MARKET OVERVIEW

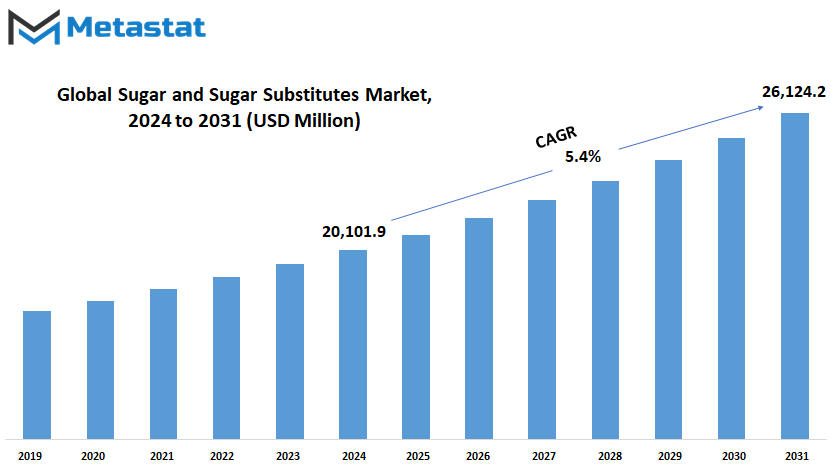

Global Sugar and Sugar Substitutes market is estimated to reach $26,124.2 Million by 2031; growing at a CAGR of 5.4% from 2024 to 2031.

The Global Sugar and Sugar Substitutes market is an important industry of the global food and beverage economy. This market encompasses the manufacture, supply, and usage of white sugar and also a line of alternative sweeteners made specifically to satisfy shifting consumer demand. It's one important market that shapes up all sorts of products, from candies and breads to soft drinks and packaged foods. It's more than a consumer goods industry-it's above health, nutrition, and sustainability trends in every corner of the world.

The market, in general, is described to have options that range from the natural sugar from sugarcane and sugar beets to an array of alternatives, including artificial sweeteners in the form of aspartame and sucralose; natural alternatives like stevia and monk fruit; and an array of sugar alcohols, including xylitol and erythritol, each of which speaks to different consumer needs, including but not limited to low-calorie versions and natural or organic choices or solutions for consumers who follow specific diets because of diabetes.

Regional variation in consumption pattern, regulatory framework, and cultural acceptance of sweetness is some of the important influencers of global dynamics in the Global Sugar and Sugar Substitutes market. The developed region has a high demand for traditional sugar as it is economical and habitual, while there is an increased adoption of substitutes in developed markets due to the increasing health consciousness. This duality creates a complex and competitive landscape that will change further with the up-gradation of technology, availability of ingredients, and analysis of consumer behavior.

The market will look to extend into product development and refinement over the next years. Producers of sugar substitutes will hone in on taste profiles and continue to work towards eliminating the aftertaste associated with some alternatives. Finally, the industry will embrace sustainability as it moves toward greener production methods and reduces the effects the traditional cultivation of sugar imposes on the environment. This will redefine the supply chain concerning how these products are sourced, processed, and delivered to the end consumer.

This Global Sugar and Sugar Substitutes market will also be influenced by the labeling standards in the regulations. Within the next decade or so, the governments and healthy organizations of nearly all regions around the globe will most likely advance the standards with the content of sugar in manufactured goods. For that reason, a great demand for innovation in place of conventional products will develop within manufacturing firms and therefore enable the substitute types another chance to grow the demand and come into the market.

More on technological changes: Technological advance will even more influence this market. Biotechnology would aid in discovering agents for sweetening more efficient and produced cheaper. Traditional sugar along with its substitutes would also find a new rearrangement about its production; that would also ensure scalability as well as better accessibility, because of these newer developed technologies, such as precision fermentation.

Changing consumer expectations and industry innovation moves will, therefore, mark the future of the Global Sugar and Sugar Substitutes market. Changes from stakeholders in this industry will be inescapable in shaping this market to be at the core of the food and beverage industry: from what to eat and drink to how businesses will operate and innovate. Through this constant change, the market will always remain at the center of producers, policymakers, and consumers.

GROWTH FACTORS

The global sugar and sugar substitutes market is constantly changing, mainly because of the change in the preferences and lifestyles of people. The most significant reason responsible for the increase in this market is the demand for sweeteners in food and beverages. In general, constant innovation in the food segment with manufacturers adding sugar and their surrogates to many more products for them to make taste-friendly and multi-accommodating consumer preferences is highly prevalent. Indeed, the market trend continues well in areas where ready-to-eat food, baked products, and beverages also become highly popular, thereby requiring a lot of added sweetness.

The awareness of health and wellness is also one other major factor that is giving the market a boost and is expected to grow throughout the forecast period. Consumers are now more focused on their dietary habits and hence find alternatives to sugar, and this will contribute to healthier living. Natural and artificial sugar substitutes such as stevia and aspartame are gaining credence amongst those who would like to reduce calorie intake but not lose the taste. The low-sugar and sugar-free products encourage food manufacturers to come out with innovative products that appeal to this market, so the market grows further.

The challenges, however, are prevalent that may dampen the market growth pace in this line. The health issues associated with excessive sugar intake, including obesity, diabetes, and other chronic diseases, have led to strict regulation in the production and marketing of sugar. Various governments and health agencies around the world are creating policies to decrease the intake of sugar, which would influence the growth of traditional sugar-based products. Furthermore, the stringent approval process for sugar substitutes complicates the entry of new products into the market.

On the other hand, challenges notwithstanding, emerging markets are so massive that growth is evident across all of them. This is because rising disposable incomes and changing lifestyles in both Asia-Pacific and Latin America regions are fertile ground to the growth of sugar and its substitutes. There is growth in demand for traditional sweeteners and alternatives alike since consumers seek what would go well with their taste bud requirements and health aspirations. All this, because of an enormous and rapidly growing consumer base.

Positive outlook and there's plenty of room for the global market for sugar and its substitute to grow with each new technology that raises the product quality and makes them cheaper, by filling up consumer demand versus government requirement the industry stands poised to take this opportunity as the dynamics shift in their favor.

MARKET SEGMENTATION

By Type

The Global Sugar and Sugar Substitutes market is undergoing a massive transformation due to the changing preferences of the consumer, increasing awareness about health and wellness, and growing consciousness toward leading a healthy life. Thus, it leads to shifting demand from traditional sugar to newer, healthier, and aligned alternatives. These alternatives, giving sweetness with minimal or no calories, are thus playing an essential role in redefining the food and beverage world at large. The market can be further divided according to type: high-fructose syrup, high-intensity sweeteners, and low-intensity sweeteners for distinct consumer requirements and applications.

High-fructose syrup, in fact, continues to dominate consumption in beverages and processed foods since it is a cost-effective product with excellent functional properties. It adds balance in sweetness and texture and hence is part of most packaged products. High-intensity sweeteners include aspartame, stevia, and sucralose, which are being widely accepted by health-conscious consumers. They are hundreds of times sweeter than sugar and therefore only a little amount needs to be used to attain the desired taste. This not only reduces the number of calories but also caters to the growing demand for low sugar or sugar-free products.

Low-intensity sweeteners, such as sorbitol and xylitol, are another very popular one. They are mainly associated with dental care products as well as a few areas of food such as sugar-free chewing gum and candies. The intensity of sweetness is much lower than that of sugar and the functional benefits specific to a consumer segment with demands for balanced sweetness augmented by health benefits are combined.

Future Trends of the Global Sugar and Sugar Substitutes Market Future directions of this market depend on advancements in food technology, which can further help in its growth with further availability and use of sugar substitutes. Diversification is expected in further production techniques through plant or synthetic findings regarding new sweeteners and also further diversification from which manufactures can make their options and choices of portfolio. Expansion would also be motivated further by tighter regulations, customer demands for clearly labeling things. That means consumers will get clear information about what's inside their food and beverage.

Evolving consumer preferences shall remain the dictators of form for this market. Products that would meet indulgent needs as well as healthy needs at the same time would become the destination to which consumers are migrating increasingly. The Global Sugar and Sugar Substitutes market would remain a highly significant growth region within the food and beverage industry by satisfying the diversified needs of various demographics.

By Composition

The global market for sugar and sugar substitutes is taking on considerable interest as consumers increasingly desire healthier dietary alternatives. While awareness of adverse effects on health due to excessive intake of sugar has been slowly building, there is indeed a growing interest in more alternatives. It is reflecting a broader move toward balanced products that also have flavor, affordability, and also health-conscious features.

Sugar substitutes have gradually become a part of the food and beverage industry, providing alternatives for reducing sugar without sacrificing taste. Compositionally, the market can be divided into such products as stevia, aspartame, sucralose, saccharin, sorbitol, maltitol, xylitol, mannitol, and others, with each having a particular application to satisfy different consumer needs. For example, natural plant-based stevia is highly valued for its calorie-free and diabetic-friendly profile. Sucralose is the best choice for baked goods and beverages because it does not break down easily when exposed to high temperatures. Thus, it remains one of the most popular options in the market. Sorbitol and xylitol are also products that fit into the oral health niche, as they do not contribute much to tooth decay.

In the coming years, the global market for sugar and sugar substitutes is most likely to expand in scale and sophistication with technology and research making the options of sweeteners even better. As consumers continue to care more for their health, they are expected to go for the more natural, plant-based substitutes. More attention might be given to Stevia and similar alternatives as the producers make improvements on taste profiles for wider appeal. Additionally, manufacturers are exploring advanced formulations that enhance the functionality and taste of substitutes to mimic the versatility of traditional sugar.

Regulatory bodies play a crucial role in the direction of this market. The imposition of taxes or labeling laws to reduce sugar in processed foods is likely to force companies to increase their use of sugar substitutes. Such a shift may help create a competitive environment, furthering innovation and reducing prices for consumers.

In the long run, the global sugar and sugar substitutes market is going to remain an exciting place within the food industry. It shows how the food industry will keep the momentum going toward healthy and sustainable solutions with consumers satisfied at the same time. These products can, in fact, change the perception and delivery of sweetness and can herald a healthier future in the global food landscape.

By Application

The Global Sugar and Sugar Substitutes market is expected to be in high growth in the near future as changing consumer preferences and technological advancements keep changing the course of this industry. This market, led by health consciousness and rising demand for alternative sweeteners, has diversified into numerous applications including bakery, confectionery, dairy products, beverages, health and personal care, and many others. These are integral to the daily lives of consumers, who are learning to accommodate the changing palates and health concerns of people.

Sugar substitutes are of utmost importance in bakery products because of demand for low-calorie and diabetic-friendly products. Innovations in sweetening agents, wherein consumers focus on health but not on taste, will help bakeries fulfill their needs with good product quality. In the confectionery industry, a trend is observed wherein companies seek to reduce sugar content but not the sweetness of the product, which is an essential characteristic of the product. The transition is supported further by the increased availability of plant-based and synthetic sweeteners, ensuring taste and texture remain appealing to consumers.

Another important application area is dairy products. Here, sugar substitutes complement the flavors and also cater to the healthy trends. From yogurts to flavored milk, it enables manufacturers to keep pace with the health-conscious customer without sacrificing indulgence. Another critical segment, beverages, have been leading in adopting sugar substitutes. Growing scrutiny over sugar consumption is compelling beverage makers to innovate with reduced-sugar and sugar-free options to allow consumers to enjoy their drinks guilt-free.

In the health and personal care sector, sugar substitutes are becoming increasingly relevant. They are used in products such as toothpaste, gums, and health supplements, where maintaining sweetness without sugar is vital for both functionality and appeal. As more people focus on wellness, this application area is expected to grow further.

Future expansions of the Global Sugar and Sugar Substitutes market are likely with the further refining of production technologies for, and integration with, new sweetener offerings. The research continues regarding better-tasting and more environmental substitutes to meet diversified demands by the consumer and environmentally sensitive industry. The continuity in such innovation across the applications is bound to take the focus away from these substitutes to consumer satisfaction while propelling the industry into further growth. All the signs point toward a great future for this market in response to increased health awareness and advances in food science.

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$20,101.9 million |

|

Market Size by 2031 |

$26,124.2 Million |

|

Growth Rate from 2024 to 2031 |

5.4% |

|

Base Year |

2022 |

|

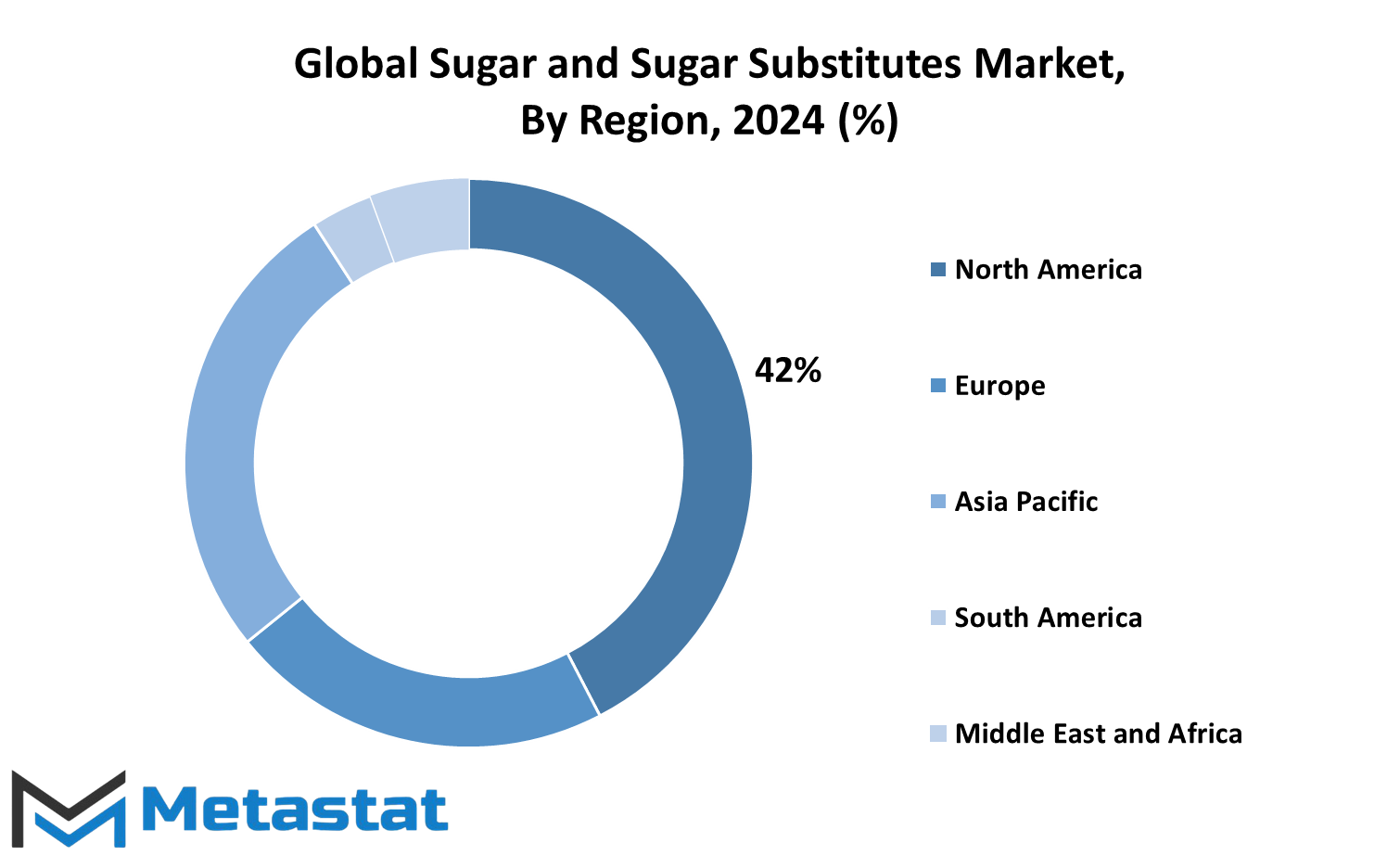

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global sugar and sugar substitutes market is gaining increased attention in the wake of healthy alternative demands and concern towards growing health issues, including obesity and diabetes. Regional variations characterize it with differences in consumers' preference, regulatory structure, and production capabilities in every region. From North America to the Middle East & Africa, each region presents its role in the shaping up of the market.

North America is a significant region and includes the U.S., Canada, and Mexico. This market is growing for sugar-free products mainly driven by health-conscious consumers in North America. The demand here is high due to population size and awareness levels towards low-calorie sweeteners across the U.S., with Canadians and Mexicans showing increased awareness in this regard. A shift in North America is more preference for natural alternatives like stevia, monk fruit, and erythritol over synthetic ones like sucralose.

The market trends in Europe are influenced by regulatory policies as well as consumer behavior of UK, Germany, France, Italy, and the remaining nations of the continent. European countries are known to have strict food safety standards, which largely influence the adoption of sugar substitutes. Manufacturers now reach out to offer low-calorie and natural alternatives as the consumers in this region are increasingly focusing on reducing the intake of sugar. Germany and the UK lead the way as the rest of Europe is adopting such practices steadily.

The Asia-Pacific region, which comprises India, China, Japan, South Korea, and many others, is a major growth region in the global sugar and sugar substitutes market. With rapid urbanization, shifting eating habits, and awareness over health issues, growth in demand for affordable substitutes in India and China and innovation leadership by Japan and South Korea are reported in developing healthier options.

South America, including Brazil and Argentina, and other close neighbors, is also playing significant roles. Brazil, after all, is one of the world's largest producers of sugar, and she has the capacity to balance such traditional sugar production with introduced substitutes that align with global demand changes. Argentina and other related countries in the region try to innovate to cater both to local and international needs.

The Middle East & Africa region, covering the GCC countries, Egypt, South Africa, and others is slowly catching up. Increasing consciousness towards health and wellness as well as efforts to reduce the consumption of sugar are some factors that are driving the demand for sugar substitutes in these regions.

Going forward, every region is going to play a key role in innovation and in supplying global demand, which puts emphasis on the interconnectedness of the global sugar and sugar substitutes market.

COMPETITIVE PLAYERS

The Global Sugar and Sugar Substitutes market has grown significantly in the last few years, and this trend is expected to continue. With people becoming increasingly aware of health issues due to excessive sugar consumption, consumers are opting for sugar substitutes as alternatives. This is mainly because of factors such as increasing cases of obesity, diabetes, and other related diseases among people. Due to this increased demand in more wholesome, natural sweeteners-like stevia and monk fruit and some others based on plants the global market of Sugar and Sugar Substitutes would see even more changing with demand in such healthier merchandise over time ahead. Companies operating in this industry will focus more on innovation.

They will come up with new sweeteners that can offer the same taste experience as sugar but have fewer calories and less impact on blood sugar levels. Manufacturers will look for opportunities to expand their product lines and enter new markets as more people seek alternatives to traditional sugar. Other drivers include advances in production technology, for example new plant-based sugars. Additionally, companies like Ajinomoto Co., Inc., Archer Daniels Midland Co., and Cargill, Inc. are expected to play key roles in how change in this market is seen; these firms have foundational presences in food and beverages production and heavily invests in research and development to help remain aligned with an increasingly aware populace regarding health. Other major players in the market include DuPont de Nemours Inc. and Ingredion Incorporated, both of whom have invested heavily into sugar substitute technologies. Each of these companies should continue the trend toward healthier sweeteners and increase their market share of the global market.

Another important factor that will shape the future of the market is organic and natural food products' popularity. More and more people are becoming conscious about the ingredients of their food, and there will be increased demand for organic and non-GMO sugar substitutes. Some of the players that will take advantage of this trend include Suminter India Organics Pvt. Ltd. and PureCircle Ltd.

Another influence of changing regulations on the sugar substitute market is that the world's governments have been looking into reducing health impacts of sugary foods and, therefore, are likely to produce policies that favor the use of sugar substitutes. In the long term, this will be a force that compels the food and beverage industry to adopt healthier alternatives.

The market for Global Sugar and Sugar Substitutes will be pretty dynamic and will be led by players such as Tate & Lyle PLC, Roquette Frères, and Sweetly Stevia USA. Consumers opting for healthier alternatives can probably make product innovations in the industry lead to upsurge in the importance of sugar substitutes in the food and beverage industry.

Sugar and Sugar Substitutes Market Key Segments:

By Type

- High-fructose Syrup

- High-intensity Sweeteners

- Low-intensity Sweeteners

By Composition

- Stevia

- Aspertame

- Sucralose

- Saccharin

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Others

By Application

- Bakery

- Confectionery

- Dairy products

- Beverages

- Health & Personal Care

- Others

Key Global Sugar and Sugar Substitutes Industry Players

- Ajinomoto Co., Inc.

- Archer Daniels Midland Co.

- Cargill, Inc.

- DuPont de Nemours Inc.

- Fooditive B. V.

- Ingredion Incorporated

- JK Sucralose Inc.

- Whole Earth Brands

- PureCircle Ltd.

- Pyure Brands LLC

- Roquette Frères

- SAGANÀ Association

- Stevia Hub India

- Suminter India Organics Pvt. Ltd.

- Sweetly Stevia USA

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383