MARKET OVERVIEW

The Global Structured Finance market consists of defining certain risks related to pools of assets such as gages, loans, leases, or receivables, and converting those risks into tradable instruments. Under these transactions, legal and financial engineering would ensure that the ownership of the assets is transferred into bankruptcy-remote entities from which securities could then be issued, backed by the expected cash flows from those assets. The classically straightforward models and structures that initially governed these processes will keep evolving, becoming more complex with the evolution of financial markets in response to requirements from different asset types and investor appetites.

The design of structured financial products is intended not only to be strategically formulated for institutions in need of capital treatment or in need of removing risky exposures from their balance sheets but also will provide a tool through which the ability to transfer risk via securitization could allow the market participant an opportunity not only to restructure their liabilities but also to reduce capital charges and raise finance at competitive rates. The instruments are expected to attract investors with unique risk-return profiles, especially in portfolios seeking unconventional or diversified sources of yield.

Risk distribution in the Global Structured Finance market will remain critical. These institutions shall then slice risks into multiple tranches by utilizing these instruments whereby the different tranches would present varied exposures for different risk appetites. While credit rating agencies and legal frameworks could go some way in instilling confidence in investors, advances in technology, especially around data analytics and modeling, will be instrumental in enhancing transparency and monitoring, thus ensuring all parties involved are well aware of trading in an enabling environment with regard to both asset performance and market conditions.

The Global Structured Finance market is a niche market within the overall financial services industry, with an aim to transform the cash flows from underlying assets into investable securities. The market will continue to provide significant importance in the generation of liquidity, capital optimization, and risk mitigation for banks, corporates, and asset managers. Selling complex funding requirements through the process of making asset-backed securities, collateralized debt obligations, and other sophisticated financial instruments will characterize structured finance.

The Global Structured Finance market is likely to support long-term investment strategies in different geographies. While capital requirements undergo change and regulative pressures intensify, structured vehicles will be an avenue for installing flexible and innovative financing solutions. Asset originators will place an increasing reliance on the deal structure in accordance with jurisdictional regulatory requirements, which will also demand technical and legal know-how to stay in compliance. This market will grow in both developed and emerging economies as the demand for diversified funding alternatives and investment products gathers momentum.

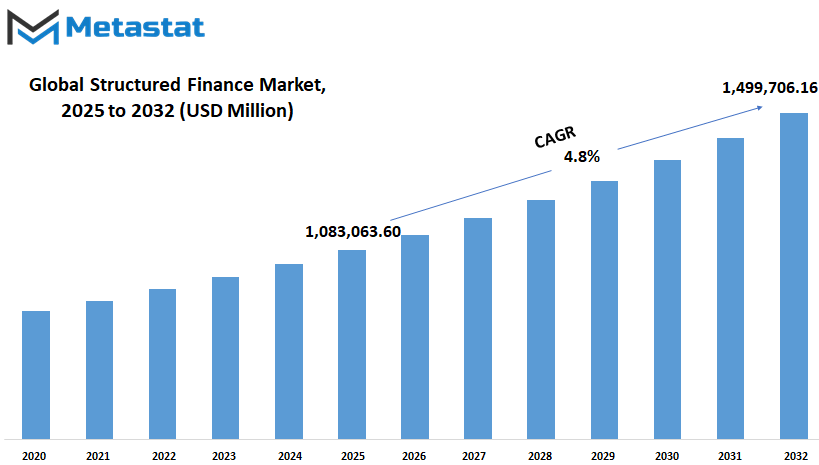

Global Structured Finance market is estimated to reach $1,499,706.16 Million by 2032; growing at a CAGR of 4.8% from 2025 to 2032.

GROWTH FACTORS

The Global Structured Finance market is modeled to pass out the phase of steady growth, changing financial needs, and an increasing level of demand for tailored investment instruments. Industrial houses as well as governments will explore innovative avenues to garner capital and manage their risks-they will go on validating the role that structured finance will play in the future, together. This sector of finance works with complex financial requirements and provides more flexible solutions to them. The flexible approach to funding will thus keep the market active and in-demand.

This has been growing primarily due to the increasing demand for better risk management instruments. For this reason, the importance of managing exposure has grown as financial markets become more connected. One can spread and manage risks in ways that are not possible in traditional lending through structured finance. This will be especially useful to firms engaged in highly volatile sectors where sudden price or demand changes are common events. Furthermore, the search for higher returns in low-interest environments will continue to attract investors toward structured products, promising improved performance due to design engineering.

Technology rapidly accelerates the growth of the Global Structured Finance market. Creating and managing structured products is now much faster and more accurate, thanks to better data tools and automation. This lowers costs and enhances accuracy by reducing the chances of errors. As financial institutions pour even more investment in artificial intelligence and digital platforms, design and development for complicated financial solutions will become more efficient. These improvements will include more players, even smaller firms that might not have had access to such platforms before.

There are however some challenges that can hinder this growth. Regulatory pressure remains a major issue, especially for countries still in the process of adjusting their regulations in line with the events of previous financial crises. Reporting requirements can be very complex and often change, making it uneconomical for small to branch into it quite easily. Additionally, lack of understanding from some investors and issuers could also deter the market because trust and clarity are essential for the long-term success of the market.

New areas can still be explored by the Global Structured Finance market. For example, growing environmental and social influence could lead to the establishment of financing products that would be oriented toward green and ethical objectives. Not only would such a shift raise new investments, but it might also create positive outcomes. If these developments are carefully guided, then they will help shape a finance future that continues supporting both innovation and stability.

MARKET SEGMENTATION

By Type

In the coming years, the Global Structured Finance market will be undergoing some major changes driven by innovation, policy adaptation and the rising demands for flexible funding channels. Since financial institutions and investors are on the lookout for safer and more profitable ways of asset management, interest in structured finance will continue to increase. The portion of grouping financial assets and turning them into tradable securities will remain an integral part of how capital flows across sectors.

Every single type within the Global Structured Finance market has a clear and distinct role in meeting all kinds of financial needs for corporates, governments and the investing public. Collateralized Debt Obligations are probably going to see some steady demand as companies look for "better ways to manage risk," as these have always been easy instruments to buy on. Such instruments enable the investors to get exposure to a mixture of debt types and to disperse losses, which will be very critical as the markets become more unpredictable.

As businesses in the digital economy grow, the asset-backed securities are likely to absorb even more attention. Consumer financing will include areas such as online retail, auto lending, and personal credit. Increasingly, loans will be packed into securities. Such financial products will give investors indirect exposure to consumer activity without holding loans directly. Modern expectations will continue to evolve for these instruments to match demand for faster, more transparent means of investment.

Mortgage-backed Securities will remain an important part of the market. The need for tied-up financing will not just fade as people seek housing; it will continue as developers build new ones. These securities can spread risk related to housing and enable more free lending from banks. In areas where housing development is being prioritized, this will be a bigger input into the financing solutions. Technologically based payments and risk management will, in the long run, make these securities more attractive.

Other types may already enter an increasing amount of consideration into structured finance, such as hybrid types or entirely different ways of bundling assets. Every single time an industry changes or a new asset type comes into being, such assets will find their way into the market. Safe and profitable will be the financial products that will satisfy an investor with a profile seeking steady return investments. The potential is huge, and the Global Structured Finance market will continue to develop as part of global investment and lending strategies.

By End-user

The Global Structured Finance market is anticipated to progressively change all the more, as financial needs become more specialized and several other groups seek easier and better ways to handle complex funding requirements. In a few years, the requirement for tailor-made financial tools will grow, with different users shaping the direction of the market. Looking ahead, however, technology, changing regulations, and broader economic goals will have a major effect on how this market grows, particularly when viewed through the lens of its key end-users.

Financial institutions will form a part of the principal drivers of the Global Structured Finance market. As always, banks and investment firms seek solutions that would allow them to manage their risk better and free up capital. If new lending options are explored by these institutions, structured finance will offer tools that will help spread risk with returns in the same equation. These instruments will be more flexible than before as digital systems will better ease structures to adapt to the changing client's needs. Over time, this set will be the driving force for greater transparency and efficiency and thus will influence future financial product designs.

Government and public sector bodies, on the other hand, will play additional roles. Endless states must obtain funding for the development of their projects - infrastructure, housing, and sustainable development included. By structured financing, they can lure outside money but warranties regarding direct involvement on the part of the governments. That way, a number of public projects can start without the full weight on the budgets of national governments. In the future, it might be about policy ambition and broader policy goals that can tie public sector use of structured finance, like making such structured finance deals more substantive as opposed to purely financial figures-green investment or job creation.

These companies are the other significant participant in this market. Given the large sums of long-term liabilities in insurance businesses, one can expect the structured finance-potential matching with the economics of these obligations. Structured products will provide investment opportunities in which they will be interested, especially with investment objectives during market down conditions. Insurance firms will probably endorse deals that will be stable and secure to promote better planning and design in how deals are assembled.

The remaining users include many pension funds, asset managers, even large corporations, and will define the market in the future. Such subjects will seek flexibility and value in how financial structures are built. In line with changing financial goals, they would continue to evolve into what types of products they would then seek, which would ensure that the Global Structured Finance market would continue to evolve with new ideas and fresh approaches.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,083,063.60 million |

|

Market Size by 2032 |

$1,499,706.16 Million |

|

Growth Rate from 2025 to 2032 |

4.8% |

|

Base Year |

2024 |

|

Regions Covered |

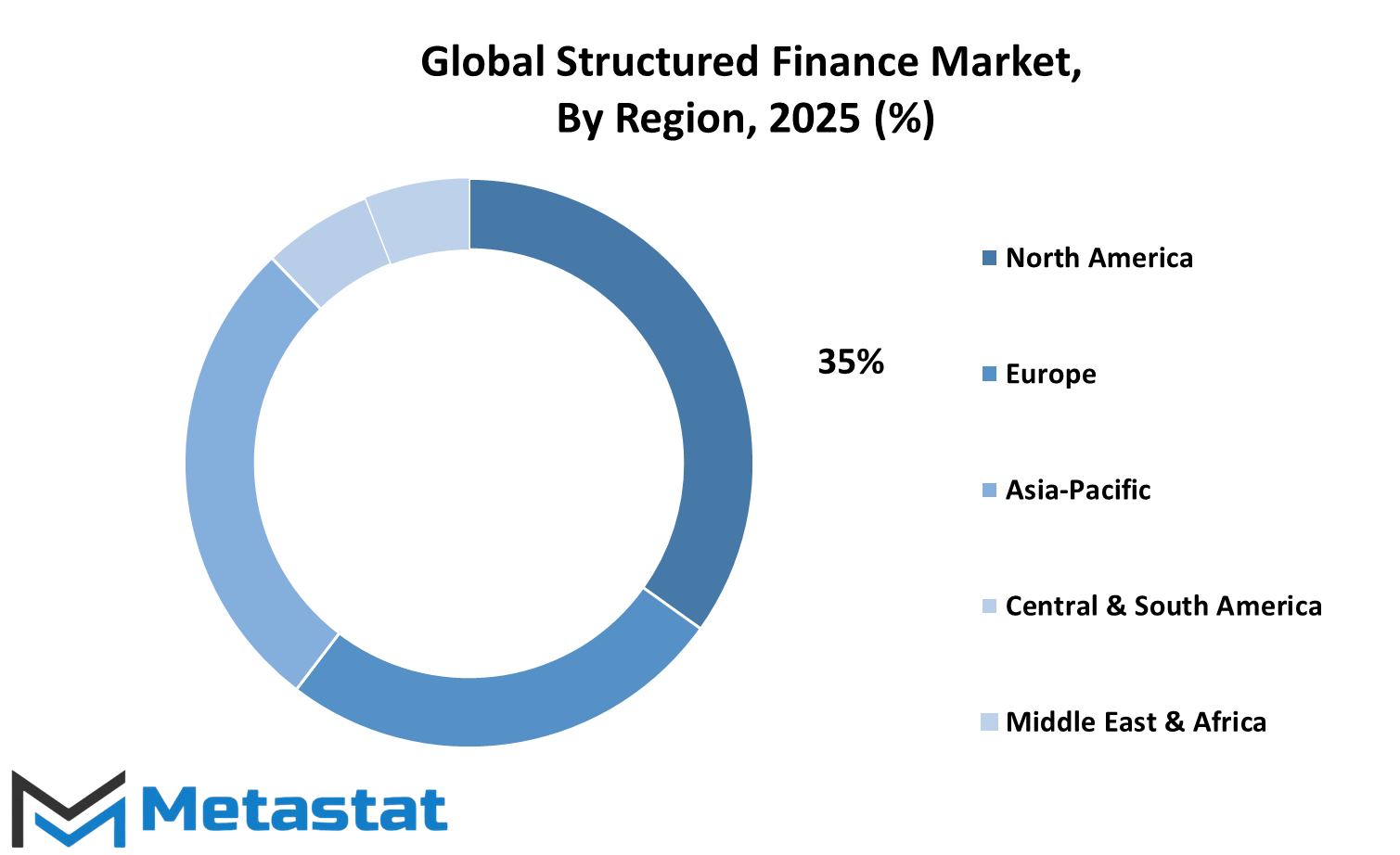

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Structured Finance market is on a trajectory of studied growth due to the increasingly they are pursing demand dimensions for customized product solutions across one region to the other. As industries need to manage risk, raise capital, and support large-scale investments, structured finance becomes a vital tool for unshackling markets operating in different financial environments. Analyzing the individual regional dynamics, each area was expected to contribute differently with its own momentum and challenges to guide the market forward.

Structured finance, having established a firm basis in North America, with heavy weights like the US and Canada actively employing asset-backed securities and similar instruments, has a strong future spearheaded by these two countries. The existence of prudent but mature financial institutions and clear regulatory guidelines will sustain an active and reliable market. Mexico is still germinating in this area but is expected to take great strides in the restructuring of its financial systems and attraction of investments. From north to south, it is envisaged that the whole region will witness growing demand for the financial products in managing risks while financing long-term projects in real estate and energy.

Europe will show itself to be one of a few remaining players due to its well-woven financial network and globalization attempt of financial practices across its countries. Germany, the UK, and France have all well-established structured product markets, and this is expected to be further assisted by a more pronounced integration of green finance and digital finance. The European countries focus on achieving a balance between finance innovation and accountability, which will cement trust in structured finance instruments. This cautious but yet forward-looking approach will create sustainable market opportunities in the years to come.

The Asia-Pacific region will land firmly on the runway to be among the fastest-growing regions in the Global Structured Financing market. Countries like China and India actively promote more infrastructure development, business expansion, and housing development. These ambitions require enormous financing support, and structured finance provides flexible solutions. The region would attract markedly better participation by further awareness and regulatory shift. Japan and South Korea will leave their imprints on the region's advancement due to their exposure to advanced financial strategies.

The South American region is visibly showing improvement, especially in Brazil and Argentina. Economic reforms and the consequent need for better funding models will allow for structured finance to become more mainstream within this region. On the other hand, in the Middle East and Africa, increasing interest in infrastructure and modernization efforts in banking systems will contribute to widespread adoption of structured financial tools. With growing interest across the globe, these regions will certainly take an active role in influencing the future of this market.

COMPETITIVE PLAYERS

The global Structured Finance market will keep transforming and expanding as financial institutions continue changing trends in investment, new economic developments, and advanced technologies. The global innovators in this space will pave the path for the Structured Finance industry through innovative financing models and risk management. These companies will aim to provide investors and borrowers with the financial solutions they require in times when global economic stability may be uncertain. As the markets keep on merging, structured finance is anticipated to play an ever-growing role in nurturing corporate growth and infrastructure growth.

A list of names such as Deutsche Bank AG, Barclays PLC, and Credit Suisse Group AG will keep on adjusting their services. They may explore ways to make the financial products flexible while still respecting the rigid standards required for complex investment. They aim at credit risk management with appropriate transparency and fast track processes through digital tools. As technology becomes more embedded within finance, these institutions will endeavor to invest more in the automation and data analytics that strengthen the activities of their structured-financing units.

Banks such as Société Générale, UBS Group AG, and ING Group will also be formulating steps to offer strong competition. Such strategies may include forming partnerships with emerging markets while concentrating on renewal energy project financing and sustainable financing. Financing these major infrastructures and green energy projects will remain high up on the agenda, and structured finance will step in to meet such demand. Meanwhile, ABN AMRO, Lloyds Banking Group, and Crédit Agricole Corporate and Investment Bank will also be looking for new ways to serve by creating customized financial products with better access to global capital markets.

Younger entrants, such as Acuity Knowledge Partner and ESFC Investment Group, will introduce fresh ideas and often a more narrowly focused approach. Their function could include providing specialized services, research, or advisory support to assist larger firms with their decisions. These smaller players are quite nimble and thus can customize their solutions for specific client needs in a way that larger firms may not be able to.

The Global Structured Finance market shall continue to show an interesting blend of conventionalism and modernism. With the rising complexity and interconnectivity of the financial environment, these firms are well positioned to engineer solutions that actively manage risk while unbolting fresh avenues for investors across the globe. The future of this market rests with the ability of these institutions to adjust to and to respond to global changes in financing and demand for investment.

Structured Finance Market Key Segments:

By Type

- Collateralized Debt Obligation (CBO)

- Asset-backed Securities

- Mortgage-backed Securities (MBS)

- Other

By End-user

- Financial Institutions

- Government and Public Sector

- Insurance Companies

- Other

Key Global Structured Finance Industry Players

- Deutsche Bank AG

- Commerzbank AG

- Barclays PLC

- Société Générale

- Raiffeisen Bank International AG

- Credit Suisse Group AG

- UBS Group AG

- ABN AMRO Bank N.V.

- ING Group

- Natixis

- Rabobank Group

- Santander Group

- SEB Group

- Crédit Agricole Corporate and Investment Bank

- Intesa Sanpaolo

- Lloyds Banking Group

- Acuity Knowledge Partner

- ESFC Investment Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252