MARKET OVERVIEW

The Global Solid Hardwood Flooring Market is a niche area within the flooring industry that has specialized in the manufacture and distribution of high-quality premium flooring solutions made entirely out of solid wood. What drives this market is a focus on delivering long-lasting, aesthetically pleasing flooring options, catering to the varied requirements of residential, commercial, and industrial spaces. The unique hardness, beauty of natural quality, and exclusive textures with grains characterize solid hardwood flooring. Due to changing consumers' tastes in favor of sustainable, qualitative materials, it is the promising sector for the world floor market. Solid hardwood flooring, a product of a natural wooden process, therefore reflects the workmanship needed for processing raw timber into planks for any type of applications.

These flooring products undergo a variety of precise manufacturing processes to ascertain their stability, resilience, and aesthetic appeal. They range from the selection of premium wood species like oak, maple, and cherry to advanced finishing techniques with which the industry continues innovating in refining its offerings. This allows the flooring to meet practical needs but also be abreast with the design changes and environmental standards. It finds strength in the market due to the ability to serve a diverse range of customer demands.

While traditional designs are liked by those looking for an old look, contemporary innovations allow homeowners and designers to explore diverse finishes, stains, and plank widths. Thus, the solid hardwood flooring remains trendy in both modern and rustic settings. In addition, there is an emphasis on sustainability; consumers tend to prefer goods that have been produced based on sustainable material sourcing. Organizations such as the Forest Stewardship Council will often certify products, leading to many purchasing decisions because of this. The market also shows some dynamic play of regional influence.

Diversities in the availability of woods, manufacturing skills, and consumer preferences contribute to diversities in products and trends observed across continents. The North American continent, as an example, has shown that people prefer strong and sturdy hardwoods. European countries mainly use minimalist designs, with people liking lighter shades and innovative finishing techniques. In Asia-Pacific, rapid urbanization and growing awareness about high-quality flooring solutions have spurred a rising interest in solid hardwood flooring.

This regional diversity underscores the global character of the market, making it a complex yet rewarding industry to navigate. Technological developments will increasingly influence the Global Solid Hardwood Flooring market, allowing manufacturers to produce more durable, moisture-resistant, and aesthetically refined products. Innovations in installation techniques, such as click-lock systems, are likely to make solid hardwood flooring more accessible to a wider audience. Augmented reality tools will further enhance the purchasing experience by allowing consumers to visualize products in their spaces, further boosting the market's adaptability to modern demands.

The Global Solid Hardwood Flooring market stands to be a testament to solid wood's continued popularity for flooring. By mixing heritage with innovation, this sector continues to grow and advance, responding to diverse market needs while upholding excellence and sustainability. Focused on high-end materials and changing consumer sentiments, the market will form the backbone of flooring in the future.

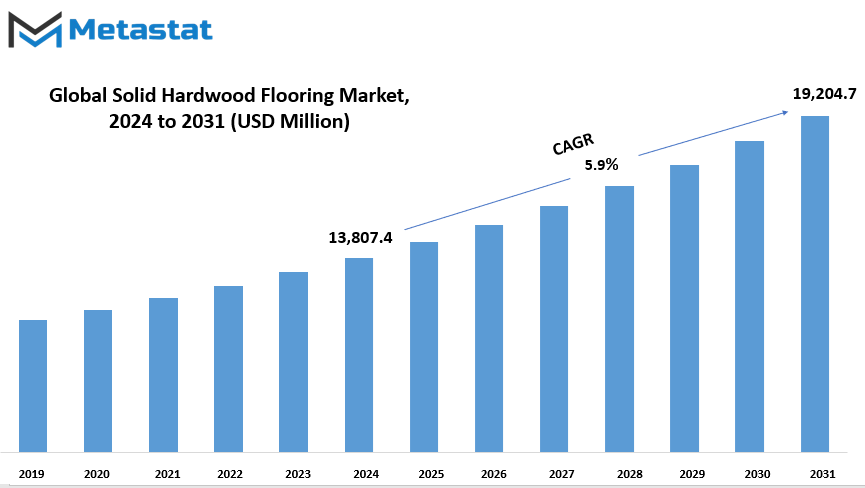

Global Solid Hardwood Flooring market is estimated to reach $19,204.7 Million by 2031; growing at a CAGR of 5.9% from 2024 to 2031.

GROWTH FACTORS

There is a constant demand for good quality and durable flooring solutions both in residential as well as commercial environments. This could be due to the demand for materials that are hard in nature and can beautify the interior but are also intact in the long run. Trends in interior design also incorporate more natural and environmental friendly materials. Consumers and designers are now seeking options that can support sustainability and minimize damage to the environment. This is part of the broader shift toward conscious living and responsible choices.

Positive drivers notwithstanding, some challenges might slow the growth of the market. The premium flooring materials are pretty pricey when compared to alternatives like laminate or engineered wood. This might render it less accessible for a budget-conscious buyer or large-scale projects. Some flooring options are also sensitive to fluctuations in moisture and temperature. This can limit where they may be installed, perhaps limiting their appeal in more extreme weather conditions or even regions with higher humidity.

However, opportunities for the market are still abundant. Expanding initiatives related to sustainable forestry opened opportunities for increasing availability in hardwood products with eco-certifications. The initiatives provide proper sourcing and production techniques in order not to spoil the natural beauty of hardwood floors while trying to sustain their environment. With the rise of awareness of sustainability, it is bound to influence demand for flooring that embodies those values, opening a gateway for new growth within this market.

Looking forward, the confluence of increased demand for premium and green products with an increased focus on sustainability provides an encouraging perspective. Though issues such as cost and material sensitivity prevail, these can be offset by new technology and design innovations. Companies and suppliers that emphasize solutions that are cost-effective, durable, and eco-conscious will find their place in this emerging market. The flooring industry will continue to progress by meeting consumer needs and trying to address these challenges to offer a balance between functionality, style, and environmental responsibility. This will, in turn, not only support market growth but set a precedent for sustainable practices in other sectors.

MARKET SEGMENTATION

By Wood Type

There are usually several distinct kinds of wood types, mainly categorized and recognized for unique features and beauty. Such as the most popular type are Oak, Maple, Cherry, Walnut, Birch, Mahogany, and Teak. These are commonly used in industries in making furniture, cabinetry, and flooring due to durability, aesthetic appeal, and versatility.

Among other things, oak is known to be the most widely available type of wood in terms of strength and hardness. In addition, the unique grain pattern of the wood adds a touch of the rustic or classic in every piece that it would be used in. Maple, being lighter, features a smooth texture, so it's great for modern as well as traditional designs. It is often selected based on its ability to absorb stain well, with options in a variety of finishes. Cherry is prized for the deep color it obtains as it ages, richly luxurious and timeless. Fine furniture and cabinetry use it often.

Walnut is a very dense and dark wood, but there's a reason why they're making such high-end furniture with it. It has the highest durability, coupled with fine, straight grains, that make them extremely fashionable and long-lasting furniture. Birch, while paler in color and having a coarser texture to it, is popular with a smooth finish and high flexibility in design. A favorite in many applications-it is commonly used for cabinetmaking as well as veneering work.

Mahogany is a very deep, reddish-brown wood known for its elegance and richness in color. It is commonly used for fine furniture and interior work of the high end to add that touch of luxury. Teak is dense and durable wood that is full of oil and can withstand water and other conditions; it is therefore most popularly used for outdoor furniture. This property of its makes it perfect for use on items that have exposure to elements such as garden furniture and boat decking.

Each of these wood varieties possesses its own distinct features to provide a wide array of choices based on a variety of styles, function, and durability requirements that will be needed for the particular project. Be it seeking the classic look or trying for a modern twist with the best of both, there are ample chances provided by these woods that go into practical and aesthetic usages.

By Product Type

These types have, based on the nature and use in the market, been subdivided into: Pre-finished solid hardwood floor and the unfinished solid hardwood flooring. Pre-finished solid hardwood flooring is installed as per the finished pre-coating with protective layers so as not to finish the laid flooring once put. Pre-finished flooring saves much time, and installation is easy because it eliminates the time that will be required for sanding, staining, or sealing the floor once the planks have been laid down. Moreover, the surface produced by the factory-finished offers uniformity and smoothness on the floor, which has a long-lasting and largely more resistance to scratches and wear.

On the other hand, Unfinished Solid Hardwood Flooring is in its raw form, so finishing has to be done once it's installed. This will give home owners and builders more power over the final aesthetic of the floor. Unfinished flooring may be sanded, stained, and sealed to the desired aesthetic or to show off the grain of natural wood. Although installation takes longer than pre-finished flooring, many people opt for unfinished hardwood because it is easier to customize the color and texture. In addition, the unfinished floor can be refinished several times within a few years. It is therefore a long-term choice for those looking for a more personal and durable flooring option.

Both types of hardwood flooring have their different benefits according to the need of the homeowner. This type of flooring is ideal for those who want easy installation and a surface ready for use. The other is unfinished hardwood flooring, better suited for those who find value in customization and extra time spent in installation toward a specific look. With the market growing, so will both options. These options will cater to different tastes and requirements.

By Application

The market can be segmented into sectors based on application, which include residential construction, commercial spaces, and industrial buildings. Residential construction is the kind of construction that has homes, apartments, and other forms of housing. It involves the construction of structures intended for human habitation. The growth of this sector relies on population growth, economic conditions, and demand for housing. With a growing demand for homes in many regions, the residential construction market will continue to grow.

Commercial spaces also have a number of buildings: offices, retail stores, and hospitality buildings such as hotels and restaurants. All of these spaces are constructed for the accommodation of businesses and organizations to conduct their operations. Business needs dictate demand for commercial space: offices, shops, and venues for recreation and tourism. The growth of urban areas as well as business expansion within different sectors will continue the development of the commercial spaces market. In this connection, the demand for fresh designs and methods of construction will continue to increase within the market, as more businesses look towards changing their operational environment as well as expanding their services.

In terms of industrial buildings, the focus lies on construction for manufacturing, warehousing, and logistics. These buildings are an integral part of the production and distribution process of goods and are commonly found in industrial zones. The industrial buildings sector forms a vital component in furthering the economy by facilitating the infrastructure for businesses to produce products, store goods, and supervise supply chains. The upsurge in global trade and increasing e-commerce will further accelerate the demand for more industrial buildings, particularly warehouses and distribution centers.

Each of these products will continue to shape the industry differently, and changing customer needs, new technologies, and new economic patterns will continue to characterize it. As these segments grow, demand for construction-related services, materials, and workforce will increase and drive the business. Residential houses, commercial structures, and industrial buildings will continually be needed to house a fast-increasing population and accelerating economies.

By Distribution Channel

The global Solid Hardwood Flooring market is distributed through various channels, most of which are very essential in reaching the consumer. These include specialty stores, home improvement stores, online retailers, direct sales through builders and contractors, and distributors and wholesalers. Each of them has its own strengths catering to different types of customers. Specialty stores are often dedicated to specific flooring solutions, offering a wide range of high-quality products. Customers who visit these stores are typically looking for expert advice and premium options.

Home improvement stores, in fact, are larger retailers. These retailers offer different lines of home improvement products-including solid hardwood flooring. Appealing to the DIYer as well as the homeowner in a position to want better floors but with the availability of a one-stop facility to shop, the other appeal is that such retail stores provide products in substantial quantities to customers wishing to finish large renovation projects.

Online retailers have significantly become the most popular mediums of solid hardwood flooring sales. Through e-commerce, consumers are able to sift through many options, see prices, and order at home. Easy access, often coupled with home delivery, has made it pretty easy for consumers to navigate through their choices.

Direct sales through builders and contractors are another critical piece of the market. Frequently, these professionals work directly with homeowners or businesses to put solid hardwood flooring in. More often than not, such a direct relationship between builder or contractor and consumer produces better deals and customized options for specific needs.

Distributors and wholesalers typically link manufacturers to retailers or contractors in the supply chain. They usually handle wholesale orders and ensure that the end product reaches the right stores or construction sites.

Each distribution channel caters to a different market segment that allows consumers to choose their most convenient or suitable options for their needs. The vast number of channels ensures that solid hardwood flooring is accessible to a wide audience, both in-person and online, which contributes to the expansion of the market and fulfillment of the diverse demands by customers around the world.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$13,807.4 million |

|

Market Size by 2031 |

$19,204.7 Million |

|

Growth Rate from 2024 to 2031 |

5.9% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

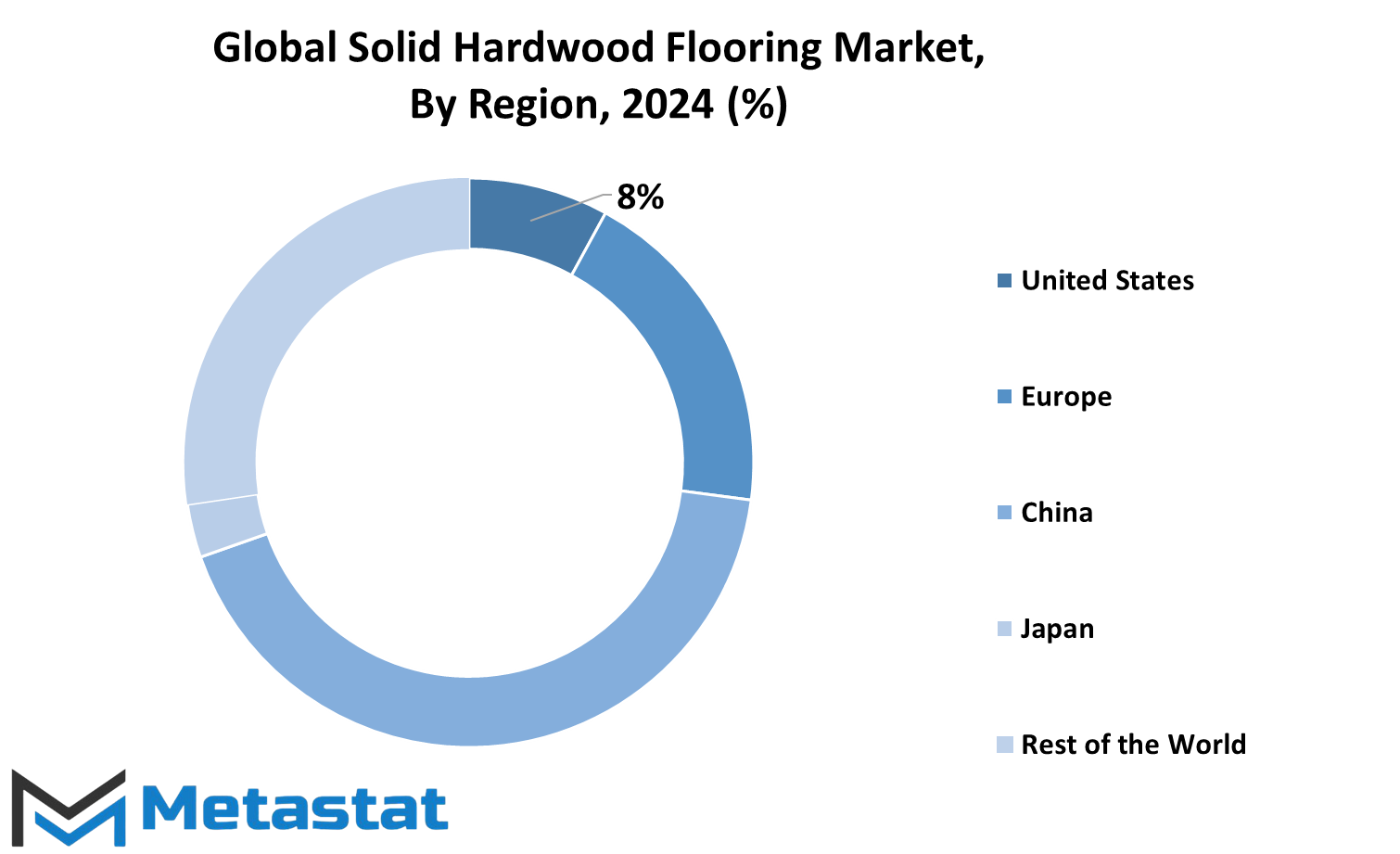

The global Solid Hardwood Flooring market is segmented by geography into five major regions; North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Further bifurcations of divisions in the region are feasible for understanding the market thoroughly. For instance, within North America, the divisions include U.S., Canada, and Mexico. Europe is divided into several key countries like the UK, Germany, France, and Italy, among others under the Rest of Europe. Asia-Pacific-a region with diversified markets - is further segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific.

The countries above play a pivotal role in solid hardwood flooring demand. Each country will have distinct market characteristics:. South America is further segmented into Brazil, Argentina, and other geographies. Middle East & Africa is also segmented into the GCC countries, Egypt, South Africa, and other geographies of Middle East & Africa. Trends as well as demand patterns in the market vary from geography to geography due to changes in economic growth, consumers' preference, and others in various regional markets.

Concomitantly, solid hardwood flooring products distribution could differ in significant ways depending on region. North America and Europe are considered mature markets that provide stable demand; meanwhile, Asia-Pacific has rapidly become a key area as the result of both increased urbanization and expansion in the middle class. South America and the Middle East & Africa are smaller markets, but are growing gradually.

South America is witnessing more construction activities and a surge in demand for high-quality flooring products. With these regional divisional understandings, it would be easy for solid hardwood flooring businesses to tailor local requirements and get their desired products in a way aligned with the locality. There is a better scope, geographically divided, from manufacturers to retailers to study about the scope of product diversification with regard to trends and consumer preferences and market demand of various types of solid hardwood flooring worldwide.

COMPETITIVE PLAYERS

The Solid Hardwood Flooring market is driven by the majority of large companies which determine the course of the development and growth of this industry. Some of the key players in the market are Mohawk Industries, Inc., Shaw Industries Group, Inc., Bruce Hardwood Flooring, Mannington Mills, Inc., and Tarkett S.A. These companies are known for their quality products and innovative designs in flooring.

Some other key players of this market include Somerset Hardwood Flooring, Kahrs Group, Anderson Tuftex, and Mullican Flooring. Every one of these brands has its broad range of hardwood floor offerings in an attempt to address several kinds of customers in their varying residential or commercial property operations. Their focus on quality and sustainability allowed them to establish a strong market presence.

Other companies including County Floors, Floor & Decor Holdings, Inc. and Junckers Industrier A/S also made to the industry. They have remained keen on providing strong, yet aesthetically friendly flooring solutions that are current trend-wise.

Bona AB, Wickes Group Plc, and Greenply Industries Limited are some of the leading companies in the market. It caters to various options available to its customers from traditional hardwood to more modern engineered floors. These companies provide expertise in flooring installation and maintenance and products for enhancing the service life of hardwood floors.

Lastly, there is Pergo Flooring. The name is a well-known brand in the industry for high-performance laminate flooring and is becoming more popular for its use in homes and businesses. Pergo also has products known for the quality and durability of along with their easy installation.

The solid hardwood flooring industry, indeed is very competitive; and indeed, the companies are working very hard in meeting these demands in such an ever-changing market. With rising demand for high-quality and sustainable flooring options, key players will certainly continue being at the frontline of developing innovative and dependable solutions to customers. It is their commitment to quality and customer satisfaction that eventually makes them dominate the market.

Solid Hardwood Flooring Market Key Segments:

By Wood Type

- Oak

- Maple

- Cherry

- Walnut

- Birch

- Mahogany

- Teak

By Product Type

- Pre-Finished Solid Hardwood Flooring

- Unfinished Solid Hardwood Flooring

By Application

- Residential Construction

- Commercial Spaces (Offices, Retail, Hospitality)

- Industrial Buildings

By Distribution Channel

- Specialty Stores

- Home Improvement Stores

- Online Retailers

- Direct Sales (Builders and Contractors)

- Distributors and Wholesalers

Key Global Solid Hardwood Flooring Industry Players

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Bruce Hardwood Flooring

- Mannington Mills, Inc.

- Tarkett S.A.

- Somerset Hardwood Flooring

- Kahrs Group

- Anderson Tuftex

- Mullican Flooring

- County Floors

- Floor & Decor Holdings, Inc.

- Junckers Industrier A/S

- Bona AB

- Wickes Group Plc

- Greenply Industries Limited

- Pergo Flooring

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383