MARKET OVERVIEW

The global press hardened steel for automobiles market will continue to undergo revolutionary developments that extend way beyond the periphery it now occupies. As part of the automotive materials industry as a whole, this sector has already carved out a niche segment due to its use in vehicle safety, structural strength, and effective manufacturing. The future, however, will introduce complexities and scenarios into the picture that challenge current applications and establish doors that were not previously linked with press hardened steel.

In the near future, manufacturers will shift their focus away from traditional car platforms to advanced architectures focused on new mobility trends. Press-hardened steel, whose strength-to-weight ratio, will be not only re-conceived as a structural element, but also as a base layer in the construction of modular car structures targeting autonomous fleets and next-generation public transportation systems. Engineers will not just redesign the material for the future They will re-use its application, working hand-in-hand with digital simulation software and artificial intelligence-driven design tools to uncover new configurations.

The use of press hardened steel in multi-material structures will necessitate changes in joining techniques, coating techniques, and heat processing. Rather than being used separately, it will be a building block material interfacing lightweight alloys and composite reinforcements. This transition is going to need collaboration between me as a material scientist and process engineers in order to overcome compatibility challenges. The Global Press Hardened Steel for Cars Market will extend beyond impact zone or door reinforcement solutions it will move to more subtle yet vital areas of car infrastructure, including battery enclosures and underbody parts, particularly in electric vehicles.

The sustainability agenda will put a different kind of pressure on this market. Recyclability, energy usage in production, and lifecycle emissions as a whole will encourage companies to redesign supply chains and production habits. Closed-loop recycling and zero-waste manufacturing will be non-negotiable. The steel market will evolve to this end, and press hardened steel will be at the forefront of new metallurgical processes that are designed to meet regulatory requirements without compromising mechanical performance.

Data-driven manufacturing will increasingly determine the trajectory of this sector. Sensors embedded in production lines will track real-time micro-variations in pressure, temperature, and material thickness, allowing for levels of quality control previously unimaginable. This data will feed design feedback loops, allowing vehicle components to be virtually iterated prior to physical production. Therefore, the Global Press Hardened Steel for Cars Market will be characterized not only by its materials but also by its deep embedding in predictive analytics and digital modeling.

The transformations that will occur in this market will extend far beyond current manufacturing and design attitudes. Schools, policymakers, and even end consumers will all have a part to play in shaping it. Vehicle safety and awareness of emissions will drive consumer choices that, in turn, will indirectly determine what types of materials the manufacturers will come to favor. Therefore, this market cannot remain in a vacuum within factory walls or auto design labs it will become an actual real-time ecosystem that is engaged with global sustainability goals, regulatory systems, and technology trends.

With the auto industry poised on the verge of a new age, global press hardened steel for automobiles market will set off on a journey that reshapes material usage, engineering practice, and standards of sustainability, forever revolutionizing how cars are thought of and produced.

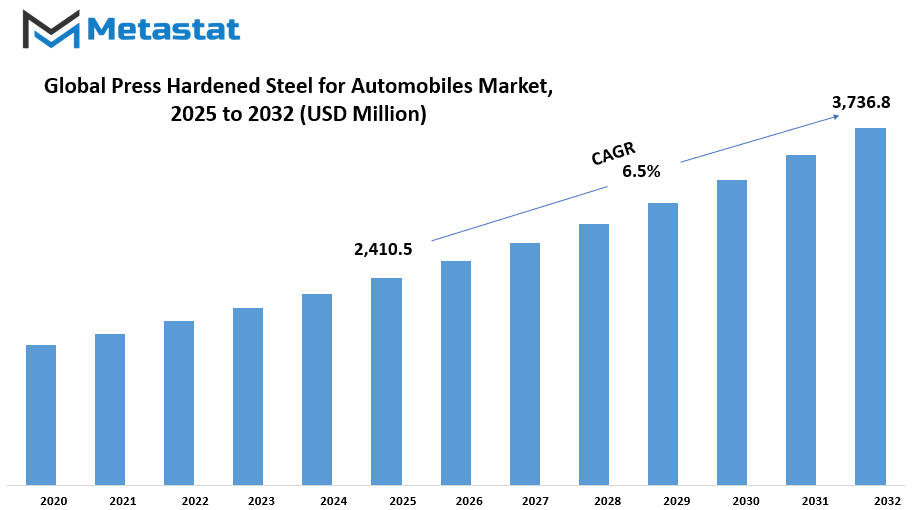

Global press hardened steel for automobiles market is estimated to reach $3,736.8 Million by 2032; growing at a CAGR of 6.5% from 2025 to 2032.

GROWTH FACTORS

The global Press Hardened Steel for Automobiles Market is projected to grow at a consistent pace driven by a growing need for lightweight and hard components in the manufacture of automobiles. Manufacturers of cars are continually seeking a way to minimize the weight of cars without the loss of performance or safety. Lightweight cars not only improve gas mileage but also cut carbon emissions. With environmental concerns continuing to change the automobile industry, producers are now looking to materials that meet safety as well as sustainability goals. Press hardened steel is a sound solution as it can achieve high strength without weight addition, making it a first pick when it comes to designing new cars.

Government policies are also pushing the shift. In the majority of countries, stringent laws have been passed to reduce vehicle emissions and increase fuel efficiency. These necessitate innovation on the part of manufacturers and seeking materials that allow this to occur without any compromise on safety. Press hardened steel is particularly appropriate in this regard as it contains strong yet light material. This allows engineers to create safer bodies for vehicles, which use less material and are lighter overall. This weight-to-strength ratio is becoming increasingly important than ever before in the present market. However, despite the apparent advantages, there are challenges which deter the growth of this market.

The main challenge lies in the extremely high production cost of press hardening technology. The process involves high-tech heating and cooling processes that require specialized tools and machinery, which are expensive to set up and maintain. These costs make it difficult for the small-scale producers to adapt to the technology. Additionally, few workers have been trained and qualified technicians to operate the machinery used in press hardening. With this shortage, there is a gap between demand and capability to provide it effectively. There are still high chances for growth despite these challenges.

Furthermore, advancements in manufacturing technologies are simplifying the process. Not only do these technologies minimize the cost of production but also maximize material performance, which is another driving factor in encouraging manufacturers to invest in the sector. Since innovation and industry support keep happening, the market will surely increase in the coming years.

MARKET SEGMENTATION

By Type

The global Press Hardened Steel for Automobiles Market continues to grow due to growing need for lighter but stronger auto components. The steel is mainly applied to improve the safety of vehicles without affecting the weight overall, which supports fuel economy and emissions regulations. Producers are currently focusing on the use of material that not only strengthens car bodies but also has better performance as well as environmental goals. Press hardened steel offers these benefits, which is why it continues to be the automotive engineers' preference.

Among the primary causes of the advancement in this sector is the growing emphasis on international safety standards. Governments worldwide are pushing motor vehicle makers to make cars more crashworthy. Press hardening steel, with outstanding strength after its high-temperature forming, complies with these safety standards. It is widely utilized in structural components such as door beams, bumper supports, and pillars, which need to absorb and transfer impact energy when a vehicle crashes. Meanwhile, this steel is also light enough to assist in reducing the total weight of vehicles.

Automotive companies are also using press hardened steel since it enables them to maintain both cost and performance levels. It is cheaper compared to other high-strength materials and not as hard to process when made in bulk. This makes it ideal for producers who want to make strong and light cars without driving costs too high. As electric cars begin to be more popular, the demand for materials that are strong and less heavy will continue to rise, adding to the market for press hardened steel growing even larger.

The market is divided by type to uncoated and coated steel. The coated type has a value of $1,133.7 million and is preferred because of its corrosion resistance, which is especially advantageous in harsh road or weather conditions. Uncoated steel is also highly demanded, especially where corrosion protection is not such an important concern. They are both important and are used depending on where they are needed in the vehicle.

As a whole, the global press hardened steel market for automobiles is expected to grow steadily. Due to its strong combination of safety, strength, and price, this material will remain critical in the future of auto production.

By Vehicle Type

The global press hardened steel for automobiles market is witnessing a steady growth with the growing demand for lighter and stronger material in automobile manufacturing. The most prominent reason for this shift is the growing demand to be fuel-efficient and decrease emissions. Car manufacturers are precisely looking for those solutions where they can reduce the weight of the vehicle without compromising on safety. And hardened steel comes into the scene here. It is renowned for its strength yet it is light, and therefore a good candidate to use when producing the structural component of a car, like pillars, door beams, and bumper reinforcement.

Depending on vehicle type, the market is divided into Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles. Passenger vehicles dominate the majority of this market. With greater consumer demand for performance and safety, press hardened steel is being utilized heavily to form strong yet light car bodies that improve crash resistance without adding to extra weight. Light commercial vehicles are also showing increasing use of the material, especially as small businesses and logistics services expand. Such vehicles need to be fuel-efficient and also have to be reliable, and press hardened steel makes both feasible. Heavy commercial vehicles also benefit from the power of this material. In large transport vehicles and lorries, durability and safety are paramount considerations, and this steel actually helps manufacturers meet such demands.

The sector is also impacted by new government policies that encourage reduced emissions as well as better fuel efficiency. These are not only impacting the way motor vehicles are built but also encouraging innovation in materials. Consequently, firms are spending a lot of money on research to discover new applications of press hardened steel and how to get the most out of it. The Asia-Pacific region is currently the leader in usage and production, particularly with the overwhelming auto production dominance of auto manufacturers in China, Japan, and South Korea. Europe and North America are also key participants, with an emphasis on how to make the most out of high-end materials in order to achieve environmental targets as well as customer demands.

Overall, the global press hardened steel for automobiles market will grow further as car manufacturers look for ways to make stronger, safer, and more efficient vehicles. With demand increasing in every type of vehicle and market, the material is becoming a key focus of the car design and manufacturing of the future. As the trend goes forward, press hardened steel will lead the way in helping makers get the best balance of safety, performance, and efficiency.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,410.5 million |

|

Market Size by 2032 |

$3,736.8 Million |

|

Growth Rate from 2025 to 2032 |

6.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

.

REGIONAL ANALYSIS

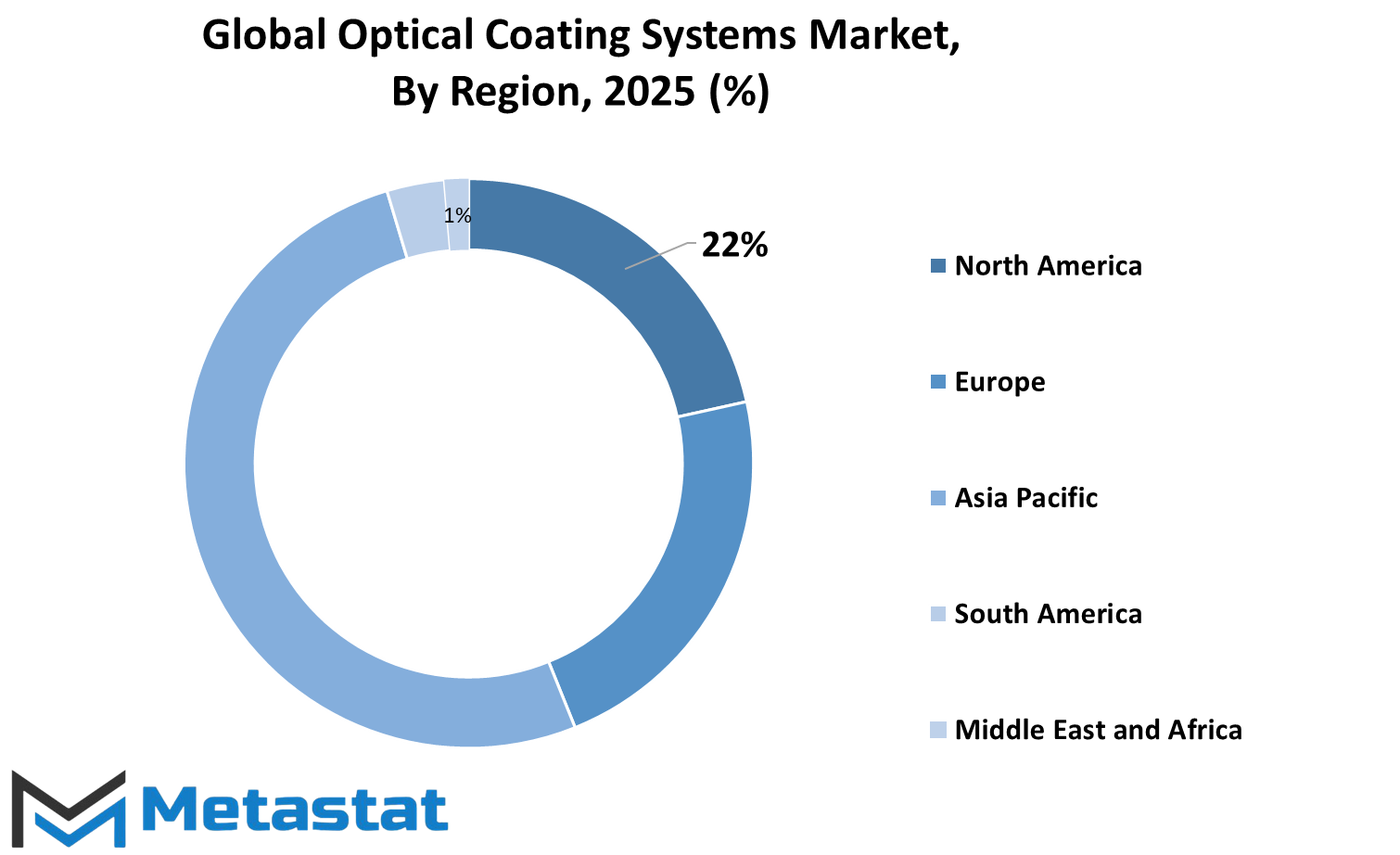

Geographically, global Press Hardened Steel for Automobiles Market is divided into several major areas to indicate the total supply and demand of materials. Areas include North America, including the United States, Canada and Mexico. These countries are a significant presence in the market due to its well -developed motor vehicle industries and invested in vehicle safety and light materials. Demand in this region will continue to increase as more and more companies change towards strong and light vehicle components. In Europe, the market is divided into the United Kingdom, Germany, France, Italy and the rest of Europe.

Germany lives among the leading contributors due to its strong car manufacturer Aadhaar as well as focusing on state-of-the-art construction technologies. Countries such as France and UK show continuous growth with their efforts to achieve emission levels and fuel efficiency using advanced steel products in automobile production. The rest of Europe chases in this trend, runs the use of press-kiss steel in vehicle design. One of the fastest growing regions includes India, China, Japan, South Korea and the rest of the Asia-Pacific.

China and India are the major markets due to their huge population, growing vehicle production and increasing needs of safe and fuel-skilled vehicles. Japan and South Korea also play a major role behind material technology progression with homegron automotive brands. There is a possibility of expanding on the back of the car ownership with increasing urbanization in the region. In South America, the major nations are Argentina and Brazil, along with other neighboring countries in the rest of South America.Brazil leads the region due to its large auto manufacturing sector. Although the increase in the market of the region may not be as much standing as the Asia-Pacific, it is a noticeable step towards the use of more durable materials in the production of cars to maintain security levels and reduce vehicle weight.

The Middle East and Africa region consists of the GCC countries, Egypt, South Africa and the rest of the people from the Middle East and Africa. South Africa has a developed motor vehicle region, while the GCC nations are trying to strengthen their manufacturing capacity. Although the region may currently have a low share of global market, its capacity will increase as regional demand for infrastructure maturity and high -performing vehicles increases which compete globally.

COMPETITIVE PLAYERS

The global press hardened steel for automobiles market is exhibiting sustained growth thanks to growing demand for lighter and stronger material in car production. As the automotive sector focuses on fuel efficiency and safety, press hardened steel is increasingly gaining significance. Such steel is subjected to a special process that renders it far stronger than standard steel, enabling car manufacturers to construct cars that are both safe and light. Such advantages find particular use in complying with stringent environmental and safety regulations without elevating the cost of production.

One of the primary drivers of the increased application of press hardened steel is the interest in keeping the weight of the automobile down. A lighter automobile requires less fuel, resulting in lower emissions and improved mileage. But safety cannot be compromised, and that's where press hardened steel becomes a help. It offers the strength necessary to safeguard passengers in a crash but maintains the total weight of the vehicle at a minimum. This perfect balance between strength and weight is what makes it so precious to the automotive sector.

Most of the major players are dominating this market and investing money in technology to enhance steel performance. ArcelorMittal, SSAB, Nippon Steel Corporation, voestalpine Stahl GmbH, thyssenkrupp Steel Europe AG, Hyundai-Steel, AP&T Group, Jobro Sheet Metal Technology AB, JFE Steel Corporation, and Baosteel Group are all contributing towards making the future of this material. They are developing new ways to strengthen and make more flexible steel components, which will assist automobile manufacturers in creating safer and more efficient vehicles.

The market is also being influenced by the increasing popularity of electric vehicles. Electric vehicles tend to have heavy battery packs, so employing tough and light materials such as press hardened steel is effective in balancing the overall weight. As electric vehicles increase in numbers, the demand for innovative steel solutions is expected to follow suit.

Moreover, numerous automakers are increasingly relying on press hardened steel for components like bumpers, roof rails, and door beams, where strength and weight are of equal importance. As research and development continue, the material is likely to become even more efficient and simpler to work with in different designs. As increasing numbers of companies utilize the material and enhance production methods, press hardened steel will continue to be a leading force in the future of automobile manufacturing.

Press Hardened Steel for Automobiles Market Key Segments:

By Type

- Coated

- Uncoated

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Key Global Press Hardened Steel for Automobiles Industry Players

- ArcelorMittal

- SSAB

- Nippon Steel Corporation

- voestalpine Stahl GmbH

- thyssenkrupp Steel Europe AG

- Hyundai-Steel

- AP&T Group

- Jobro Sheet Metal Technology AB

- JFE Steel Corporation

- Baosteel Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383