MARKET OVERVIEW

The Global Silicon Carbide Wafer Market stands as a testament of semiconductor technology, where precision and efficiency play pivotal roles. Silicon carbide (SiC) wafers, integral components in this market, have garnered attention for their exceptional properties that propel technological advancements in various sectors.

Silicon carbide, a compound of silicon and carbon, presents a unique blend of characteristics that make it an ideal material for semiconductor applications. The Global Silicon Carbide Wafer Market revolves around the production and utilization of these wafers, showcasing their significance in cutting-edge technological developments.

One of the key drivers behind the demand for silicon carbide wafers is their ability to operate at higher temperatures and withstand extreme conditions. This resilience is particularly crucial in industries such as power electronics, where SiC wafers enable the creation of devices capable of handling elevated temperatures and harsh environments. As the world witnesses a growing reliance on electronic devices in various sectors, the demand for silicon carbide wafers in power electronics continues to surge.

Moreover, the Global Silicon Carbide Wafer Market plays a vital role in the realm of renewable energy. SiC wafers contribute to the development of efficient power devices, facilitating the conversion and management of energy in renewable sources like solar and wind. The unique electronic properties of silicon carbide make it an essential material in enhancing the overall efficiency and performance of power systems in the renewable energy sector.

In the automotive industry, silicon carbide wafers find applications in electric vehicles (EVs) as power electronics components. The high-temperature tolerance and superior electrical conductivity of SiC wafers contribute to the development of compact and efficient power modules, enhancing the performance of EVs and supporting the global shift towards sustainable transportation.

Furthermore, the Global Silicon Carbide Wafer Market extends its influence into the realm of communication technologies. The deployment of SiC wafers in high-frequency and high-power devices for radio frequency (RF) applications is on the rise. The ability of silicon carbide to handle high-power levels with minimal losses makes it an attractive choice for RF components, paving the way for advancements in wireless communication systems.

The Global Silicon Carbide Wafer Market is not merely a segment of the semiconductor industry; it is a catalyst for innovation and progress across diverse sectors. Silicon carbide wafers, with their unique properties, contribute significantly to the development of advanced technologies that shape the future of power electronics, renewable energy, automotive systems, and communication networks. As industries continue to evolve, the demand for silicon carbide wafers is set to rise, propelling the market forward as a key player in the transformative journey of modern technology.

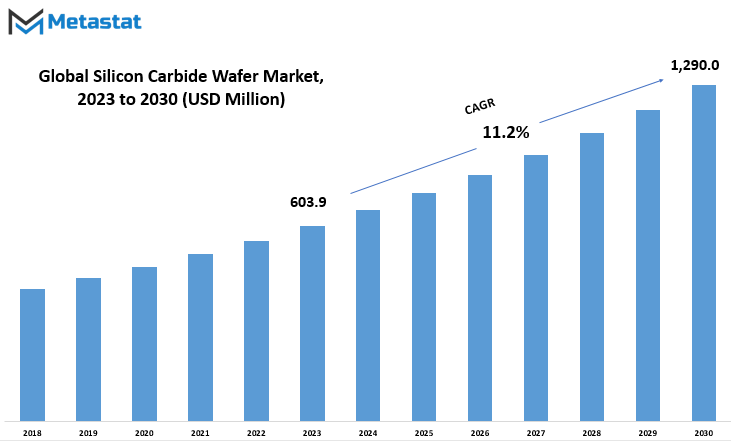

Global Silicon Carbide Wafer market is estimated to reach $1,290.0 Million by 2030; growing at a CAGR of 11.2% from 2023 to 2030.

GROWTH FACTORS

The Global Silicon Carbide Wafer market experiences growth due to specific factors that play a crucial role in propelling its development. These key driving factors contribute significantly to the market's positive trajectory. On the flip side, certain challenges pose potential obstacles, acting as deterrents to the market's growth. It's essential to recognize and address these hindrances to ensure sustained progress.

One of the primary growth factors influencing the Global Silicon Carbide Wafer market is the increasing demand for this specialized product. As industries evolve and technologies advance, the demand for silicon carbide wafers, a critical component in electronic devices, experiences a proportional surge. The rising need for efficient and high-performance semiconductor materials fuels the market's expansion, creating opportunities for manufacturers and stakeholders alike.

Additionally, advancements in manufacturing processes contribute to the market's growth. As technology evolves, there is a constant push for innovation and improvement in silicon carbide wafers production. This results in enhanced quality, increased production efficiency, and cost-effectiveness, all of which positively impact the market dynamics.

However, despite these favorable growth factors, challenges persist that might impede the market's progress. Factors such as economic fluctuations and uncertainties can create a volatile environment, affecting the overall demand and supply chain of silicon carbide wafers. It is crucial for market players to navigate and adapt to these challenges effectively to ensure sustained growth.

Furthermore, regulatory constraints and environmental considerations present additional hurdles. The market must adhere to various regulations governing the production and usage of silicon carbide wafers. Compliance with these standards not only ensures ethical business practices but also safeguards the industry's reputation.

While challenges exist, the market outlook remains optimistic, driven by the anticipation of lucrative opportunities. Emerging technologies, increasing R&D investments, and the continual demand for improved electronic components are expected to create a favorable landscape for the Global Silicon Carbide Wafer market in the coming years. Industry players should remain vigilant, proactively addressing challenges and capitalizing on emerging prospects to foster a resilient and flourishing market environment.

MARKET SEGMENTATION

By Type

The global Silicon Carbide Wafer market is classified based on its types, with a breakdown into 2 Inch, 3 Inch, 4 Inch, and 6 Inch and above. In 2019, the 2 Inch segment held a value of 31.4 USD Million, the 3 Inch segment was valued at 59.6 USD Million, the 4 Inch segment recorded a value of 124.3 USD Million, and the 6 Inch and above segment reached 152.9 USD Million.

This categorization sheds light on the market’s diversity, showcasing distinct segments with varying values. The 2 Inch category, starting at 31.4 USD Million, represents a specific market share within the broader Silicon Carbide Wafer landscape. Moving up the scale, the 3 Inch segment stands at 59.6 USD Million, indicating a higher valuation compared to its 2 Inch counterpart.

Further ahead, the 4 Inch segment, valued at 124.3 USD Million, reflects a considerable market presence, underscoring its significance within the Silicon Carbide Wafer industry. Finally, the 6 Inch and above category, with a value of 152.9 USD Million, emerges as a prominent player in the market, contributing substantially to the overall valuation of the Silicon Carbide Wafer industry.

This segmentation not only provides a comprehensive overview of the market but also allows stakeholders to discern the relative importance of each segment. It facilitates a nuanced understanding of the market dynamics, indicating the varied contributions and impact of different Silicon Carbide Wafer types. As a result, businesses and investors can make more informed decisions based on the specific strengths and opportunities associated with each segment.

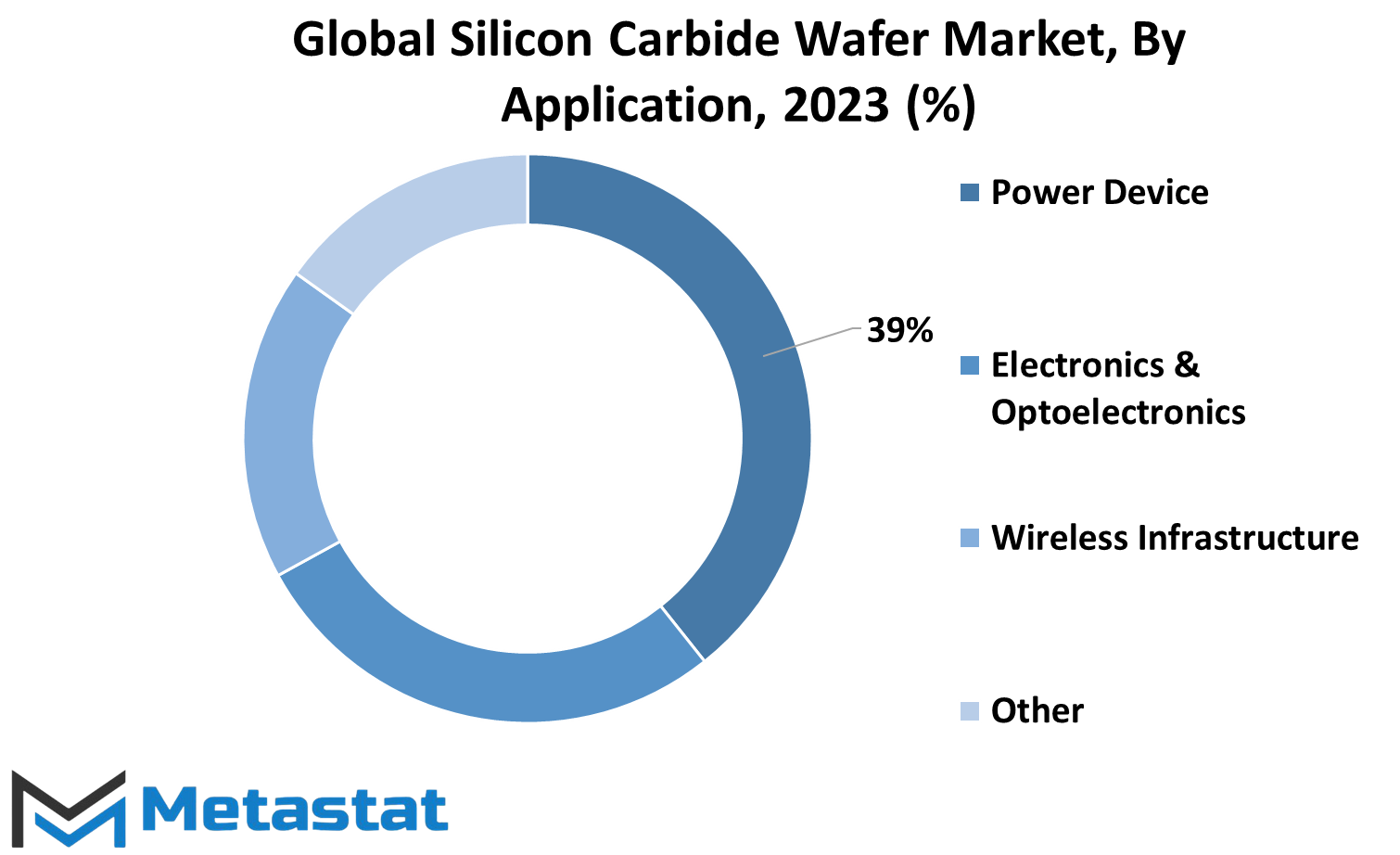

By Application

The Global Silicon Carbide Wafer market can be categorized based on its applications, namely Power Device, Electronics & Optoelectronics, Wireless Infrastructure, and Other. These applications play a crucial role in defining the market landscape and influencing its trajectory.

One of the significant applications of Silicon Carbide Wafers is in Power Devices. These wafers are integral in the production of power electronic devices that find applications in various industries. The demand for efficient power devices has been on the rise, given the increasing need for energy-efficient solutions in today’s world. Silicon Carbide Wafers, with their unique properties, contribute to the development of power devices that enhance energy efficiency and performance.

Another key application is in Electronics & Optoelectronics. Silicon Carbide Wafers play a vital role in the manufacturing of electronic components and optoelectronic devices. The semiconductor industry heavily relies on these wafers to produce high-performance electronic circuits and optoelectronic devices like LEDs and photodetectors. The versatility of Silicon Carbide Wafers makes them a preferred choice in this domain.

Wireless Infrastructure represents another crucial segment for Silicon Carbide Wafers. With the growing demand for wireless communication and the deployment of advanced technologies like 5G, the need for reliable and high-performance semiconductor materials becomes paramount. Silicon Carbide Wafers support the development of components used in wireless infrastructure, ensuring the efficient functioning of communication networks.

Apart from the mentioned applications, Silicon Carbide Wafers also find utility in various other sectors. The versatility of these wafers allows for diverse applications, depending on the specific requirements of different industries. This flexibility contributes to the widespread adoption of Silicon Carbide Wafers across various technological domains.

The Global Silicon Carbide Wafer market is intricately linked to its applications. The diverse applications, ranging from Power Devices to Electronics & Optoelectronics and Wireless Infrastructure, showcase the adaptability and significance of Silicon Carbide Wafers in contemporary technological advancements. As industries continue to evolve, the demand for these wafers is expected to persist, driven by the need for efficient and high-performance semiconductor solutions in a dynamic and ever-changing technological landscape.

REGIONAL ANALYSIS

The global Silicon Carbide Wafer market exhibits diverse regional trends, shaping the landscape of this industry. Regional segmentation plays a pivotal role in understanding the market dynamics and tailoring strategies accordingly.

One of the prominent regions contributing to the Silicon Carbide Wafer market is North America. The technological advancements and widespread adoption of Silicon Carbide Wafers in various applications fuel the market growth in this region. Industries, ranging from electronics to automotive, find value in the unique properties offered by Silicon Carbide Wafers, contributing to their increasing demand.

Moving across the Atlantic, Europe emerges as another significant player in the Silicon Carbide Wafer market. The region's emphasis on sustainable technologies and the increasing focus on electric vehicles amplify the need for Silicon Carbide Wafers. As industries seek more energy-efficient solutions, the adoption of Silicon Carbide Wafers becomes integral to achieving these goals.

Asia-Pacific, with its burgeoning economies, stands out as a key player in the global Silicon Carbide Wafer market. The region's rapid industrialization and growing electronic manufacturing sector drive the demand for Silicon Carbide Wafers. China, in particular, plays a pivotal role as a major consumer and producer of Silicon Carbide Wafers, contributing significantly to the regional and global market.

On the other hand, Latin America and the Middle East & Africa regions are gradually embracing Silicon Carbide Wafers, albeit at a slower pace. The adoption is influenced by factors such as technological awareness, economic development, and industry requirements. As these regions continue to progress, the Silicon Carbide Wafer market is likely to witness a gradual but steady rise in demand.

The regional segmentation of the global Silicon Carbide Wafer market underscores the diverse factors influencing its growth across different parts of the world. From North America's tech-driven demand to Asia-Pacific's industrial surge, each region contributes uniquely to the overall landscape of the Silicon Carbide Wafer market. Understanding these regional dynamics is crucial for businesses to tailor their strategies and tap into the varied opportunities presented by the global market.

COMPETITIVE PLAYERS

The Global Silicon Carbide Wafer market features key players actively engaged in the Silicon Carbide Wafer industry. Among these, prominent names include Cree and SK Siltron Co., Ltd. These companies play a crucial role in shaping the dynamics of the silicon carbide wafer market.

Cree, a significant player, has made noteworthy contributions to the industry. Their involvement spans various aspects of silicon carbide wafer manufacturing and distribution. With a focus on innovation and quality, Cree has established itself as a reliable presence in the market.

Another noteworthy participant is SK Siltron Co., Ltd. Their engagement in the silicon carbide wafer sector brings a unique perspective and contributes to the overall growth of the market. SK Siltron Co., Ltd. has demonstrated a commitment to delivering products that meet industry standards, further solidifying its position in the competitive landscape.

Both Cree and SK Siltron Co., Ltd. exemplify the drive for excellence within the Silicon Carbide Wafer market. Their contributions extend beyond mere participation, as they actively influence trends and advancements in the industry. This dynamic interaction between key players is essential for the market's vitality and continued development.

The presence of influential companies like Cree and SK Siltron Co., Ltd. underscores the significance of key players in the Global Silicon Carbide Wafer market. Their roles extend beyond individual achievements, contributing collectively to the growth and evolution of the silicon carbide wafer industry. As these companies navigate the challenges and opportunities within the market, their impact is pivotal in shaping the course of this dynamic sector.

Silicon Carbide Wafer Market Key Segments:

By Type

- 2 Inch

- 3 Inch

- 4 Inch

- 6 Inch and above

By Application

- Power Device

- Electronics & Optoelectronics

- Wireless Infrastructure

- Other

Key Global Silicon Carbide Wafer Industry Players

- Cree

- SK siltron Co.,Ltd.

- SiCrystal

- II-VI Advanced Materials

- Showa Denko K.K.

- STMicroelectronics

- Aymont Technology

- TankeBlue

- Hebei Synlight Crystal

- CETC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252