MARKET OVERVIEW

The Switzerland Facility Management market is a niche industry, which specializes in the effective operation and maintenance of facilities in any sector. As such, this market finds its base in precision and innovation to become the backbone of organizations looking to optimize their infrastructure and operational processes. The Swiss standard for efficiency and quality makes the facility management sector offer tailored solutions that best satisfy the needs of businesses, public institutions, and residentials.

The range of services under this industry caters to make sure buildings, spaces, and systems function in an entirely fluid manner. These services run from technical operations like maintenance of HVAC systems and electrical networks to soft services such as cleaning, security, and catering. Facility management demand in Switzerland is characterized by the unique structure of the economy and society in the country.

As more businesses emphasize sustainability, they want facility management that complies with environmental standards and minimizes energy usage. This has increasingly become the focus of embedding technology and data-driven practices into improving service delivery while minimizing the costs of operation.

The Switzerland Facility Management market also caters to a diversified range of clients such as commercial offices, healthcare facilities, educational institutions, and retail spaces. Each segment poses its own set of challenges and requirements, compelling service providers to use innovative methods to meet client expectations. For example, the healthcare sector requires high standards of hygiene and regulatory compliance, while commercial spaces focus on tenant satisfaction and cost optimization.

An important characteristic of this sector is its dependence on trained personnel and sophisticated technologies. Facility management companies in Switzerland make use of trained staff and modern technologies to provide the best results. The incorporation of smart building technologies, like IoT devices and automation, is slowly becoming a bedrock of the sector. Such tools will ensure real-time monitoring and predictive maintenance to ensure that functions do not stop and to maximize asset life.

Additionally, the market’s framework is influenced by Switzerland’s regulatory environment. Compliance with local laws and standards will remain a fundamental component of facility management practices. As the industry evolves, companies will prioritize transparency and accountability to maintain client trust and adhere to legal requirements.

The future trends of the Switzerland Facility Management market are expected to be in terms of flexibility and innovation. Workplaces and public spaces are continuously changing because of the advancements of technologies and shifting societies. These changes would force the industry to adjust its service delivery models and provide solutions, which can be adapted based on various factors, from analytics reliance to flexible and customized services.

The Switzerland Facility Management market will continue to respond to Switzerland trends, applying best practices to maintain an edge in the market. Service provider and client collaboration will remain strong, promoting partnerships fostering mutual growth and efficiency in the industry. The capability of the industry to discern and respond to changing needs will ensure its continued sustainability in the future.

The Switzerland Facility Management market is the most important part of Switzerland's infrastructure landscape. Since it is committed to quality, innovation, and sustainability, the industry is well-equipped to face all future challenges while meeting a wide range of client needs. Through a combination of knowledge and advanced technologies, it will play a key role in shaping the functionality and efficiency of Switzerland's built environment.

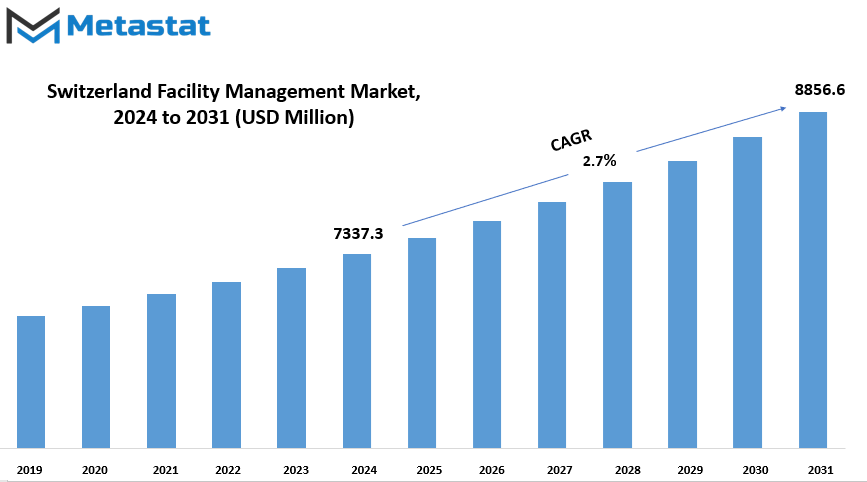

Switzerland Facility Management market is estimated to reach $8856.6 Million by 2031; growing at a CAGR of 2.7% from 2024 to 2031.

GROWTH FACTORS

As it is, there are increasingly high demands from this growth and the need to pursue ever more sustainable and efficient facilities management solutions. Expanding businesses and living spaces need innovative ways of keeping spaces running efficiently, effectively and sustainably. Today's companies are fast looking into sustainability as an ideal step toward reducing the impacts brought about by them without loss of operational efficiency, yet this is but an epitome of larger actions into adopting practices for bettering economics alongside ecology.

Due to this, sustainable facility management solutions are now becoming the top priority for both commercial and residential sectors. Growth of the market is further fueled by commercial and residential infrastructure development at a steady pace. With this expansion of urban areas, new projects coming up in the area will always give rise to an increased need for effective facility management. Such developments are only viable if coordinated in a way that allows for smooth, safe, and resourcefully optimal operation. This will be a significant business opportunity as demand continues to rise to meet specific needs within diverse industries and residential communities.

Despite these opportunities, there are still some challenges. Companies in this field face a significant challenge in terms of high operational costs, especially when combined with the shortage of skilled labor. Facilities management requires trained personnel to handle various tasks, and the increasing demand for expertise often leads to higher costs. Government regulations also impose strict compliance requirements, which can add complexity to operations. It is time-consuming and resource-intensive, and achieving these standards is not cheap for businesses. Nevertheless, the advancement of technology is an opportunity for the industry.

The implementation of tools such as IoT and AI is changing the management of facilities. These technologies facilitate better monitoring, data-driven decision-making, and increased efficiency. For instance, IoT devices can monitor energy usage or equipment performance. This helps managers to address issues before they become severe. AI-powered systems help optimize workflows, reduce costs, and improve overall service delivery.

Another trend which is more evident is outsourcing facility management services. Several businesses realize the importance of outsourcing such tasks to the specialized service providers, so that they can focus on core activities. Outsourcing leads to greater efficiency and relief from maintaining in-house teams for such facility-related works. The market potential, therefore, remains strong since businesses and residents alike will look for solutions that integrate sustainability, technology, and operational efficiency in their quest for the future of facility management.

MARKET SEGMENTATION

By Vertical

Vertical industries are divided into separate sectors with their specific needs and issues. Among them, the key sectors include IT and ITeS, Telecom, BFSI, Healthcare and Life Sciences, Education, Retail, and many more. These sectors together add to the market and work as a backbone in terms of economic growth and technological advancements.

IT and ITeS provides technology-driven services from software development to IT support in the sense of making business processes more efficient and streamlined. In contrast, telecom drives the communication infrastructure by offering services connecting people and organizations worldwide at a faster and more reliable rate of data transmission.

Banking, Financial Services, and Insurance is another sector that is extremely vital in this regard. This sector provides banking facilities, investment opportunities, and insurance coverage. This sector guarantees financial stability and growth at the individual and corporate levels. Healthcare and Life Sciences plays an important role in adding to the quality of life through the advancement of medical research, patient care, and health technology solutions.

The education sector, being one of the key areas, focuses on providing accessible and effective learning systems to empower people with knowledge and skills. Technological integration in this sector is changing the education sector to provide online learning platforms, virtual classrooms, and interactive tools that can make education more inclusive and adaptable to modern needs.

This aspect emphasizes consumer satisfaction, through vertical distribution across traditional stores and electronic means of shopping. The industry is one that continually develops according to changing consumer desires, with the intention of providing convenience and innovation within shopping experiences.

Other verticals which do not fall into these categories include niche markets or emerging industries. They address specialized needs or focus on upcoming technologies that shape the future. These diverse verticals altogether contribute to the interconnectedness of industries, fostering growth, development, and innovation in all areas.

Each segment functions as a vital part of a larger jigsaw, emphasizing its role in defining the overall market scenario. Their combined effect reflects the value of customized solutions and targeted interventions in meeting particular needs, promoting advancement, and opening up avenues for development in different industries.

By Service Type

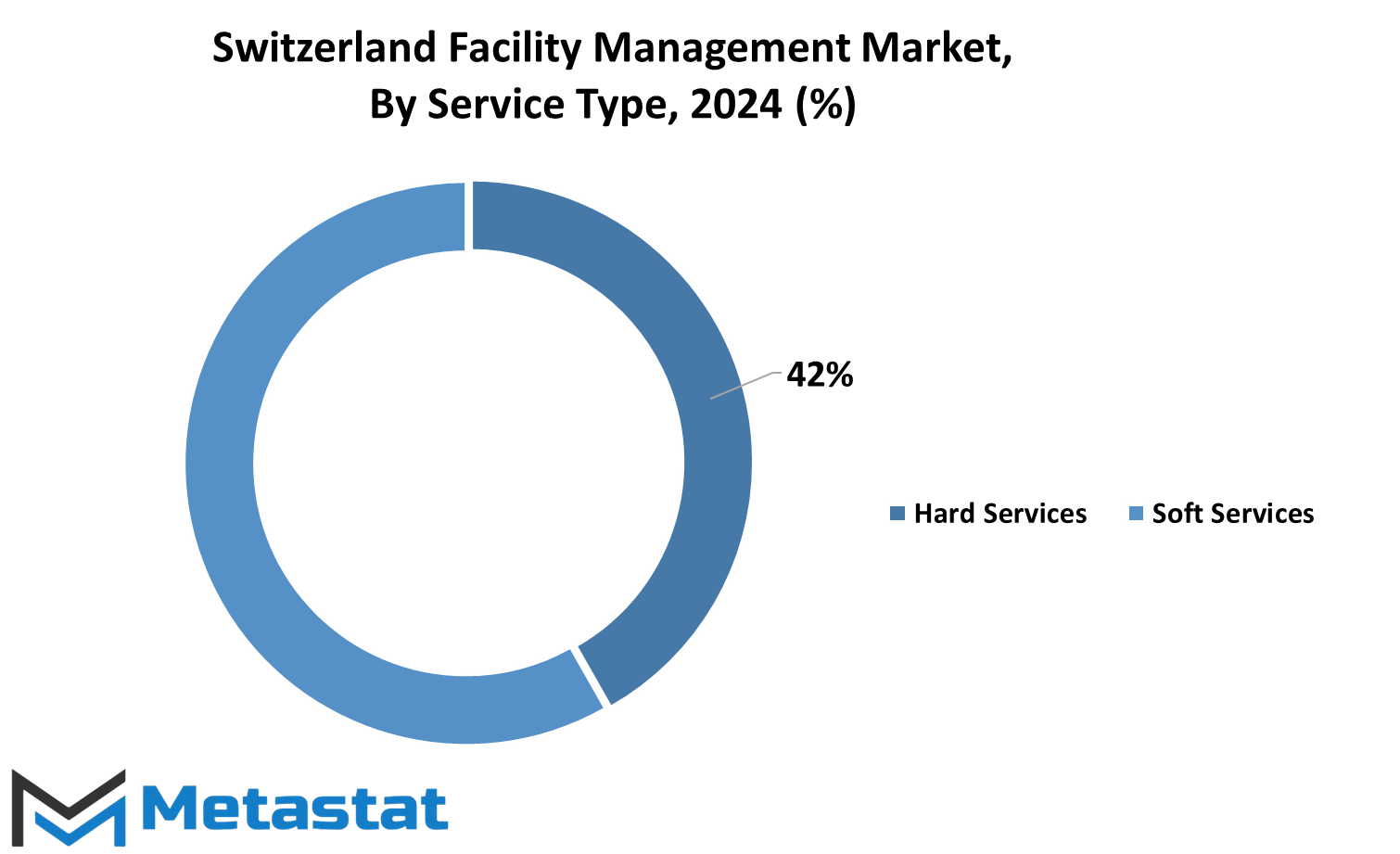

Market Based on the Type of Facility Services Offered The facility management market can be divided into two significant segments, which are either classified under the group known as hard services or soft services. For 2023, the hard services segment was substantial, taking a share of 41.9% in total market size of 3011.2 million USD. This segment is projected to experience steady growth over the coming years, with a forecasted compound annual growth rate (CAGR) of 2.41% from 2024 to 2031. By the end of 2031, its market value is expected to rise to 3621.5 million USD.

Hard services typically focus on the physical components of a facility, such as maintenance, repairs, and technical support for infrastructure and equipment. They also become significant in ensuring that buildings with associated systems, such as electricity and electrical, plumbing, and heating, ventilation, and air-conditioning facilities and plumbing all have a good working state in preserving and supporting the structural integrity of those facilities and their operational dependability.

Soft services, however, are aimed at the nontechnical aspects of facility management and are driven by creating comfort and health for the occupants. These include cleaning, security, landscaping, and waste management services. Soft services cannot directly change the physical framework of the facility but represent a fundamental aspect of safe and pleasant utilization of the facility.

This is evident from the stable growth in the hard services sector. Such is the increase in infrastructure needs to be maintained and updated, mainly within industrial processes, where aging buildings and emerging technology are causing an uninterrupted need for services for the operation of intricate systems. Furthermore, with increasing awareness on sustainability and energy efficiency, more services will be needed for facilities to maintain the growing standards.

Both segments, hard and soft services, are significant contributors to the overall facility management market. Although hard services dominate a larger share because of their critical role in facility upkeep, soft services are equally important for ensuring a positive and productive environment. Together, these segments illustrate the diverse needs of modern facilities and the ongoing importance of effective management strategies to meet those needs.

By Model

Based on the nature of facilities management, it can be classified as outsourcing and in-house services. Outsourcing facilities management involves the involvement of third-party organizations, which will be hired for handling maintenance, cleaning, security, and other operational functions in the facilities. In such a case, business will focus more on core activities, relying on experts to make efficient use of their time on everyday facility operations. Companies prefer outsourcing if they want to save money, acquire expertise in certain fields, or want better services without an internal team to support them.

Conversely, in-house facilities management is the operations being handled by a business themselves. They hire staff who manage the maintenance and security services of their company, among other essential services. This model gives the companies more control over the management of their facilities and ensures that internal standards and practices are followed consistently. It can be very resource-intensive in terms of investment, training, and equipment. Organizations that value direct oversight and customization often prefer this option, especially if their operations demand tailored services or have specific compliance requirements.

The choice between the two models may depend on a variety of factors such as the size of the organization, its nature of operations, and the long-term goals of an organization. Organizations that have large-scale operations with lots of facilities would tend to keep management in-house due to the scale and complexity of needs. Small organizations or firms looking to minimize costs while improving flexibility will lean more towards outsourcing.

Advantages and challenges for both models, both outsourcing and in-house management, exist. With outsourcing, one can achieve expert service with less burden on internal teams, but such arrangements might come with loss of direct control or risk in terms of quality if the external provider fails to perform well. In contrast, the advantage of in-house management is more control and alignment with the vision of the company, but it consumes more resources and time.

Determining the most suited facilities management approach requires identifying the specific needs of any business. Based on assessing factors such as budget, achieving operational goals, and general resource availability, organizations need to determine whether outsourcing would be best or if in-house management would better meet a company's requirements and support a general strategy for efficient, effective operations.

By Region

The Switzerland Facility Management market can be broadly divided into regions with distinct characteristics and contributions to the sector. The regions are Central Switzerland, Eastern Switzerland, the Zurich Region, Northwest Switzerland, Western Switzerland, the Bern Region, and Ticino. This division will enable an understanding of how facility management services are distributed and customized to meet the requirements of various areas in the country.

Central Switzerland is known for its blend of urban and rural settings, which creates a demand for diverse facility management solutions. Similarly, Eastern Switzerland brings a mix of industrial and residential requirements, with services often tailored to support manufacturing hubs alongside community infrastructure. The Zurich Region is a leading economic and financial center that demands highly efficient facility management services for offices, retail spaces, and residential complexes. The fast-paced environment of this area demands streamlined operations and a focus on sustainability and innovation.

Northwest Switzerland is another important player in this market, where pharmaceutical and life sciences industries highly influence the demand for specialized facility management services. Western Switzerland, comprising Geneva and other cities, is more internationally oriented and has higher requirements for facility management to match international standards. International organizations based here create a high level of complexity and scale for the region's needs.

The Bern Region is the central administrative hub of the country and has strong emphasis on maintaining public and governmental buildings. Facility management in this region, therefore, has to balance maintenance of historical sites with the demands of modern administrative offices. Finally, Ticino with its cultural orientation towards Italy and the combination of tourist and local business activities requires services that meet the needs of hospitality-oriented businesses and a business environment unique to the region.

Each of the aforementioned regions showcases the numerous differences in needs and preferences in the Swiss facility management market. This specific requirement is an excellent way to help providers tailor these solutions in order to deliver services that enhance efficiency while sustaining high standards in diversified settings throughout the country. Awareness of the regional break allows businesses to optimize their approaches, deliver services that resonate well with their clients in Switzerland, and meet their requirements better.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$7337.3 million |

|

Market Size by 2031 |

$8856.6 Million |

|

Growth Rate from 2024 to 2031 |

2.7% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

Facility management is one of the important fields in running businesses and organizations effectively. It has a broad area of services in facilities that combine all activities for maintaining functionality, safety, and sustainability in various environments. Such top-level firms that include key players within the sector include ISS Facility Services AG, Johnson Controls, Bouygues E&S InTec Switzerland Ltd., Dussman Services AG, Honegger AG, Sodexo, IBM Corporation, Oracle Corporation, CBRE Group, Inc., Jones Lang LaSalle IP, Inc., Nemetschek Group, Infor, MRI Software LLC, Planon, and Apleona GmbH, amongst others that play the lead role in defining global facilities management.

Each of these organizations specializes in different aspects of facility management, meeting the specific needs of their clients. Whether it is cleaning, security, maintenance, or energy management, they provide customized solutions to enable businesses to run more effectively. For instance, organizations such as ISS Facility Services AG and Sodexo are known for their strength in integrated facility services, focusing on bringing together multiple offerings into a single streamlined system. This approach not only enhances efficiency but also reduces the operational costs of clients.

Technology also plays a significant role in modern facility management. Companies such as IBM Corporation, Oracle Corporation, and MRI Software LLC are leading companies that develop new software and tools that improve planning, monitoring, and decision-making processes. These technologies help organizations better manage their assets, optimize resource usage, and ensure compliance with regulations. This is where digital solutions come in, enabling facility managers to identify issues beforehand and implement strategies that reduce the level of disruption.

Moreover, global facility management companies like CBRE Group, Inc. and Jones Lang LaSalle IP, Inc. contribute significantly to the industry through their years of experience. Most of these companies specialize in real estate and workplace strategies that enable businesses to align their physical space with their operational objectives. In addition, most of them have lately integrated green initiatives to increase the efficiency of energy usage and decrease the impact on the environment.

The Facility Management industry continues to grow due to the increasing demand for holistic and efficient solutions. These leaders are spearheading advancement in the industry, equipping organizations around the world with better management of their spaces, improved productivity, and adapting to the changing needs of users. The contributions of these players underscore the importance of facility management in fostering operational excellence.

Switzerland Facility Management Market Key Segments:

By Vertical

- IT & ITeS

- Telecom

- Banking, Financial Services, & Insurance (BFSI)

- Healthcare & Life Sciences

- Education

- Retail

- Other Verticals

By Service Type

- Hard Services

- Soft Services

By Model

- Outsourcing Facilities Management

- In-House Facilities Management

By Region

- Central Switzerland

- Eastern Switzerland

- Zurich Region

- Northwest Switzerland

- Western Switzerland

- Bern Region

- Ticino

Key Switzerland Facility Management Industry Players

- ISS Facility Services AG

- Johnson Controls

- Bouygues E&S InTec Switzerland Ltd.

- Dussman Services AG

- Honegger AG

- Sodexo

- IBM Corporation

- Oracle Corporation

- CBRE Group, Inc.

- Jones Lang LaSalle IP, Inc.

- Nemetschek Group

- Infor

- MRI Software LLC

- Planon

- Apleona GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252