MARKET OVERVIEW

The global optical coating systems market will continue to shape the future of precision engineering and high-performance manufacturing across a series of advanced industries. Being an extremely specialized segment of the broader photonics and materials processing industry, this market will be heading towards applications demanding higher levels of accuracy, lower energy loss, and increased optical clarity. In the future, its influence will extend far beyond traditional boundaries, redefining how light manipulation is applied in technologies that extend up to deep-space imaging and down to next-generation medical diagnosis. Optical coating systems will not only be efficiency tools; they will be essential building blocks of core technological infrastructure.

Since space exploration missions are planned deep into the following decade, these systems will become a part of telescope technology utilized in equipment requiring ultra-low reflectance and high signal transmission. Their status in scientific instruments will no longer be to simply improve performance passively. Instead, they will have an active role to play in delivering repeatable and stable results under extreme operating conditions, e.g., a vacuum environment or extremely corrosive environment. Defense and aerospace will also undergo another era of revolution with specialized coatings that will augment camouflage detection, spectral selectivity, and secure signal transmission. The global optical coating systems market will also redefine what is achievable optically by engineering thin films that can manage wavelengths outside the visible regime. This will also give rise to systems that react in real-time to dynamic threats and environmental inputs, paving the way for adaptive sensing platforms.

Health diagnostics will be altered as optical coatings become the foundation for equipment that requires high-contrast imaging and precise light control. Biomedical instruments, specifically non-invasive scanners and transportable analysis tools, will leverage these coatings to introduce better resolution and higher throughput. These systems will assist with visual output; they will assist in accelerating decision-making in clinical settings where precision and time sensitivity are the concern.

In the consumer electronics space, virtual and wearable technologies will need coatings that enhance visual quality and energy efficiency. As manufacturers strive to offer thinner, tougher, and more visually improved displays, optical coatings will evolve in function and formulation. Anti-glare, anti-reflective, and color-sharpening capabilities will be designed on nanoscale levels, driven by materials that respond anticipatively based on usage patterns and ambient conditions.

Furthermore, the global optical coating systems market will begin to converge increasingly with data infrastructure as an application in photonic circuits and laser communications systems. With increasing bandwidth requirements, the need for materials that allow minimum possible loss of light while transmitting will become unavoidable. These systems will not remain restricted to old telecommunications but will enter new domains like quantum computing and edge processing.

Its future in this market is not a simple extension of its past, but a role as critical enabler. It will be the unsung partner in revolutionary technologies across sectors that will ride on optical precision as a foundation for expansion. Its producers, integrators, and developers will lead the pace in sectors where performance, clarity, and consistency cannot be traded.

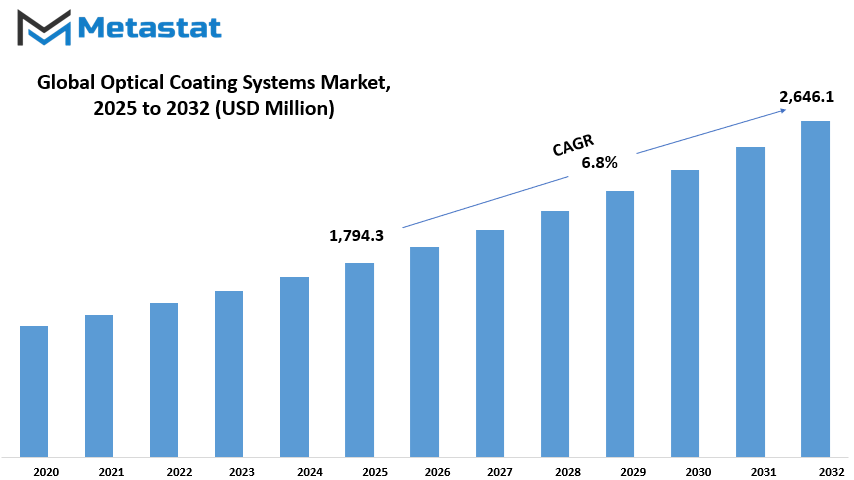

Global optical coating systems market is estimated to reach $2,646.1 Million by 2032; growing at a CAGR of 6.8% from 2025 to 2032.

GROWTH FACTORS

The global optical coating systems market is also experiencing long-term growth as industries more and more incorporate higher technological optical technology. Among the leading drivers in this context is the growing need for high-performance optics in consumer goods. Smartphones, tablets, and cameras, for example, more and more rely on precise optical components to offer enhanced image output and performance. As consumers seek better user experience, companies are employing optical coatings to upgrade their products. Optical coatings help to reduce glare, improve light transmission, and shield sensitive surfaces and hence play a vital role in modern electronic devices.

Another major factor influencing the rise in the market is increasing use of optical coatings by the automobile and aeronautical sectors. In vehicles, they are used in head-up displays, sensors, and lighting equipment for improved performance and safety. Similarly, in the aerospace sector, optical coatings are vital to the navigation system, the image systems, and other onboard technologies. With these industries continuing to develop and add more optical components, their need for a stable coating system will increase further.

But the market does have some hindrances too. The largest among them is the high initial and recurrent cost of setting up and operating optical coating systems. These systems are likely to require specialized machinery and controlled environments, which makes it expensive for an initial entrant into the market. Secondly, uniform quality is difficult to achieve, especially with mass production. This deters small competitors, which gradually slows down the growth of the market as a whole.

Even the manufacturing process itself can be a limitation. Optical coatings must be deposited with precision, and even the smallest discrepancies can affect product quality. Developing and maintaining the process takes time, money, and human capital, something that most companies find difficult to manage.

Despite all these constraints, there are promising developments in the works. One of them is photonics and solar energy. As the need grows for efficient energy solutions and advanced communication systems, optical coatings will be tasked with advancing such systems in performance as well as longevity. A second new phenomenon is the advent of nanocoating technologies. Such very thin coats can give them increased performance at the molecular level as well as unlock new possibilities for advancement in many different industries. As research continues and technology becomes more accessible, these advances could lead to new paths of market growth and offer strong opportunities for companies that are going to invest in the optical coatings of the future.

MARKET SEGMENTATION

By Type

The global optical coating systems market has been increasing steadily as a result of demand from a wide range of industries that range from the electronics industry to the automotive, aerospace, and healthcare sectors. The systems are employed to improve the performance of optical devices through modification of how light reflects or transmits surfaces. The most dominant segment in the industry is by the type of coating system employed. All the types contribute specifically to enhancing visual acuity, glare reduction, or management of light transmission.

All the types, Antireflective Coating Systems are unique. This segment, which is worth $710.9 million, can minimize reflection and enhance visibility in applications such as eyeglasses, lenses of cameras, and solar panels. The principal function of these coatings is to allow more transmission of light through a surface compared to reflection from it, thus yielding clearer and sharper images. Even on displays and screens, the technology is used where lesser glare helps in giving a better viewing experience, particularly in harsh lighting.

Reflective Coating Systems, by contrast, are processed with reflection and not absorption of light. Reflective coatings also find applications in telescopes, mirrors, and other optically employed devices where reflectivity is considerable. They optically capture or deflect light more effectively by way of reflecting light. They are particularly employed in the case of devices where image formation and brightness ought to be accurate.

Filter Coating Systems have another critical function. Filter coatings regulate the quantity or quality of incoming light in an optical surface. Applied to cameras, sensors, and medical equipment, they filter certain wavelengths of light, and this is needed for color correction, signal purity, or medical diagnosis. When employed, their operation enhances performance and accuracy in devices.

Transparent Conductive Coating Systems are conductive and transparent in nature. They find application in touchscreens, LCDs, and photovoltaic cells. Their primary role is to be transparent but conductive, thus being utilized in today's electronic devices. Collectively, they assist in formulating thinner energy-saving panels and screens.

The market also encompasses specialty coatings that accommodate industry-specific requirements. These could be coatings utilized in UV protection, thermal stability, or scratch resistance. Combined, the segments illustrate the extensive application and increasing significance of optical coating systems. As technology continues to advance, such coatings will have an even greater influence on shaping the direction of optics and electronics.

By Technology

The global optical coating systems market is experiencing steady growth, particularly the way various technologies are being employed to meet targeted industry requirements. The systems are crucial in maximizing the performance of optical devices by coating thinly surface areas of material in order to manage the way light reflects, transmits, or absorbs. Maybe the most straightforward way of accomplishing this is through a series of coating processes, each with targeted advantages depending on intended purpose and application.

Ion-assist deposition (IAD), e-beam evaporation, sputtering process, and vacuum deposition are the technologically advanced market segments. Ion-assist deposition aids the development of hard and stable coats through densification of coating layers with the help of ions. It assists in sustaining the coat life as well as adhesion to the surface, which is of great use in defense-related applications, medical imaging, and precision optics. E-beam evaporation involves the use of an electron beam to evaporate and warm material, which then is deposited on the surface. The method is prized for its potential to deposit high-purity coatings with excellent optical properties, and it has found extensive application in laser applications and telecommunications.

Sputtering is also extensively employed. Sputtering is a process of bombarding a target material with ions, which ejects particles and allows them to fall onto the optical surface. The process is more controllable in terms of thickness and uniformity and hence appropriate for precise uses. Finally, vacuum deposition, as the term indicates, is performed under a vacuum condition, which prevents contamination and yields extremely good-quality coating. It is a more general term covering several techniques, the above mentioned being included, but generally refers to the lower-cost, less complex arrangements employed for simple coating demands.

They all have their place in the market, contingent upon the application requirements and the intended effect. As companies like electronics, aerospace, and healthcare are being increasingly required by higher-tech optical components, the demand for improved coating systems will also increase. The thing that makes these technologies stand out is the way in which they address certain needs, whether this is greater light transmission, less glare, or greater toughness. Thanks to ongoing development and concern for performance and quality, the world market for optical coating systems is likely to be firm and promising in the coming days.

By Application

The global optical coating systems market keeps expanding as demand increases in different sectors. On the basis of application, the industry is also divided into Ophthalmic Lenses, Consumer Electronics, Solar, Automotive, Telecommunication, and Others. Every sector has its specific reason for employing optical coatings, and together they are held accountable for the growth of the industry continuously.

Optical coatings used in ophthalmic lenses improve vision quality and eliminate glare, thereby becoming comfortable to use. The coatings also offer improved protection of lenses from smudges and scratches, thereby enhancing their durability. With a rise in the prescription glass and contact lens usage because of the added amount of screen time, the segment is likely to maintain robust demand. Optical coatings are used in consumer devices to enhance the performance of display screens of smartphones, tablets, laptops, and TVs. The coatings are able to reduce reflections, improve contrast, and enhance readability of the screens in different light conditions. With constant product innovation and high customer demands, producers will continue investing in developing coatings for a better user experience.

In the solar sector, optical coatings are applied on panels to facilitate more transmission of light with less loss through reflection. This improves the efficiency of solar cells to generate more power from the same sunlight. As nations strive to achieve energy targets and decrease their carbon footprint, solar power becomes increasingly critical, hence an increasing demand for these coatings. In the automotive sector, optical coatings are applied to mirrors, displays, and light systems. Besides enhancing visibility and appearance, they also contribute to safety features. With advanced vehicles entering the market that have smart features and better display systems, optical coatings will increasingly contribute to enhancing functionality.

Telecommunication is also one of the areas where optical coatings are a necessity. They find application in fiber optics and associated components to provide clearer and quicker data transmission. As the need for improved connectivity and increased data speed increases with the rollout of 5G networks, this segment will continue to demand superior coating solutions. The 'Others' sector encompasses applications such as medical devices and industrial machinery, wherein coatings are utilized for enhanced performance and safeguarding sensitive surfaces. Every use of an application brings value to the overall market and showcases just how vital these systems are to various industries. As technology progresses, the need for optical coating systems will continue to grow.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,794.3 million |

|

Market Size by 2032 |

$2,646.1 Million |

|

Growth Rate from 2025 to 2032 |

6.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

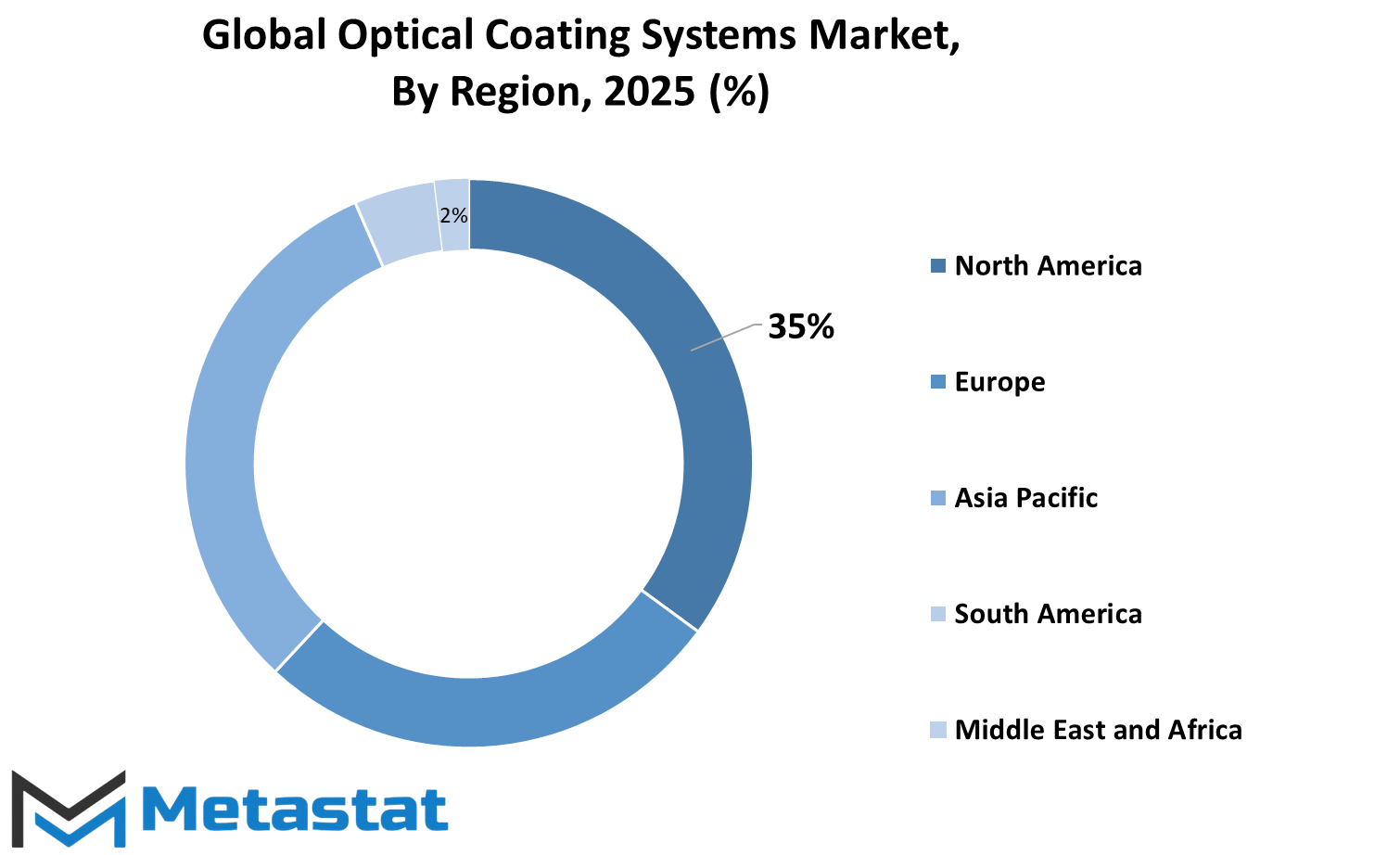

The global optical coating systems market is geographically divided into regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. These are further divided to define countries that are significant in terms of their contribution to the market. For North America, these include the United States, Canada, and Mexico. This is an area of high-tech foundation and considerable investments in development and research, which are the foundations for the demand of sophisticated optical coatings in industries like healthcare, telecom, and consumer electronics.

The European market includes the United Kingdom, Germany, France, Italy, and Rest of Europe. These are nations with established industries and strong infrastructures that contribute to the support of increased development of optical coating applications. These coating systems are widely used in manufacturing, automotive, and defense equipment. Germany, in particular, has a wide renown for precision engineering and superiority in optics and photonics, and thus coating systems are required. The UK and France also make colossal contributions based on their focus on medical technologies as well as aerospace innovation.

Asia-Pacific includes countries like India, China, Japan, South Korea, and the Rest of Asia-Pacific. This area is, at present, observing massive growth in the market with the expansion of electronics manufacturing and increasing customer demand. Japan and China are leading the production activity, while South Korea and India are catching up fast with steady developments in their industries. The increase in demand for smartphones, displays, and solar panels in the region is constantly driving the demand for optical coatings.

South America includes Brazil, Argentina, and the Rest of South America. Brazil's largest contribution is here due to its growing electronics sector as well as its growing healthcare industry. Although the market size in this region is smaller than it is in other regions, it is gradually increasing with more technology adoption and better local manufacturing capacity.

The Middle East & Africa region includes GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa. These countries are seeing increasing demand for optical coating systems, most notably in defense and the energy sector. The UAE and Saudi Arabia are also making investments in high-tech infrastructure and smart city developments that contribute to the expansion of the market. South Africa and Egypt also contribute because their rising industrial and medical device requirements. They all contribute a unique contribution to the global market to help them shape the optical coating technology world.

COMPETITIVE PLAYERS

The global optical coating systems market is progressing steadily with increasing demands for high-performance optical components across various industries such as electronics, healthcare, and defense. The systems are used to coat thin layers of material on the surface of optics to improve reflection, transmission, and resistance. As technology improves and application specificity increases, the demand for precise and reliable coating solutions is more important than ever.

Several major players are charting the future of this industry with innovation and technical expertise. Companies like Buhler, Satisloh, Coburn Technologies, OptoTech, Chengdu Guotai, Ningbo Junying, Optorun, Ultra Optics, and Korea Vac-Tec are leading the charge. They are developing high-tech coating systems that meet the mounting needs of industries that require high-quality optical performance. The systems have uses in eyeglasses, camera lenses, microscopes, laser systems, and even in space technology. With their capacity to change the manner in which light behaves when interacting with surfaces, these coatings allow for better clarity, reduced glare, and the protection of sensitive equipment from damage. Growing use in day-to-day life is one of the inherent reasons demand has become so massive.

Smartphones, wearables, and medical devices rely on precise optics. Optical coating systems bring these products into action with precision by enhancing image clarity and reducing energy loss. The medical industry, for example, makes use of coated lenses in diagnostic equipment that need unobstructed imaging in order to work properly. The military and aviation industries also require coatings that are resistant to extreme conditions while still doing their job. Energy efficiency is another important drive.

Optical coatings are able to control light and heat transmission through materials, and this is what makes them suitable for solar panels and low-energy windows. As the globe works to reduce energy consumption, this property greatly improves these systems. The companies are also keen on improving the durability and environmental resistance of the coatings since this helps extend the life of optical goods and reducing replacements. Despite the strong competition, companies are investing in R&D to stay competitive.

They aim to achieve coating systems that are quicker, efficient, and more accurate. They are mostly also exploring automation and intelligent technologies to enhance manufacturing flexibility and responsiveness to markets. With steady growth expected, and industry leaders remaining committed to investing in technology as well as worldwide presence, the Optical Coating Systems market will further experience increased innovation and wider adoption across industries.

Optical Coating Systems Market Key Segments:

By Type

- Antireflective Coating Systems

- Reflective Coating systems

- Filter Coating Systems

- Transparent Conductive Coating Systems

- Others

By Technology

- ion-assist deposition (IAD)

- e-beam evaporation

- Sputtering Process

- Vacuum Deposition

By Application

- Ophthalmic Lenses

- Consumer Electronics

- Solar

- Automotive

- Telecommunication

- Others

Key Global Optical Coating Systems Industry Players

- Buhler

- Satisloh

- Coburn Technologies

- OptoTech

- Chengdu Guotai

- Ningbo Junying

- Optorun

- Ultra Optics

- Korea Vac-Tec

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252