MARKET OVERVIEW

The Global Oil and Gas Infrastructure market and its industry have an important role in facilitating the exploration, extraction, transportation, and processes of one of the most valued energy resources on earth. This market encompasses various assets and systems that guarantee safe and efficient transportation of crude oil, natural gas, and its by-products from production sites to end-users. From extensive pipeline networks to the storage facilities and refinery operations, oil and gas infrastructure operates at the heart of a continuously functioning supply chain that feeds energy in demand by the entire global population.

Primarily, the market is concerned with the development, maintenance, and upgrading of physical structures and technological systems for oil and gas activities. Upstream infrastructure deals with facilities and equipment used to extract hydrocarbons and undertake first processing. Midstream infrastructure includes pipelines, tankers, and terminals that play a vital role in transporting crude oil and natural gas downstream. This involves refineries, distribution networks, and storage systems that supply refined products such as gasoline, diesel, and petrochemicals to consumers and industries worldwide.

The Global Oil and Gas Infrastructure market is of strategic importance to global economic stability and energy security. As oil and gas continue to be in demand, so does the need for infrastructure that is efficient, reliable, and advanced in terms of technology. Countries with infrastructure that is in place can meet local needs and project themselves into global markets. This market also separates itself in creating jobs and innovations and becomes part of further investments in several industries such as construction, engineering, and manufacturing.

Future developments will likely focus on modernizing and sustainable principles. The application of digital technologies, automation, and smart monitoring systems will help increase efficiency and safety while keeping environmental compliance. Technology innovations related to pipeline integrity, leak detection, and predictive maintenance would reduce our operational risks and expenses. The coexistence of renewable energy sources alongside the classic oil and gas market will be critical in regulating the evolution of global infrastructure in favor of cleaner and diversified energy portfolios.

Expansions and modernizations in oil and gas infrastructure will be fashioned according to regulatory environments and geopolitical dynamics. International partnerships and investments will fuel the development of cross-border pipelines and liquefied natural gas terminals, which will secure global energy connectivity. In response to environmental regulatory compliance, infrastructure modifications will also ensure sustainability and integrity.

However, the scope of the global oil and gas infrastructure transcends physical assets and encompasses logistics and operational frameworks. Supply chain optimization, effective transport networks, and strategically planned storage capacity are the lifeblood of the market that keeps it resilient. The rise of advanced data analytics and digitalization will enhance decision-making processes that will allow real-time monitoring and performance optimization.

Therefore, with the evolution of the energy terrain, this market’s adaptability and innovation will determine its longevity. Infrastructure investments will supplement maintaining the capacity, safety, and efficiency of operations while at the same time addressing environmental concerns and changing energy demands. The growth of this market will adequately reflect the trends of global energy consumption at large, technological advancement, and the policy frameworks guiding them.

The relevance within the Global Oil and Gas Infrastructure Market continues to grow as nations and industries look for energy access and economic growth through developing infrastructure. The advancement of this market will further incubate these very principles underlying the energy systems around the world.

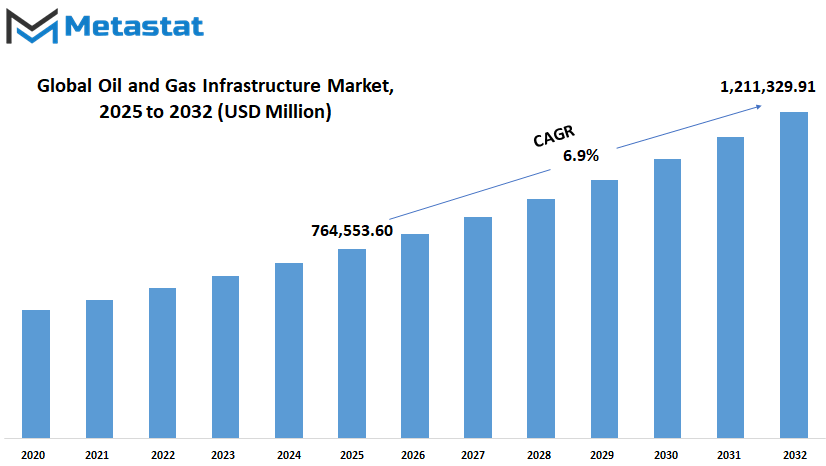

Global Oil and Gas Infrastructure market is estimated to reach $1,211,329.91 Million by 2032; growing at a CAGR of 6.9% from 2025 to 2032.

GROWTH FACTORS

The Global Oil and Gas Infrastructure market will witness remarkable growth in the years to come. This is driven mainly by the increasing demand for energy worldwide. Population increases and economy growth pressurizes the people to require a safe and reliable source of energy. Oil and gas infrastructures are crucial in meeting the increased energy demand, which includes developing and maintaining pipelines, storing facilities, refineries, and transporting networks. Countries want to create energy security, and thus investments in that system will continue to increase.

The fastest growing factor driving this market is the speed at which technology develops. Innovations are helping to make oil and gas operations more efficient, cheaper, and safer. Modern pipeline monitoring systems, for instance, help detect leaks. While innovative drilling technologies are increasing extraction rates with minimal damage to the environment. Automation and digital tools are also gathering momentum toward having better infrastructure management and quicker fixing of any problem. These advancements make infrastructure projects more attractive to investors and operators because they reduce downtime while enhancing productivity.

However, there are certain challenges that may pose hindrances to this market’s growth. Amongst them is the most significant one which is the high capital cost involved in building and maintaining oil and gas infrastructure. These projects usually require significant initial investment but take a long time before being able to generate returns. This extended payback period leads to apprehension among potential investors in such projects. Besides the above, getting approvals for projects is a second challenge because of strict environmental regulations.

As governments and organizations make pushes toward cleaner energy sources and more stringent environmental standards, so too does increased pressure on the oil and gas industry to lessen their ecological impact. This, in turn, complicates the planning of the projects, lengthening the period for obtaining approvals, hence delaying the projects.

Good opportunities are waiting on the threshold. Emerging development areas include expansion in liquefied natural gas (LNG) infrastructure. It is emerging as a cleaner alternative to conventional fossil fuels, thus gaining ground across the globe; hence, better storage and transport systems will be increasingly needed to support this transition. Investment in new LNG terminals, specialized ships, and several advanced storage facilities will increase and hence create new opportunities for the Global Oil and Gas Infrastructure market.

Future market development would be according to global energy needs with consideration to environmental protection. Companies will be better positioned for long-term success. There are still many challenges, but it is evident that huge potential For growth and innovation makes this indeed a lead development area in energy.

MARKET SEGMENTATION

By Type

The Global Oil and Gas Infrastructure market is very vital in determining the energy landscape of the world. As the energy demand continues to rise, the development and modernization of oil and gas infrastructure will assume even greater importance. The markets deal with a very wide network of facilities and systems dealing with the production, transportation, storage, and refining of oil and gas. The rising demand for energy-efficient solutions and sustainable energy infrastructure surely proposes a very great prospect ahead due for upgrades and changes.

Generally, infrastructural support to this market has three prime compartments: upstream, midstream, and downstream. Upstream infrastructure focuses on exploration and production activities. It involves everything from the search for new oil and gas reserves to the development of these resources by means of drilling and extraction. Since technology comes of age, one can expect the upstream to adopt even more sophisticated methods to maximize productivity while mitigating environmental impacts. Digital oilfield technologies and automated drilling systems appear as a potential game-changer for exploration and production, rendering precise and cost-effective operations.

Midstream infrastructure deals with all activities related to transportation, storage, and management of oil and gas after their extraction. A pipeline, storage facility, and transportation networks provide the backbone to this sector. It can be stated that in the coming years, considerable attention could be paid to raising the safety and efficiency standards of the pipeline. Smart pipelining technologies employing sensors and monitoring systems could greatly assist in the prevention of leaks as well as for smoother running. Storage solutions could also integrate advanced features through the establishment of new, robust, flexible facilities in terms of supply and demand.

Downstream infrastructure refers to the refining and distribution. The sector takes crude oil and natural gas through processing into marketable products such as gasoline, diesel, and other petrochemicals. Refining in the coming days will most probably become cleaner by use of cleaner technologies that focus on emissions and waste reduction. Distribution will also undergo major changes with an advanced software system that integrates logistics with supply chain management.

Dilemmas from one side and prospects from another shall be in store before the Global Oil and Gas Infrastructure market as the world takes on cleaner energies. One would expect supportive infrastructure for ever-lower carbon fuels and sustainable practices to increase. Hybrid systems supported by oil and gas facilities along with renewable sources could come up, providing flexible and less-polluting alternatives. Investment in R&D is critical for sustaining innovation and relevance for the future energy market.

Overall, the future pathway of the Global Oil and Gas Infrastructure market would be determined by the adaptability and innovativeness of the market. The Global Oil and Gas Infrastructure market will sustain its viability over the coming decades by utilizing technology for efficiency and sustainability, as much as it will in meeting global energy demand.

By Location

The Global Oil and Gas Infrastructure market is paramount in meeting the world’s ever-growing demand for energy. So long as oil and gas remain in demand, the supporting infrastructure will continue changing to adapt to future challenges and opportunities. This market has a very wide area of coverage of facilities, equipment, and systems involved in exploration, production, transportation, and storage. In other words, the Global Oil and Gas Infrastructure market has great to be both technologically advanced in the coming years and under pressure to deliver better outputs through improved operations across varied sustainable platforms.

Location will be among the key variables determining the future dynamics of the Global Oil and Gas Infrastructure market. As conceptualized in most analyses, this market can be broadly divided into two major groups namely, onshore and offshore projects. Onshore infrastructure consists of facilities and pipelines on land, which, for the most part, have been the backbone of the industry. These operations are easier to establish and maintain, with cheaper solutions and accessible transport links. With increasing demand, it is likely that existing facilities will be upgraded and onshore expansion to accommodate global energy needs will also be performed.

But offshore infrastructure deals with operations being conducted in waters away from the coastline. The offshore projects have increased in importance, including deepwater and ultra-deepwater drilling, as they allow access to large untapped reserves. These projects, however, come with costs and engineering complexities, making it an opportunistic area for future production increases. Technological enhancements in offshore infrastructure will become more efficient and safer and will therefore proceed to play a crucial role in industry expansion.

With the future direction of the Global Oil and Gas Infrastructure market being contingent on sustainability and the impact it has on the environment, several projects will therefore need to implement greener technologies that encourage efficient processes, which countries strive to uphold. Developments like carbon capture and storage, digital monitoring systems, and automation are likely here to stay as core comportments carrying the utmost processing capability with a firm sense of responsibility.

In addition, geopolitical considerations and emerging economic policies will have an influence on investments and development in this particular market. The fluctuations in the global demand and willingness of different countries to adjust their energy strategies would compel the market to remain flexible. Such partnerships for infrastructure-nations joint undertakings, public-private partnerships, investments between local and foreign firms-would significantly help ensure the stability and resolute continuity of an integrated and resilient infrastructure network.

The balance of innovation, efficiency, and sustainability would define the trajectory of the Global Oil and Gas Infrastructure market in future times. Both onshore and offshore projects will evolve as technology advancements and energy sector changing demands interact with each other. This will enable an investment in modernized infrastructure that will empower industries to better service global energy requirements while taking cognizance of environmental and socioeconomic hurdles.

By Type

As the future holds out for the Global Oil and Gas Infrastructure market, this will remain critical for defining the future within the global energy sector. Increasingly, as the world demands more energy in the future, the market will be essential in ensuring the full production, transportation, and storage of oil and gas resources. Continuous development the industry will continue experiencing through improved technology, changing energy policies, and the demands for efficient infrastructures.

The growing emphasis on sustainability and energy security will transform this market beyond anything that it's seen during the next few years. The main thrust of this market would be the types of crude oil, natural gas, and liquefied natural gas (LNG) because it includes crude oil, natural gas, and LNG- liquefied natural gas. Crude oil is broadly the most used energy source that involves heavy infrastructure in extraction, refining, and distribution.

Expansion and renovation of pipelines, storage capacity, and refineries are integral to future-demand needs. Investing in advanced technology may boost their efficiency and cause lower environmental effects, producing a more adaptable industry to new energy needs.

Natural gas ascends as a cleaner alternative to fossil fuels. Its infrastructure (piping, processing plants, and distribution networks) will expand quickly. The demand for natural gas infrastructure will burgeon as countries turn to renewable low-carbon energy. Innovations in pipeline technology and digital monitoring systems will create more safety and efficient supply chains.

Liquefied natural gas (LNG) is expected to play an important role in energy markets across the globe due to its flexibility for transport and storage. LNG infrastructure, such as liquefaction plants, regasification terminals, and specialized shipping, would keep expanding with the more international demand. Thus, it is seen as an important component of the world's energy system whereby countries that wish to diversify their sources of energy and reduce dependence on specific suppliers would be seeing investments in this sector.

The above all-in-Global Oil and Gas Infrastructure Market will pave the way to future scenarios. Adapting renewable energy together with digitalization and smart infrastructures will provide efficiency and sustainability solutions. The market will likely be responsive to investments in new technology and greener practices as governments and businesses barrel toward cleaner energy solutions.

In the years ahead, the nations and industries will be critical in developing adaptive and resilient infrastructures. In such a scenario, it wouldn't be surprising if improvements and strategic investments are continued so that the Global Oil and Gas Infrastructure Markets would still exist as a pillar of global energy supply.

By End-user

The Global Oil and Gas Infrastructure Market is quite essential and does support industries all around the globe by laying down the infrastructure for energy production, transportation, and distribution. The emerging technologies, changing energy demand, and environment-related developments will place the Global Infrastructure Market for oil and gas under unprecedented change as the demand for oil and gas, a driver of global economies, continues to grow.

One cannot overemphasize the need for robust infrastructure in the industry since it guarantees the smooth and timely delivery of resources to various end-user industries. The further development of this market would focus on better investment and innovative practices geared towards sustainability and efficiency.

The Global Oil and Gas Infrastructure Market is very closely tied to a few major sectors that are, in turn, highly reliant on a consistent and stable energy supply. Energy and power are among the largest consumers of oil and gas in providing fuel to power generation facilities and supporting grid stability. Transition to cleaner energy sources will gradually transform this industry, whereby oil and gas infrastructure will still be crucial for a smooth transition. Advanced systems of pipeline, storage, and processing will hold the balance during this time of transition.

The oil and gas infrastructure are also heavily relied upon by the automotive industry. Even if electric vehicles are in vogue, the conventional fuel-fired transport will remain in the global view for decades to come. Improvements made to this infrastructure will, therefore, focus on enhancing efficiency while reducing the attendant environmental impacts. Intelligent technologies are likely to come into wider use within refineries and distribution networks to optimize fuel production and supply chains.

In the manufacturing industry, oil and gas infrastructure creates key raw materials and provides energy for production processes. Industries producing goods on a large scale require reliable access to fuels and chemicals derived from oil and gas. Future improvements will seek to reduce downtime in the oil and gas industries and improve energy efficiency for a more economically viable and sustainable form of production.

Oil and gas infrastructure is another major element for the chemical industry, which produces plastics, fertilizers, and pharmaceutical products. Investments in security of supply of raw materials of good quality will drive necessary infrastructures with a view of safety and emission reduction as the sector metamorphoses.

The marine shipping industry also relies on oil and gas for procuring ships and protecting global merchants. The existing infrastructure for this sector will be updated by enhancing fuel storage and transportation practices, along with environmental protection measures to meet global regulatory standards and reduce carbon footprints.

The Global Oil and Gas Infrastructure market will evolve with new technological advancements and energy priorities in the coming decades. By supporting key sectors through innovation and efficiency, it will substantially contribute to the two-time agenda of global economic developments and energy security.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$764,553.60 million |

|

Market Size by 2032 |

$1,211,329.91 Million |

|

Growth Rate from 2025 to 2032 |

6.9% |

|

Base Year |

2024 |

|

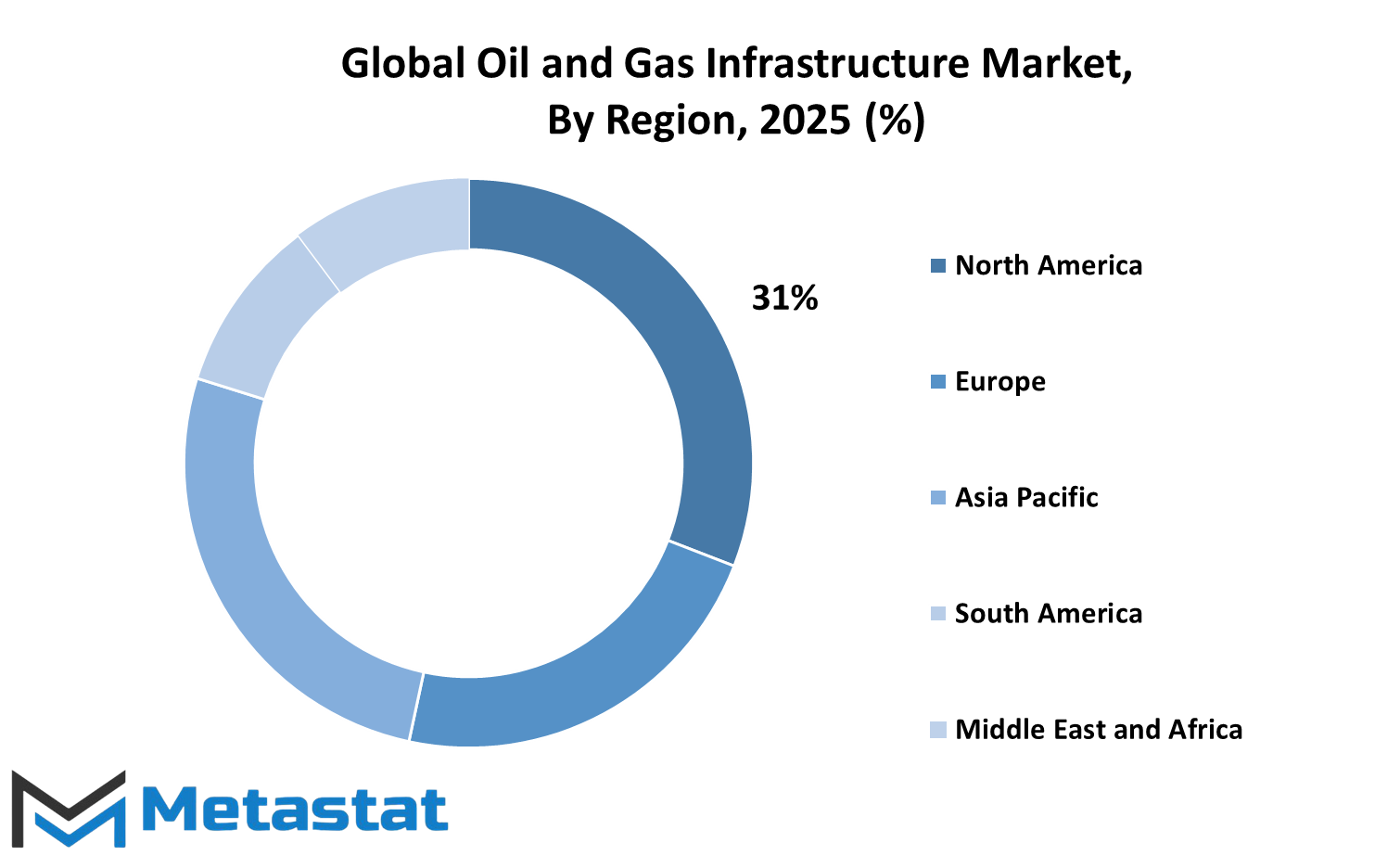

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Oil and Gas Infrastructure market is also poised for considerable shifts and growth in the next few years, depending on developments in various parts of the world. Every region contributes differently to the opportunities and challenges, guided by technological changes, energy demand, and geopolitical influences. The growth of the market is likely to be influenced by how countries respond in investing and modernizing their infrastructure to meet today's energy-related needs and sustainability targets.

Probably still at the forefront in this market shall remain North America, where the U.S., Canada, and Mexico are projected to lead growth through continuous investment in pipeline network systems and storage and refining capacities. In particular, the U.S. is endowed with a significant oil and gas infrastructure but continues to modernize aging infrastructure while maximizing the efficiency of technology. The abundance of natural resources in Canada are supplementing the region's overall growth, while energy reforms in Mexico and new exploration programs may provide for opportunities.

Infrastructure for oil and gas within Europe is likely to change considerably as the region pivots itself towards cleaner energy sources. State-level actors such as the UK, Germany, France, and Italy will likely undertake a balancing act of traditional oil and gas operations with new investments in renewable energy integration. As energy security and carbon reductions emerge, these countries will probably turn to building more advanced storage systems and extensive pipeline networks for both natural gas and alternative fuels.

Some of the fastest developments in today’s scenario will probably take place in Asia-Pacific due to high energy demand in the coming decades in countries like China, India, Japan, and South Korea. This entire region will require investment in industrialization and urban infrastructural development. China and India are expected to develop oil and gas pipelines and storage facilities in response to rising domestic consumption, while also looking at alternative fuels to prevent further damage to the environment.

In South America, Brazil and Argentina will significantly contribute to oil and gas infrastructure developments. Brazil's offshore exploration projects and Argentina's shale gas potential will likely help attract foreign investment into infrastructure development. The region aims to improve production and distribution networks to meet domestic and export demands.

Owing to the vast oil and gas reserves present within it, the Middle East & Africa is likely to remain a substantial contributor to the global market. GCC countries, along with Egypt and South Africa, are expected to remain active in investing in advanced infrastructures to keep their position as top energy exporters. As the energy needs of the world evolve, they will attempt to diversify their operations and enhance efficiencies along their supply chains.

COMPETITIVE PLAYERS

The Global Oil and Gas Infrastructure market is to be transformed in the next few years. With the rising global demand for energy and the transition to more sustainable practices, this industry must balance efficiency, innovations, and environmental accountability. Heavy investments and technological advancements will likely enter oil-and-gas-supporting infrastructure for production, transportation, and distribution. With energy demands conflicting with climate change priorities, the evolution of this market will have pronounced ramifications on the global economy as well as the energy interface.

Key actors in this market are expected to be major players in this transformation. For instance, Royal Dutch Shell, BP plc, and Chevron Corporation are the industry veterans that have for decades used their resources and capabilities to meet changing demands. These blue-chip companies are investing heavily in modernizing their infrastructure, thereby maintaining efficient and resilient operations. Side by side, they are also seeking cleaner alternatives in energy, combining renewable technologies with existing oil and gas projects. This, in a nutshell, is a growing trend in the industry toward diversification and innovations.

Companies such as TotalEnergies SE, Equinor ASA, and Sinopec Limited have a big share in reconstructing infrastructure capability. By leveraging advanced digital tools and automation, these companies can create more efficiency and safety in operations. Real-time monitoring, predictive maintenance, and remote monitoring have become standard practices to minimize downtime and operational cost. This technological transformation is anticipated to continue with many more companies adopting smart infrastructure solutions to remain competitive in the dynamic energy environment.

Infrastructure development and maintenance are bound inextricably to service providers such as Baker Hughes, Halliburton, and Schlumberger. Their expertise from drilling, engineering, and equipment manufacturing underpins the supply chain of the entire industry.

These companies expect the market transformation to drive them to innovate in the services they provide, giving rise to more sustainable and cost-containment options. Therefore, collaborations between infrastructure developers and service providers will continue to become more common, forming partnerships that drive efficiency and technological advancement.

The Global Oil and Gas Infrastructure market in future will also be affected by various geopolitical aspects and environmental regulations. Infrastructure investment will have to match regulations, as governments start to impose stricter emission targets and promote the use of cleaner energy. This will generate a lot of traction for carbon capture technologies, hydrogen infrastructure, and any other initiatives designed to lessen the environmental burden of oil and gas infrastructure.

The coming years will essentially promote the evolution of the Global Oil and Gas Infrastructure market through partnership, innovation, and adaptation. With the collective efforts of industry leaders and service providers, the energy infrastructure will be built towards greater efficiency, sustainability, and resilience to ensure meeting global energy demand and addressing environmental concerns.

Oil and Gas Infrastructure Market Key Segments:

By Type of Infrastructure

- Upstream Infrastructure (Exploration & Production)

- Midstream Infrastructure (Pipelines, Storage, Transportation)

- Downstream Infrastructure (Refining, Distribution)

By Location

- Onshore

- Offshore

By Type of Oil & Gas

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

By End-user Industry

- Energy and Power

- Automotive

- Manufacturing

- Chemical

- Marine & Shipping

Key Global Oil and Gas Infrastructure Industry Players

- Royal Dutch Shell

- MRC Global Inc.

- BP plc

- Chevron Corporation

- TotalEnergies SE

- National Oilwell Varco

- Wood Group

- Equinor ASA

- Baker Hughes

- TechnipFMC

- Sinopec Limited

- Schlumberger

- Halliburton

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383