Global Pest Control Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

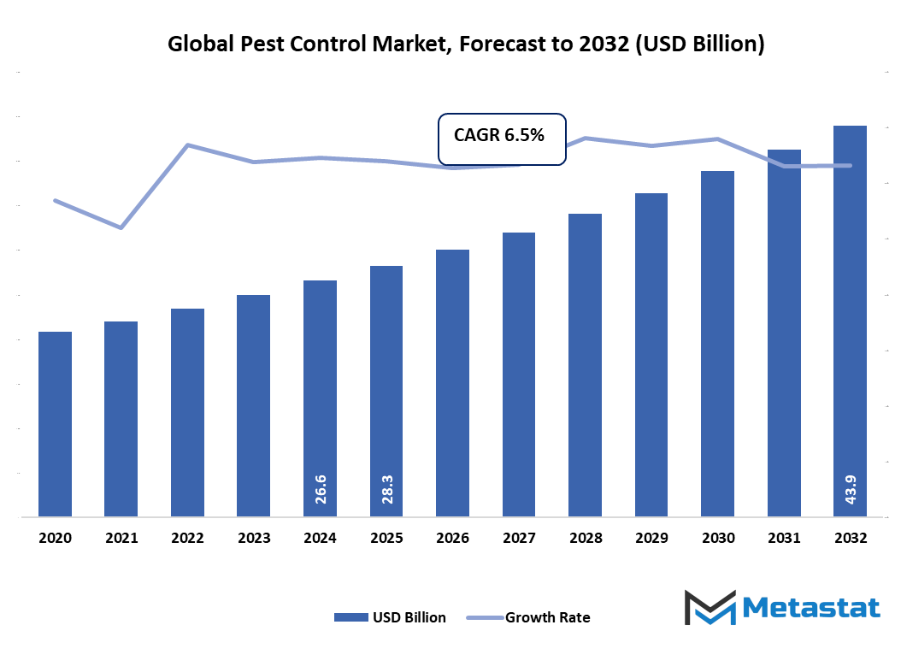

- Global pest control market valued at approximately USD 28.3 Billion in 2025, growing at a CAGR of around 6.5% through 2032, with potential to exceed USD 43.9 Billion.

- Powder account for a market share of 11.1% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Increasing concerns over food safety and public health, Rising urbanization leading to higher pest infestations

- Opportunities include: Growing demand for eco-friendly and biological pest control solutions

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global pest control market will be a niche division within the overall environmental services sector, with emphasis on protecting human health, agricultural output, and building integrity from pest organisms. The market is going to exceed the scope of home remedies to cover a huge variety of services and products that are designed for commercial buildings, food processing plants, agricultural fields, and public infrastructure. Moreover, it will combine the three main technological areas: chemistry, biology, and mechanics to eliminate pests that have the potential to cause insects, rodents, termites, and other destructive pests to materials, and at the same time, comply with safety and environmental regulations.

Moreover, the sector is likely to move increasingly further from its prior reliance on traditional methods and instead adopt more advanced applications, such as monitoring technology and ecologically sound practices, as the trend continues. The International Pest Control Market will be the meeting point between public health requirements and environmental issues, in response to growing concerns about the transmission of disease and food safety. It will also respond to regional problems, as the incidence of infestations will differ based on climate, urbanization, and agricultural cycles. This will provide a context in which local knowledge and international innovations collaborate, establishing new standards of efficiency and dependability.

Over the next few years, the global pest control market will not just provide instant safeguarding but also determine long-term approaches to prevention and risk management. It will continue to drive the manner in which governments, industries, and homes plan ahead for environmental shifts and protect resources. Integrating science-backed solutions with operational flexibility, the market will emerge as a key component to ensuring safety, stability, and sustainability in many sectors globally.

Market Segmentation Analysis

The global pest control market is mainly classified based on Mode of Application, Type, Pest Type, Application.

By Mode of Application is further segmented into:

- Powder: One of the top powdered pest control products that are widely used in the global pest control market will most probably remain their most significant application due to their simple usage and their success. Moreover, they are expected to become not only long-lasting but also safe, eco-friendly, and effective in controlling pests both in households and industries thus reducing chemical exposure.

- Sprays: It is predicted that in the market, the use of sprays will remain one of the main methods of pest control and they will be able to provide a quick, targeted killing of pests as they have always done. The development of sustainable and bio-based sprays will lower the impact of the pollution, help in safety, and provide the detailed part of the area, which is efficient for both city residential area as well as vast commercial areas.

- Pellets: Pellets in the market will become more significant as they provide controlled, slow-release activity against insects. Smart pellet formulations will provide prolonged performance and lower toxicity, enabling safer use in homes, fields, and industrial areas, without compromising convenience and efficiency in pest control.

- Traps: Traps are likely to witness a significant rise in their share of the market as the popularity of non-chemical solutions continues to grow. One such advanced trap technology is a sensor-equipped and auto-alert-enabled trap that allows for easy pest control and monitoring, thus being an ideal solution for both urban and rural areas where efficient and eco-friendly pest control methods are required.

- Baits: Pest baits would be the centerpiece of the global pest control market by Nature of their specificity. Future innovation will likely revolve around creating species-specific, environmentally safer baits with lowered collateral environmental impact but still maintaining high effectiveness of insect, rodent, and other pest species control over a wide variety of application areas.

By Type the market is divided into:

- Insecticides: Insecticides is still the front-line weapon of the global pest control market. Such products will be the new ones in which biodegradability and safety will be the key features. New techniques will concentrate on the targeted performance, which will not only decrease the damage to the non-target organisms but also increase the effectiveness of resistant pests and be appropriate for commercial as well as domestic use globally.

- Rodenticides: Rodenticides is going to be one of the high-quality products in the market in particular in Agriculture and Cities keeping up with the trend. The safety of humans and pets will be improved by the emerging technologies in controlled-release and low-toxicity rodenticides without compromising high efficacy against rodents and thus, promoting sustainable pest control.

- Microbials: Microbials will be the leading force of the Pest Control Market Global, as they are natural and eco-friendly. In the future, bacteria, fungi, and viruses will be the tools to eliminate pests entirely and not pollute the environment and crops, thus making microbial pest control a clean solution for both agriculture and industrial sectors.

- Plant Extracts: Natural plant extracts are slowly becoming more influential in the market due to the rising demand for natural products. Neem, citronella, and other similar plant extracts will be transformed into sprays, powders, and baits that are effective and safe, non-toxic, and environmentally friendly will be used both for domestic, commercial and agriculture purposes.

- Predatory Insects: Predatory insects are becoming a sustainable source of the market. These biocontrol agents will be more and more used as a part of integrated pest control programs, whose target is to eliminate pests that destroy the crops, without the use of chemicals, thus making it possible to have eco-friendly farming and a lesser use of synthetic pesticides.

- Traps: Despite the growing use of new technologies, traps still play an important role in the market as they deliver targeted, chemical-free pest management. Next-generation designs will feature smart sensors, automatic alerts, and better capture efficiency that will allow users to oversee and control the pests effectively in residential, commercial, and agricultural settings while as well as reducing the environmental impact.

- UV Radiation Devices: Devices that emit UV radiation are becoming a major non-chemical method of insect control in the market. The progress made in energy-efficient UV technology combined with the implementation of sensors to make the device more effective, less power-consuming and safer, as well as friendly to the environment, will allow its use in residential, commercial, and industrial pest control applications.

- Mesh Screens: Mesh screens are one of the commonly used methods to keep bugs and other pests out of a place in the market. The use of materials that are durable, weather-resistant, and fine-mesh will help to increase protection, and the lightweight and easy-to-install designs will allow them to be suitable for houses, offices, farms, and public spaces, thus ensuring long-term, maintenance-free pest prevention.

- Ultrasonic Vibrations: Ultrasonic vibration gadgets are becoming the future of pest control in the global pest control market. They use high-frequency sound waves, which are inaudible to humans, to scare pests away without the use of chemicals, thus providing a safe, environmentally friendly, and silent alternative for residential and commercial environments. Works on further improving the range of coverage, energy consumption, and the ability to keep away more than one kind of species at a time will continue to be done in the future.

- Others: Besides this, other new approaches will also bring about a positive development in the global pest control market which will be represented by such innovative technologies as smart technology, artificial intelligence-based monitoring systems, and hybrid methods that combine mechanical, chemical, and biological methods, offering complete and advanced solutions for pest management across industries.

By Pest Type the market is further divided into:

- Insects: Insects will become the leading demand of the global pest control market, as they are one of the most threatening pests that can destroy properties, food, and health. Emerging chemical and biological compounds will provide rapid and sustainable control, while electronic monitoring devices will prompt detection and prevention strategies in households, farms, and business establishments.

- Termites: Termites are going to lead the demand for specialized products in the global pest control market because they are one of the most destructible pest natures. New baits, treated barriers, and environmental termiticides will be used for protecting residential and commercial buildings against termite attacks, while at the same time, helping in reducing environmental pollution and maximizing the performance of long-term termite control.

- Rodents: Rodents will be one of the main concerns in the market and will still be prioritized because of the threat they pose to food safety and properties. Smart traps, targeted baits, and low-toxicity rodenticides will propel control options ahead, while integrated tactics will support prevention and monitoring in urban, industrial, and agricultural areas.

- Mosquitoes: Mosquitoes will be the driving force behind innovation in the market due to their potential for spreading vector-borne diseases. The future roadmap will also feature biological control, repellents, and eco-friendly insecticides apart from online monitoring and predictive modeling for containing outbreaks and safeguarding public health.

- Birds: Birds are a major source of trouble in the market. Their potential to destroy crops, property, and food storage is the main reason. Humane deterrent systems, acoustic devices, and exclusion methods will be the future solutions that not only manage populations efficiently but also minimize ecological disturbance and ensure safety in urban, agricultural, and commercial areas.

- Wildfile: Nature management is being recognized as a pivotal issue in the market as the spread of urban areas and human activities are causing multiple human-wildlife interactions. To maintain public safety without compromising the ecological balance and biodiversity, solutions including smart monitoring, humane traps, and habitat management strategies will provide the necessary help in controlling populations in a responsible way.

- Others: The global pest control market size will be fueled by the inclusion of other pest species such as fungi, mites, and ants. Homeowners, the commercial sector, and agriculture will benefit from the solutions made possible by the steady stream of R&D and technology adoption which targets safety, efficacy, and sustainability.

By Application the global pest control market is divided as:

- Residential: Residential applications are going to stay as the major drivers of the global pest control market with the main factor being the need for safe and hygienic living areas. Ecologically-friendly aerosol, trap and bait will be the trend among homeowners while the advent of smart devices and the automated monitoring system will make the whole process of pest management more handy and less reactive for the dwellers of cities and suburbs.

- Commercial: Commercial applications, on the other hand, will be another area that will take the market to the next level. Offices, hotels, restaurants, and retail spaces will be the main factors in the rise of the demand of pest management solutions that are both effective and lasting. The future scenario will play a crucial role in this by offering the safety and hygiene aspects that employees and customers look for through the digital monitoring part of the integrated systems that will use all methods chemical, biological, and mechanical ones.

- Industrial: Besides these, the industrial applications will also be on the rise in the market, more so in the sectors of food processing, manufacturing, and warehousing. Some of the advanced solutions could be the use of automated traps, the production of durable devices for pest control and developing eco-friendly formulations that will not only maintain but also help in going beyond regulatory compliance. In addition to this, these solutions will also have the role to play in the reduction of contamination risks as well as supporting efficient operations in largescale industrial environments.

- Livestock: Moreover, the successful implementation of livestock applications will be the major contributor to the growth of the market not only just through providing animal health but also through stopping the pests that lower productivity or are carriers of diseases. The continuous use of biological agents and harmless chemical solutions coupled with integrated pest management will not only lead to the health of animals but assure higher yields and promote practices that are sustainable in the farm and dairy sectors.

- Others: The global pest control market will also be supported by applications-including public spaces, transport hubs, and educational institutions apart from the ones mentioned above. Customizing products and implementing preventive measures will be a must-have in the maintenance of hygiene and safety while the advancement of technologies will ensure precise pest control along with monitoring over a wide range of environments thereby posing fewer risks to humans and their property.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$28.3 Billion |

|

Market Size by 2032 |

$43.9 Billion |

|

Growth Rate from 2025 to 2032 |

6.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

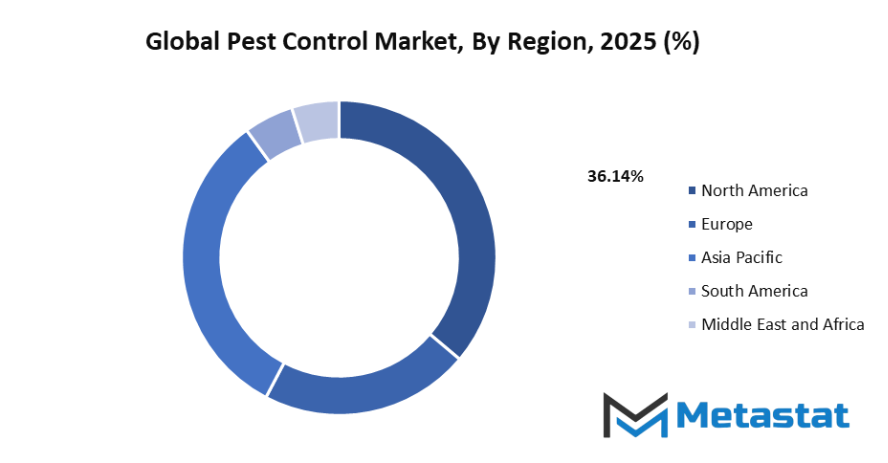

By Region:

Different regional characteristics will be the direct result of the global pest control market, influenced by the climate, the pattern of urban development, and the regulatory frameworks. In the North American market, which includes the U.S., Canada, and Mexico, advanced pest control technologies, strict safety regulations, and a widespread use of integrated pest management services will be the main features. Enterprises located in such territories will engage the issues of precision-targeted solutions, automated monitoring as well as eco-friendly chemicals, to be able to satisfy the requirements of both residential and commercial sectors.

Europe made up of the UK, Germany, France, Italy, and other countries will strive to achieve the use of pest control methods that are safe for the environment and also regulated. Suppliers will unveil products that are safe for the environment and service protocols that deal with health and ecology concerns of the region. Great health concern and awareness among both consumers and businesses will drive the use of professional pest services that help keep the pest population under control as well as meet regulatory requirements.

Urban population growth, industrial expansion, and acute sanitation needs will turn the region of Asia Pacific, including India, China, Japan, South Korea, and neighboring countries, into a major growth market. South America, led by Brazil and Argentina, will build-up its pest control infrastructure to back the region’s agricultural productivity and urban hygiene. The Middle East and Africa, made up of the Gulf Cooperation Council (GCC) countries, Egypt, and South Africa, will switch to present-day pest management techniques that will lessen the environmental and health difficulties in the various climatic situations. In all parts of the world, the global pest control market will be transformed by the incorporation of technology, the adoption of environmentally friendly practices, and the flexibility of service models that take into consideration the specific needs of people as well as nature.

Market Dynamics

Growth Drivers:

- Increasing concerns over food safety and public health: The global pest control market is being propelled by strengthening concerns about food safety and public health. Both consumers and the industries want solutions that are effective in avoiding contaminations and the spread of diseases, thus the introduction of advanced pest control methods that promise cleanliness, safety, and compliance in the areas of households, businesses, and industries is being encouraged.

- Rising urbanization leading to higher pest infestations: The market is getting a rise in urbanization which is leading to the increase of pest infestations. As cities and human settlements continue to expand, there is a rise in the number of infestations of rodents, insects, and other pests, so the companies are being forced to come up with new management strategies, integrated solutions, and monitoring technologies to keep the cities clean and safe.

Restraints & Challenges:

- Stringent environmental regulations on pesticide use: Strict environmental regulations that limit the use of pesticides have set bounds to the types of chemicals that can be used in the market. Meeting such standards by manufacturers means an investment in safer alternatives, certifications, and testing that can lead to an increase in production costs and a decrease in the availability of new products in all the regulated markets around the world.

- Health risks associated with chemical-based pest control methods: The health risks associated with the use of chemicals in pest control have limited the market's adoption of such methods. The concern about the exposure to toxic substances is raised by both consumers and businesses, who are now more eager to have safer and low-toxic solutions. Thus, companies need to ensure the safety of the products even if it means losing some effectiveness so as to keep the confidence of consumers and be in compliance with the regulations.

Opportunities:

- Growing demand for eco-friendly and biological pest control solutions: The need for environmentally friendly and biologically-based pest control solutions is being elevated, which is opening door opportunities for the global pest control market. A rise in the use of natural and biodegradable products, such as microbial agents, plant extracts, and predatory insects, is expected to be a key driver of market growth as these products will be implemented more broadly in the areas of agriculture, residential, commercial, and industrial applications for the sustainable pest management practices worldwide.

Competitive Landscape & Strategic Insights

The global pest control market will have the influence of both top-notch multinational corporations and smart local companies, resulting in a market that is characterized by competition from innovation, technology, and expertise in operations. Such big companies as Bayer AG, Corteva Agriscience, BASF SE, Syngenta AG, and Rentokil Initial plc will be the main drivers of the market through the provision of research-intensive solutions, the use of advanced chemical formulations, and the introduction of services for integrated pest management that are adaptable to varied ecosystems. In order to ensure standard quality, follow the regulations and reach a wide range of markets, these players will utilize their international footprint and technical know-how.

Moreover, companies in the local geographical area or those with a narrow focus such as Anticimex, Ecolab Inc., FMC Corporation, De Sangosse, Bell Laboratories, PelGar International, and Fort Products Limited are the ones that will bring forth a diverse market by addressing pests that are specific, along with the environments and the range of operations. These companies will be committed to sustainability, the development of eco-friendly products, and coming up with service models that can be easily accessed to meet the changing needs of both residential and industrial customers.

The company's strategic growth will be mainly focused on the adoption of the latest technologies, accuracy in the monitoring, and the use of methods that are environmentally gentle and yet effective to control the pests. The employment of data-driven methods, the use of predictive analytics, and the application of smart techniques will enable the companies to increase their efficacy while at the same time decrease the chemical exposure and the ecological impact. The relationship between global leaders and regional innovators will make it possible for the customers of the global pest control market to receive the most current and the most ecological approaches which would still be able to accomplish the varying pest management challenges around the world what continues to be a difficult matter of addressing pests in nature.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 28.3 Billion in 2025 to over USD 43.9 Billion by 2032. Pest Control will maintain dominance but face growing competition from emerging formats.

Over the next few years, the global pest control market will not just provide instant safeguarding but also determine long-term approaches to prevention and risk management. It will continue to drive the manner in which governments, industries, and homes plan ahead for environmental shifts and protect resources. Integrating science-backed solutions with operational flexibility, the market will emerge as a key component to ensuring safety, stability, and sustainability in many sectors globally.

Report Coverage

This research report categorizes the global pest control market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global pest control market.

Pest Control Market Key Segments:

By Mode of Application

- Powder

- Sprays

- Pellets

- Traps

- Baits

By Type

- Insecticides

- Rodenticides

- Microbials

- Plant Extracts

- Predatory Insects

- Traps

- UV Radiation Devices

- Mesh Screens

- Ultrasonic Vibrations

- Others

By Pest Type

- Insects

- Termites

- Rodents

- Mosquitoes

- Birds

- Wildlife

- Others

By Application

- Residential

- Commercial

- Industrial

- Livestock

- Others

Key Global Pest Control Industry Players

- Bayer AG

- Corteva Agriscience

- BASF SE

- Syngenta AG

- Rentokil Initial plc

- Anticimex

- Ecolab Inc.

- FMC Corporation

- De Sangosse

- Bell Laboratories

- PelGar International

- Fort Products Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252