MARKET OVERVIEW

The global network performance monitoring market will remain a key segment in the larger information technology and telecommunications sector due to increasing reliance on smooth digital operations. This market will transcend performance measurement into fields beyond the traditional latency detection or packet loss. The industry will start determining how companies plan, manage, and re-strategize their digital infrastructure. With emphasis on providing seamless user experiences and facilitating smart decision-making, network performance monitoring will not be a reactive function anymore but will transform as a proactive agent integrated within the strategic plan of business processes.

In the next few years, the global network performance monitoring market will have an increasingly complex role to play in synchronizing with AI-powered network smarts, decentralized enterprise paradigms, and cloud-native architectures. This shift will be driven by an increasing need for observability that is capable of looking beyond dashboards and alerts. Businesses will look for solutions that don't just report on performance metrics, but deliver actionable foresight. As networks become increasingly dispersed with hybrid and multi-cloud-based deployments, the solutions in this market will need to function with real-time contextual understanding across highly complex digital domains. Static monitoring methods will increasingly give way to dynamic, learning-driven techniques that will foresee congestion, security threats, or system inefficiencies before they affect end-users.

The competitive landscape of the industry will also change. Legacy players will not be able to base themselves on legacy solutions, and new players will shake things up with more intelligent, lighter, and more agile platforms. These platforms will provide embedded intelligence that can process enormous amounts of data without burdening human operators. This transition will lead to autonomous network environments in which bandwidth allocation decisions, load balancing, or fault correction would be made automatically without any direct human intervention. These developments will transform the goals and range of the global network performance monitoring market from visibility to ongoing optimization.

In addition, as digital economies grow and are based on global connectivity, the importance of location-independent, scalable monitoring abilities will increase. It will no longer be enough to monitor cloud endpoints or data centers in a vacuum. The emphasis will turn toward end-to-end network paths, with several different vendors, platforms, and geographies involved. Firms will have to build credibility in their systems not based on how they function in routine conditions but on how robustly they react to stress, breakdowns, and surges in demand. In such a scenario, network performance monitoring will be not just an ancillary operation but a strategic enabler directly linked to business continuity and reputation management.

In brief, the global network performance monitoring marketplace will now not continue to be inside the area of traditional performance diagnostics. It will become an smart ecosystem that equips groups with foresight, agility, and the confidence to scale friction-unfastened. This ahead-questioning metamorphosis will reshape the way corporations approach community fitness, no longer only as a technical parameter but as a commercial enterprise-critical issue in a data-pushed era.

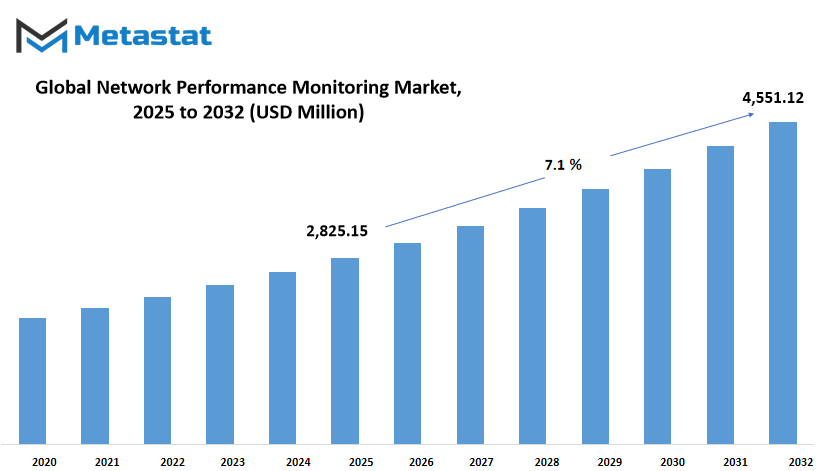

Global network performance monitoring market is estimated to reach $4,551.12 Million by 2032; growing at a CAGR of 7.1% from 2025 to 2032.

GROWTH FACTORS

The global network performance monitoring market, as explicated by Metastat Insight in its recent analysis, is consistently growing in significance as businesses demand seamless digital encounters and non-stop access to services. As more businesses extend their digital endeavors, handling the performance and consistency of their networks has turned into more than merely a technical endeavor it's a business objective. As enterprise network architecture becomes more sophisticated and uptime is no longer negotiable, the function of performance monitoring tools has evolved from being auxiliary to absolutely crucial.

Companies today increasingly depend upon cloud-based systems, remote access systems, and international operations, all of which require consistent and responsive networks. This increasing reliance has given rise to a pressing necessity for traffic monitoring tools that not only track traffic but also assist in the detection of potential weak areas prior to them becoming actual issues. A few seconds of delay in data transfer can throw work processes off-kilter, impact customer experience, and end up causing monetary losses. These issues have prompted numerous companies to spend money on performance monitoring systems that provide real-time information and keep their networks responsive and efficient.

On the other hand, however, the expense and technical difficulty of deploying these systems particularly in big or mixed environments may be hard to justify. Most companies hold back because of the amount they have to invest in infrastructure as well as trained people to handle the systems efficiently. These challenges are even more acute for companies spanning hybrid environments, where traditional systems need to be integrated with newer, cloud-first platforms. In these instances, the integration process not only becomes costly but also time-consuming, slowing down the adoption pace.

Reducing this issue is emphasized on data privacy. In the form of monitoring tools, scan in abundance of traffic, anxiety is increasing on what is being done with that data. Many industries have strict compliance guidelines, and any slip in handling sensitive data can spend them in punishment or loss of customer's trust. These things caution some companies, especially those working in regulated industries such as finance or healthcare, where someone will have to worry constantly about being in compliance.

Despite these obstacles, hope is the cause of hope. The application of artificial intelligence and automation in this region is creating promising avenues. Through smarting performance monitoring, AI tools will be able to identify users before feeling possible issues. This change from reactive to active management will reduce downtime, increase the user experience, and lighten the charge on IT teams. Automation will also help to overcome general problems, which will enable human experts to focus on more complex tasks. These developments will not only conserve time and resources, but will also make the network performance monitoring more scalable and versatile for all sizes.

As organizations become more digital in their appearance and work, the need for continuous network performance will continue to increase. Cost and compliance issues are valid and they should be contacted carefully, but long-term benefits providing these systems will be particularly beating issues with the advent of intelligent technologies.

MARKET SEGMENTATION

By Hardware

The global network performance monitoring market is witnessing increased focus as more organizations make consistent and reliable network activity a priority. In the larger market, hardware finds an important place to ensure seamless digital functioning. Of the hardware categories, Network Packet Brokers (NPBs) Appliances on my own will attain a really worth of $618.42 million, reflecting their indispensable function in assisting firms in managing information flow efficiently by using collecting, filtering, and directing network visitors to monitoring equipment.

Some other essential hardware classes in this area are Network Terminal Access Points (TAPs), which provide an unobtrusive approach of monitoring information passing via a community. These gadgets allow IT directors to monitor site visitors without interfering with the gadget's overall performance and retaining transparency and command. Network Access Control (NAC) Appliances are also becoming increasingly more full-size.

Such gear control user get right of entry to consistent with pre-hooked up policies, making sure they play a important position within the enforcement of security standards and compliance on inner and outside networks. Moreover, Network Performance Monitoring Platforms form the muse of this category with the aid of supplying real-time insight into network activity, allowing groups to discover troubles before those have an effect on productiveness.

As digitalization continues to redefine sectors, the need for reliable monitoring hardware will never waver. Companies will depend on these tools for not only resolving problems, but also for proactive network administration. The future for the global network performance monitoring market will be one of more blended hardware and software, smarter handling of data and heightened security responsiveness. As companies extend their IT infrastructure, the importance of trusty, dedicated hardware in the global network performance monitoring market will only intensify.

By Services

The global network performance monitoring market will hold growing as corporations turn out to be increasingly more reliant on dependable, high-pace connectivity with a purpose to perform effectively. Network overall performance tracking is now not an afterthought; it's now a key aspect of enterprise strategy. Businesses have to ensure their systems are capable of managing accelerated records degrees, user necessities, and protection expectations. This change has created a excessive demand for offerings that ensure community fitness and overall performance at all times.

Professional Services and Managed Services make up the global network performance monitoring market via offerings. Professional Services are normally referred to as in for specialised paintings inclusive of implementation, optimization, or isolated troubleshooting. These professionals assist organizations in interpreting problematic community troubles and provide quick-time period recommendation to get systems up and strolling. On the opposite hand, Managed Services provide continuous assist. They take at the duty of monitoring and managing networks across the clock, freeing up in-residence teams to recognition on different areas. This technique is mainly beneficial for agencies without a massive IT department or the ones trying to avoid provider interruptions that could hurt productiveness or purchaser experience.

As networks expand in complexity and size, both Professional and Managed Services will become increasingly vital for enabling business to stay one step ahead. Many companies are discovering that anticipating and preventing downtime saves money in the long term. As business follows into the digital age, keeping the network fast and available is not merely a technical endeavor it's a business imperative.

By Enterprise Size

The global network performance monitoring market is coming into the spotlight as organizations more and more depend on digital systems for communication, data exchange, and normal operations. With networks expanding further, performance and reliability become key. Companies are no longer ready to tolerate slow connections or sudden downtimes. They desire seamless operations, real-time visibility, and rapid resolutions to network problems. This need has created an opening for network monitoring and management technologies and services that ensure systems remain efficient and responsive.

Throughout various business environments, the demand for reliable network performance tools is increasing rapidly. Small and medium-sized businesses (SMEs) and large organizations are both coming to understand the importance of having a consistent system available. By size of enterprise, the market is also segmented into SMEs and Large Enterprises. While bigger companies tend to implement sophisticated tools to manage intricate network architecture, SMEs are closing the gap with more affordable and scalable solutions. Such a move indicates network reliability is no longer a concern for large businesses only it's a concern for every business now.

The emphasis is no longer entirely on repairing issues when they occur. Now, there is more emphasis placed on foretelling problems ahead of time. Software that can track network traffic in real time, detect anomalies, and notify teams immediately are becoming increasingly prevalent. It enables organizations to respond quicker and get in front of disruptions. Therefore, IT departments are transitioning from reactive to more strategic in their function.

Another fundamental shift is the increasing adoption of cloud-based infrastructure and remote work patterns. These have compelled businesses to review how they secure and monitor networks with a presence in multiple locations. Rather than doing this through traditional approaches, firms are looking to more intelligent, more adaptable monitoring technologies. This change is opening up new market opportunities for providers to provide services to address today's needs.

What differentiates this market is increased pressure to deliver seamless digital experiences for customers. Whether remote workers or online consumers, no one wants to experience sluggish speeds or loss of connection. Increased use of digital tools will keep dictating how firms invest in network performance monitoring in the future.

In short, the global network performance monitoring market is not longer simply about keeping things up and running it's about keeping businesses running smarter. When businesses expand, evolve, and are challenged by the next issues, they will increasingly go back to solutions that deliver speed, stability, and control. The global network performance monitoring market is not only growing in terms of size, but also in how it relates to the day-to-day needs of contemporary businesses.

By End User

The global network performance monitoring market keeps growing as digital connections become the hub of day-to-day business in various industries. From cloud platforms and telecom service providers to public entities, the necessity to ensure smooth network performance is no longer an option but a priority. With increasing reliance on web-based systems, companies and institutions will find themselves relying more on products that track, identify, and troubleshoot network-related problems prior to causing significant disruptions.

For IT and telecommunication service providers, network reliability has a direct impact on customer satisfaction and service continuity. A delay or disruption can mean huge setbacks for both the providers and the clients. Therefore, such companies spend on sophisticated monitoring systems to monitor performance across devices, identify faults, and optimize utilization in real-time. The instruments enable quicker troubleshooting and prevent expensive downtime, particularly in areas where demand for high-speed connectivity is developing rapidly.

Cloud hosting providers experience another type of stress. With cloud computing hardware shared and remotely accessible, performance in large-scale infrastructures must be maintained at all times. Performance monitoring tools enable such providers to provide service consistency, handle data movement, and ensure that applications running in the cloud do not experience any glitches. As increasingly more companies transition their businesses into the cloud, performance monitoring shall be at the forefront of maintaining user confidence and ensuring services remain trouble-free.

Governments and public sector organizations have also realized the value of fault-free networks. Whether it's for emergency communication, operating public databases, or energizing citizen services, a glitch can prove catastrophic. These organizations are supposed to implement better network visibility solutions to ensure systems are responsive and secure. In an era when electronic governance is gaining popularity, reliable network infrastructure will become even more critical.

The global network performance monitoring market, by end user, is influenced extensively by these primary industries: IT and telecom service providers, cloud service providers, governments and public sector units, and others. Each has its own motivations behind embracing performance monitoring solutions, but all have one thing in common to remain connected without compromise. As networks expand and become more complex and traffic gets heavier, the function of network monitoring will be increasingly crucial, enabling all user groups to stay one step ahead of future issues.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,825.15 million |

|

Market Size by 2032 |

$4,551.12 Million |

|

Growth Rate from 2025 to 2032 |

7.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

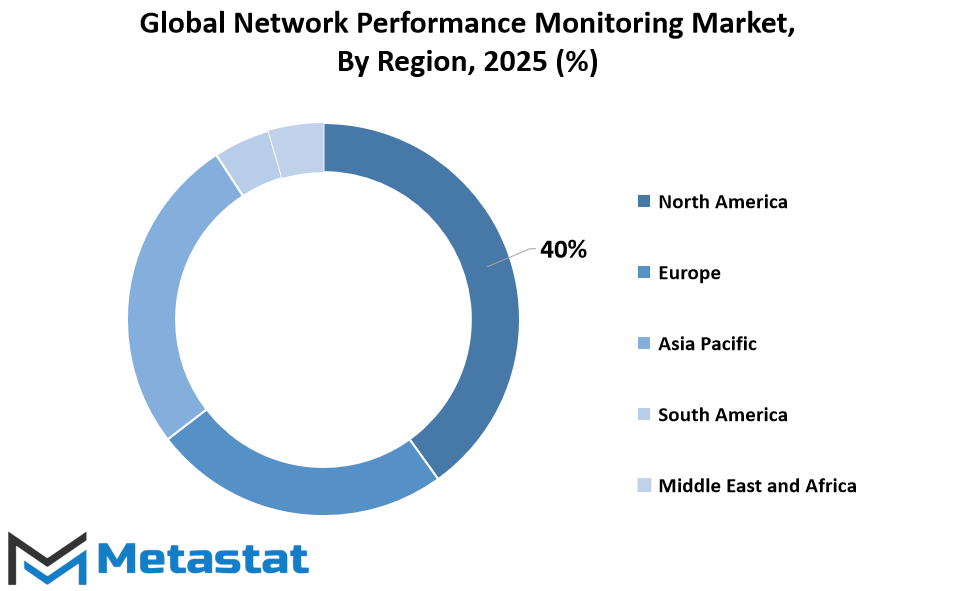

The global network performance monitoring market demonstrates a unique trend when considered from a geographical perspective. Various geographies have their priorities, technology infrastructure, and significance of implementation, which color the manner the tracking tools get adopted and scaled up. In North America, nations along with America, Canada, and Mexico are at the vanguard with high utilization of statistics and aggressive efforts towards digital transformation. This vicinity is served with the aid of big generation corporations, sturdy net infrastructure, and increasing call for for seamless connectivity, specially as far off paintings and online services hold to amplify.

On the opposite facet of the Atlantic, Europe mirrors a corresponding interest in maximizing community visibility. The location, including the UK, Germany, France, Italy, and elsewhere in Europe, is reason on boosting its virtual economic system. As agencies penetrate in addition into cloud computing systems and embody rising technologies, they increasingly rely on solutions that offer secure and solid statistics transmission. This requirement is followed via regulatory initiatives within the European Union, which additionally affect the improvement and implementation of monitoring gear to address specific compliance requirements.

Traveling similarly east, the Asia-Pacific place is some of the maximum colourful in technological improvement. Together with India, China, Japan, South Korea, and others in the location using virtual transformation at exceptional stages, the global network performance monitoring market reviews ongoing activity. Rapidly growing internet penetration and extending mobile networks translate to sustained demand for systems that prevent interruptions and evaluate traffic performance. The nations also have a diversity of mature and emerging economies, resulting in a broad set of use cases and product adoption patterns.

In South America, countries such as Brazil and Argentina are spending more on digital infrastructure. The rate may differ from one country to another, but the need for network monitoring is still on the increase due to the rising importance of online platforms in business and government services. Firms in these places are slowly replacing their systems with ones that meet international standards, making opportunities for providers in this field better.

At the same time, the Middle East & Africa region is slowly but surely following international trends. States like the GCC countries, Egypt, and South Africa are clearly demonstrating technological progress. With expanding internet services and industry upgrades, priority has turned to improved network management. The increased number of users and higher dependency on digital services make it an area to monitor in the next few years. These markets, together with the remaining countries in each grouping, add to an overall view of how the market will develop, influenced by regional demands and technological readiness.

Looking at these regional bifurcations, it is obvious that the global network performance monitoring market will not progress uniformly. Rather, each region's pace and direction will be contingent upon its infrastructure, policy environment, and digital agenda. This makes it more complicated but also provides varied growth opportunities for firms that play in this space.

COMPETITIVE PLAYERS

Composed by Metastat Insight, the global network performance monitoring market report gets a closer look at what organizations around the globe are doing to address the increasing demand for secure and dependable digital infrastructure. With businesses increasingly depending on networked systems to operate, supply customers, and manage internal communications, the capacity to continually monitor and optimize network performance is more crucial than ever. Whether it's overseeing massive data movements, maintaining minimal downtime, or detecting problems before they become threats, performance monitoring has become an essential function for today's enterprises.

The current marketplace is defined by an immediate need for speed, visibility, and control. As digital platforms continue to grow in size and sophistication, companies can't afford to operate in the dark. They need tools that not only monitor how a network is performing but also provide predictive analysis, automated notifications, and data analysis to inform decision-making. This increasing reliance on smart monitoring tools is creating a competitive market in which responsiveness and innovation are heavy-hitters.

Several established players and upstart innovators are actively defining this space. Some of the prominent players in the Network Performance Monitoring market are Cisco Systems, Inc., SolarWinds Worldwide, LLC, Broadcom Inc. (CA Technologies), NETSCOUT Systems, Inc., Riverbed Technology, Inc., ExtraHop Networks, Inc., ManageEngine (Zoho Corporation), Paessler AG, Nagios Enterprises, LLC, Viavi Solutions Inc., Datadog, Inc., Splunk Inc., Opsview, Corvil (Pico), Kentik Technologies, Inc., Ixia (Keysight Technologies), and LiveAction, Inc. These organizations are focused on improving the reliability and efficiency of digital environments, offering solutions that are tailored to various network types and sizes.

In the years to come, we will witness growing focus on automation, cloud infrastructure, and AI-driven diagnostics. With remote work and cloud computing being an integral part of the business landscape now, the capability to identify performance issues early on, even in hybrid environments, will not be an indulgence but a requirement. Businesses in this space will keep breaking ground, catering to customer requirements of increased transparency, improved speeds, and improved cost management.

As the global network performance monitoring market expands in importance, it will not only assist IT departments but also assist organizations in bringing network behavior in line with strategic objectives. By breaking down technical insights into actionable results, these tools are emerging as more than a safety net they're becoming business-critical.

Network Performance Monitoring Market Key Segments:

By Hardware

- Network Packet Brokers (NPBs) Appliances

- Network Terminal Access Points (TAPs)

- Network Access Control (NAC) Appliances

- Network Performance Monitoring Platforms

By Services

- Professional Services

- Managed Services

By Enterprise Size

- SMEs

- Large Enterprises

By End User

- IT and Telecom Service Providers

- Cloud Service Providers

- Governments and Public Sector Units

- Others

Key Global Network Performance Monitoring Industry Players

- Cisco Systems, Inc.

- SolarWinds Worldwide, LLC

- Broadcom Inc. (CA Technologies)

- NETSCOUT Systems, Inc.

- Riverbed Technology, Inc.

- ExtraHop Networks, Inc.

- ManageEngine (Zoho Corporation)

- Paessler AG

- Nagios Enterprises, LLC

- Viavi Solutions Inc.

- Datadog, Inc.

- Splunk Inc.

- Opsview

- Corvil (Pico)

- Kentik Technologies, Inc.

- Ixia (Keysight Technologies)

- LiveAction, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252