MARKET OVERVIEW

The global offshore supply vessel (OSV) market will remain the framework of support for offshore oil and gas activities, carving out its own niche in the marine logistics market. Contrary to surface readings that tend to limit this industry to ship deliveries and rig supply, the future will see an even more vibrant makeover through changes in marine energy logistics, tightened safety protocols, and remote asset integration. With increasing complexity and depth of offshore fields, the function of OSVs will not be mere transportation or supply; instead, it will be specialized work with adapted engineering capabilities that can carry out tough operational environments.

Technological adoption will no longer be a choice but a natural necessity. Future ships will have to be designed with adaptive propulsion technologies, intelligent navigation systems, and real-time communication interfaces in order to stay relevant. As conventional energy companies venture increasingly into deeper seas or less prospected offshore areas, demands on these ships will skyrocket. It will no longer be just a matter of transporting drilling equipment or staff; they will be called upon to act as independent support stations, capable of reacting to capricious weather patterns and remote mechanical malfunctions.

There will be a radical change in the design philosophy for these ships. Future OSVs will emphasize multi-purpose capability, enabling a vessel to perform multiple functions with minimal human reconfiguration. This will require engineering groups to collaborate closely with operational data scientists and ship architects. Artificial intelligence and digital monitoring solutions will not be an add-on—they will be the normal foundation of operational continuity. Ships will be expected to figure out learning, route and resource optimization with little shore-based intervention.

Policy-wise, environmental laws and global maritime regulations will have an increasing say in how the global offshore supply vessel (OSV) market develops. Targets for carbon neutrality and emissions reduction will drive operators towards sustainable fuels and hybrid power. The industry would experience substantial transformations in contractual structures as well, with long-term vessel use contracts giving way to performance-based and modular deployment strategies. This demands that businesses stay nimble, both in terms of vessel design and crew training, to adapt to liquid mission requirements and changing marine topography.

Investment patterns in OSV development will change from volume-driven purchasing to capability-driven evaluations. Rather than purchasing additional ships, firms will allocate funds to ships that provide multifunctional results with precision of efficacy. The new strategy will redefine financial viability calculations, emphasizing more on operational life, maintenance cost management, and digital infrastructure compatibility.

Finally, the global offshore supply vessel (OSV) market will be provided to the market not only from its size, but to the extent of the value in exploration, maintenance and emergency response operations. With the emphasis on sea industries more speed, greater safety and more stability, OSVs should exceed their traditional boundaries and develop to complete a future that tested not only their design but also their operational culture. This change will be not only about the testing of technical preparations, but it will also redefine the strategic idea process in the region, to adopt traditional norms completely new level of offshore support.

Global offshore supply vessel (OSV) market is estimated to reach $54,978.2 Million by 2032; growing at a CAGR of 5.1% from 2025 to 2032.

GROWTH FACTORS

The global offshore supply vessel (OSV) market will remain of key importance in facilitating offshore energy operations. With the development of discovery of offshore oil and gas, the need for reliable and multipurpose vessels for important supply on crew, machinery, and distant platforms will increase equally. These ships are important to operate offshore operations smoothly and without phenomena, especially in areas where it is not possible to reach platforms in the traditional way. Another major factor running demand for OSVs is being more emphasis on offshore wind power projects. Since more and more investment is going into renewable energy, the size and complexity of the offshore wind fields is expanding. These projects demand constant supply of materials and crew, which OSV is particularly well equipped for management. This growing interest in wind power will develop new sources of growth in the OSV industry.

In spite of this rising demand, there are some issues that can impact the performance of the global offshore supply vessel (OSV) market. Among these is the very high cost of running and servicing these vessels. Offshore conditions are recognized as harsh and volatile, which puts immense pressure on equipment as well as men. Continuous wear and tear result in frequent servicing and repair, which is costly to companies to operate OSV fleets. Furthermore, the international oil industry has traditionally fluctuated with oil prices. When oil prices drop, companies tend to reduce exploration operations, directly impacting the demand for support vessels. These are the factors that bring uncertainty to vessel operators and may slow new investment in the industry.

Despite these fears, the future of the global offshore supply vessel (OSV) market is bright. As the world keeps adopting cleaner energy, the application of OSVs will not be limited to oil and gas. Offshore wind farms are increasingly being installed and maintained using these vessels by more companies. This movement will not just boost the usage rate of current fleets but also stimulate the creation of new, specialized ships designed for renewable energy operations. The growing interest in cleaner fuels will temper the troubles that the traditional oil industry presents, and so a new way forward will be formed by the industry. As companies adjust to these changes, the global offshore supply vessel (OSV) market will find fresh opportunities to grow and remain relevant in a changing energy landscape.

MARKET SEGMENTATION

By Vessel Type

The global offshore supply vessel (OSV) market will witness gradual changes over the next few years due to the development needs of market offshore exploration and production activities. The role of these ships is central to facilitate offshore oil and gas operating by serving tools, supply and personnel from offshore platforms. The vessel will be partitioned at the basis of type, especially with each type to have a different purpose for offshore operations. Anchor handling tug supply (AHTS) will play an important role in digging rigs and anchor handling for vessels drilling activities. AHTS vessels are designed to handle heavy equipment under heavy sea conditions, making them a better option in deep sea applications. Platform supply vessels (PSV) will be the backbone of offshore logistics with various drilling materials, chemicals and consumables with their sufficient deck space and bottom-deck storage capacity. They will be constantly in demand as the offshore operations become more complex and demand, which requires ongoing revival efforts.

Multipurpose Support Vessels (MPSV) will be utilized in a multitude of offshore tasks, ranging from subsea construction and pipe laying to support in maintenance. They will be a valuable investment for firms seeking to save cost while broadening their capabilities in services. Crew Vessels, which are for secure and effective transfer of personnel, will continue to be important because mobility of the workforce will be an everyday necessity in remote offshore areas. Emergency Response and Rescue Vessels (ERRV) will function as essential safety resources. These ships are specifically designed to deliver instant medical assistance, firefighting, and evacuation in the event of emergencies. Their presence will be required by safety standards, particularly in risk areas.

Standby Vessels will act as auxiliary safety measures, located close to offshore platforms in order to respond rapidly under emergency conditions. Well Intervention Vessels will be responsible for maintenance and repair operations on currently existing wells, enabling their life to be extended without the necessity of large rigs. Chase Vessels will be retained to carry out surveillance and monitoring functions, protecting off-limits zones around offshore installations from unauthorized access.

With the development of the global offshore supply vessel (OSV) market, the position of these ships will become clearer and vital to offshore operations. Companies will streamline their fleets by investing in higher efficiency, technically equipped ships to satisfy operational requirements and environmental demands. This transformation will define the future of offshore logistics and support with vessel specialization at the core of industry planning.

By Fuel Type

The global offshore supply vessel (OSV) market, when viewed through fuel type lenses, will gradually be away from its traditional dependence on diesel. For decades, diesel-operated OSV has dominated offshore operations due to its strong engine performance and wide availability of fuel. However, with increasing environmental awareness and regulatory pressures, the global offshore supply vessel (OSV) market will begin to increase interest in alternative fuel options. While the existing infrastructure and familiarity will continue to use diesel for some time, increasing fuel costs and strict emission criteria will encourage companies to consider cleaner and more durable fuel.

Liquidized natural gas (LNG) is an option that will look at the growing demand. It provides a cleaner-burning option for diesel, which emit a lower level of sulfur oxide and nitrogen oxide. The LNG-operated OSV will appeal to companies aimed at reducing its environmental impact without compromising on performance. Although the shift will not be overnight, LNG infrastructure and fuel supply systems will help make this option more practical and accessible in the coming years.

At the same time, hybrid ships will slowly engrave their own location in the global offshore supply vessel (OSV) market. These ships use a combination of traditional fuel engines and battery systems, which improves fuel efficiency and improve emissions. Hybrids offer a middle ground for operators that are not fully ready to go into electric or LNG-operated fleet, but still want to progress towards stability. Over time, technical reforms will make the hybrid system more reliable and cost effective, leading to their appeal in both shallow and deep sea operations.

Electric OSV, while still in their early stages, will be seen as a long -term future of offshore supply operations. Their use will depend a lot on the availability of battery technology progress and reliable charging infrastructure. As the capacity of the battery improves and the charge decreases, electric utensils will become more practical for small offshore routes and special tasks. Operators will possibly adopt electric OSVs in stages, start with pilot projects and expand their use as confidence in technology increases.

Overall, while diesel does not disappear immediately, the global offshore supply vessel (OSV) market will move towards more diverse fuel mixture. LNG, hybrid, and electrical options will provide cleaner options, each with a set of its own advantages. Adopting these fuel gradually will shape more efficient and environmentally responsible offshore supply area.

By Application

The global offshore supply vessel (OSV) market, when divided by application, shows the two major areas of the focus- shallow water and deep water. Both regions play a specific role in supporting offshore operations, and their relevance will continue to shape the global offshore supply vessel (OSV) market structure. The operation of shallow water is usually close to the beach, where the depth is low and access is easier. These ships are small, more flexible and cost effective for short distance supply routes. In areas where offshore drilling activities are based in shallow parts of the sea, such as in the Gulf of Mexico or parts of Southeast Asia, shallow water OSVs are often preferred options. They are ideal for completing regular supply tasks, supporting construction platforms and handling emergencies in areas where deep water abilities are not required.

On the other hand, deep water Osv is equipped with large, strong and more advanced technology. They are designed to work away from the edge, where the drilling platforms are deployed in very deep water. These ships are important for the transport of equipment, chemicals and fuel over long distances. Like oil and gas companies grow towards searching for reserves that are difficult to reach, the demand for deep water OSV will increase. They play an essential role in ensuring uninterrupted operation of deep sea platforms, especially in a challenging environment such as North Sea, West Africa and parts of South America. The shallow water supply should be able to handle deep water OSVs, unlike the vessels, which have relatively projected routes and conditions, the thick season, large waves and long -term operating hours.

The future of the global offshore supply vessel (OSV) market will largely depend on how companies balance the cost and evil with technical capacity. While shallow water projects are more inexpensive and faster to start, deep water projects provide large resource capacity. As global energy is required, both applications will continue to fulfill different objectives. Countries willing to expand their offshore energy resources will invest in the type of vessel that is best suited for their geographical and industrial needs. Some regions may bend towards the shallow water fleet to support mature areas near the beach, while others may push them to deep marine enterprises to reach the unaccounted reserve.

The global offshore supply vessel (OSV) market, when divided by application, shows clear indications that both shallow and deep-water segments will play an important role in meeting the future needs of the offshore energy sector.

By End-Use

The global offshore supply vessel (OSV) market will continue to underpin the requirements of various end-use industries as operations move further away from shorelines. These vessels will continue to be vital in taking equipment, supplies, and personnel to offshore installations that would be hard to access by conventional means. The oil and gas industry will be one of the biggest consumers in this sector. Offshore exploration and production operations require a reliable supply of equipment, machinery, and manpower. OSVs will be employed for transporting drilling equipment, fuel, chemicals, spare parts, and even rations, and contribute significantly to offshore operations with no breaks.

But the global offshore supply vessel (OSV) market will not be dominated by oil and gas. Growth in the renewable energy industry, particularly offshore wind farms, will generate regular demand for the vessels. Installation and servicing of wind turbines offshore call for a variety of support services, which OSVs will be in a good position to provide. As governments and private investors look to go greener with their energy options, OSVs will keep helping develop and maintain offshore infrastructure needed.

Defense and military industries will also benefit from OSVs, employing them for transportation, surveillance support, and logistics during naval operations. These ships will provide maneuverability in poor conditions, which is usually necessary for military operations conducted away from the shore. By carrying heavy loads and covering long distances, they will be ideal for national defense and border patrol operations.

Research and surveying activities are another expanding end-use segment where OSVs will have a significant role to play. From oceanographic research to seabed mapping and environment monitoring, researchers will depend on these vessels to carry out research in deeper water environments. OSVs will serve as floating bases for crews that have to gather and process data while remaining offshore for long periods of time.

Further, the global offshore supply vessel (OSV) market will serve a number of other applications that do not strictly qualify as part of the classical industrial industries. These may involve responding to disaster relief, humanitarian aid, and aiding remote construction projects. As offshore operations become more diversified, the capacity of OSVs to be responsive to divergent requirements will play an even greater role.

In total, demand in oil and gas, renewables, military, research, and other industries will keep the global offshore supply vessel (OSV) market on its feet and in demand. The ability of the vessels to offer safe and reliable service in harsh offshore conditions will dictate their future demand in sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$41,292.1 million |

|

Market Size by 2032 |

$54,978.2 Million |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

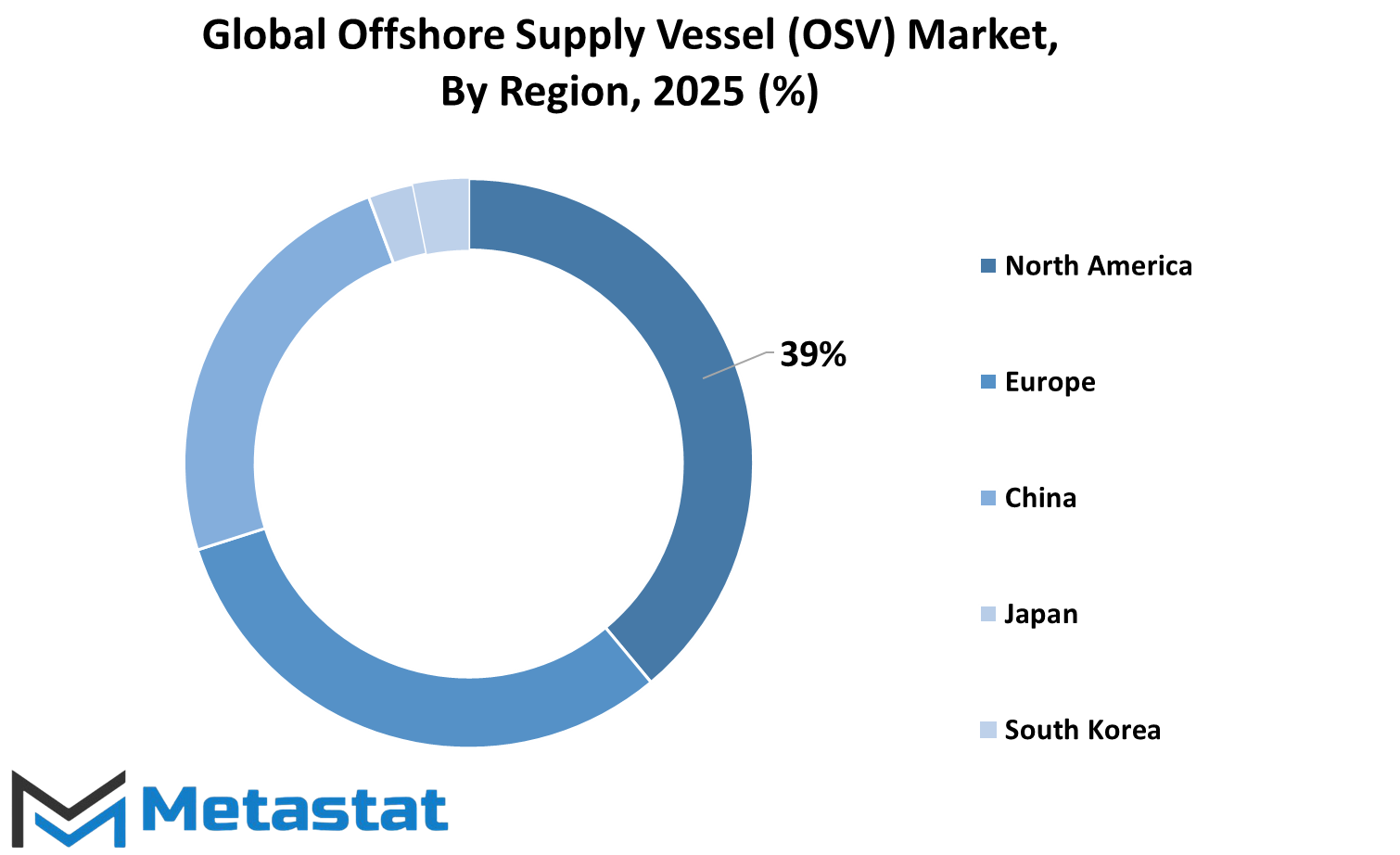

The global offshore supply vessel (OSV) market will continue to expand into different fields, each featured unique characteristics and will contribute differently in the industry. Depending on geography, this market is divided into North America, Europe, Asia-Pacific, South America and Middle East and Africa. North America includes U.S., Canada and Mexico. The region will possibly maintain a strong presence in the global offshore supply vessel (OSV) market due to its ongoing offshore activities and support infrastructure. The U.S., especially, has been involved in prolonged offshore exploration and will continue to invest its fleet in modernization, which will affect the demand for offshore supply vessels.

In Europe, the offshore supply vessel (OSV) market is shaped by UK, Germany, France, Italy and the rest of Europe. UK will be an important player due to its constant offshore operations in the North Sea. Other countries like Norway, often include the rest of Europe, are also expected to remain active contributors due to their deep sea drilling and supply chain network. European countries will be focused on stability and technological upgrades, which will encourage innovation in vessel design and performance.

The Asia-Pacific, including India, China, Japan, South Korea and the rest of the Asia-Pacific, will see rapid growth. The region will experience rising offshore projects, especially in countries such as China and India, where the demand for energy and the government interest in offshore resources is increasing, carrying on further discovery efforts. South Korea and Japan will contribute to shipbuilding expertise and technological progress in shipbuilding. The industrial focus that expands the region will result in installed and increase in vessel production and use in new offshore regions.

South America includes Brazil, Argentina and the rest of South America. The Brazilian region will remain at the center of offshore activities, as its pre-numb oil reserves are still being discovered and developed. This continuous development will keep the demand for offshore supply ships stable. Argentina can see more investigation efforts in future based on policy assistance and market conditions.

The Middle East and Africa region includes GCC countries, Egypt, South Africa and the rest of the Middle East and the rest of Africa. These areas will be important due to their oil and gas resources. GCC countries such as Saudi Arabia and UAE will continue investing in offshore infrastructure, while nations like Egypt and South Africa will gradually increase their participation in offshore explores and related services. Each region will play a role in shaping the future of the OSV market, influenced by local resources, government policies and technological development.

COMPETITIVE PLAYERS

The global offshore supply vessel (OSV) market will be shaped by a small but impressive group of companies that are central for operating offshore oil and gas activities. These companies include Borbon Offshore, Tidewater Inc., Marsk Supply Service, Edison Choust Offshore, DOF Group, Siem offshore Inc., Solstad Offshore ASA, Sechor Marine Holdings Inc., Vron Group, Harvey Group, Harvey Gulf International Marine, Ink. Shipbuilding Group, Inc. Each of these players holds a strategic position in the market and will possibly maintain their impact due to operating capacity, global footprint, and long -term relationship with exploration and production companies.

The global offshore supply vessel (OSV) market itself operates largely from the continuous requirement of logistic support in offshore projects. OSVs will need to handle a variety of tasks, ranging from transport equipment and supply to subsia operations and emergency response. The presence of these ships near the offshore platforms ensures that operations continue without interruption. Since the offshore exploration moves in deep water and rigid environment, these companies will focus on modernizing their fleet, integrating new technologies and increasing ship capabilities to stay relevant.

Some of the mentioned companies have already made significant invested in hybrids and fuel-efficient ships, which reflects a gradual change towards reducing operating emissions and improving energy efficiency. For example, new ships will come up with advanced navigation systems, remote monitoring tools and increased automation features that will support safe and more cost -effective operations. This infection will not only improve performance, but will also help to meet environment and regulator expectations, which are becoming strict in various fields.

In addition, strategic partnership, merger and acquisition between these companies will play an important role in shaping the global offshore supply vessel (OSV) market direction. These efforts will allow players to combine their strengths, adapt resources and expand their access to high-affected areas. While the competition will remain strong, it will be difficult to challenge these major players' dominance off -offs without significant investment and experience in offshore logistics.

The global offshore supply vessel (OSV) market is special and demanding. Because of this, companies that already have infrastructure, have technical information, and global access will have a clear advantage. As the offshore activity again increases speed, these installed players will continue to lead in this way, change the changing requirements and set new standards for offshore maritime support services.

Offshore Supply Vessel (OSV) Market Key Segments:

By Vessel Type

- Anchor Handling Tug Supply (AHTS) Vessels

- Platform Supply Vessels (PSV)

- Multipurpose Support Vessels (MPSV)

- Crew Vessels

- Emergency Response and Rescue Vessels (ERRV)

- Standby Vessels

- Well Intervention Vessels

- Chase Vessels

By Fuel Type

- Diesel

- LNG (Liquefied Natural Gas)

- Hybrid

- Electric

By Application

- Shallow Water

- Deep Water

By End-Use

- Oil & Gas Industry

- Renewable Energy Industry

- Military & Defense

- Research & Surveying

- Others

Key Global Offshore Supply Vessel (OSV) Industry Players

- Bourbon Offshore

- Tidewater Inc.

- Maersk Supply Service

- Edison Chouest Offshore

- DOF Group

- Siem Offshore Inc.

- Solstad Offshore ASA

- Seacor Marine Holdings Inc.

- Vroon Group

- Harvey Gulf International Marine

- Hornbeck Offshore Services, Inc.

- Havila Shipping ASA

- PACC Offshore Services Holdings (POSH)

- Island Offshore Management AS

- Eastern Shipbuilding Group, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252