MARKET OVERVIEW

The Global Real Estate Technology market and industry are in a deep state of flux. The sector is an inseparable part of property transactions, management, and development and is going far beyond traditional modalities. Innovations have changed the way properties are developed, sold, and maintained-today the focus is not on mere automation or better listing platforms. Most of the discussion has been about the technology's immediate effects, but the wider implications are often overlooked.

The most significant changes will concern a greater role for predictive analysis. If one can predict changes in the market based on data analysis, then there will be a new era of decision-making at all levels, predicting tenant preferences and investment risks. This industry will not merely respond to demand, but will see future patterns that will redefine asset valuation. AI will play a vital role in this process by providing deep-learning algorithms that will improve property valuation, risk evaluation, and leasing strategies. Conventional valuation methods will be put to the test in this new change, with traditional appraisal approaches being made obsolete over time.

In addition to improving transactional efficiency, digital twin technology is set to radically change real estate development and asset management. Their ability to create virtual replicas of physical properties will let developers and investors simulate scenarios even before construction work begins. The market will rely not only on historical data for construction but also to implement real-time insight to build sustainable and adaptable infrastructure. This shift will greatly influence the field of urban planning, where buildings will be designed for dynamic adaptability driven by data, instead of following rigid blueprints.

The integration of blockchain will redefine the core operations within the industry. While the role of blockchain in securing transactions and mitigating fraud has received widespread attention, property ownership through tokenization will fundamentally change the game. Investment assets will be further fractionalized, allowing investors to own digital shares with none of the hassles of traditional ownership. This will revolutionize real estate investment around the globe by removing many hurdles that have historically limited the entry into high-yielding markets.

Beyond commercial and residential properties, technological advancements will redefine the workings of cities. Smart infrastructure will transform from being a vision of the future into an indispensable reality of the urban landscape. IoT-enabled devices will make various ecosystems work seamlessly, with energy efficiency, security, and predictive maintenance forming the backbone of real estate operations. Therefore, these technologies will be built into new constructions as cities grow, not retrofitted afterward.

The regulatory frameworks will be unable to keep apace with these developments and thus provide fertile ground for clashes between innovation and compliance. Therefore, governments are now called upon to set up adaptive policies capable of striking a balance between the fast pace of technological progress and the slow but surely important considerations of ethics on matters of data privacy and AI decision-making. Legal frameworks must change to address new issues such as algorithmic bias in valuation processes and AI-based models with respect to accountability.

The Global Real Estate Technology will stretch beyond the limits into industry transformation to ways beyond immediate transactions. AI, Blockchain, IOT, and Digital Twin technologies will create a paradigm that is hinged on efficiency, accessibility, and innovation. Although the transformation in the market has already begun, its full impact is far from realization, challenging just about everything pertaining to property development, management, and experiences.

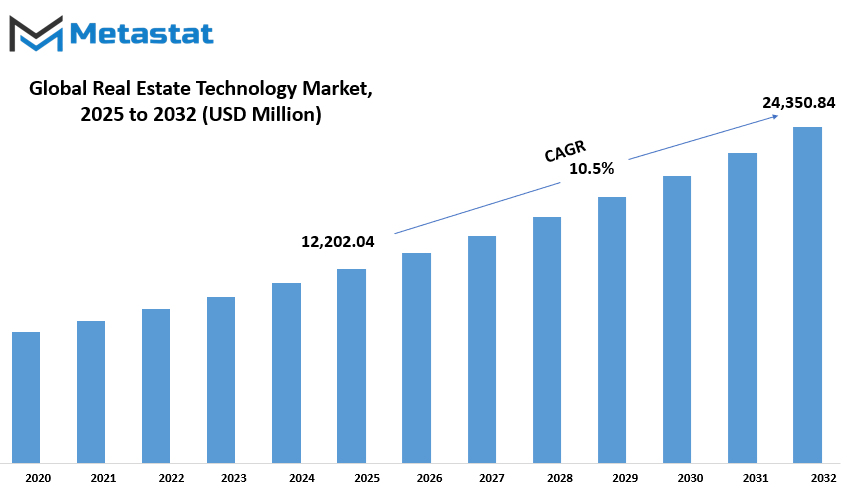

Global Real Estate Technology market is estimated to reach $24,350.84 Million by 2032; growing at a CAGR of 10.5% from 2025 to 2032.

GROWTH FACTORS

The rapid growth of the global real estate technology market can be attributed to the influx of technology and the corresponding changes in the industry landscape. One of the sponsoring instances fueling the growth is the rising application of artificial intelligence and big data analytics in real estate transactions. These technologies radically change how property management, sales, and customer interaction processes are handled. AI assists real estate professionals in analyzing an enormous amount of data and subsequently enabling them to make decisions, anticipate market trends, and enrich client experience. Big data analytics definitely contribute to efficiency, equipping property decision-makers with avenues to assess value, investment, and risk to make a property transaction more strategic and data-driven.

The growing demand for smart property management solutions is yet another factor that greatly catalyzes market growth. Property owners and managers are developing an appetite for automating mundane tasks such as rent collection, maintenance requests, and energy management. Anyone would be an admirer of smart technology: IoT-based systems facilitate real-time monitoring of and control over various functional areas of a building to enhance efficiency and reduce operational costs. In tandem with delightful services, they further enhance the experiential quality of property ownership while raising tenant satisfaction levels.

In spite of all this development, the market still faces some challenges that, if left unattended, might hinder growth. One of the foremost disadvantages is the high cost of implementing and integrating new technology into the real estate systems that are currently functioning. Many real estate firms, especially the small ones, cannot sustain the financial costs of upgrading to the advanced digital solution. More often than not, it proves to be an intricate and laborious task to integrate various technologies into different platforms involving technical expertise at an altogether different level.

Apart from these, security and privacy concerns have also emerged as vital stumbling blocks to the adoption of technology in real estate. As digital transactions become prevalent, the risks of cyber threats and data breaches increase. With personal and financial sensitive data involved in real estate transactions, the need for security becomes essential. Organizations need to bolster their security capabilities to protect customer data and maintain the overall trust of the industry.

An equally range of new opportunities exists in the market. Blockchain technology is gaining ground as a potential resolution for securing and guaranteeing the transparency of real estate transactions. Blockchain provides a decentralized and incorruptible system that has the potential to accelerate property transfers while lessening fraudulent activities and enhancing trust between sellers and buyers.

Another trend sparking innovation is the ever-growing investment in proptech startups and digital platforms. Investors appreciate the possibilities of technology-oriented solutions to real estate and are financing nascent companies seeking to enhance the industry's efficiency, accessibility, and security. This growth of the real estate technology market is poised for further evolution into tomorrow, given the concerted momentum of consistent advances and increasing adoption.

MARKET SEGMENTATION

By Deployment

Advances in digital solutions for business efficiency improvement, operation streamlining, and customer experience enhancement, have pushed the global real estate technology market towards tremendous growth. Today, more clients and investors look into new technologies that provide better property management, analytics, and automation. Smart houses, artificial intelligence, and block chains will fuse to ensure transformations in buying-selling-management processes within the real estate industry.

Another defining segment of this market is deployment, further linked to on-premise solutions or cloud-based platforms. On-premise solutions are worth $5,249.95 million and apply widely amongst agencies that handle data security and control over infrastructure harshly. Most of them require dedicated hardware and maintenance, which makes IT support a necessity and thus suits only very large firms with established resources. Alternatively, cloud platforms are picking up because of their flexibility, cost-effectivity, and ease of accessibility. Cloud technology in enterprises offers access to real-time data, a scalelessness feature, and lower operational costs. This would apply to both new establishments and existing businesses.

Adopting real estate technology is a result of all sorts of factors, inclusive of market demand, regulations, and technological advancements. Digital tools are great for most property managers, realtors, and investors for decisions making, asset management optimization, and bettering customer experiences. Among the most recognizable examples is the use of predictive analytics by AI-powered platforms to allow businesses to figure out a trend in the market and make investment driven by data. The other typical technology involved in the property transaction matrix is block chain, whereby contracts and ownership verification is accomplished more transparently, securely, and efficiently.

Consumer expectations are also evolving, with buyers and renters searching for increasingly frictionless digital experiences in their quest for the ideal property. Common features offered in real estate platforms now include virtual tours, AI-driven chatbots, and automated customer service solutions. These bluntly save time and improve engagement between buyers, sellers, and real estate professionals.

Challenges still abound in inhibiting real estate technology from advancing at breakneck speed. High cybersecurity threats, data privacy, and need for different companies density-wide standards are barriers for companies willing to engage in digital transformation. Also, many organizations do not want to change their traditional operations since they are very much rooted in real estate processes. However, with increasing competition and the growing demand for efficiency, companies are seeing the future benefits of bringing technology into their processes.

In terms of the future, the real estate technology market will keep growing. Smart investments are made by companies toward digitization in developing smarter, faster digital solutions. On-premises solutions still have a dogged hold on the trail, but the growing adoption of cloud solutions will also boost further evolution in the industry that will clearly define the forthcoming future of the real estate world in transactional dealings.

By Solution

The global real estate technology market is developing drastically because industries are now becoming very dependent on technology, thus increasing their efficiency. Keeping businesses busy with operational speed-ups, various technologies are being developed to suit the dynamic needs of real estate professionals. It is now market segmented by solution type-including documentation, accounting, compliance, business intelligence, enterprise resource planning, customer relationship management, asset management, and other solutions. Such processes include improving workflows, reducing manual incidences, and managing data accurately.

For example, documentation tools would help real estate firms work with contracts, lease agreements, and other core paperwork much more effectively. One digitizes these processes to minimize errors, expedite approvals, and improve security. The importance of accounting solutions has its desired accurate financial tracking and budgeting tools for companies to run in transparent operations. Compliance software will make sure that the firms are within the boundaries set out by the rules, largely mitigating legal risks and giving them good standing in business.

Companies can monitor changes in market trends, property pricing, and investment opportunities through business intelligence solutions. This kind of knowledge will help make informed decisions through the insight that comes with real-time results. ERP software is simply an integration of a business: the major facets-human resources, inventory, costs, and finances-into one operating entity premise. CRM solutions are used to cater to the establishment of good customer relations such as built-in communication, following people, and personal marketing.

With the help of asset management technology, firms can manage property portfolios, schedule maintenance, and track expenses efficiently. Other offerings in the market are targeted for very specific needs like virtual property tours, tenant screening, or AI-powered analytics. The technologies will help organizations maintain competitiveness and adapt to changes in the business environment.

The scope of demand for improved solutions will continue increasing for the future, which real estate will tend to absorb. Offsetting their inefficiency and poor customer experiences with improved decision-making would in part be realized through such investments in technology. The future of the market will hinge on pivoting towards automation and being data driven, hence influencing how properties are bought, sold, and managed. Ongoing innovation ensures that real estate technology will continue evolving, even in the face of obstacles such as cybersecurity and integration. Businesses that harness these advancements will be more capable to tackle the changes in the industry and respond to the increasing demands of clients and investors.

By End User

The continuing development of Global Real Estate Technology moves along its way with the digitizing tools that transform the buying, selling, and management of property, with technology driving the improvement of efficiency, customer experiences, and transaction processes in both the residential and commercial spaces. As demand for smarter solutions increases, companies are making investments in these innovative platforms to remain competitive.

In the residential sector, real estate technology is changing the home-buying process. Buyers can now go online and check listings, take virtual tours, and receive AI-driven recommendations to weigh their options at home. The use of digital mortgage platforms and smart contracts based on blockchain to simplify paperwork has minimized unnecessary delays and made transactions more secure. Home automation and smart home systems have become popular solutions for homeowners to gain improved control over security, energy management, and comfort. Meanwhile, property management software is vital when it comes to allowing landlords to efficiently collect rents, manage maintenance requests, and ease tenant communication.

With this technology entering commercial use, the real estate sector will never remain the same. Real estate investment platforms now give data-driven insights that enable investors to make informed decisions. Companies leverage AI-backed analytics to assess trends in the market, property valuation, and potential returns such smart building technologies, including IoT sensors and automated climate control systems, to promote energy savings at lower costs. Digital tools have also proven beneficial for co-working spaces and flexible office solutions where companies manage leases, book workspaces, and track their levels of occupancy more seamlessly.

Technology also impacts transaction processes and property management. With virtual and augmented reality, technology offers better property visualization to enable architects, developers, and buyers to experience spaces before they are built. Big data analytics allow real estate professionals to forecast changes in the market and adjust strategies accordingly. The priority has also shifted to cybersecurity solutions with transaction processing going online, guaranteeing that sensitive financials and personal information stay protected.

Much as technology adoption is all beneficial to the real estate world, some challenges still remain. The industry needs to address these issues, including those regarding data privacy, regulatory loopholes-mostly those that may further the digital divide, thereby leaving a huge section of buyers and sellers at a disadvantage. However, with the advancement of technology, the real estate market is expected to be even more accessible, transparent, and efficient. Companies that choose to go for digital transformation will gain a competitive advantage in the near future and will largely influence how properties are marketed, managed, and sold in residential as well as commercial sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$12,202.04 million |

|

Market Size by 2032 |

$24,350.84 Million |

|

Growth Rate from 2025 to 2032 |

10.5% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

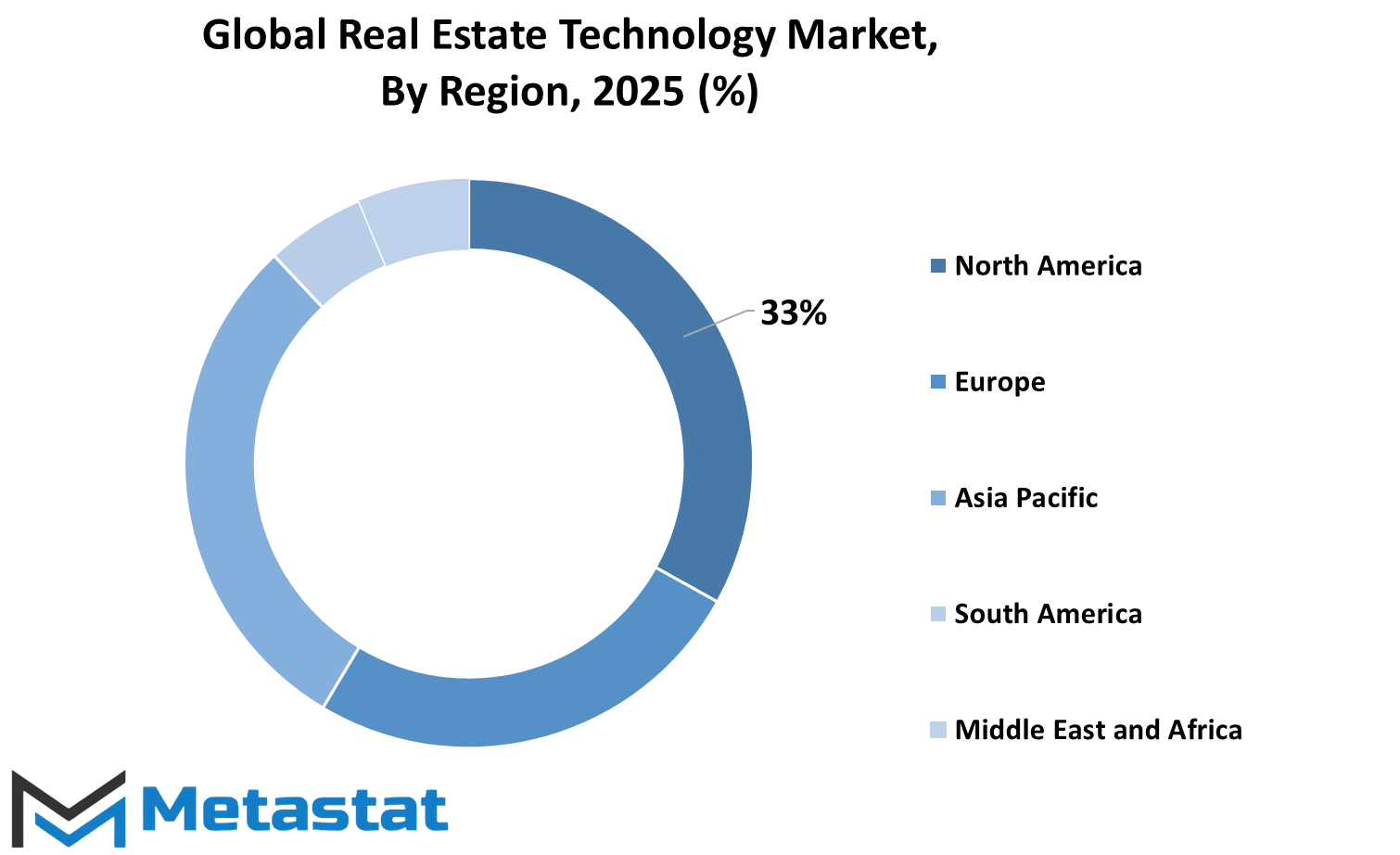

Emerging technologies across the globe have continuously fueled growth in the real estate technology market. In terms of geography, the market is segmented into several key zones such as North America, Europe, Asia Pacific, South America, and the Middle East and Africa. Each of these regions plays an important part in the development and adoption of technology into real estate.

North America is an extremely influential market with the USA, Canada, and Mexico at the forefront. The region has a solid technological infrastructure combined with heavy investments into innovations within the real estate industry. The US per se remains a stronghold; advances in such areas as artificial intelligence, blockchain, or smart home technology are already altering the real estate landscape. Whereas Canada runs a close second, embracing similar technologies to facilitate property management and streamline real estate transactions. Despite being a late starter in this sector, Mexico is gradually warming up to technology to gain efficiencies at the housing or commercial property levels.

Europe is notable, with the UK, Germany, France, and Italy being the primary players. Sustainability and smart city projects have been the buzzwords in the region, leading to the push for energy-efficient buildings and data-driven property management solutions. The UK has been in the lead with proptech being used to optimize real estate services. Germany and France are also on the way, setting up digital platforms for discomforting buying, selling, or leasing property. Italy and the rest of Europe are catching up, starting to adopt solutions that are meant to renovation real estate activities.

India, China, Japan, and South Korea are the most relevant markets in Asia-Pacific. Rapidly smart building solutions and AI-driven analytics have been used in the real estate sectors of China and Japan, known for being technologically well advanced. Downtown apartments that come with daily maintenance of real estate will soon receive investment like never before in India, which in turn is causing mass urbanization in need of solutions for efficient housing. South Korea is also wearing new strides by using the digitalization of platforms and automation for ease in real estate services. The other countries in the Asia-Pacific region are slowly turning to these technologies as contributions to the growing demand in the area.

South America, which includes Brazil and Argentina, is moderately progressing with accepting real estate technology. Brazil is leading the region with its digital transformation in property management and real estate financing. Argentina is following closely in this march, with certain online platforms geared toward facilitating property transactions. The rest of South America, however, is being trained at the technological, albeit at a slower pace.

In the Middle East & Africa, developments are being witnessed, mainly within the GCC Countries, Egypt, and South Africa. Large-scale infrastructural project undertakings within the GCC region are investing in the development of smart cities and AI-driven real estate platforms. Technology is being embraced in the real estate scene by Egypt and South Africa, albeit with a concentration on digital solutions that ease property transactions. The rest of the region is slowly following suit in adopting similar trends, which are overall favorable to enhance the global real estate technology scene.

COMPETITIVE PLAYERS

With technology reshaping the ways properties are bought and sold and managed, the global real estate technology industry seems to be witnessing growth. Players in this domain are constantly improving on newer solutions for better efficiency, streamlining transactions, and providing assistance. In this regard, several of these technologies are enabling buyers and sellers to simplify property searches, automate financial tasks, and aid decision-making.

There is a large number of firms such as SAP SE, Redfin, Compass, Opendoor, CoStar Group, Salesforce.com Inc., Matterport, Procore Technologies, RealPage, Yardi Systems, Sage Group plc, AppFolio, Zillow, Qualia, and CommonFloor operating in areas ranging from property management and real estate analytics to digital transactions and virtual property walkthroughs.

Technology has transformed the traditional real estate landscape as one of its greatest inventions. Online platforms have minimized the gap between buyers and sellers, discouraging the use of more intermediaries. Features such as offering a virtual tour and recommending properties via AI give consumers the ability to make unbiased decisions without having to physically visit every property. Matterport and Zillow have been pioneering in the mass adoption of 3D property visualizations, allowing potential buyers to see a home from anywhere. This not only advances the customer experience but also furthers accessibility for the international buyer.

Another major innovation flooding into the industry is big data and artificial intelligence. These businesses provide in-depth market analysis that arms the investor or real estate professionals with intelligence to make strategic decisions. These platforms help forecast property values, rental demand, and viable investment opportunities by performing trend analyses and examining historical data. Such a data-driven approach significantly reduces guesswork and enhances accuracy in predicting market behavior.

As the above-mentioned solutions further tighten security and enhance efficiency in real estate transactions, the heavy-handed integration of blockchain also comes into play. For example, Qualia is a company specializing in digital closing solutions that streamline a process that is guaranteed to be smooth and transparent. Under blockchain technology, fraud is less likely due to the generation of a safe, unchangeable record of ownership transfers and financial transactions. Consequently, this has made the buying-selling process more trustworthy and time-efficient.

On the other hand, property management software has changed the way landlords and real estate agencies conduct their businesses. With Yardi Systems, AppFolio, and Procore Technologies, these cloud-based solutions help streamline rent collection, maintenance tracking, and tenant communication. These programs reduce manual efforts and assist property managers in efficiently serving tenants.

As technology continues to grow and evolve, the real estate industry is on the verge of an even greater number of efficiency enhancements, additional security parameters, and improved customer experience. Thanks to the innovation inputs from the key players, the industry is soon bound to witness transparency and hassle-free access for buyers, sellers, and investors alike around the globe.

Real Estate Technology Market Key Segments:

By Deployment

- On-premise

- Cloud

By Solution

- Documentation

- Accounting

- Compliance

- Business Intelligence

- Enterprise Resource Planning

- Customer Relationship Management

- Asset Management

- Other Solutions

By End User

- Residential

- Commercial

Key Global Real Estate Technology Industry Players

- SAP SE

- Redfin

- Compass

- Opendoor

- CoStar Group

- Salesforce.com Inc.

- Matterport

- Procore Technologies

- RealPage

- Yardi Systems

- Sage Group plc

- AppFolio

- Zillow

- Qualia

- CommonFloor

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252