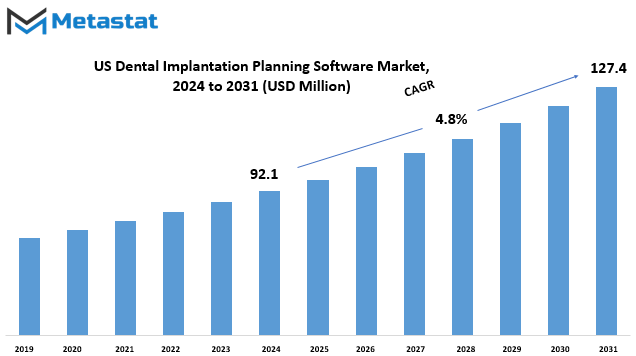

The US Dental Implantation Planning Software market is estimated to reach $127.4 Million by 2031; growing at a CAGR of 4.8% from 2024 to 2031.

GROWTH FACTORS

The US Dental Implantation Planning Software market is experiencing substantial growth, driven by various factors that play a pivotal role in shaping its trajectory. These growth factors are instrumental in propelling the market forward. However, certain challenges pose potential hurdles to the market's expansion.

One of the primary growth drivers in this domain is the increasing awareness and adoption of dental implantation planning software among dental professionals. As practitioners recognize the benefits of these technological tools, there has been a notable surge in their integration into dental practices. This heightened awareness contributes significantly to the market's positive momentum.

Moreover, advancements in technology are fostering the development of more sophisticated dental implantation planning software. The integration of innovative features and capabilities enhances the overall efficiency and precision of the planning process. Dental professionals are increasingly inclined towards adopting software solutions that streamline their workflow and provide accurate implantation planning.

On the flip side, challenges such as regulatory constraints and the high cost associated with implementing advanced software solutions can impede the market's growth. Regulatory hurdles often slow down the approval process for new software, delaying its availability to practitioners. Additionally, the substantial upfront costs and ongoing maintenance expenses may act as barriers for smaller dental practices.

Furthermore, the market is not immune to the potential impact of economic downturns and uncertainties. Economic fluctuations and uncertainties can lead to a reduction in capital investments by dental professionals, affecting the overall market growth. It is essential for stakeholders in the dental implantation planning software market to navigate and adapt to such challenges effectively.

Looking ahead, there lies a promising landscape of opportunities for the market in the coming years. The increasing prevalence of dental disorders and the growing aging population are factors that are likely to fuel the demand for dental implantation planning software. As more individuals seek dental treatments, the need for accurate and efficient planning tools is expected to rise, presenting lucrative prospects for market players.

While growth factors drive the US Dental Implantation Planning Software market forward, challenges like regulatory constraints and economic uncertainties may pose impediments. Despite these challenges, the market is poised for opportunities, especially with the rising awareness among dental professionals and the continuous technological advancements in the field. The future holds promise for sustained growth, provided the market can effectively address and overcome the obstacles in its path.

MARKET SEGMENTATION

By Product

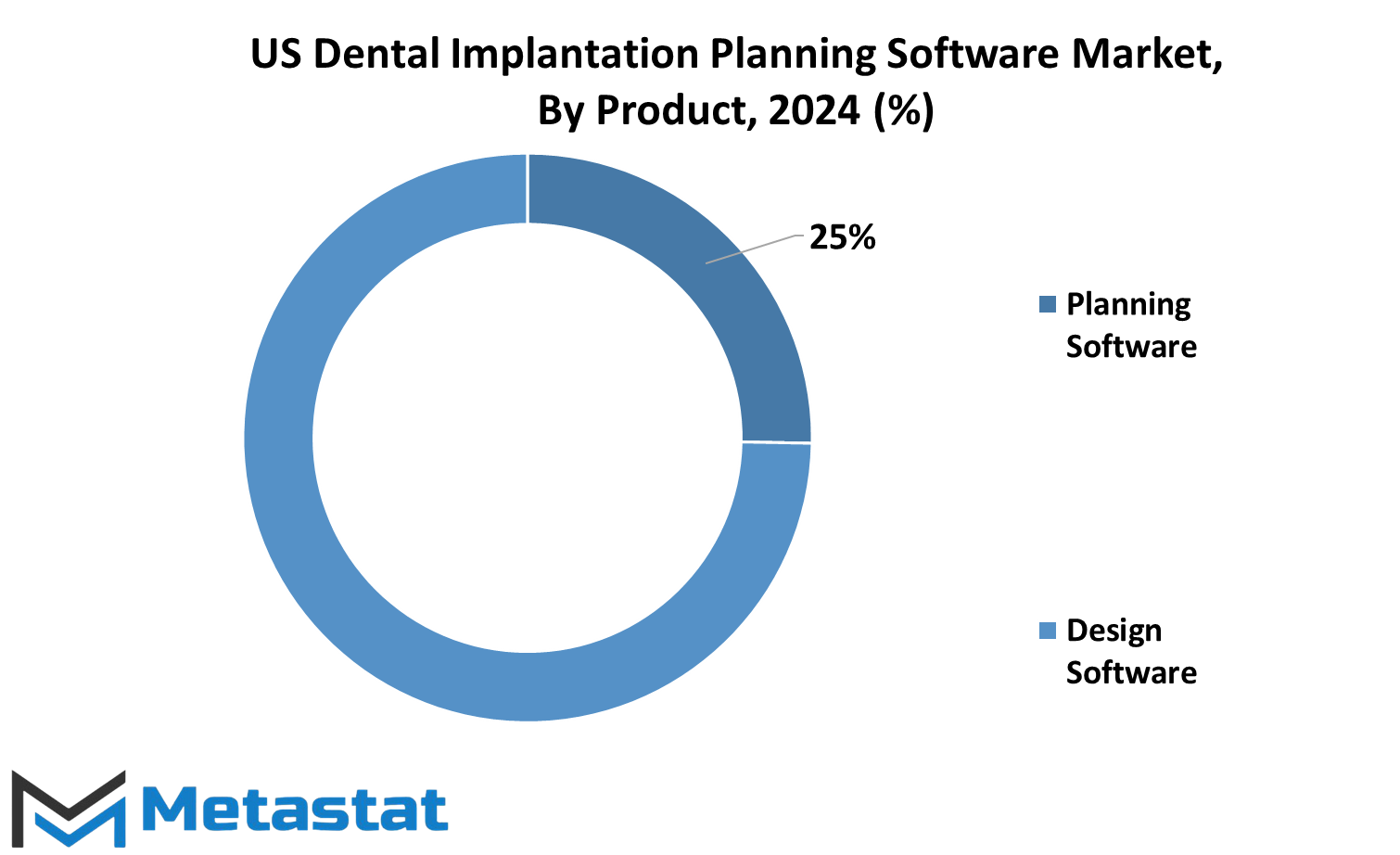

The US Dental Implantation Planning Software market is divided into distinct product categories, specifically Planning Software and Design Software. These segments play a crucial role in the overall landscape of dental implantation technology.

Dental implantation, a significant advancement in the field of dentistry, has paved the way for the development of sophisticated software solutions. Among these, Planning Software and Design Software stand out as essential components in the dental implantation process.

Planning Software is a fundamental tool that aids dental professionals in mapping out the implantation procedure with precision. It allows for meticulous assessment of the patient's oral structure, helping the dentist make informed decisions regarding implant placement. This software streamlines the planning phase, ensuring a comprehensive and accurate approach to dental implantation.

On the other hand, Design Software complements the planning process by offering a platform for creating customized implant designs. This software empowers dental practitioners to tailor implants based on the unique anatomy of each patient. Through intuitive design interfaces, dentists can craft implants that align seamlessly with the individual's oral structure, promoting optimal functionality and aesthetic appeal.

The segmentation of the US Dental Implantation Planning Software market into Planning Software and Design Software reflects the specialized nature of these tools. While Planning Software focuses on the strategic aspects of implantation, Design Software adds a layer of customization to enhance the overall efficacy of the procedure.

The US Dental Implantation Planning Software market, with its distinct product segments, underscores the importance of technology in modern dentistry. As dental professionals continue to embrace these software solutions, the precision and customization they offer contribute significantly to the success of dental implantation procedures across the country.

By End User

The US Dental Implantation Planning Software market is characterized by its diverse end user segments, each contributing significantly to the overall market landscape. In 2023, these segments displayed varying values, shedding light on their respective contributions.

Hospitals, as a key end-user, played a substantial role, recording a valuation of 27.4 USD Million in 2023. This underscores the importance of dental implantation planning software in hospital settings, where precision and efficiency are paramount.

Dental clinics, another vital end-user segment, demonstrated a higher valuation, reaching 33.7 USD Million in 2023. This suggests a substantial reliance on implantation planning software within the dental clinic domain, perhaps driven by the need for specialized tools in dental procedures.

Ambulatory Surgical Centers (ASCs), constituting a distinct end-user category, held a market value of 14.3 USD Million in 2023. The significance of dental implantation planning software in ASCs emphasizes its adaptability across various healthcare settings.

Academic and Research Institutes, rounding out the end-user spectrum, contributed with a valuation of 10.8 USD Million in 2023. This reveals a noteworthy presence of implantation planning software in educational and research environments, underscoring its role in advancing dental knowledge and techniques.

The US Dental Implantation Planning Software market thrives on its diverse end-user segments, with hospitals, dental clinics, ambulatory surgical centers, and academic institutions all playing integral roles in shaping its dynamic landscape. The distinct values attributed to each segment in 2023 provide insights into the unique demands and preferences within these healthcare settings.

COMPETITIVE PLAYERS

The landscape of the US Dental Implantation Planning Software market is marked by the presence of several key players, each contributing to the industry's growth and innovation. These companies play a vital role in shaping the market dynamics and catering to the diverse needs of dental professionals and patients alike.

Among the notable players in the Dental Implantation Planning Software industry are Dentsply Sirona, Dental Wings Inc., Blue Sky Bio, LLC, Planmeca Oy, Exocad GmbH, Institut Straumann AG, ImplaStation, DTX Studio Suite, GuideMia Technologies Inc, and 3Shape A/S. These companies have established themselves as frontrunners, bringing a range of software solutions designed to enhance the precision and effectiveness of dental implantation procedures.

Dentsply Sirona, a prominent player in the field, has been at the forefront of developing advanced software solutions that streamline the implantation planning process. Their commitment to technological innovation has earned them a reputable position in the market, catering to the evolving needs of dental practitioners.

Dental Wings Inc. is another key player contributing to the competitive landscape. Known for its cutting-edge software offerings, the company focuses on providing user-friendly solutions that empower dental professionals in their implantation planning endeavors. This dedication to user accessibility and functionality has solidified Dental Wings Inc.'s standing in the market.

Blue Sky Bio, LLC, adds its unique touch to the competitive mix by offering innovative software solutions that prioritize both efficiency and affordability. Their commitment to making high-quality planning software accessible to a broader range of dental professionals has garnered attention and contributed to their competitive edge.

Planmeca Oy, Exocad GmbH, Institut Straumann AG, ImplaStation, DTX Studio Suite, GuideMia Technologies Inc, and 3Shape A/S round out the list of significant players in the US Dental Implantation Planning Software market. Each of these companies brings its own expertise and specialization, contributing to the diversity of solutions available in the market.

The presence of these key players not only fosters healthy competition but also stimulates continuous advancements in dental implantation planning software. This competition ultimately benefits dental practitioners and patients by ensuring a range of options that cater to different preferences and requirements. As the industry continues to evolve, the contributions of these players will play a crucial role in shaping the future of dental implantation planning software in the United States.

Dental Implantation Planning Software Market Key Segments:

By Product

- Planning Software

- Design Software

By End User

- Hospitals

- Dental Clinics

- Ambulatory Surgical Centers

- Academic & Research Institutes

Key US Dental Implantation Planning Software Industry Players

- Dentsply Sirona

- Dental Wings Inc.

- Blue Sky Bio, LLC

- Planmeca Oy

- Exocad GmbH

- Institut Straumann AG

- ImplaStation

- DTX Studio Suite

- GuideMia Technologies Inc

- 3Shape A/S

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value • Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383