MARKET OVERVIEW

The global baby infant formula market will be the reflection of consumers turning toward being more health conscious. There'll be parents watching out for products aligned to what they stand for, i.e., sustainability, high life-, and ethical sourcing. This turns to green-washing disasters that will force the brands to use green practices, look into creative packaging that has a least environmental impact, and tread paths of eliminating the environmental footprint.

The following are the sectors that would keep on emerging as important in the future food and nutrition industries. This market is ensuring it meets diverging needs and tastes due to parental demand for safe and healthy baby food products. In general, the company's objective, in a world with changes in lifestyles, would be to provide baby infant formula associated with working moms and increasing awareness concerning the nutritional needs for infants.

This market would basically consist of one that satisfies exceptional dietary needs and ones based on preferences. This would be kept in mind by the manufacturers to come up with formulations for infants with special dietary needs such as allergies to certain ingredients and lactose intolerance, among others. Organic and plant-based formulas would thus sell the concept to health-conscious consumers who give priority to clean and natural ingredients.

Going by this trend, there is going to be a surge in specialist formula preparations for preterm and low-birth-weight babies, thereby further increasing the commitment of this industry to the fulfillment of a variety of health concerns. As developments take place in the Global Baby Infant Formula market, there may be increased engrossment of companies in Research and Development activities in relation to product formulations.

Research investment will impart to the formula the crucial set of nutrients like vitamins, minerals, and fatty acids essential for infant development. There will also be a somewhat special focus on prebiotics and probiotics, with an ever-larger crowd of parents aware that gut health in childhood is crucial.

This change shall serve not only to enhance the array of products but also to allow some room for brands to differentiate themselves in an otherwise competitive landscape. Global distribution of baby and infant formula should increase access and affordability in emerging markets. Formula should provide a viable alternative to breastfeeding wherever traditional breastfeeding may be difficult.

The companies will most likely work alongside local distributors to penetrate the various demographics, especially favorable to rural and underserved regions. This would widen the market, but it would also increase access to much-needed nutrition for all babies notwithstanding geographical hindrances. Regulatory frameworks will sculpt the Global Baby Infant Formula. Some may even go stricter, in terms of safety, labeling, and nutrition, as governments turn more to the infant's health. There shall be a forced adaptation of the best standards of manufacture and quality assurance aimed in compliance with these regulations.

Transparency would be the very hallmark of successful brands, as parents will wish to inform themselves about sourcing and actual elements of the formula they are feeding their children. Brand-consumer interaction concerning digital marketing interaction strategies is all about getting redone. The huge window of opportunity new parents opens up to is that of social media and e-commerce channels. It will help these companies build trust and bonds through well-targeted and educative campaigns.

This in turn will give the brands a chance to indicate the degree to which they stand behind quality and nutrition in their formulae against very common doubts. In the years to come, it will be looked upon as an opportunity for this market to survive in taking care of the changing needs of parents and infants as well, under this very ambit; the launch of any product is tested with a positive mind to ensure that child health and well-being have been accounted for.

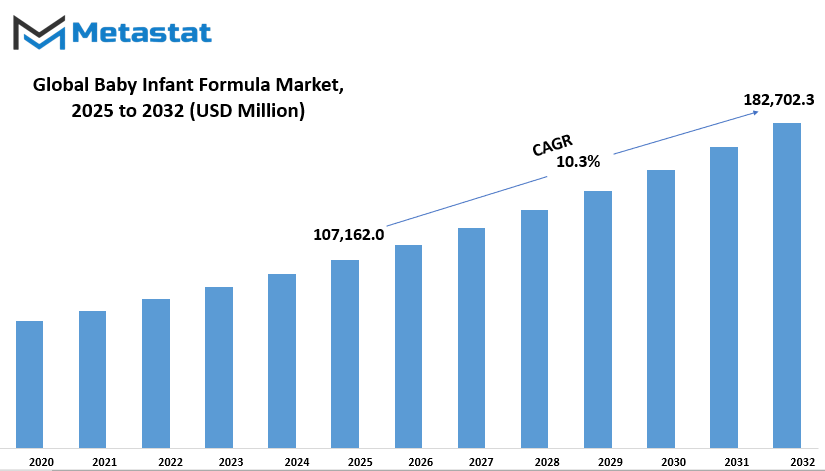

Global Baby Infant Formula market is estimated to reach $182,702.3 Million by 2032; growing at a CAGR of 10.3% from 2025 to 2032.

GROWTH FACTORS

Knowing the fact that adequate infant nutrition and health have priority for development, the global baby infant formula market stands to experience higher growth in the near future. Parents in different parts of the world today have realized that the early years in the life of a child are very important in his or her development and nutrition at that stage of life. Increasing awareness for convenience and nutritional balance for such infant formula products is stimulating demand. With busy lifestyles limiting the time that parents can be with their children, they want answers that first take care of their child's nutrition over quick need for formula. Infant formula will be an alternative to breast milk while sometimes complementing it when breastfeeding is not feasible to ensure the infant receives the required nutrition.

One of these necessities is providing more convenient feeding options that retain nutrition, and old formulas lean heavily in favor of convenience to the exclusion of nutrition. More mothers are going back to work within weeks of giving birth and there is a growing demand for formulas that are nutrition-wise closer to breast milk; therefore, manufacturers are fast-tracking the development of formulas that better represent breast milk. The packaging innovations introduced by the manufacturers have increased the convenience of formula-based feeding as they allow easier preparation and storage of formula.

While these trends are driving the market, some of the factors may prove to be a restraint in the growth path of the global baby infant formula market. One of the biggest challenges is that premium infant formulas are very expensive. Indeed, there are so many parents who are willing to pay any price for their child's healthy growth and his or her strength, but many of these parents are held back by the cost factor. This high price consideration remains the bottleneck in accessing higher-end types of formula, especially in low disposable income areas. Yet there still are some concerns that remain in the minds of consumers with regards to the quality and safety of infant formula products. Any complaints that have occurred involving contamination or mislabeling of ingredients were serious and caused warnings to consumer markets that led to the enactment of stricter regulations. There needs to be transparency and strict quality control from manufacturers if these products are to gain consumer confidence and abide by stringent safety standards.

Otherwise, opportunistic scenarios of growth and innovation abound in the global baby infant formula market. One such influential trend is the growing demand for organic and clean-label products. Consumers are becoming increasingly aware of what they feed their children; hence, the preference now lies with natural products as opposed to chemically synthesized ones. This is an excellent opportunity for companies to brand and market organic baby formulas to parents who are concerned about health.

According to the baby infant formula market is bounding toward radical growth, with increasing awareness regarding infant nutrition and health and a rise in demand for convenient feeding options. Though high prices and safety concerns were some of the major challenges restricting the market growth, the opportunities for innovation and expansion cannot be overlooked. If the challenges are given due consideration, then there lie some really profitable opportunities that will serve an important role in shaping the infant nutrition and wellbeing of the forthcoming generation.

MARKET SEGMENTATION

By Type

Advance Baby Infant Formula expects to go through tremendous sets of opportunities in coming years under the influence of some variables like increased awareness about the importance of infant nutrition, greater number of parents working, and so on. Segmentation by type will include four major categories: Infant Milk, Follow-On Milk, Specialty Baby Milk, and Growing-Up Milk, addressing particular needs and/or preferences of parents or caretakers. Infant Milk is meant as a powder for feeding newborns. Usually, it will be the first formula parents would buy for their babies. It will remain one of the basic items on the infant nutrition list, mainly for babies that cannot be breastfed. It is specially formulated to fulfill the many requirements of a baby's development in early life. Growing awareness regarding the importance of nutrition in infancy will keep the demand flowing for this category.

Follow-On Milk is supposed to be given to babies who have reached six months. This milk supplement becomes very important when babies begin to eat solid foods because the solids simply do not supply enough nourishment. This is in line with the new trend of late introduction of solids and more consumption of the Follow-On Milk to guarantee that children are supplied with enough nutrients during this crucial phase of growth.

Speciality Baby Milk is intended for babies with special health requirements, like allergies or other metabolic problems. Hence, speciality baby milk will thus be expected to be influenced by this category, owing to the rising percentage of infants inflicted with such conditions. As more parents come to realize the need for special diets, there is a simultaneous increase in the demand for Specialty Baby Milk, thereby increasing technology and new product development.

Growing-Up-Milk is a lot like an infant formula as it is connected to regular cow's milk in terms of association. Parents, choosing this formula type, intend to ensure that their young one receives nutrients before starting to vary on their diet. Hence, growing-up milk will be positioned in a healthy context of growth and development to entice health-conscious parents looking for good nutrition for their toddlers.

With the momentum in the awareness of infant nutrition in place, this Global Baby Infant Formula market is lined with much to cater to the multiple requirements of infants and toddlers. Each segmentation will contribute to defining what is going to be the future of feeding infants: Infant Milk, Follow-On Milk, Specialty Baby Milk, and Growing-Up Milk. The market shall quite likely go hand-in-hand with the dynamics of changing consumer preferences to provide the best for health and development of their children to the parents.

By Ingredient

As the market changes, parents keep on searching for healthy alternatives for their babies. A major driving reason for this market is increasing awareness regarding nutrition during the early stages of a baby's life. Given this knowledge, parents will naturally lean towards products that provide their children with suitable amounts of core nutrients.

The market based on ingredients is significant since it relates to defining nutrient needs. Carbohydrates will form a substantial share in essence because they will prove useful in fulfilling the energy needs of the infants. The sugars from this carbohydrate source, such as lactose, must be present for the healthy development of the infant. Then there will be fats, which are important for the development of the brain and other aspects of growth in infants. Hence, it would be important to have different types of fats, both saturated and unsaturated, to be able to balance for the utmost benefit of the infant.

Proteins constitute yet another vital ingredient for the Global Baby Infant Formula Market. With time, parents will be in search of formulas that provide premium protein sources-whey and casein-that assist in muscle development and also fortify the immune system. Then the formula might add many more proteins that are easily digestible, with parents seeking allergy- and digestion-friendly options.

Vitamins and minerals will continue to act as an equally important driver. Elements like Iron, calcium, and DHA will take center stage since they are important for cognitive and physical development. Parents will seek the ones fortified with these key ingredients so that their infants may grow at their best capacity from the early stages of life.

Other ingredients will maintain their place in the market as innovations in infant formula evolve. Enhancing gut health-centered probiotics and prebiotics will be considered among emerging ingredients as more is being unveiled related to the gut-brain axis. This will push manufacturers to bring about products that don't just nourish but also nurture people's feelings.

The global Baby Infant Formula market, growing more and more day by day, will be shaped by newest trends in consumer attitudes and developments in food science and technology. Manufacturers will be developing products to serve the crucial needs of infants under conditions of safety and quality. It is such a commitment that shall give the future picture of the market a dynamic edge and that is responsive to the needs of premodern and modern families. The goal will be to provide babies with good nourishment for an inevitably healthy start in life.

By Product Form

The global immature infant formula market is forecast to grow over the coming years. Increase in birth rates, developing awareness towards infant nutrition, and many more are the few reasons that drive this world market. This market greatly contributes toward a child's early years to ensure that he or she gains all essential nutrients needed. Furthermore, awareness is growing among parents with regard to their children's health, and the same istaking popularity among consumers; thus, demand for high-quality infant formula will increase, further driving research and development within this sector.

This has been segmented into powdered formula, liquid formula, and ready-to-feed formulas. The powdered formula product continues to be well accepted by parents because of its ease of use and long shelf life. Easy preparation and storage facilities make it suitable for a family that is always on the go. With more parents making this selection, manufacturers will likely concentrate on improving the nutritional balance of their formulas to address the various needs of infants. The demand for formulas made with organic and natural ingredients is expected to intensify, prompting companies to consider the invention of new formulations themselves.

Liquid formula demand will also develop, both concentrated and ready-to-drink. Convenience would be the choice here among parents who sometimes opt for an immediate assist in feeding. With busy lifestyles getting busier by the day, very much a preference could be gained by liquid formats; forcing manufacturers to up their production. Convenience in application will continue attracting more parents toward liquid formula feeding and sway market dynamics.

Baby formula or Ready-to-feed is thus destined to carve out its place. This subsection is for the casual feeder-the-one-with-absolutely-no-need-for-any-hassle. Ready-to-feed formula, since it is already pre-mixed and requires no preparation, will likely become energy-saving formulas for frantic new parents that are craving some practicality without sacrificing quality. In this respect, awareness about proper infant nutrition will push the segment forward.

The gross movement that will still continue in the Global Baby Infant Formula would be wherein the innovation in terms of product formulation, packaging and marketing strategies, really will become the platform on which this industry will be built while attempting toe-to-toe to meet the ever-changing taste buds of consumers. As infant health gains more and more public attention, so does the demand for the different sorts of baby formula: Parent is to be endowed with the right products for his child's growth and development.

By Distribution Channels

In the next few years, the Global Baby Infant Formula market will witness tremendous changes according to different diversified channels of distribution, which are functioning to meet differential needs of parents and caretakers. The equity to which this market caters is highly principal for the proper growth and development of infants by providing the required nutrition. The prime distribution channels considered in this category include supermarkets and hypermarkets, specialty stores, pharmacies, and online retail. All channels act differently, keeping in mind the delivery system of the commodities to consumers.

Supermarkets and hypermarkets shall continue to dominate the global baby infant formula market. These giant retail outlets claim a hefty convenience-undiluted by variety angle-wherein parents have the chance and choice to procure basically any sort of baby formula along with their customary grocery shopping. With numerous brands and types on offer, these outlets will possibly retain this charm for a very long time. In this regard, most parents would approach these supermarkets, which later on may have aisles set aside just for infant products, making it extremely comfortable for shoppers who are parents.

In the market, specialty stores, hence, definitely must hold an important position. Such stores have specificity to baby products and, being so, give professional advice and offer very specific recommendations. Given how picky modern parents are about nutritional contents of formula, safety, and the rest, such specialty stores have all the chances to prosper in giving selections. They will build trust and create a community among parents, aiding them in all decisions through knowledgeable staff.

Pharmacies will remain a key channel for distributing special infant formulas, especially. Most pediatrician-recommended infant formula can be found in pharmacies, so parents looking for specific nutritional solutions go to these types of outlets. In the future, most likely, pharmacies will, on the other hand, be encouraged to stock more monamn ites of infant formula to assist parents in finding the one needed for their babies.

One thing shipping in the opposite direction to global baby infant formula market will be online retail. At the height of e-commerce, it has changed entirely consumer shopping behavior. More parents will launch their search on online platforms for convenience and home delivery. The more advanced the technology gets, the better service these online retailers can provide to their consumers through subscription models to ensure that families with newborns never run out of essential items.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$107,162.0 million |

|

Market Size by 2032 |

$182,702.3 Million |

|

Growth Rate from 2025 to 2032 |

10.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

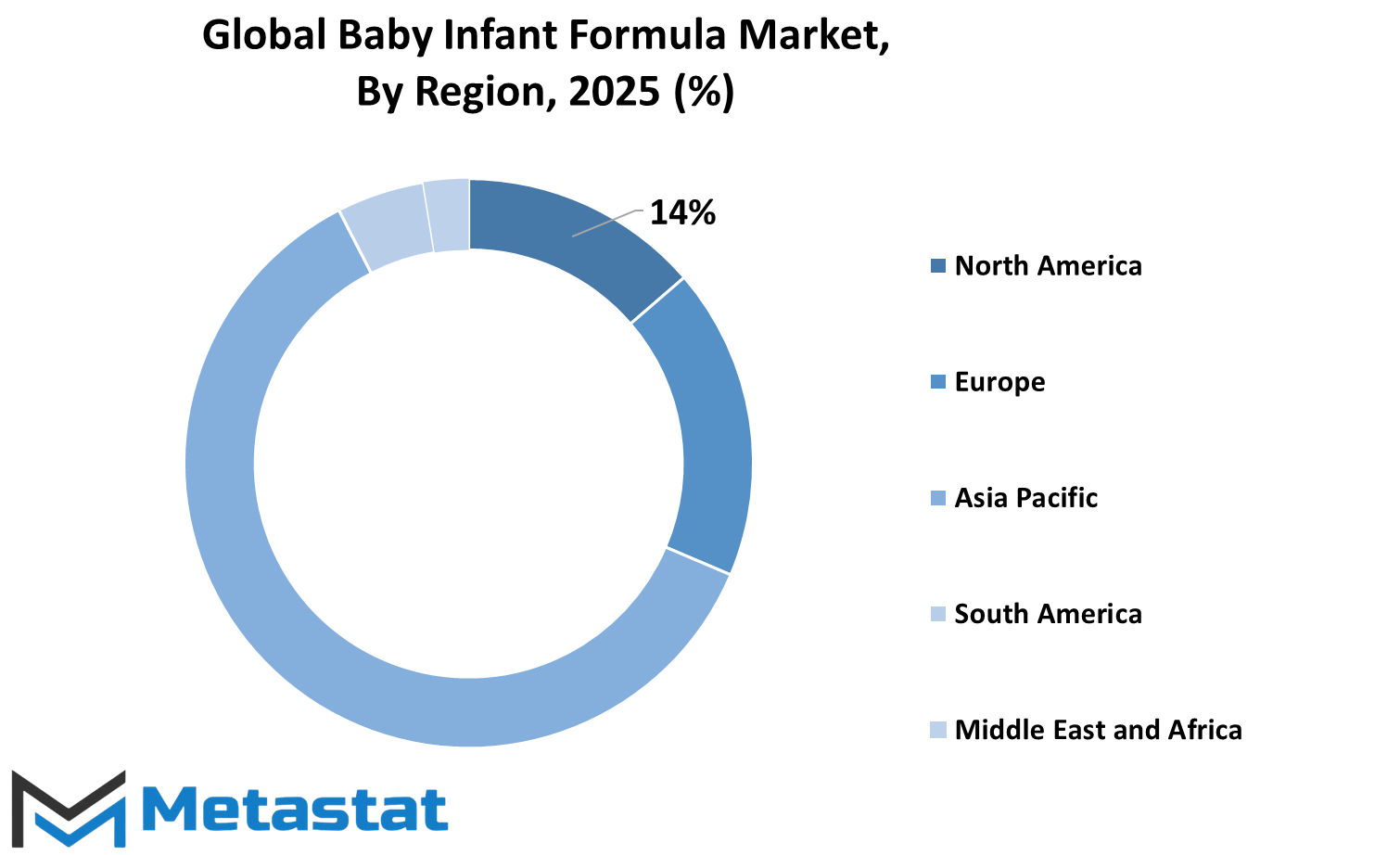

The global baby infant formula market is witnessing a major change under the influence of regional dynamics. In terms of geography, segmentation has been done into high priority regions such as North America, Europe, Asia-Pacific, South America, and Middle East & Africa. Each region has its own set of opportunities and challenges that will decide the course of its future development.

In North America, being the U.S., Canada, and Mexico, the market is expected to see further growth in baby nutrition due to increasing awareness. The parent participants are very well informed about specialized formulae and the benefits associated; the demand for types that are organic and non-GMO grows. This is part of an overall health and wellness trend, which will continue to influence purchasing decisions over the next few years.

Growth is observed for the baby infant formula industry also in Europe, with inclusion of countries like the UK, Germany, France, Italy, and others. This demand from European consumers is for quality-oriented products that are transparently labeled at the front of the pack. Being stringent, the regulatory environment in Europe will help ensure that products are made respecting strict safety and nutrition norms. Perhaps the high emphasis on quality can facilitate more development whereby brands come up with specific formulations addressing precise dietary needs and wants as a way of further differentiating their brands and competitive offerings.

Across developed and developing Asia Pacific countries being India, China, Japan, and South Korea, the market is likely to experience a considerable expansion. With the rise of a middle class in these countries, a major thrust will be the demand for premium infant formula products. This being said, however, changing lifestyles with more dual-income households will, to some extent, lead to earning formula feeding more arduous weight. Companies that will be able to capitalize on this mix of tastes and cultural nuances will do well in this complex and dynamic market.

That means South America becomes a mixed terrain with powerhouse countries such as Brazil and Argentina. Despite economic instability in some countries, infant formula demand is definitely climbing. While this shall somewhat inhibit the market growth, consumer confidence will improve alongside a conscious concern toward infant nutrition in the coming years.

The other would be the Middle-East & Africa further bifurcated into GCC countries, Egypt, South Africa, and others. With ever-growing urbanization, alterations in consumer behavior will continue to foster demand for infant formula. But businesses endeavoring to find success in the regions will have to conquer hurdles in dissimilar regulatory standards and distribution logistics.

COMPETITIVE PLAYERS

The global baby infant formula market grows at a rapid pace because the parents are now more concerned about their infants' nutrition. This growth also attracted numerous key players shaping the industry's future. Truly, companies like Abbott Laboratories and Nestle S.A., in particular, constitute the competitive landscape due to the strength in research culture to develop quality and safety products. Such companies will further develop new formulae that meet infant dietary requirements and, thereby, determine industry standards.

Equally important roles are played by Arla Foods and Danone, with a focus on natural ingredients and the sustainability of their product lines. Their commitment to organic and clean-label product manufacturing puts them in alliance with the rising consumer demand for transparency and health consciousness. As parenting gets more discerning regarding the products used, companies must adjust strategies to retain consumer trust and brand loyalty.

These include prominent companies such as Beingmate Group Co., Ltd. and HiPP GmbH & Co. Vertrieb KG, which target regional markets where local preferences and taste dictate the product. Localization becomes increasingly important as brands work to penetrate emerging markets with growing demand for infant formula. Moreover, innovative and convenient forms of packaging—based on the realization that present-day parents are busy-constitute the major focus areas of Mead Johnson & Company LLC and The Hain Celestial Group. They would certainly invest in technologies that make feeding easier, such as single-serve packaging and ready-to-use formulas, so that their products would retain relevance for modern families.

The situation further diversified with companies from other food sectors, traditionally exemplified by Campbell Soup Company and Kraft Heinz. Their entry into the market at once increases competition, thereby forcing incumbents to innovate and launch superior product lines. The entry by these established brands spells more profits for the Global Baby Infant Formula.

This competitive terrain probably sees much of the strategic partnerships and acquisitions style pursued by FrieslandCampina and Perrigo. Luring engagement of healthcare professionals and parenting influencers may also come into vogue, as brands endeavour to bring home a measure of credibility to the audiences who outrightly use their products.

Baby Infant Formula Market Key Segments:

By Type

- Infant Milk

- Follow On Milk

- Specialty Baby Milk

- Growing-Up Milk

By Ingredient

- Carbohydrate

- Fat

- Protein

- Minerals

- Vitamins

- Others

By Product Form

- Powder

- Liquid

- Ready-to-feed

By Distribution Channels

- Supermarket/Hypermarket

- Specialty Store

- Pharmacies

- Online Retail

- Others

Key Global Baby Infant Formula Industry Players

- Abbott Laboratories

- Arla Foods

- Beingmate Group Co. Ltd.

- Dana Dairy Group Ltd.

- Danone

- HiPP GmbH & Co. Vertrieb KG

- Nestle S.A

- Mead Johnson & Company LLC

- The Hain Celestial Group

- Bellamy's Organic

- Perrigo

- FrieslandCampina

- Campbell Soup Company

- Meiji Holdings Co. Ltd.

- Reckitt Benckiser Group PLC

- Royal FrieslandCampina N.V.

- The Kraft Heinz Company

- Ausnutria Dairy Corporation Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252