MARKET OVERVIEW

The Global Patient Engagement Solutions market will work as an ever-shifting force in the healthcare technology industry, determining how interactions will develop among patients, providers, and health systems in years to come. Long gone will be the era of traditional approaches forged wholly upon clinical communication; this market will be moving toward ever-newer avenues, driven by deep personalization, digital integration, and behavioral analytics. The next era of health will not only focus on just increasing access or creating convenience but will actually be about mindful and connected journeys through healthcare for every individual.

Patient engagement will move beyond portals and appointment reminders. It will evolve into an ecosystem wherein real-time data, emotional health, and personalized pathways will play the prime roles. The Global Patient Engagement Solutions market will be the driver behind this process, altering the relationship between patient and health care from discrete clinical encounters to a continuous and collaborative experience. Going beyond the mere digitization of interactions, it will aim at predictive health interventions and active lifestyle management, with patients being equal partners in their health outcomes.

As health systems move away from volume-based care, the focus on outcomes will reengineer the structure and objectives of patient engagement platforms. Integrating these solutions into patients' daily lives will be an area of development starting shortly wearable tech, ambient interfaces, voice-assisted technologies, and AI-backed decision-making tools. The Global Patient Engagement Solutions market will be the engine driving this integration, allowing for a person-centered care environment in which technology anticipates needs rather than merely responds to them.

Another area for consideration is what types of trust the market will be building between patients and providers. Transparency, digital empathy, and personal health data control will become the new prerequisites rather than optional features. Ultimately, platforms in this space will likely operate within frameworks of data sovereignty, patient-driven preference, and psychological motivators for long-term engagement. Far-reaching change will include not only large hospitals and urban centers. First world-style rural and under-resourced areas, often overlooked by digital engagement efforts, will begin to derive benefits from decentralized engagement strategies supported by mobile-first solutions and localized content. The Global Patient Engagement Solutions market will quietly but gradually fill the accessibility gap in zones that were previously underprivileged by healthcare innovation.

Another area influenced by the market is research and population health. It will help to establish a proactive agenda for public health by elaborating aggregated and anonymized behavioral patterns. Engagement tools will form parts of comprehensive health surveillance frameworks, often helping communities manage diseases and prevent them in subtle, non-intrusive ways.

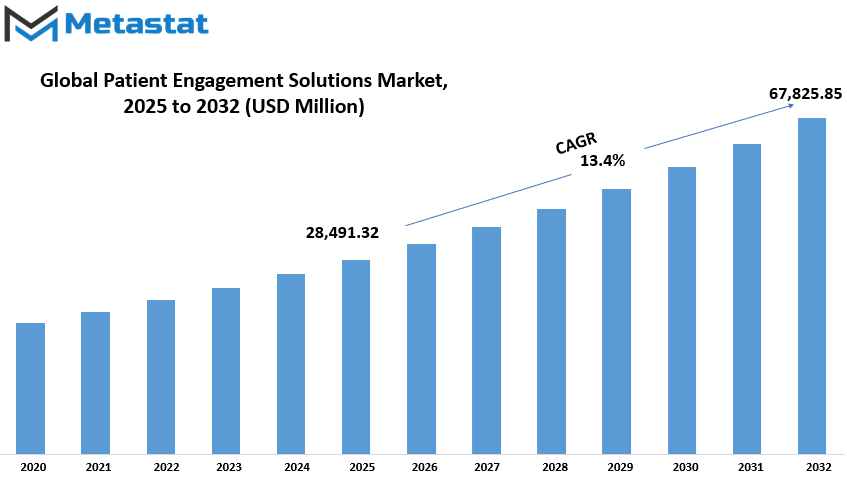

Global Patient Engagement Solutions market is estimated to reach $67,825.85 Million by 2032; growing at a CAGR of 13.4% from 2025 to 2032.

GROWTH FACTORS

As more individuals and healthcare professionals continue to lean towards digital tools that communicate and improve care, the Global Patient Engagement Solutions market has attracted considerable attention. The highest driving force for this development is through telehealth and mobile health applications that allow patients to access medical advice, self-monitor health, and connect with doctors. These tools specifically assist patients living in remote geographical areas or those who have constant schedules since they can eliminate frequent visits to clinics and facilitate ongoing care outside conventional settings. The undercurrent of this growing market is also fueled by the shift toward personalized healthcare and value-based care. These healthcare models center on individual patient needs and betterment rather than curing the illness. This will allow a physician to fashion a treatment plan based on the individual patient's history, behavior, and preferences, thereby enhancing patient satisfaction and subsequent results.

However, some challenges do exist. Arguably, the main issues surrounding these concepts are related to privacy and security of data. Patients are becoming very cautious about sharing and storing their health information; in a system where transparency and security lack, trust is bound to be massively compromised. Patients may simply avoid using digital tools if they want their data to remain secure, which is a massive constriction of the market. High implementation costs are another hurdle since they're very expensive for hospitals and clinics yet working with older systems. The transition to new technology plus the bridging of existing tools will take time and, of course, cost a lot. This could be difficult for smaller healthcare providers, and thus, the solution has a barrier in the cost of deploying the solution.

The future still seems bright despite those challenges. The enhancement in the usage of AI-powered chatbots and virtual assistants opens up new avenues for keeping patients engaged. Apart from answering frequently asked questions, they remind patients to follow medication schedules and track symptoms, making it easier for people to keep an eye on their well-being. These also lessen the load on the medical staff by allowing them to pursue more complex tasks. As these technologies continue to develop, they will be expected to create myriad opportunities for patient engagement while powering the overall future growth of this market.

MARKET SEGMENTATION

By Type

The global patient engagement solutions market is steadily rising, with the growing necessity of better interaction between healthcare professionals and the patients being the prime driver. At a time when all health systems across the globe are focusing on the quality and satisfaction of the patient services they provide, engagement mechanisms become more highly demanded. The most significant development in this respect is the introduction of AI-driven engagement projected to capture a $3,693.18 million market share. This will enable healthcare providers to better personal experiences for individuals through data analysis and understanding of patient needs, ultimately improving outcomes while reducing costs.

One other such vertical to contribute this growth is telehealth solutions, which have become significant especially in light of the current spotlight on remote care. With telehealth, patients can consult their physician from anywhere, providing convenience and reducing time in seeking care services, notably in rural or underserved areas. Patient portals are being evident features among these telehealth solutions. They allow patients restricted secure access to medical records and test results and facilitate direct physician messaging, appointment scheduling, or prescription refills.

Every other emerging type is remote patient monitoring, which is receiving close consideration in the market. Devices that measure blood pressure, glucose, or heart rate can relay real-time information to doctors so they can respond quickly if needed. Such monitoring will be particularly beneficial for patients with established chronic illnesses who require close supervision. In addition, population health management is also of relevance in that it allows health care organizations to monitor health data from a larger population. Consequently, through patterns identification, early actions may be taken to prevent disease spread or offer a better chronic care support system.

Appointment and medication reminders are great, easy-to-use and effective functions in this market. It usually reminds patients of their next doctor visit or when it's time to take medication. Though small, it can give major change to health outcomes. However, this market is not limited to these kinds of engagement; it includes many others, each contributing value by improving how patients present themselves with healthcare systems.

All of these varied types have come together to produce a future where patients will be more informed, engaged, and empowered in their care. As long as digital usage rises, Global Patient Engagement Solutions will keep growing and promoting better healthcare systems.

By Delivery

As more healthcare organizations seek ways to better connect with their patients, the Global Patient Engagement Solutions market is steadily rising. This connection comes in transit through the delivery mode of these solutions. In this market, delivery means two things: it is primarily classified into either Web/Cloud-based systems or On-premise systems. Each has its own importance depending on the requirements and resources with which any healthcare provider works.

Because they are seen as allowing easier access and greater flexibility, web/cloud-based solutions are becoming the preferred solution. The cloud-based platform allows healthcare professionals and patients to communicate, make health records available, and track progress almost anywhere, provided that there is internet connection. These systems are automatically upgraded, which saves healthcare providers from spending extra time and money for the maintenance of the software. Thus, for a great number of hospitals and clinics, especially those with limited IT staff or space, it is really practical and efficient to go for cloud solutions. This is also the reason patients are engaged in their care-they can log in from home or on the go, receive reminders about appointments, and even have virtual check-ins with their doctors.

On the other hand, some healthcare groups still prefer to use on-premise solutions, as it gives them complete control over their data. These solutions are installed right onto the hospital's or clinic's own servers and administered by their internal IT teams. Although more capitalization and efforts for maintenance are required, some providers prefer this option because it gives them peace of mind knowing that their data is safely stored on site. For big hospitals that have enough budget and staff to operate their own systems, on-premise solutions are still providing good performance and security.

Both types of delivery-the cloud and on-premises-have their place in today's healthcare scenarios. The decision often depends on factors like cost, size of the organization, security needs and the speed at which a provider wants to leverage new technologies. Deliverability of these tools so remains one axial factor determining their effectiveness as healthcare progresses further into patient-centered care. The goal, whether by clouds or on-premise setups, still remains the same: keeping patients engaged, informed, and supported in their health journey.

By Functionality

The Global Patient Engagement Solutions market is expanding, propelled mainly by the efficacy of the solutions offered therein. The foremost benefit of these solutions, Enhanced Communication, refers to improved sharing of information between healthcare professionals and patients and, more to the point, strengthens their relationship and patient activation regarding their health management. It can take various forms, including mobile apps, patient portals, reminders, which are meant to engage patients more in their health-care teams.

Patient Education is another major feature. It features communication on medical conditions, treatment, and care instructions put in layman's terms. When patients become familiar with the condition they face, they will more likely adhere to treatment plans and make healthier decisions about their well-being. All these will be favorable clinical outcomes by lowering complications and reducing hospital admission rates.

Predictive Analytics has also found a successful application in encouraging further patient interaction. It analyzes past and current data to recognize trends in health problems and forewarn health problems before they become serious. So, looking at patient history, behavior, and lifestyle, proactive action can be taken by the provider to avoid an illness, thus leading to better care and, often, saving time and money. Patients as well as doctors get a head start.

This has entered streamlined operations in their changing ways. Healthcare systems could be smooth with appointment scheduling, records management, and routine tasks. One will not only relieve with pressure the staff but would have an improved experience for the patient. No one wants to wait in an hour or write so many papers. Patients are appreciated and well cared for in such an effortless process.

Tools might also include feedback collection systems or wellness program managers. Although having less airtime in the value proposition, these functions still enrich the personalization and efficiency aspects of care delivery. Each function gives an added layer of support to make healthcare more friendly and responsive to its patients.

The potential for improvement in access to and use of healthcare services will continue to mount as patient engagement becomes more relevant. The technology fostered by communication, learning, data use, and operations is a springboard for making stronger, more trusting relationships with patients. These solutions aren't about the systems. They concern people. When patients feel they are seen and heard, they are likely to stay on track and feel confident in their care journey.

By End User

The need for enhancing communication and care coordination among patients and healthcare providers has been fueling steady growth of the Global Patient Engagement Solutions market. Patient-centered care is further increasing the demand for tools and systems that help create an interrelationship between patients and their care teams. With these solutions, patients learn more about their health issues, support their treatment plans, and always keep the communication channel open with their healthcare providers.

In terms of end-user types, the global Patient Engagement Solutions market is divided into Healthcare Providers, Health Payors, Pharma, and Pharmacy. Healthcare providers, like hospitals and clinics, are some of the major users of these solutions. The solutions allow healthcare providers to streamline communications with patients, such as sending appointment or medication reminders and giving access to medical records. Such tools also enable providers to view chronic care from the angle of patient engagement and self-management.

Healthcare Payors, which refer to insurance companies or entities that pay for healthcare, also use the patient engagement tools to engage their members and enhance member satisfaction. By fostering solutions that drive membership toward preventive care, adherence to prescribed treatment, and managing their health effectively, these solutions reduce hospital readmissions and emergency visits. Healthy and better-informed members favor the payors, who in turn tend to support the adoption of digital health platforms towards that end.

Pharmaceutical companies, or pharma, are using patient engagement tools for improved engagement with those who use their drugs. Patient engagement solutions assist patients in adequately understanding how to take their medications, reporting side effects, and remaining encouraged to adhere to treatment plans. Therefore, for pharma companies, better engagement equals more trust, greater medication adherence, and knowledge for valuable inputs into how patients respond to their products.

Pharmacies also offer an important share. With the help of patient-engagement solutions, pharmacies can offer services like prescription refill reminders, medication education, and health screenings. These instruments give pharmacists the privileges to support their patients beyond the counter, thus contributing toward helping such patients keep their health routines and manage their prescriptions efficiently.

Different groups employ these tools for different purposes, yet they all share one common goal: to enhance the patient experience and achieve optimal health outcomes. The continuous evolution that technology offers into people's ability to manage their health keeps the use of patient engagement solutions burgeoning, with multitudes of opportunity to support patients in reducing costs while making healthcare equally connected and efficient for everyone involved.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$28,491.32 million |

|

Market Size by 2032 |

$67,825.85 Million |

|

Growth Rate from 2025 to 2032 |

13.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

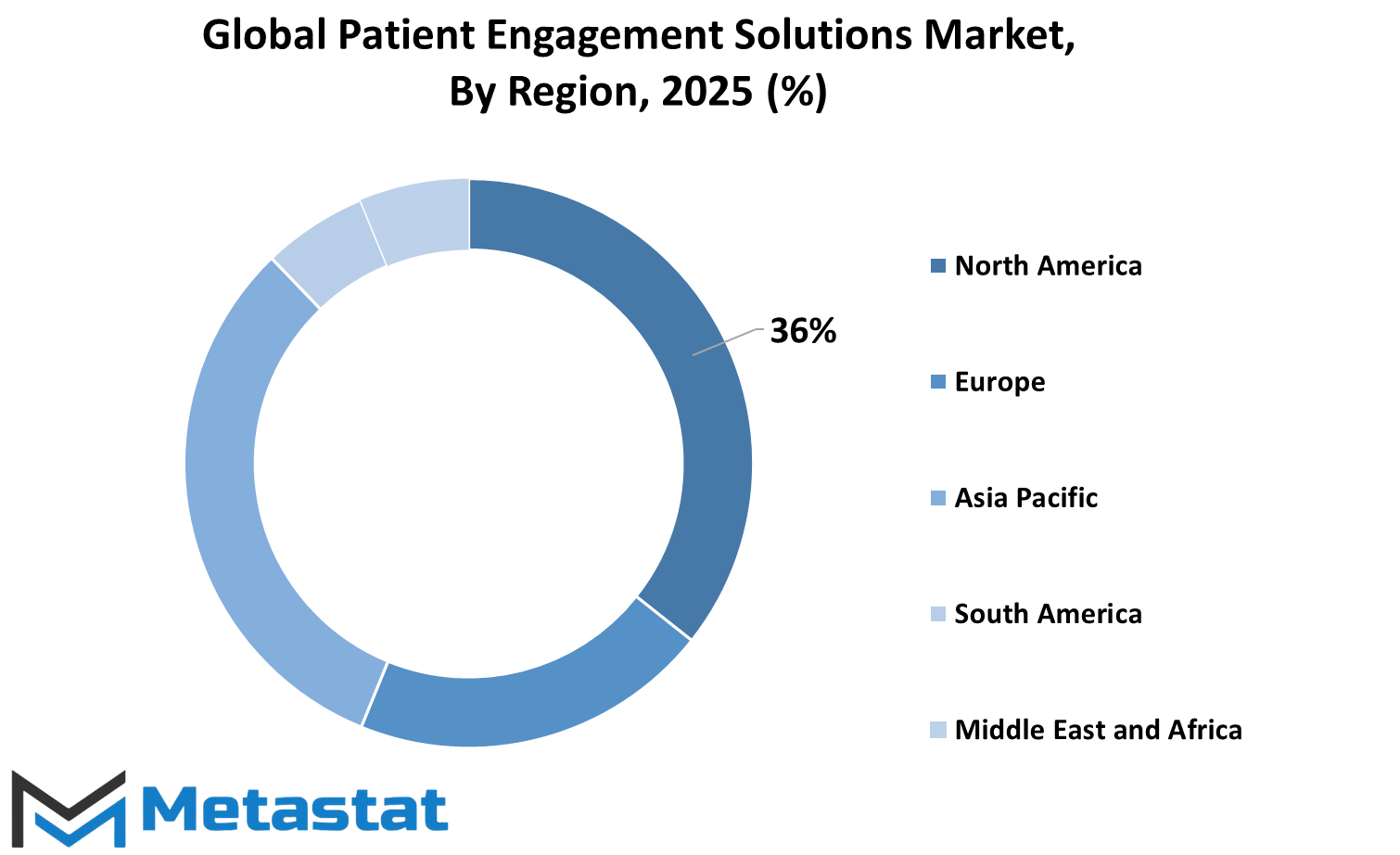

REGIONAL ANALYSIS

A steady globalization of the patient engagement solution market can be noticed. It is, in general, sub-segmented by geography into the broad areas of North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. These regions with different health systems, government policies, and technological adoption speeds are all somewhat responsible for the market working. This regional market has more impetus in North America, where the advancements and adoption of patient engagement solutions are concerned, being driven by high healthcare expenditure and good infrastructure. This further classifies into North America, that is, the U.S., Canada, and Mexico, where the U.S. is the star contributor due to a huge adoption rate of electronic health records and digital platforms connecting patients and healthcare.

In Europe, the UK, Germany, France, and Italy have steadily been moving forward in their aim to improve the quality of care offered with the help of digital solutions that enable better communication and monitoring. European support for patient engagement solutions is growing and focuses mostly on mobile applications and virtual consultations. The rest of Europe is following suit through public health initiatives intended to promote digital health throughout the region.

Asia-Pacific is yet another fast-growing area of focus in this market. These countries, India, China, Japan, and South Korea, are driving growth by investing in health tech and expanding Internet access across the broad domain of intervention. Governments and private organizations in these countries work hand-in-hand to create awareness for patients and provide tools that enable preventive care, remote monitoring, and simple appointment scheduling. The slow restructuring of the environment in the remaining countries of Asia-Pacific sector is coming up with increased mobile health platform and online resources access for the population.

Brazil and Argentina are the key players within the South American region. While these countries work to consolidate their healthcare systems through the implementation of patient engagement platforms that can assist in minimizing hospital visits and enhance chronic disease management, the rest of South America is being treated as a growing territory with increased interest towards making healthcare more accessible and reachable.

Progress is being made in the Middle East and Africa, composed of GCC Countries, Egypt, South Africa, and the Rest of Middle East and Africa. Governments are beginning to adopt large-scale support for digital tools to increase patient participation and rectify healthcare imbalances. Education and technology development are underway, thus providing the basis for a steady market growth in the near future.

COMPETITIVE PLAYERS

The Global Patient Engagement Solutions market will expand rapidly since healthcare providers focus on better communication with patients and patient involvement in their care. Digital tools are there for the purpose of being able to help understand and manage health difficulties; these are tracking appointments, medication management, and retrieval of medical records. All the increasing demands of personalized and easily accessible healthcare make such systems indispensable in a hospital, clinic, or even home care services.

The increase in chronic conditions, aging populations, and the demand for quicker services all drove healthcare systems to adopt such patient engagement platforms. They assist in making care more efficient and provide conveniences for patients by bridging the monumentally expansive gap between them and healthcare professionals. Many healthcare providers are now adopting passcodes so patients can instantly access every information about their health from anywhere.

Leading companies are working relentlessly to improve these solutions. Cerner Corporation, Now owned by Oracle, NextGen Healthcare, Inc., Epic Systems Corporation, Veradigm LLC, McKesson Corporation, ResMed, Koninklijke Philips N.V., Klara Technologies, Inc., CPSI, Ltd., Experian Information Solutions, Inc., Athenahealth, Solutionreach, Inc., MEDHOST, and Nuance Communications, Inc.: These are some key players in the Patient Engagement Solutions industry. The attention of these companies is bound, among others, to improving user experience and data security. In addition, they have to ensure that their products integrate easily with existing hospital management software, thus making tools to meet healthcare standards user friendly.

Encouragement is extended to patient engagement through government and healthcare regulators in regard to using digital healthcare initiatives. Most countries have various funds and policies for the promotion of particularly public health in these initiatives. Their efforts shall help the suppliers install the latest technology and train the staff, so they use such tools.

Patient engagement solutions will continue booming in the industry, given that many patients are now accustomed to getting health care via apps and websites. These systems improve patient knowledge and participation in their care while making life easier for healthcare professionals by automating low-level office functions. There will still be more flexibility, security, and access in the future because all people should have equal opportunities for enhanced health communication, regardless of their specific location.

Patient Engagement Solutions Market Key Segments:

By Type

- AI-Driven Engagement

- Telehealth Solutions

- Patient Portals

- Remote Patient Monitoring

- Population Health Management

- Appointment and Medication Reminders

- Others

By Delivery

- Web/Cloud-based

- On-premise

By Functionality

- Enhanced Communication

- Patient Education

- Predictive Analytics

- Streamlined Operations

- Others

By End User

- Healthcare Providers

- Healthcare Payors

- Pharmaceutical Companies (Pharma)

- Pharmacy

Key Global Patient Engagement Solutions Industry Players

- Cerner Corporation (Oracle)

- NextGen Healthcare, Inc.

- Epic Systems Corporation

- Veradigm LLC

- McKesson Corporation

- ResMed

- Koninklijke Philips N.V.

- Klara Technologies, Inc.

- CPSI, Ltd.

- Experian Information Solutions, Inc.

- Athenahealth

- Solutionreach, Inc.

- MEDHOST

- Nuance Communications, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

.jpg)

US: +1 3023308252

US: +1 3023308252