MARKET OVERVIEW

The Offshore and Commercial Ship Repair market in the UAE plays a strategic role in supporting its maritime and logistics industries. As the UAE is a strategic maritime hub in the Middle East, the market includes the services and facilities dedicated to the maintenance, repair, and overhaul of offshore vessels and commercial ships that operate within and beyond the Arabian Gulf. The UAE is a key passage for global shipping routes, and high standards in terms of vessel operability, safety, and efficiency are important. The market is both focused on offshore vessels and commercial vessels, which generally involve different types of vessels, purposes, and operational needs. From routine maintenance work to full-scale repairs, the market offers a wide range of services that are crucial for the economic lifeblood of maritime activities to be maintained in the UAE.

Offshore vessels serve an extremely important role in supporting the oil and gas extraction businesses of the UAE. Such operations often involve hard conditions of marine environment, and the execution must be carried out strictly in accordance with operational standards. Offshore vessels are generally types of rigs, platforms, or supply vessels, hence, require proper care to ensure continued service, safety, and functionality. This market is also a significant commercial segment as it covers the variety of ships moving the commodity from and into the UAE ports, including bulk carriers, tankers, and container ships. With the UAE acting as a trade bridge between the East and the West, there would always be a need to maintain such commercial ships with no letup in trades that would otherwise have been jeopardized by such occurrences.

The infrastructure underpinning the UAE Offshore and Commercial Ship Repair market is very extensive. Specialized shipyards, dry docks, and repair facilities spread all over the country. Jebel Ali, Abu Dhabi, and Fujairah have come up as primary venues with capabilities running the gamut from minor repairs to major overhauls. All of these facilities have ready access to high technologies, skilled labor, and materials adapted to the demanding specifications of the marine industry. Investments in automation and digitalization will drive the future of this market. Investments in digitalization will ensure faster repair times, more precise diagnostics, and a much higher quality of workmanship. The UAE is committed towards modernizing this market through innovation by adopting newer repair methods that meet the global requirements on environmental regulations and safety standards. This progressive approach will ensure that UAE repair facilities can effectively service a wide range of vessel types with diverse needs.

In addition, the UAE Offshore and Commercial Ship Repair market will be more oriented toward sustainability as the world maritime industry moves toward greener operations. The market will use technologies that reduce emissions, increase energy efficiency, and apply environment-friendly materials. Ship repair companies are also expected to retrofit vessels to meet stricter environmental standards so that clients can enjoy regulatory compliance and competitive advantage.

The UAE Offshore and Commercial Ship Repair market is one which is quite dynamic and an industry that supports both the offshore and commercial sectors. Due to its strategic location and access to its extensive infrastructure coupled with strong incentives for innovation, the UAE will remain at the very heart of the maritime services globally. As the market matures in technology and sustainability, it will not only meet the various demands of changing vessels within the region but also promote economic resilience in the UAE and its standpoint as a global leader in maritime operations.

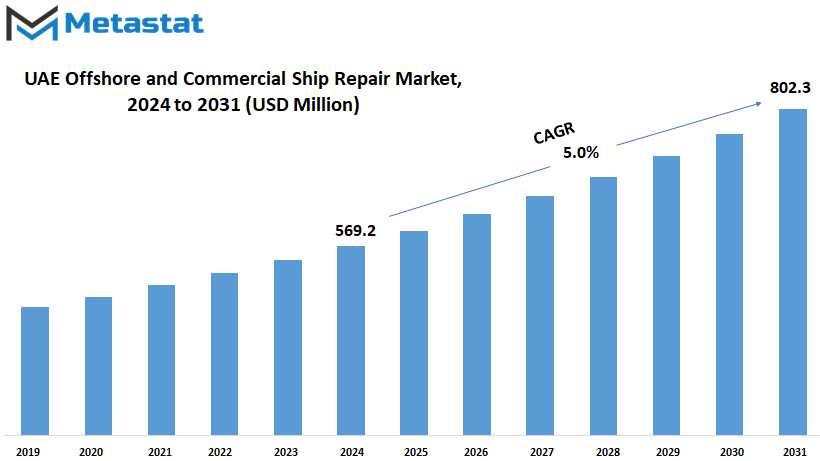

UAE Offshore and Commercial Ship Repair market is estimated to reach $802.3 Million by 2031; growing at a CAGR of 5.0% from 2024 to 2031.

GROWTH FACTORS

The UAE Offshore and Commercial Ship Repair market is likely to remain very active in the years to come, driven by several key market drivers. Rising from these pros will be the UAE's strategic location because it puts it as a central hub for maritime trade and transport. This can be attributed to the fact that with the UAE's geography and infrastructure, this region holds a lot of potential for a ship repair and maintenance industry. Since the UAE waters have become an integral part of the adapted trade routes, more vessels are passing through. Continuous expansion and modernization of the ports and repair facilities within the UAE naturally contribute to further expansion due to ease of access for ships coming from every corner of the globe to access repair and maintenance services around the region.

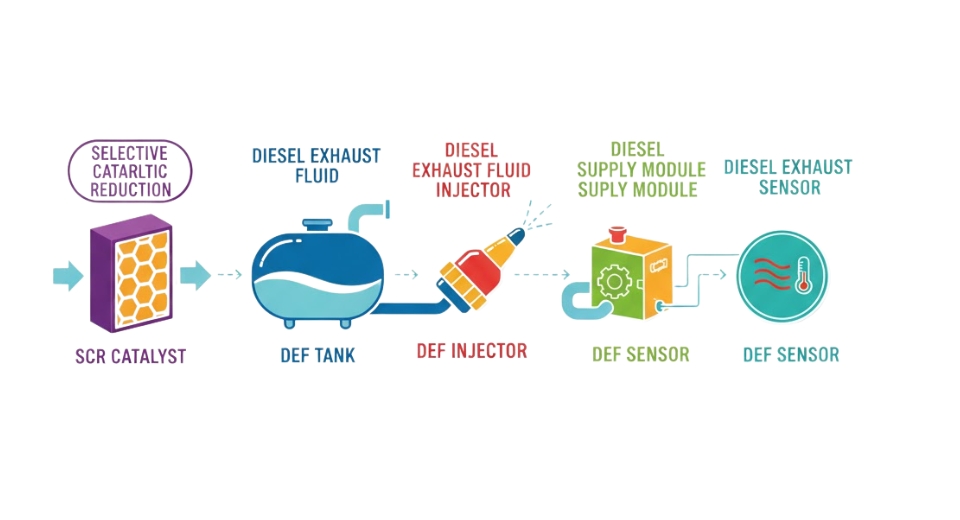

Technological advancements within the sector itself are pushing the UAE Offshore and Commercial Ship Repair market forward. Automated systems with digital monitoring in the maritime operations allow for better diagnostics of ship maintenance needs as they are quicker and more precise. Only through these innovations could breakdowns be avoided; in fact, repair timelines are optimized, thus making the entire process of ship repair more efficient and economic for operators. The increasing environmental concern led to demands for greener technologies as well as adherence to international standards regarding emissions and waste management. The demand for special services, such as retrofitting a ship with greener technologies, arose from such demands. Also, the country has facilities to meet these requirements since the UAE is proactive in environmental sustainability, inviting ship owners who prefer green repair.

However, some factors could work against this growth:. High skilled labors and high-cost advanced machineries, which are necessary for efficient ship repairs, may become a serious concern. Moreover, economic downturn globally and, in the worst scenario, shipping industry crisis could lessen the market stability. Nevertheless, initiatives by the UAE government to increase investments in the maritime sector would provide a solid ground for further development and balance some of such challenges. Moreover, the region approach of workforce training and technological development helps to shave off labor costs over time and adds to the stable growth environment.

The future opportunities for the UAE Offshore and Commercial Ship Repair will be abundant given the emphasis on renewable energy sources and sustainability. Any business operating in this market will have opportunities in upgrading of vessels to adopt more strict environmental standards and shifting to alternative fuels. There is a preference toward sustainable practices and modern technology, and businesses that engage in "green" repairs, retrofits, and upgrades will find a very welcoming market in the UAE. The evolution will bring in a much more comprehensive set of clients into the UAE as the world's most preferred destination for ship repair and maintenance solutions. Not in the least, there is a lot of potential in the UAE Offshore and Commercial Ship Repair market in terms of technology advancement, strategic investment, and commitment to sustainable growth.

MARKET SEGMENTATION

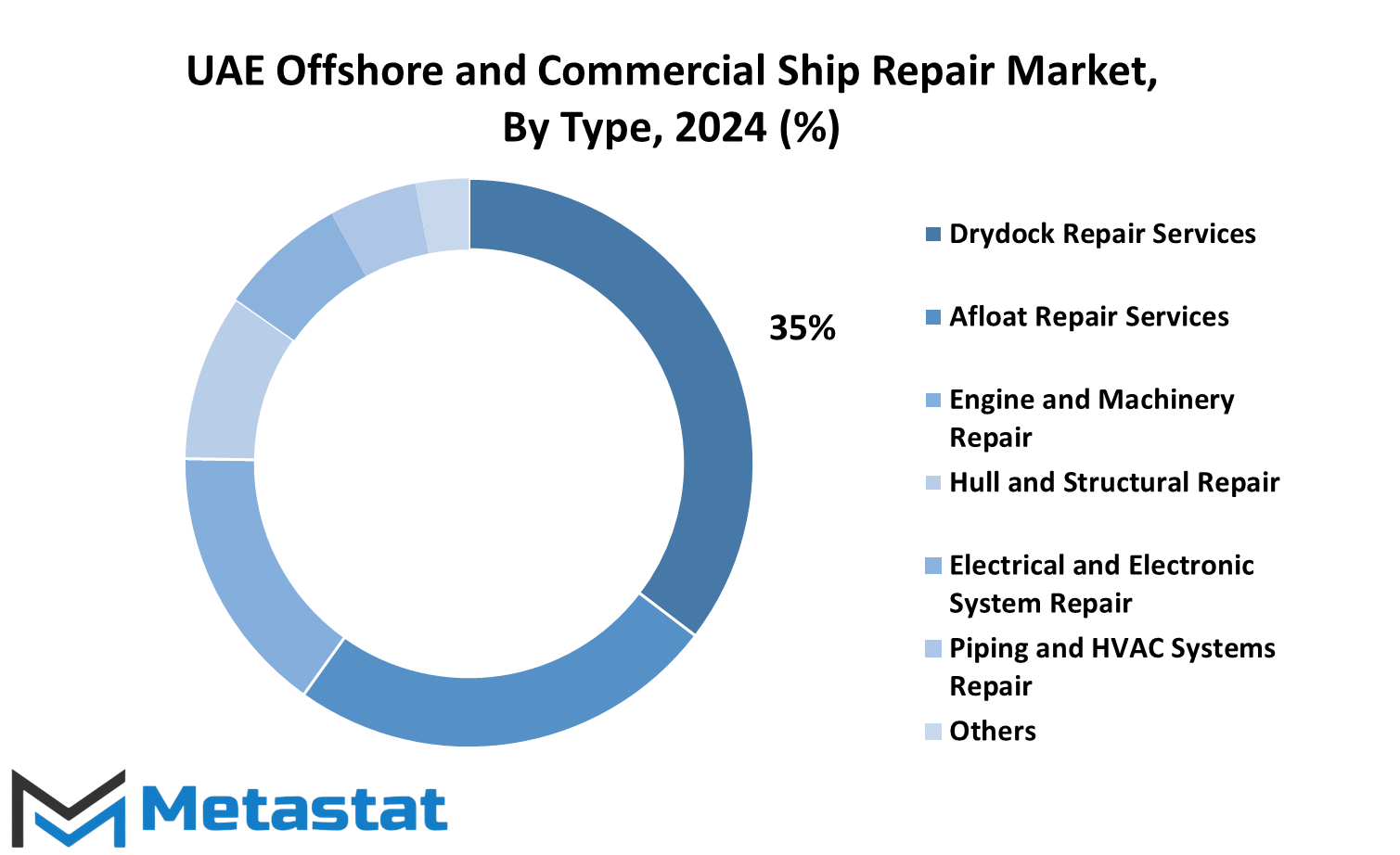

By Type

The UAE Offshore and Commercial Ship Repair market will see an increase in upcoming years. The country will take strong strides to be the main center of maritime trade and industry. In line with the rising demand for maintenance and repair services, the need for activities such as docking and repairs will increase substantially across different industries that operate in the UAE because of its geographical location near the main shipping lanes from Asia to Africa and Europe. There are various kinds of repair services in the market. Every kind of service type provides differences, which enables it to be applicable to other types of vessels. Among the major categories of repair services include the following: drydock repair services; afloat services; engine and machinery repair; hull and structural repair; electrical and electronic system repair; and piping and HVAC systems repair.

Drydocking repairs services are very useful because, in such condition, a vessel can be repaired completely outside the water to easily and safely get access to all areas of the ship. These repair jobs are of great importance as they are used by ships which have huge structural or hull repair operations on board and continue to be in the market to keep offshore vessels and commercial ships at bay. The afloat repair services will cater to ships that need minor changes or spot overhauls but cannot afford the time lost during full drydock. This will enable critical maintenance to be done speedily and get a vessel back into service without much delay.

Engine and machinery repair will remain one of the significant niches as the reliability of these segments determines the overall operational efficiency of a vessel. It is expensive, therefore it requires constant repair and maintenance to ensure smooth operation without disruption of the vessel. The hull and structure will require the same kind of repairs in order for any vessel to stay for a long time and be safe because of its protection from the harmful wear and corrosion that results from constant exposure to the harsh marine environments. The mechanical and structural repair needs will not be lacking when electrical and electronic systems repair growth is also incorporated. Such systems are essential in navigation, communication, and safety onboard vessels. For that reason, their maintenance and repair must be made regularly. The same case applies to the pipe and HVAC systems repair as it ensures comfort and safety onboard a vessel through the reduction of extreme temperatures often experienced at sea.

The UAE Offshore and Commercial Ship Repair market is likely to continue a march of innovation in marine technology for the foreseeable future. New materials and digital systems should make operations more efficient, and concerns for sustainability can boost demand for ecologically friendly repair technologies and materials. Overall, the industry seems well-positioned to support the UAE's aspirations to position itself as a global maritime center, to be better placed to serve the needs of an evolving global fleet.

By Application

Of course, the UAE Offshore and Commercial Ship Repair market is high on the radar, for it is a critical component of the country's economic landscape and a specific segment of the overall global maritime industry. As technologies advance and the ship repair needs of industry evolve, the UAE is well-positioning itself to accommodate all kinds of different vessel types-from offshore support vessels to commercial cargo ships and including tankers, barges, luxury yachts, and even leisure boats. Being dynamic and very diverse with different types of vessels, each with particular maintenance and repair solutions, the market is a broad one. Geographical position, state-of-the-art infrastructure, and rising know-how make UAE an important center for these critical services and stabilize the growth of the maritime sector.

In the future, ship repair facilities in the UAE are likely to further expand their capabilities as automation technology, smart technology, and sustainability-based solutions advance. In fact, more vessels in the future will be equipped with advanced fuel-efficient engines and digital navigation systems. As these technical upgrades take place, more requirements for repair and maintenance services will arise. This will be a significant area of the market for ship repair in UAE and will provide competitive advantage to those companies who can do high-tech repairs. In addition, green solutions such as fuel-efficient and emission-reducing repairs are gaining importance with each passing day. This reflects the overall trend towards sustainability around the world.

UAE Offshore and Commercial Ship Repair Offshore support vessels are the major application of the market. These vessels augment the oil and gas industry, which supports the offshore drilling activities. As exploration will continue to be intensified, their efficient maintenance and repair at intervals will become critical, with a special emphasis on minimizing downtime so that they are back in action. Commercial cargo vessels form the lifeline of international trade. Their proper maintenance is necessary to ensure that goods keep flowing uninterruptedly. The UAE will most probably be ready to house these vessels, so that they remain in prime operating conditions and poised up to international safety standards.

Naval and defense vessels: This will also form the future growth area. The rising interest in maritime security particularly in the Gulf region will have the UAE's ship repair market as playing an essential part in keeping the vessels at an optimum level. Meanwhile, the leisure segment, which includes yachts, is also bound to increase as the UAE is expected to emerge as a luxurious destination. This diversified service renders both regional and international clients, hence underscoring the flexibility of the UAE in light of the proactive approach toward ship repair.

The UAE Offshore and Commercial Ship Repair market will grow from strength to strength based on evolving needs, driven by technological advancements and a strengthened focus on sustainability across different vessel types.

By Vessel Size

With this happening, the UAE offshore and commercial ship repair market has grown a lot in recent years and continues to go on with the increase in global trade and maritime activity. This market is really essential as it ensures that ships remain safe, functional, and compliant with regulations. The strategic location of the UAE and high-quality port facilities ensure better provision of this market. Given the presence of several shipping routes across the world passing through the region, the demand for ship repair services continues to be high depending on the ease with which the UAE can process and carry out vessel maintenance and repair. The market spans small, medium, large, and very large vessels with different requirements in terms of service provision and demand for repairs.

Future advancement of the industry will see the usage of sophisticated repair technologies. Advanced high-tech solutions will be needed for maintaining and repairing larger vessels. The UAE offshore and commercial ship repair market will be one of the leading-edge players in innovative practices such as predictive maintenance, where AI and data analytics predict potential issues before they become costly and time-consuming repairs. This reduces operational downtime for vessels and cuts costs for owners, a factor likely to spur growth in the sector.

Regional transport and niche maritime services operate a large majority of the smaller and medium-sized vessels. The ship repair market in the UAE remains largely held by these smaller vessels because, although relatively easier and quicker to repair in many respects, their maintenance proves important for uninterruptive port and regional functions. The market has also begun to cater to the needs of the smaller vessels by maintaining specific facilities that offer efficient and prompt service to minimize downtime and to keep the vessel running.

Large and very large vessels, such as tankers, bulk carriers, and container ships, are often required to avail themselves of extended repair services because of the complexity of their operation and the stress that these experience in long voyages. The UAE market's capability for serving such vessels makes it an attractive hub for operators worldwide, especially as new environmental and safety regulations mean more frequent inspections and more complex repairs. With increased awareness of sustainability and green shipping, the market for retrofitting older vessels with eco-friendly technology in the UAE offshore and commercial ship repair market is also expected to increase, thereby following an internationally upgraded initiative.

The industry's adaptation to modern technological innovation and changes it is compelled to adopt from the regulations will continue to position it at par with the best centers of offshore and commercial ship repair in the UAE. The market is poised to produce a range of vessel sizes, coupled with innovation and sustainability, which puts it well to take future challenges and is well in a good stead for further growth going forward with an ongoing pattern in world maritime activity growth profile.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$569.2 million |

|

Market Size by 2031 |

$802.3 Million |

|

Growth Rate from 2024 to 2031 |

5.0% |

|

Base Year |

2022 |

.

COMPETITIVE PLAYERS

An important constituent of the regional maritime industry, the UAE Offshore and Commercial Ship Repair market provides critical support to a whole gamut of vessels plying waters in the Gulf and beyond. The market is marked by its dynamic growth, participated by many aggressive players engaged in providing specialized services for both the offshore and commercial sectors. The UAE ship repair industry is likely to grow extensively because the nation is further establishing itself as a global maritime hub. More sustainable practices, efficient service delivery, and newfound technology will translate into the growth of demand for ship repair solutions and put companies in a position to capitalize on this trend.

There are several key market drivers as far as competition is concerned, with each offering a different set of expertise with unique innovation solutions. Drydocks World is a significant name in the UAE that deals with sophisticated offshore projects and repair services, and Abu Dhabi Ship Building (ADSB) is regarded for an overall scope of work extending to naval and commercial vessel support. Kingfisher Marine Engineering and Damen Shipyards Group also play pivotal roles by providing complete repair and maintenance services that are necessary to sustain maritime operations in this region. These companies are using that technical knowledge to service the specific needs of the Gulf's offshore industry, as the industry often faces severe marine environments and demanding operational requirements.

The global push to meet sustainability goals will most likely see new green technologies implemented in the UAE ship repair market, helping to decrease emissions and wastes. Grandweld Shipyards and Elcome International LLC will introduce green technology to their repair operations, which will highlight environment-friendly methods in line with the UAE's sustainable development goals. Players including L&T Shipbuilding Ltd. and Goltens Co. Ltd. will innovate consistently for delivering high-efficiency services while reducing time taken by repairs to revive productivity, which is very crucial in this competitive climate to keep up with the expectations of the clients.

Future also promises enhanced digitization of this market. Advanced diagnostic tools and predictive maintenance systems are likely to be integrated into companies for their operating needs. These technologies will allow ship repair companies, including Green Ocean International Ship Repair LLC and Inter Ocean Ship Repairs LLC, to enhance repair workflows and more accurately offer services. Predictive maintenance will give vessel operators an opportunity to prevent breakdowns, hence lowering the long term cost of any repair and minimizing downtime. Other competitors like Nanje Marine Services and Nakilat will continue to herd up the same type of strategy to maintain their competitive front and remain in the competition bound to keep up with the new need and preference of global maritime customers.

Overall, the growth of UAE Offshore and Commercial Ship Repair is on its way. In addition, future-oriented companies and the strategic maritime vision of the UAE will further enhance the expansion in the repair industry in terms of quality service to the regional and international clients.

UAE Offshore and Commercial Ship Repair Market Key Segments:

By Type

- Drydock Repair Services

- Afloat Repair Services

- Engine and Machinery Repair

- Hull and Structural Repair

- Electrical and Electronic System Repair

- Piping and HVAC Systems Repair

- Others

By Application

- Offshore Support Vessels

- Commercial Cargo Vessels

- Tankers

- Barges

- Naval and Defense Vessels

- Yachts and Leisure Boats

By Vessel Size

- Small Vessels

- Medium Vessels

- Large Vessels

- Very Large Vessels

Key UAE Offshore and Commercial Ship Repair Industry Players

- Drydocks World

- Abu Dhabi Ship Building (ADSB)

- Kingfisher Marine Engineering

- Damen Shipyards Group

- Grandweld Shipyards

- Elcome International LLC

- L&T Shipbuilding Ltd

- Goltens Co. Ltd.

- Green Ocean International Ship Repair LLC

- Inter Ocean Ship Repairs LLC

- Nanje Marine Services

- Nakilat

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383