MARKET OVERVIEW

The Global Tapentadol (Palexia) Market and its industry is a niche area in the pharmaceutical industry, specializing in a particular pain management solution. Tapentadol is a centrally acting analgesic marketed under the brand name Palexia, and it is used to treat moderate to severe pain. It occupies an especially unique market space, catering to a distinct therapeutic demand for efficacy at lower risks of addiction when compared with the broader class of opioid analgesics. Its need continues to rise because more diverse solutions to pain control continue to grow within healthcare settings in many nations. The market is based on Tapentadol's production, distribution, and usage in diverse medical settings such as postoperative pain, neuropathic conditions, and chronic pain disorders. It is a diversified list of stakeholders: pharmaceutical companies, healthcare providers, regulatory bodies, and patients. The stakeholder plays a role in influencing the course that this market will take regarding its offerings, accessibility, and use in real-world medical practice. Global Tapentadol (Palexia) Market in the Pharmaceutical Industry has strict regulatory systems. Regulations ensure the product is safe, effective, and of quality and hence guiding both development and approval processes.

Developers of these products have to adapt to changing guidelines or meet requirements in different places such as the United States, Europe, and the Asia-Pacific region. This compliance-driven approach dictates the way the companies would go about drug formulations, clinical trials, and marketing strategies, thus paving the future direction of this sector. The market also boasts a competitive environment. Pharmaceutical majors have been innovating their drugs with the help of R&D. Such innovations have given rise to better formulations, like extended-release formulations that not only benefit patients but also bring better compliance. This also incorporates further effects of intellectual property rights and patents in the competitive scenario. The companies would vie with each other for attaining market exclusivity for their respective drugs and devise strategies for optimal usage in the market.

Global distribution networks and alliances will be the principal thrust for Tapentadol. More and more health care services are reaching the developing world and pain management therapy awareness increases; so the market is expected to move beyond the conventional borders. There are chances that the pharmaceutical industries would find a way over the issues of affordability and availability, making this medication reach a large number of patients. Global Tapentadol (Palexia) Market is also in evolution since it can evolve according to changing medical technology development. This sector will open up further through advancements in drug delivery systems and personal medicine. Integration with digital health solutions, like tools that monitor patients, will probably advance the treatment outcomes and easily make the management of chronic pain conditions.

It would continue to model the future of the Global Tapentadol (Palexia) Market and its industry with diversified health needs and advancement in sciences involved. Once such issues as regulations are met, it will only then work on innovation and availability throughout the globe, which will only guarantee that it shall form part of this pharmaceutical business. It will contribute to a better future in pain management and redefine the nature with which healthcare systems address their solutions for pain-related treatments.

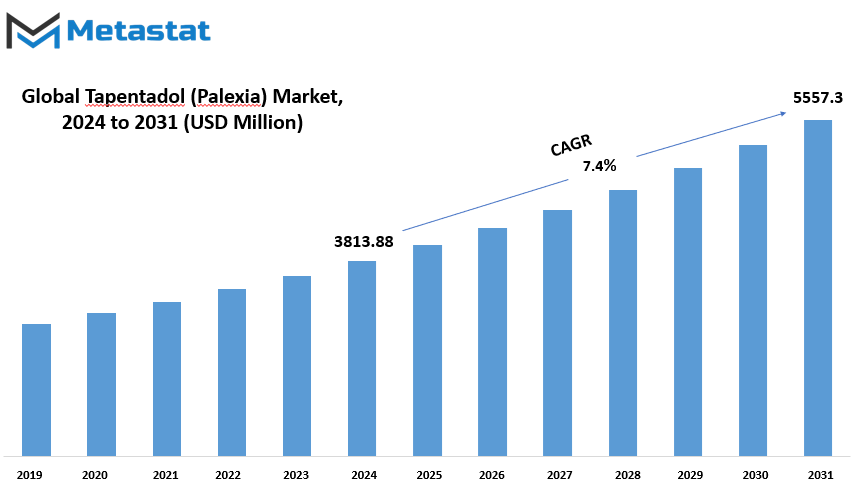

Global Tapentadol (Palexia) market is estimated to reach $5557.35 Million by 2031; growing at a CAGR of 7.4% from 2024 to 2031.

GROWTH FACTORS

With the prevalence of chronic pain conditions now at an all-time high, there has been a corresponding rise in demand for drugs to alleviate the pain. The pharmaceutical market has recorded an increase in the consumption of certain drugs as the world continues its quest to find more efficient ways to control persistent pain. Of these, one of the most preferred drugs among both healthcare providers and patients is Tapentadol. Because its mechanism of action is double, it offers a stronger pain management, as this drug acts both on central and peripheral nervous systems, which makes the treatment approach more effective but also presents the possibility of fewer adverse effects than those with any other opioid-based medication in similar drugs, making it a wonderful option for people who constantly need pain relief.

Yet, despite these benefits associated with the use of such opioid-based drugs as Tapentadol, there remain challenges. Regulatory challenges and limitations have become one of the biggest concerns regarding the opioid crisis. Governments and health authorities worldwide are exerting more controls to contain the misuse and over-prescription of these drugs. However, these steps, in an attempt to correct a pressing public health concern, tend to create a barrier between patients who have a medical need for such pain medication and those who do not. Another factor that is still associated with the opioids side effects and risk of addiction, so it will limit their usage in some specific populations. In some populations who are more likely to be at risk for dependency or reactions, they will not use opioids. But there is an opportunity for the pain relief medication market in emerging markets. Better access to healthcare services and higher awareness about effective pain management solutions are driving the growth of this market in these regions.

With the development of health systems in developing countries, more patients are now able to both be diagnosed and treated for chronic pain. This development will create new opportunities for pharmaceutical companies to address a hitherto unmet need while also contributing to improved health outcomes worldwide. In the near future, this market would have to balance the benefits of pain management with the challenges of safety and regulatory issues. Innovation, along with efforts to increase awareness about safer medications and improve access to them, is likely to shape its future. Thoughtful addressing of these factors can meet the growing demand while keeping the risks associated with opioid-based treatments at bay, ensuring that patients receive care without compromising their overall well-being.

MARKET SEGMENTATION

By Type

Tapsentadol is generally regarded as a medication primarily dispensed to treat pains such as acute and chronic issues. There are two distinct preparations of this medication namely Tapentadol Immediate Release as well as Tapentadol Extended Release. Therefore the two types of treatments complement each other in meeting both mild and severe pain, bringing relief to the sufferer from the pain.

Tapentadol Immediate Release Tapentadol is made to give immediate relief to sudden or severe episodes of pain. It works rapidly after administration, thus becoming the best drug in case of pain that has emerged suddenly or needs to be controlled quickly. IR Tapentadol is commonly used for short-term therapy in cases that need to be treated immediately but should not be kept long-term. The fast-acting characteristic of IR Tapentadol will ensure that patients get back their comfort and continue living their normal lives.

Extended Release Tapentadol on the other hand, slowly releases the medicine over an extended period to provide continuous relief. They are specially designed for managing continuing or chronic pain where this kind of drug is supposed to release its action into the body slowly. Slowly, it releases this drug to help keep a smooth level of pain control going throughout the day or night. Patients who have severe cases of arthritis, neuropathies, or post surgery recovery would benefit the most from this because it prolongs comfort while reducing the instances of frequent dosing.

Both forms of Tapentadol operate through influencing the brain's response to pain, offering relief and enabling the individual to function better. Immediate Release and Extended Release Tapentadol are two options that depend on the needs of the patient and recommendations from a healthcare provider. Medical advice is necessary for this medication as it helps ensure the proper dosage and reduces possible side effects or risks.

Tapentadol is versatile and effective in a wide range of circumstances in which pain management is concerned. Whether the short-lived episodes of pain are being treated with Immediate Release or the steady flow of relief with Extended Release, it makes a difference in many people's lives. By judicious use and proper guidance, Tapentadol can help patients better navigate their pain management journey.

By Indication

The market is categorized by indication into Acute Pain, Chronic Pain, and Other Pain Conditions. Typically, acute pain occurs instantly and for a short duration, usually due to injury or surgery or medical intervention. It is treated by administering treatments that offer instant relief, such as over-the-counter painkillers or prescription drugs. Chronic pain, however, persists, lasting months or even years. It is mainly associated with underlying health problems like arthritis, nerve disorders, or other diseases. Treatment of chronic pain is often multidimensional, involving medication, physiotherapy, and at times, alternative treatments including acupuncture or mindfulness techniques.

Other Pain Conditions are a collection of problems that do not easily fit into the categories of either acute or chronic. They could encompass pain from specific diseases, conditions that cause recurrent periods of pain, or pains from less common medical events. These conditions tend to be treated on a more individualized basis due to factors unique to the causes and nature of the pain.

This way, the division of the market by indication gives a better view of how different types of pain affect people and how the healthcare industry responds to such needs. Acute pain solutions often focus on immediate relief, while chronic pain management emphasizes long-term strategies that improve quality of life. Similarly, addressing other pain conditions involves a more specialized approach to meet diverse needs.

Each category presents its own challenges, requiring health care professionals to assess the underlying causes and make the most appropriate intervention. By breaking the market into these clear categories, it's easier to focus on innovation and assure that patients receive solutions fit for their specific conditions. This approach supports the increasing emphasis on personalized care to provide effective relief and to improve overall well-being.

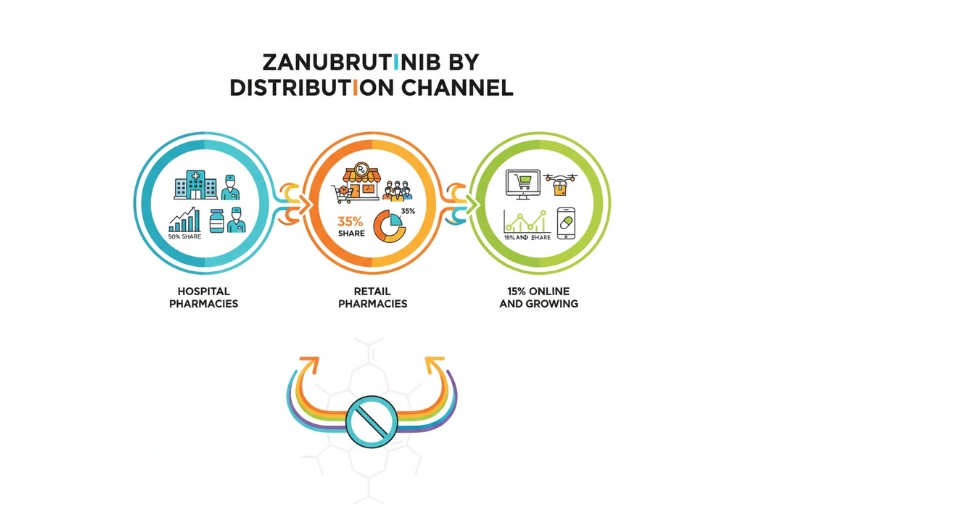

By Distribution Channel

The market is based on a few main distribution channels. These are hospital pharmacies, retail pharmacies, and online pharmacies. Each of these plays its part so that products reach consumers as efficiently as possible to cater to various preferences and accessibility needs.

Hospital pharmacies serve the patient already receiving care within a health facility. They perform an essential function in serving specialty products and in executing prescriptions, especially in terms of recommendations given by health providers. Mostly, patients will get medications from the hospital pharmacies because this would cover emergency needs where there is treatment that can only be handled under tight observation or that which is not available elsewhere.

Retail pharmacies are, however, the ones that are most accessible to the masses. These are places available to the majority of the clients and easy to access. They sell over-the-counter medications, prescription drugs, and even health-related items such as supplements and personal care products. Retail pharmacies usually bridge the gap between healthcare providers and patients; they are convenient and bring about trust because of their personalized service and face-to-face contacts with pharmacists.

The online pharmacies have been one of the most popular pharmacy services over the past years. They offer unmatched convenience by allowing customers to order medications and health products from the comfort of their homes. This channel is especially beneficial for people with mobility issues, those living in remote areas, or anyone who values the simplicity of doorstep delivery. They provide competitive pricing and detailed information about the products, which makes them even more appealing. Nevertheless, it is still important to confirm whether or not drugs purchased over the Internet for consumption are genuine and safe. .

All distribution channels have their unique advantages and serve different sections of the population. While hospital pharmacies are about urgent and specialized care, retail pharmacies are about accessibility and personalization, and online pharmacies are about unparalleled convenience for modern consumers. All of these channels come together to create a system that caters to the diversity of patients and customers in terms of making sure essential health products are available to all who need them. What hits the mind here is a need to look towards more flexible and accepting approach in the health marketplace, in view of dynamics involving adaptability toward changing consumer and technological advancement. In respect of difference of preference and challenge differences being responded, these channels of distribution work toward improvements in health care accessiveness for people across the world as well.

By End-User

The global Tapentadol (Palexia) market is classified into different segments of its end-users, such as hospitals, clinics, and homecare. This segmentation further elaborates the multifunctional nature of the drug, thereby pointing out the scope of pain management within a varied health care setup. Every segment points to specific patient and provider needs and illustrates how Tapentadol meets different requirements.

Hospitals are large portions of the market and use Tapentadol to tackle acute and chronic pain conditions. The drug is administered as per the prescription of physicians in hospitals to ensure right dosages and monitor reactions from patients. In that scenario, the drug especially proves useful in managing severe post-surgical pain or accidents to provide relief to patients under treatment. The use in hospitals reflects the importance of effective pain management to enhance patient outcomes and overall comfort.

Clinics also have an important role in the market. They provide a more accessible option for patients who are experiencing ongoing or moderate pain conditions. Tapentadol is usually prescribed in clinics where there is a need to have regular consultations with the healthcare provider, such as in neuropathic pain or musculoskeletal disorders. The clinic setting provides for the individualized care and closer monitoring of the patient for the safe and effective use of the medication.

Homecare settings further expand the market by catering to patients who require pain relief outside of traditional medical facilities. This segment includes individuals managing chronic pain conditions or those who prefer the convenience of at-home treatment. Tapentadol’s availability for homecare use reflects its adaptability and the growing demand for patient-centered solutions. With proper guidance from healthcare professionals, patients in homecare settings can maintain their quality of life while managing pain in a comfortable environment.

This categorization of the Tapentadol market by end-users underlines its wide applicability in multiple healthcare settings and the paramount importance of pain management for the patients. It applies in hospitals, clinics, or at home. As such, it becomes the drug of choice for any medical professional or patient because it is effective and versatile in usage, which underlines the value of this drug in modern healthcare. With continued attention to meeting the diverse needs of various groups of users, Tapentadol will also remain vital for bettering their lives.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$3813.88 million |

|

Market Size by 2031 |

$5557.35 Million |

|

Growth Rate from 2024 to 2031 |

7.4% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

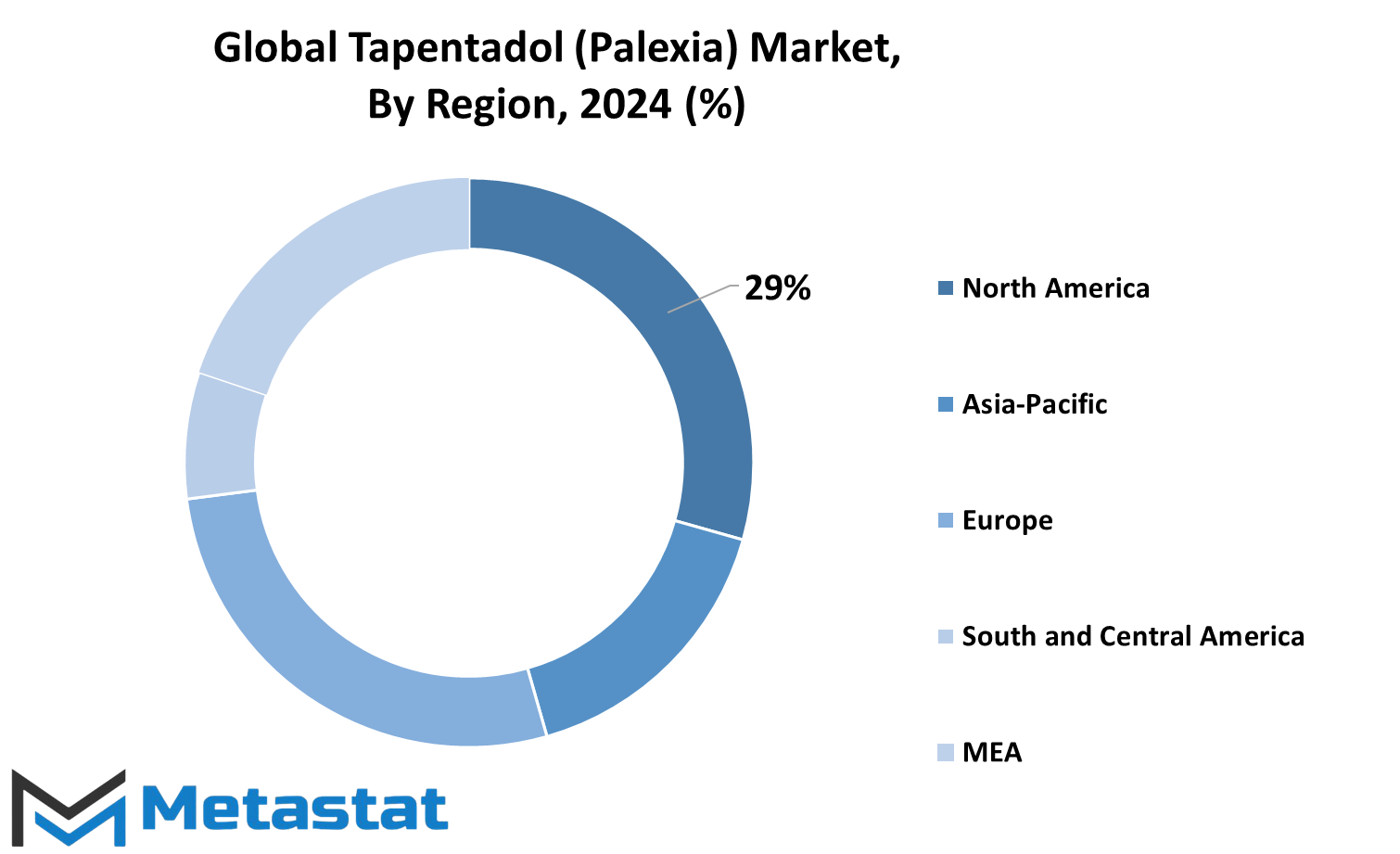

The geographic division of the Tapentadol (Palexia) market can be further categorized into regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Further to these regions, North America includes countries such as the U.S., Canada, and Mexico. Europe is categorized into countries including the UK, Germany, France, Italy, and the Rest of Europe. Asia-Pacific represents India, China, Japan, South Korea, and the Rest of Asia-Pacific. South America comprises Brazil, Argentina, and the Rest of South America. Last but not least, the Middle East & Africa region is broken down into the GCC countries, Egypt, South Africa, and the Rest of the Middle East & Africa. The regional market dynamics, as well as characteristics, can be significantly influenced by several factors including healthcare infrastructure, regulatory environment, and the demand for Tapentadol. Regional segmentation helps business leaders and other stakeholders know exactly where they can expect the potential of growth and expansion and pinpoint what challenges will appear in the respective region. More about these regions must be known for any company planning to penetrate the international Tapentadol market.

The different subdivisions within these major regions allow for a more precise analysis of market trends, consumer preferences, and regulatory frameworks specific to the area. Companies will have to adapt their strategies according to the region they are targeting to meet local demand and comply with regional laws and regulations. This segmentation also enables manufacturers, healthcare providers, and distributors to tailor their product and service offerings to suit the specific needs of the market. Overall, geographic segmentation of the global Tapentadol market will continue guiding businesses in making the most informed decisions regarding market entry, expansion, and long-term growth strategies.

COMPETITIVE PLAYERS/ COMPETITIVE LANDSCAPE/ KEY PLAYERS/MARKET LEADERS

The Tapentadol (Palexia) industry is dominated by several large companies that are playing an important role in the manufacture and marketing of this drug. The major players of the market are Grünenthal GmbH, Johnson & Johnson, Alkem Laboratories Ltd., Depomed (now Assertio Therapeutics, Inc.), IPCA Laboratories Ltd., Lupin Laboratories Ltd., Macleods Pharmaceuticals Pvt. Ltd., Sun Pharmaceutical Industries Ltd., Wockhardt Ltd., and Collegium Pharmaceutical, Inc. These firms are engaged in the production, marketing, and sale of Tapentadol, a primarily pain management drug.

Grünenthal GmbH is another major stakeholder in this market. The company is among the pioneering ones that had developed Tapentadol. This is a company well established in the pharmaceutical sector with a lot of expertise in solutions for pain relief. Another major player in this market is Johnson & Johnson. This is a company that has vast global reach, and it has been engaged in multiple areas of pain management through its extensive portfolios of medications.

Alkem Laboratories Ltd. and IPCA Laboratories Ltd. are other important contributors to the Tapentadol market. Both these companies are involved in the production of generic versions of the drug, which makes it more accessible to a wider population. These companies are well-established in the pharmaceutical industry and have a strong network for distribution.

Lupin Laboratories Ltd., Macleods Pharmaceuticals Pvt. Ltd., and Sun Pharmaceutical Industries Ltd. are among the leading manufacturers and marketers of pharmaceutical products. They offer a wide range of medicines, including generic versions of Tapentadol, and have a strong presence in both domestic and international markets.

Other very significant names in the market are Wockhardt Ltd. and Collegium Pharmaceutical, Inc. These companies take an innovative approach to manufacturing pharmaceuticals. Collegium Pharmaceutical, Inc. marked the industry with pain management drugs and a commitment to caring for patients.

These companies together ensure that Tapentadol is available for those who require it for relief from pain. Competition among them will help maintain the diversity of the supply chain, which is easier for the patients to obtain the medication, while the prices remain competitive in the market. Ongoing research and development in these companies will lead to further formulation improvements of Tapentadol and availability in the near future.

Tapentadol (Palexia) Market Key Segments:

By Type

- Immediate Release (IR) Tapentadol

- Extended Release (ER) Tapentadol

By Indication

- Acute Pain

- Chronic Pain

- Other Pain Conditions

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By End-User

- Hospitals

- Clinics

- Homecare Settings

Key Global Tapentadol (Palexia) Industry Players

- Grünenthal GmbH

- Johnson & Johnson

- Alkem Laboratories Ltd.

- Depomed/Assertio Therapeutics, Inc

- IPCA Laboratories Ltd.

- Lupin Laboratories Ltd.

- Macleods Pharmaceuticals Pvt. Ltd.

- Sun Pharmaceutical Industries Ltd.

- Wockhardt Ltd

- Collegium Pharmaceutical, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252