MARKET OVERVIEW

The global semi-trailer market, a vital segment of commercial transport and logistics services, will remain to shape the way heavy cargo is moved across multiple terrain and distance conditions. Semi-trailers, being essential pieces of freight equipment, lack a front axle and rely on a tractor unit for propulsion. This design potential supports adjustable weight distribution and improved fuel efficiency, on which transportation fleets across continents will increasingly be dependent. The global semi-trailer market will cover a range of applications, from logistics services, construction, and oil and gas to agriculture and retail distribution.

Because freight requirements become more specific as far as industrial growth and supply chain optimization go, the Global Semi-Trailer industry must reflect such growth by broadening product form and application designs. These include flatbeds, reefers, tankers, lowboys, dry vans, and curtain-side trailers. All have a specific logistical purpose, with some being used to haul perishables, others heavy equipment, and some to haul general loads. The demand for niche configurations will also broaden, driven by transport contracts demanding durability, security, and regulatory adherence.

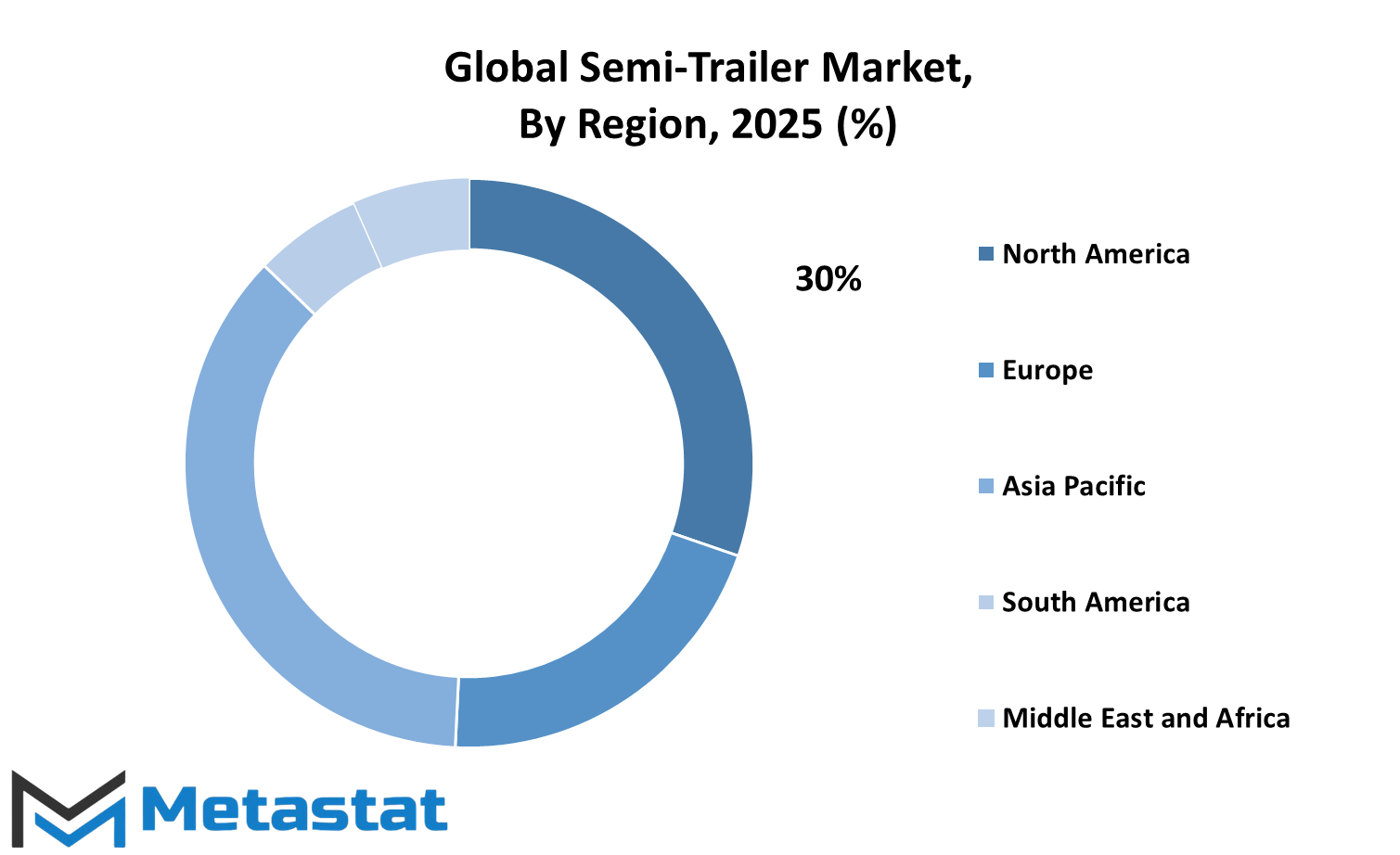

The global semi-trailer market will not only be in manufacturing but will also spread to supply chains, leasing companies, fleet maintenance, and downstream industries that use these trailers for intra-regional and cross-border transport. North America, Europe, and Asia-Pacific will be the powerhouse regions where competitive action is going to take place on multiple fronts designing innovation, axle configuration, material durability, and trailer systems intelligence. These regions will not just witness persistent deployment but will also be the proving ground for intelligent load management technology and high-level braking systems.

The global semi-trailer industry will find adoption both among private and public institutions. Cities will use semi-trailers for carrying out infrastructure projects, whereas private entities will boost business by optimizing long-haul loads using multi-axle configurations. Based on evolving market demand, trailer manufacturers will design newer models that are compatible with different fuel tractor units, autonomous technologies, and premium telematics. The transition will widen the scope of operations and influence the value chain of semi-trailer production and distribution.

In the next few years, new players will join the global semi-trailer market, attracted by the increased demand for eco-friendly freight solutions. Experienced players will keep retrofitting solutions with lightweight materials and improved loads. While demand for sustainability and digitalized logistics accelerates, the semi-trailer will not only be a mode of transport but also a networked asset that is part of end-to-end supply efficiency.

As countries move toward an age of harmonizing safety and weight regulations, the global semi-trailer market will be compelled to address these factors on every level of operation and production. This market will not be alone; it will be influenced by, and in turn influence, trends in global trade, industrial distribution, and long-distance connectivity. With its wide spread network and operational significance, the market will remain a necessary component of commercial freight infrastructure for the foreseeable future.

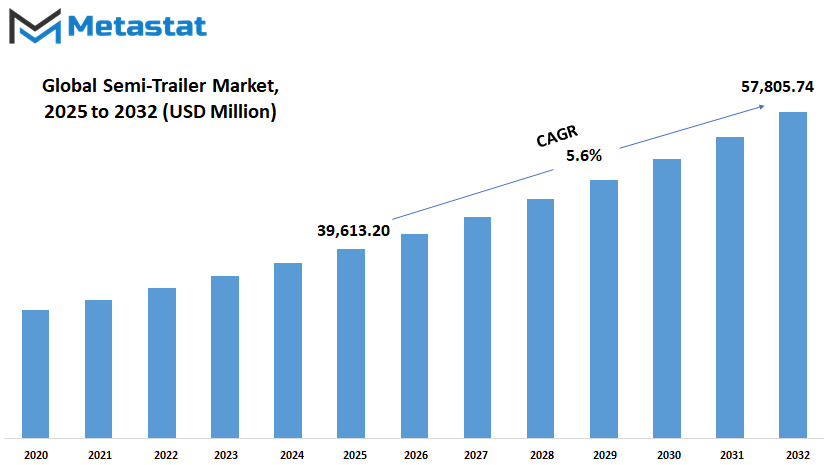

Global semi-trailer market is estimated to reach $57,805.74 Million by 2032; growing at a CAGR of 5.6% from 2025 to 2032.

GROWTH FACTORS

The global semi-trailer market is likely to witness considerable growth in the near future on the back of some extremely major reasons that reflect strong demand and steady growth. As more people use the internet for buying products, businesses are feeling the need to transport goods at a faster and better pace. The rise of e-commerce is pushing businesses to invest in better means of transportation, and semi-trailers are part of that prime focus. Semi-trailers help move huge volumes of freight over great distances, and with the increase in online purchasing, so too will demand for trusted hauling gear.

In the meantime, infrastructure development is going full steam in most nations. New roads, bridges, and building work are being planned and built, especially in regions that desire to spur economic growth. These activities require secure transportation of heavy material and equipment, which semi-trailers can provide. This connection between construction growth and the need for haul services plays a pivotal role in shaping the direction of the market. The more projects come on line, so will semi-trailer demand, creating steady support for the industry.

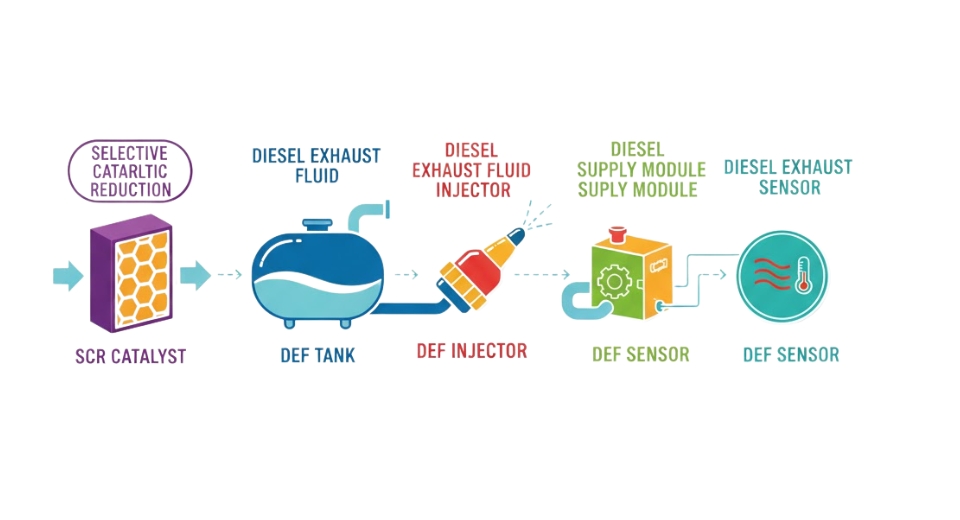

While the projection is good, there are roadblocks that might be roadblocks to progress. One of the most significant concerns for trucking companies is the ongoing fluctuation of fuel prices. Since trucks rely on fuel day to day, a slight fluctuation in price can impact overall costs. This unpredictability makes it that much harder for companies to budget and harder for them to invest in new equipment. Moreover, government regulations regarding emissions, safety, and maintenance standards continue to tighten. While these regulations contribute towards safer roads and cleaner air, however, they also place manufacturers and fleet operators under additional pressure to upkeep.

In spite of this, there are hopeful opportunities for the future in the marketplace. Possibly the most interesting field of development is the integration of technology into semi-trailer design and operations. Telematics abilities allow fleet managers to monitor performance in real-time, which improves safety and efficiency. The introduction of autonomous capabilities, even in limited form, could even revolutionize the mode of transportation for goods. All these are indicators that the semi-trailer is going to become even more intelligent and effective, and with it new market opportunities.With powerful drivers driving growth and new technologies coming onto the stage, the global semi-trailer market is ready to continue to evolve based on changing needs and new innovation.

MARKET SEGMENTATION

By Type

The global semi-trailer market is on the verge of enormous growth in the years to come, with changing logistics needs and rising industrial demand driving the process. Companies across different sectors rely more and more on efficient means of transportation, and semi-trailers continue to be an efficient and versatile solution. As industries expand, the need to move products faster, securely, and at lower costs also rises. This demand fuels the demand for innovation and investment in different types of semi-trailers that are tailored for specific transportation needs.

Of the various varieties, flatbed semi-trailers remain a dependable choice for heavy or peculiarly-shaped cargo, especially construction and equipment. These are expected to be worth USD 13,995.96 million by 2025. Refrigerated semi-trailers, on the other hand, are pivotal in transporting temperature-controlled commodities such as food and medicine. With increasing need for fresh products and vaccines, these are expected to be worth USD 6,264.74 million by 2025.

Dry van semi-trailers, with their security and extensive use, are forecasted to lead in value at USD 12,113.53 million. They are especially useful for general freight and form a consistent part of global supply chains. Tanker semi-trailers are also on the rise steadily, with a value of USD 4,561.30 million expected. They are very significant in hauling liquids and gases, which are always in demand in most industries like fuel, chemicals, and water supply.

Lowboy semi-trailers, which are capable of carrying tall or heavy machinery effectively, are going to be worth USD 2,677.66 million. Their design allows for possibilities of carrying items that are risky or difficult to carry via other trailers. With infrastructures increasing, these are going to be used more.

In the coming years, the global semi-trailer market will see greater benefits of more advanced manufacturing methods, sophisticated safety options, and computerized systems for tracking. All of these developments are aimed at reducing downtime, optimizing load capacity, and meeting stricter environmental regulations. The move towards electric and hybrid forms of transportation may also open the door to newer generation semi-trailers being designed specifically for clean energy applications. All of this points towards a transportation future that is smarter, more responsive, and more sensitive to the requirements of a changing world.

By Tonnage

The global semi-trailer market will see radical changes in the next few years. Because the logistics and transport industry is expanding, semi-trailers will be one of the key drivers of the way goods are moved over long distances. Semi-trailers are essential in transporting heavy loads with minimum effort and in safety, and their significance will only increase as the world demands faster, faster deliveries. As industries regularly request better supply chain performance, demand for more efficient and long-lasting semi-trailers will increase. Companies are already directed toward using lighter metals, more robust design, and improved safety features to meet future needs.

In the future, the global semi-trailer market will evolve based on the weight that the trailers will need to carry. Based on tonnage, the market is divided into four segments: Below 25 T, 25 T-50 T, 51 T-100 T, and Above 100 T. These four segments cater to various industries and requirements. Light trailers, for instance, can be used for city deliveries where flexibility and fast movement are required. Medium-weight trailers will remain in service to cover general freight transportation within regional and national boundaries, balancing between load-carrying capacity and fuel efficiency.

For the heavier categories, particularly the 51 T-100 T and Over 100 T range trailers, they will be increasingly vital in the transportation of construction materials, heavy equipment, and other bulk commodities. These trailers of large capacities will probably be loaded with technology to assist in weight distribution and control, thus making them more stable and secure on the roads. Automation and electrification can also define the design and operation of semi-trailers in the future.

The future may behold trailers that are fitted with a communication system for coordinating and monitoring with trucks. Electrical trucks, which are becoming more common, will require trailers that match their capability, especially in weight and energy use. As people become more climate-conscious, the market will be pushed towards cleaner operations. This might be through reusable materials or developing trailers that result in lower drag, increasing fuel efficiency. The global semi-trailer market will continue to evolve in order to address emerging challenges and innovations. Its fate will be determined by how far the manufacturers and logistics companies are able to collaborate in addressing emerging needs while ensuring transport is made safe, efficient, and sustainable.

By Length

The global semi-trailer market will keep on steady expansion in the next couple of years. With the demand for transportation rising and logistics being more at the center of commerce and supply chains, semi-trailer demand will increase. Semi-trailers are critical for the delivery of goods over long distances, keeping industries connected. Their use for the transport of raw materials, finished items, and even temperature-controlled items will keep them in action across industries, ranging from agriculture to manufacturing.

The market, if measured in length, is usually split into two parts up to 45 feet and above 45 feet. Each part fulfills different transportation requirements. Less longer semi-trailers of up to 45 feet are used for more concentrated urban delivery or for extremely dense road conditions on routes. They offer greater maneuverability to navigate through jammed city streets or where deliveries need to be done in spaces with limited room. On the other hand, semi-trailers that are over 45 feet in length are best used to transport high volumes or heavy loads an extended distance. They are most effectively used on cross-country hauls, where efficiency and fewer trips are huge contributors to minimizing expenses.

In the years to come, the global semi-trailer market will be driven by a change in fuel types, advanced safety features, and growing demand for smart technology. Companies are already considering how data monitoring and automation can be integrated into trailers to make them safer and more efficient. Load balance, tire pressure, and brake system sensors are just some of the technologies that could become standard. More and more, there is a desire to cut emissions, which may have an effect on trailer design and how they are coupled with new truck engines, including electric and hybrid engines.

Infrastructure development worldwide will also influence this market. As countries improve roads, ports, and logistics hubs, there will be a greater demand for high-capacity semi-trailers. The trailers need to be more resilient against tougher conditions and greater distances, and manufacturers will be forced to increase durability and performance without compromising on cost efficiency.

The global semi-trailer market of the future will be shaped by functional need, smarter solutions, and ongoing research into greater efficiency of transport. As corporations look to further reduce delivery times and more effectively load cargo, demand for tailored trailer length will continue to propel the market. Short or long, every type of trailer will be a significant tool in addressing tomorrow's transport demands.

By End-User

The global semi-trailer market will continue to be a leading factor in how goods move from one country or continent to another. With growing business and transport needs, the need for semi-trailers will follow. They not only become critical in moving goods with efficiency, but they also reduce the number of small trips needed, and this can lower fuel usage and alleviate congestion. With an increase in demand for clean and efficient transport mechanisms, companies will use semi-trailers as a solution to undertake large-scale operations.

By end-user, the global semi-trailer market is classified into Transportation & Logistics Companies, Construction Industry, Agriculture, Manufacturing, and others. Each of these segments has different specifications that are met by semi-trailers. Transport and logistics operators utilize them to haul large quantities of freight over a considerable distance. As global commerce widens, this sector will need more advanced and adaptable semi-trailers to keep up. Semi-trailers support the hauling of heavy equipment and construction supplies between locations in construction, and usage will continue to increase as urbanization and infrastructure investment expand.

In agriculture, semi-trailers allow for the carriage of produce, livestock, and equipment across broad distances, and this is especially essential during planting and harvesting times. These trailers allow farmers to manage their supply chains better, and as agricultural operations become more advanced, there will be a greater need for effective and customized trailer options. For the industrial sector, semi-trailers facilitate raw materials and finished products to pass through warehouses and factories. With factories being increasingly mechanized and supply chains being more complex, applications of heavy-duty and reliable trailers will become more critical.

The future of the global semi-trailer market will be shaped by developments in autonomous design, fuel efficiency, and connectivity by smart technology. Semi-trailers will be more dependable and simpler to maneuver with innovations such as tracking systems, load sensing, and auto safety equipment. The focus will be to create trailers that not only haul goods but also provide information and feedback that make companies wiser. With companies becoming more integrated and globalized, companies will need better transport arrangements, and semi-trailers will be at the center of such innovation. Their importance will only increase as businesses seek enhanced performance and economies of cost.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$39,613.20 million |

|

Market Size by 2032 |

$57,805.74 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global semi-trailer market globally is showing trends of slow change, with patterns of development influenced by global and regional factors. Each region has a rate of development and specific requirements, and regional examination is therefore an important tool to find out the path of the market. North America, for example, remains one of the world's most developed regions due to strong infrastructure, advanced logistics networks, and stable freight transport demand. The United States, Canada, and Mexico are leading trend drivers of this region. Their continued focus on motor roads and long-distance freight encourages continued investment in more efficient, longer-lasting, and eco-friendly semi-trailers.

Europe, though, is a different story. Germany, the UK, France, and Italy continue to be at the forefront for sustainability and technology-driven solutions. These governments are encouraging initiatives to reduce emissions and improve the safety of vehicles, thus altering consumer needs. Demand for electric and smart semi-trailers is also increasing in this region and is sure to become common in the near future. These trends show that Europe is not simply trying to keep up with the rest of the world but might also be leading the way in creating cleaner, more efficient transportation. Asia-Pacific is quickly becoming an area of massive potential.

China, India, Japan, and South Korea are all investing heavily in infrastructure, and their growing economies are prioritizing better transport solutions. While production and trade expand across Asia-Pacific, semi-trailer demand is likely to follow. Locally, the sector will tend toward high-capacity trailers and cost-efficient designs favoring domestic as well as export logistics. Rural-urban connectivity and government policies that encourage development will also generate further growth. South America, dominated by Brazil and Argentina, is catching up with the development of improved transport infrastructure and encouraging more efficient logistics networks.

Although the pace may be slow, there is some progress in the replacement of old trucks by new semi-trailers with better performance and fuel economy. Lastly, the Middle East & Africa region, more specifically GCC countries and South Africa, is showing an increasing interest in diversification of transport modes. Industrialization and economic growth are helping to drive this market forward. Every region in the coming years will likely contribute to the worldwide Semi-Trailer market in a specific manner, making the market more competitive and interdependent.

COMPETITIVE PLAYERS

The global semi-trailer market will continue to be an essential component of the transport and logistics sector in the years to come. As goods movement needs grow stronger, the contribution of semi-trailers will not be lesser in satisfying industries' growing demands around the world. Semi-trailers are the cornerstone of road transport, creating connections between manufacturers and markets and facilitating the supply chain with flexibility and reliability. As the transport sector continues to be more and more sensitive to technology developments, semi-trailers are gradually being reimagined to suit changing business needs and environmental goals.

Among the key expansion drivers in the future will be embracing new technologies. As transport companies try to improve efficiency, reduce operating costs, and meet emission regulations, trailer manufacturers are likely to put money into smart systems. Features such as real-time tracking, temperature management, and periodic maintenance alert are not add-ons they will become standard. Electric towing and hybrid towing capabilities, along with trailers that merge invisibly into autonomous trucks, are in the planning stages in most development plans. These trends are not in some far-off future; they already are shaping investment.

The competition among manufacturers is becoming more intense, with each manufacturer striving to deliver greater value, security, and durability. The likes of CIMC Vehicles Co., Ltd and Schmitz Cargobull AG are not only expanding their production capacity but also coming up with lighter but tougher material to improve fuel economy. Hyundai Translead and Wabash National Corporation, on the other hand, are strongly investing in research and partnerships to stay ahead. Others, including KRONE Trailer and Manac Inc., are focusing on design improvements and customer service to develop credibility and loyalty in a limited marketplace. Because customers are becoming increasingly particular, they will look for trailers that offer long-term value, performance on varied roads, and minimal maintenance requirements.

This will prompt companies to swap performance with sustainability. Companies like Stoughton Trailers, Lamberet SAS, and Langendorf GmbH & Co. KG are already coming up to the challenge through improved manufacturing processes and testing of less environmentally damaging alternatives. Competition will no longer involve building the most robust trailer it will be a question of who is best able to adapt most quickly to new expectations in the global marketplace. The world semi-trailer market in the future will not stand still. It will become more dynamic, and businesses that continue to be technology and service and quality leaders will dictate the direction it heads.

Semi-Trailer Market Key Segments:

By Type

- Flatbed Semi-Trailers

- Refrigerated Semi-Trailers

- Dry Van Semi-Trailers

- Tanker Semi-Trailers

- Lowboy Semi-Trailers

By Tonnage

- Below 25 T

- 25 T-50 T

- 51 T-100 T

- Above 100 T

By Length

- Up to 45 Feet

- Above 45 Feet

By End-User

- Transportation & Logistics Companies

- Construction Industry

- Agriculture

- Manufacturing

- Other

Key Global Semi-Trailer Industry Players

- CIMC Vehicles Co.,Ltd

- KRONE Trailer

- Qingdao CIMC Special Vehicles Co., Ltd

- Wielton S.A.

- FAYMONVILLE

- Lamberet SAS

- Lider Trailer

- Wabash National Corporation

- Manac Inc.

- Vanguard National Trailer Corp.

- Langendorf GmbH & Co. KG

- Schmitz Cargobull AG

- SDC Trailers Ltd.

- Stoughton Trailers, LLC

- Strick Trailer Corporation

- Utility Trailer Manufacturing Company

- Felling Trailers

- Hyundai Translead

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383