MARKET OVERVIEW

The Sweden Cybersecurity market and its industry will continue to be a leading aspect in securing digital infrastructures and sensitive information with the advent of a more connected future in Sweden. Strongly founded on technology, Sweden emerged at the forefront of the cyber world, providing new solutions to the increasing threat of cybercrime. This is where businesses and governments continue relying on digital platforms, and consequently, demand for cybersecurity services and products will grow in support of organizational resilience in all sectors. This market will be a large array of services, from network security to endpoint protection, data encryption, and threat intelligence.

These services will be needed as organizations attempt to secure their operations and protect their assets from a growing array of cyber threats. With finance, healthcare, and manufacturing becoming increasingly digitalized in Sweden, demand for advanced cybersecurity solutions will increase. This will promote local companies to create custom security frameworks that tackle not only the traditional threats, such as phishing attacks, but also modern threats such as ransomware. In addition to these core offerings, next-generation security solutions such as AI-driven security systems and cloud-based protection models are emerging in the Sweden Cybersecurity market.

These will help companies automate their security measures, thereby proactively responding to threats before any damage is caused. With growing data dependency in cybersecurity, machine learning and big data analytics will be incorporated into their products by Swedish cybersecurity providers to update customers regarding the dynamic risk situation. This would reduce detection and resolution time with more agility in businesses with detection of vulnerabilities and breach issues. Sweden's government will be a driving force in the cybersecurity market. It will push for regulations that will make companies put in place strong security measures. Sweden will invest more in its cybersecurity framework through initiatives such as the Swedish Civil Contingencies Agency (MSB) and the National Cybersecurity Strategy.

As digital transformation accelerates in all sectors, Swedish organizations will increase their focus on securing supply chains. Because of growing globalization and interconnectedness, any weaknesses in a partner organization's cybersecurity infrastructure will pose a threat to everyone. This means that there will be greater attention on third-party security assessment and compliance checks. Secondly, cybersecurity providers in Sweden will engage in collaborations with international players, improving their capabilities and offering better security for their clients in multiple countries.

A growing workforce of skilled professionals will be an added benefit to the Sweden Cybersecurity market. Top-tier educational institutions in Sweden, providing advanced training in information security, will continue to produce experts to take on the challenges of modern cybersecurity. These will be key professionals in developing, managing, and evolving the security systems that protect Sweden's enterprises and critical infrastructures.

The Sweden Cybersecurity market will remain an anchor for the nation in its digital future. Through maturity, the market is going to give businesses and individuals a significant amount of protection that Sweden will provide a safe and resilient path into its digital future for years to come in the fight against evolving cyber threats. The country will use the innovation, regulations, and skilled workforce to create the cybersecurity environment businesses and citizens can depend on for a long time to come.

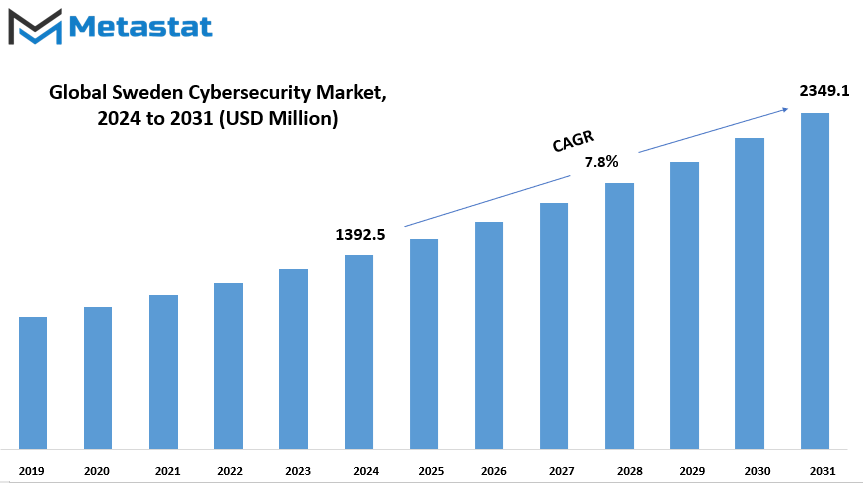

Sweden Cybersecurity market is estimated to reach £ 2349.1 Million by 2031; growing at a CAGR of 7.8% from 2024 to 2031.

GROWTH FACTORS

Some factors that affect the cyber market in Sweden include; ever-rising threats, action taken by the government, rising problems, and emerging trends. With the growing population of cyber threats, Sweden and other countries have really found a great need to acquire sophisticated cybersecurity measures as much as possible in a vast sector of activity. And so are organizations with interest in safe solutions for the secure safeguarding of sensitive data while at work to maintain an uninterrupted operation. This increased focus on cybersecurity is in line with global trends but has been particularly essential in Sweden, which is rapidly expanding its digital infrastructure.

Government initiatives have been crucial in stimulating cybersecurity investments. Policies aimed at building digital defenses and ensuring protection of critical national infrastructure have motivated businesses to invest in advanced technologies. Such policies not only strengthen national security but also help to instill public confidence in Sweden's digital ecosystem, which is crucial for further growth and innovation.

Despite these efforts, the market faces challenges that may limit its potential growth. Perhaps one significant barrier is cost. Complete cybersecurity solutions might be unaffordable for most small and medium-sized companies, contributing to slower rollout in a few areas. The current shortage of sufficient cybersecurity-skilled professionals, too, is a challenging issue because the growing expertise needed for sophisticated threats only widens the gap with industry demands in terms of holding the rhythm of development at the set pace.

Despite these challenges, there is promising opportunity within the Swedish cybersecurity landscape. The increasing move toward cloud-based solutions within the digital transformation efforts created a demand for cloud security technologies. Businesses are seeking scalable and efficient ways to safeguard their operations as they move to the cloud, making this a key area of growth. Another area of expansion is through the increasing popularity of managed security services. Enterprises, especially those with limited internal resources, are seeking the help of external providers to manage their security comprehensively, thus driving the demand for specialized services.

The Sweden cybersecurity market is underpinned through rising threats and government support with challenges associated with high prices and shortages of talent available. Nonetheless, opportunities arising from the growth of cloud-based security and managed services promise higher growth potential for the security industry. A growing trend of demand from secure systems to resilient ones will increase in demand, forcing the urgent need to have these kinds of challenges address and unlock the potential that will define the future of cybersecurity in Sweden.

MARKET SEGMENTATION

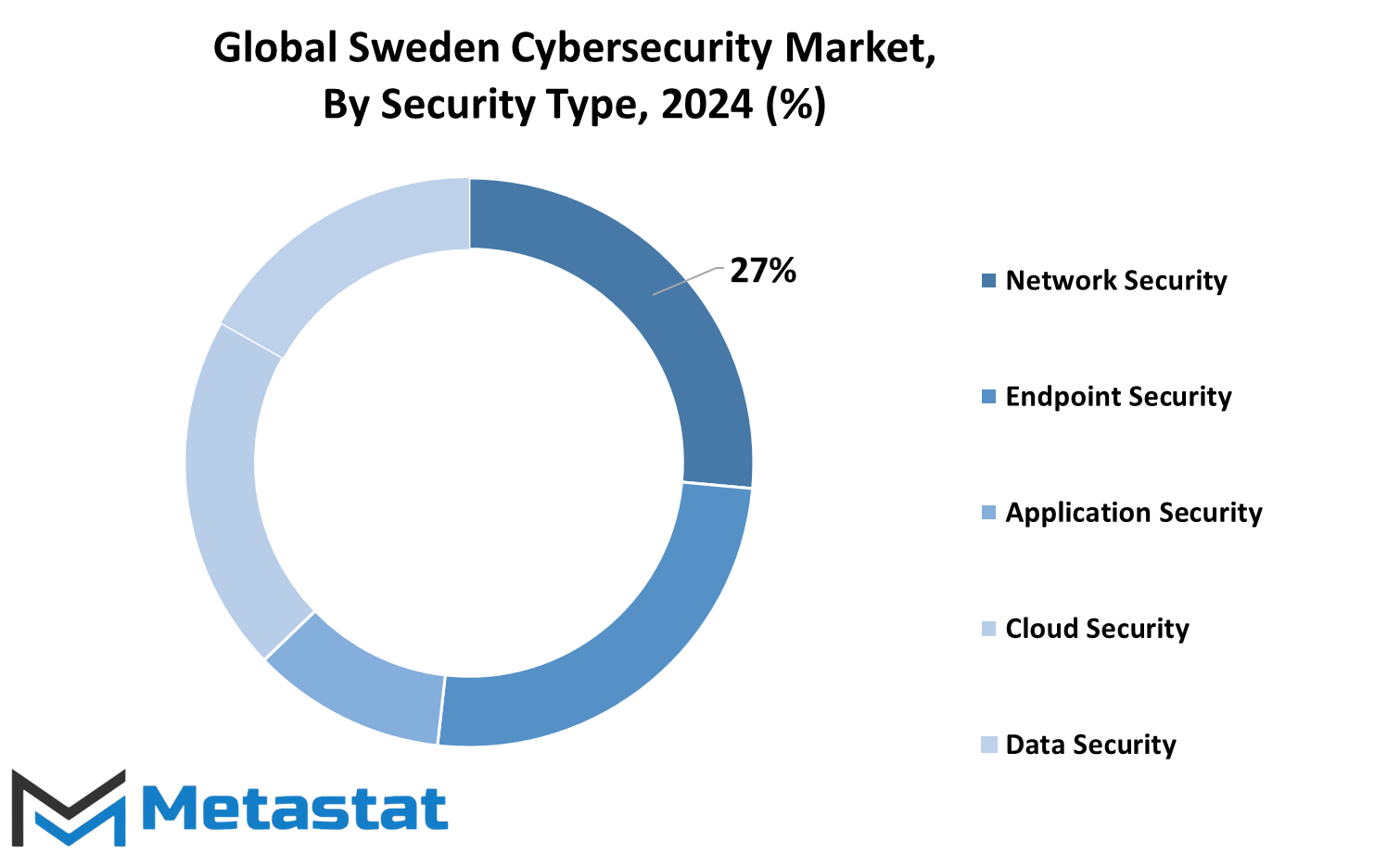

Security Type

The cybersecurity market is divided into several sub-markets that specialize in one form of protection of digital systems and data. One of them is Endpoint Security, which, according to the forecast, in 2023 will amount to 260 million euros and take 20.8% of the total market. This segment is expected to grow steadily with a compound annual growth rate of 8.04% from 2024 to 2031. By 2031, the value of the Endpoint Security market will rise to approximately 498 million euros.

The endpoint is a significant part of security since it protects computers, mobile phones, and other tablet devices that connect to the network. Most of the times, these devices are points of entry for cyber threats. For the overall safety of the system, their protection becomes an imperative. With the advancements of sophisticated cyberattacks, there is a growing need for proper endpoint protection.

The Application Security segment revolves around securing the software application from threats, while ensuring the data's safety from theft for storage and processing in a cloud environment falls under the segment of Cloud Security; Data Security secures the system against unauthorized access and theft of sensitive information. IAM is one more crucial segment of the same, because it ensures businesses are enabled to manage access and secure systems and data by controlling and limiting the entry of just those people who have permission to do so.

This has, of course, taken another crucial role in cyber security - the monitoring and incident response to security breaches. These incidents occur in real time. Another segment in this field of cybersecurity is called "Others" where some new fields come within the category of "others".

Demand for security solutions in the marketplace is booming across every industry. In this sense, securing the data and systems as well as keeping networks secure from cyber attacks will, of course continue to remain a business imperative worldwide as the digital world continues advancing. Higher dependence on digital technology, however, means demand for more cybersecurity solutions can only see one direction: further increase and be a significant component of today's digital world.

By End User

The market is divided into various key sectors by the end user. The sectors are Finance and Banking, Healthcare (Hospitals), Government, Defense, and Public Sector, IT and Telecommunications, Industry and Manufacturing, Retail and E-Commerce, and Other sectors. Each of these categories has its unique set of needs and demands, which plays a major role in determining market trends and drives growth in its respective fields.

For instance, the Finance and Banking sector is one of the largest and most significant sectors in the market. The services range from banking to investments and financial services. It will continue to grow with new technologies because financial institutions are developing their innovative solutions to improve efficiency, security, and customer experience.

In Healthcare, especially within hospitals, there is an immense demand for solutions supporting patient care, improving operational efficiency, and enhancing the health care experience in general. These factors include the advancement of medical technology in terms of equipment and patient management systems and the continuous desire for high-quality health services.

The Government, Defense, and Public Sector sectors are always in need of strong systems to provide national security, public safety, and administration. The technology and services needed here often are specific to ensure the safety and efficient running of public institutions and governmental organizations. Advanced cybersecurity and data management solutions have increased demand in these fields as governments deal with intensifying challenges.

IT and Telecommunications have become fundamental in supporting communication networks and digital transformation across industries. The growth of digital services, cloud computing, and network infrastructure has contributed to the growth of the sector, offering new opportunities for businesses and consumers.

Industry and manufacturing would be the central pillars for economic development, with themes of automation, supply chain management, and production efficiency. Technological advancements in IoT and AI are changing this sector, allowing for smarter factories and making processes more efficient.

Retail and E-Commerce keep growing rapidly and are steered by changing consumer behaviors with online shopping in mind. They are developing their digital presences while making customers have seamless experiences across channels.

Lastly, the "Other" category encompasses a broad spectrum of other industries that are not covered in the above primary groups. These can be educational, hospitality, transportation, agricultural industries, and many more with different needs and demands. These categories illustrate the different uses and expansion drivers in the market and show the need for a customized solution for each group of end-users.

By Organization Size

The market may be divided into two major categories based on the size of the organization, which includes Small and Medium Enterprises and Large Enterprises. Small and Medium Enterprises, often known as SMEs, represent businesses that have fewer workers and lower revenues compared to larger organizations. These business organizations are very important for the economy because they influence innovation and provide employment at various levels. SMEs are normally elastic and respond to the newness in the market, as well as to their customers' needs, faster. They mainly operate in local or niche markets and tend to be more personal, hands-on operations.

On the other hand, Large Enterprises are businesses with many employees, larger revenue, and a much larger scale. They usually have more processes in place, greater access to resources, and the potential to cater to wider markets, domestic and international. They also usually have more complicated structures, including many departments and several tiers of management. Because they are large-scale, such organizations can spend very much on research and development, marketing, and expansion activities, and thus remain leaders in their respective markets.

The difference between SMEs and Large Enterprises is vital in distinguishing how companies consider business strategies and decision-making. That is, whereas SMEs may focus on flexibility, cost, and niche markets, large enterprises may focus more on the scalability, efficiency, and global reach of their offers. This also translates to other differences in terms of types of products or services developed. SMEs may produce more personalized or specialized offers, while large enterprises concentrate on mass production and offer standardized products or services.

By knowing what makes these two categories differ, businesses, investors, and analysts will be better positioned to determine market trends, opportunities, and challenges. Smaller enterprises will require support, mainly in finance and access to markets, while the larger enterprises may face high regulatory scrutiny and competitive pressures by other global players. Therefore, both kinds of entities are important to keep an economy balanced and healthy; they contribute in different ways to the market.

By Deployment Type

Based on deployment type, the Sweden cybersecurity market is segmented into On-Premises and Cloud-Based. Each of the above deployment types has its set of benefits, catering to different needs of businesses and organizations across Sweden.

The On-Premises form of deployment refers to cybersecurity solutions hosted and managed within an organization's own infrastructure. In this case, all hardware and software are kept on-site, often on company data centers. The beauty of this deployment is that an organization will have full control over their cybersecurity systems to custom design a solution specific to their needs. There are several businesses that select the On-Premises solutions simply because of data security.

It can be ensured that the sensitive information does not leave their physical premises. However, this form of deployment also has the costs, which are a bit pricey in terms of equipment at the onset and in the later stages of maintenance, particularly for small business ventures and cost-cutting businesses.

Cloud-Based is another one, where cybersecurity solutions are offered on remote servers, mostly managed by third-party companies. This deployment type can offer access to cybersecurity tools and services over the internet, thus obliterating the need for expensive in-house infrastructure. Cloud-Based solutions are usually more scalable, and the business can grow or adjust security features as the business changes. For many organizations, Cloud-Based deployment is appealing because it reduces the burden of managing physical hardware and can lower operational costs.

Moreover, cloud services often include automatic updates and patches, ensuring that the systems are always up to date with the latest security measures. However, some organizations have certain concerns about trusting any third-party provider with handling sensitive data, which would become a limitation of this form of deployment.

On the other hand, On-Premises and Cloud-Based have their own advantages when it comes to cybersecurity solutions and mostly depend on the actual requirements of an organization in selecting one over the other. Businesses may consider control over infrastructure, cost constraints, requirements in terms of scalability, and their approach to data security when choosing the most suitable type of deployment. Therefore, understanding these types of deployments will help businesses in Sweden make more informed decisions concerning the protection of their data and networks in light of top priorities on cybersecurity by these companies.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$1392.5 million |

|

Market Size by 2031 |

$2349.1 Million |

|

Growth Rate from 2024 to 2031 |

7.8% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

Major industries found in the cybersecurity sector would mainly include Accenture PLC; these companies help to drive their development and direction. Organizations such as Arrow Electronics or Broadcom Inc. help people seek advanced solutions and services provided under advanced security technologies. Companies Check Point Software Technologies Ltd and Cisco Systems, Inc offer security technologies that help individuals and businesses avoid different sorts of cyber risks. CrowdStrike Inc. is another giant company, famous for its innovative approach in preventing and responding to cyber attacks.

Ericsson AB and F5, Inc. are other companies that contribute significantly to the protection of networks and ensuring smooth digital communication. Fortinet, Inc. and IBM Corporation are also highly known for their cybersecurity skills, offering a wide range of protective tools and services to businesses across different sectors. AO Kaspersky Lab has focused strongly on security software, creating a name for dependable solutions that safeguard users against malware and other cyber risks.

Another important player in cybersecurity is Microsoft Corporation, offering security solutions for individuals and organizations. Network Services Group, LLC, Omegapoint, and Orange Cyberdefense are also key players that protect critical information systems by offering consulting and managed services to organizations. Palo Alto Networks, Inc., Sophos Ltd., and Telenor Group are the leaders that remain at the forefront with their innovations in cybersecurity and full security solutions.

TietoEvry and Trellix are also big names in the business, guaranteeing digital infrastructures to be very strong. Trend Micro, Inc., with its complete protection against a broad range of cyber threats, is another giant player. Truesec specializes in incident response and advanced threat detection, which means helping organizations stay ahead of possible security breaches.

These companies, among others, are the bedrock of the cybersecurity landscape, offering various services and products that would guard against the increasingly diversified and numerous cyber threats. Indeed, as business and individual concerns become more complex in terms of security, these players will make a difference in creating a safe digital environment.

Sweden Cybersecurity Market Key Segments:

By Security Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Data Security

- Identity and Access Management (IAM)

- Security Operations and Incident Response

- Others

By End User

- Finance and Banking Sector

- Healthcare (Hospitals)

- Government, Defense, and Public Sector

- IT and Telecommunications

- Industry and Manufacturing

- Retail and E-Commerce

- Others

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Deployment Type

- On-Premises

- Cloud-Based

Key Sweden Cybersecurity Industry Players

- Accenture PLC

- Arrow Electronics, Inc.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- CrowdStrike Inc.

- Ericsson AB

- F5, Inc.

- Fortinet, Inc.

- IBM Corporation

- AO Kaspersky Lab

- Microsoft Corporation

- Network Services Group, LLC

- Omegapoint

- Orange Cyberdefense

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383