MARKET OVERVIEW

The Global Solar Cables Market as it appears today and as it will emerge in the near future is destined to go beyond the traditional expectations in several ways, particularly through future energy transitions and their emerging worldwide significances in power infrastructure. Future developments and applications in this sector would stretch beyond what is currently known as merely facilitating the photoelectric systems. Innovative participation would continue in the area of deep integration into sustainable construction, off-grid applications, and hybrid power models. As solar energy transforms itself from providing an alternative energy source to becoming a mainstream energy supplier, the very relevance of highly specialized cable systems will assume new dimensions.

In contrast to past situations where solar cables were reduced to be just a piece within the complex system of photovoltaic applications, the future shall require these very systems to function as intelligent, responsive connectors. They would not merely carry electricity; they would also enable system optimization, performance diagnostics as well as energy management particularly in decentralized power networks. Such wires will need to withstand high UV exposure, intense moisture, and excessive mechanical stresses. Beyond these capabilities, the future sees them playing roles in advanced digital connectivity, data transmission, and adaptive response mechanisms with energy grids.

What really lies ahead for the Global Solar Cables market will not be merely geographical but also technical scaling. High demand will create needs for cables that would need to adapt to different environmental conditions, ranging from desert installations to marine applications, but without losing efficiency or safety. This will have an impact on how new types of solar cables are designed, tested, and innovated by manufacturers today against such complicated applications. The increasing market demand will be for modular energy solutions, portable solar units, and integrated energy storage systems where quality cabling serves as a backbone.

The future solar infrastructure will have attributes such as reliability, longer life, and minimum maintenance. This will include the materials for solar cables too. There are interests that would exist in recyclable, lead-free compounds as well as halogen-free ones with respect to the dictates of the country for global sustainability. Materials science will be the origin of the next generation of solar cables promising flexibility without thermal degradation as well as durability without environmental harm.

The market itself would also have affected changes in project timelines and delivery standards. Rapid urbanization and emergency energy setups in remote areas will intensify the needs for future fast deployments. It points out the importance of standardized cabling for easy installation but very robust performance. Commensurately, the demand for smarter, better-sustained solar cable solutions will grow as the energy plans and incentives evolve with countries' national policies.

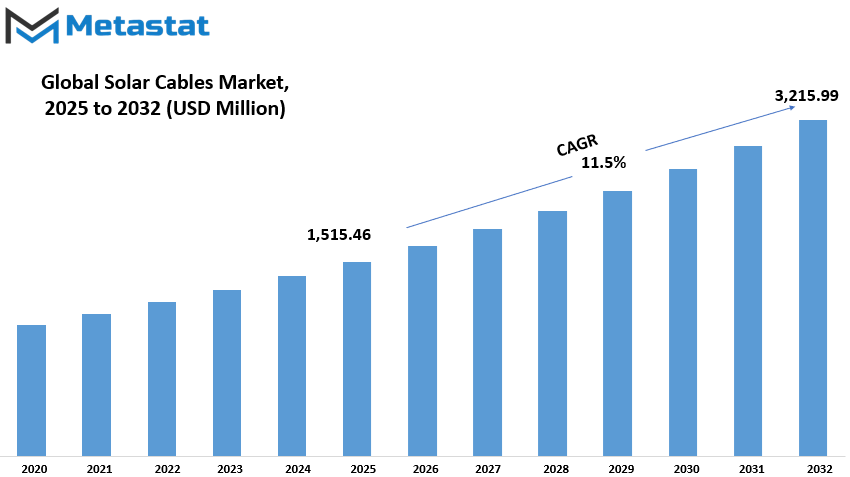

Global Solar Cables market is estimated to reach $3,215.99 Million by 2032; growing at a CAGR of 11.5% from 2025 to 2032.

GROWTH FACTORS

The global solar cables market is expected to grow significantly in the future with increasing installations of solar photovoltaic systems. In addition, governments are formulating supporting policies that encourage renewable energy consumption in most, if not all, countries, thus making solar energy one of the preferred sources for energy generation because of reduced carbon emissions as well as dependence on fossil fuels. This growing interest in solar energy brings about an increase in demand for solar cables that are highly important in transferring generated power from solar panels to a storage system or electrical grid.

The governments all over the world have been introducing incentives such as tax benefits, subsidies, and feed-in tariffs as an effort to catalyze the uptake of solar power. The measures typically turn solar projects into unfeasible ones into financially viable projects for both residential and commercial customers' dealings. More installations will, in turn, create a boost for the demand level for high-quality, durable solar cables that would be capable of functioning seamlessly under unpredictable environmental conditions.

Though there has been a positive trend above, there are still hurdles which can impede the progress of the market. One such challenge is fluctuating raw material prices, with one of the major materials being copper, which goes into the manufacturing of solar cables. Price changes can result in overall increased costs for solar installations, making it harder for some consumers or developers to go through with their projects. Furthermore, the absence of a clear set standard or regulations in some regions would create uncertainties; without common guidelines for manufacturing and installation, product quality and safety can be ill-defined, which can slow down the adoption rate in those areas.

Even with those hurdles, the market is likely to garner very good opportunities, particularly in growing off-grid solar and remote installations. Many rural or isolated places do not have access to a reliable supply of electricity. Solar energy systems installed in these areas provide efficient solutions to the issues of energy supply, and with the expansion of such projects, the demand for solar cables is bound to increase. This is especially true in developing countries, where access to energy remains very challenging.

The near future is expected to offer the solar cables market a very promising growth prospect. As technology improves, accompanied by more policies emphasizing support, solar cables will witness tremendous market growth in the years to come. Institutions in the sector will advance with the better regulation of challenges besieging the sector, coupled with stabilized material costs. Overall, a brighter future lies ahead for the market as the world propels toward cleaner and more sustainable energy sources.

MARKET SEGMENTATION

By Material Type

The solar cables market on the global front is increasing at a wondrous pace due to rising demand for renewable energy. Amongst various parts of solar energy systems, cables play a pivotal role in connecting all components so that they function properly and deliver a safe operation across the entire system. These cables are specially manufactured and designed to face harsh external conditions, have no chance of experiencing wear and tear over long durations of easy conductance of electricity, and even guard against any outside ends. With the home or business and utility companies now going for solar energy, the solar cable has become one of the increasingly popular markets among the industry's demand.

When considering the market in terms of material, copper is the clear leader with a value of US$ 1,033.07 million. Copper has been most popular on account of its excellent electrical conductivity, which means it can carry electricity with very little loss. It is also strong, flexible, and heat-resistant-all perfect qualities to have in a material for this use. Though copper may carry a higher price tag than others, it essentially pays for itself on performance and durability, especially in situations where long-term reliability is important.

Aluminum is another material used in solar cables. While its conductivity is not as favorable as that of copper, it's very low weight and cost have made it a viable option in the case of large fields of solar energy generation plants, where weight and cost considerations are of utmost importance. Aluminum cables can sometimes be used with copper cables to strike a balance between cost and performance. In the future, the use of aluminum will likely increase, especially in areas where saving costs is a priority for increasing solar infrastructure.

There are also other materials used in the manufacture of solar cables, which make up a very small share of the market. These blended or specially treated materials focus on being resistant to the environment. This includes potential damage by UV radiation, moisture, and extreme temperatures. Alternative materials could also play a useful role when standard cables are not suitable for certain conditions or applications, but their practical use is less than that of copper or aluminum.

As the solar sector continues its growth, the demand for dependable and efficient cables will further rise. Each material type has its own peculiar merits, and a selection is based on meeting the requirements of the project. Whether copper for peak performance, aluminum for cost-effectiveness, or other specialized-purpose materials, the market has set itself for clean energy growth.

By Type

The ever-present growth coming into the market keeps getting better because of the customers' choice. They are demanding renewable energy sources and advancing toward a cleaner electricity generation segment. They check their power flow from solar panels, to inverters, to batteries with solar cables to make smooth and efficient energy cash flows. Hence installation in homes, commercial buildings, and factories becomes much more popular, requiring many more solar cables to withstand lifetime long use.

There are two categories concerning types of cables: solid cables and stranded cables, wherein solid cables have a wire of considerable thickness, either made from copper or aluminum, that serves as its one conductor. This makes it suitable for short distances and fixed installations, wherein it is firm and reliable, exhibiting very stable electrical performance. Stranded cables, on the other hand, consist of several thin wires twisted together into a single conductor. Such flexibility is advantageous for larger or more complicated solar systems since it has the capability of bending and having tight corners without the worry of breaking during installation.

Every application has solid and stranded cables used because of their respective advantages for such application. Solid cables are typically in an application where flexibility is not needed; stranded cables are more fitted with providing easy handling and flexibility when installation is done. As solar power systems become increasingly sophisticated and mainstream, much will be relied upon in the choice between solid versus stranded cables: types of installations, size of systems, and environmental conditions.

Manufacturers are investing in improving the quality as well as the lifetime of solar cables to meet these increasing demands from solar energy customers. Areas of focus are improved insulation, fire resistance, and conductivity. Innovations in the solar cable market are also being fueled by the shift towards smart energy solutions and sustainable infrastructure. Also, with many countries investing in solar energy projects and incentivizing clean power through government policies, demands for high-performance solar cables would continue to surge, opening new avenues for cable manufacturers. This way, the entire journey toward greener solutions in the energy sector would be supported.

By End-Use

The world's solar cables market has almost linear growth, mainly due to the increasing acceptance of solar in different sectors. Solar cables are components of solar power systems, linking solar panels with equipment ensuring electricity runs throughout the systems. With industrial and individual users shifting toward renewables, demands for solar cables are poised to increase exponentially. Solar cables can withstand severe weather conditions for years, making them an ideal component within robust solar installations that should last for decades.

The application areas define the market into residential, commercial, and industrial segments. Thus, it has become a common practice for homeowners to install rooftops for solar energy generation. Pitch cables need to be flexible, safe, and tolerant of the outside environment in such installations. Householders are making this effort to lessen their electrical bills as well as reduce carbon emissions, hence the demand from the residential segment for solar cables will increase.

The direct benefits of solar energy in the commercial sector are mostly in the form of low operating costs for the company in the long run and aligning with sustainability objectives. Schools, hospitals, office buildings, and shopping malls are installing solar panels either on rooftops or in people's open areas. These places usually end up with a greater number of panels installed as compared to the average residential setting, which leads to longer and more advanced cabling solutions to carry more significant power loads. With businesses searching for reliable methods to cut energy expenditures while enhancing their environmental profile, the commercial application of solar cables is set to grow.

The industrial segment constitutes a major proportion of the market. Large factories and manufacturing units consume high power, making solar power a good option. Solar cables installed in these environments have to exhibit durability, heat resistance, and capability to deal with high-voltage transmissions. Industries are also increasingly raising solar farms adjacent to their premises to meet their own energy requirements. This would help them with cost-cutting and contribute towards their sustainability goals. Hence, the demand for solar cables with high strength and efficiency will grow as more industrialists embrace clean energy.

In conclusion, the solar cables market is expected to grow across all three spread headings. The increased knowledge of solar energy benefits and advancement in technology will lead to a greater need for dependable cabling solutions. Such a trend speaks even more for a sound global future of the solar cables business.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,515.46 million |

|

Market Size by 2032 |

$3,215.99 Million |

|

Growth Rate from 2025 to 2032 |

11.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

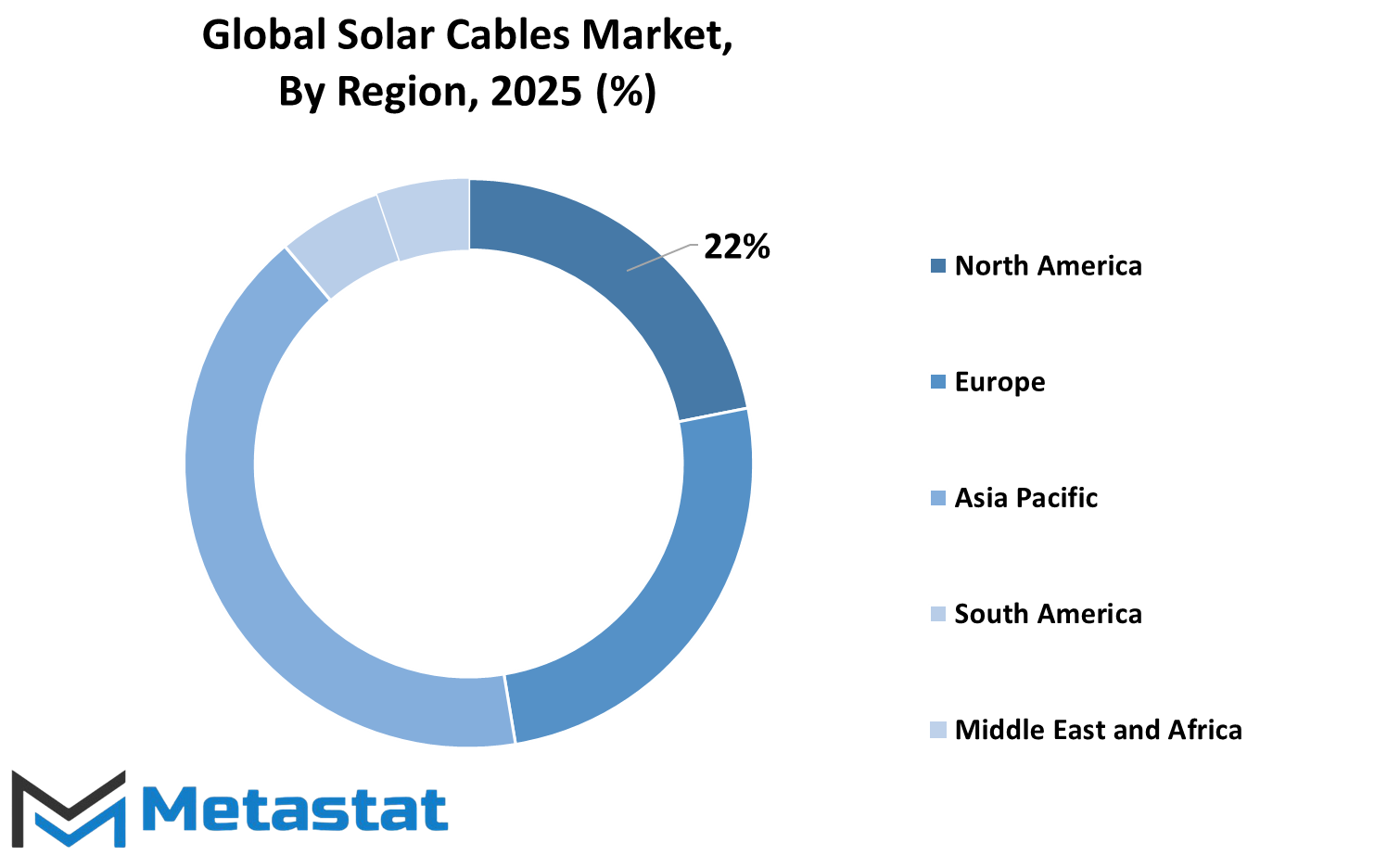

The global Solar Cables market can be segmented into regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions caters to an important share of the market value as the world transitions into the use of clean energy sources. North America, probably, is one of the top markets and comprises the countries that are the United States, Canada, and Mexico, with the U.S. being one of the strongest develop countries under the growing trend of solar installations and government initiatives that help reduce carbon emissions. The development of solar energy capacity is ongoing in Canada and Mexico to drive the demand for reliable and durable solar cables.

Major countries contributing to the growth of solar cables in Europe include the UK, Germany, France, and Italy. These have been persistent against fossil fuel use and moved to the use of solar. As a pioneer among most countries, Germany has been exposed to solar technology, while France and the UK share investment in solar projects. The rest of Europe picks up speed, as there is a growing awareness on renewable energy and existing enabling policy which increase installations.

Sun energy harnessing is, indeed, expanding day by day in the Asia-Pacific region. India, China, Japan, and South Korea are the economies where solar energy is actually on to scale in this region. While China continues to be the largest supplier of large solar farms with a firm government mandate, India is also booming in solar energy with all its initiatives and decreasing installation costs. Meanwhile, Japan and South Korea keep on expanding their solar networks, thus increasing the overall demand for solar cables. The remainder of the Asia-Pacific countries also join the bandwagon, as many are now initiating investment into solar projects for the consumption of power.

Brazil and Argentina make the top of South America. Not specifically for solar, both countries are increasingly showing interest in clean energy alternatives for large-scale solar projects to first pass from fossil fuels. The rest of the continent is slowly but surely developing the capacity to harness sunlight energy, actions which will increase the demand for world-class solar cables sometime soon.

The Middle East and Africa region will consist of the GCC Countries, Egypt, South Africa, and all other adjacent countries. These countries depend more on solar power generation in light of their greatest natural endowment of sunshine. Investments by countries such as the UAE and Saudi Arabia in solar power plants to provide their communities are gradually being matched by South Africa and Egypt's efforts in renewable energy development. This expansion in solar networks in these regions will bring about an increase in demand for durable and efficient solar cables for global sales.

COMPETITIVE PLAYERS

Majorly increasing demands by people for global demand for clean renewable energy. Solar cables thus become an integral part of solar power systems. It connects and transmits all the components of a solar power system through solar panels, inverters, and these batteries. This technology has become the best source for households and offices. Cables that are efficient, in terms of performance, are a great need now. Expansive environmental conditions, UV exposure, and extremes of temperature are typically perceived by these cables, making sure that installations remain in good form for several years.

These companies are majorly involved in paving the future for the solar cables industry through their innovative approach to product development and market strategy. Call it the tentacles of giant companies like Prysmian Group, Nexans S.A., and General Cable Corporation venturing into the advanced cable technologies that would pave the way to larger-scale solar projects. Lapp Group and Allied Wire & Cable, Inc. deal in specialized solutions compliant with international standards. LEONI AG and Helukabel GmbH add their own to the market by supplying technically competent and consistently quality products. KEI Industries Limited and Changzhou Painuo Electronic are expanding their global footprint at a competitive price and with an efficient supply chain.

Other companies like Shanghai Jiukai Wire & Cable, Universal Cables Ltd., and Orient Power Cables (India) Pvt. Ltd. are also feeding on the increasing demand in regions across the globe, most especially Asia. KBE Elektrotechnik GmbH, Eland Cables, and Ram Ratna Wires Ltd. also contribute through various types of solar cables designed for different installation requirements. Apar Industries Limited and Top Cable are also a great force in boosting the market with a dedication to safety and performance towards long-term reliability.

The rising popularity of global sustainable energy in construction provides an incentive for any investment into solar infrastructures or new possibilities in solar cables. With an increasing demand to achieve specific environmental goals in countries, it reduces their dependence on fossil fuels, thus increasing the importance of dependable and efficient solar power systems. In this sense, the companies' involvement becomes much more significant. The market is going to be under the clutches of these key players as their ability to provide advanced, safe, and economically viable cable solutions is going to direct it toward future advancement. In fact, the solar cables market is going to be one of the most important markets in the overall global shift towards cleaner energy sources with the support of these key players.

Solar Cables Market Key Segments:

By Material Type

- Copper

- Aluminum

- Others

By Type

- Solid

- Stranded

By End-Use

- Residential

- Commercial

- Industrial

Key Global Solar Cables Industry Players

- Prysmian Group

- Nexans S.A.

- General Cable Corporation

- Lapp Group

- Allied Wire & Cable, Inc.

- LEONI AG

- Helukabel GmbH

- KEI Industries Limited

- Changzhou Painuo Electronic

- Shanghai Jiukai Wire & Cable

- Universal Cables Ltd.

- Orient Power Cables (India) Pvt. Ltd.

- KBE Elektrotechnik GmbH

- Eland Cables

- Ram Ratna Wires Ltd.

- Apar Industries Limited

- Top Cable

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252