MARKET OVERVIEW

The global business process management market will remain at the forefront of a significant portion of the enterprise software market. It will drive business processes to optimum levels by automating, integrating, and monitoring workflows between departments and geographies. As companies move toward digitally connected ecosystems, the need for efficient and elastic solutions managing intricate process flows will gain momentum. The global business process management market will not be a mere technological paradigm but will be a core layer of enterprise infrastructure, which will make every enterprise more efficient and compliant in complex environments. This market will be for a variety of industries finance to manufacturing wherever processes have to be orchestrated between legacy systems, cloud platforms, and third-party services.

In contrast to conventional enterprise solutions that prioritize siloed outcomes, this market will enable end-to-end visibility, decision logic embedding, and optimum optimization on an ongoing basis. Solutions in this market will not only assist in modeling and simulating workflows but also deliver actionable insights via real-time analytics, making it simpler for enterprises to adjust operations based on policy changes, customer behavior, and supply chain variables. Architecturally, Global Business Process Management solutions will transform from static rule-based engines to smart, adaptive systems that use historical process data for predictive modeling. Vendors in this category will concentrate on developing platforms that support dynamic process changes without the need for full-scale reconfigurations. Cloud-native deployment, event-driven architecture, and API-first integration will prevail in product design as businesses call for solutions that scale by volume and complexity.

This marketplace will cater to stakeholders that need operational flexibility without sacrificing auditability and governance. Businesses that are experiencing large-scale transformation will depend on these solutions not only to automate manual processes, but also to rethink operational hierarchies altogether. From procurement supply chains to employee onboarding processes, the aim will not be merely to automate steps but will instead move towards uncovering bottlenecks, redundancies, and performance leaks before they become inefficiencies.

Over the coming years, the global business process management market will react to organizational structure and workplace shifts. As remote and hybrid modes of working change inner work flows, the market will require integration with cooperative ecosystems that facilitate asynchronous input and decentralized approval. Integration with other business technologies like enterprise resource planning, customer relationship management, and data lakes will get more standardized in order to provide unified operational intelligence.

In addition, regulatory environments will place new pressures on process transparency and traceability. This will compel the global business process management marketplace to include sophisticated compliance tools that monitor user activity, data flow, and approval deadlines without any human intervention. Artificial intelligence will no longer be a discretionary add-on; it will be a built-in capability employed to predict delays, suggest optimizations, and enable data-driven governance.

As organizational complexity grows, this market will be used less as an overlay tool and increasingly as the operational backbone. While early adoption was limited to administrative processes, future use will extend to strategic operations, allowing executives to shift resources and priorities at scale, with precision and control.

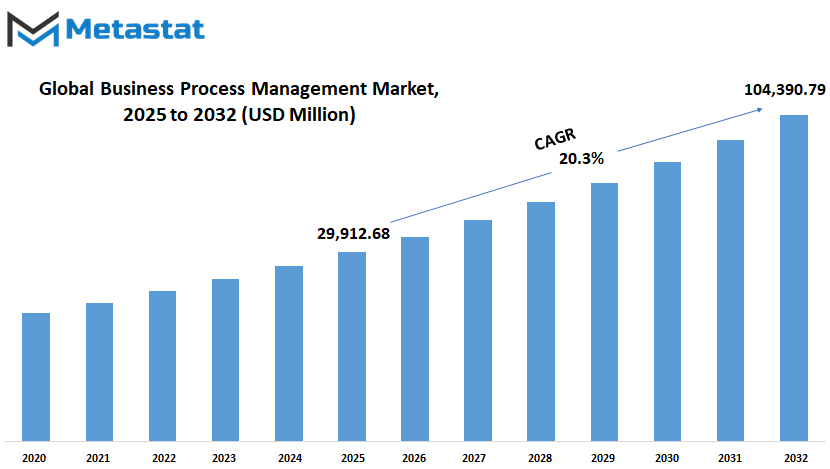

Global business process management market is estimated to reach $104,390.79 Million by 2032; growing at a CAGR of 20.3% from 2025 to 2032.

GROWTH FACTORS

The global business process management market is gaining attention as more companies look for ways to improve how they run their operations. Businesses today face growing pressure to become faster, more efficient, and better connected. This is pushing them to look beyond traditional methods and consider tools that support digital transformation. A major reason for this shift is the growing need for operational efficiency. Organizations are trying to cut down delays, avoid unnecessary costs, and streamline their daily tasks. This can be done by rethinking how processes are carried out and finding better ways to manage them. Business Process Management, or BPM, allows companies to look at every step they take and find areas where time and resources can be saved.

Cloud-based BPM tools are playing a big part in this. Unlike older systems that needed hardware and in-house setups, cloud tools can be used from anywhere and often come with easier updates and lower costs. They also make it easier for teams in different locations to work together. Alongside this, workflow automation is helping teams avoid manual tasks that slow them down. Instead of spending hours sorting emails or entering data, employees can focus on more important tasks while the system handles the rest.

Even with these benefits, there are still barriers to growth. One major issue is that putting a new system in place isn’t always simple. It can take time, money, and a lot of planning. Also, companies often face resistance when making big changes. Employees might be used to the old way of working and find it hard to adapt to something new. On top of that, there are technical hurdles. Older systems, often referred to as legacy systems, don’t always connect well with newer tools. Data stuck in silos can make it harder to get a clear picture of how the business is performing.

Looking ahead, the future of this market seems promising. The use of artificial intelligence and analytics is expected to grow. These tools can help businesses not just follow a process, but also understand it better and make smarter decisions in real-time. AI can predict where delays might happen and suggest better routes to take. With these capabilities, the global business process management market is likely to play an even more important role in helping businesses stay competitive and future-ready.

MARKET SEGMENTATION

By Solution

The global business process management market will continue to expand as companies across different industries search for ways to improve their workflows, cut down on inefficiencies, and keep up with increasing customer expectations. Looking ahead, this market will be shaped by a strong need for more automation and smoother coordination between various departments and systems. Businesses are shifting towards solutions that help them move faster, reduce manual errors, and make decisions based on real-time data.

One of the major segments in this market is Automation. It is gaining attention because it allows companies to streamline tasks that once required human effort. Automation tools reduce the time spent on repetitive actions, and this will allow employees to focus on higher-value work. With growing interest in artificial intelligence and machine learning, the use of automation will only grow stronger. This shift will lead to faster service delivery and improved accuracy in day-to-day operations.

Process Modeling is another solution that plays a key role. It helps businesses understand how their current operations work and shows where changes can be made. By creating clear visual maps of tasks and activities, companies can find better ways to work. This solution will be useful for those trying to stay flexible in a fast-changing market. It also helps reduce the risks tied to major process changes, since adjustments can be tested before they are fully rolled out.

Content and Document Management will also remain important as businesses generate and store large volumes of information every day. Organizing and protecting this data is a growing priority. More companies will adopt systems that let employees access the right documents quickly, no matter where they work from. With the rise in remote teams and digital communication, document control systems will become more advanced and easier to use.

Monitoring and Optimization solutions help businesses keep an eye on how well their processes are performing. These tools allow for regular adjustments that keep the business running at its best. Over time, they will grow smarter by using analytics that give useful insights without needing hours of review. Integration solutions tie everything together. They allow different systems and tools to talk to each other, which will be critical as businesses use more apps and platforms. Others in this group might include tools that fill special needs, and they will keep changing as new challenges come up. As time goes on, the global business process management market will focus more on adaptability, making it easier for companies to adjust and grow.

By Deployment

The global business process management market is set to experience steady growth in the years ahead as businesses continue to seek smarter ways to manage daily operations. As industries become more competitive and customers expect faster services, companies are under pressure to simplify how they work. This has led many to look for solutions that help improve performance, lower costs, and respond quickly to change. Business Process Management, or BPM, is a method that helps companies design, analyze, and update how they carry out tasks. It allows teams to work better together, spot issues earlier, and find new ways to improve service.

Looking ahead, technology will continue to play a major role in shaping this market. One of the biggest decisions companies face is choosing between cloud-based and on-premise deployment. Cloud-based BPM is becoming more popular because it gives businesses the flexibility to work from anywhere and scale as needed. It also reduces the need for expensive hardware and regular maintenance. Many companies like how cloud options let them start quickly without long setup times. On the other hand, some still prefer on-premise systems because they offer more control over data and security. This is especially important for industries with strict rules or sensitive information.

Over time, it's likely that cloud-based solutions will become the top choice, especially for growing businesses that need to adapt quickly. As artificial intelligence and machine learning become more common in workplace tools, cloud platforms will be better positioned to use these technologies. This means companies will not only manage tasks more easily but also make better decisions using real-time data. Even with this shift, on-premise options will still have a place, particularly where custom setups or tighter security are needed.

The global business process management market will also be shaped by how businesses value speed and customer satisfaction. As companies aim to respond faster to changes in demand or market conditions, they will look for tools that help them change their processes without starting from scratch. BPM solutions, whether in the cloud or on-site, will give them this ability. As a result, more businesses across different sectors will adopt these tools not just to stay competitive, but to lead with better service, faster turnaround, and improved teamwork. The future will likely see even more focus on ease of use and deeper integration with other systems, making BPM a key part of business success.

By Business Function

The global business process management market is steadily shaping the way companies function and compete. It will continue to influence how businesses handle everyday operations across different departments. As the need for faster decision-making and cost reduction grows, more organizations will look for ways to simplify tasks and improve workflows. Business Process Management, often known as BPM, helps firms do just that. Instead of working in disconnected systems, BPM encourages businesses to connect their processes so that work moves smoothly from one step to another. This shift is already changing how major areas like Human Resource Management, Procurement and Supply Chain Management, Sales and Marketing, Accounting and Finance, and Customer Service Support operate and the impact will only grow stronger in the future.

In Human Resource Management, BPM tools are expected to take on a larger role by automating hiring processes, tracking employee performance, and managing training. This will help HR teams spend less time on routine paperwork and more time focusing on employee growth. In the area of Procurement and Supply Chain Management, BPM will likely bring more control and visibility. Companies will be able to track suppliers, manage inventory better, and avoid delays. This means fewer supply chain interruptions and faster deliveries.

Sales and Marketing teams will also see improvements. Instead of working with spreadsheets and disjointed tools, they will use systems that track campaigns, analyze customer behavior, and adjust strategies in real-time. BPM systems will help them respond faster to market changes. For Accounting and Finance, managing reports, budgets, and audits will become simpler. These systems will reduce errors and speed up compliance checks, giving finance teams more confidence in their data.

Customer Service Support will become more personal and efficient. With better tracking and faster routing of support tickets, customers won’t have to wait long for help. Other business functions, such as administration and IT, will also benefit from process automation. With fewer manual steps, companies will reduce mistakes and increase productivity.

Looking ahead, the global business process management market will play a key role in how companies evolve. By making daily tasks faster and smarter, BPM will not only save time and money but also help businesses grow in a more focused and flexible way. As companies continue to look for better performance, this market will only become more important in shaping the future of work.

By Industry Vertical

The global business process management market is growing steadily and is expected to play a major role in shaping how organizations handle tasks and improve their operations. As more businesses look for better ways to manage their resources, the need for flexible and effective solutions becomes more important. This market brings together technology and process planning to help companies reduce waste, cut costs, and deliver faster results. In the future, this will only become more necessary, especially as digital systems become a bigger part of everyday work routines. Businesses will look to automate routine tasks and focus more on strategy and innovation.

By industry vertical, the global business process management market is divided into several sectors: BFSI, IT and Telecom, Retail and Consumer Goods, Healthcare and Life Sciences, Manufacturing, and Others. Each of these sectors uses Business Process Management in unique ways to meet different needs. For example, the BFSI sector relies on these solutions to meet strict regulations and improve service delivery. In banking and insurance, small mistakes can lead to large losses, so having strong processes in place is essential. In IT and Telecom, speed and data handling are key. Companies in this area will depend on these tools to keep up with growing customer demands and improve service reliability.

Retail and Consumer Goods companies use Business Process Management to track inventory, manage customer service, and make sure orders are filled correctly. These improvements lead to smoother operations and better customer satisfaction. Healthcare and Life Sciences will see a big impact as well. With growing concerns about patient care and data safety, better management tools will help doctors and hospitals deliver care more efficiently and securely. In manufacturing, it will help balance production lines, reduce delays, and improve product quality. Even industries that don't fall under one specific category, like government services or education, are starting to see the value in organizing their work better through Business Process Management.

Looking ahead, the global business process management market will continue to expand as businesses of all sizes aim to become more efficient. As technology advances, especially in areas like artificial intelligence and cloud computing, the tools used in process management will also improve. This will help industries stay ahead in a world that expects faster services and better results, while still keeping costs under control.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$29,912.68 million |

|

Market Size by 2032 |

$104,390.79 Million |

|

Growth Rate from 2025 to 2032 |

20.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

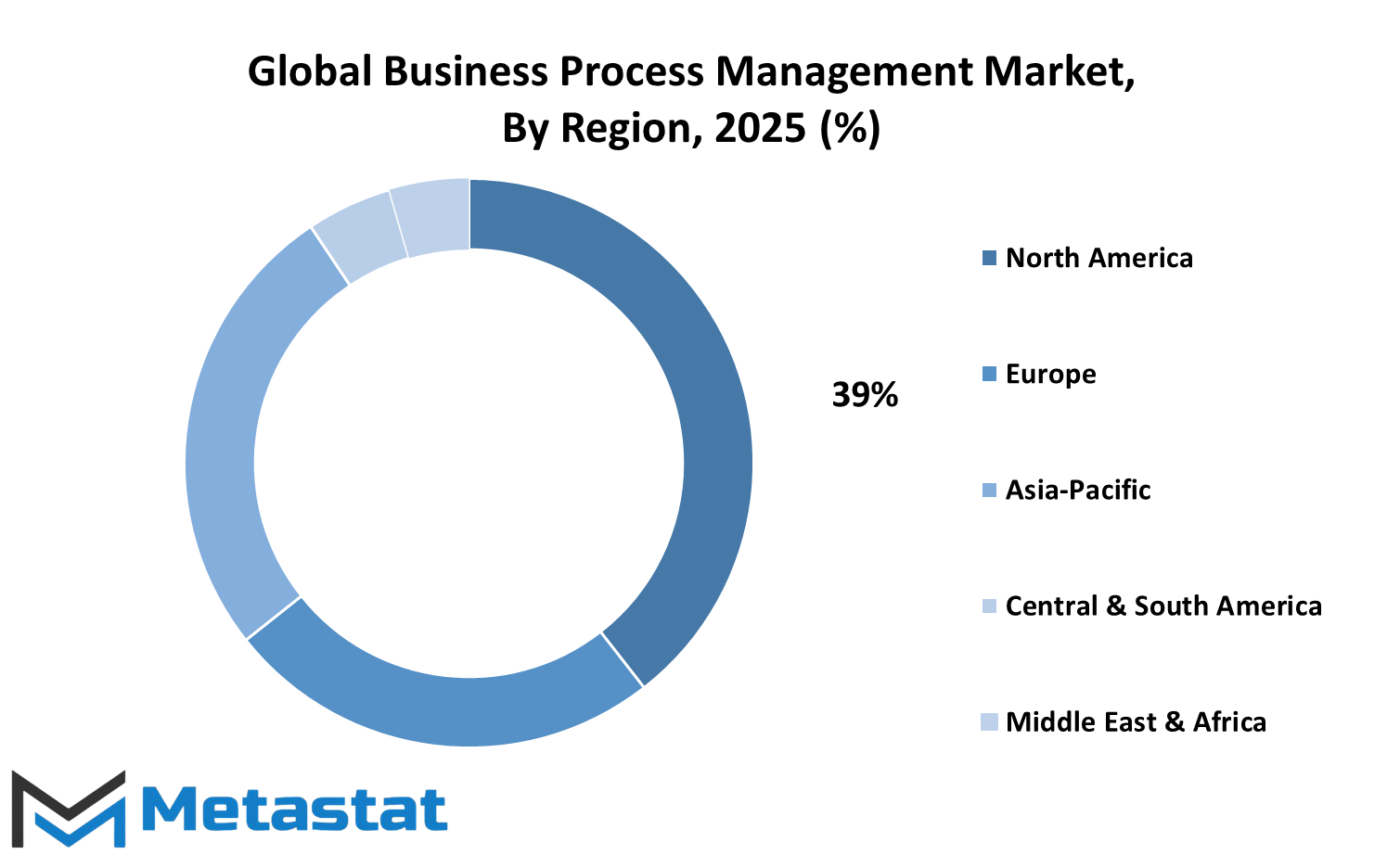

The global business process management market is expected to grow steadily in the coming years, supported by technological advancements and increased demand for efficient systems. This market, which focuses on improving the way organizations manage and optimize their business processes, is gaining traction across various regions. As companies continue to look for ways to streamline operations and improve productivity, the need for effective process management tools and services will keep rising.

Geographically, this market is segmented into key regions including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each region plays a unique role in shaping the overall market. North America, which includes the U.S., Canada, and Mexico, has been a leader due to its early adoption of digital transformation and strong presence of major technology providers. The U.S., in particular, continues to be a major hub for innovation and enterprise solutions. Canada and Mexico are also showing growing interest, especially in sectors like finance, healthcare, and manufacturing.

Europe, covering the UK, Germany, France, Italy, and the rest of the region, is also progressing in this area. With the push for automation and regulations that require transparent processes, European countries are adopting business process solutions to remain competitive. The presence of established industries and a focus on quality standards drive this trend. Germany and the UK are among the top contributors due to their industrial and economic strengths.

Asia-Pacific, divided into India, China, Japan, South Korea, and the rest of the region, is showing rapid growth. This region holds a strong future potential because of expanding economies and digital infrastructure. As businesses here continue to scale, there is a greater need to handle complex operations efficiently. Countries like India and China, with their large workforces and tech development, are investing more in process management to maintain operational balance and meet global standards.

South America, including Brazil, Argentina, and others, is gradually catching up. As local companies grow and global partnerships expand, the demand for effective process control tools is likely to increase. Similarly, the Middle East & Africa, which includes the GCC countries, Egypt, South Africa, and others, is seeing growing awareness of process efficiency. As businesses in these regions modernize, investment in business process management will play a key role in supporting growth and stability.

Looking ahead, as more industries recognize the value of agility and process clarity, the global business process management market will likely continue to evolve and expand across all major regions.

COMPETITIVE PLAYERS

The global business process management market is gradually shaping the future of how organizations operate, plan, and deliver services. As technology advances and business needs become more dynamic, companies are moving toward structured systems that help manage, automate, and improve their everyday operations. This shift is not just about efficiency; it’s about staying competitive in a fast-changing world. Organizations across sectors are recognizing that managing their internal processes through structured frameworks is key to long-term success. The market for Business Process Management tools is steadily growing, supported by a strong demand for solutions that help reduce costs, improve productivity, and increase flexibility.

In this space, several companies have taken a lead role in pushing innovation and setting industry standards. Well-known names like IBM, Oracle, SAP, and Pegasystems have built solid reputations for offering dependable tools and platforms that support process automation and analytics. These companies are not only maintaining their position but are also investing in new technologies like artificial intelligence and machine learning to stay ahead. These developments help organizations make smarter decisions, manage risks better, and adjust to changes quickly. Other companies like Appian, Software AG, TIBCO Software, and Bizagi are also making their mark by offering user-friendly platforms that allow both IT professionals and business users to work together with more ease. These tools make it easier to model, run, and monitor business processes without needing deep technical skills.

As the global business process management market continues to expand, new players are also entering with fresh ideas. Firms such as Bonitasoft, AgilePoint, Ultimus, Creatio, and Newgen Software are offering solutions that focus on flexibility and speed. They allow businesses to change their workflows as needed, without starting from scratch. This kind of adaptability will be more important in the future as customer expectations grow and market conditions shift. Meanwhile, companies like Genpact and Fujitsu are focusing on combining process management with broader digital transformation strategies, showing that the market is not just about tools, but also about guiding change.

Looking ahead, the global business process management market will likely keep evolving as new challenges appear and technologies improve. Competitive players will need to keep refining their services, focusing on ease of use, better integration, and stronger support for real-time data. Businesses that adopt these tools today will be better prepared for tomorrow.

Business Process Management Market Key Segments:

By Solution

- Automation

- Process Modeling

- Content & Document Management

- Monitoring & Optimization

- Integration

- Others

By Deployment

- Cloud-based

- On-premise

By Business Function

- Human Resource Management (HRM)

- Procurement and Supply Chain Management (SCM)

- Sales and Marketing

- Accounting and Finance

- Customer Service Support

- Others

By Industry Vertical

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Manufacturing

- Others

Key Global Business Process Management Industry Players

- IBM

- Oracle

- SAP

- Pegasystems

- Software AG

- Appian

- TIBCO Software

- Bizagi

- Nintex

- OpenText

- Newgen Software

- BP Logix

- Bonitasoft

- Fujitsu

- Signavio

- Intalio

- AgilePoint

- Ultimus

- Red Hat

- AuraPortal

- Creatio

- Genpact

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252