MARKET OVERVIEW

The Shipping Software Market is a dynamic and competitive sector where technology has become an indispensable tool. As companies worldwide strive to streamline their operations and enhance customer satisfaction, shipping software has emerged as a vital solution. In this digital age, the need for efficient shipping processes is more pronounced than ever. E-commerce, global trade, and supply chain management all rely on the timely and cost-effective delivery of goods. The Shipping Software Market responds to these demands by offering a range of software solutions designed to optimize shipping operations.

These software solutions encompass various functionalities, from order processing and label printing to tracking and analytics. They are tailored to meet the specific needs of businesses, whether they are small e-commerce ventures or large multinational corporations. This flexibility is a key strength of the Shipping Software Market, allowing companies to choose the tools that align with their unique requirements.

One of the primary benefits of shipping software is automation. It minimizes manual tasks, reducing the likelihood of errors and improving efficiency. For instance, address validation features help ensure that packages reach their intended destinations, cutting down on costly delivery mistakes. Automation also extends to shipping rate calculations, allowing companies to select the most cost-effective shipping methods.

Moreover, the Shipping Software Market provides real-time tracking and visibility into shipments. This feature is invaluable for both businesses and customers, as it enables them to monitor the progress of packages and anticipate delivery times accurately. Security is a paramount concern in the Shipping Software Market, as sensitive customer and business data are often involved. Vendors invest in robust security measures to protect this information. Furthermore, the software must comply with various regulations and standards, ensuring that the shipping process remains secure and reliable.

The Shipping Software Market plays a pivotal role in modern commerce. It offers a range of solutions that enhance shipping processes by automating tasks, providing real-time tracking, optimizing costs, and integrating with e-commerce platforms. As e-commerce and global trade continue to grow, the demand for efficient shipping solutions will only increase, driving further innovation in this dynamic market.

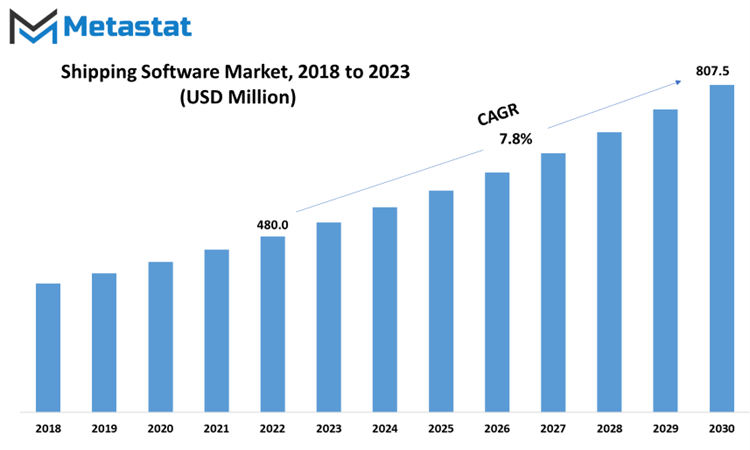

Global Shipping Software market is estimated to reach $807.5 Million by 2030; growing at a CAGR of 7.8% from 2023 to 2030.

GROWTH FACTORS

The shipping software market is being driven by the explosive growth of e-commerce. Factors contributing to this growth include increased smartphone and internet access, accelerated by the COVID-19 pandemic, and the need for fast, reliable, and cost-effective shipping options. Shipping software solutions are essential for optimizing routes, managing inventory, and providing accurate shipment tracking. This trend has led businesses, both small and large, to adopt shipping software to streamline operations, reduce costs, and improve customer satisfaction.

The growth of the shipping software market is also influenced by globalization and the increasing complexity of supply chains. As businesses expand internationally, the need for tools to manage and optimize complex supply chains has grown. Shipping software provides real-time visibility, integrates with various data sources for tracking, and uses analytics to make informed decisions. With consumer demands for faster and more reliable deliveries, shipping software has become essential for businesses to stay competitive and manage global logistics.

High implementation costs are a significant restraint in the shipping software market. These costs include licensing fees, customization, integration with existing systems, and employee training. Small businesses may find these costs prohibitive, leading to a digital divide between larger and smaller enterprises. Reducing upfront costs and offering scalable solutions and comprehensive training packages is essential for fostering wider adoption and market growth.

Security concerns pose a restraint on the shipping software market, given the sensitive nature of the data involved. Data breaches, both external and internal, can lead to financial losses, damage to a company's reputation, and supply chain disruptions. To address these concerns, shipping software providers must prioritize cybersecurity, while businesses should invest in employee training and awareness programs to reduce the risk of internal threats.

The integration of sustainability practices into the shipping software market is an emerging opportunity driven by the growing awareness of environmental issues. This opportunity includes the demand for eco-friendly shipping options, stricter emissions standards, and the reduction of food waste in the logistics of perishable goods. Shipping software is well-positioned to support these sustainability efforts by providing real-time visibility into emissions data, route optimization, and tools for reducing spoilage and waste. To capitalize on this opportunity, shipping software providers should develop sustainable features that align with environmental goals, catering to a market demand for more responsible supply chain practices.

MARKET SEGMENTATION

By Type

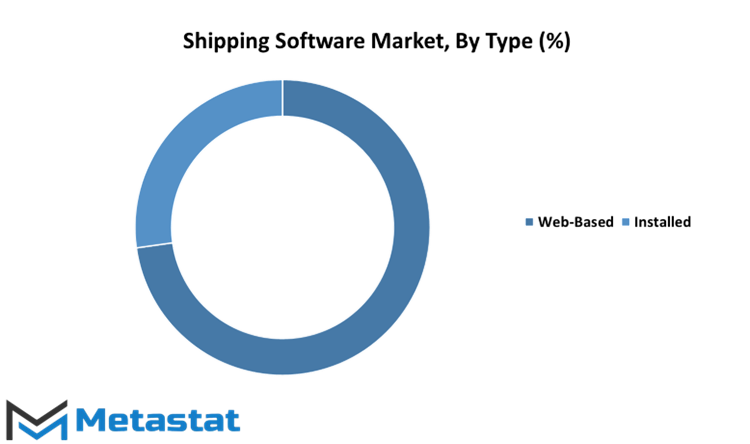

The Shipping Software Market, categorized by type, can be divided into two main segments, Web-Based and Installed. In 2021, the Web-Based segment held a value of 1177.1 USD Million, while the Installed segment's value stood at 397.7 USD Million.

The Web-Based segment represents shipping software solutions that operate in a web-based environment. These solutions are accessible through web browsers, offering convenience and flexibility to users. Web-based shipping software is often preferred for its accessibility from various devices and locations, making it suitable for businesses with distributed operations.

On the other hand, the Installed segment comprises shipping software that needs to be installed directly on users' devices, such as computers or servers. This type of software is typically hosted locally, requiring maintenance and updates on the user's end. The Installed segment's value in 2021 was 397.7 USD Million, reflecting its continued relevance for businesses with specific operational requirements.

The choice between web-based and installed shipping software depends on various factors, including the organization's needs, preferences, and infrastructure. Some may opt for web-based solutions for their flexibility and accessibility, while others may favor installed software for control and specific customization options.

Both segments play crucial roles in the Shipping Software Market, catering to the diverse demands of businesses involved in shipping and logistics. As technology continues to advance, these segments are likely to adapt and evolve to meet the ever-changing needs of the industry.

By Application

The Shipping Software Market, with its diverse applications, caters to the needs of various sectors. The market is divided into Couriers, Express, and Parcel Services (CEP), Air & Ocean Forwarding, Contract Logistics, and Land, In-house, and Other. Each segment holds its significance in the shipping software landscape.

The Couriers, Express, and Parcel Services (CEP) segment, with a value of 282.4 USD Million in 2021, plays a pivotal role in ensuring the swift and efficient delivery of packages. It's the backbone of e-commerce and global trade, where rapid delivery is non-negotiable. Shipping software aids CEP services in managing their extensive operations, from tracking packages to optimizing delivery routes.

In contrast, the Air & Ocean Forwarding segment, valued at 205 USD Million in 2021, focuses on the transportation of goods via air and sea. This segment is crucial for international trade and the movement of goods between countries. Shipping software simplifies the complex logistics involved in air and ocean freight, enabling forwarders to coordinate shipments and navigate customs regulations seamlessly.

The Contract Logistics segment, valued at 267.2 USD Million in 2021, is all about the storage, distribution, and management of goods. It's an integral part of the supply chain, ensuring that products are efficiently stored and delivered to their destinations. Shipping software optimizes warehouse operations, inventory management, and order fulfillment in this segment. The Land, In-house, and other segments, valued at 820.2 USD Million in 2021, covers a wide range of logistics operations that happen on land. This includes road transportation, in-house logistics, and other miscellaneous logistics activities. Shipping software aids in route planning, vehicle management, and overall logistics coordination.

In summary, the Shipping Software Market's segmentation into Couriers, Express, and Parcel Services (CEP), Air & Ocean Forwarding, Contract Logistics, and Land, In-house, and other highlights the diverse applications of shipping software. These segments collectively contribute to the efficient and reliable movement of goods across the globe, benefiting businesses and consumers alike.

REGIONAL ANALYSIS

In the expansive world of the Shipping Software market, geographical divisions play a pivotal role in determining the market's worth. These divisions enable us to gauge the market's performance and potential, unveiling a more detailed picture of its economic value. In this context, the global Shipping Software market is separated into geographical segments. These segments, or regions, each carry their own economic weight, reflecting the market's status and economic contributions.

One such geographical segment is North America, a region that commands a significant presence in the Shipping Software market. In 2017, the estimated value of the North America Shipping Software market reached an impressive 306.8 million US dollars. This notable figure underscores the robust activity and demand for shipping software solutions within the North American market.

Another key player in this geographical breakdown is Europe. Europe's Shipping Software market exhibited its own substantial value in 2017, with an estimated worth of 247.5 million US dollars. This figure demonstrates the significant role that Europe plays in the global Shipping Software market, highlighting the demand for such solutions within the region.

These geographical segments, North America and Europe, are just a glimpse into the multifaceted landscape of the Shipping Software market. They reveal the market's economic significance within these regions, shedding light on the evolving trends and demands within the Shipping Software industry

As we explore these segments further, we gain a deeper understanding of the global Shipping Software market's economic dynamics. These insights enable stakeholders to make informed decisions, shape strategies, and stay abreast of market trends, ensuring they are well-positioned in the ever-changing and competitiveShipping Software market.

COMPETITIVE PLAYERS

The Shipping Software Market is a dynamic and competitive industry. Key players in this field include 2Ship Solutions and Action PC. These companies offer a range of software solutions that cater to the diverse needs of the shipping and logistics sector.

2Ship Solutions is a prominent player in the Shipping Software Market. The company provides innovative shipping and logistics software that streamlines the shipping process for businesses of all sizes. Their software offers features such as multi-carrier rating, shipment tracking, and reporting tools. This aids businesses in optimizing their shipping operations and reducing costs. 2Ship Solutions is known for its commitment to providing user-friendly software that integrates seamlessly into existing systems, making it a preferred choice for many in the industry.

Another key player, Action PC, specializes in providing shipping software solutions tailored to the unique needs of freight forwarders and logistics companies. Their software is designed to handle complex international shipping requirements, making it an essential tool for businesses involved in global trade. Action PC's software offers functionalities such as rate management, document generation, and customs compliance. This ensures that businesses can efficiently manage their international shipping operations, staying compliant with regulations and delivering goods across borders without disruptions.

Both 2Ship Solutions and Action PC play a vital role in the Shipping Software Market by offering solutions that simplify the often complex and time-sensitive processes involved in shipping and logistics. Their software not only enhances efficiency but also contributes to cost savings, making them indispensable partners for businesses seeking a competitive edge in the shipping industry.

Shipping Software Market Key Segments:

By Type

- Web-Based

- Installed

By Application

- Couriers, Express and Parcel Services (CEP)

- Air & Ocean Forwarding

- Contract Logistics

- Land, In-house, and Other

Key Global Shipping Software Industry Players

- 2Ship Solutions

- Action PC

- Aljex Software

- BoxTop Technologies

- ComFreight

- Cone Center

- Epicor Software Corporation

- First BIT Canada

- I Code Technologies

- Logistyx Technologies

- Magaya Corporation

- Malvern Systems

- Transcount

- V-Technologies

- WiseTech Global

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383