MARKET OVERVIEW

The South Korea FMS market is one of the largest sectors dealing with financial technology in the country. With rising demand from financial institutions aiming to improve their operations and increase efficiency levels, sophisticated management systems seem to have a good outlook. In this regard, the advanced technological landscape of South Korea is very conducive to the expansion and innovation of finance management systems.

The South Korea FMS market is bound to experience strong growth in technology and its applications over the next couple of years. These systems will be utilized by financial institutions, from large banks to small FinTech firms, to perform intricate financial processes with accuracy and in accordance with evolving standards in regulations. This market will turn more crucial when the need for robust financial oversight and operational efficiency becomes prominent.

Customer expectations will also change in the FMS market of South Korea. These customers will look increasingly for more user-friendly and integrated solutions that provide seamless access to all financial data and analytics. Artificial intelligence and machine learning will further enhance the capabilities of these systems in delivering predictive analytics and more informed decision-making processes. Systems offering real-time data processing, automated reporting, and advanced risk management features will remain in the radar of the financial institutions.

Moreover, the competitive landscape for the South Korea FMS market is going to increase. Companies would come up with innovation after innovation in their products to capture a larger market share. The focus will be on developing such systems that are not only efficient in their working but also secure, given the rising concerns over data breaches and cyber threats. Accordingly, cybersecurity measures will be prominent in the region, hence ensuring that providers have their systems in line with the highest standards of security.

On the other hand, the role of South Korea's regulatory environment will also be played through technological development. In this regard, new regulations from the government and the updating of those already in force will force financial institutions to ensure that their systems are compatible. This will drive the demand for agile and scalable finance management systems that can respond promptly to regulatory change. Providers will be oriented towards developing end-to-end compliance features of systems that allow institutions to adhere to the requirements of regulators without hurting operational efficiency.

The strong infrastructure and high internet penetration rate will further drive the South Korea FMS market. This would support the growth of cloud-based finance management systems that bring flexibility, scalability, and cost-efficiency. With the growing need to derive these benefits, financial institutions will migrate to cloud-based solutions and develop better operational capabilities while reducing overhead costs.

As the South Korea FMS market evolves in the future, it would be characterized by partnerships and collaborations. Companies will want to enter into strategic alliances that would enhance their offerings and also increase their market reach. Collaboration between technology providers, financial institutions, and regulatory bodies would foster innovation and ensure that solutions developed really meet the diverse needs of the market.

The South Korea FMS market is on the verge of thriving and changing dramatically. With technological advancements, evolving customer expectations, regulatory changes, and increasing competition, innovative ways and adaptations will further develop in the market. Advanced finance management systems would help financial institutions gain in terms of efficiency, accuracy, and compliance. The market will feature prominently in determining the future of financial management in South Korea during this process of increasing the sophistication and resilience capacity of the industry.

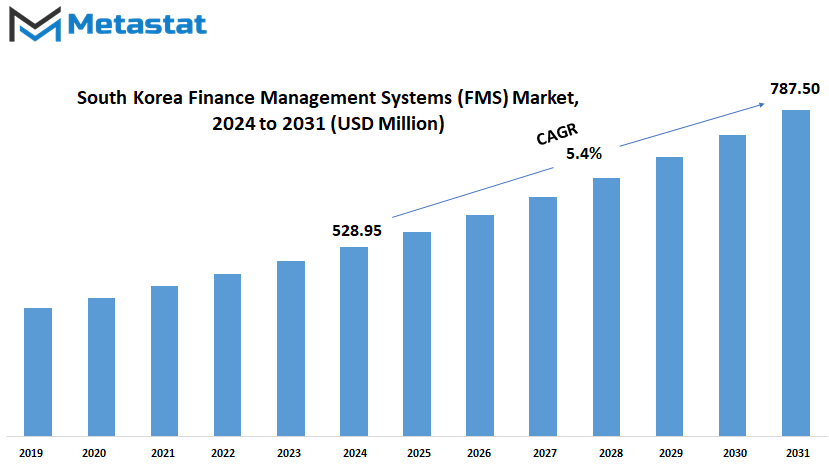

South Korea Finance Management Systems (FMS) market is estimated to reach $787.50 Million by 2031; growing at a CAGR of 5.4% from 2024 to 2031.

GROWTH FACTORS

With all the factors in place, the South Korea Finance Management Systems (FMS) market will grow tremendously. There is a growing demand for the automation of financial operations, hence improving its accuracy and efficiency. Companies are racing to try and simplify their financial processes; as this happens, the employment of automation tools will increase so much, easing human error and saving time, and financial operations will be very smooth and reliable. Another key driving factor of the market is the increased adoption of cloud-based financial management solutions. Cloud technology provides access and scalability that no other approach can give, making it easier for companies to manage their finances from anywhere and at any time. For companies with multiple locations or remote work setups, it's easier to handle finances from different locations.

Despite these encouraging growth factors, there are some major challenges to the market. Among the major concerns is the high cost for implementing and maintaining such advanced systems. Small- and medium-sized enterprises might find it hard to afford technologies in which bigger companies can easily invest, due to a general shortage of financial resources. These costs tend to become barriers, slowing down the pace of the adoption rate of such technologies within such organizations. Other critical issues include data security problems and compliance with regulations. The financial data are of high sensitivity, and any sort of breach can prove to be disastrous. Hence, companies should be very sure that the FMS solutions incorporate rigid regulatory standards so that data breaches and other forms of cyber threats can be prevented. This need for rigid compliance complicates the adoption process and adds to the overall costs.

Several lucrative opportunities lie in the South Korea Finance Management Systems market looking ahead. Probably the most promising area is the growing integration with other enterprise systems. A person would, therefore, value the ability to integrate FMS with other systems, such as ERP and CRM, for a view of this magnitude regarding the financial health of an organization and thus help strategic decisions with long-term planning. Artificial intelligence and machine learning will undoubtedly have a lot of influence in this market in the near future. These can enrich the predictive analytics of FMS by providing deeper insights and more accurate forecasting.

Though there are also some or other obstacles, the future looks promising for the South Korea finance management systems market. Due to their high costs and stringent regulatory requirements, the drive for automation and cloud-based solutions will continue fueling this market growth. These opportunities will be of an integral view to ensure that the growth of the market is assured in the upcoming years as FMS will undertake integration with other enterprise systems and see the adoption of advanced technologies in line.

MARKET SEGMENTATION

By Deployment Mode

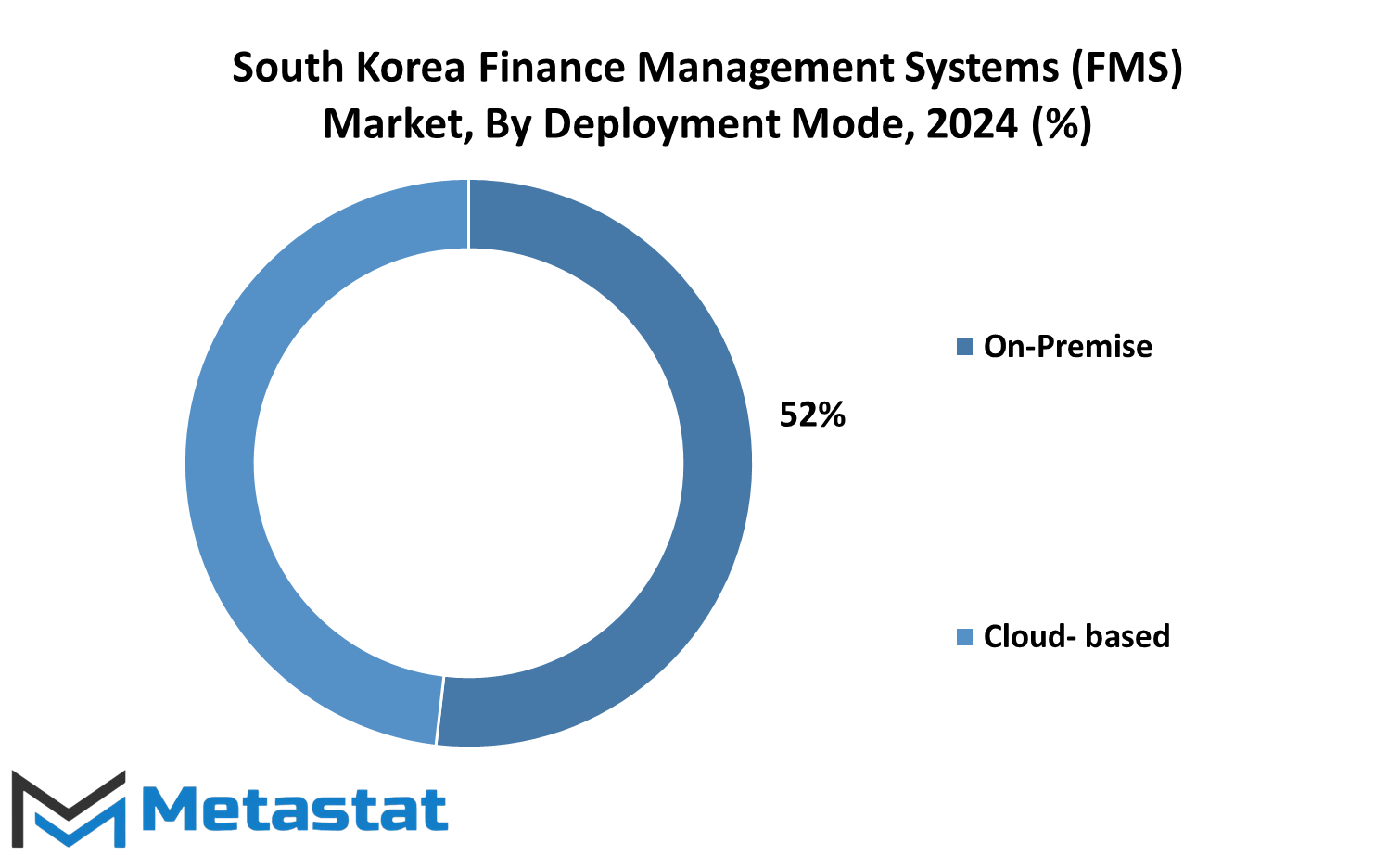

These developments in technology, coupled with changing business needs, will definitely see the South Korea FMS market posting outstanding growth. In a world demanding efficient financial management, companies in South Korea will definitely rely on advanced systems to assist them in their financial operations. The market will be classified based on deployment mode into cloud-based and on-premises solutions; each deployment mode presents unique advantages that best fit different business requirements.

Cloud-based systems will dominate finance management because they are flexible, scalable, and cost-effective. While organizations are trying to cut down on upfront costs and enhance operational efficiency, cloud-based solutions will offer a very convincing way out from traditional on-premises systems. This will ensure access to real-time data, thereby making it possible for companies to make informed decisions in a very short period. Added to this is the ease of integration with other business applications that makes cloud-based systems very attractive to any business, whether small or large.

On-premise finance management systems will also remain relevant, especially for large enterprises that have unique data security and regulatory compliance requirements. These will offer greater scope for customization so that companies can modify the software to suit their specific operational needs. While the on-premise systems are expensively placed as an upfront investment, in the long term, it will benefit regarding control and data security. These systems will be more preferred by companies with large IT infrastructures in order to maintain direct oversight of their financial data.

As the South Korea FMS market continues to grow, most businesses will shift their focus to solutions that have seamless user experiences and are coupled with robust support services. The vendors will, hence, remain focused on developing easier-to-use interfaces and ensuring thorough training and help to ensure that users can effectively draw all the benefits from their financial management systems. Integration with mobile applications will increase this accessibility even further by enabling users to manage finances on-the-go.

By Organization Size

The outlook for the FMS market in South Korea is very promising. By organization size, the market can be segmented into two categories: SMEs and Large Enterprises. With more and more businesses acknowledging the importance of efficient management of finances, the adoption of these systems would definitely widen to all types of organizations. SMEs are increasingly going to focus on FMS for simplification of business operations and better financial management if they have to compete with more illustrious competitors. In this new era of cloud-based solutions, SMEs can get hold of advanced financial management apparatuses that hitherto were not available for them because of the high cost and complexity. They can now improve decision-making processes, bring transparency into the finance area, and establish better health for the finance system.

Large Enterprises will also drive demand for FMS through seeking integration and optimization of their complex financial operations. The growing large enterprises need scalability in the sophisticated financial management solution, where FMS will assist by managing huge amounts of data related to finances, compliance, and performance improvement. Secondly, with globalization being the increasing trend in doing business today, large enterprises will have a need for strong FMS to handle several currencies, international transactions, and a variety of financial regulations. It will turn out important to consolidate the financial information from various subsidiaries and regions so as to obtain accurate reporting needed for strategic planning.

In a nutshell, technological evolvement in the future, such as artificial intelligence and machine learning, will further support the growth of the South Korea Finance Management Systems market. It will aid FMS in providing predictive analytics, automating routine financial activities, and bringing in real-time insights. As a result, organizations of all sizes can be more proactive in their decisions by spotting possible financial risks and knowing how to optimize their financial strategy. Besides, blockchain technology itself is more and more adopted, and it will further strengthen the security and transparency of financial transactions, thus helping to increase demand for advanced FMS.

By Application

In the next couple of years, South Korea’s FMS market is likely to grow huge as many applications are developing to ease and improvise the financial operations. Financial Planning and Analysis is viewed as the major factor to drive this market. Having advanced analytics and forecasting tools, FP&A would permit proper decision-making and optimization of financial strategy for any business. Such systems shall enable companies to plan better for the market, manage their resources better, and improve on the bottom line.

Another critical segment of the South Korea FMS market is represented by asset and liability management. These ALM systems are going to help organizations manage their financial assets and liabilities more effectively, thereby reducing the associated risks with interest rate fluctuations and liquidity risks. Combining real-time data along with advanced modeling techniques will help place a company in a better position to balance its portfolios and assure long-term stability of finance.

One of the essential applications to increase its adoption in the FMS market in South Korea is risk management. Given that financial markets are turning increasingly volatile and complex, businesses will need robust risk management systems that can identify, assess, and mitigate potential risks. Such systems will utilize predictive analytics and machine learning algorithms to provide early warnings and actionable insights that would enable companies to protect their financial health and maintain regulatory compliance.

Other applications of FMS within the market of South Korea will also help in accelerating its growth. This will include budgeting, financial forecasting, and financial consolidation. These solutions will automate such diversified finance processes, enhance accuracy, and strengthen decision-making capabilities. With increasing digitalization of businesses, the need for integrated FMS will continue to rise, thereby driving innovation and the development process associated with this segment.

The FMS market in South Korea will shift at a phenomenal rate; this shift will be influenced by technological developments and evolving business needs. As cloud-based solutions within the realm of FMS continue to gain greater adoption, this growth will surge since these technologies bring along scalability, flexibility, and cost efficiency. The importance of robust and integrated FMS solutions can only increase as companies strive to maintain their competitive edge in this dynamic market. Embracing such systems will, therefore, uniquely position businesses in South Korea to negotiate all intricacies of the financial landscape toward sustainable growth in the future.

By End-User

The FMS market in South Korea would witness sustained growth and push itself against a host of rising trends and technologies that can cause fundamental changes to take place. Finance management systems in the BFSI vertical could use more of their composition from advanced technologies, including artificial intelligence and machine learning, to further its risk management, frauds detection, and customer service.

Most likely, the advanced features of data analytics and automation shall be available in these systems that no doubt would help streamline operations, bringing efficiency into the decision-making process of financial institutions. The role of FMS solutions in ensuring compliance and managing regulatory risk will only continue to grow with the tightening regulatory environment. Industry 4.0 technologies will find high integration within Manufacturing and Finance Management Systems. It shall present real-time monitoring of financial performance and operational efficiency in the manufacturing sector, hence giving manufacturers insights regarding cost structures and financial health. Such systems would aid optimal production processes, better supply chain management, and rapid responses to changes on markets.

Advanced analytics and customer insight are some of the capabilities FMS solutions will offer to retail and e-commerce businesses in support of dynamic pricing strategies, inventory management, and personalized marketing efforts. As omnichannel retailing continues to grow, the Financial Management Systems will become very important in consolidating financial data across multiple selling channels for better profitability and customer satisfaction.

In the Healthcare sector, the focus shall fall on finance management systems, which shall be more health-oriented in patient care and operational efficiencies. They help the health providers track expenditure, budget management, and effective allocation of resources. While developing value-based healthcare models, the FMS solutions shall ensure management of financial performance since events correlate with the patient outcomes.

Thus, finding a suitable financial management system that copes with the peculiar financial challenges resulting from ever-fast landscapes of technologies and competitive pressure remains a challenge for IT and Telecom. It is much it would mean for the management in capital expenditure management, financial operations optimization, and strategic investment in new technologies.

Secondly, government and public sector entities will adopt financial management systems that support enhanced transparency and accountability of financial management. Presumably, such a system is meant to ensure budgeting, financial reporting, and allocation of resources that would enhance better performance in the public sector for service delivery.

Financial management systems will be highly crucial in managing complex financial transactions and investments in infrastructure within the Energy and Utilities sector. The financial management system will enhance the operation of the financial department and keep risks within manageable levels while ensuring that the companies comply with all environmental legislation.

Real-time FMS solutions will also have financial insight to support, which may enable transportation and logistic companies to manage their logistics costs efficiently. They help in route planning optimization, management of fleet operations, and improvement in the financial performance at large.

Financial Management Systems will play the prime role in the Media and Entertainment industry to handle a lot of financial complexity associated with producing, distributing, and licensing of content. They can, therefore, manage revenues more effectively, plan finances accordingly, and carry out an analysis of financial performance.

The Financial Management Systems market in South Korea will continue to evolve as technology advances and leans toward more advanced financial management solutions. Each industry vertical benefits uniquely from these systems in their ability to sail through the modern finance challenges.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$670.9 million |

|

Market Size by 2031 |

$828.5 Million |

|

Growth Rate from 2024 to 2031 |

5.4% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

South Korea FMS market would grow and change significantly over the next five years on continued technology evolution and increasing demand for advanced Financial management solutions. Some prominent players in the market are Samsung SDS, KPMG Korea, PwC Korea, and Deloitte Korea. The companies will be expected to utilize their knowledge base and technological advancements to offer innovative solutions that deal with the dynamic needs of businesses in South Korea.

Due to this strong technological background, Samsung SDS is likely to lead the FMS market further in infusing state-of-the-art technologies, including artificial intelligence and machine learning technologies, in their products for enhancing efficiency and accuracy in FMS, thus establishing their foothold as leaders in providing advanced solutions to their clients.

The value-added financial consulting that KPMG Korea and PwC Korea provide globally will further continue to remain ahead of the curve. With its global know-how base, the major aspect will remain to offer specialization solutions and strategic insights that will assist companies in dealing with complicated financial landscapes and realize their objectives.

Also, Deloitte Korea's focus in the arena of digital transformation and data analytics will really drive its big agenda for success. The incorporation of advanced data-driven techniques into the provision of their FMS solutions will enable Deloitte Korea to help organizations make informed financial choices and enhance their operations.

Throughout time, however, there will be a major presence of Oracle Korea and SAP Korea as market leaders thanks to strong and scalable FMS platforms. The solutions will tend to force businesses with tighter efficiency and precision in managing financial operations from vast experience and technological capabilities.

Moreover, specialized companies like Finotek and Best One Solution Co., Ltd. are expected to similarly contribute positively to the market with their innovative FMS solutions customized to meet the needs of a particular industry segment. Such a focus on providing unique features and functionalities will raise the general competitiveness of the said market.

Companies like Epicor Software Corporation, IBM Korea Inc., Infor, and Unit4 AB will also make big in the market with their versatile and flexible FMS solutions. A core focus on integrating advanced technologies with the assurance of a smooth user experience will help them in the race to cater to heterogeneous business requirements.

Fiserv, Inc. and FM: Systems will be adding more value to the market with their niche-based solutions towards streamlining the whole process of financial management in different organizations, thus helping the businesses to gain superior financial control and operational efficiency.

These key players will eventually define the South Korea FMS market's future, riding on innovations and strategies, which will chart the course of financial management in South Korea toward a more effective, more accurate, and business-need-oriented outcome.

South Korea Finance Management Systems (FMS) Market Key Segments:

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Application

- Financial Planning and Analysis

- Asset and Liability Management

- Risk Management

- Governance, Risk, and Compliance (GRC)

- Other Applications

By End-User

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Retail and E-commerce

- Healthcare

- IT and Telecom

- Government and Public Sector

- Energy and Utilities

- Transportation and Logistics

- Media and Entertainment

- Others

Key South Korea Finance Management Systems (FMS) Industry Players

- Samsung SDS

- KPMG Korea

- PwC Korea

- Deloitte Korea

- Oracle Korea

- SAP Korea

- Finotek

- Best One Solution Co., Ltd.

- Epicor Software Corporation

- IBM Korea Inc.

- Infor

- Unit4 AB

- Fiserv, Inc.

- FM:Systems

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252