Global Smartphone Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

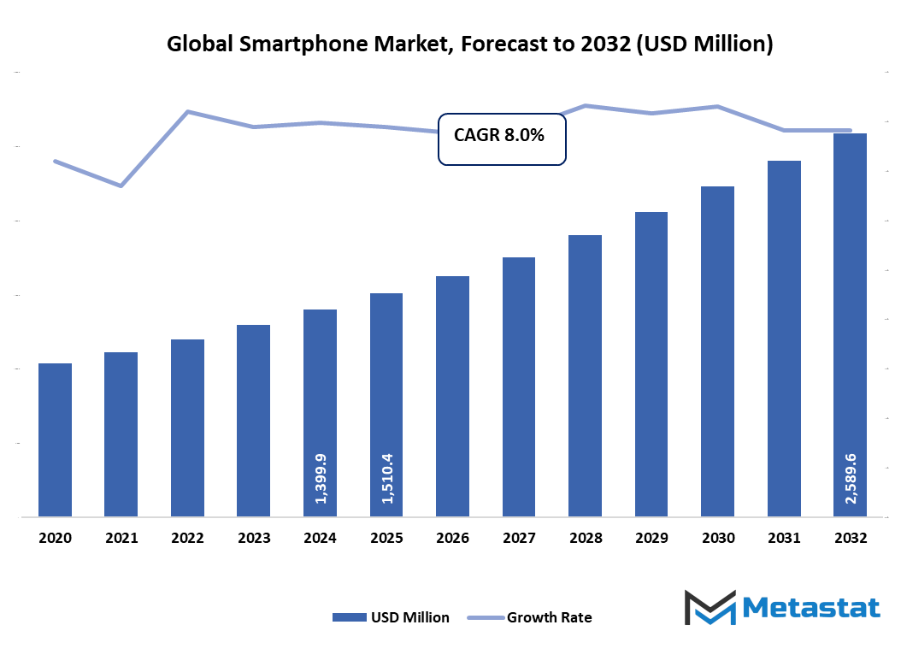

- The global smartphone market valued at approximately USD 1510.4 million in 2025, growing at a CAGR of around 8.0% through 2032, with potential to exceed USD 2589.6 million.

- Android account for a market share of 73.6% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising consumer demand for connectivity and smart applications, Rapid technological advancements in hardware and software integration

- Opportunities include: Expansion of 5G and AI-driven features creates significant growth opportunities

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global smartphone market is one that will keep influencing the way people communicate, work, and get information globally. Unlike standard cell phones, smartphones will be multipurpose devices that combine communication, computing, entertainment, and commerce all under one platform. The market will move beyond being just a mere consumer good and will become a vital component of individual lifestyles and business processes. With the constant evolutions in hardware, software, and network technologies, smartphones will be the primary interface between human and digital ecosystems.

The global smartphone market will no longer be device-centric but also encompass the vast ecosystem around the devices, such as operating systems, application development, and integrated services such as mobile banking, e-learning, and telemedicine As smartphones will be the entry points for new technologies, they will be the fulcrum to drive artificial intelligence-based experiences, cloud computing, and data-thirsty applications into reality. The segment will also further divide into premium, mid-range, and base models, catering to varying consumer preferences and varying degrees of buying power across geographies.

Market Segmentation Analysis

The global smartphone market is mainly classified based on Operating System, Ram Size, Price Range, Distribution Channel.

By Operating System is further segmented into:

- Android

Android is a leader in the global smartphone market and is the preferred choice for many because of its reasonable price, the fact that it is customizable, and that it is available in almost all price segments. Its ability to be used in high-end and low-end gadgets ensures that there will always be demand from different consumer groups all over the world. - iOS

iOS is the choice for affluent users who value the smooth integration, high security, and great performance that it offers. The segment is very strong in highly industrialized areas where the consumers are more loyal to a particular brand, and they also choose high-quality products. - Others (Linux, Windows)

Operating systems such as Linux and Windows which are alternatives to mainstream ones cater to a small population of the market; however, their shares are comparatively much smaller than those of Android and iOS.

By Ram Size the market is divided into:

- Below 2GB

Devices with less than 2GB RAM are mainly designed for users living in the lowest-income areas of the world. This segment remains relevant because of its low price, though the demand is slowly moving towards larger RAM options. - 2GB-4GB

Mobiles with 2GB-4GB RAM are the best sellers among mid-range models and offer flawless performance for the user’s daily routine. This range has a wide prevalence among buyers who are budget conscious and are looking for a gadget that will perform common functions well. - Up to 8GB

Smartphones with higher RAM options are manufactured keeping in mind high-end users such as gamers and professionals who require a PC-like multitasking function and speedy processing for their work. The popularity of mobile gaming and productivity apps are the main reasons for this segment to grow.

By Price Range the market is further divided into:

- Below US$ 100

Entry-level smartphones under $ 100 are still in great demand in developing countries as they are suitable for the first-time buyers and people with very limited budgets. - US$ 100-200

This price range is where most mid-segment devices can be found. The main feature of these devices is that they are affordable and offer good performance. This segment is strongly growing in the developing countries with the rise of disposable income. - US$ 200-500

The smartphones in this category come with many advanced features such as high-resolution cameras, fast processors, and large storage capacities. Such devices are in high demand among buyers who aspire to have the qualities of luxury at reasonable prices. - US$ 500 and above

The luxury segment consists of the most hyped models, foldable phones, and expensive devices. The major buyers who tend to be brand-conscious consumers and people who are in search of the very best in terms of performance and quality are attracted by this group of products.

By Distribution Channel the global smartphone market is divided as:

- OEMs stores

Direct brand outlets are the places where manufacturers can display their most luxurious model, offer after-sales service, and encourage and maintain customer loyalty. - Retailer

Physical retailers are still popular in places where consumers prefer buying personally and testing the products before purchase. - E-commerce

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1510.4 Million |

|

Market Size by 2032 |

$2589.6 Million |

|

Growth Rate from 2025 to 2032 |

8.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

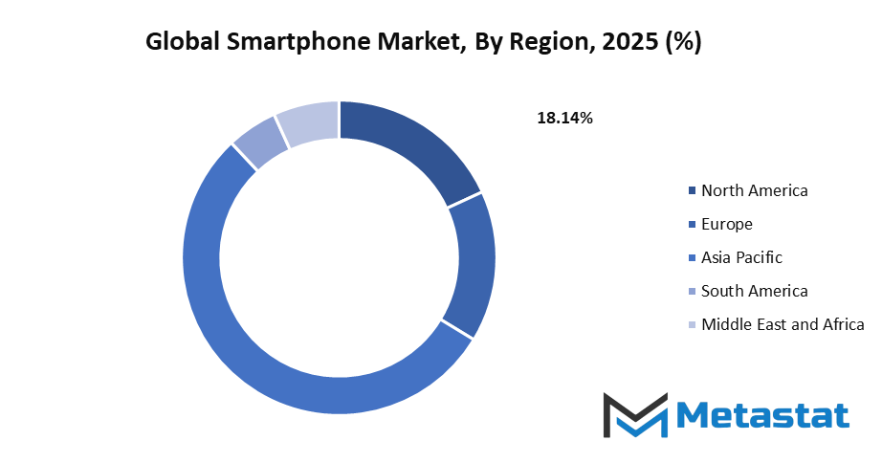

By Region:

The Smartphone market worldwide shows diverse regional distribution, corresponding to diversity in adoption rates, customer needs, and technological base. North America, with the U.S., will be a strong market due to high premium and next-generation connectivity penetration. Europe, encompassing Germany, France, and the UK, will emphasize innovation and compliance and drive the trend towards sustainability and data protection.

Within the Asia-Pacific region, technological urbanization and sheer numbers of individuals in China and India will drive the region to be the fastest-growing hotbed for smartphone take-up. Primarily, South Korea and Japan are going to be at the forefront of global technological innovation, especially concerning 5G implementation and cutting-edge display technologies. Moreover, the rest of Asia-Pacific will be the beneficiaries of a steady flow of more affordable devices. The likes of Brazil and Argentina will be the leading countries of South America that will focus on mid-range and low-cost smartphones, which will be a direct reflection of the economic profile of the people living in that area.

Meanwhile, Middle East & Africa will see robust growth as smartphone penetration increases with better digital infrastructure. GCC nations will look for premium phones and advanced features, whereas Egypt and South Africa will be major growth regions with increased demand for affordable and stable devices. In all these markets, the worldwide Smartphone market will modify its propositions to align with local economic realities, cultural affinities, and technological preparedness, thus forming a balanced but competitive marketplace.

Market Dynamics

Growth Drivers:

Rising consumer demand for connectivity and smart applications

The demand for never-ending connection and availability of smart applications has become one of the most powerful movers of the world smartphone market. Consumers today heavily depend on their smartphones not just for communication but also for entertainment, online learning, payments, and location. The adoption of lifestyle apps such as health tracking, online banking, and social networking has emerged as a key reason that positions smartphones at the top. Such an emerging reliance on smart ecosystems is bound to raise demand not only in the developed market but also in emerging markets.

Rapid technological advancements in hardware and software integration

One of the key explanations for remarkable customer experience with smartphone technology development is the innovation of faster processors, sophisticated chipsets, AI-based software, and high-resolution cameras. The manufacturers' ongoing innovation is to integrate hardware and software to offer services that are not merely faster but also more personalized and secure. Many of the features such as foldable screens, biometric authentication, and improved gaming performance are instances of such integration. Such quick advancements not only increase the expectations of consumers but also push manufacturers to launch newer devices, hence making the international smartphone market continue to grow.

Restraints & Challenges:

High device costs limit accessibility in developing markets

Even as high-end smartphones get all the spotlight, their cost is still out of reach for the majority of the world's population. Low cost is essential in developing markets, which typically pushes buyers towards low-cost phones or second-hand phones. Even with installments and credit, flagship offerings are out of reach for many. This cost barrier damps down adoption levels in cost-conscious markets and forces firms to battle aggressively to sell mass-market versions without compromising on features.

Short product life cycle leading to frequent replacements

The smartphone market is challenged by a rapidly shortening product life cycle. A combination of fast technological advancement and competitive promotional activities makes people change their devices often. As this improves sales volume in the immediate term, it poses sustainability issues and leads to electronic waste. Consumers in certain markets are increasingly also becoming cautious of investing in devices that become obsolete too rapidly, which might deter long-term commitment and put pressure on companies to walk the fine line of innovation vs. longevity.

Opportunities:

Expansion of 5G and AI-driven features creates significant growth opportunities

One of the major changes in the smartphone market comes from the implementation of 5G networks and the rising use of AI. The faster speeds allow for smooth streaming, gaming in real time, and more IoT integration, which basically means that the capabilities of smartphones go above usual. AI-powered features such as smart assistants, prediction-based input, personalization of content, and AI-assisted imaging have become standard in users' lives. These technologies when combined, will open up the limitless potential and consumers will make their purchase, thus resulting in growth not only in the new markets but also in the existing ones

Competitive Landscape & Strategic Insights

The Global Smartphone industry is typified by established multinational giants as well as fast-rising local brands. Market leaders such as Samsung Electronics Co Ltd, Apple Inc, and Huawei Technologies Co Ltd will continue to lead with wide product offerings, brand recognition, and better technology implementation. These customers will set the pace of innovation on foldables, camera gear, and chip processing, among others in the market must follow suit or cross these boundaries.

Xiaomi Corporation and BBK Electronics Corporation, which own brands like Vivo, Oppo, Realme, and OnePlus, will become stronger by attracting various segments of the customers at competitive prices and differentiated products. Their capability to retain low cost in high specification maintenance will enable them to grab serious market share both in emerging and developed world. Other companies, such as Lenovo Group Limited, HMD Global Oy, and Sony Corporation, will hold niche positions, emphasizing unique characteristics or selective regional demands in order to remain competitive.

New entrants from Google LLC and ZTE Corporation will also increase market dynamics. Google will extend its Pixel line on the back of its software platform, whereas ZTE will extend its low-cost strategies particularly in Asia and Africa. Therefore, the Smartphone market worldwide will remain highly dynamic where product innovation, ecosystem integration, and competitive pricing strategies will decide long-term success and regional dominance.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1510.4 million in 2025 to over USD 2589.6 million by 2032. Smartphone will maintain dominance but face growing competition from emerging formats.

In the next few years, the global smartphone market will be more inclined towards personalization-based innovations, security, and seamless integration with other devices that they are connected to. aside from personal use, smartphones will be major catalysts for business, governments, and industries in general that would like to streamline communication and digital processes. This kind of shift will render the smartphone market one of the biggest influencers in world technology, setting the tone for the future of communication, commerce, and culture as a whole.

Report Coverage

This research report categorizes the smartphone market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the smartphone market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the smartphone market.

Smartphone Market Key Segments:

By Operating System

- Android

- iOS

- Others (Linux, Windows)

By Ram Size

- Below 2GB

- 2GB-4GB

- Up to 8GB

By Price Range

- Below US$ 100

- US$ 100-200

- US$ 200-500

- US$ 500 and above

By Distribution Channel

- OEMs stores

- Retailer

- E-commerce

Key Global Smartphone Industry Players

- Samsung Electronics Co Ltd

- Huawei Technologies Co Ltd

- Apple Inc

- Xiaomi Corporation

- BBK Electronics Corporation (Vivo, Realme, Oppo and OnePlus)

- Lenovo Group Limited

- HTC Corporation

- HMD Global Oy

- Sony Corporation

- ZTE Corporation

- Google LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383