MARKET OVERVIEW

The Global Organic Infant Formula market can be stated as a niche of the large infant nutrition business. Here, it caters specifically to parents who are on the look-out for high-quality and organic-certified options available for their infant’s diets. This particular market finds its definition within its importance of producing organic formula to the highest possible organic standard, free of synthetic additives, pesticides, or genetically modified organisms. As consumer awareness about health and nutrition continues to expand, the demand for organic options in infant formula will continue to grow, placing this sector at the forefront of modern infant care solutions. Organic infant formulas are therefore designed to mimic the nutritional profile of breast milk while keeping the purity and safety associated with organic production processes intact.

Manufacturers in this market emphasize clear sourcing of ingredients and transparent production processes, citing that their organic products have to meet the global regulatory standards for organic certification. In contrast to conventionally manufactured infant formulas, organic ones promise a clean label that appeals to the increasing numbers of health-conscious parents who prefer natural, environmentally friendly products for their children. The Global Organic Infant Formula market spans across multiple geographic segments, each with distinct consumer requirements and regulatory conditions. In mature economies, it has significantly picked up since consumers with higher disposable incomes have taken greater interest in organic baby formulas due to their advantage of being better than counterparts.

On the other side, in emerging markets, it has immense latent potential given the increasing organic awareness among consumers and improving purchasing capabilities. This also presents diversified products that shall cover more specific nutritional demands as an individual product will have offerings toward infants with some sensitivity to or an allergy toward particular elements which lactose-free, and or plant-based organic formula. Product innovation would then constitute the heart of evolution within Global Organic Infant Formula Market, as manufacturers must fine-tune their formula using these functional ingredients-probiotics, prebiotics, and omega fatty acids all while being sure it aligns with the guidelines from organic standards. Packaging will also become a major emphasis, with green options increasingly popular among the sustainability-conscious consumer.

E-commerce will significantly impact the distribution landscape of this market, making it easier for parents to access multiple organic infant formulas while giving brands a direct platform to communicate their quality and authenticity. The market environment would determine its course, with compliance to international organic standards not being a flexible area for the participants. Stricter labeling requirements and third-party certifications would help establish consumer confidence and further acceptability across the world. Supply chain partnerships and collaborations will make ingredient sourcing and product development more efficient, enhancing organic integrity for the market. The Global Organic Infant Formula market will see intense action in the years ahead with technological advancements and evolving consumer expectations. As parents are demanding more natural and organic products to support their infants’ early development, the market will expand its presence across diverse cultural and economic contexts.

With a strong focus on sustainability, nutrition, and transparency, the Global Organic Infant Formula market is poised to redefine infant nutrition standards while paving the way for healthier, more conscious feeding practices in the world. Through innovation and adherence to organic principles, this market will continue to solidify its relevance and appeal in a competitive landscape, ensuring sustained growth and significance.

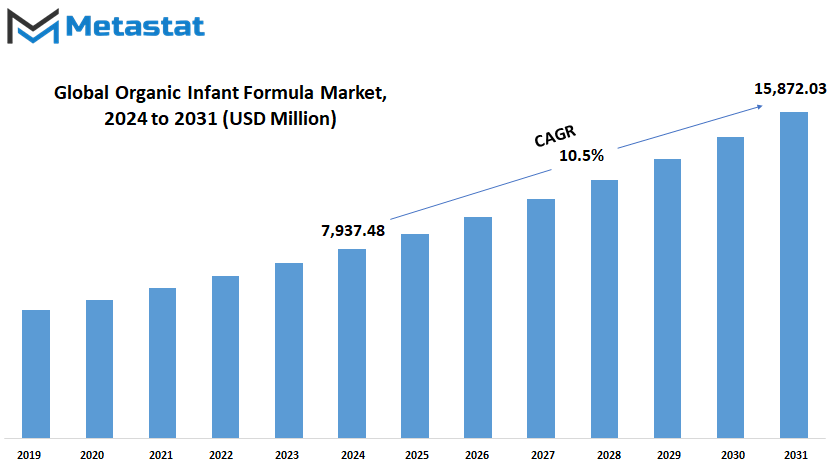

Global Organic Infant Formula market is estimated to reach $15,872.03 Million by 2031; growing at a CAGR of 10.4% from 2024 to 2031.

GROWTH FACTORS

The Global Organic Infant Formula market is expected to grow significantly in the near future, influenced by a set of factors that represent the changing needs of consumers and the developments in related industries. Increasingly, parents are opting for healthier alternatives for their infants, which has seen the demand for organic options rise steadily. The increase, aside from the increasing public awareness of the possible positive impacts of organic products toward their health, is equally triggered by an expanding sector of consumers who consider not just the sustainability factor of using environmental-friendly products in the same buying process. A crucial driving force behind the surge of this market is rising interest in automated material handling systems, especially within a mine and manufacturing sectors.

These systems increase efficiency and work-flow while helping in streamlining production and distribution efforts related to organic infant formulas. Also, investments being made for the development of infrastructure, and improvement being brought to transportation networks, helps create a stronger supply chain where the company can easily carry its product to the diverse set of consumers. Although promising, challenges exist that might impact market growth. Some parts, such as idlers, have high maintenance and replacement costs, posing a burden on manufacturers. Moreover, these parts are also more susceptible to wear and tear in industrial applications, thereby making it harder to ensure that production runs remain steady. This can act as a brake on market expansion, especially for the smaller players with lesser capabilities.

However, the industry is pushing back against these challenges. The creation of energy and durable idlers seems one of the promising ways going forward. These advanced products not only extend operational lifetimes but also reduce energy intake, in line with the wider push toward sustainable practices on the global scale. Indeed, these innovations are in a position to attract increased investments and support long-run growth as they address pertinent concerns regarding cost and durability.

Looking ahead, the Global Organic Infant Formula market has a lot of potential. With technology constantly advancing, it will lead to more efficient production processes and open up new avenues for inter-industry collaboration. Consumer demand for high-quality, organic products will continue to drive manufacturers to adapt and innovate. Challenges notwithstanding, the combination of technological advancement and shifting consumer trends promises to sustain growth in this dynamic market.

MARKET SEGMENTATION

By Type The Global Organic Infant Formula market is likely to grow with a huge increase in the awareness of health and nutrition for infants. Parents are becoming increasingly conscious about the ingredients of products they use for their children, and this increases the demand for organic alternatives. This is also because of the concerns over the content of contaminants and artificial additives in the standard products. Organic infant formulas, obtained from organic and natural ingredients are safer to administer to infants with the wish to get quality nutrition to the babies from their parents. This particular market has been segmented under different types of formulas meeting the special needs of various stages in infants' life.

Starting Milk Formula is meant for a baby and provides enough nutrients that can help their growth within the first months after birth. This is a good substitute for breast milk and allows the baby to have a perfect intake of what she/he requires during the primary stages of life. The Follow-On Milk Formula is designed for babies six months and older. It helps in weaning since babies begin introducing solids into their diet. Its formulation provides further nutritional support for the infant at this susceptible stage. Special Milk Formula is formulated on the specific dietary or special medical requirements of those having cases of lactose intolerance and allergy, and many others, all aimed to give parents specialist nutritional care support to their infant's health. Finally, in "Others" falls a more pioneer and niche products oriented at new trends and new needs related to infant nutrition. In the future, the quality and availability of these products will improve through organic farming methods and sustainable production practices. Global regulation in organic labeling and certification is likely to be tighter in the future, so consumers will have more trust and transparency in the market.

More refined formulas, to the extent possible, from the breast milk nutritional profile, likely to be through scientific research integrated into product formulation. Firms are producing plant-based and other allergen-free formulations to accommodate the wider scale of dietary preference and even health considerations into their formulation. The future of the Global Organic Infant Formula market will be defined by innovative packaging solutions that ensure not only the quality of the product but also a decrease in environmental impact. Brands will look to include more eco-friendly materials into their packaging strategies as sustainability awareness grows.

Overall, the market will be subject to strong growth due to factors related both to preferences by the consumers and production improvements with an increased interest towards baby's health and wel being. Parents will, after all, still center around products that represent values by the parents: such as markets, there is also much potential here.

By Ingredient Source

Global Organic Infant Formula Market is set to rise significantly due to an increased awareness of the importance of organic nutrition. Mothers from all parts of the globe are giving priority to healthier, organic options for infants’ feeding, which pushes demand for organic infant formulas forward. Unlike traditional formula products, organic infant formula contains no synthetic additives and pesticides, which is another advantage for families looking to opt for a safer and healthier feeding alternative. This trend is expected to pick up further, supported by the growing focus on sustainability and environmentally responsible farming practices.

The market is segmented by ingredient source into cow milk-based, goat milk-based, soy-based, and other formulations. Each type caters to specific dietary needs and preferences, offering a range of options for parents. Cow milk-based formulas are the most used due to their similarity in nutrient content to natural breast milk and wide availability. These are preferred because they enable healthy growth and development of infants, making them highly preferred. However, goat milk-based formulas are being preferred due to their ease of digestion and lower potential of allergens, especially to infants with sensitive stomachs or lactose intolerance. Soy-based versions, though less common, remain a good alternative to those families who follow a plant-based diet or whose infant cannot tolerate cow or goat’s milk.

These formulas include nutrient-rich compounds from the protein of plants and evolve in their formulations to eventually reach nutritional standards. Other formulations, including those based on specialized protein blends or novel sources, address niche requirements such as hypoallergenic diets or specific medical needs, reflecting the adaptability of the market to diverse demands. The future of the Global Organic Infant Formula market will likely see advancements in formulation science, with manufacturers exploring innovative ingredient sources and enhancing product quality.

As research deepens, the emphasis on tailoring formulas to meet the specific developmental needs of infants is expected to grow. Consumers will also gain more confidence in the authenticity and safety of these products as technology improves traceability of organic ingredients. This transparency will be a key factor in informing purchasing decisions. Furthermore, when more parents begin to live the lifestyle that reflects environmental and ethical values, companies would be expected to focus more on eco-friendly packaging and more sustainable production processes. These are developments that not only create growth in the market but also contribute to the betterment of environmental conservation at large. With growing awareness, the market is supposed to change to suit the preferences of parents, nutrition science, and sustainability ideals.

By Packaging Type

The Global Organic Infant Formula market is booming because parents worldwide increasingly are focusing on the well-being of their children. This is because organic infant formula has become a popular option based on its promise to adhere to quality ingredients, without synthetic chemicals, pesticides, and genetically modified organisms. With the awareness of the importance of feeding babies healthier choices, the demand for organic alternatives will rise constantly in the future. Meeting these increasing demands, packaging fulfills the needs of expanding market and provides convenience for functionality in modern families.

Market for organic infant formula: The market is diversified based on three types of organic infant formula packaging: powdery, liquid-based, and ready-to-feed. Each type caters to specific consumer preferences and their lifestyle. Powdered still leads the market due to a longer shelf life along with cost-effectiveness. Parents appreciate its lightweight nature and ability to be stored easily, making it an ideal option for those who prefer to prepare formula as needed. On the other hand, liquid formula provides a pre-mixed option that appeals to those looking for a quicker and more convenient feeding solution. Ready-to-feed formula, though more expensive, is valued for its ease of use and time-saving advantages. This segment is specifically attractive to busy parents or those who are always in transit.

Looking ahead, the future of the Global Organic Infant Formula market seems promising. Innovations will be pushed on by technological advancements and shifts in consumer trends. It is likely that the use of packaging materials will turn out to be more eco-friendly and sustainable in response to the overall trend for environment responsibility. Brands may also embed smart packaging technologies such as freshness indicators or QR codes that will further add security for parents about product quality and safety. The next, as the science regarding infant nutrition becomes even better known, the manufacturing can continue to look at other formulation and packaging designs for varying dietary needs and cultural sensitivities.

E-commerce is another factor influencing this market. With more shoppers choosing online platforms as the new norm, companies will have to optimize packaging for easier delivery and improved shelf appeal. Lightweight, durable, and resealable packaging may become the new standard to ensure products reach their destination in great condition with less waste.

In the near future, the Global Organic Infant Formula market will be undergoing significant expansion, with adaptations to meet the changing demands of families across the world. Through innovation in packaging solutions and sustainability, this industry is likely to help shape the future of infant nutrition.

By End-Users

The Global Organic Infant Formula market is currently in focus as an indispensable sector to meet the requirements of infant and young child nutrition in a health-conscious world. Parents today focus more on organic options for their children due to growing awareness of the benefits of such natural and chemical-free products. The market caters to different stages of early childhood, classified by end-users into infants aged 0-6 months, babies aged 6-12 months, and toddlers aged 12-36 months, each requiring specific nutritional formulations to support their growth and development.

Organic infant formula is an essential substitute for infants aged 0-6 months for parents who cannot or do not wish to breastfeed. Formulations in this segment need to be as close to the nutritional profile of breast milk as possible, with important nutrients such as DHA, ARA, and probiotics. As scientific discoveries continue to improve these formulations, the future for this segment is bright, with the possibility of delivering even more accurate nutrition within strict organic standards.

Organic formulas in this 6-12 months stage are customized to support a baby’s introduction to solid foods. These products address the developing body and exploding cognitive powers of babies at this stage. As consumers have increasingly begun to demand that manufacturers be transparent, sources and ingredients will likely continue to take center stage; parents can then make appropriate choices for their children’s health. The industry will also likely expand further into fortified products that match common deficiencies, reflecting on the growing interest in customized nutrition.

For children between 12-36 months, the focus would be on providing balanced nutrition to support their active lifestyle and immune system development. Organic whole milk-based formulas, which are rich in vitamins and minerals, may be included in this market to enhance bone strength and energy production. In a world that is becoming increasingly concerned about sustainability, the products will include eco-friendly packaging and locally sourced ingredients to align with the consumers' expectations for environmental responsibility.

The Global Organic Infant Formula market has immense potential to grow in the coming years as clean-label, high-quality alternatives are being sought after for their children by parents. With advancements in food science, a greater understanding of what a child needs to survive and thrive will be known, which may revolutionize this market into innovative, effective, and environmentally-friendly products. As more people are becoming aware and organic products are more easily accessible, this market will expand hugely and become the go-to choice for health-conscious families worldwide. This trend suggests that the future holds organic formulas that not only fulfill nutritional requirements but also embody sustainability and care.

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$7,937.48 million |

|

Market Size by 2031 |

$15,872.03 Million |

|

Growth Rate from 2024 to 2031 |

10.4% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

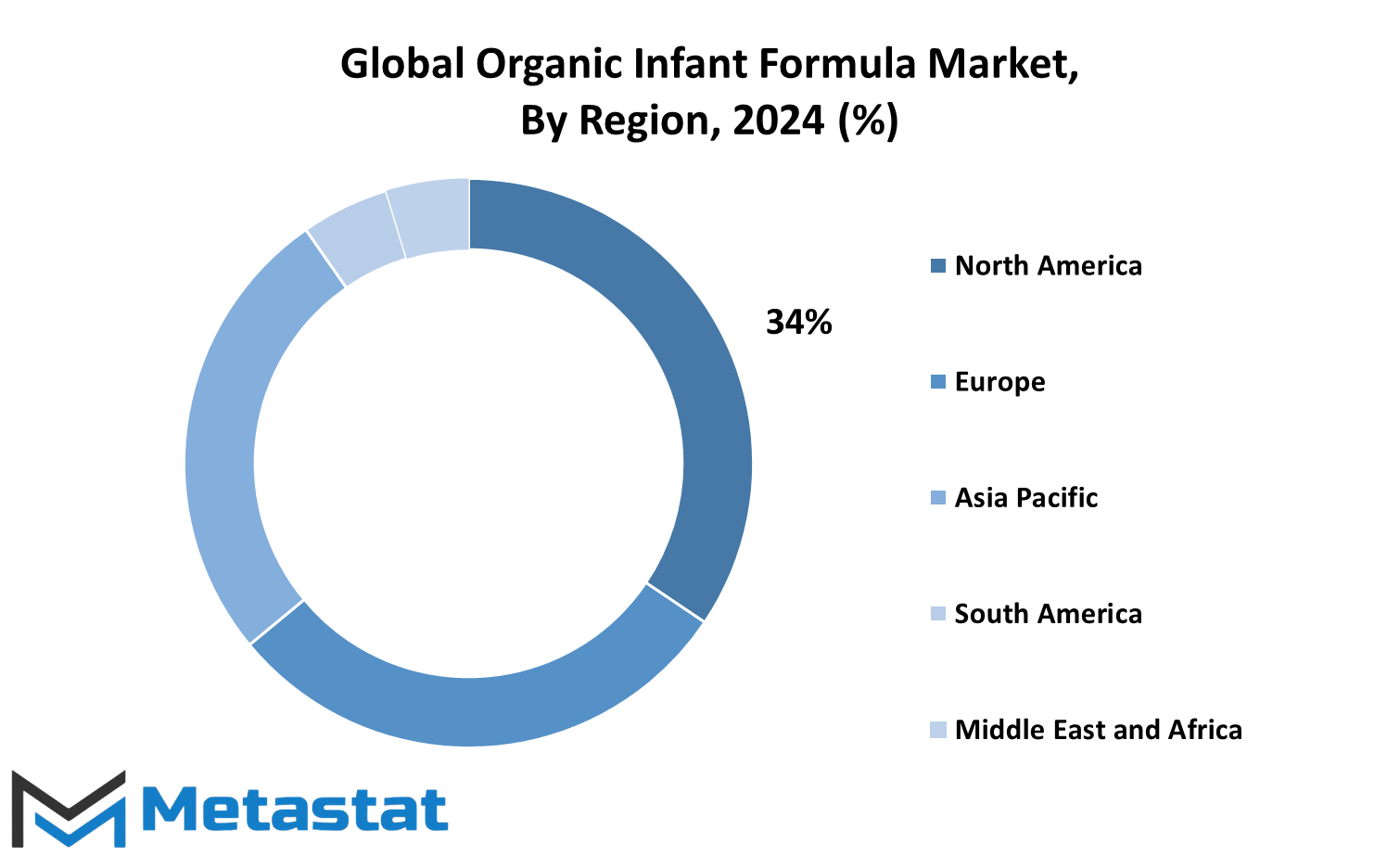

The Global Organic Infant Formula market is growing slowly and is geographically dependent, which helps shape its growth and potential. This market, driven by increasing parental awareness of better nutritional choices for infants, has a different regional signature that drives its growth and development. Each region comes with unique opportunities, ranging from consumer preferences, the economic environment, and regulation policies that define the direction of this market.

North America stands as a significant player in the Global Organic Infant Formula market. The United States, with its high disposable income and increased health awareness among parents, leads the region. Canada and Mexico also contribute to the market, with growing demand for premium organic baby products. The focus on stringent safety and quality standards in these countries ensures sustained interest in organic infant formula, creating a positive outlook for the future.

The region of Europe is seeing a consistent preference in the UK, Germany, France, and Italy, among others, for organic baby food. This has been driven by consumer demand for natural and organic products, along with regulatory environments that are strict on the safety of food. Organic formulations and convenient product offerings will support steady growth in the region.

The Asia-Pacific region is emerging as a powerhouse in the Global Organic Infant Formula market. Countries like China and India, with their vast populations and increasing urbanization, are experiencing a surge in demand for organic infant formula. The growing middle class in these nations is seeking high-quality and safe nutrition options for their infants. Advanced food technology and organic trends drive the markets in Japan and South Korea. The region has immense potential because of its evolving consumer base and increasing awareness of organic products.

Led by Brazil and Argentina, the trend in South America is being seen toward organic infant formula since increasing natural ingredients among consumers. Developing economic conditions along with growing organic baby food interest in this region make for a hopeful future in the market here.

Finally, the Middle East and Africa is an unexplored potential of the Global Organic Infant Formula market. Countries like Egypt, South Africa, and other countries in the GCC region are experiencing increased awareness and gradual acceptance of organic products. Despite issues concerning cost and distribution, this region is likely to drive growth in the market as more awareness campaigns and economic progress take place.

The unique features of each region and the growing awareness of organic options are promising for the Global Organic Infant Formula market. Geographically driven growth will likely continue to expand, catering to the health-conscious needs of an increasingly health-conscious global population.

COMPETITIVE PLAYERS

With more consumers increasingly adopting the natural and organic trend, the Global Organic Infant Formula market is likely to have immense growth. The global organic infant formula market targets parents who want their infants to be healthier and safer through nutritional options. These companies are always looking forward to innovation to remain in front of the competition while fulfilling the expectations of a healthy family. These players in the industry, such as Nestlé, Danone, Abbott Laboratories, Reckitt Benckiser, and many more, are strategically positioning themselves to capitalize on these emerging trends. The rising demand for organic infant formula can be attributed to increased awareness about the potential risks associated with synthetic ingredients and pesticides found in conventional products.

Being highly knowledgeable regarding the long-run health effects of organic nourishment has made it profitable to develop for manufacturers and the space created in terms of its market. Spreadingly and globally, through its rising awareness, brands such as HiPP, The Hain Celestial Group, Bellamy's Organic, and Holle continue their expansion and even their enhancement of products through targeted outreach. Their efforts to maintain transparency and adhere to strict regulatory standards are key factors driving consumer trust. Future developments in this market are expected to align with advancements in sustainable and ethical production practices. The demand for organic certifications and traceable supply chains will likely encourage companies like Topfer, Nature One, Babybio, and Arla Foods to innovate further in sourcing and manufacturing.

These measures not only ensure product safety but also enhance brand credibility among increasingly eco-conscious consumers. Moreover, the integration of cutting-edge technology to improve the nutritional profile of organic infant formula could redefine product quality, giving competitive players a distinctive edge. Competition within the Global Organic Infant Formula market is fierce, as companies vie for dominance through mergers, acquisitions, and partnerships. These strategic moves help companies expand their portfolios and enter emerging markets.

For example, many of the largest players are focusing on Asia and Africa, where there is still much room for growth due to rising populations and disposable incomes. Personalized nutrition is another trend that may spur innovation as companies seek to develop formulas tailored to the individual needs of infants. In the coming years, the Global Organic Infant Formula market is likely to find increased cooperation between business enterprise and research institutions. Potential collaborations will unlock unprecedented potential and ensure that market players continue to live up to the expectations of choosiest consumers while fostering health competition.

Organic Infant Formula Market Key Segments:

By Type

- Starting-Milk Formula

- Follow-On Milk Formula

- Special Milk Formula

- Others

By Ingredient Source

- Cow Milk-Based

- Goat Milk-Based

- Soy-Based

- Others

By Packaging Type

- Powder

- Liquid

- Ready-to-Feed

By End-Users

- Infants (0-6 months)

- Babies (6-12 months)

- Toddlers (12-36 months)

Key Global Organic Infant Formula Industry Players

- Nestlé

- Danone

- Abbott Laboratories

- Reckitt Benckiser

- Perrigo

- HiPP

- The Hain Celestial Group

- Bellamy’s Organic

- Holle

- Topfer

- Nature One

- Babybio

- Arla Foods

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383