MARKET OVERVIEW

The global packaged salad market will make food retailing's future look different in unexpected ways. Within its industry, this segment will provide fresh new alternatives to customary meal solutions, extending beyond convenience to lifestyle congruence. The story of that industry will be rich and compelling, cutting channels across grocery aisles and home kitchens too.

In years to come, consumers will increasingly look for ready-to-eat greens that both suit their taste and satisfy their values. Fresh blends will be more than side courses; they will be fast healthful options that cater to busy lifestyles and conscious living. That sector will showcase new packaging that guarantees crispness and shelf life without gummy or watery sacrifice.

Stores will start working with farmers and packaging designers to provide varietal blends—from pungent kale combinations to subtle baby spinach blends. These products will be paired with dressing combinations that are packaged individually, so dressings do not get soggy and loose leaves stay crisp. These blends will have a feeling of being personalized and thoughtful, even when mass-produced.

What buyers will see is the move from plain, generic bags to colorful, transparent pouches that show leaf color, texture, and garnish information. The draw will not be on buzzwords but on the sensory guarantee: that crunch you hear when you crack open the bag, the delicate aroma of herbs, the combination of delicate and robust greens that make you want to taste more than mere flavor—inviting texture and freshness.

Manufacturers will shift towards lighter, more recyclable packaging that minimizes environmental footprint. They will employ discreet visual messaging—such as a transparent leaf-shaped window or earthy brown highlights—to convey quality and consciousness without screaming labels. That same tactile and visual design will directly communicate to consumers who judge by the initial glance and feel.

Logistics personnel will optimize temperature control in transit. Bags will be made to withstand bruising from stacking and moving, so that by the time a consumer selects a package from the shelf, it will feel as if it was just picked. That immediacy will enhance the shopping experience beyond a mundane pick-and-go transaction.

At home, having such pre-packaged salads on hand will alter meal planning. Busy parents will enjoy that the blend is ready with no washing, yet still provide flexibility to mix with grains, protein, or raw fruit. Young professionals will appreciate a quick yet healthful base for lunch bowls or rapid side dishes. That incorporation into everyday life will be natural, as if the product has always been in the refrigerator.

Advertising will shift to storytelling that won't over-promote concepts. Rather than bland sentences about farm fresh or always changing, brands will post plain observations: where the blend was cultivated, the types contained, the mood they intended—bright, mellow, savory. That way, consumers can connect on an individual basis without being talked down to.

By emphasizing actual sensory appeal, considerate design, and understated communication, this sector will encourage consumers to rediscover greens in a form that accommodates contemporary life. The global packaged salad market will keep on growing its presence in daily routines with ready-to-eat blends that seem almost hand-prepared, a quiet friend to hectic days. That transition will come to feel less like a commercial item and more like a respected pantry staple. The Global Packaged Salad industry will slowly reframe convenience not as compromise, but as thoughtful freshness.

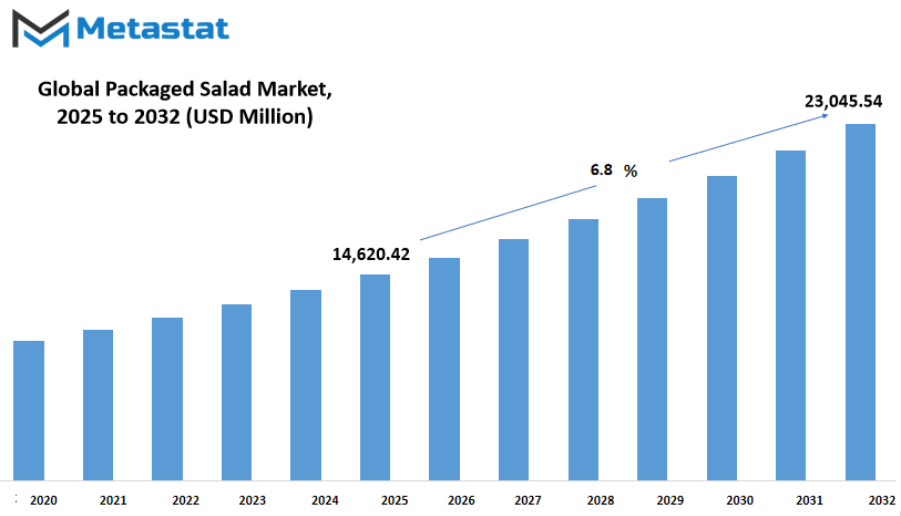

Global packaged salad market is estimated to reach $23,045.54 Million by 2032; growing at a CAGR of 6.8% from 2025 to 2032.

GROWTH FACTORS

The global packaged salad market will continue to gain attention as changing lifestyles and busy work schedules push demand for quick, healthy, and ready-to-eat food options. The need for convenient meals that save time while offering nutritional benefits will drive growth in the coming years. The rising awareness about health and wellness will also push more consumers toward fresh and organic salad choices available in sealed packaging, ensuring safety and hygiene. Urbanization and the expansion of retail chains will make these products more accessible, allowing manufacturers to reach a wider consumer base.

Another factor supporting the global packaged salad market will be the growing adoption of advanced packaging technologies. These innovations will help extend product shelf life without compromising quality, giving consumers fresher options and reducing food waste. Attractive packaging and clear labeling will also encourage informed choices, building trust and loyalty among buyers. The trend of plant-based diets and the increasing popularity of low-calorie, nutrient-rich food will create steady demand for a variety of salad mixes, from leafy greens to exotic blends.

However, certain challenges might slow down the pace of growth. Fluctuations in the prices of raw materials, especially fresh vegetables, will create cost pressures for producers. Additionally, concerns about preservatives and the environmental impact of plastic packaging might lead to hesitation among environmentally conscious buyers. Seasonal variations affecting the supply of fresh produce will also pose difficulties for maintaining consistent product quality and availability throughout the year.

Despite these challenges, technological innovations in sustainable packaging and advancements in cold-chain logistics would provide lucrative opportunities for the global packaged salad market in the future. Investment in biodegradable packaging materials and improved storage methods will address environmental and supply concerns effectively. Expanding e-commerce platforms will further boost sales as more consumers turn to online shopping for convenience and variety. The introduction of personalized salad mixes tailored to dietary preferences will also attract health-conscious buyers seeking customized solutions.

As awareness about fitness, sustainability, and convenience continues to rise, the global packaged salad market will witness significant transformation. Companies focusing on quality, innovation, and eco-friendly practices will be well-positioned to capture emerging opportunities, ensuring long-term growth and consumer satisfaction in the years ahead.

MARKET SEGMENTATION

By Nature

The global packaged salad market is set to witness consistent growth as changing lifestyles and a growing preference for convenient, ready-to-eat foods drive demand. The need for healthier meal options continues to increase, and packaged salads are becoming a preferred choice in both households and workplaces. The trend toward health-conscious eating is expected to remain strong in the coming years, supported by advancements in food processing, packaging, and distribution that keep products fresh for longer periods.

By nature, the global packaged salad market is further segmented into organic and conventional options. The organic segment is projected to expand steadily as more consumers show interest in pesticide-free and naturally grown ingredients. Rising awareness of the benefits of organic food, coupled with growing concerns about chemical-based farming methods, will fuel the demand for this segment. On the other hand, the conventional segment will continue to maintain a strong share of the market, primarily due to its affordability and wide availability. Competitive pricing and ease of access in retail stores will help this category maintain steady growth in the years ahead.

Innovation in packaging technology will play a major role in shaping the future of the global market. Improved packaging materials that extend shelf life while preserving freshness will attract more consumers looking for convenient yet healthy choices. Companies are also expected to invest in smart packaging solutions that monitor freshness and quality, enhancing trust and overall satisfaction.

Online retail platforms are also expected to support the growth of the global market. With the rise of e-commerce and digital grocery platforms, accessibility to fresh packaged salads has never been easier. Faster delivery systems and expanded product ranges will likely increase the reach of brands, especially in urban areas where demand for quick, healthy meals is highest.

Sustainability will also shape the future direction of the global market. Growing environmental awareness is driving producers to shift toward eco-friendly packaging and sustainable sourcing of ingredients. Brands that adopt greener practices are likely to gain stronger customer loyalty and stand out in a competitive space.

Looking ahead, the global market will continue to evolve, driven by technological innovation, a shift toward healthier living, and the convenience that packaged salads offer. Both organic and conventional segments will play vital roles, with organic products gradually gaining more ground as consumers prioritize quality and health benefits. With continuous advancements and growing demand, this market will remain a key area of growth in the global food industry.

By Product

The global packaged salad market will experience remarkable transformation in the coming years as changing lifestyles and health awareness continue to rise. Growing urbanization, busy schedules, and increasing focus on nutrition will drive the preference for ready-to-eat food options that save time while delivering freshness. Packaged salads will stand out as a convenient solution for consumers looking for quick yet healthy meals, leading to steady expansion of this market on a global scale.

By product type, the global packaged salad market will be divided into Vegetarian and Non-Vegetarian categories. The vegetarian segment will likely witness significant growth because of the increasing adoption of plant-based diets, rising vegan population, and awareness about the benefits of fruits and vegetables. More consumers will opt for fresh greens, mixed vegetables, and plant-based proteins as part of daily meals. The vegetarian packaged salad options will also benefit from advancements in packaging technology that maintain freshness for longer durations without losing taste or nutrition.

On the other hand, the non-vegetarian segment will cater to consumers seeking high-protein meals combined with convenience. Salads containing chicken, seafood, or eggs will remain popular among fitness-focused individuals and those wanting balanced diets. This segment will also see innovation in terms of low-fat dressings, organic ingredients, and ethically sourced meat products to meet changing consumer expectations.

Technology will play a major role in shaping the future of the global market. Smart packaging solutions with features such as freshness indicators, biodegradable materials, and enhanced shelf life will improve consumer trust and reduce food waste. Online retail platforms will further boost availability, enabling customers to access a wide variety of options with just a few clicks.

Sustainability will become a key focus area, with producers shifting toward eco-friendly packaging and responsible sourcing of ingredients. Collaborations between food companies and agricultural technology firms will likely bring precision farming techniques into the supply chain, ensuring consistent quality of raw materials. Overall, the global market will continue to grow as health consciousness, convenience, and technological innovation converge, offering consumers diverse and nutritious choices for the future.

By Distribution Channel

The global packaged salad market is expected to transform spectacularly in the near future, guided by advances in technology, consumer behavior, and logistics. A shift toward healthier lifestyles will drive demand for convenient, ready-to-eat options that save time and reduce waste. Growth of smart packaging will play a key role, ensuring freshness and extending shelf life. Sensors that monitor temperature and humidity will become more affordable and widespread, allowing clear indicators of quality without opening sealed packs.

Expansion of urban vertical farms will reshape supply chains. These farms will supply greens to local production centers, cutting transportation time and energy use. As a direct result, flavor and nutritional value will remain high. Transparent tracking systems will allow consumers to scan codes and see exactly when produce was harvested, packed, and distributed.

By distribution channel, the global market will split between Offline and Online pathways. Offline channels such as supermarkets, convenience stores, and local grocers will continue to benefit from in-person browsing and immediate pickup. In store, visual displays of fresh, colorful salads will attract attention and encourage impulse purchases. Staff recommendations and taste-testing stations will reinforce confidence.

Online distribution will expand rapidly. Digital platforms will offer subscription services that deliver fresh salads on a schedule selected by each household. These platforms will provide customization, letting each order include mix-and-match greens, toppings, or dressings. Algorithms will suggest recurring favorites and introduce new blends, based on past selections. Delivery logistics will improve with micro-fulfillment hubs located in neighborhoods. These hubs will allow same-day or next-day delivery via eco-friendly vehicles, cutting waste and ensuring freshness.

Integration of augmented reality (AR) in online shopping will help visualize salads through virtual previews, showing texture and color in realistic detail. Interactive guides will explain recommended pairings or serving ideas. As automation grows, robotic packing systems will sort greens and assemble each pack precisely, reducing human error and improving consistency.

Sustainability will become a priority. Plant-based, compostable packaging will replace plastics. Energy-efficient cooling systems will reduce electricity use. Waste from unsold salads will be minimized through donation programs and dynamic pricing before expiration. Transparent reporting will show reductions in carbon footprint and resource use.

Future visibility for the global packaged salad market shines bright. Balance between Offline and Online channels will provide both comfort and innovation. Freshness, convenience, customization, and sustainability will shape how healthy salads reach tables worldwide.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$14,620.42 million |

|

Market Size by 2032 |

$23,045.54 Million |

|

Growth Rate from 2025 to 2032 |

6.8% |

|

Base Year |

2024 |

|

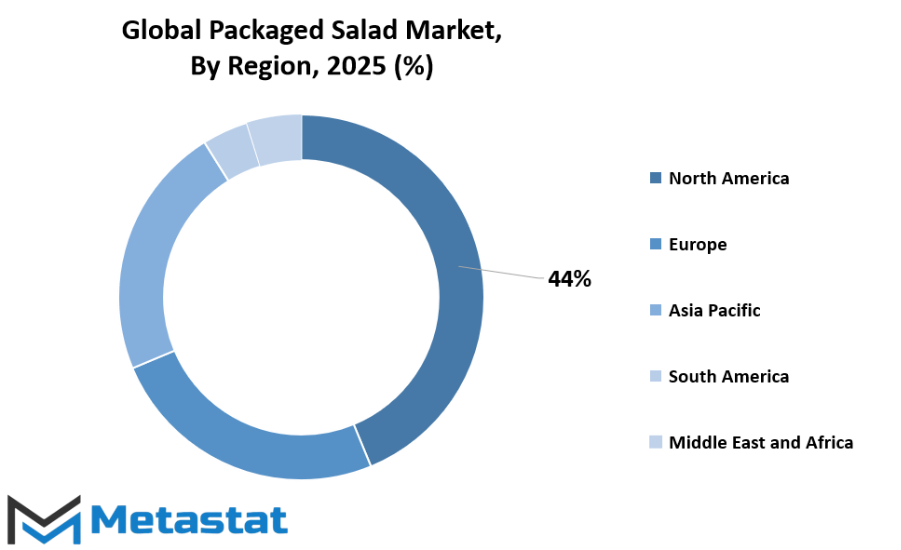

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global packaged salad market is expected to witness significant changes in the coming years as demand for convenient and healthier meal options continues to grow. Rising awareness about healthy eating habits, along with the increasing influence of urban lifestyles, will drive steady growth. As consumer preferences shift toward ready-to-eat and fresh products, packaged salads will see a consistent rise in demand across multiple regions.

Based on geography, the global packaged salad market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America, which includes the U.S., Canada, and Mexico, will continue to lead the market due to higher adoption of ready-to-eat foods and the presence of established food processing companies. The growing trend of meal customization and the preference for organic ingredients will further support expansion in this region. Europe, with key markets in the UK, Germany, France, and Italy, along with the Rest of Europe, will see strong growth driven by increasing consumer focus on sustainability and clean-label products.

Asia-Pacific, segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific, will present the fastest growth opportunities. Rapid urbanization, rising disposable income, and greater access to global food trends will contribute to expanding demand in this region. As more consumers become health-conscious, interest in diverse salad options and innovative packaging will likely rise. South America, with Brazil, Argentina, and the Rest of South America, will see moderate growth, mainly supported by changing dietary habits and the growing presence of international brands in the region. In the Middle East & Africa, which includes GCC Countries, Egypt, South Africa, and the Rest of the region, the market will expand steadily as urban populations grow and modern retail formats become more accessible.

Looking ahead, technological advancements in packaging will play a key role in shaping the future of the global market. Extended shelf-life packaging, eco-friendly materials, and smart labeling will improve consumer trust and enhance market competitiveness. Increasing investments in automation and digital supply chains will ensure better quality and quicker distribution, supporting a seamless customer experience.

With ongoing innovation and a growing focus on health-driven products, the global packaged salad market will continue to develop, offering diverse opportunities across regions. Sustainable practices, product variety, and strategic partnerships will define future growth, making packaged salads an essential choice for consumers seeking convenience without compromising on quality or nutrition.

COMPETITIVE PLAYERS

The global packaged salad market will continue to gain attention in the coming years as demand for fresh, convenient, and healthy food options rises. Changing consumer lifestyles, the growth of urban areas, and the increasing focus on health will push this market forward. Ready-to-eat salads offer a quick meal solution without compromising on nutrition, which will drive stronger adoption across both retail and foodservice sectors.

Competitive players will play a major role in shaping the direction of the global packaged salad market. Leading companies such as Dole Food Company, Inc., Bonduelle Group, Fresh Express, Mann Packing Co. Inc., BrightFarms, Inc., Gotham Greens, Taylor Farms, Greengrocer, and Organicgirl are expected to focus on innovation to stay ahead. Expanding product lines with organic blends, high-protein combinations, and unique flavors will become more common as companies try to meet the preferences of a broader audience. These efforts will not only attract health-conscious customers but also strengthen brand loyalty in a market that is becoming more crowded each year.

Technology will also play a key role in the growth of the global market. Better packaging solutions that extend shelf life while keeping freshness intact will allow for wider distribution and less food waste. Advances in vertical farming and hydroponics will improve year-round supply, helping companies like BrightFarms, Inc. and Gotham Greens continue to meet demand while maintaining quality. Digital tools will help track consumer preferences and trends, allowing brands to make informed decisions about new product launches.

Sustainability will remain an important factor, influencing both production and packaging strategies. Competitive players will work toward using recyclable or biodegradable packaging to appeal to environmentally conscious buyers. Sustainable farming practices will also gain importance, with more companies investing in reduced pesticide use and efficient water management systems to align with customer values and industry standards.

Looking ahead, the global packaged salad market will see stronger partnerships between retailers and producers to ensure consistent supply and wider availability. Expansion into new regions will create more opportunities, especially in markets where packaged salads are still gaining popularity. Increased online grocery shopping will further support growth, as convenient delivery options will make these products more accessible to a larger customer base.

With innovation, sustainability, and technology driving progress, competitive players will continue to influence how this market evolves. By addressing changing consumer expectations and focusing on quality, the global packaged salad market will keep moving toward steady growth and greater global reach in the years to come.

Packaged Salad Market Key Segments:

By Nature

- Organic

- Conventional

By Product

- Vegetarian

- Non-Vegetarian

By Distribution Channel

- Offline

- Online

Key Global Packaged Salad Industry Players

- Dole Food Company, Inc.

- Bonduelle Group

- Fresh Express

- Mann Packing Co. Inc.

- BrightFarms, Inc

- Gotham Greens

- Taylor Farms

- BrightFarms, Inc

- Greengrocer

- Organicgirl

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252