MARKET OVERVIEW

Micro-electronic acoustics refers to the small, detailed acoustic parts that make up the audio system in smartphones. These components are mainly made up of microphones, speakers, and receivers, all of which are very essential in enabling smartphones to carry out their basic audio functions. These functions range from the use of phone calls, supporting media playback, and responding to voice commands. Micro-electronic components in a smartphone ensure that users can easily interact with them, be it a call, listening to music, or even Siri or Google Assistant voice assistants.

In smartphones, microphones play the role of sound reception. They convert the waves to electrical signals, which are then processed by the phone. This technology allows users to be heard clearly during calls, make voice memos, and participate in video calls. Its size has dramatically decreased from past years, yet their performance is still strong, with some even bettered in certain ways. The technology can now be miniaturized so that it can fit into modern small and compact smartphone design without losing quality. Speakers, on the other hand, take these electrical signals and convert them back into audible sound.

These speakers are also smaller and more powerful than ever before. They allow for high-quality sound during media playback, whether it's a video, music, or a game. Small smartphone speakers may look so much smaller, and it appears they can't produce sound like large audio systems, but due to this technology, smartphones can easily produce loud and clear music with detailed qualities. Receivers are another important part in the acoustics of smartphones; they ensure that the sound when one is calling is clear and audible. The receiver works with the microphone to ensure that the person's voice and the voice of the other party are well heard. This technology plays a very important role in ensuring that communication is good during phone calls, even in noisy places. The evolution of smartphone micro-electronic acoustics has greatly improved the audio experience. The improvements that these technologies have and will continue to achieve can only mean better quality, smaller components, and advanced features in future smartphones. It is one of the biggest reasons why smartphones continue to become more efficient and user-friendly, despite their small size.

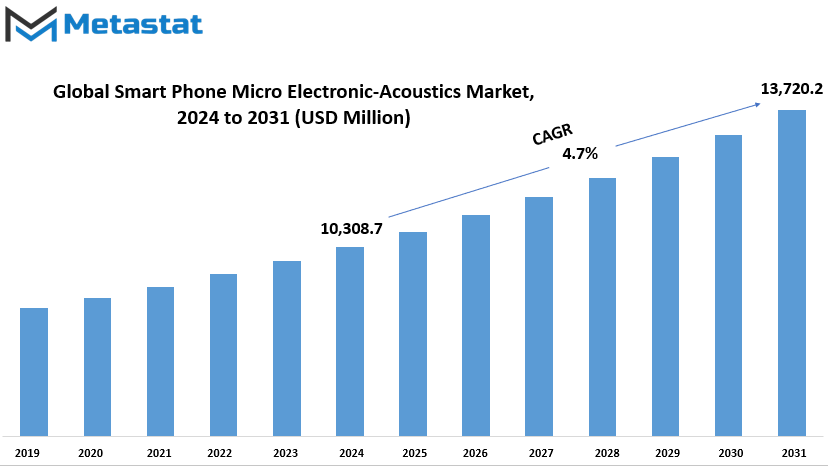

Global Smart Phone Micro Electronic-Acoustics market is estimated to reach $13,720.2 Million by 2031; growing at a CAGR of 4.7% from 2024 to 2031.

GROWTH FACTORS

The growing demand for audio quality in smartphones has emerged as a significant growth driver for the market. As consumers spend more time using their phones for media consumption and gaming, they expect premium audio quality. This trend forces manufacturers to enhance the audio capabilities of their devices. Whether it is listening to music, watching videos, or playing mobile games, clear, immersive sound is becoming increasingly in demand. With this, the increasing use of voice-activated virtual assistants and AI-powered features is adding further momentum to the market. With more people using their smartphones for hands-free applications, such as reminding themselves of appointments, making calls, or controlling smart home devices, the demand for effective voice recognition and good quality sound output has grown.

However, this increased demand comes with several challenges. Competition among smartphones has brought great pressure upon manufacturers. So many competing brands have driven competition within the market that continuous struggle for offering latest features with competitive pricing has put negative effects on the profit front of companies. There lies a cost-cutting struggle while integrating sophisticated audio technology while being competitive with respect to price. This has posed a challenge to many manufacturers to retain high margins yet ensure that consumer expectations on excellent audio are met.

Smaller smartphones are another challenge expected to limit market growth in the future. As they become smaller, it has become increasingly difficult to create optimal acoustic performance. Sometimes, the small size reduces the space available for great audio components, and a negative impact on sound clarity is experienced. The manufacturers struggle continually to find innovative ways for overcoming this limitation, yet such a limitation is a crucial one in delivering the anticipated level of audio quality required in the market.

Despite all these challenges, there are promising opportunities for the market in the coming years. The first of these is advanced artificial intelligence and machine learning technologies. With these technologies integrated into smartphones, manufacturers can enhance voice and sound recognition systems, thereby improving audio quality and efficiency of virtual assistants. As AI further develops, smarter and more responsive audio experiences will only open newer avenues for expansion in the smartphone market. In essence, while there are also some potential barriers that would slow market progress, this continued momentum of technological advancement with consumers always seeking better experiences will also drive the near future for the industry.

MARKET SEGMENTATION

By Type

The audio equipment industry is huge, and one of the primary ways it is structured is through the type of devices that exist. These devices are grouped into several types based on their functions, each with a specific role in the audio experience. By Type breaks down into three main categories: Microphones, Speakers, and Receivers.

Microphones are devices designed to capture sound. They play a very important role in different settings, including recording studios and live performances. It works by converting sound waves into electrical signals that may be processed or amplified. There are different types of microphones for different purposes. For example, dynamic microphones are strong and therefore used in live sound while condenser microphones have higher sensitivity and are suitable for studio recording. Microphones also come in different types.

These include handheld, lapel, and boom mics, among others. This shows that speakers are just part of the whole audio equipment needed to carry out an audio recording session. They primarily function by converting electrical signals into sound waves, hence making them audible. Quality will depend on the material used, design, and the kind of technology integrated into the speaker. Speakers can be observed within a variety of settings: home entertainment systems, public address systems, and even portable Bluetooth speakers. Some units are meant to be small and portable, while others have focused on sound quality through large, powerful drivers. Given the evolutions made in technology today, speakers come with new functionalities and features, such as wireless connectivity, smart capabilities, and sophisticated sound algorithms for optimization.

The third key component is that of the receivers. A receiver is a device that takes audio signals from various sources such as a microphone or speaker and processes them. The receiver works as the center in an audio system, and it disperses the signals to the appropriate outputs. A receiver can amplify audio signals, enhance the quality of the sound, or offer extra features like radio tuning, wireless streaming, and connections to other devices. Receivers are used in home theaters and professional sound systems as they can handle a large number of audio inputs and outputs. They are also widely used in car audio to play music, podcasts, or any other form of media in the best quality.

Audio equipment by kind is important for shaping ways of experiencing sound in places. Microphones, speakers, and receivers form the basis for any audio system, such that it ensures quality with both casual and professional usage. As technology continues developing, these devices are likely going to be much more impressive, changing the way we share and enjoy our sound around us.

By Technology

There are a few key technological advances that have transformed the market of audio. The most important one is Active Noise Cancellation, which is used in headphones and earphones to cancel out unwanted ambient noise. This technology picks up on external sounds through microphones and then produces sound waves that are the exact opposite to cancel out the noise. ANC has emerged as a feature for high-quality audio experiences in noisy places, such as airplanes, trains, or crowded streets.

Another key technology that impacts the market is Beamforming. This technology is mainly used in devices such as microphones and speakers. Beamforming will project sound in a particular direction, so voice clarity increases, and noises produced by neighboring areas will get reduced. This way it is appropriate for using application such as conference calls, voice assist, smart home devices, among many others that require quality talk. Sound quality becomes richer by emphasizing the speaker's voice while trying to remove extraneous sounds from noisy locations.

Audio of better quality also involves Acoustic Echo Cancellation. It is highly present in audio-communications device-like instruments phones and video conferencing system as this device is designed with two key functionalities: eliminating echoes while ringing which might occur in any conversation with two-way audio stream so that sound isn't "bouncing" off a speaker and back into a microphone. By doing this, it allows the overall clarity of conversations and blocks unwanted feedback from disrupting these conversations.

Finally, Sound Field Enhancement plays an important role for richer, more immersive audio experiences. The technology is used to enhance the spatial characteristics of the sound, creating a more natural, full-bodied listening experience. It commonly occurs in home theaters and music equipment, where surround sound is necessary for creating the perception that audio really happens. Sound Field Enhancement works by tailoring the audio to the physical environment it is hosted in such that there is a balanced and pleasant listening experience.

All these technologies: Active Noise Cancellation, Beamforming, Acoustic Echo Cancellation, and Sound Field Enhancement, have shaped the modern audio market and will remain at the vanguard of innovation as consumers continue to seek improved sound quality and better user experiences.

By Application

The market can be segmented into different segments depending on the application. The application areas include smartphones, wearable devices, and accessories for smartphones. All of these application areas contribute greatly to the overall landscape of the market by providing diverse products that satisfy the requirements of the different customers.

The sector of smartphones remains one of the highly influential sectors in the market. The demand for smartphones continues increasing as they are continuously evolved with increasingly better technological improvements. This means companies continue launching new versions with upgrades, including greater processing capability, enhanced camera power, and increased battery lives. A smartphone is an absolute necessity these days in people's daily use to communicate, enjoy entertainment and enhance productivity. Thus the segment is bound to grow ever higher, with customers perpetually interested in getting new technology to replace old ones.

Wearables, such as smartwatches and fitness trackers, are another significant category. They have become very popular in recent years because they can easily integrate with a smartphone and offer convenience. Wearables provide health monitoring, step counting, and heart rate tracking, among other features, making them highly useful for the growing number of consumers concerned with fitness and wellness. More people have turned out to be health conscious as well, leading to increased usage in wearable devices, with most looking into purchasing them for daily purposes. The future will reveal that wearable devices are the better aspect of technology that leads many to have one as time increases.

The market is driven, among other factors, by crucial smartphone accessories, ranging from cases and chargers, to earphones and screen protectors, among others. Accessories are essential for enhancing the functionality, protection, and personalization of smartphones. With the vast array of accessories available, consumers can tailor their devices to suit their preferences and needs. The increasing variety of accessories also reflects the growing consumer demand for customization and convenience. As smartphone usage continues to rise, the accessories segment is expected to experience steady growth as well.

The segmentation of the market into smartphones, wearable devices, and smartphone accessories highlights the wide variety of products that cater to the various needs of consumers. Each of these segments will continue to change with advancements in technology, further pushing growth and innovation. With changes in consumer preferences and the emergence of new trends, the market will adjust to ensure that these products are at the forefront of modern technology.

By Distribution Channel

The global Smart Phone Micro Electronic-Acoustics market is segmented into two main distribution channels: OEMs and Retail Channels. Such channels are highly significant for the total distribution of micro-acoustic technologies used in smartphones.

OEMs refers to the firms which design and manufacture electronic components that eventually enter a smartphone from other companies. The micro-acoustics provide OEMs that make smartphone manufacturers equip their devices with good audio solutions. These can range from speakers to microphones to audio chips. Most of the large-scale relationships between smartphone brands like Apple, Samsung, and Xiaomi are usually taken up by such OEMs as these companies buy the essential parts of the micro-acoustics for their products. Through OEMs, smartphone manufacturers can access the special technologies and innovation needed to enhance the audio experience for users.

Retail channels represent another major segment of the distribution process. Retail channels are the various ways in which a product is sold directly to consumers. The case of smart phone micro-acoustic involves retail channels that include online and offline platforms, which are further sub-divided into physical stores, online platforms, and other types of direct consumer sales. Retailers would liaise with the manufacturers and distributors of smartphones to get devices to market equipped with advanced micro-acoustic technologies. Consumers may opt to buy smartphones through a variety of online websites or in-store outlets. Retail channels play an important role in completing the distribution process to reach the ultimate consumer, ensuring that products reach as many people as possible.

Two sides are connected with each other; OEMs supply the technological components constituting the acoustic systems of smartphones, while retail channels ensure that these products are distributed to the consumers. This division ensures that the supply chain runs smoothly, with OEMs focusing on production and innovation, while retail channels concentrate on distribution and customer interaction. Together, these two channels form the backbone of the global market for smartphone micro-acoustics, ensuring that the latest audio technologies are readily available to users worldwide.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$10,308.7 million |

|

Market Size by 2031 |

$13,720.2 Million |

|

Growth Rate from 2024 to 2031 |

4.7% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

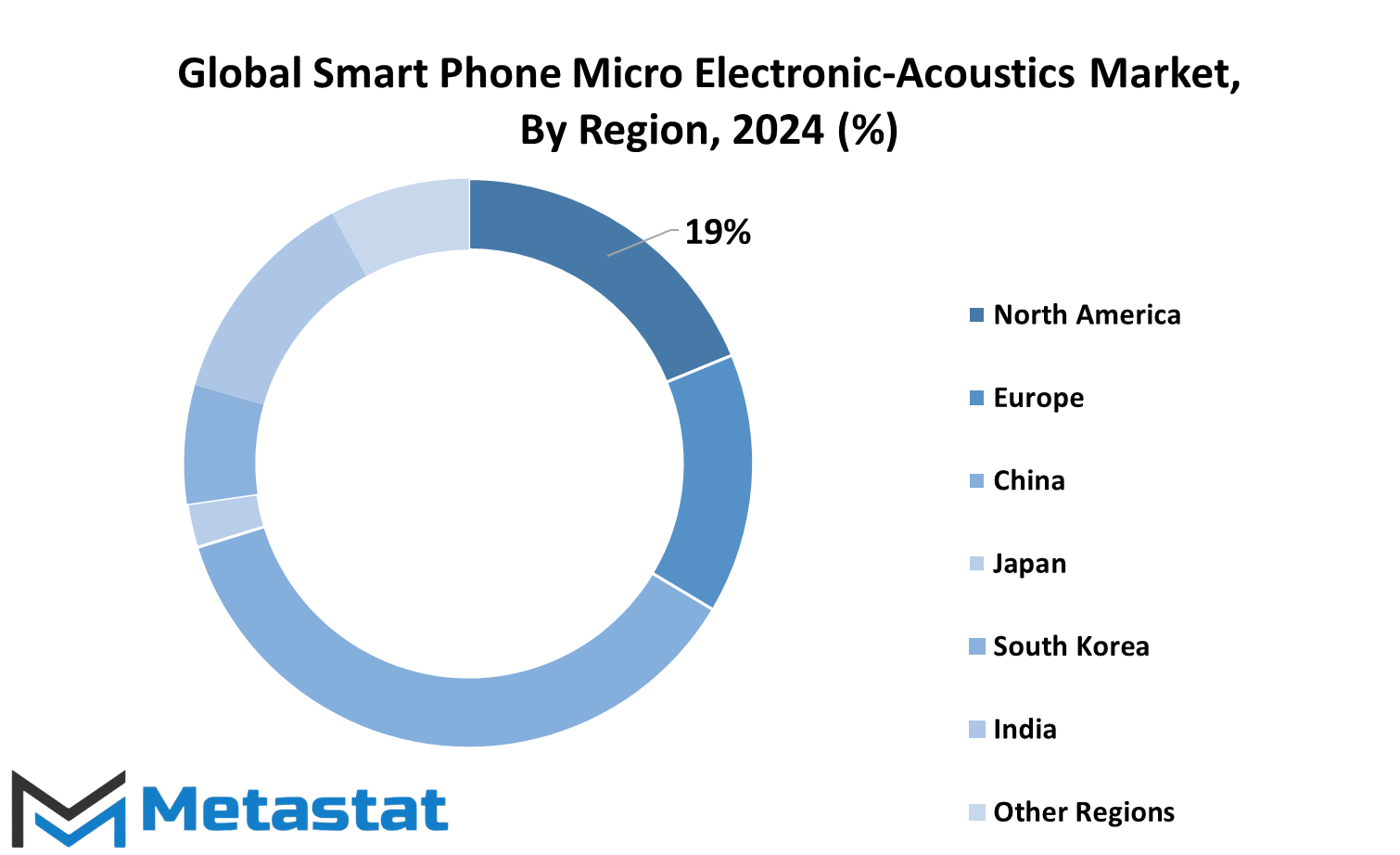

REGIONAL ANALYSIS

Based on geography, the global market for Smart Phone Micro Electronic-Acoustics is divided into various regions, such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. These all differ in terms of their distinct features and potential, which gives way to unique market dynamics.

The North American market breaks down into three main countries: the United States, Canada, and Mexico. They have their own consumer bases and technological advancements and market needs, making these countries contribute to the overall growth and trend of the region. The United States is a leader in technology and continues to influence technological trends around the world. As such, Canada and Mexico are valuable opportunities due to their growing tech industries.

Whereas in Europe, there are some key markets that include UK, Germany, France, Italy, and the rest. Smart Phone Micro Electronic-Acoustics business is majorly contributed to the two - UK and Germany, considering its development in high-tech industries along with a great demand for top-quality electronic products. It is also a significant role played by France and Italy, offering specific market opportunity, mainly in the area of luxury tech. The rest of Europe consists of several smaller but expanding markets, which add to the diversity of the region.

Asia-Pacific is segmented into the major countries of India, China, Japan, and South Korea, while the remaining Asia-Pacific region also contributes. China and Japan are known for rapid technological advancement and high demand for smartphones from consumers and are, therefore, considered major players in the global market. South Korea is also significant due to its advanced electronic companies, while India, with its large and growing smartphone market, is an emerging force in the region, as the rest of Asia-Pacific continues to expand with increasing tech adoption.

South America is Brazil, Argentina, and the rest of South America. Brazil, being the largest country in the region, dominates the market with its huge consumer base and ever-increasing demand for smartphones. Argentina also offers a great market for technology products, while the rest of the countries in the region are gradually catching up, expanding their tech landscapes.

This category, the Middle East & Africa region comprises countries including the GCC, Egypt, South Africa, and others within the region. The demand of the GCC countries is at very high tech levels due to highly affluent consumers and the higher level adoption of advanced technologies. This growth within the region is further promoted with increased markets in Egypt and South Africa. The rest of Middle East & Africa continues to improve with enhanced infrastructure and growing access to technology. Each presents different opportunities and challenges, but together they form the diverse global market for Smart Phone Micro Electronic-Acoustics.

COMPETITIVE PLAYERS/ COMPETITIVE LANDSCAPE/ KEY PLAYERS/MARKET LEADERS

The smartphone microelectronic and acoustic industry is of great importance in the market of global technology. There is a lot of value added to the development of smartphones through this industry in terms of creating and bettering small yet crucial parts in the form of microphones, speakers, and the like, which are sound related and are integral to the successful experience of a smartphone. Companies in this industry work hard to design more compact, efficient, and sound-quality-delivering products. The more advanced smartphones become, the more the demand for better performance in microelectronic-acoustic devices.

Some of the major players have emerged as market leaders in the smartphone microelectronics-acoustics market. GoerTek Inc. is one of the few companies that have become world famous for their acoustic components and microphone technologies. Among other major players, there is AAC Technologies Holdings Inc., which designs high-performance acoustic solutions for smartphones and a range of other devices. Knowles Corporation is known for being a leading supplier of microphones, which are in high demand for providing fundamental components for advanced voice recognition and noise cancellation technologies.

Besides these, BSE Co., Ltd. and Hosiden Corporation are also other noteworthy contributors, offering high-performance micro-electronic-acoustic solutions in response to increasing demand for better smartphone performance by the consumer. Merry Electronics Co., Ltd. is working hard on the basis of its experience with design for speakers and audio components so that it enhances sound from smartphones.

Foster is one of the established players that focuses on the creation of high-quality acoustic components and advanced speaker technologies. Jiangsu Yucheng Electronic and Shandong Gettop Acoustic are also doing well and making considerable advancement in microphone and speaker systems. Cresyn, one of the most superior sound solutions providers, has strengthened its position in the competitive landscape of smartphone acoustics.

These companies are constantly moving to create products that not only match but also surpass what today's smartphone user may look for. As there is a rising demand in audio and voice performance for a better experience, so do the needs of these key companies to advance the overall quality of the smartphone experiences. Innovation is what will definitely see this industry for smartphone microelectronics-acoustics advance due to these companies. The competitive nature of this industry will continue to fuel advancements that benefit consumers with smarter, more efficient, and more enjoyable smartphone experiences.

Smart Phone Micro Electronic-Acoustics Market Key Segments:

By Type

- Microphones

- Speakers

- Receivers

By Technology

- Active Noise Cancellation (ANC)

- Beamforming Technology

- Acoustic Echo Cancellation

- Sound Field Enhancement

By Application

- Smartphones

- Wearable Devices

- Accessories for Smartphones

By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Retail Channels

Key Global Smart Phone Micro Electronic-Acoustics Industry Players

- GoerTek Inc.

- AAC Technologies Holdings Inc.

- Knowles Corporation

- BSE Co., Ltd.

- Hosiden Corporation

- Merry Electronics Co., Ltd.

- Foster

- Knowles

- Jiangsu Yucheng Electronic

- Shandong Gettop Acoustic

- Cresyn

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252