MARKET OVERVIEW

The UAE Oil Storage Terminal market will continue to remain a key player in the oil and gas industry within the region with significant infrastructure for storing, managing, and distributing crude oil and refined petroleum products. The UAE, having established itself as an oil hub, will continue to be a major energy transit center handling millions in terms of barrel movements on a daily basis. This market will play an important role in supporting the rising needs for efficient storage solutions meeting international standards and regulatory frameworks.

Another chief pull that acts in favor of the UAE Oil Storage Terminal market is its strategic location. As an important junction of oil movement from the Middle East to various destinations worldwide, the UAE will remain the gateway for energy resources. Storage terminals will facilitate the uninterrupted movement of oil from producers to refineries, without interruption to facilitate smooth operation of the supply chain. Such terminals will also act as important linkages to balance oil stocks for export and local consumption.

In the next few years, construction of new state-of-the-art storage terminals is likely to become a sort of regional focus for the UAE. The changes there will reflect a growing trend in an opposite direction of the market toward increased capacity toward both classical oil and the newer petroleum products now gaining prominence on the world stage. These advancements will address the growing demand for facilities that can handle even more complex logistics associated with diverse energy products. Increasing automation and digitization use in storage management will further optimize operations, improving efficiency and minimizing human error. This evolution will help redefine oil storage as not merely a functional arm of the supply chain but the advanced technological arm of the energy landscape.

The UAE Oil Storage Terminal market will continue to attract investments from both government and private sectors to expand capacity and improve supporting infrastructure for future oil activities. Modernizing existing facilities would underpin these improvements to ensure operational efficiency and safety of the highest standard. The increasing demand for storage facilities will bring about enhanced partnerships with energy companies, logistics providers, and technology companies furthering joint efforts toward exploiting market opportunities.

Consequently, the UAE Oil Storage Terminal market will experience opportunities due to sustainability measures being taken in the UAE. Environmental accountability will perhaps be heightened, such that new projects will apply pioneering technologies conceived to decrease carbon footprints and bolster eco-friendly operations.

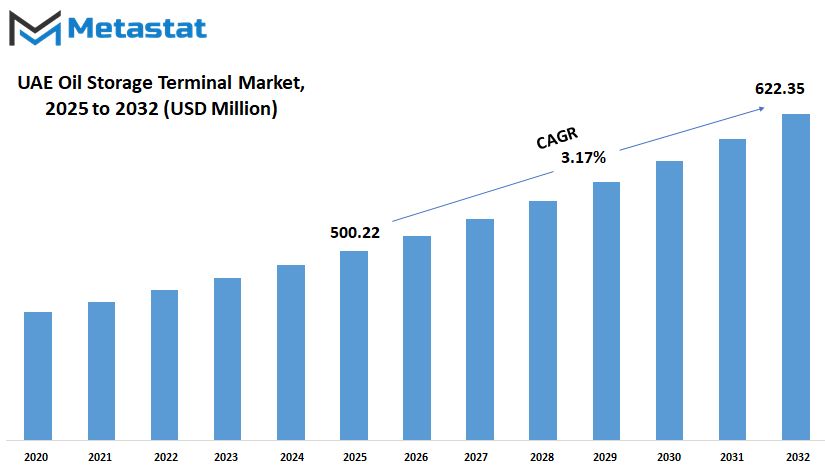

UAE Oil Storage Terminal market is estimated to reach $622.35 Million by 2032; growing at a CAGR of 3.17% from 2025 to 2032.

GROWTH FACTORS

The UAE Oil Storage Terminal market is experiencing good growth due to several factors and challenges. The important driver is the growing global demand for oil storage solutions. Where oil prices fluctuate, there is a lot of need for more flexible and also secure storage options. Such demands thus create a high requirement for facilities capable of handling large volumes of oils efficiently to allow businesses a little better inventory management and mitigate risks related to price instability. The UAE being an important place at the crossroads of international trade routes facilitates an important role that country plays in oil logistics, as ports and storage terminals deal with oil transport and storage.

However, developing oil storage infrastructure poses some challenges to be faced by the UAE. The major constraint is the high capital investment needed for the advanced oil storage facilities, which require heavy investment in setting up advanced terminals. Establishing state-of-the-art terminals provides huge financial resources and becomes a barrier for smaller companies or investors interested in coming to the market. On top of that, safety and environmental regulations, coupled with rising sustainability concerns, have also compelled this sector. Efforts should be made to ensure good effective oil storage, but at stricter environmental standards, which now costs higher in operations and usual use of newer eco-friendly technologies.

On the flip side, it also offers several opportunities for the market. One major opportunity is the increasing need for energy security and strategic oil reserves. As political upheaval and economic uncertainties around the world increase, most countries seek to strengthen energy security by setting up reserves. The UAE, with its well-established infrastructure, is in a good position to cater to this need, providing secure storage facilities for governments and corporations wanting to secure their oil supplies.

The rising renewable energy sector presents another very exciting opportunity to the UAE Oil Storage Terminal market. With growing awareness about sustainable energy sources, there is a greater demand for multi-oil storage services. The increasing demand for storage solutions that will be able to supply a combination of traditionally generated and renewable energy sources, or that will be the transition to hybrid models, will likely multiply in upcoming years. This opens up new avenues for growth for the companies that are able to adapt and offer more integrated storage solutions that will meet the needs of both conventional and emerging energy markets.

Conclusively, the demand for secure storage solutions and the growing focus on energy security still provide much room for development despite challenges such as high investment costs and environmental regulations in the UAE Oil Storage Terminal market.

MARKET SEGMENTATION

By Type

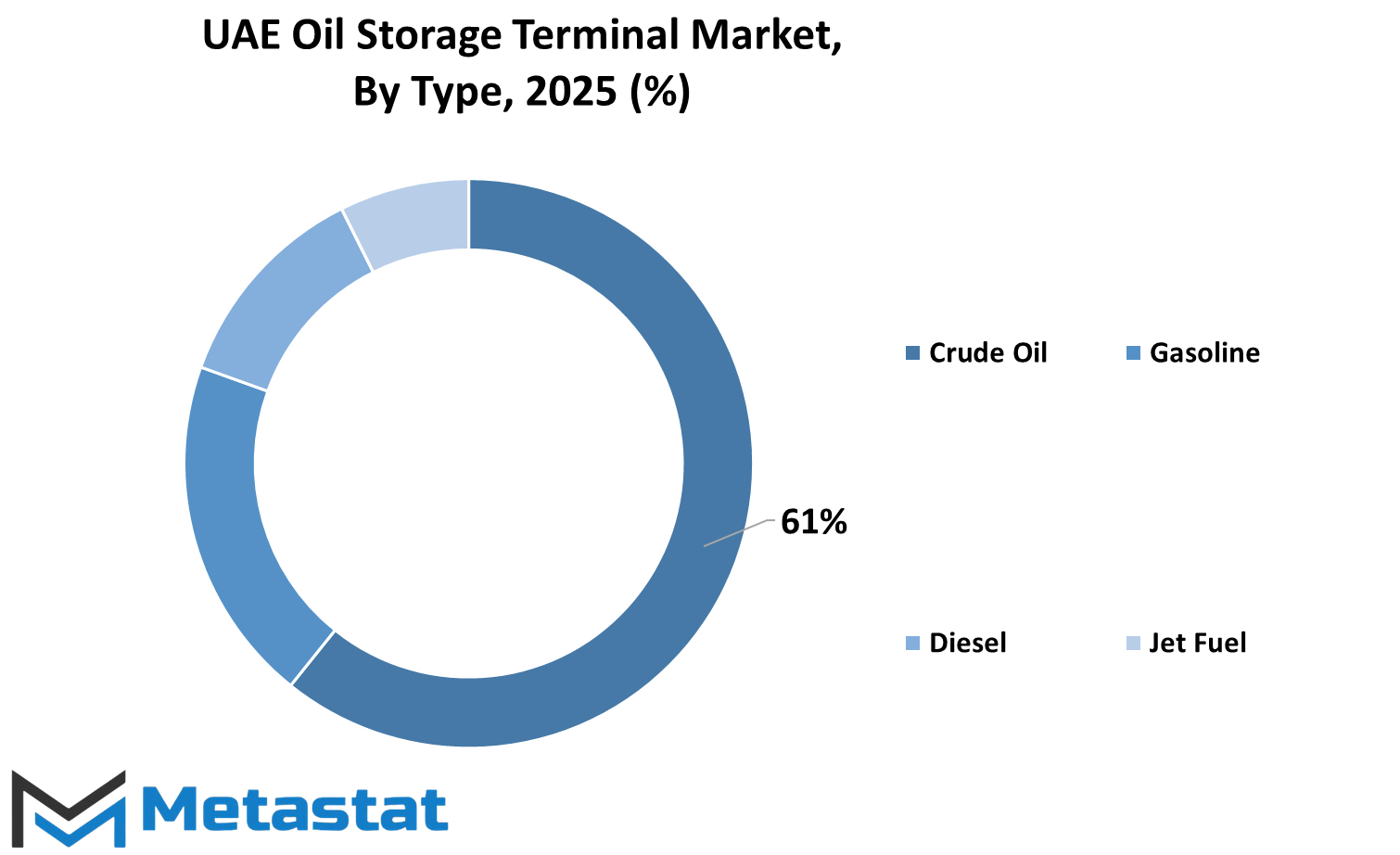

Detron says the United Arab Emirates Oil Storage Terminal market is an essential entity of world energy, making provisions for storaging and movement of different types of oil and fuels. It would therefore be seen to be stratified into several different types depending on the different kinds of oil and fuel being taken into storage. Among the most noteworthy of these main categories is crude oil, having a market value of $71.6 million, giving an insight into its importance to the storage industry. In addition to crude oil, other products are stored including gasoline, diesel, jet fuels, and so forth.

Crude oil, being the true crude form of petroleum, has to rest on huge storage capacities owing to its much-needed position in global energy generation. Thus, crude oil storage constitutes quite a large sector as it really underpins the production of refined petroleum products such as gasoline and diesel around which crude oil storage revolves. The importance of crude oil storage in the oil storage industry is accentuated by virtue of it carrying a colossal amount of $71.6 million.

Gasoline and diesel, besides being covered under such a label, make up quite substantial segments within the oil storage market. Gasoline stands among the most-used fuels in transport and other industries, whereas diesel primarily pertains to trucks, buses, and other heavy machinery. Both of these have special storage requirements for quality and stability reasons; hence their storage facilities are specially designed to cater to these requirements.

Jet fuel is yet another key segment within oil storage. The demand for storage of jet fuel grows in tandem with the growing demand for air transportation all over the world. Timely storage and prompt movement of jet fuels ensure uninterrupted supplies for the airline company's operation of its fleets. This part becomes vital in such high traffic areas in the air, such as in the UAE, where aviation is the greatest contributor to the economy. There is finally a comprehensive category: others; that is, the rest of all other classes of fuels and oils that may just not be classified or categorized as crude oil, gasoline, diesel, or jet fuel. Note that industrial oils, lubricants, or even alternative energy sources may fall into this category; however, this classification stands for the overall variety of fuel types stored at oil terminals, allowing the market to cater to diverse industries and their particular energy needs.

In conclusion, the UAE Oil Storage Terminal market is the backbone of the global energy supply chain. With the above five categories of crude oil, gasoline, diesel, jet fuel, and others disentangled, the market ensures the transportation and storage of major energy sources in an efficient manner. As the world increases in demand for oil and fuels, there will be an increased need to have working operational storage in place.

By Tank Type

The oil storage terminal market in the United Arab Emirates plays an extremely important part in the oil and gas sector that is responsible for the storage and management of oil products prior to their eventual distribution. The market can thus be divided according to the type of tank used for storage. The major types are those of floating roof tanks, fixed roof tanks, spherical tanks, and other types of tanks.

Floating roof tanks are widely preferred in oil storage owing to design measures intended to reduce evaporation of the more volatile types of liquids such as crude oil. The tank has a roof that rises and falls with the level of the liquid inside, thus preventing the accumulation of vapor space at the top of the tank. With reduced emissions of gases, the particular design becomes more viable environmentally. Furthermore, floating roof tanks are likely to be in increased demand because of their efficiency and safety concern-taking in large quantities of oil storage.

Fixed roof tanks are stationary or non-adjustable roofs in regard to the liquid level. These tanks are economically and easily constructed compared to floating roof tanks; however, they can be responsible for a relatively higher evaporation and gas emission rate, therefore being unfit for the storage of more volatile products. Nevertheless, fixed roof tanks find continued application especially for storage of products that are comparatively less susceptible to evaporation.

Spherical storage tanks are highly specialized solutions primarily used for storing liquefied gases such as propane and butane. Spheres, having properties of withstanding high pressure and thus minimizing the risk of leakages, are therefore the most suitable shape for these products. Though rarer than the other two, Spherical tanks still form an integral part of the oil storage infrastructure with all its peculiar features, operational and logistic.

Lastly, there are others in the market, which may include underground storage tanks or smaller sizes for miscellaneous purposes. These tanks are lesser in number, yet they enhance the total storage capacity and flexibility of the oil industry in the UAE.

To summarize, the UAE oil storage terminal market is the central player in the oil supply chain in the world. By using any of the tank types, such as floating roof tanks, fixed roof tanks, or spherical tanks, this country thus manages to meet its storage requirements proficiently. Each tank type presents its own unique advantages and disadvantages, and tank selection primarily depends on particular requirements for storage and the nature of oil or gas in question. With growing demand for oil storage, further enhancement of these storage solutions will remain a crucial step in cementing the UAE's standing as a lead player in the oil and gas business.

By Storage Capacity

The UAE Oil Storage terminal market is one of the major segments of the oil and gas industry because of the considerable role played by this country in the global energy production and distribution hence the storage capacities determine the market mainly, which thus plays an important role in determining the operational efficiency and economic impact of the oil storage facilities.

Storage capacity is one of the important factors on which functioning of oil terminal can be divided into small scale terminals, midsize terminals, and large-scale terminals. Small-scale terminals generally have localized or regional functions, which often do not provide for larger volumes of oil. Smaller storage areas in regions that are not high enough to warrant larger storage facilities or have spatial constraints cannot be expanded to allow larger oil volumes. They are also considered flexible and quick to change with the market but have limited capability in handling large volumes of oil at a time.

Mid-scale terminals would be the facilities catering in between small-scale and large-scale. Terminals moderate in volume yet potentially cater to regional and national demands are mid scale. Infrastructure is built in a very advanced and improved manner in comparison to small-scale terminal infrastructure; this improves efficiency and handling capacity. Consequently, for many operators, mid-scale terminals are viewed as the most balanced choice between flexibility and larger storage capabilities.

Large terminal, as the term suggests, accommodates larger volumes of oil and is almost invariably located in very strategic points, usually close to major ports or hubs, and is of great significance to the demands of global trade. Such storage terminals, in enormous storage, shall play the very important role of transport and distribution of oil and, generally, they hold millions of barrels of oil. These terminals require huge investments in infrastructure as well as technology to carry out their efficiency and safety. They are well tied in the UAE oil storage infrastructure with local as well as international markets.

The disaggregation of the UAE Oil Storage Terminal market into these categories allows for a finer understanding in terms of their different needs and challenges faced by specific segment types of oil storage facilities. Each type of terminal serves a specific purpose for the oil industry in the country, ranging from large-scale terminals serving worldwide appetite to mid-scale serving the national demand to small scale serving much more localized purposes. Differentiating and thus understanding is the key to appreciating how much dynamic oil storage is in the UAE.

By Ownership

The market for oil storage terminals is a sector forming a vital link in the rapidly evolving oil & gas industry of the UAE. This segment is a direct hand to the storage & distribution of crude oil and all other petroleum products for both local and international markets. The market divides into ownership categories: National Oil Companies (NOCs), Independent Oil Companies (IOCs), and Terminal Operators. NOC is in control over terminal operations, whereas the other company types secure the truly independent terminal space.

National oil companies in the UAE dominate the oil terminal markets due to support from the government and development of massive national infrastructure. They deal with reserves at almost all levels from production to storage of petroleum products. As major players, NOCs would exercise control over the storage capabilities and operationality of the oil terminal due to having such seniority in the industry. This management flow of terminals secures smooth operations with appropriate storage solutions and distribution services supporting the global oil trade of the country.

The Independent Oil Companies also account for sturdy market participation alongside the NOCs. Such companies operate independently of the government powers but are accepted into legitimacy by offering immense storage capacity joined by an array of other merits. IOCs normally build their own storage facilities to meet their operational requirements, such as securing a smooth and steady supply of oil for refining or distribution. This competition builds up the market and contributes to increased overall storage capacity within the country. Independent oil companies are just not as strong as the national oil companies, but they nonetheless contribute very heavily in this sector and work hand in hand with other stakeholders to ensure effective oil storage.

Terminal Operators present another bottom lines on the UAE oil storage terminal market. These organizations are mandated with the managerial and operational duties of the storage installations. Notably, terminal operators may not hold the crude oil stored in their terminals, but they participate in the maintenance of the infrastructure to receive, maintain, and ship petroleum products. They also serve an important role with regard to oil storage, working with the National Oil Companies and Independent Oil Companies to coordinate on issues including logistics, safety, and regulations.

In summary, the UAE oil storage terminal market can essentially be divided into three broad categories according to ownership: National Oil Companies, Independent Oil Companies, and Terminal Operators. Each category offers a unique but interrelated approach towards the maximization of the oil storage capacity within the country as an adjunct to the oil and gas sector. The collaboration of these entities is crucial for sustaining the UAE's walkway in the international oil-producing and -exporting arena.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$500.22 million |

|

Market Size by 2032 |

$622.35 Million |

|

Growth Rate from 2025 to 2032 |

3.17% |

|

Base Year |

2024 |

COMPETITIVE PLAYERS

According to the report, the oil storage terminal market in the UAE has been an important part of the global oil supply chain. Important for the country with its strategic location and oil-exporting importance, oil storage facilities are extremely important in the storage and delivery of petroleum products. Recently this market expanded with the growing demand for fuel and other petroleum products internationally. From expansion to efficiency, several major market players have contributed to this segment along the way.

Emirates National Oil Company Ltd. (ENOC), one of the most outstanding and leading companies in this oil storage segment in the UAE, works as an integrated energy solution provider and is increasingly into the oil provision storage, transportation, and distribution. End-user government-owned corporation storage terminals are high-end facilities serving demand ever-increasing in respect of oil storage in the market region.

Fujairah Oil Terminal FZC is yet another leading player in the UAE oil storage market. Located in the emirate of Fujairah, this terminal offers a strategic location on the eastern coast of UAE. It has a stand-out ability to store large volumes of crude oil and refined products and is, therefore, indispensable in the storage and distribution network. Fujairah really oily storage terminal plays one of the most vital roles in the arena and global oil trade.

Another one of the most important companies is the Gulf Petrochem Group that operates the entire oil and petrochemical supply chain. It handles storage of crude as well as refined products. With a strong presence in UAE, Gulf Petrochem Group supports the growing demand for oil storage and transportation solutions.

Emirates General Petroleum Corporation is a government-owned corporation that provides oil storing services across the UAE. With the aim to provide fuel storage and distribution services meeting the energy necessity in that region, Emarat undertakes the same in petroleum products. Emarat terminals are equipped to transport several petroleum products.

Fujairah National Group (FNG) has a strong footprint in the oil storage business in the UAE. The company owns and manages oil storage facilities in Fujairah and is a part of the supply chain and energy infrastructure in the region. FNG continues to invest in modern facilities, meeting the growing demand in oil storage.

Other significant players in this sector include Brooge Energy Limited (BPGIC), Vopak Horizon Fujairah Limited, E3 Energy Group, Gulf Energy Limited L.L.C, and Horizon Terminals Limited. These companies have developed highly sophisticated storage terminals and infrastructure to satisfy the requirements of oil traders and distributors. Their investments ensure that the UAE remains a key hub for oil storage, trade, and distribution in the Middle East.

UAE Oil Storage Terminal Market Key Segments:

By Type

- Crude Oil

- Gasoline

- Diesel

- Jet Fuel

- Others

By Tank Type

- Floating Roof Tanks

- Fixed Roof Tanks

- Spherical Tanks

- Others

By Storage Capacity

- Small-scale terminals

- Mid-scale terminals

- Large-scale terminals

By Ownership

- National Oil Companies

- Independent Oil Companies

- Terminal Operators

Key UAE Oil Storage Terminal Industry Players

- Emirates National Oil Company Ltd (ENOC)

- Fujairah Oil Terminal FZC

- Gulf Petrochem Group

- Emirates General Petroleum Corporation

- Fujairah National Group (FNG)

- Brooge Energy Limited (BPGIC)

- Vopak Horizon Fujairah Limited

- E3 Energy Group

- Gulf Energy Limited L.L.C

- Horizon Terminals Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252