MARKET OVERVIEW

The Global Softgel Contract Manufacturing Market is the one area utilized largely in the pharmaceutical and the nutraceutical segment, with this being considered an important solution to the pharmaceutical companies that typically outsource their softgel manufacturing. It performs a critical function in the world of pharmaceutical and in the availability of necessary medicines and drugs to various parts of the world. It plays a critical part in the pharmaceutical world and the supply of necessary medicaments and drugs around the globe. In the future, this sector will adapt to changing demands of consumers and businesses. This would include offering advanced manufacturing capabilities that can meet new health trends, regulatory standards, and consumer preferences.

The world is shifting towards dietary supplements and personalized medicine, which means the Global Softgel Contract Manufacturing market will be constantly moving toward innovations that enhance efficiency as well as quality. Companies will seek manufacturing partners that can provide customized solutions with a special focus on formulating softgels. Future technology and process development will enable the manufacture of softgels to be made more conveniently and easier for manufacturers to produce custom-made softgels, capable of encasing various types of ingredients, such as liquids, powders, and more nutritional elements. This flexibility will help accommodate the vast array of consumer needs, from simple vitamins through to formulations for targeted health concerns.

As the demand for nutraceuticals continues to grow, the softgel manufacturing process will evolve further to offer more precise dosages and faster release times. This will lead to more companies looking to partner with contract manufacturers that have the latest technology and deep knowledge of the intricacies involved in softgel manufacturing. The Global Softgel Contract Manufacturing market will become even more integrated into the research and development phases of new products, as manufacturers are expected to partner with brands to bring innovative solutions to market.

The future market will look to have the contract manufacturer's ability to scale their production levels according to clients' needs. Gaining demand for softgel-based products will motivate the manufacturers to reduce their costs while maintaining the highest level of quality. This will be achieved through continuous investment in state-of-the-art facilities, technology, and trained personnel. The ability to meet the rising need for high-volume production at a competitive price will be a determinant of success in this field.

Global regulatory standards will define the softgel manufacturing industry going forward. It will be an era of increasing standards for both pharmaceutical and nutraceuticals. Manufacturers will have to work to higher levels of product safety, consistency, and compliance. This means there will be more dependency on contract manufacturers that are capable of maneuvering through the tough complex requirements and still delivering products at international standards. It is in the future that companies skilled in providing compliance solution services will differ from the unskilled.

However, the next significant development will come in terms of the kind of material used for softgel production. Sustainability is now a key issue not only for consumers but also for regulators, and this is changing as manufacturers are now working to develop eco-friendly biodegradable capsules. The rising demand for plant-based ingredients and clean-label products is going to help in innovation in the formulation of softgel capsules. These shall not only meet the health requirements of the customers but will also respond to the demands of the ecologically conscious consumers.

Conclusion In the forthcoming years, the Global Softgel Contract Manufacturing market would be dictated by innovation, regulatory compliance, and a trend to seek customized solutions. Continued advances in technology, formulation, and scalability will result in the increased outsourcing of production by businesses that need to serve an ever-evolving consumer marketplace. The industry will continue growing, and it will be an important part of getting new products to market-softgels which are safe, effective, and of high quality.

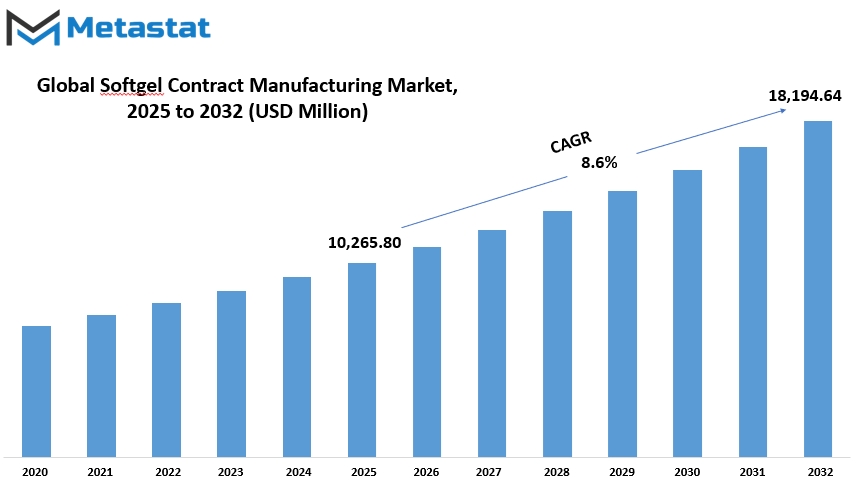

Global Softgel Contract Manufacturing market is estimated to reach $18,194.64 Million by 2032; growing at a CAGR of 8.6% from 2025 to 2032.

GROWTH FACTORS

There are multiple factors behind this rapid growth, but one important factor is increasing demand for nutraceuticals and dietary supplements in softgel forms among global consumers. Global consumers today become more health conscious, and for this reason, they need something that can present them with simple and effective entry into their routine life. Softgels become popular in nutraceutical companies due to its easy swallow properties and ability to carry a wide array of ingredients in one product form. This recent demand has further led companies in search of seeking contract manufacturing facilities to meet such market demands.

The other big reason for which the market thrives is mainly because of it being cost-efficient and convenient in terms of savings for companies, which do not have in-house facilities. Establishing a softgel production facility is expensive and time consuming; thus, it would be more prudent for most firms to outsource this function to contract manufacturers. In this way, companies would avoid big capital investment in the production equipment and facilities while being able to serve consumer demands. In this manner, they can focus their efforts on core business operations, which only saves on cost, especially on operational costs, hence leading to market lengthening.

However, there are still challenges that are likely to pose obstacles to this market. There are several constraints that will bar the growth in this softgel contract manufacturing market. One is the high set-up costs mainly for small enterprises or companies in softgel manufacturing. In addition, strict regulatory controls that govern softgels manufacture might make compliance more challenging to follow for manufacturers. Regulations are indispensable in ensuring product safety and quality but add extra costs and make production more complex. Furthermore, relying on third-party manufacturers reduces control over one's supply chain and may therefore compromise the quality of the final product and extend delivery times.

These include significant challenges, though the expansion of personalized medicine will create new opportunities for the softgel contract manufacturing market. Since the demand for customized health solutions is increasing, companies are trying to create formulations of softgel tailored to specific needs. This trend will fuel the need for contract manufacturers that can provide customized and flexible production options, thereby opening up attractive opportunities for the market in the coming years. Overall, though there are some limitations, the market is well-positioned for continued growth, driven by consumer demand and industry advancements.

MARKET SEGMENTATION

By Type

The global softgel contract manufacturing market is divided into several types, each serving the various needs and preferences of the market. Among them is the gelatin-based softgels type, which constitutes the largest revenue sector at present. With its market value at $7,584.51 million, gelatin-based softgels remain the industry's leader since they are the most commonly applied both in dietary supplements and pharmaceuticals. These softgels are always renowned for their excellent ability to entrap the active ingredients in a stable form, making them popularly used for a wide variety of applications.

The other important segment includes vegetarian or vegan softgels, which is increasingly popular in the market and is highly consumed by those who want plant-based or animal-free options. These softgels are made from HPMC, for instance, providing an option aligned with vegetarian and vegan lifestyles. Growing awareness on health and environmental issues is propelling the demand for these alternatives, making it a key part of the market's expansion.

Modified release softgels are included in the marketplace, which would deliver a controlled-release active ingredient system for consumers to use. These have been developed and designed to disintegrate as they dissolve progressively over time so that extended release benefits are conferred. In general, modified-release softgels are most essential in the pharmaceutical industries, which may be used on drugs that can be absorbed through the body by slow absorption methods to sustain extended periods of use.

Finally, enteric-coated softgels have a special coating that protects their contents from the acidic environment of the stomach so that the active ingredients are released in the intestines. Such a softgel is especially useful for supplements or drugs that would be damaged by stomach acid or that are supposed to target certain areas of the digestive system.

These softgel types play important roles in the softgel contract manufacturing market. They provide a solution to satisfy different consumer preferences and industry demands. As health-consciousness grows, and more and more people are looking for alternatives that cater to specific dietary requirements or offer controlled release options, these different types of softgels will keep increasing in demand, shaping the future of the market.

By Application

The global softgel contract manufacturing market caters to a wide portfolio of industries such as pharmaceuticals, nutraceuticals, and cosmetics. They require softgels to formulate consumable products that are easier to consume and more effective, which in turn increases their shelf life. This categorization highlights the variation in the nature of the industries where softgels are being used to offer consumers innovative products according to their needs.

Softgels are highly used in the pharmaceutical industry and act as a means of medication delivery. The softgels are a better form for both solid as well as liquid forms of active ingredients, are smooth, and easy to swallow. This will be one of the good advantages for the users, who would face difficulties in consuming the traditional tablets. Softgels can also help increase the bioavailability of some medications, which are absorbed correctly in the human body. Pharmaceutical firms will rely much on softgel contract manufacturing due to its flexibility and efficacy in terms of delivering all kinds of drugs, especially over-the-counter medicines and prescription medicine, which has been growing extremely fast in demand in the near future.

Softgels in the nutraceutical industry produce supplements that have a positive health effect. Such types include vitamins, minerals, and other supplements to generally provide healthy well-being or specifically for a condition such as arthritis pain, increase immunity, or enhance gut health. Softgels give the consumer a more streamlined, hassle-free way to receive their daily dose of supplements.

As they are versatile in their capacity to carry oils and dry powders, it makes them uniquely effective in dispensing ingredients not readily mixed into tablets or capsules. As people are becoming more health-conscious and look for preventive measures to maintain their health, the demand for nutraceutical softgels will increase further.

Cosmetics also have benefits from softgel contract manufacturing, especially for beauty supplements and skincare products. Softgels deliver nutrients and antioxidants that improve skin health, hair growth, and appearance. The effective delivery of active ingredients through the application of softgels makes it one of the primary methods of packaging in various beauty products that intend to remove wrinkles or restore the complexion of youthful-looking skin. Increasing consumer demands for new innovations in personal care may propel the increasing usage of softgels in cosmetics.

This way, softgel contract manufacturing provides a reliable, efficient, and cost-effective route to produce quality products that cater to consumer needs for all these industries. As the demand for softgels in these sectors increases, the market is likely to grow further, presenting more opportunities for innovation and growth across different applications.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,265.80 million |

|

Market Size by 2032 |

$18,194.64 Million |

|

Growth Rate from 2024 to 2031 |

8.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

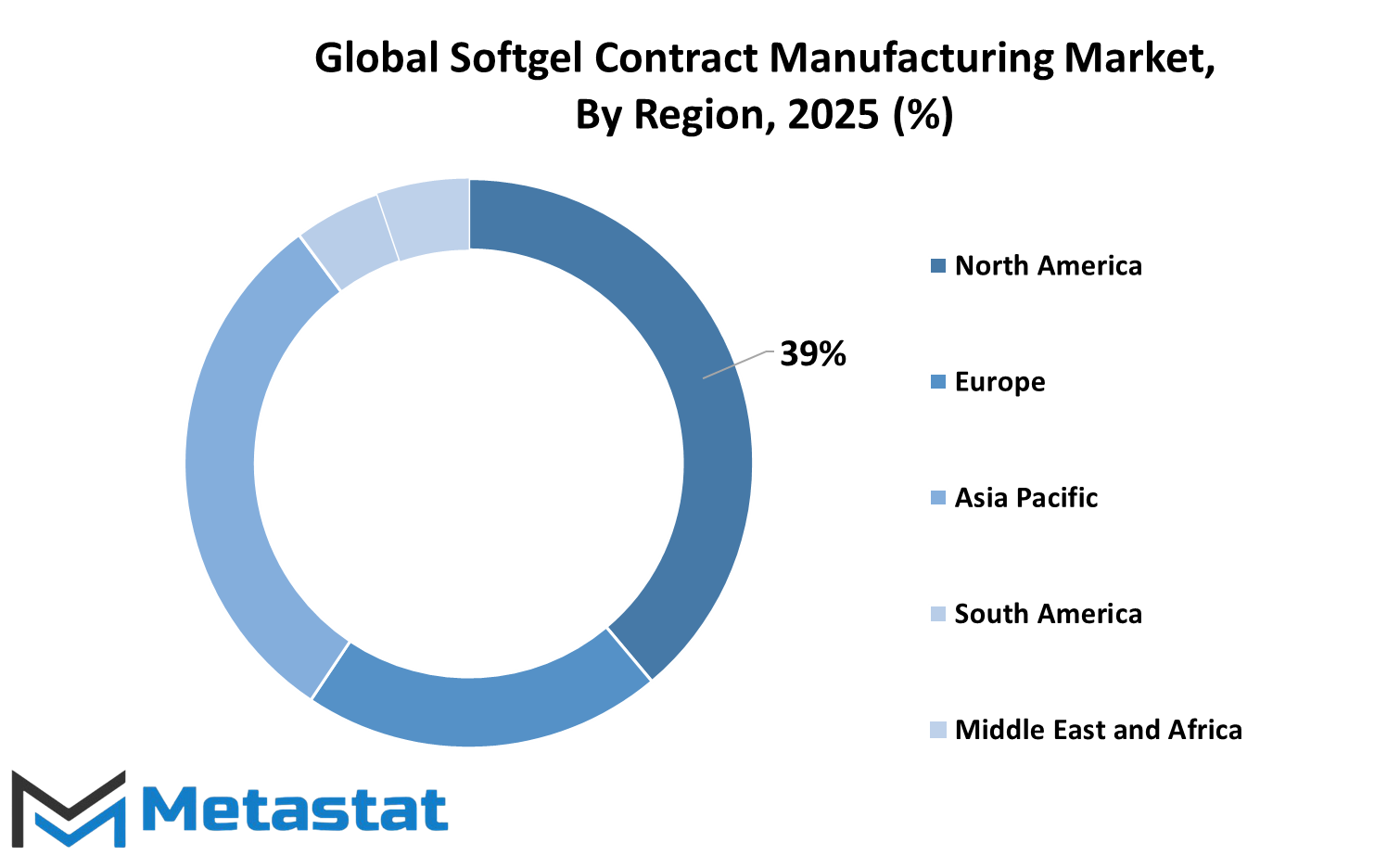

The geographies covered within this report for the global Softgel Contract Manufacturing market are classified into five broad regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. These further extend to various sub-geographies based on their distinct characteristics of this market.

North America is segmented into three major markets: the United States, Canada, and Mexico. This division helps in viewing the specific needs and growth opportunities of each country. Every country is different from the rest because of industry regulations, consumer preferences, and the general economic landscape. The U.S. is most important because it houses large pharmaceutical and nutraceutical sectors that increase the demand for softgel manufacturing services.

The other major region is Europe. This region further comprises five major subregions-the United Kingdom, Germany, France, Italy, and the Rest of Europe. The other reason driving up the demand for health supplements is that an aging population is increasing in Europe, while rising health awareness is also propelling the health supplement market in this region. Additionally, regulatory environments, especially in Germany and the UK, impact manufacturing in this region.

The Asia-Pacific is one of the largest and fast-growing markets; it comprises countries such as India, China, Japan, South Korea, and the rest of Asia-Pacific. Increasing application in the pharmaceutical, nutraceutical, and cosmetic industry in the use of softgels is primarily propelling the market in the Asia-Pacific. Major opportunities also prevail in developing healthcare sectors due to the existence of a larger population base across nations like China and India.

South America consists of Brazil, Argentina, and the Rest of South America. This region's market is growing with increased health consciousness and demand for nutritional supplements. In Brazil and Argentina, there is growth in demand for softgel products because of improved access to healthcare and consumer awareness.

The Middle East & Africa is also segmented into GCC countries, Egypt, South Africa, and Rest of the Middle East & Africa. The market in this region is relatively small compared to other markets, but here too, steady growth is happening due to improving healthcare awareness. Countries like UAE and Saudi Arabia are showing higher growth rates and South Africa pharmaceutical sector is rapidly growing, leading to the development of the contract manufacturing market in softgels within the region.

In summary, the geographical segmentation of the worldwide Softgel Contract Manufacturing market will provide a better overview of local market dynamics, growth drivers, and regional opportunities. All regions have different advantages and difficulties that manufacturers have to face up to in their strategic planning.

COMPETITIVE PLAYERS

The softgel contract manufacturing industry is critical for the production of softgel capsules, used widely in pharmaceutical, dietary supplement, and nutraceutical sectors. The advantages are easy intake, hiding of lousy tastes, and enhanced absorption of active ingredients. Company-wise, it is the activity that a group of key players predominantly undertakes for the formulation, production, and packaging of softgel capsules.

The above company is certainly one of the major players that operate in Softgel Contract Manufacturing. Catalent, Inc has been recognized on account of all the services in which it had specialized and successfully delivered high-end manufacturing processes without compromising the integrity of the output in terms of safety and potency. This will be because their product development proficiency and advanced infrastructures make Catalent, Inc as a market leader of this type.

Another important company is Aenova Group, which is famous for its strong capabilities in the production of softgel capsules. Aenova offers a diversified product portfolio in pharmaceutical and dietary supplements and keeps innovation and quality control at a high level, thus enabling it to cater to the increasing demand for customized solutions in the Softgel Contract Manufacturing market.

Capsugel is now a part of Lonza but is well-known for its advanced technologies in capsule manufacturing. The company specializes in the development of softgel capsules that provide high-quality bioactive ingredients in a precise and reliable fashion. The company commits to customer-centric solutions that have built a strong presence in the industry for a firm that serves a global market.

Procaps Group is another major player that offers full-service contract manufacturing, including softgel capsules, among other dosage forms. Their commitment to excellence in product formulation and manufacturing makes them a trusted partner for many companies seeking to develop new products.

Other notable companies that operate in this sector include EuroCaps, Sirio Pharma, AlderBiochem, and Elder Pharmaceuticals. These companies have established their own specialized offerings and contribute to the growth of the Softgel Contract Manufacturing industry by providing a range of services tailored to meet the needs of their clients.

Other big contributors are Fuji Capsule Co., Ltd. and Captek Softgel International, Inc. Both of them have excellent reputations for the production of quality softgel capsules. These companies have the most advanced technologies, which help them provide businesses that require contract manufacturing services with efficient and cost-effective solutions.

In conclusion, the Softgel Contract Manufacturing industry is highly competitive. Catalent, Aenova, and Capsugel, among others, are major leaders in the business. This would ensure continuous demand for soft gel capsules from pharmaceutical and nutraceutical companies as they continually pursue innovation, quality, and customer satisfaction.

Softgel Contract Manufacturing Market Key Segments:

By Type

- Gelatin-based Softgels

- Vegetarian/Vegan Softgels (e.g., Hydroxypropyl Methylcellulose - HPMC)

- Modified Release Softgels

- Enteric-coated Softgels

By Application

- Pharmaceuticals

- Nutraceuticals

- Cosmetics

Key Global Softgel Contract Manufacturing Industry Players

- Catalent, Inc.

- Aenova Group

- Capsugel

- Procaps Group

- EuroCaps

- Sirio Pharma

- AlderBiochem

- Elder Pharmaceuticals

- Fuji Capsule Co., Ltd.

- Captek Softgel International, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383