Global 3D Cardiac Mapping System Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

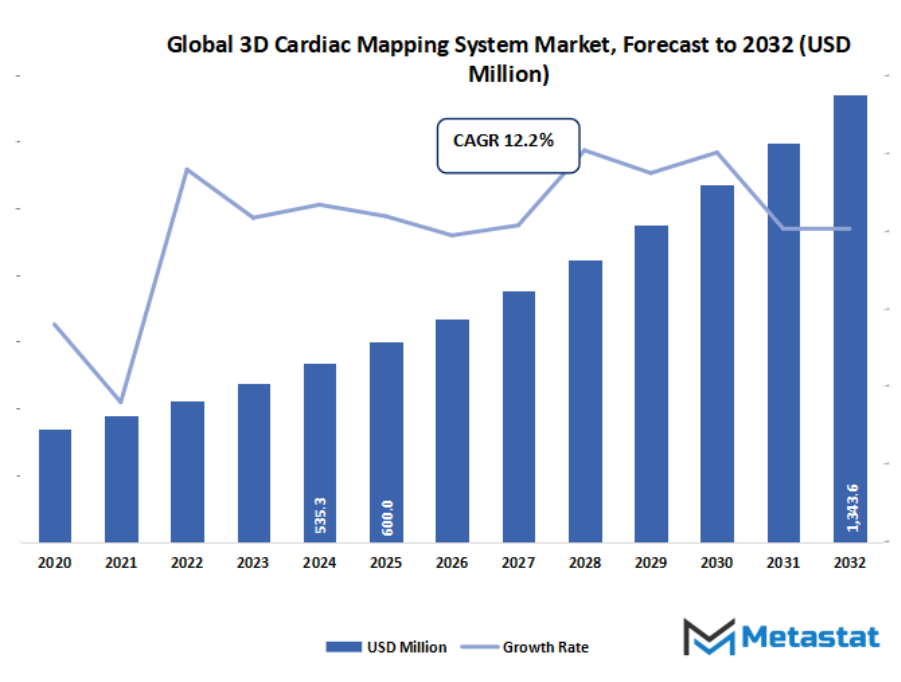

- The global 3D cardiac mapping system market valued at approximately USD 600 million in 2025, growing at a CAGR of around 12.2% through 2032, with potential to exceed USD 1343.6 million.

- Electroanatomical Mapping account for a market share of 52.3% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising prevalence of cardiac arrhythmias and growing adoption of electrophysiology procedures., Increasing demand for minimally invasive and precise cardiac navigation systems.

- Opportunities include: Growing integration of AI, real-time imaging, and catheter-based mapping technologies.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

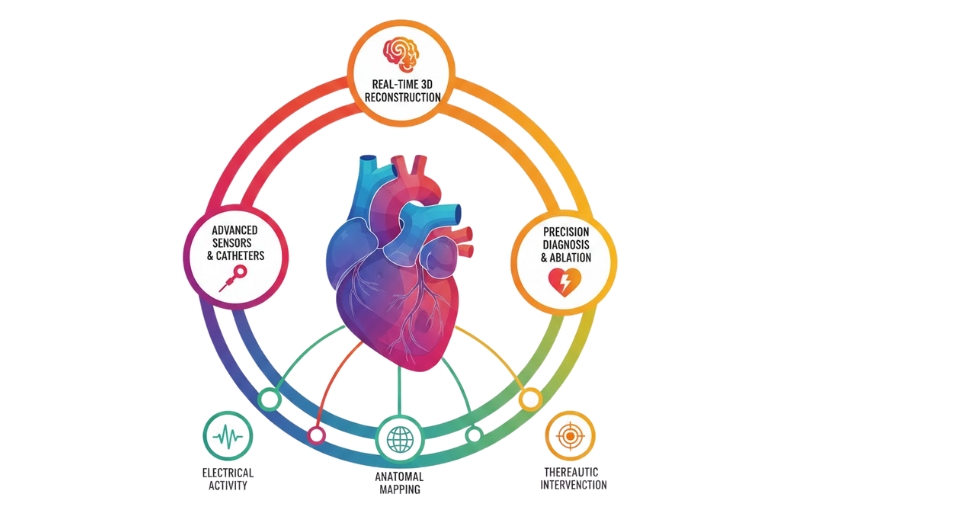

The global 3D cardiac mapping system market will continue to open conversations about how heart-related care may advance in ways that stretch beyond today's expectations. It is an industry that will not be confined to diagnosing rhythm disorders but will, over time, affect how clinicians understand the behaviour of the heart as a whole. As hospitals and research centres dig for clearer insight into electrical patterns that govern every heartbeat, these systems are likely to be studied not only as diagnostic tools but also as instruments of broad inspiration in medical thought. Their future carries with it the prospect of connecting complex data to individualised paths of treatment, forming a space in which cardiologists may find patterns previously hidden behind conventional methods.

As this innovation continues to push forward, the technology will reach outside its existing constraints and perhaps stimulate new forms of collaboration among engineers, clinicians, and data specialists. Discussions of this market's future may well not be about competition per se but about how these systems could help ignite new clinical ways of doing things. In the face of growing attention to digital health worldwide, the convergence of mapping platforms with advanced models of analysis will eventually open up new therapeutic styles of planning that intuitively feel very different both for doctors and patients.

Market Segmentation Analysis

The global 3D cardiac mapping system market is mainly classified based on Technology, End User, Product Type, Channel Type.

By Technology is further segmented into:

- Electroanatomical Mapping

Future growth in the global 3D cardiac mapping system market will strongly attract attention towards electroanatomical mapping as increasing medical accuracy expectations will drive healthcare settings towards dependence on highly detailed visuals of heart activity. Gradual advancements in the design of sensors and precision in software will contribute to better navigation during treatment, thus assisting medical teams in targeted planning.

- Basket Catheter Mapping

Basket catheter mapping will find increased usage in the global 3D cardiac mapping system market, as healthcare settings seek quicker and wider heart electrical readings. The increasing interest in less time-consuming procedures will further open up avenues for the adoption that would allow the medical teams to create wider coverage patterns, thus supporting better planning during complex cardiac treatments.

- Real-time Positional Management

Real-time positional management will bear growing importance in the global 3D cardiac mapping system market as medical environments seek stronger control during cardiac procedures. Advanced tracking tools will support steady monitoring of device movement, thus allowing treatment teams to reduce uncertainty and maintain clearer guidance while conducting high-precision heart-related tasks.

By End User the market is divided into:

- Hospitals

Hospitals will continue to reshape demand within the global 3D cardiac mapping system market as these places handle a number of heart patients in large volumes; hence, requiring advanced diagnostic support. Growing attention toward structured pathways for treatment will continue to create space for enhanced mapping tools that assist hospitals in strengthening performance in high-pressure cardiac care procedures.

- Clinics

Clinics will exhibit gradual adoption across the global 3D cardiac mapping system market as smaller centers seek compact, reliable, and simplified mapping systems. Increasing willingness to integrate advanced heart-monitoring tools will support better outcomes by giving care providers refined information that aids early decision-making during cardiac treatment cycles.

- Diagnostic Centers

Diagnostic centers will play an increasing role in the global 3D cardiac mapping system market as such facilities look to provide accurate cardiac diagnoses without delaying treatment. The need for faster testing methods with substantial information will drive adoption, enabling centers to provide formatted data that informs medical teams at various points of care.

By Product Type the market is further divided into:

- Contact Cardiac Mapping Systems

Contact cardiac mapping systems will find increased adoption in the global 3D cardiac mapping system market, as direct touch helps in providing minute details related to electrical impulses of the heart. Future interest will surge when medical teams look for reliable tools that maintain strong accuracy, especially during complex procedures where performance needs to remain stable.

- Non-contact Cardiac Mapping Systems

In the global 3D cardiac mapping system market, non-contact cardiac mapping systems will attract rising attention as interest in processes that are safer, faster, and less invasive increases. Advancing imaging and sensing methods will help support broader acceptance, allowing treatment teams to capture clear heart signals without extended device contact.

By Channel Type the global 3D cardiac mapping system market is divided as:

- Single Channel Mapping Systems

Single-channel mapping systems would continue to retain a certain user base in the global 3D cardiac mapping system market, particularly in environments where focused electrical readings are necessary. This is expected to see incremental innovations in the future years, catering to basic diagnostic requirements and providing economical solutions for care teams with moderate volumes of cardiac procedures.

- Multi-channel Mapping Systems

Multichannel mapping systems will secure deeper expansion across the global 3D cardiac mapping system market, as advanced procedures demand wider and faster heart data collection. Advances in integrated software and multi-signal coordination will support stronger performance, giving medical teams access to expanded information during intricate cardiac assessments.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$600 Million |

|

Market Size by 2032 |

$1343.6 Million |

|

Growth Rate from 2025 to 2032 |

12.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

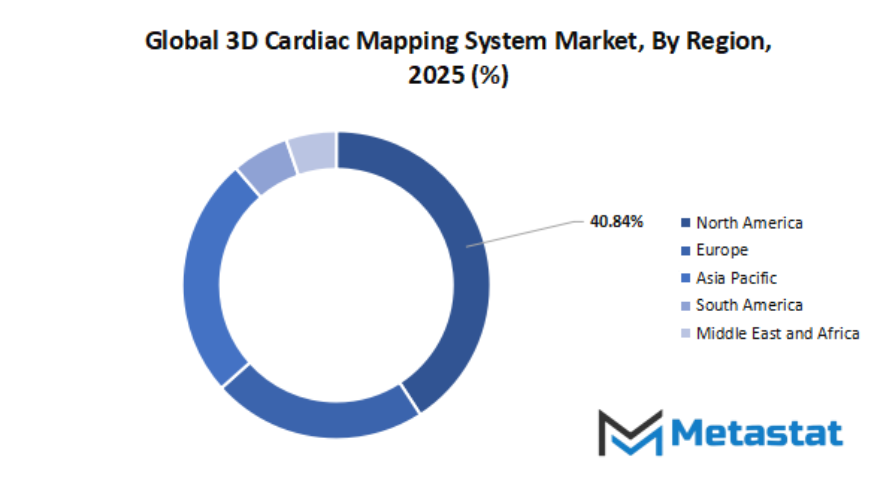

By Region:

- Based on geography, the global 3D cardiac mapping system market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Increasing occurrence of cardiac arrhythmias, coupled with the developing adoption of electrophysiology approaches.

The Global 3-D Cardiac Mapping System Market will benefit traction due to the fact growing cases of irregular coronary heart rhythms are pushing hospitals in the direction of adopting superior strategies of mapping, which help quicker analysis and improved treatment planning. Growing choice for electrophysiology tactics will toughen the want for systems imparting reliable visualization and managed guidance in medical settings.

Growing call for for minimally invasive cardiac navigation systems which are relatively correct.

The Global 3-D Cardiac Mapping System Market will see elevated usage of tools that help gentle interventions, as healthcare centers work towards minimum patient soreness and decreased recuperation time. Advances in imaging and navigation will foster broader system popularity for constant accuracy in hard cardiac opinions and healing steps.

Restraints & Challenges:

High costs of systems and procedures reduce access in emerging economies.

The growth in the global 3D cardiac mapping system market will further be dampened by slow expansion in cost-sensitive regions, where hospitals have to grapple with tight budgets. High costs of installation, maintenance, and procedures will limit wider diffusion, furthering the gap between highly resourced advanced centers and facilities that rely on less expensive diagnostic practices.

Complexity in operation requiring skilled electrophysiologists.

The growth of the global 3D cardiac mapping system market will be hindered by the fact that trained specialists are needed for the operation of such complex mapping steps and associated data interpretation. Inadequate availability of experienced electrophysiologists will impede the adoption of such platforms, particularly in regions where special training programs and cardiac advanced units are still underdeveloped.

Opportunities:

Integration of AI, real-time imaging, and catheter-based mapping technologies is growing.

Rapid progress in intelligent software, better visualization, and refined catheter tools that support smooth navigation inside the heart will benefit the global 3D cardiac mapping system market. Smarter automation and synchronized imaging will help clinicians reach faster insights, creating strong opportunities for improved outcomes and advanced treatment strategies across healthcare environments.

Competitive Landscape & Strategic Insights

The global 3D cardiac mapping system market is poised to march ahead with a broad combination of well-established international names and aggressive regional players continuing to enter this space. Every participant will introduce their own unique strength, and in this blend lies the way in which new ideas would reach hospitals and clinics around the world. The structure of the industry stands not on one group but grows through steady competition where continuous updates in medical technology will guide the way for companies to adjust their positioning.

The large players like Olympus Corporation, Medtronic Plc, GE Healthcare, Siemens Healthineers AG, Smith + Nephew, Abbott Laboratories, Intuitive Surgical Inc., Koninklijke Philips NV, Stryker Corporation, and Zimmer Biomet would ensure that their impact continues to influence progress. Many of these groups have long been committed to advanced medical tools, and their presence would add a sense of stability to the global 3D cardiac mapping system market. Their long history within medical devices will be a factor in helping them introduce systems that will support doctors in understanding heart conditions with more accuracy and speed.

Along with these leaders, some companies, such as Biosense Webster, Inc. (Johnson & Johnson), Boston Scientific Corporation, Kardium Inc., Acutus Medical Inc., APN Health LLC, BioSig Technologies Inc., BIOTRONIK SE and Co. KG, Catheter Precision Inc., CoreMap Inc., EPMap-System GmbH, MicroPort Scientific Corp., and Sichuan Jinjiang Electronic Science and Technology Co. Ltd., will continue to build their space in the global 3D cardiac mapping system market. Such names often show a targeted improvement, smaller-scale specializations, or new design ideas to make a difference. Their quick pace of movement will enable the industry to remain open toward newer methods that improve patient care.

This mix of long-standing giants and agile new developers will allow steady movement in the global 3D cardiac mapping system market. Each company will play a unique part in shaping future progress, and this balance will help ensure that new tools reach doctors with better clarity, accuracy, and safety. As competition grows, the industry will continue to shift toward solutions that make heart mapping more reliable for medical teams across the world.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 600 million in 2025 to over USD 1343.6 million by 2032. 3D Cardiac Mapping System will maintain dominance but face growing competition from emerging formats.

In the coming years, this industry is not only going to monitor irregular rhythms but will be in a position to shape long-term thinking on cardiac care. The conversations shaped by these systems may lead to broader interpretations of disease progression, early signals, and patient-specific responses. As the technology grows in confidence and accuracy, it will gently expand its presence into teaching environments, global research collaborations, and decision-making processes that guide tomorrow's cardiology practices. In making this transition, the market will carry with it a sense of purpose, stretching far beyond standard diagnostics, leaving space for new ideas and possibilities to unfold.

Report Coverage

This research report categorizes the 3D Cardiac Mapping System market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 3D Cardiac Mapping System market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the 3D Cardiac Mapping System market.

3D Cardiac Mapping System Market Key Segments:

By Technology

- Electroanatomical Mapping

- Basket Catheter Mapping

- Real-time Positional Management

By End User

- Hospitals

- Clinics

- Diagnostic Centers

By Product Type

- Contact Cardiac Mapping Systems

- Non-contact Cardiac Mapping Systems

By Channel Type

- Single Channel Mapping Systems

- Multi-channel Mapping Systems

Key Global 3D Cardiac Mapping System Industry Players

- Olympus Corporation

- Medtronic Plc

- GE Healthcare

- Siemens Healthineers AG

- Smith + Nephew

- Abbott Laboratories

- Intuitive Surgical Inc

- Koninklijke Philips NV

- Stryker Corporation

- Zimmer Biomet

- Biosense Webster, Inc. (Johnson & Johnson)

- Boston Scientific Corporation

- Kardium, Inc.

- Acutus Medical Inc.

- APN Health LLC

- BioSig Technologies Inc.

- BIOTRONIK SE and Co. KG

- Catheter Precision Inc.

- CoreMap Inc.

- EPMap-System GmbH

- MicroPort Scientific Corp.

- Sichuan Jinjiang Electronic Science and Technology Co. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383