Global On Demand Transportation Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global on demand transportation market in the transport industry will be a transformative process which reorganizes how people and stuff move from town to city. It will have its genesis in the early 2000s when mobile apps and GPS-equipped cell phones began bringing drivers and passengers directly together without the mediation of previous taxi networks. During the same time, some start-ups in urban areas tried out ride-hailing concepts, piloting dynamic pricing and instant booking systems. Small in numbers though, these early pilots paved the way for large-scale adoption of on-demand transportation solutions.

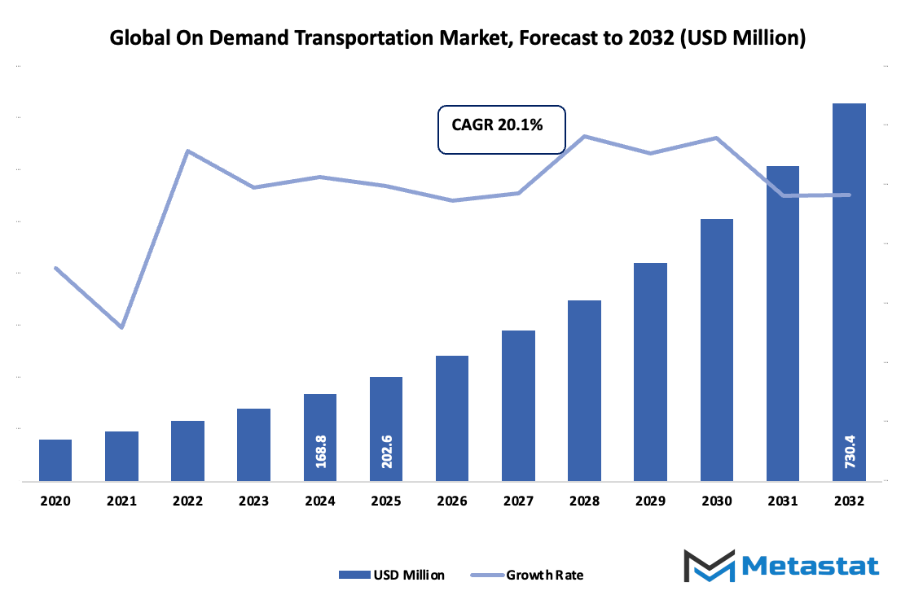

- Global on demand transportation market size of close to USD 202.6 million in 2025 at a CAGR of nearly 20.1% by 2032, with projected growth opportunities over USD 730.4 million.

- E-Hailing has almost 65.0% market share, and it inspires innovation and widening applications through intensified research.

- Key growth drivers: Growing smartphone penetration and usage of e-payments, Urbanization and aspiration for comfortable, flexible travel

- Some of the opportunities are: Scaling up electric and autonomous vehicle fleets to complement sustainable on-demand solution

- Key takeaway: The market is going to grow exponentially in value over the next decade, demonstrating strong growth prospects.

The industry will see milestone instances during the mid-2010s when giant platforms go global, bringing with them innovations such as dynamic routing, real-time tracking, and cashless payments. Such developments not only make travel easier but also bring a connotation of security and reliability that has been missing in traditional transport systems. At the same time, the change in what consumers want to purchase convenience, speed, and customization will fuel the market, which will include services like ride-sharing, micro-mobility modes, and subscription models targeting urban dwellers seeking flexible alternatives to car ownership. Technology will be a deciding factor in the course of the market. Artificial intelligence and machine learning will streamline routes, minimize waiting time, and enhance fleet management, while autonomous cars will begin to appear in pilot schemes, a precursor to a possible future where human drivers are a thing of the past.

Simultaneously, the regulation environment will come of age, with governments introducing safety regulations, licensing, and data protection legislation that will govern how the services are run in various regions. These shifts in policy and operations will steer the market towards more open, organized, and secure platforms. As the world on demand transportation sector advances, it will increasingly involve elements of sustainability, with hybrid and electric vehicles becoming increasingly robust, and platforms prioritizing sustainable modes. Together, evolving consumer trends, technological revolution, and policymaking will define a marketplace increasingly responsive, increasingly efficient, and increasingly integrated. What began as a straightforward concept of linking drivers to riders will evolve into an advanced network providing mobility solutions best fitting the aspirations of urban dwelling in this day and age, leading the way towards a time when unbroken transportation is the standard.

Market Segments

The global on demand transportation market is mainly classified based on Service Type, Vehicle Type, Power Source, Application.

By Service Type is further segmented into:

- E-Hailing: The On Demand Transportation sector globally will experience a revolutionary surge with e-hailing services. Web-based platforms will keep on increasing as humans increasingly depend on punctual and reliable travel. Smarts apps, real-time tracking, and increased demands for secure and efficient city trips will be fulfilled through the evolution.

- Car Sharing: The global on demand transportation market will grow with car sharing, where cities seek eco-friendly solutions to offset congestion. Growth will be fueled by growing urban populations, sustainability issues, and cost-saving advantages. Shared mobility will contribute significantly to reducing the number of private vehicles on the road.

- Car Rental: Global On Demand Transportation will be helped by computerized car rental websites. Technology will facilitate simple booking, touchless service, and variable rental terms. Demand will increase as consumers and companies want convenience, and compatibility with hybrids and electric vehicles will continue to support the long-term future of the rental business.

- Station-Based Mobility: The global on demand transportation market will integrate station-based mobility and provide ordered and predictable service. Customers will still go to cars in fixed stops, enhancing accessibility of urban centers. The scheme will minimize traffic problems as well as provide an equilibrium between productivity and cost.

By Vehicle Type the market is divided into:

- Four-wheelers: The global on demand transportation market will continue to depend on four-wheelers as the central transportation mode. Four-wheelers are time-saving, they provide space, and they perform efficiently, with passenger and cargo transport requirements met via them. Progress in electric and hybrid variants will see four-wheelers continuing to occupy a central position in deciding the future of mobility.

- Two-wheelers: The global on demand transportation market will expand with increasing use of two-wheelers for convenient and affordable transport. They are best suited in densely populated cities with their traffic handling and wallet-friendly lightness. Two-wheelers will play an important role in environmentally friendly transport solutions with the rise of electric models.

- Micro Mobility: The global on demand transportation market will grow with micro mobility solutions like e-scooters and bikes. Short-distance city mobility will further trend towards such vehicles due to convenience and sustainability. Seamless interfacing with other transport services through smart app integration will create more user satisfaction.

By Power Source the market is further divided into:

- Fuel Powered: The global on demand transportation market will be having a proportion of fuel vehicles based on infrastructural accessibility and cost. Although expansion will occur in the future to electric and hybrid vehicles, fuel vehicles will remain prominent where charging systems and advanced vehicle technologies have not reached there as yet.

- HEV: The global on demand transportation market will enhance the demand for HEVs as a fifty-fifty split between conventional and electricity power. HEVs will promote lower emissions and efficiency. Government incentives and raised awareness levels will motivate service providers to increase hybrid fleet vehicle usage for mobility services.

- PHEV: The global on demand transportation market will witness expansion of plug-in hybrid electric vehicles (PHEVs), which provide fuel and charging convenience of use. PHEVs will appeal to both service providers and users who want lower emissions without compromising long-distance capability. Expansion of infrastructure will also enhance global adoption.

- BEVs: The global on demand transportation market will experience aggressive adoption of battery electric vehicles (BEVs). Zero emissions and reduced operating costs will maintain BEVs at the center of the future of mobility. Governments and growth in charging infrastructure will drive their position in clean transportation, sustainable transportation.

By Application the global on demand transportation market is divided as:

- Passenger Transportation: The global on demand transportation market will experience a huge rise in passenger transport services. Comfortable, quick, and easy rides will be in demand, thereby pushing this segment. Urban planning, online portals for booking, and the use of green cars will define the growth of passenger transport over the next few years.

- Goods Transportation: The global on demand transportation market will expand at a fast pace in the transportation of goods. Companies and buyers will increasingly be dependent on on-demand transport. Increases in e-commerce demand and quicker supply chain needs will drive demand. Hybrid and electric cars will continue to transform the transportation of goods towards sustainability and efficiency.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$202.6 Million |

|

Market Size by 2032 |

$730.4 Million |

|

Growth Rate from 2025 to 2032 |

20.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

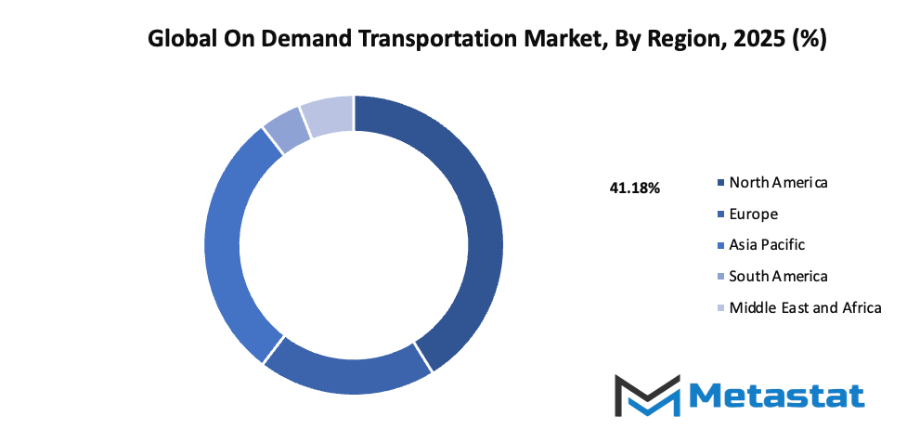

- Based on geography, the global on demand transportation market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing smartphone penetration and digital payment adoption: The global on demand transportation market benefits greatly from increasing smartphone ownership and digital payment systems. With mobile access, booking a ride becomes quick and simple, while secure payment options make users more confident. This combination ensures higher adoption rates and creates stronger growth opportunities for service providers worldwide.

- Growing urbanization and demand for convenient, flexible transportation options: The global on demand transportation market is supported by rapid urban growth, which creates heavy traffic and limited parking space. People prefer flexible and convenient transportation choices to avoid delays and stress. On-demand services offer affordable and accessible solutions, which makes them attractive in densely populated cities and urban centers.

Challenges and Opportunities

- Regulatory challenges and legal restrictions in certain regions: The global on demand transportation market struggles with differing rules that restrict growth in some areas. Government policies vary, making expansion difficult for providers. Licensing, pricing, and operational guidelines often differ across regions. Overcoming these challenges requires collaboration with authorities and flexible business models tailored to local regulations.

- Safety and security concerns among users impacting adoption: The global on demand transportation market experiences hesitation due to safety and security concerns. Incidents of fraud or misuse lower user confidence, slowing adoption. Providers must improve monitoring systems, driver background checks, and emergency features to build trust. Strong safety measures will encourage more people to adopt these services.

Opportunities

- Expansion of electric and autonomous vehicle fleets to enhance sustainable on-demand transportation solutions: The global on demand transportation market is set to benefit from the use of electric and autonomous vehicles. Electric fleets reduce emissions, supporting environmental goals, while autonomous systems lower operational costs and improve efficiency. These advancements will shape a cleaner and smarter transportation future, attracting wider adoption across cities.

Competitive Landscape & Strategic Insights

The global on demand transportation market is expected to experience significant transformation in the coming years as technology, consumer preferences, and regulatory frameworks continue to shift. The industry is a mix of both international leaders and regional competitors, each playing a vital role in shaping future growth. Companies such as Uber Technologies Inc., ANI Technologies Pvt. Ltd. (OLA), Lyft, Inc., Grab, Careem, Taxify OÜ, Gett, Beijing Xiaoju Technology Co., Ltd. (Didi Chuxing), BlaBlaCar, Wingz, Inc., Curb Mobility, Easy Taxi Serviços LTDA., Cabify, Turo, Enterprise Holdings, Inc., Car2go NA, LLC, DriveNow GmbH & Co. KG, Cabio CarSharing, Mobility Cooperative, SOCAR Mobility Malaysia, Europcar, Sixt SE, The Hertz Corporation, and Avis Budget Group, Inc. are all competing in the global on-demand transportation market. The presence of such a wide range of players highlights how dynamic the competitive landscape has become.

Future developments in this sector will likely be influenced by advances in digital platforms, artificial intelligence, and connected mobility solutions. Data-driven systems will make ride-hailing and car-sharing services more efficient, reducing wait times and improving route optimization. The introduction of autonomous vehicles has the potential to disrupt traditional business models by lowering operational costs and providing safer, more reliable services. Electric vehicle adoption is also set to grow, encouraged by government incentives and the rising need for sustainable solutions. With environmental concerns increasing worldwide, companies that adapt quickly to electric and hybrid fleets will be better positioned to meet customer expectations.

Regional competition will remain intense, as local companies often understand the unique cultural and regulatory conditions of their markets better than larger global firms. For instance, Asian companies like Didi Chuxing and Grab have built strong networks by tailoring services to local habits, while European operators have integrated car-sharing and rental systems that suit urban lifestyles. This balance between international giants and local innovators will keep the industry competitive and fast-moving.

Market size is forecast to rise from USD 202.6 million in 2025 to over USD 730.4 million by 2032. On Demand Transportation will maintain dominance but face growing competition from emerging formats.

Looking forward, the global on-demand transportation market will be shaped by broader technological ecosystems. Integration with smart city infrastructure, digital payment systems, and predictive analytics will help companies deliver smoother and more customized experiences. Partnerships across technology firms, automotive manufacturers, and public authorities will further expand the opportunities available. The next stage of growth will not simply depend on expanding fleets or customer bases, but on creating seamless, sustainable, and interconnected transport solutions that fit into the daily lives of people everywhere.

Report Coverage

This research report categorizes the global on demand transportation market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global on demand transportation market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global on demand transportation market.

On Demand Transportation Market Key Segments:

By Service Type

- E-Hailing

- Car Sharing

- Car Rental

- Station-Based Mobility

By Vehicle Type

- Four-wheelers

- Two-wheelers

- Micro Mobility

By Power Source

- Fuel Powered

- HEV

- PHEV

- BEV

By Application

- Passenger Transportation

- Goods Transportation

Key Global On Demand Transportation Industry Players

- Uber Technologies Inc.

- ANI Technologies Pvt. Ltd. (OLA)

- Lyft, Inc.

- Grab

- Careem

- Taxify OÜ

- Gett

- Beijing Xiaoju Technology Co., Ltd. (Didi Chuxing)

- BlaBlaCar

- Wingz, Inc.

- Curb Mobility

- Easy Taxi Serviços LTDA.

- Cabify

- Turo

- Enterprise Holdings, Inc.

- Car2go NA, LLC

- DriveNow GmbH & Co. KG

- Cabio CarSharing

- Mobility Cooperative

- SOCAR Mobility Malaysia

- Europcar

- Sixt SE

- The Hertz Corporation

- Avis Budget Group, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252