MARKET OVERVIEW

The global RegTech market size has expanded considerably to be part of the significant financial technology industries, which come up with new solutions for handling regulatory challenges and compliance. There is an enormous increase in the demand for technologies that will reduce the complexity in compliance. This will grow at a considerable level as the world moves forward, considering the future global RegTech market, which would be integrated into artificial intelligence, machine learning, and blockchain. These innovations will aim to not only address regulatory requirements but also offer more efficient and secure ways of managing compliance processes.

One of the key areas where the global RegTech market will see development is in the automation of compliance tasks. Organizations will need to stay abreast of the fast-changing regulations in jurisdictions, and automation will become a primary solution in this regard. Advanced algorithms and data analytics will help these technologies automatically monitor and assess compliance, which will minimize the burden of oversight through manual monitoring. This will enable businesses to focus on more strategic operations and minimize risks that are associated with human error and violations of regulatory standards.

Another space ready to transform in the global RegTech market is risk management. By implementing predictive analytics and real-time data analysis, it will become easier for organizations to measure and track risks in an efficient manner. Predictive models, with the power of AI, will spot potential problems well before they develop into full-fledged problems. Organizations can, therefore, act pre-emptively to mitigate these risks. It will especially be very beneficial to financial institutions because proper management of risk will help these organizations gain stability and profitability over time.

Regulations will still guide the way forward in the global RegTech market. There will be rising data privacy, anti-money laundering, and fraud prevention regulations that businesses will face. It will, therefore, be necessary to use RegTech solutions in such an endeavor. These technologies would not only help streamline the compliance process but also ensure the adaptability of an organization in eventuality with future regulatory changes. As regulations continue to change, greater adaptability by the RegTech platforms will be essential in enabling businesses to adjust to new rules without major disruptions.

Further collaboration between traditional financial institutions and emerging technology startups would further drive the innovation in global RegTech market. Established players partnering with firms in the area of RegTech shall gain access to cutting-edge solutions that can fortify their frameworks of regulatory compliance. This is going to open up new ways of developing newer products and services that will eventually redefine the means of operations in financial institutions within a regulatory environment.

The global RegTech market will evolve over time, not only within the financial services industries but also within health, insurance, and energy. All these industries are now facing similar pressures under regulatory pressures and will be more likely to embrace RegTech to manage compliance, run operations, and ensure evolving standards for regulations. The future landscape of the global RegTech market will be diverse and expansive, with new industries incorporating this element of regulatory technology into their operations, thereby opening up avenues for new growth opportunities among businesses and investors.

In conclusion, the global RegTech market is poised to become a leading force in the regulatory technology landscape. As regulations grow more complex and stringent, innovative solutions will be needed. With the use of emerging technologies, the global RegTech market will help businesses better navigate the regulatory landscape with greater ease, efficiency, and security to shape the future of compliance in industries around the world.

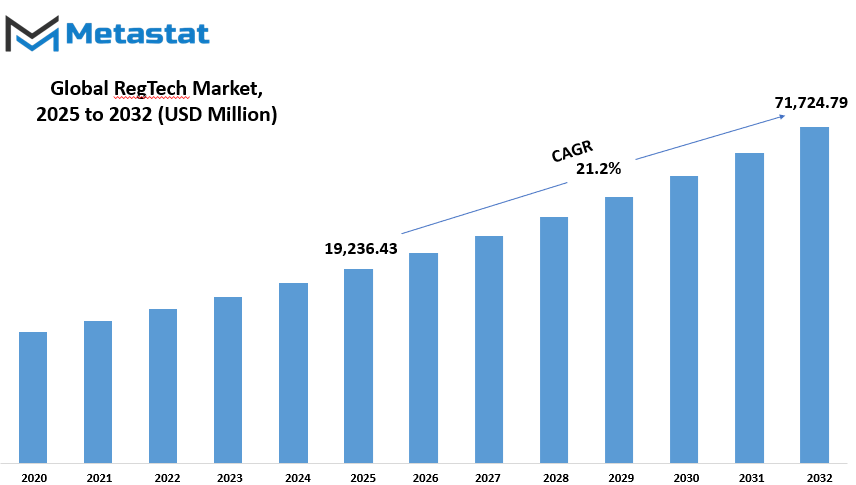

global RegTech market is estimated to reach $71,724.79 Million by 2032; growing at a CAGR of 21.2% from 2025 to 2032.

GROWTH FACTORS

The global RegTech market is growing fast, as companies and governments look for innovative ways to address the rising complexity of regulations. Increasing regulatory requirements in many sectors have given rise to demand for RegTech solutions. The rising trend of businesses resorting more and more to technology to meet demands has made the RegTech market a necessary element in keeping abreast with changes in laws and guidelines. It has been the interest of businesses that have been dealing with stricter rules and regulations aimed at compliance and risk minimization. The complexity of regulations, in particular, is the prime driver of market growth for RegTech.

With more detailed and stringent regulatory frameworks, businesses are looking for tools that will aid them in adhering to rules and avoid the resultant penalties. Such complexity calls for simplification of this process and the automation of compliance-related tasks with RegTech solutions. Technological advancements have also had a significant impact on the growth of RegTech. Artificial intelligence, machine learning, and big data analytics, among other emerging innovations, help reduce the load that companies carry as they process volumes of regulatory information. These developments help improve efficiency but also bring scope for expanding the business activities of RegTech companies.

Nevertheless, wide dispersion of RegTech does not take place without issues. One of the main challenges is high implementation cost-related difficulties for most of the firms, particularly the smaller ones. This statement makes costs a major limiting factor to the penetration of RegTech solutions throughout all sectors, thereby making it slightly easier to access and cheaper for larger companies. Another constraint comes in the form of data privacy issues. As regulatory technologies handle sensitive and personal data, new concerns about data security and privacy have emerged. Issues involved can thus impede the development of the RegTech market. This is for both companies and customers not to take risks in availing solutions that will compromise confidentiality for data.

Notwithstanding all this, there is a rich and immense potential to be had through RegTech markets. Emerging markets have a vital position in taking it to higher planes. These regions are gradually embracing technology-led compliance solutions. This is an untapped opportunity for firms in the RegTech space to explore these geographies. Secondly, the increased focus on the automation of compliance processes will also be a new revenue stream for the companies in the RegTech space. As the need to simplify the complexity and the cost of compliance through manual effort increases, solutions that are automated will gain even more appeal, providing further growth prospects in the market.

The future of the RegTech market seems promising, with strong drivers pushing for innovation and opportunities that will shape the industry. However, it will be important to address the implementation challenges and privacy concerns that will be critical in maintaining its growth and achieving broader adoption.

MARKET SEGMENTATION

By Deployment Mode

The Global Regulatory Technology (RegTech) market is in a significant shift, especially when it comes to deployment modes. These deployment modes are mainly classified into two major types: On-Premises and Cloud-Based solutions. Both of these methods have their merits, which meet the varied requirements of businesses from different industries.

Worth $8,273.76 million, On-Premises is the most appealing deployment mode for businesses looking to exert maximum control over their data and infrastructure. It allows organizations to host and manage their RegTech solutions from within their own premises, fully retaining ownership of the data. It is likely to promise increased security and compliance as well as higher customization, making it popular with businesses that are most interested in these aspects. With on-premises deployment, business organizations can customize the systems as they are responsible for its maintenance and upgrades as well. However, it does call for substantial upfront investment in hardware, software, and the IT infrastructure to support it all.

The Cloud-Based deployment mode is also very popular these days due to its flexibility and scalability. In the case of cloud-based solutions, businesses will have access to the tools and services of RegTech over the internet, as third-party providers will host these services. It eradicates heavy up-front investment requirements because companies need not purchase or maintain hardware themselves. Moreover, cloud-based RegTech solutions can be accessed from anywhere around the world due to remote access, allowing businesses to access vital regulatory tools anywhere around the world. Also, it automatically updates, meaning that businesses do not have to manage their systems directly. Organizations will be able to scale up or down easily according to changing needs, thus making it more affordable for many.

Increasing demand for flexible and efficient deployment models will result from the ever-changing regulatory landscape. Both On-Premises and Cloud-Based solutions offer distinct benefits, depending on the specific needs and resources of the businesses adopting them. While On-Premises solutions provide control and customization, Cloud-Based options offer convenience, scalability, and reduced costs. Ultimately, businesses will need to evaluate their unique requirements to determine which deployment mode best aligns with their operational goals and regulatory needs.

By Organization Size

The global RegTech market is growing significantly, as businesses want to find new ways for compliance so that the risk and cost associated with compliance are reduced. The market can be broadly categorized into two segments: Large Enterprises and Small and Medium-sized Enterprises (SMEs).

Large enterprises are usually large in terms of resources, operations, and complexity in regulatory needs. These organizations operate in multiple regions with their respective sets of rules and regulations, thus making it quite challenging to maintain regulatory compliance. RegTech solutions for large enterprises are generally broad, encompassing a variety of tools for the automation of compliance tasks, management of risk, and satisfaction of all regulations in different jurisdictions.

These organizations have the capability to spend significantly on state-of-the-art technology that would be able to support their expansive regulatory needs. Additionally, large firms can utilize sophisticated solutions that aid them in the management of high volumes of data, tracking of regulatory changes, and ensuring openness in their businesses. In the case of SMEs, their issues are altogether different in the regulatory arena. With fewer resources and smaller teams, SMEs will find it harder to manage complex compliance requirements manually or through traditional methods.

The RegTech solutions tailored for SMEs are usually more flexible, cost-effective, and easy to implement. Such solutions focus on streamlining compliance processes, reducing the burden of regulatory tasks, and helping SMEs avoid costly penalties for non-compliance. Though SMEs would not require such a level of customization and complexity as in large enterprises, the growth of automation, data analytics, and real-time compliance monitoring are benefits. It will make it possible to track the regulations' change without expensive compliance departments and labor-intensive processes.

The growth of the global RegTech market benefits both large enterprises and SMEs. The two types of organizations are more and more going to technology as the regulatory landscape continues to change. For large enterprises, scalability and efficiency are what RegTech offers in handling large volumes of regulatory data. For SMEs, it provides affordability and accessibility, allowing them to compete on a more level playing field. The future of such organizations, however big or small, will, therefore, witness the continued and progressive development of RegTech solutions that will make a difference.

By Application

The global RegTech market is rapidly emerging and encompasses applications in all its spectrum across companies to help manage regulatory challenges with greater ease. This category can be divided into various key areas, including risk and compliance management, identity management, regulatory reporting, AML and fraud management, and regulatory intelligence.

Risk and compliance management is the most important application of RegTech. It helps the application to identify possible risks and ensures businesses become compliant with regulatory requirements and, most importantly, ensures the business is legal. Advanced technologies assist companies in automating processes that otherwise require so much time and may be associated with human errors. It will help the organization reduce financial penalty risks and safeguard their reputation.

Other than the above uses, identity management is another big application. Given the rise of threats in cyberspace and increased identity theft cases, companies seek solutions that authenticate and manage all identities accessing systems of the company. RegTech solution in this particular area ensures there is only authorization to access specific information, increases security, and prevents fraudulence.

RegTech is very important to businesses that require timely and accurate reports to regulatory bodies. The reporting process is automated and streamlined, hence minimizing the burden on staff and minimizing errors. The automated system will allow a business to file compliant reports to regulatory bodies, thereby saving time and resources.

The main applications of RegTech are anti-money laundering and fraud management. The rapidly accelerating global rate of financial crime means the stakes are higher against those organizations that might want to look away or conceal evidence of such illegal activities as money laundering or fraud. Through real-time transaction analysis, the RegTech solutions flag a suspicious transaction and then allow further research into it, ensuring the business stays on top of these threats and follows the AML requirements.

Regulatory intelligence is the last application and is significant in the global RegTech market. It helps business concerns stay updated about changes in the laws and regulations that may have an impact on their operations. With real-time data and predictive analytics, companies gain valuable insights on emerging trends to make informed decisions on how they should comply with new regulatory requirements.

Therefore, the global RegTech market transforms how businesses face their regulatory compliance needs. Specialized solutions across varied applications help in managing risks and maintaining security as well as regulatory compliance in this increasingly complex environment.

By End-user

The global RegTech market is divided into end-user industries, which include BFSI (Banking, Financial Services, and Insurance), Manufacturing, IT & Telecom, Healthcare, Government, and Other sectors. These segments reflect the different industries that are embracing regulatory technologies to improve compliance, risk management, and operational efficiency.

The BFSI sector is one of the biggest contributors to the growth of the global RegTech market. Rising regulatory pressure calls for the need for managing complex compliance requirements in the financial institution. It becomes necessary to design technologies that can support business compliance management. Solutions in RegTech help businesses automate and execute compliance operations such as fraud detection and managing financial risks efficiently. Under evolving regulatory standards, financial institutions maintain an edge with these solutions while ensuring that they adhere to strict legal and financial regulations.

The other sector gaining prominence is manufacturing. Manufacturers constantly face regulatory issues pertaining to safety, environmental standards, and labor laws. The RegTech tools assist these companies in monitoring compliance, tracking changes in regulations, and ensuring adherence to the needed industry standards. Through automation of regulatory tasks, manufacturers can avoid the likelihood of human error and ensure timely reporting, which is a factor in operational efficiency.

Significantly contributing to the global RegTech market are also the IT and Telecom sectors, which require stringent data privacy protection, cybersecurity practices, and full compliance with their regulatory standards; both rely so much on using RegTech. Data encryption technology, fraud detection systems, as well as automating compliance tool usage are frequently applied in handling the escalating nature of regulations related to these companies.

It plays an important role in the healthcare industry in managing the privacy of patients' data and ensuring compliance with healthcare regulations globally, such as HIPAA, in the United States. With RegTech, healthcare providers ensure that patient records are kept safely, billing procedures are streamlined, and they follow the required guidelines for compliance. This is highly relevant because healthcare is becoming a more digitized and technologically advanced industry.

The government sector also plays a significant role in the global RegTech market. Governments worldwide are using regulatory technologies to improve transparency, combat financial crimes, and ensure that businesses and organizations comply with national and international regulations. RegTech tools can assist in policy enforcement, streamline reporting systems, and monitor tax compliance, ultimately making governance more efficient and transparent.

The "Others" category in the global RegTech market is comprised of industries that do not fall under the above sectors but still require regulatory technology to manage risks and compliance effectively. These could include sectors such as retail, education, and transportation, where regulatory compliance plays a key role in their daily operations. As these industries recognize the value of regulatory technologies, the global RegTech market will grow rapidly in the coming years.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$19,236.43 million |

|

Market Size by 2032 |

$71,724.79 Million |

|

Growth Rate from 2024 to 2031 |

21.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

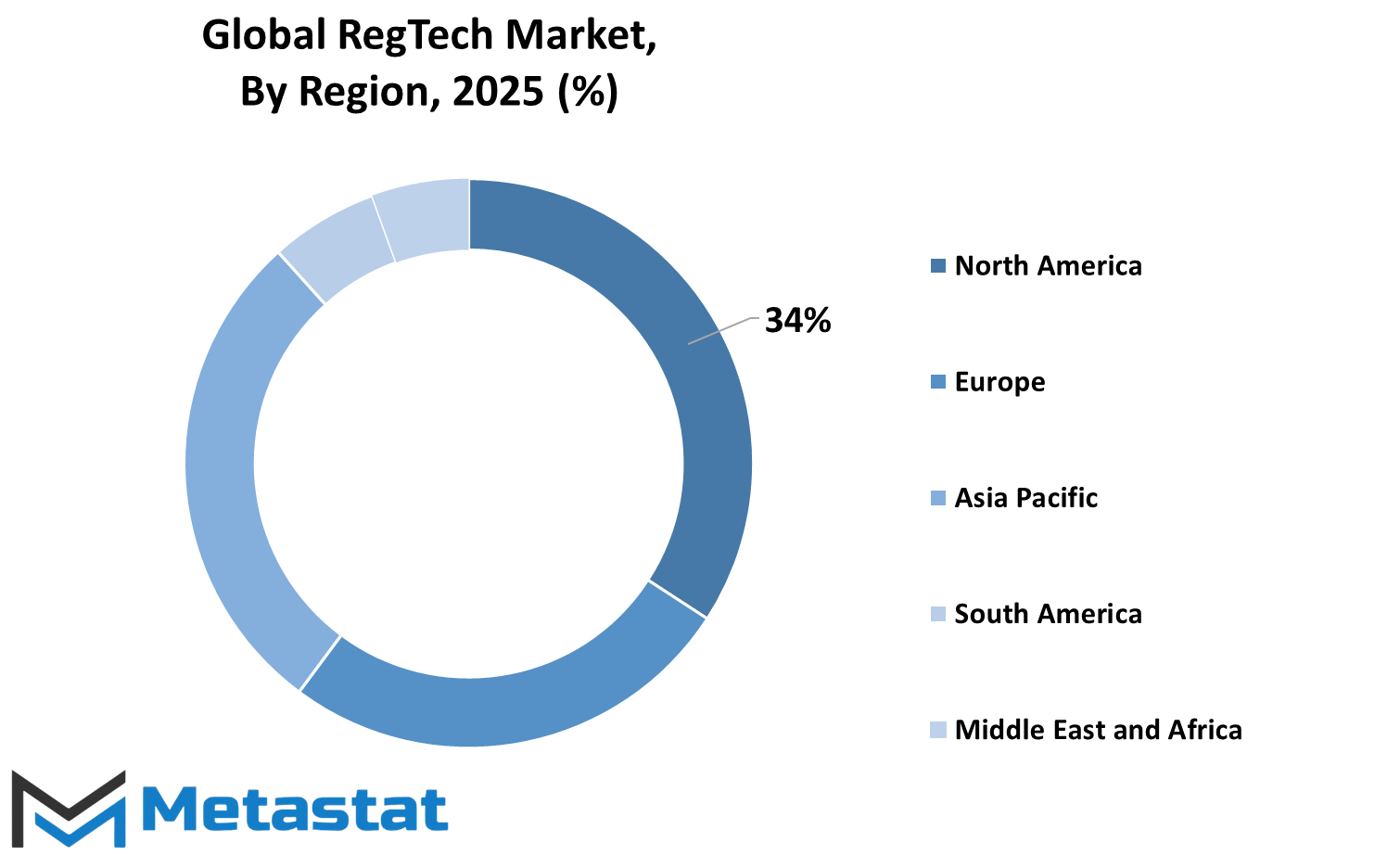

The global RegTech market is divided into various regions based on geography. These regions include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. In North America, the market is further broken down into the U.S., Canada, and Mexico. Europe is categorized into the UK, Germany, France, Italy, and the rest of Europe. Asia-Pacific encompasses countries such as India, China, Japan, South Korea, and the remaining ones, commonly referred to as Rest of Asia-Pacific.

South America comprises three major markets, namely Brazil, Argentina, and Rest of South America. The Middle East & Africa region is divided into the Gulf Cooperation Council countries, Egypt, South Africa, and the rest of the Middle East & Africa, which together are referred to as the Rest of the Middle East & Africa.

Geographical segmentation helps businesses, in addition to other stakeholders, in the RegTech sector understand the needs and opportunities of the markets. For instance, North America and Europe have led in terms of RegTech adoption due to advanced regulatory frameworks that are found in place and increased demand for compliance solutions. More investment is witnessed within countries from such regions on RegTech solutions in enabling businesses to meet the complicated regulations.

Meanwhile, Asia-Pacific is growing rapidly as companies in China and India seek technological solutions to navigate an increasingly changing regulatory environment. Even though small compared to the above regions, South America represents an enormous opportunity for RegTech companies, especially for countries like Brazil and Argentina which are focusing more on the improvement of their regulatory systems.

The Middle East & Africa is diverse, but it is also a fast-emerging market for RegTech. The region has a growing need for regulatory technology, especially from the GCC countries, who are pushing for greater transparency and compliance within their financial and business sectors.

The global RegTech market is massive, diversified, and challenging, varying for every geographical segment. By understanding the nuances of each geography, business will be in a better position to adjust the product offering and strategies in the specific market for respective needs.

COMPETITIVE PLAYERS

The global RegTech market has grown rapidly in the last few years as businesses and financial institutions look to enhance compliance, risk management, and regulatory reporting. RegTech is the use of technology, including software and solutions, to help companies comply with regulations efficiently and effectively. This market plays a critical role in ensuring that organizations adhere to ever-changing rules and regulations, especially in industries like finance, healthcare, and insurance.

Some of the highly recognized names of technology and the financial services, key players exist in the business of RegTech. Accuity Inc. can be known, for instance for its compliance as well as money laundering detection coupled with payments' solutions to corporations. Broadridge Financial Solutions engages in investor communications, regulatory reportage, coupled with data, which helps solve the problems concerning the demands created by regulations imposed on financial enterprises. Deloitte is global consulting services enterprise that also produces RegTech whose solution will navigate complex regulatory situations.

ACTICO GmbH is another notable player, offering software solutions that streamline compliance, risk management, and fraud prevention. IBM Corporation, with its vast experience in technology, plays a significant role in the market by offering advanced artificial intelligence (AI) and cloud-based solutions to address regulatory challenges. NICE Actimize, a division of NICE Systems, focuses on delivering solutions to financial institutions to help them comply with anti-money laundering regulations and fraud detection. MetricStream is the leading provider of governance, risk, and compliance (GRC) solutions. Ascent Technologies Inc. has developed an AI-driven platform for the automation of compliance processes.

Another major player in this market is Wolters Kluwer, which focuses on providing regulatory reporting and compliance management solutions to multiple industries. ComplyAdvantage focuses on using data and AI to help companies prevent financial crime and follow up with the necessary regulations. Last but not least, Jumio Corporation, a leading company in identity verification, supports organizations with compliance by offering digital identity and KYC (Know Your Customer) verification services.

These companies, among many others, are shaping the future of the global RegTech market by providing businesses with critical tools needed to thrive amidst complex regulatory and risk management environments. As pressure grows to meet compliance within all industries, the adoption of RegTech solutions will continue to grow, thereby driving the pace of innovation and new market opportunities in this area.

RegTech Market Key Segments:

By Deployment Mode

- On-Premises

- Cloud-Based

By Organization Size

- Large Enterprises

- SMEs

By Application

- Risk & Compliance Management

- Identity Management

- Regulatory Reporting

- AML and Fraud Management

- Regulatory Intelligence

By End-user

- BFSI

- Manufacturing

- IT & Telecom

- Healthcare

- Government

- Others

Key Global RegTech Industry Players

- Accuity Inc.

- Broadridge Financial Solutions

- Deloitte

- ACTICO GmbH

- IBM Corporation

- NICE Actimize

- MetricStream

- Ascent Technologies Inc

- Wolters Kluwer

- ComplyAdvantage

- Jumio Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252