MARKET OVERVIEW

The global polybutadiene rubber market is at a fascinating crossroads in the larger synthetic rubber market, showing a trajectory that reaches much deeper than conventional data and surface-level predictions could possibly indicate. Though its application in tire production and other industrial uses remains important, the future of this market will be influenced to a great extent by technological discovery and the readiness of the industry to embrace newer frontiers in materials science. With advancements in synthetic rubber technologies, the future of polybutadiene rubber will be decided less through the volume of its production and more by the ways in which it will be altered, compounded, and used in unpredictable industries.

The future trends of the global polybutadiene rubber market will not be restricted to known industrial fields. The increasing demand for resilient, low-temperature-resistance materials in space technology and harsh climate engineering can place polybutadiene rubber at the forefront as a candidate of choice. Such new environments pose certain polymer needs, and by adjusting its molecular weight and crosslinking trends, polybutadiene might be engineered to address the new requirements. It is not far-fetched to consider that space vehicle insulation, deep-sea instrumentation, or Arctic-quality components can use this rubber in new configurations.

As for that, academic and business research will still be migrating away from merely producing more rubber and towards producing higher-quality rubber. The global polybutadiene rubber market will thus probably experience a change brought on by material innovation. Research ongoing in hybrid elastomer systems, for example, could soon introduce new composites that fuse polybutadiene with materials such as graphene or bio-based polymers. This may generate a new generation of rubbers with greater tensile strength, chemical resistance, or degradability in the environment each holding the prospect of an unseen application.

The long-term vision of the market will also be influenced by sustainability. As businesses worldwide shift toward decreasing their carbon footprint, the manufacturing of polybutadiene rubber could see some major change. Biotechnological processes can even substitute certain petroleum-derived inputs, allowing the introduction of semi-synthetic rubbers that have the advantages of polybutadiene with lowered environmental issues. The circular economy concepts might also make the manufacturers invest in rubber reclaiming, recycling, and reprocessing technologies such that polybutadiene continues to be relevant in a world with emphasis on long-term environmental equilibrium.

Outside of its historical strongholds, the global polybutadiene rubber market may cross over into the medical industry as well, particularly in creating flexible, durable elements for wearable health devices. As the need for bio-compatible materials continues to grow, particularly those that don't incite allergic reactions and can handle constant motion, polybutadiene may have uses that previously belonged to silicones and thermoplastic elastomers.

Although the fundamental commercial uses of polybutadiene rubber will hold firm, it is the unexpected, the unconventional, and the innovative that will actually shape the global polybutadiene rubber market of the future. As global industries seek out performance materials that defy conventional wisdom and transcend functional barriers, it is a market that will not only evolve but potentially redefine itself in ways as yet unconceived.

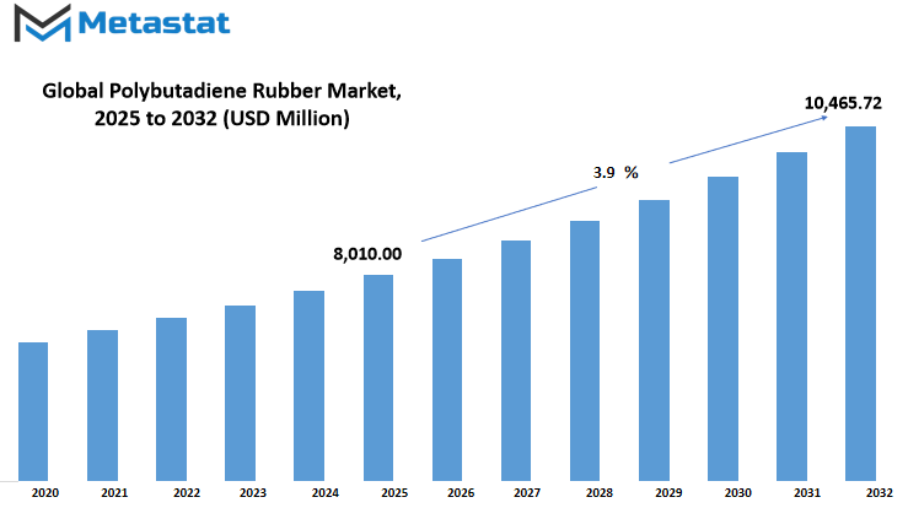

Global polybutadiene rubber market is estimated to reach $10,465.72 Million by 2032; growing at a CAGR of 3.9% from 2025 to 2032.

GROWTH FACTORS

The global polybutadiene rubber market is witnessing tremendous momentum with increasing demand throughout diverse principal enterprise verticals. One of the key drivers for this boom is the rising production of automobiles, in particular in developing countries. PBR is a very essential material for tire production because it possesses excellent wear resistance and low rolling resistance, which aids in fuel economy. With automobile companies increasing production to fill the demand of consumers and overseas exports, the demand for quality rubber parts particularly tires keeps rising. This consistent demand from the automobile sector should maintain the market dynamic and competitive in the immediate future.

The growth of the construction and manufacturing sectors is another factor that is significantly contributing to the growth of the market. PBR products find application in different industrial uses such as conveyor belts, insulating materials, and rubber mats. As more infrastructure works are undertaken and heavy industries expand their operations, the demand for synthetic rubbers such as PBR increases automatically. All these industries derive advantage from the flexibility and durability PBR provides, hence the choice material in harsh work conditions. This extensive usage beyond the automobile industry further widens the scope of the market's potential and maintains demand fairly constant.

There are also major challenges facing the global polybutadiene rubber market that might constrain its growth rate. One such challenge is the volatility in raw material prices. As PBR is produced synthetically from petroleum-based materials, crude oil prices immediately have an effect on production costs. This inconsistency makes it tough for producers to expand long-term price techniques and places strain on earnings margins. Moreover, increasing environmental worries concerning the cease-of-use disposal of synthetic rubbers have created sensitivities regarding the existence cycle of PBR products. These issues feed into increasing regulatory pressures and lead manufacturers to reconsider their waste and pollutants management.

All challenges aside, there are encouraging prospects ahead. The sector is seeing a gradual but visible transition towards sustainable synthetic rubbers. While companies start taking an investment in cleaner technology and alternative raw materials, innovation emerges as a vital key to upcoming development. This change is not only about sustainability it also presents competitive advantage. Companies who shift early towards such trends of sustainability have more chances of reaping consumer confidence and regulatory benefits. These developments unlock opportunities for new product, and new market segments that enable the PBR market to tap new ground while responding to global issues.

Forward, although there are uncertainties, the global polybutadiene rubber market is set to experience strong potential driven by industrial expansion and development of sustainable methods. As there is a direct correlation between the development of automobiles and industry and demand for synthetic rubbers, the market is set to advance further. Development of environmentally friendly alternatives will be a determining factor in how effectively the industry manages future challenges and addresses shifting expectations worldwide.

MARKET SEGMENTATION

By Product

The global polybutadiene rubber market is poised to develop steadily within the coming near years, fueled by way of the giant utility of this product in car, construction, and footwear industries. Characterized by means of high put on resistance and capacity for repeated strain, polybutadiene rubber is extensively utilized in tire manufacturing, wherein it will increase performance, prevents overheating, and boosts gas economic system. With transport needs growing the world over, in particular in developing economies, demand for tires and consequently for polybutadiene rubber is also possibly to develop. The material additionally has use in golfing balls, conveyor belts, and different molded goods due to its elasticity and hardness.

Of the product types, High Cis polybutadiene rubber has the largest market share, worth around $5,525.45 million. High Cis type is extensively applied in tire manufacturing due to its higher mechanical properties and outstanding abrasion resistance. The reign of High Cis is likely to persist, particularly with key tire makers paying more attention to durability and safety. Low Cis, High Trans, and High Vinyl types are also categories in overall product differentiation. These grades are selected according to particular end-use demands, for example, the requirements of enhanced elasticity, higher tensile strength at various temperatures, or enhanced compatibility with other synthetic rubbers and plastics.

An increased trend towards electric vehicles (EVs) is a further driver of market drive. EV producers require materials that can minimize rolling resistance while providing grip and durability. Polybutadiene rubber, particularly High Cis, is an appropriate fit in these performance needs. Also, in view that stricter environmental legal guidelines force industries to undertake substances with higher performance and decreased power use, the position of synthetic rubbers along with polybutadiene becomes increasingly more important. Companies are also putting attention on enhancing production strategies in an effort to limit waste and decorate excellent, permitting lengthy-term marketplace boom.

Yet, the world additionally has a few demanding situations. The fee and supply fluctuations in uncooked substances in addition to deliver chain obstacles may also impact the value-effectiveness and manufacturing of polybutadiene rubber. The environmental problems surrounding the recycling and disposal of synthetic rubber products are also rising. All these problems are motivating the development of sustainable solutions and extra environmentally pleasant processing techniques. Nevertheless, existing infrastructure and dependency of the foremost industries on polybutadiene guarantee that call for for this product will by no means dwindle each time in the near destiny.

In the years yet to come, the global polybutadiene rubber market is expected to witness accelerated investment and innovation, with a focus on product development and overall performance improvement. The pass towards area of interest rubber grades that meet a variety of application necessities will inspire manufacturers to diversify their portfolios. As High Cis remain in ascendance, and with increasing consciousness on Low Cis, High Trans, and High Vinyl kinds for specialized makes use of, the market awaits a future described via the aggregate of commercial requirements and technological enhancement.

By Application

The global polybutadiene rubber market will keep on expanding steadily because it has widespread applications in a number of different industries. The production of tires is one of the most important uses, as it requires huge amounts of this product. Famous for its superior wear resistance and rolling resistance, polybutadiene rubber makes tires fuel-efficient and long-lasting. This makes it a top pick for numerous tire manufacturers globally, particularly as vehicle demand keeps increasing. As the automotive industry grows in emerging economies, this phenomenon is also expected to increase even more.

In shoes production, polybutadiene rubber is used extensively to make soles and different tough elements. Its durability and elasticity make it a really perfect match for regular, athletic, and commercial shoes. Its shock-soaking up assets presents consolation and prolongs footwear life, making it a established cloth for manufacturers. As humans are seeking comfort and overall performance of their normal put on, mainly sports and paintings settings, the demand from this marketplace will continue to stay sturdy.

Sports accessories too are a rapidly expanding market segment. Items such as golf balls, sporting equipment grips, and protective equipment are aided by the elastic and abrasion-resistant nature of polybutadiene rubber. This application is also enhanced by increased health consciousness and recreational activity among various age groups. The fact that the material can retain its properties even upon repeated use makes it an important commodity in the manufacturing of these items.

Other uses are in chemical industries and in modifying polymers. Polybutadiene rubber finds common use in enhancing the impact strength of plastics and creating new materials that have improved mechanical properties. This has led to its application in packaging, consumer appliances, and construction. With industries looking to enhance the performance with not an increase in cost, the utilization of polybutadiene rubber in these fields is expected to increase.

Overall, the global polybutadiene rubber market will gain from its vast presence in conventional and growing packages. With ever-evolving improvements in materials technological know-how and the call for price-green, long-lasting, and flexible answers, polybutadiene rubber will continue to be applicable throughout industries. Its awesome capabilities make it properly-suited for in addition application in daily products and commercial tendencies alike.

By Distribution Channel

The global polybutadiene rubber market is more and more gaining momentum as organizations seek substances that promise strength, flexibility, and resistance to put on. With its excessive resilience and occasional warmth technology, polybutadiene rubber unearths substantial utility in tire production, automobile components, and business products. With increasing call for lightweight and durable substances in the car and creation industries, this rubber remains an green alternative. Its feature in reducing rolling resistance in tires and increasing gasoline efficiency has brought about it becoming even extra attractive to manufacturers that emphasize overall performance and sustainability.

Distribution-smart, the global polybutadiene rubber market is divided among on-line and offline channels. The offline channel still remains properly-placed, in particular in regions where industrial shoppers are willing in the direction of traditional procurement strategies. Most groups depend upon long-status supplier relationships, neighborhood distribution centers, and direct negotiations to maintain a reliable deliver chain. Offline channels aid physical fine inspections or even faster transport inside centered geographies. Furthermore, bulk purchases and bespoke packaging are also easier to manipulate via those traditional channels, whose enchantment does now not fade in an environment of dependence on reliability and consistency.

But the online platform is rapid catching up. With better digital infrastructure and steady price systems, more customers are trying to on-line structures for their rubber wishes. This trend is specifically discernible amongst small and mid-sized firms, which locate it easier to supply on line and typically more in your price range. E-trade portals and specialised B2B web sites are facilitating the shopping for process, with complete product precise specifications, price comparisons, and user reviews all in a single place. This convenience is fueling greater use of digital selling channels in both developed and emerging regions.

As the patterns of global trade continue to evolve, online distribution will increasingly influence the dynamics of markets. While offline selling will be resilient in mainline industrial areas, online channels will cover more customers, extending to buyers in territories hitherto regarded as out of reach. More rapid shipping capabilities, improved inventory control, and customer support assistance are making the online channel more attractive than ever. Nevertheless, the channel choice is frequently a matter of the purchaser requiring speed, volume, or customization.

In fashionable, the global polybutadiene rubber market will keep growing with its sizable packages and the moving scene of material sourcing and promoting. Online and offline channels each have their very own strengths, and their co-life will allow providers to reach a extra various and annoying patron base. The future challenge could be ensuring that distribution is efficient, but is capable of fulfill growing demands for excellent and cost-effectiveness.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8,010.00 million |

|

Market Size by 2032 |

$10,465.72 Million |

|

Growth Rate from 2025 to 2032 |

3.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

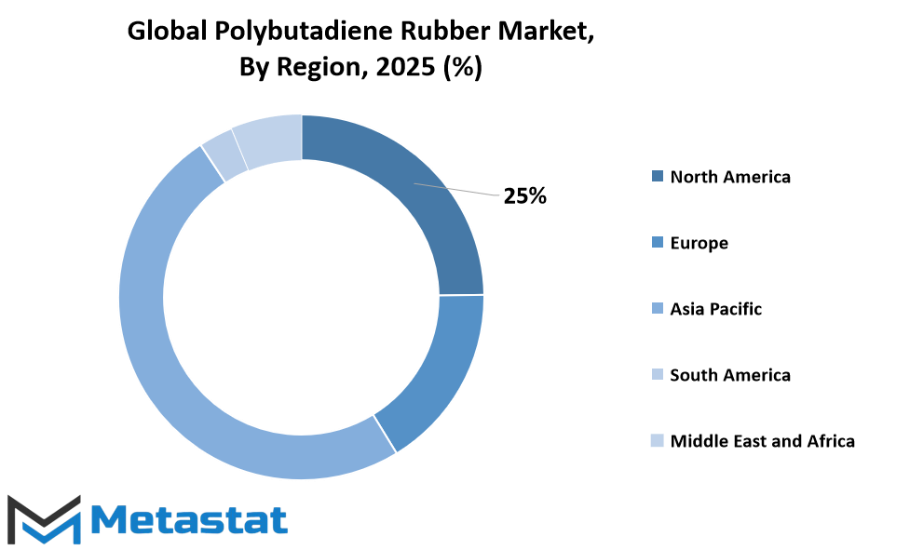

The global polybutadiene rubber market reflects evident disparities when examined region-wise across various geographic areas. In North America, nations such as the U.S., Canada, and Mexico continue to reflect stable demand, primarily fueled by the robust presence of automotive and tire manufacturing sectors. The U.S. is particularly noteworthy with its strong established industry base and ongoing research and development in rubber products. Canada and Mexico also make important contributions by way of trade associations and increasing industrial operations, thereby ensuring the region's equilibrium presence in the market.

In Europe, nations such as the UK, Germany, France, and Italy establish the market dynamics, where industrial development and ecological concerns are primary determinants. Germany, with its automobile industry, understandably has a greater application of polybutadiene rubber in tires. France and Italy pattern the same way, although they also contribute in different rubber-based manufacturing activities. The rest of Europe supports with smaller but stable markets. By and large, Europe's emphasis on sustainability and quality production has kept it in the scene in the global landscape.

Asia-Pacific is where most momentum is being built. China, India, Japan, and South Korea are spearheading gigantic growth due to industrialization, urbanization, and increasing consumer demand. China, as a leading producer and consumer, presses enormous amounts through its large manufacturing base. India's growing auto and construction industries are also driving market growth. Japan and South Korea, although mature markets, are driving through high technologies and export. The rest of Asia-Pacific maintains its importance through regional demand and cross-border trade.

South America, spearheaded by Brazil and Argentina, demonstrates an increased interest in polybutadiene rubber, primarily for automotive and industrial applications. The market size is smaller in this region than elsewhere, though, and continued investment in local manufacturing and infrastructure suggests potential growth. Brazil is the central hub, with prospects for future market development. Argentina and the other regional countries are slowly ramping up their consumption, though at a reduced rate.

The Middle East & Africa region, comprising the GCC Countries, Egypt, South Africa, and the surrounding regions, is comparatively less developed but not devoid of opportunity. The GCC countries are employing their plans for industrial diversification to enhance chemical and rubber manufacturing. Egypt and South Africa add their share with their expanding automotive and mining industries. Though the market in these countries is yet to mature, sustained investment in manufacturing and trade infrastructure will extend support to gradual growth over the next few years.

COMPETITIVE PLAYERS

The global polybutadiene rubber market will remain an important contributor to various industries, particularly the automotive and tire industries. Due to its extreme wear resistance as well as its capacity to support repeated stress, polybutadiene rubber is the most commonly used rubber in tire manufacturing to improve performance and longevity. With increasing demand for cars in both developing and developed worlds, producers will be looking to find materials that are not only cost-effective but also possess high mechanical properties. Demand will keep polybutadiene rubber on the radar as companies look to satisfy performance criteria while controlling costs of production.

Besides the automotive industry, applications in shoes, plastics, and electronics will further boost overall demand. Its toughness, wear resistance, and good low-temperature properties make it a consistent material throughout these uses. In golf ball, hose, belt, and coating production, polybutadiene rubber continues to demonstrate its worth. These consistent areas of use indicate that the market will continue steady growth, even as producers seek new means of enhancing processing and quality of synthetic rubber.

Top players in the global polybutadiene rubber market will continue to be integral to the way the market develops and expands. Major players include ARLANXEO, Indian Oil Corporation Ltd, ENEOS Materials Corporation, Kumho Petrochemical, LANXESS, LG Chem, Reliance Industries Limited, SABIC, SIBUR International GmbH, Synthos, UBE Corporation, ZEON CORPORATION, KURARAY CO, LTD, Versalis SpA, and Globus Rubchem Pvt Ltd. These gamers are concerned with increasing production capacity, optimizing supply chain efficiency, and creating sophisticated formulations that are aligned with environmental and regulatory requirements. Their innovations will establish the path for the whole marketplace, particularly as sustainability becomes an increasing issue across various industries.

Meanwhile, the global polybutadiene rubber market will have to overcome certain issues. Price volatilities in raw materials and increasing issues regarding environmental impact can influence production expenses and supply. Businesses are, however, starting to pursue sustainable options and effective processing techniques, which can potentially decrease waste and emissions in the long run. Governments and international institutions are also contributing by promoting the adoption of cleaner technologies and recycled content, providing businesses with new avenues for innovation.

In summary, the global polybutadiene rubber market will continue to be dynamic as it's influenced by evolving industrial needs, sustainability objectives, and ongoing innovation by dominant producers. With industries depending on robust and adaptable materials, polybutadiene rubber stands to continue its status as a mainstay in manufacturing processes globally.

Polybutadiene Rubber Market Key Segments:

By Product

- High Cis

- Low Cis

- High Trans

- High Vinyl

By Application

- Tire Manufacturing

- Footwear

- Sports Accessories

- Other Applications (Chemicals, Polymer Modification, etc)

By Distribution Channel

- Online

- Offline

Key Global Polybutadiene Rubber Industry Players

- ARLANXEO

- Indian Oil Corporation Ltd

- ENEOS Materials Corporation

- Kumho Petrochemical

- LANXESS

- LG Chem

- Reliance Industries Limited

- SABIC

- SIBUR International GmbH

- Synthos

- UBE Corporation

- ZEON CORPORATION

- KURARAY CO, LTD

- Versalis SpA

- Globus Rubchem Pvt Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252