MARKET OVERVIEW

The Global Tappet Market are comprised of significant automotive industries as an engine. Proper function and working in the internal combustion engines depend on the tappets' operation, otherwise known as valve lifters. The tappets actually provide timing and function for the opening and closing of the valves, determining the air and fuel intake and the exhaust of different combustion gases. This particular market is concerning the manufacturing, distributing, and innovating of tappets for different types of vehicles, such as passenger cars, heavy-duty trucks, and high-performance autos.

The extent of the Global Tappet Market cuts across traditional automotive applications and enters into marine and industrial machinery, where fuel efficiency matters. Tappets include different types of models and designs, such as flat tappets and roller tappets, which can be meant for individual engines with specific performance standards. As engines are upgraded to meet stringent emissions and efficiency requirements, demand for new tappet designs and materials will likely be higher, thus driving manufacturers toward novel solutions.

The Global Tappet Market will also witness an impact due to the advancing technologies intended to improve and facilitate performance and durability of engines through friction reduction. Emerging lightweight and wear-resistant materials are in the limelight as the industry strives toward compliance with continually changing automotive standards. Coupled with these will be the use of sophisticated manufacturing techniques and deep engineering precision, which will add further assurance of quality and reliability across the diversity of tappets in applications.

Global Tappet Market extends geographically through the prominent automotive manufacturing hubs, which include North America, Europe, and the Asia-Pacific region. These regions are significant in consumption as they are equipped with advanced automotive industries and rapidly growing procurement of sophisticated engine technologies. Potential emerging markets within Latin America and the Middle East also pave the way for expansion as they have rising vehicle production and increasing demand for high-performance automotive components in their country.

The Global Tappet Market will be affected due to changing automotive design patterns-from internal combustion engines to hybrid and electric vehicles. They likely will dominate the industry's landscape for the foreseeable future. As the industry drifts toward the alternative powertrains, this will gradually compel its participants to look for new application possibilities and diversify the products in their portfolio. This shift will lead to partnerships with OEMs in the automotive field to manufacture tappets that will have to pass several performance and efficiency geometries.

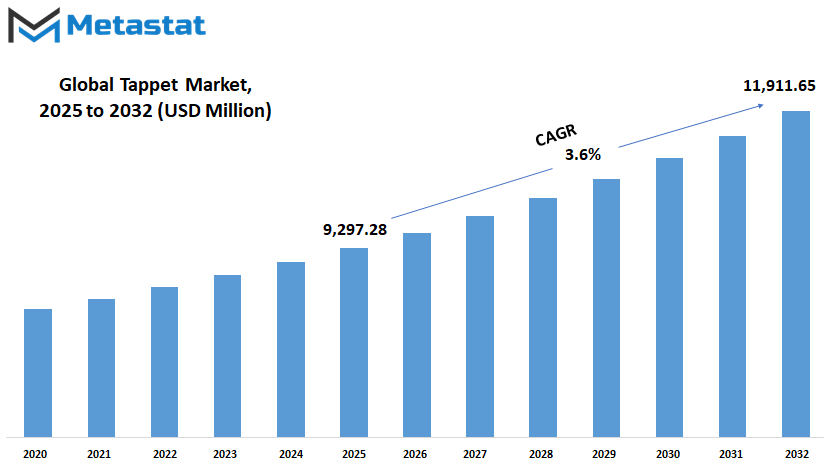

Global Tappet market is estimated to reach $11,911.65 Million by 2032; growing at a CAGR of 3.6% from 2025 to 2032.

GROWTH FACTORS

The global tappet market is expected to see vast changes and developments in the years to come. The continuing growth and evolution of the automotive sector have established a strong demand for efficient and high-performing engine components. Tappets being an integral part of this whole system that affects the timing and movement of engine valves control, thus it is this demand that truly propels the tappet market toward substantial growth with increased fuel efficiency and performance of vehicles. The need for advanced tappet technology is becoming even more apparent as manufacturers work to meet more stringent emission requirements and enhance engine performance.

High-end fuel-efficient engine demand is one of the major drivers responsible for the growth of the market. Consumers and manufacturers are now both focused on cars that deliver good mileage, without any price to power and reliability. This so-called "efficiency solution" is spurring activities around push-tappet designs intending to minimize friction, enhance durability, and improve overall performance. Furthermore, as production of automobiles increases worldwide, the demand for quality tappets remains unperturbed in both OEM and aftermarket. The steady demand for spare parts and regular maintenance allows taps to be businesswise for the manufacturers.

Nonetheless, the global tappet market will continue to face some stumbling blocks in the course of this otherwise great time. The rapidly growing acceptance and popularity of electric vehicles (EVs) can pose a significant challenge since they do not require traditional internal combustion engines and, therefore, do not require tappet applications. Once the transition to electric mobility starts gathering pace, the demand for tappets in the automotive sector may temporarily dwindle. Besides, producing tappets with the precision required by modern engines is expensive. Such concerns regarding costly raw materials and stringent standards of production can hinder competition for some players.

But still, the technology looks bright. The important shout on lightweight and durable materials is going to be sounded in tappet production in the near future of the market. It will serve as some kind of foundation paving the way for the future construction of tappets that would not only be strong but lightweight, thus serving the manufacturers in the future towards increasing engine efficiency and controlling emissions. These innovations would most likely attract the interest of automakers who wish to save fuel resources and meet the required standards for emissions. The vast potential of technology in advancing truly efficient and versatile tappet designs will be robust in times to come.

In the years to come, it is expected that the global tappet market will find its balance between challenges and opportunities. Indeed, it will continue innovating with dynamic changes in efficiency and performance-driven technologies of automobile manufacturers. Keeping abreast of technological trends and proactive adaptations with the changes in vehicle manufacturing will open new opportunities for manufacturers in this emerging and changing period.

MARKET SEGMENTATION

By Type

Without a doubt, it is set to speed up substantially in years to come, as automotive technology is always undergoing changes and vehicular engine performance is demanding continually. Tappets are a crucial part of the mechanism that controls the timing and movement of engine valves. This component ensures the proper running of an engine. With the establishment of tapping technology in the auto industry, there is bound to be a rise in the applications of tapping for emerging trends like the increase of vehicle production, fuel efficiency stimulation interventions, and advanced engine designs.

One of the factors driving the Global Tappet Market is the rising inclination towards efficiency and better performance of engines. The manufacturers of engines continue to improve the engine designs to adapt to the better emission standards and fuel economy regulations. Tappet controls all valve movements and thus affects engine efficiency. High demand for high-performance maintenance-free engines will raise the requirement for advanced tappet systems.

The market segmentation in terms of type includes flat tappets, roller tappets, and others as the major segments. Flat tappets remain the simplest and the most economical types and used in the maximum number of engine designs. They have a performance that may not be sustained at a frequency comparable with that of others. Roller tappets are made for greater durability and efficiency. They have been able to reduce the friction in the engine to produce from the engine movement and serve well in modern high-performance engines. Others include specialized tappet designs often made from high-performance materials and with advanced engineering due to their specificity to an engine.

Looking forward, the Global Tappet Market would be in constant change as the automotive technology penetrates the dawn phase. In comparison, electric and hybrid vehicles are starting to creep into the market; whereas, the former continous use of the present internal combustion engines is likely to be done for years, especially hulting for commercial and heavy-duty vehicles. This would create the demand for innovations in tappet design, such as for wear reduction and improvement of efficiency.

Further, as high fuel efficiency along with emission reduction compels more lightweight material adoption in other engine components, trappings could also follow in the wake of such. In some ways, newer and advanced production processes and new materials could open up new frontiers for taps with increased strength, lower wear, and longer life. All these futuristic changes will be paving paths for the development of the market. Taps will always be Continuing to reshape within the requirements of the automobile industry.

So the summary Global Tappet Market implies a continual growth trajectory for the economy, attributed to boosting encouraged measures towards better engine performance and efficiency. The future of the market with advances in technology and evolution adopted by the industry with changes in demands will also leave an impact of innovations in tappet design and material on its equation.

By Engine Capacity

Adapting to evolving demand from the automotive industry and advancements in engine technology will result in significant growth in the Global Tappet Market in the years to come. Tappets, commonly known as valve lifters, play an important role in the regulation of engine valves and form thus a critical component of the system that ensures smooth and efficient performance of an engine. With the continuing focus of vehicle manufacturers toward engine efficiency and property-linked emission reduction, the advanced systems of tappets are expected to give further growth to the market. This transition between present interactive approaches and future interaction with different engine capacities would form a significant legacy from now onward.

Considering the market under engine capacity perspective, one can see each segment having different potentials and challenges. The <4 cylinder engine category applies broadly to small vehicles like compact cars or motorcycles, or even scooters. These engines usually get their selling power as fuel-efficient and cost-effective. Because of consumerism and value-consumption-linked green vehicles, the demand for these efficient tappets is bound to increase. Lightweight materials along with precision-engineering innovations could elevate their performance further, rendering them even more interesting for the automobile manufacturers.

The 4-6 cylinder engine group is for mid-segment vehicles, such as sedans, SUVs, and light trucks. This category normally stands balanced in power against efficiency, thereby making it almost every driver's choice. With the increasing trend of hybrids and electric vehicles in the market, the remaining internal combustion engines will have to revamp their technology to meet the more exacting environmental parameters attached to running such vehicles. Fuel-efficient high-performance tappets designed to lower friction will be an important requirement for keeping pace with these engines as part of the evolution in motor vehicle technology. The need for such innovative changes would be a pressure point where manufacturers come up with intelligently manufactured sophisticated products ensuring the reliability and durability of engines in this category.

On the other hand, engines with more than 6 cylinders are usually focused on heavy-duty vehicles, sports cars, and luxury models. Such engines, because of the output they deliver, work at a high- power and high- performance level, which requires much stouter and robust tappet systems. As long as there is demand for these high-performance vehicles and

Advanced tappet technologies enabling high-speed operations and carrying heavier loads will drive market development. Within the automotive industry, the Global Tappet Market will evolve with the move toward increased efficiency and cleaner energy. Manufacturers will be introducing innovations to address specific needs of different engine capacities and thus, will create new performance and sustainability standards. These market trends will consider future innovation and improved vehicle performance-a typical example of what will ensure their growth in the years ahead.`

By Vehicle Type

Increasing innovations in the automotive sector and growing demand for efficient components for the engines are expected to induce substantial growth in the global tappet market over the next few years. The tappets ensure the smooth functioning of any engine by controlling the movement of the valves for internal combustion engines. The need for high-performance tappets becomes more crucial for vehicle manufacturers aiming to improve fuel economy and reduce pollutants. The future development and growth of the global tappet market are expected to be influenced by this dissipating emphasis on performance and sustainability.

Various equipment types have different demands on tappets. Therefore, based on equipment types, heavy commercial vehicles such as trucks, and buses typically demand rugged and durable components to endure long hours of heavy-load operation. There will always be a very high demand for tappets that are reliable and durable in this segment. With logistics and freight services still expanded worldwide, the demand for high-performance tappets will increase as the production and sales of heavy commercial vehicles increase. Eco-friendliness may also compel manufacturers to adopt advanced engine technologies, which may in turn drive the advancement of innovative tappet designs.

Among light-duty vehicles, passenger cars and small commercial vehicles constitute a huge chunk of the global automobile industry. This segment concentrates on fuel economy, comfort, and performance, which puts certain demands on engine components such as tappets. With consumers increasingly looking for vehicles with low emissions and high mileage, it is expected that automakers will invest In lightweight engine systems that are more advanced. This will likely allow modern tappet technologies to become more commonplace that are designed toward enhancing engine performance while reducing environmental impact. Furthermore, the ever-increasing popularity of electric and hybrid vehicles may provide a further push for innovative tappet design and application in the market.

The global tappet market will be very dynamic with more sustainable and efficient alternative solutions for the automotive industry. The evolution of technology, changes in consumer behavior, and stricter emission regulations will play a decisive role in shaping trends in the market. The focus for manufacturers would likely remain on developing tappets that exhibit improved durability, less friction, and greater efficiency. Diverse demands for vehicle types and increase in global demand tend to favour the future of the tappet market by way of innovation and development opportunities in heavy commercial and light-duty vehicle segments.

By End Users

The global tappet market is expected to make some significant leaps and bounds in coming years owing to advances in automotive technology and shifting consumer demands. Tappets ensure the smooth operation of internal combustion engines, hence their demand depends closely on the automotive industry. As vehicle manufacturing increases around the world, the demand for tappets that offer efficiency and durability is also expected to increase. With more emphasis on performance, fuel efficiency, and lower emissions, the tappet market will evolve to meet these newer standards.

One of the central demand drivers of this market is the diversity in the range of passenger cars of three broad categories: economy, luxury, and mid-priced. Each category brings its own range of requirements and expectations, thus influencing the demand for certain types of tappets. Economic passenger cars typically focus on cost-effective and practical use, so they require parts that are cheap and reliable. Tappets fitted into these types of vehicles build on their strengths of durability and efficiency without unduly compromising the costs. The growing demand for affordable transportation facilities, especially in the low-end developing regions, is, therefore, an indication that this segment is likely to sustain the ever-expanding growth of the global tappet market.

Luxury cars, on the other hand, are definite about performance, technology, and driving experience. Hence, they are manufactured with much higher standards of precision and quality in respect to tappets. Besides, the demand for high-performance tappets will further gain momentum as automakers shift into further innovations by making powerful engines and sophisticated designs. The consumers of the segment abide to speed, driving comfort, and sophisticated features, making the engine parts quality a paramount issue. As the increase in sales of luxury cars continues to take root across the globe, a demand for premium tappets will grow in tandem with the latest cutting-edge automotive technology.

Mid-priced passenger cars have balanced the scales between affordability and quality, appealing to a broad customer base. In this segment, reliability is derived from economic vehicles, whereas advanced features are imported from luxury models. Tappets under this category are expected to ensure engine performance at a reasonable cost of production. With the influx of mid-priced vehicles that offer value and comfort, this segment will greatly drive the future of the global tappet market.

In the near future, the market growth will therefore be influenced by technology and automotive trends. These automobile trends, which would include the shift to electric and hybrid vehicles, may affect demand; however, the presence of internal combustion engines practically ensures that tappets will be around for some time. The forthcoming innovations in materials and manufacturing processes are likely to give rise to performance-efficient, durable tappets tailored towards sustainable and performance requirements of the industry.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$9,297.28 million |

|

Market Size by 2032 |

$11,911.65 Million |

|

Growth Rate from 2025 to 2032 |

3.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

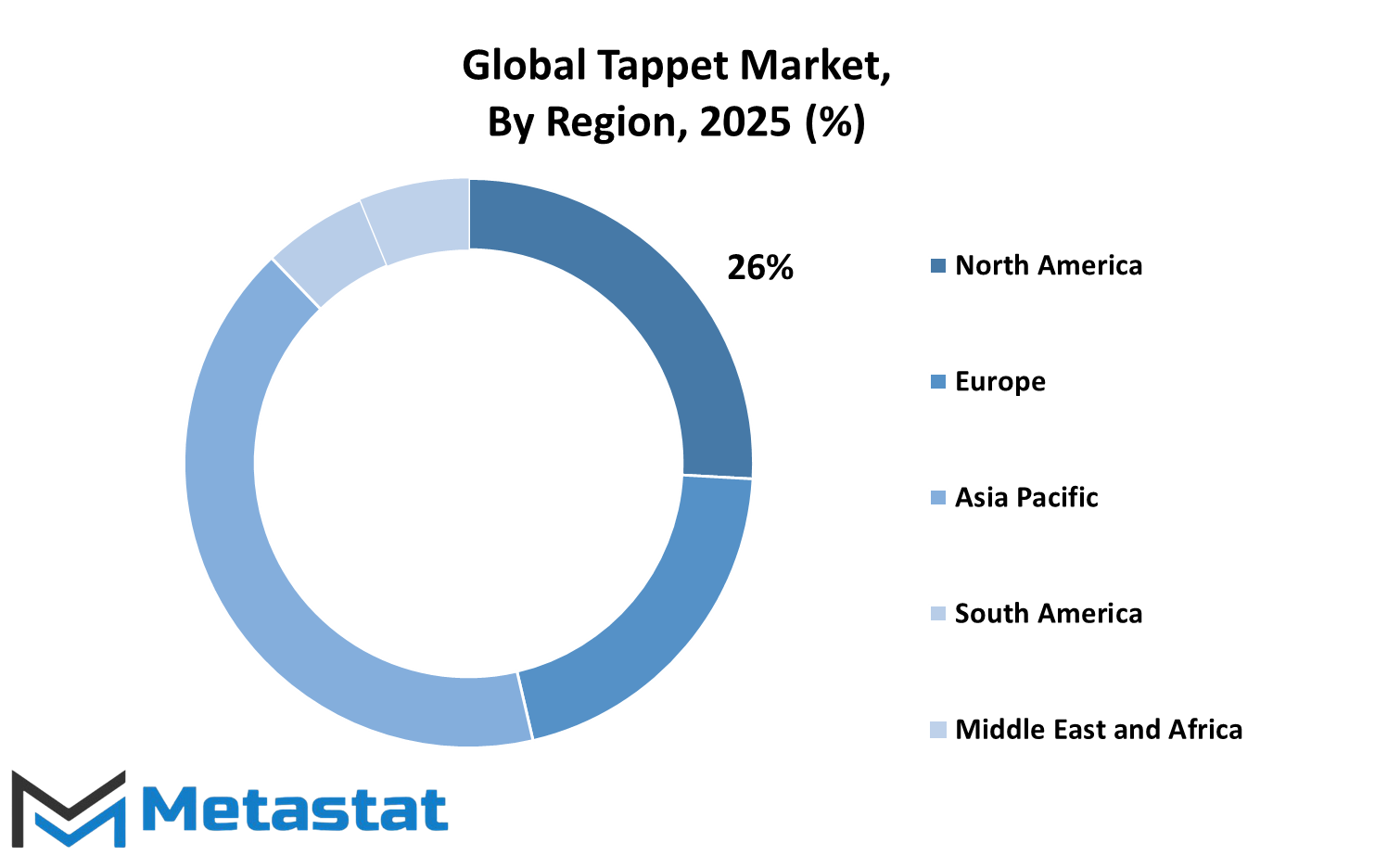

The global tappet market is propelled by various regions of the world, each one playing an important part in the formation of the market's growth and development. As industries get matured and technological innovations become more widespread, parts of the world contribute various advantages toward this market. Geographically, the global tappet market has been segmented into the North America region, Europe, Asia-Pacific, South America, and the Middle East & Africa, where each region presents unique opportunities along with challenges.

North America occupies a highly critical position in the market due to being a stronghold of automobile manufacturers and having a well-established industrial sector. The major players in the tappet market are U.S.A., Canada, and Mexico, among which the U.S.A. leads with its highly advanced automotive industry and high levels of innovation investment. Given the potential growth of demand in efficient engine components, the current urge toward technological improvements and environmental solutions will mean a further enhancing role for North America in the market.

To the European verp, global tappet market distinguishes itself with the reputation of engineering excellence and strong automotive manufacture. The UK, Germany, France, and Italy are dominant countries, while Germany is often in the forefront due to its strength in automotive technology and production. The demand for high-performance and precision-engineered components spurs innovation in the region, and as electric and hybrid vehicles become popular, the requirements for flexible and efficient engine components will intensify.

In the Asia-Pacific, with rapid industrialization, growth in the automotive sector, and other factors, the global tappet market may witness immense growth. India, China, Japan, and South Korea are key players, with China and India being noteworthy for their huge production capabilities and rising automobile demand. Growth in the region is also fueled by increasing disposable incomes, rapid urbanization, and government support programs for technology and manufacturing. As these nations evolve, the market for advanced automotive components such as tappets should witness tremendous growth.

In addition, South America contributes to the global tappet market, with Brazil and Argentina being the frontrunners among countries in the region. While the automotive sector in this region is not nearly as massive compared to others, there is a steady demand for high-quality engine components driven mainly by local manufacturing and export activities. Future investments and advances in automotive technology and infrastructure will only serve to bolster the market position of the region.

Thus, the promise of the global tappet market in the Middle East & Africa lies in industrialization and emerging local automotive industries in the respective countries. The GCC countries, Egypt, and South Africa are major partakers in this section, with infrastructure projects and economic diversifications needing machinery and automotive components that would increase the new possibilities for the tappet market.

In Economic terms, the growth of the overall tappet market will continue to be determined by the capabilities of regions and shifts in demand patterns. Each region is bringing forward a uniqueness that will affect the general economics of the global market. Given that technology keeps advancing, it would appear the market has a bright future in all areas.

COMPETITIVE PLAYERS

Tappet is a crucial component in the engines of automobiles whose demand is driven by the associated development of efficient and high-performance vehicles. With the gradual drift toward advanced automotive technologies, it is expected that the tappet industry will also change, with the leading manufacturers at the forefront in strategic development concerning innovations and quality. The competitive scenario in this market embodies the presence of well-established players along with emerging businesses ing this uxt concerning the market development in their own different way.

Some well-known players have expanded their competencies in the Global Tappet Market and have, thus, contributed to the advancement of this industry through their innovation-oriented approach and the continuous supply of high-quality engine components. Schaeffler Technologies AG & Co. KG stands out for its laser focus on innovation and engineering excellence. The company's continued investment in research and development has led to advanced tappet solutions that optimize engine efficiency and longevity. Eaton Corporation plc also stands ahead with an unquestionable commitment to high-quality engine parts, producing products that meet modern vehicle requirements.

Federal-Mogul Corporation has acquired fame due to its long experience in the manufacture of automotive components, including tappets. Their reputation for quality and reliability keeps them competitive in a market where performance and precision are critical. In the same way, NSK Ltd. combines advanced technological capability and commitment to sustainability, and thus is a key influencer in pushing future industry trends. Otics Corporation and Competition Cams, Inc. bring to the table their own unique specialization in performance and custom applications that attract a varied customer base in assisting with the growth of the market.

Companies such as Rane Holdings Limited, Lunati LLC, and SM Motorenteile GmbH cement their positions in the market by providing a plethora of tappet solutions that meet varying engine requirements. Wuxi Xizhou Machinery Co., Ltd. as well as Suzhou Topu Engine Parts Co., Ltd. aim for low-cost manufacturing and good production processes to guarantee competitive pricing on their tappets without compromising on quality. Power Industries, Johnson Lifters, and Melling Engine Parts are other players who support innovation and reliability in the industry.

With the gradual shift into efficiency and technology of sophistication in the automotive field, the Global Tappet Market will see enhanced collaboration, strategic partnerships, and investment in advanced manufacturing techniques. The competitive players must coordinate between innovating and being cost-effective to meet both industry requirements and customer satisfaction.

Tappet Market Key Segments:

By Type

- Flat Tappet

- Roller Tappet

- Others

By Engine Capacity

- 4–6 Cylinders Engine

- >6 Cylinders Engine

By Vehicle Type

- Heavy Commercial Vehicles

- Light Duty Vehicles

By End Users

- Economic Passenger Cars

- Luxury Passenger Cars

- Mid-Priced Passenger Cars

Key Global Tappet Industry Players

- Schaeffler Technologies AG & Co. KG

- Eaton Corporation plc

- Federal-Mogul Corporation

- NSK Ltd.

- Otics Corporation

- Competition Cams, Inc.

- Rane Holdings Limited.

- Lunati LLC

- SM Motorenteile GmbH

- Wuxi Xizhou Machinery Co., Ltd.

- Suzhou Topu Engine Parts Co.,Ltd.

- Power Industries

- Johnson Lifters

- Melling Engine Parts

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252