MARKET OVERVIEW

The scope of disposable tools and equipment of Single Use Technologies for Biopharmaceuticals market is great and important, contributing substantially in the manufacture of biologics. Some such inclusions would be bioreactors, filters, mixers, etc. Among these are a must in producing a good product. This is a vast contrast to what has, hitherto, been employed-reusable ones. After all, once their function by the process of manufacture is served, then they stand to become disposable. Thus, these provide them with the nomenclature for being referred to as such. Their major advantage in using SUT is in the prevention of cross-contamination during manufacturing, which becomes highly critical in the process of developing biologics. As such equipment is single use, contamination from previous runs and or materials cannot occur.

SUT's other very important contribution in cost efficiency is in cutting down the operational costs associated with them. In normal systems, cleaning and then sterilization of equipment between manufacturing runs is known to take loads of time and work and also being resource- and cash-intensive. Single-use technologies avoid this step entirely. This makes the production process much more streamlined and efficient so that the manufacturers save time and money.

The need for cleaning and sterilization reduces and, thus, helps in increasing overall productivity and decreases the chances of errors that may come up in these processes. Another thing SUT contributes to is flexibility in the production process. Since these technologies are easily installed and removed, it means faster adjustments of manufacturing processes to various demands in productions. Manufacturers can easily change between the production process types without having to clean and sterilize the equipment. SUT is an effective solution for such needs while ensuring product quality and safety. Clearly, disposable equipment has the advantage of not posing a risk of contamination and also reduces production costs, making it very valuable in the biopharmaceutical sector.

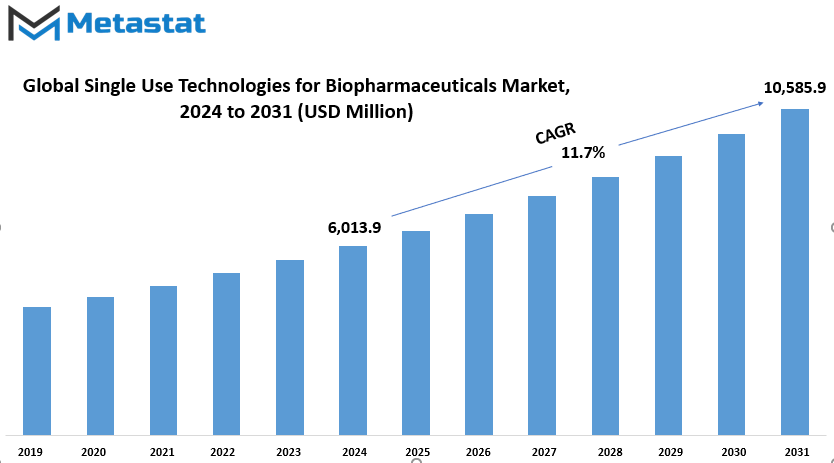

Global Single Use Technologies for Biopharmaceuticals market is estimated to reach $10,585.9 Million by 2031; growing at a CAGR of 11.7% from 2024 to 2031.

GROWTH FACTORS

The biggest growth driver in the market is an increased demand for cost-effective and flexible manufacturing in the production of biologics. The companies want efficiency as well as means to lower their production costs, for which they have built dependence on single-use systems that are flexible and scalable. The flexibility to meet constantly changing demands for production by avoiding lengthy cleaning and equipment decontamination processes has highly attracted the attention of producers of biopharmaceuticals.

Another contribution toward the increased demand for single use technologies is the advancement of biopharmaceuticals in production. More complex drugs from biologics, especially because there is a trend toward the personalization of drugs and treatments, require production processes to be more flexible and efficient. Single use systems help develop small batches of individually customized biologics-very important because now that the trend is to treat with personalized medicine for every individual patient.

Other disadvantages include the challenges with their own potential impact on market growth. One of the important challenges is environmental concerns based on the disposal of their disposable components. The volume produced here from single-use systems does typically not get reused and usually adds to environmental pollution without some proper management. This becomes another constraint that might make manufacturers take more sustainable alternatives, incurring further delays in the full adoption of single-use systems.

Further, the high investment to get specialized equipment for a single-use system may hinder the growth of this market. The cost of introduction, which includes new equipment acquisition and staff training, may limit some companies, especially small ones, from entering the single-use systems market. Although the costs associated with single-use systems reduce in the long term when it comes to operation costs, the initial investment does discourage some organizations.

However, the market for biopharmaceuticals is still growing, especially in emerging markets, which offers great opportunities for increasing single-use technologies. Manufacturers are expected to embrace single-use systems to increase their demand due to increased demand for biopharmaceutical products worldwide. The swift scalability of production will continue to present the market with golden opportunities in the near future.

The conclusion would be to say that though challenges exist due to environmental issues and cost of investment in the initial product, demand for biologics production that is low-cost and agile is expected to grow over time with biopharma and personalized medicine. Overall, emerging markets will make the opportunity pool bigger for single use technologies.

REPORT SCOPE

By Type

The bioprocessing industry is witnessing major growth due to new emerging technologies. It has evolved significantly for efficiency and less cost in manufacturing products. Single-use systems are considered the latest developments that will revolutionize the way products are manufactured, as they have been created for single-use application and will not require any cleaning or sterilization processes; this results in saving time and resources required for maintenance.

Single-use bioreactors, or SUBs, are one of the major pieces in this space. They're designed to support the growth of cells or microorganisms in the production of biologics. In contrast to traditional systems, which require extensive cleaning and sterilization, SUBs are a more streamlined, cost-effective solution. By using disposable components, manufacturers can avoid the risk of contamination between batches, thereby providing a higher level of safety and consistency in their processes.

The bioprocessing uses another basic application, which is the mixing system, especially for using ingredients or compounds that need mixing in the manufacturing process. The use of single-use mixing systems benefits in saving on the establishment and working processes as it also negates the complications involved during the cleaning process. Disposal of the mixing equipment at the end of its usage assures proper hygiene because there will be no complications by cross-contamination.

Single-use storage and transport bags are another important component in the bioprocessing industry. They are used to store and transport raw materials, intermediates, and finished products. The single-use bag reduces the expensive cleaning processes and makes it easier to maintain a sterile environment. These bags are designed to be flexible and easy to handle, thus making better use of space and logistics.

They can also be crucial in delivering single-use filtration systems as single-use filtration systems ensure to have the pure product of production. It removes a particle or contaminants from either liquid or gases in processing during the manufacture. On the advantages side, replacement in use after a single occurrence can avoid the contamination problems hence being effective each time over there.

Single-use connectors and tubing serve to transfer fluids from one component of the system to another. These disposable parts provide a secure and sterile connection with minimal risk of contamination in securing an otherwise complex overall setup and maintenance.

They assist manufacturers in taking samples throughout the various stages of a manufactured product. Single-use sampling systems are designed to provide ease of use and facilitate the collection of samples devoid of contaminants. Sterile and efficient sampling is hence essential for maintaining quality over production.

In addition to these key products, there are several other single-use solutions available that help in improving the bioprocessing process. These products have been designed to provide greater flexibility, reduce costs, and improve the overall efficiency of manufacturing operations.

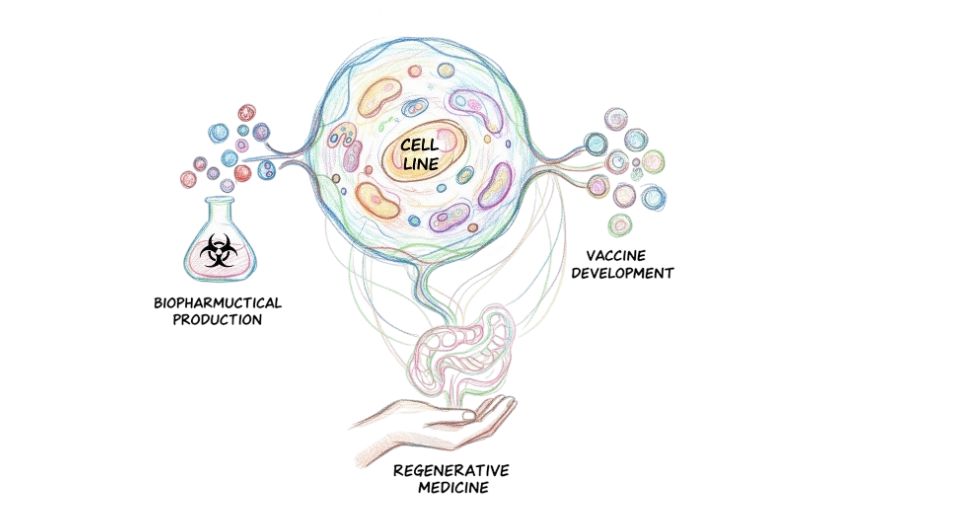

By Application

It constitutes a part of biopharmaceutical companies that address the requirement of enhancing the medicinal drugs level; that is, these biopharmaceuticals industries remain under development to come up with solutions for emerging problems. The greater portion of growth assumes the form of technological applications that would facilitate the production of essential therapy products, vaccines, gene therapies, etc., in future health directions. Based on the products being developed and the methods of development, the market is segmented into various sections. The market possesses one fundamental area dealing with monoclonal antibody manufacturing.

Monoclonal antibodies are used in curing a wide scope of diseases, ranging from cancers to autoimmune disorders. Their production must be highly specialized; the processes ensure that antibodies are effective and safe enough for patient use. Today, this method has come to become one of the pillars of modern medicine, offering fewer side effects than traditional therapies since it targets specific areas. Another major application is in vaccine manufacturing.

Advances in biopharmaceutical technologies have ensured that vaccines are developed within a much shorter period than before and in much higher quantities, which saves a population from serious health threats. This sector has received even greater attention due to global efforts toward managing pandemics and emerging diseases. Cell and gene therapy is one of the core areas in the biopharmaceutical market.

These therapies alter cells or genes for the treatment and cure of disease, including genetic conditions. It necessitates greater understanding of genetics, biology, and biotechnology when producing cell and gene therapies. This industry would change our approach to treatment for many chronic and life-threatening diseases. Recombinant protein production is another major application. Recombinant proteins are used in an extremely wide range of therapies, from insulin for diabetes to clotting factors for hemophilia. The process includes inserting the gene responsible for producing a specific protein into a host organism, such as bacteria or yeast, to mass-produce the protein needed for therapy.

Blood and plasma products is another major segment of the biopharmaceutical market. Clotting factors and immunoglobulins are some of the blood and plasma products that are derived from human blood and have applications in the treatment of a number of conditions, mainly immunological and bleeding disorders.

There are, finally other biopharmaceutical applications not considered within the categories above, which may yet have important contributions toward new therapies and improvement of patient care. Overall, the entire market focuses on the accessibility of new treatments being effective and safe for patients in need.

By End-User

The growth in most of the company's market segments was due to single-use technologies for biopharmaceuticals. One of the leading segments above is manufacturers in biopharmaceuticals. The market segment grew up to 32,864 units in the year 2019 and made it 40.9% market share of single-use technologies for biopharmaceuticals. In terms of the growth rate, it is expected that the market will expand at a CAGR of 11.04% during the forecast period of 2020-2026. In 2026, it is expected to reach a unit number of 68,202. Such a high growth rate is due to the growing demand for advanced and efficient manufacturing solutions in the biopharma industry.

The second prominent area in the market is Contract Manufacturing Organizations, or CMOs. One significant industry of CMO in biopharmaceutical is engaged in the business of providing manufacturing services for pharmaceutical companies. This business gives better flexibility, better cost efficiency, and a faster way of producing things, which is a significant requirement of the entire market. The demand of single-use technologies from the CMOs will go up as the biopharmaceutical companies want to increase their production processes.

Apart from biopharmaceutical manufacturers and CMOs, academic and research institutes also contribute to the growth of the market. These institutions are involved in the development and testing of new biopharmaceutical products and often rely on advanced manufacturing technologies. This adoption of single-use technology by such institutions enables it to cater to the mounting demands of biopharmaceutical production with the quality and safety intact.

The Single Use Technologies for Biopharmaceuticals Market will continue further up that trend only. The market based on biopharmaceutical manufacturers, along with growing CMOs and research institute applications, is expected to surge the adoption of single-use technologies in the market. It is expected that the market will not break its growth trend in the next few years, as biopharmaceutical manufacture is on a progressive level and so are several benefits associated with single-use solutions.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$6,013.9 million |

|

Market Size by 2031 |

$10,585.9 Million |

|

Growth Rate from 2024 to 2031 |

11.7% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

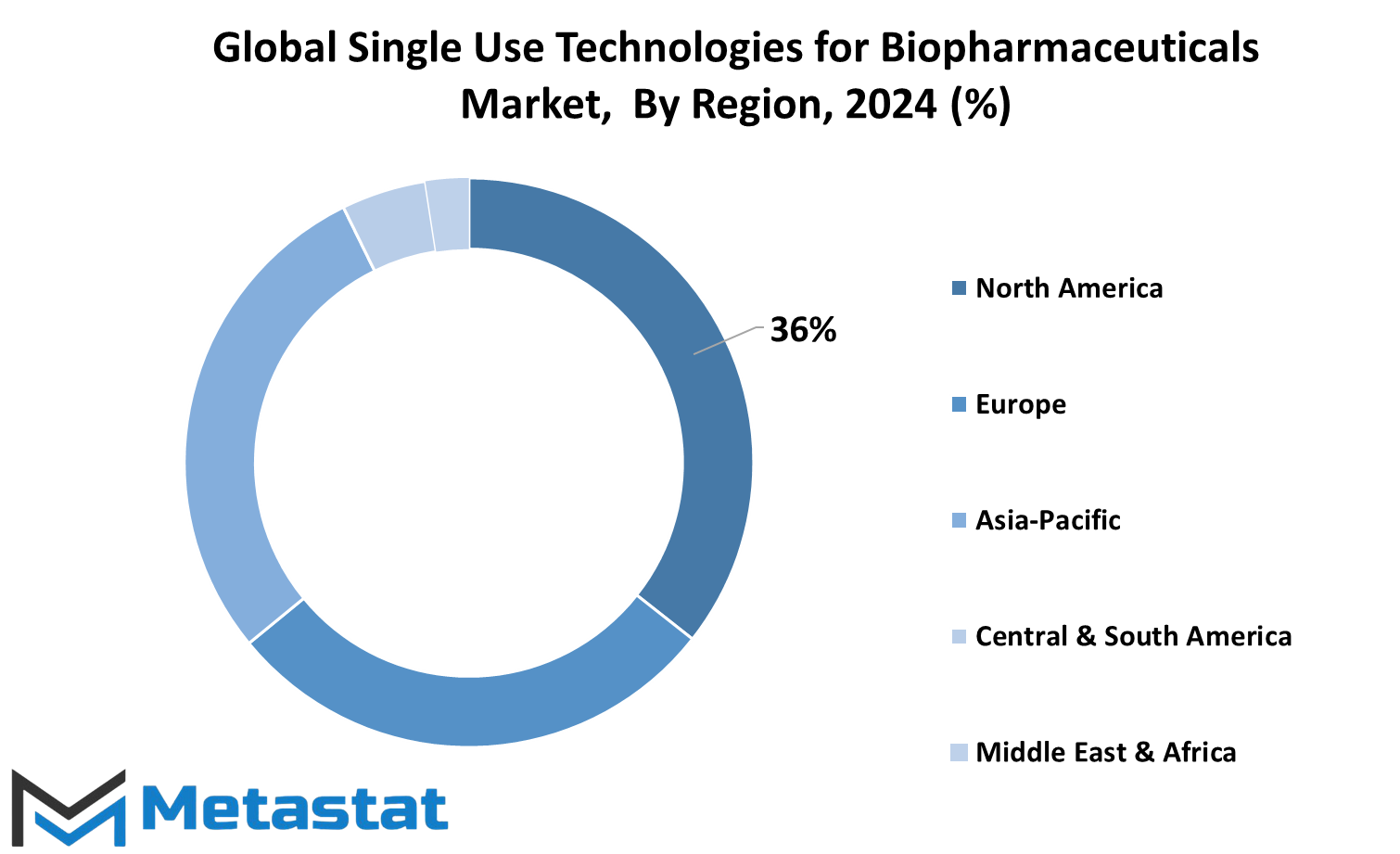

REGIONAL SEGEMENTATION

The global Single Use Technologies for Biopharmaceuticals market is segmented based on regional regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America is also split into three key countries - the United States, Canada, and Mexico. Several prominent countries of Europe also make up Europe - namely, the United Kingdom, Germany, France, Italy, and others constituting Rest of Europe.

In Asia-Pacific, the market is segmented across major countries like India, China, Japan, and South Korea; all other countries are put in one category named Rest of Asia-Pacific. South America comprises Brazil, Argentina, and all the other countries in the region, termed as Rest of South America. The Middle East & Africa market is further bifurcated into several types, which include the GCC Countries, Egypt, South Africa and other countries under Middle East & Africa, that further includes Rest of Middle East & Africa.

These have helped businesses to evaluate and analyze the market for geographic regions. It would reveal regional demand and growth in an area. Each region has its own market dynamics, driven by factors like economic conditions, regulatory frameworks, and technological advancements. Understanding regional variations helps companies better adapt their strategies to the needs of different markets. This classification into the specified regions also enables stakeholders to track the performance of Single Use Technologies for Biopharmaceuticals in various regions of the world and find emerging trends to make informed data-driven decisions for the future.

COMPETITIVE LANDSCAPE

The Single Use Technologies for Biopharmaceuticals industry is one of the most important in drug development and manufacturing, offering tools that streamline processes and increase efficiency. The key players dominate this industry and contribute their expertise to drive innovation and support growth in biopharmaceutical production.

Sartorius AG, one of the leading global manufacturers in lab and process technologies, presents sophisticated solutions for biopharmaceutical production. Specializing in single-use systems that provide vital requirements in cell culture, fermentation, and filtration to ensure biologic drugs' manufacture, Thermo Fisher Scientific delivers integrated services and technologies for scientists and manufacturers that produce innovative drug production, vaccine, and therapies by giving prominence to innovative single-use system technology.

Merck KGaA is another leader in this industry because of its huge range of products and solutions for development and manufacturing biopharmaceuticals. Single use technology forms the basis for production that is cost efficient, scaleable and flexible in regard to biologics. Similarly, Avantor provides highest quality material equipment and also services which make support production of biopharmaceuticals and especially supports singleuse systems in enhancing effectiveness and increasing efficiency at cheaper costs.

New Horizon Biotechnology and PBS Biotech are companies concentrating on developing advanced technologies for biopharmaceuticals, especially in applications like single-use bioreactors and systems that support cell culture and fermentation processes at scale. In short, their innovations could meet the growing demand in biologic drugs worldwide.

Other key contributors include Getinge AB, Eppendorf SE, and Parker Hannifin Corporation, which provide critical components and technologies that support the biopharmaceutical production process for efficiency. Entegris and Saint-Gobain also provide various materials and products for single-use technologies, ensuring safer and more reliable biopharmaceutical manufacturing processes.

Corning Incorporated, Lonza, and TECNIC Bioprocess Equipment Manufacturing bring the critical expertise in designing and developing single-use systems, which are important in biopharmaceutical manufacturing. Kühner AG, who is a specialist in bioreactor systems, supports scalable cell culture processes with their high-end technologies.

These companies-by their constant innovation and technology development-help ensure that production of biopharmaceuticals remains efficient, cost-effective, and responsive to change. Their contributions are therefore critical to continuing progress in the biopharmaceutical industry.

Single Use Technologies for Biopharmaceuticals Market Key Segments:

By Type

- Single-Use Bioreactors (SUBs)

- Single-Use Mixing Systems

- Single-Use Storage and Transport Bags

- Single-Use Filtration Systems

- Single-Use Connectors and Tubing

- Single-Use Sampling Systems

- Other Products

By Application

- Monoclonal Antibody (mAb) Production

- Vaccine Manufacturing

- Cell and Gene Therapy

- Recombinant Protein Production

- Blood and Plasma Products

- Other Biopharmaceutical Applications

By End-User

- Biopharmaceutical Manufacturers

- Contract Manufacturing Organizations (CMOs)

- Academic and Research Institutes

Key Global Single Use Technologies for Biopharmaceuticals Industry Players

- Sartorius AG

- Thermo Fisher Scientific

- Merck KGaA

- Avantor

- New Horizon Biotechnology

- PBS Biotech

- Getinge AB

- Eppendorf SE

- Parker Hannifin Corporation

- Entegris

- Saint-Gobain

- Corning Incorporated

- Lonza

- TECNIC Bioprocess Equipment Manufacturing

- Kühner AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252