MARKET OVERVIEW

The Global Steel Ingots market is the most vital part of the steel industry. This is a step of producing steel from its initial stage. Steel ingots are one of the most basic forms of metals used in manufacturing a vast array of products. They are mostly manufactured via casting processes and serve as the primary source material from which bars, billets, and other forms of steel are subsequently produced and delivered as end products. Demand for steel ingots is therefore derived from overall demand for steel across construction, automotive, infrastructure-related markets.

As industries expand around the world, the need for high-quality steel will push the demand for ingots. Steel ingots provide the foundation necessary for producing products that are integral to the development of urban landscapes, transportation networks, and manufacturing processes. The current trends in industrialization and infrastructure development make it probable that the market will continue to evolve to meet the needs of these growing sectors. Steel ingots are produced through a number of processes, and the most widely used is either the blast furnace process or electric arc furnace method. These manufacturing methods will be the backbone of the industry for years to come and allow the manufacturer to churn out enormous amounts of steel. With improvements in technology, quality control of the steel ingot will only increase and keep pace with the stringent requirements of the industries using them, resulting in better product quality and efficiency. Global Steel Ingots is a crucial element of international trade. In the major steel-producing countries of the world, such as China, India, Russia, and the United States, huge quantities of steel ingots are produced.

The ingots are then exported to regions with high demand for steel products. The international market will continue to be dynamic with changing economic conditions and political factors influencing trade relationships. Exporters would focus on countries that need such ingots to further process in their production facilities into finished steel products. Another relevant factor for the future of the industry of steel ingots is environmental attention. Steel making in a sustainable world would mean changing techniques and production methods of steel ingots towards more environmentally friendly technologies. Innovative developments that target carbon reduction for processes used in making steel would mean changes to methods involved in the making of ingots.

Manufacturing methods in the making of ingots will, by themselves, change in view of increased government measures regulating their levels of emissions globally. As would be expected, even though the Global Steel Ingots market would still continue to form a major constituent of the steel industry, growth would depend on factors of technological development, global changes in trade, and sustainability demands for producing steel. This changing market will remain one of the keystones to the industries that use raw materials such as steel in their productions, and also the future development of modern economy will be centered upon this aspect. With new technologies and environmental changes, steel ingot production will therefore evolve, ensuring that the industry remains sensitive to the needs of its market and the sustainability goals for years to come.

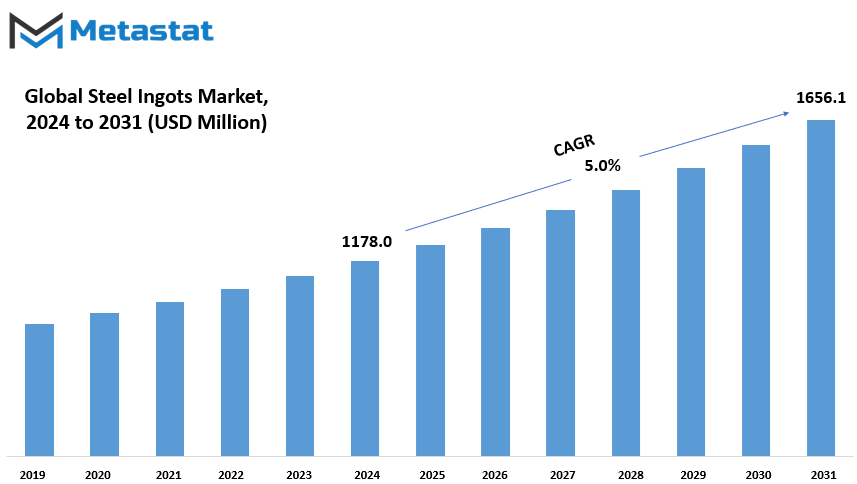

Global Steel Ingots market is estimated to reach $1656.1 Million by 2031; growing at a CAGR of 5.0% from 2024 to 2031.

GROWTH FACTORS

The demand for steel is continuously increasing, because it is used in infrastructure and construction projects. As cities mushroom and new developments continue to be undertaken, there is an ever-stronger urge for versatile and strong materials such as steel. Its durability and flexibility make it a preferred choice for erecting bridges, skyscrapers, and transportation systems. This persistent demand testifies to the significant role steel plays in shaping modern urban landscapes and supporting development initiatives.

Steel manufacturing processes have been advanced further, increasing its usage and appeal. Technological advancements have increased the efficiency of production without waste and low costs. New developments in methods like electric arc furnaces and continuous casting enabled the faster and better-quality production of steel. The industries will, therefore be able to cope with increased demand at good standards that will ensure the steel product remains the anchor of industrial growth.

The steel industry has its challenges, too. Uncertainty in production costs comes with fluctuation in the prices of raw materials like iron ore and coal. This impacts overall profitability in steel manufacturing, affecting the supply and pricing of the same in the market. Companies have to react swiftly, which may involve large changes in their operations.

Environmental regulations have also put pressure on the steel industry. Steel production can lead to carbon emissions, and sustainability is a significant focus area. Stricter regulations are forcing manufacturers to adopt more eco-friendly practices and reduce their environmental impact. These measures are important for global sustainability goals but add costs and challenges to the industry.

There are, however, some significant opportunities for growth despite these restraints. The demand for steel in emerging economies is rising, where they continue to invest in infrastructure and industrial development. The steel manufacturers shall look forward to opportunities that will enhance their reach to these potential markets. Further, the surge in recycling and sustainable manufacturing methods will solve the long-term environmental concerns. They will be able to bring their industry into line with the global efforts toward sustainability without losing out on productivity and competitiveness.

Steel remains a vital material for global progress. Balancing demand, environmental concerns, and innovative practices will ensure its continued significance in shaping the world’s infrastructure and industrial future.

MARKET SEGMENTATION

Type

It further categorizes into the three main types: Stainless Steel, Mild Steel, and several other types with unique characteristics and applications. The Stainless Steel is perhaps most recognized for its resistance against rust and corrosion, hence found more commonly in areas of damp or extreme conditions. Often applied in construction, car, and kitchen utensil manufacturing due to its ability to be durable and good-looking. This material also retains strength at high temperatures, making it versatile in use within several applications.

Mild Steel is another material that is very cheap and easy to shape. It may not be as resistant to corrosion as Stainless Steel, but it is highly valued for its malleability and strength, which make it suitable for construction, machinery, and other structural applications. It is especially suited for projects requiring large amounts of material without exceeding budget constraints, as it delivers solid performance at a lower cost.

The "Others" category comprises materials that are not directly within the Stainless Steel or Mild Steel groups but are still relevant for particular industries. Examples of these include special alloys developed for particular applications or experimental materials created to solve specific challenges. They are usually applied for very specific needs like greater conductivity, lesser weight, or higher resistance to extreme environmental factors.

The segmentation into these types allows industries to select the material best suited for their needs. Each type has qualities that make it an optimal choice in its domain, whether it is the rust resistance of Stainless Steel, the adaptability of Mild Steel, or the specialized benefits offered by the materials in the "Others" category. By understanding these differences, business firms and manufacturers can know which one to use in making decisions. This then helps companies produce efficient and quality projects.

This approach in the categorization of materials allows streamlining of production processes to cater to the different needs of various sectors. In this regard, users can identify what best fits their needs based on the strength of each type and can choose material for end products that are durable, cost-effective, and functional. This categorization is therefore one of the primary reasons why resources can be optimized to meet industry standards while trying to solve practical challenges.

By Application

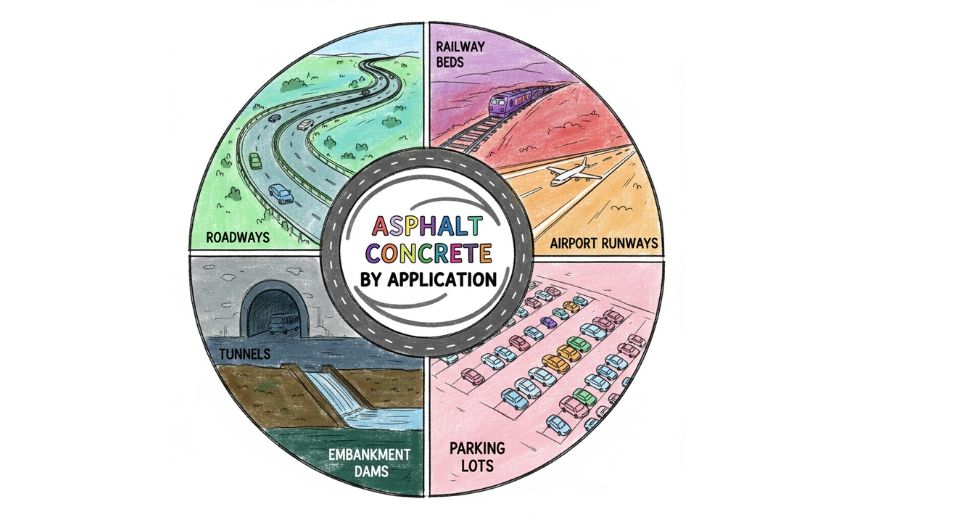

The market is divided based on its applications, which are construction, automotive, industrial machinery, power generation, transportation, shipbuilding, and others. Each of these reflects the different uses and demands for the products or services within its particular field. This segmentation will make it easier to understand how the market works and where the potential for growth lies.

In the construction sector, products and technologies are often applied to support infrastructure development, enhance durability, and increase efficiency in building processes. The demand in this area is driven by the need for advanced materials and equipment that can withstand environmental challenges while meeting modern design requirements.

The automotive industry focuses on innovation and performance enhancement. This segment is driven by the need for lightweight materials, improvements in safety, and energy-efficient solutions. From vehicle manufacturing to maintenance, various products are applied in this sector, and their significance continues to grow with technological advancements.

Industrial machinery is yet another area where demand can be attributed to manufacturing and production. These machines require materials and components that can work under high stress and should be reliable in continuous service. This application area gives emphasis to productivity and the ability to accommodate various industries that rely on machinery for its operations.

The power generation sector is playing a very prominent role in this regard also. Tailor-made products and services towards this sector also help contribute to energy productions either by renewable sources or by the traditional methods in which focus on sustainability nowadays increases demand for efficient solutions that are non-environmentally friendly to power generation within the market.

Transport remains a second big area where products are being used to make systems transporting goods and people more efficient and reliable. It includes improvements in logistics and vehicle and infrastructure designs. In the shipbuilding industry, products focus on materials and parts made durable and designed for marine conditions. Safety and efficiency at sea require specialized products.

The Others category consists of applications that may not fall under the main categories but are still part of the market dynamics. All these divisions reflect the various uses and demands that make up the market and shape its evolution over time.

By Distribution Channel

The Steel Ingots market has been analyzed based on its distribution channels, which are mainly direct sales and distribution partners. Of these, the direct sales segment was the most significant in the global Steel Ingots market in 2023, earning a revenue of USD 690.4 billion. This segment is expected to grow steadily and reach a value of about USD 991.2 billion in 2031. It has recorded a compound annual growth rate (CAGR) of 4.75% for the years of the forecast period.

The dominance of the direct sales segment can be linked to its efficiency in offering products directly to the consumers without involving intermediaries, hence giving cost savings and close tie with customers. Businesses adopting channels of direct sales tend to have more control over sales processes, pricing methods and mechanisms for customer feedback; this strengthens their market and even enables them to deliver precisely what a customer may have requested promptly.

On the other hand, distribution partners play a very critical role in taking the market share of Steel Ingots to markets that may not be easy to reach directly. These intermediaries act between the manufacturer and a much larger customer base. Even though their share of the overall market is not as significant as direct sales, they are essential in ensuring that there is always availability in diverse regions and industries.

The growth trajectory of the Steel Ingots market brings an excellent balance between direct sales and the strategic role of a distribution partner. They together manage varied industrial and commercial clients while allowing for the development of different sectors such as construction, automobile, and manufacturing sectors. The dual-channel approach thereby accommodates the flexibility for any business to adjust according to changing market conditions.

As the industries are constantly expanding and modernizing, the demand for high-quality Steel Ingots will continue to grow, thus further increasing the importance of both channels of distribution. Maintaining a strong customer needs focus while optimizing their strategies for distribution will further allow the market to grow as it continues to contribute towards improvements in various industries. Sustained growth like this shows the need to recognize and capitalize on both direct sales and distribution partnerships to increase market potential.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$1178.0 million |

|

Market Size by 2031 |

$1656.1 Million |

|

Growth Rate from 2024 to 2031 |

5.0% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

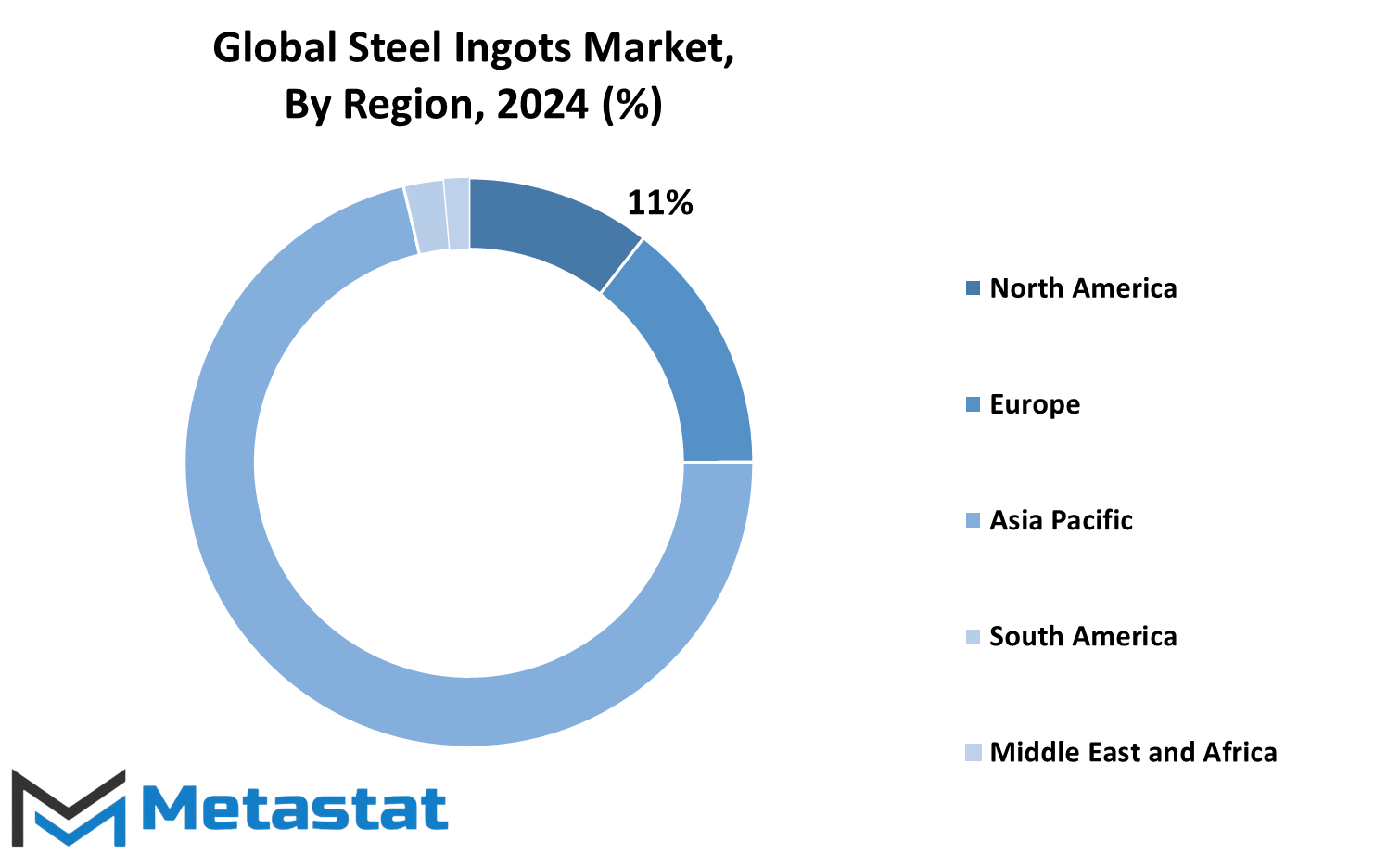

REGIONAL SEGEMENTATION

The global market for Steel Ingots is segmented based on geographies; each geography contains specific countries within itself. Such classification allows one to study the market dynamics of various regions in finer detail. North America is divided into the United States, Canada, and Mexico. Each one of these countries significantly adds to the demand and supply of steel ingots within the region. Similarly, Europe comprises the United Kingdom, Germany, France, Italy, and all other countries which together form the rest of Europe, pointing out its diverse contributions to the market.

Asia-Pacific is another prominent region, comprising India, China, Japan, South Korea, and all other countries of this region. This region is quite important because of the rapid growth in the industrial sector and a huge rise in the demand for steel products, which is directly proportional to the growth in the market for steel ingots. South America, particularly Brazil and Argentina, is significant; however, all other countries in South America contribute to the overall trend in the regional market.

Further segmentation in the Middle East and Africa will detail specific areas to understand the unique market characteristics of those regions. These are divided into the GCC countries, which are known for having robust construction and infrastructure projects; Egypt; South Africa; and all the other countries within that region. This segregation makes evident the differences in the steel ingot market based on the nature of economic activities and industrial demands in these regions.

This regional breakdown is essential for comprehending the market trends, as it sheds light on the different factors driving the steel ingots market in various parts of the world. It provides insights into production capabilities, consumption patterns, and trade flows. Understanding these divisions helps stakeholders identify opportunities and challenges in each region, guiding their decisions in terms of investment and market strategies. Geographical segmentation of the market by businesses and analysts will better highlight the future developments with regard to corresponding goal setting. This will sum up a comprehensive outlook towards the global steel ingots market.

COMPETITIVE PLAYERS

The steel ingots industry is very important in global manufacturing and infrastructure development, led by major players that have built their competency in producing high-quality steel. Some of the leading names in this field include Hyundai Steel Co., Ltd, Industeel (ArcelorMittal S.A.), JFE Steel Corporation, and Jianlong Group. These companies have contributed to meeting the growing demand for steel in construction, automotive, and machinery industries.

Other major companies like Japan Steel Works M&E, Inc., Nippon Steel Corporation, and Shagang Group also continue innovating steel production with improved techniques and processes. Other companies focus on providing structural steel to specialized alloy compositions that vary according to client requirements. Tata Steel Limited and MITSUBISHI STEEL MFG. CO., LTD. are also involved in the market and are strong in sustainability and technological advancement.

Ambica Steels Limited, Laxcon Steels Limited, and Jay Jagdamba Limited are small but significant companies that have found their way through market-specific niches and tailor-made solutions. Quality and customer satisfaction are their biggest assets that keep them abreast in the industry. Kisco Castings India Ltd., TK Steels, and Sribir Group add up to the list.

The presence of large-scale producers such as China Baowu Group, Ansteel Group, and HBIS Group shows the global nature of the industry. These companies are well known for their large-scale operations and ability to provide large quantities while maintaining a high quality. POSCO, a market leader, focuses on research and development in order to stay ahead in this competitive landscape.

Collectively, these businesses comprise the core of the steel ingots industry, enabling the manufacture of critical commodities for modern development. Such collaborative efforts, focus on innovation, and drive to achieve excellence allow the industry to sustain itself and meet the changing needs of the global economy. Quality products are the resultant outcomes, thus supporting economic growth through infrastructure development. Through their expertise, the steel ingots industry remains a critical component of industrial growth, contributing to advancements in multiple sectors and laying the foundation for a stronger future.

Steel Ingots Market Key Segments:

By Type

- Stainless Steel

- Mild Steel

- Others

By Application

- Construction

- Automotive

- Industrial Machinery

- Power Generation

- Transportation

- Shipbuilding

- Others

By Distribution Channel

- Direct Sales

- Distribution Partners

Key Global Steel Ingots Industry Players

- Hyundai Steel Co., Ltd

- Industeel (ArcelorMittal S.A.)

- JFE Steel Corporation

- Jianlong Group

- Japan Steel Works M&E, Inc.

- Nippon Steel Corporation

- Shagang Group

- Tata Steel Limited

- MITSUBISHI STEEL MFG. CO., LTD.

- Ambica Steels Limited

- Laxcon Steels Limited

- Jay Jagdamba Limited

- Kisco Castings India Ltd.

- TK Steels

- Sribir Group

- China Baowu Group

- Ansteel Group

- HBIS Group

- POSCO

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252