Global Octane Boosters Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

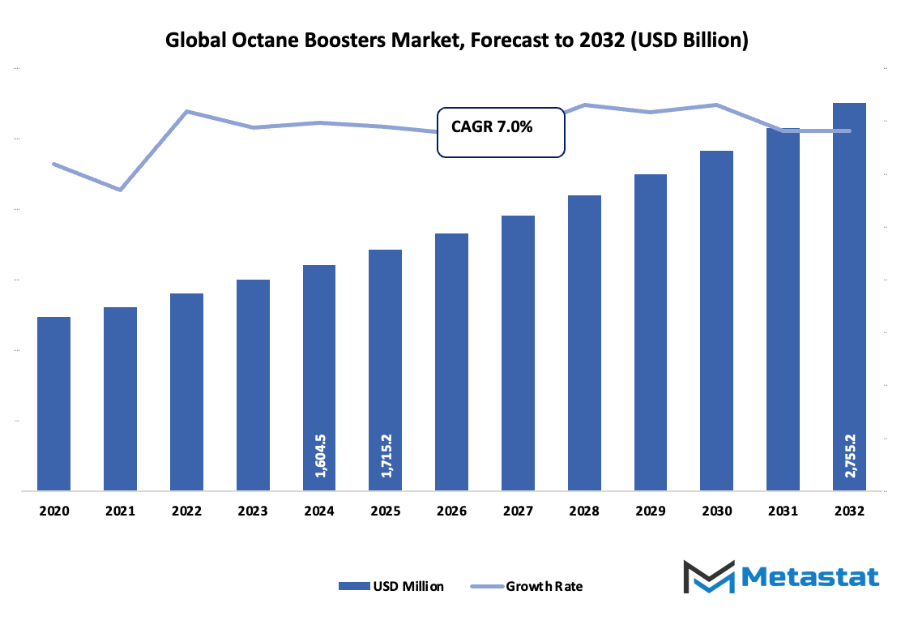

- The global octane boosters market valued at approximately USD 1715.2 million in 2025, growing at a CAGR of around 7.0% through 2032, with potential to exceed USD 2755.2 million.

- Fuel Additives account for a market share of 40.2% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising demand for high-performance and premium fuels in automotive and motorsport sectors., Growing older vehicle fleet requiring aftermarket fuel treatments.

- Opportunities include: Growing opportunity for eco-friendly octane-boosting additive technologies aligned with cleaner fuel mandates.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global octane boosters market has come from being a minor part of fuel chemistry to becoming an accepted segment of automotive performance culture. Its first chapter can be written in the mid-20th century when increasing engine compression ratios drove the fuel chemists to look for additives that would stabilize combustion and save the engines from knocking. The first mixes were very basic and most often made in small quantities by racing teams or local mechanics who depended on trial and error. A turning point that would define the industry came after the U.S. Clean Air Act of 1970 and later the global halt of leaded gasoline. As governments phased out tetraethyl lead, North America, Europe, and Japan have all been searching for alternative compounds, which then gave the market a scientific basis.

During the 80s and 90s, car manufacturers apparently reported a 10% increase in average passenger vehicle compression ratios by the National Highway Traffic Safety Administration, which naturally drew attention to the additives to be used for this purpose to help fuels keep stable performance. The manufacturers’ change of mindset encouraged the commercial suppliers to further develop their products with additives like oxygenates, metallic salts, and subsequently organic compounds that were compatible with the cleaner fuel standards. By the beginning of the 2000s, the consumers’ expectations had also changed. Customers wanted smoother acceleration and better fuel stability for high-mileage engines while the motorsport community insisted on high-purity blends. Furthermore, the public safety authorities in Europe also developed testing protocols that assessed the impact of additives on exhaust temperatures and vapor pressure, thus helping to set quality benchmarks in the industry.

Market Segmentation Analysis

The global octane boosters market is mainly classified based on Product Type, Distribution Channel, Application,

By Product Type is further segmented into:

- Fuel Additives:

The global octane boosters market is buoyed by fuel additives that enhance combustion quality and engine response. With regular use, such additives enable the engine to cope with tough conditions, thus providing smoother acceleration and less knocking. The growing interest in reliable vehicle maintenance fosters the broader acceptance of the products, allowing consumers to keep their engines in good condition without worrying about the performance of different categories of vehicles.

- Octane Boosters:

Octane boosters give a leg-up to the global octane boosters market by bringing about swift remedies for those engines that are prone to knocking. More and more users are after a more powerful throttle response, thus causing these engines to efficiently reduce their consumption under pressure. The rising number of car owners is a factor that can be highlighted as the main reason for the increased demand, since the quality of fuel that has been improved is mostly for the performance-seeking drivers who want their cars to be reliable.

- Performance Enhancers:

Performance enhancers bring to the global octane boosters market the value of being along with the engines while demanding driving situations take place. Products in this category help engines to keep their output stable, especially under high-speed or uphill conditions. Continuous education about engine longevity and efficiency being the factors that are making the segment broader, the consumers are going for those supplements that are really helping in the maintenance of smooth and reliability operation of the engines.

- Liquid Additives:

Liquid additives are quietly doing their part in supporting the global octane boosters market by providing an easy and quick application through their blending with fuel. A vast number of vehicle owners are there who prefer the solutions that require the least effort but still provide significant improvements in mileage consumption and engine sound. The ever-increasing interest in the maintenance that is effortless is one of the reasons for this segment's growth, as users would like to have performance-supporting products that are convenient.

- Other:

Product types reinforce the global octane boosters market by addressing needs outside common additive categories. These options provide flexibility for different engines, including older models requiring special care. Broader availability ensures that consumers with unique fuel requirements find suitable support, helping maintain consistent demand across various regions and vehicle conditions.

By Distribution Channel the market is divided into:

- Online Retail:

Online retail strengthens access within the global octane boosters market by giving buyers simple comparison options, wider product choices, and steady availability. Many buyers appreciate doorstep delivery and transparent user reviews, encouraging more confident decisions. Digital expansion helps niche brands reach broader audiences, supporting consistent growth in consumer engagement and product discovery. - Automotive Specialty Stores:

Automotive specialty stores contribute trusted guidance to the global octane boosters market by offering expert advice and focused product selections. Many vehicle owners depend on knowledgeable staff for recommendations tailored to specific engine needs. Reliable access to verified products encourages repeated visits, helping maintain stronger consumer confidence and long-term purchasing habits. - Gas Stations:

Gas stations support the global octane boosters market by offering convenient access during fuel stops. Many drivers choose additives impulsively when performance concerns arise, making availability at pumps beneficial. Easy shelf visibility promotes quick decisions, helping expand product reach while supporting travelers needing immediate solutions for improved engine response. - Others:

Other distribution channels enhance the global octane boosters market by offering flexible purchasing points such as workshops or general stores. These outlets serve consumers seeking fast solutions without extended searches. Broader placement ensures more consistent visibility, encouraging trial purchases and helping products reach locations lacking large retail networks.

By Application the market is further divided into:

- Automotive:

Automotive applications strongly influence the global octane boosters market as daily-use vehicles often require stable fuel quality for smoother operation. Many drivers rely on additives to reduce knocking, improve combustion, and support engine longevity. Growing transportation activity supports demand, with more consumers seeking affordable ways to maintain consistent driving performance. - Motorcycles:

Motorcycle usage supports expansion within the global octane boosters market as riders seek better throttle response and improved fuel efficiency. Smaller engines often react quickly to fuel quality changes, encouraging use of supportive additives. Increased commuting and recreational riding contribute to stronger demand for products that help engines run smoothly under varied road conditions. - Racing Cars:

Racing cars create a performance-driven segment within the global octane boosters market, where engines demand high resistance to knocking and stable combustion under extreme stress. Additives within this category help support strong acceleration and consistent power. Competitive events encourage continued product development focused on reliability, speed, and consistent engine output. - Others:

Other applications broaden the global octane boosters market by serving specialized engines such as older vehicles, modified engines, or small equipment requiring additional fuel support. These uses help maintain steady demand outside mainstream segments. Expanding awareness of simple maintenance practices encourages consumers to adopt additives that help engines operate with greater stability.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1715.2 Million |

|

Market Size by 2032 |

$2755.2 Million |

|

Growth Rate from 2025 to 2032 |

7.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

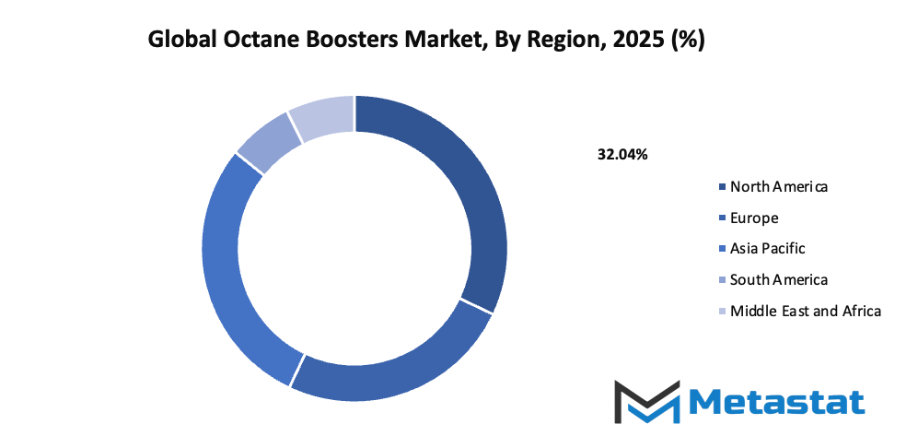

By Region:

- Based on geography, the global octane boosters market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

- Rising demand for high-performance and premium fuels in automotive and motorsport sectors.

Rising demand for high-performance and premium fuels in automotive and motorsport sectors supports stronger interest in advanced additive solutions. Higher engine output, cleaner combustion goals, and greater focus on fuel efficiency create consistent attention toward enhanced fuel treatments within the global octane boosters market, encouraging broader adoption across professional and consumer segments. - Growing older vehicle fleet requiring aftermarket fuel treatments.

Growing older vehicle fleet requiring aftermarket fuel treatments encourages wider usage of supportive fuel-enhancing products. Aging engines benefit from additives that support smoother operation, reduced knocking, and stable performance, leading to consistent aftermarket activity and sustained interest in products designed to maintain engine life and fuel system stability.

Restraints & Challenges:

- Regulatory scrutiny on fuel additives and chemical emissions in some regions.

Regulatory scrutiny on fuel additives and chemical emissions in some regions creates caution for manufacturers and distributors. Compliance obligations, approval delays, and evolving regional standards shape production decisions, requiring careful formulation choices and additional investment to meet expectations tied to environmental safety and chemical management requirements. - Shift toward electric vehicles reducing long-term demand for gasoline-based solutions.

Shift toward electric vehicles reducing long-term demand for gasoline-based solutions places pressure on businesses connected to fuel treatment products. Expanded charging infrastructure, supportive policy frameworks, and rising consumer interest in alternative power systems gradually affect future prospects for gasoline-enhancing additives within traditional internal combustion engine markets.

Opportunities:

- Growing opportunity for eco-friendly octane-boosting additive technologies aligned with cleaner fuel mandates.

Growing opportunity for eco-friendly octane-boosting additive technologies aligned with cleaner fuel mandates encourages development of safer, low-impact formulations. Cleaner-burning options, reduced toxic components, and improved compatibility with emission standards support new pathways for sustainable innovation, allowing additive producers to match regulatory expectations while appealing to environmentally minded automotive users.

Competitive Landscape & Strategic Insights

The global octane boosters market shows steady expansion as demand grows across automotive communities seeking stronger engine response and consistent performance. The market contains a wide range of producers, from long-established multinational brands to fast-advancing regional firms. Each producer offers distinct formulas and additive blends designed to support cleaner combustion and smoother acceleration, creating steady interest from professional mechanics, motorsport groups, and everyday drivers who look for improved engine behaviour. High fuel standards across many countries encourage ongoing product development, encouraging new mixtures that aim for dependable gains without causing harm to engine parts or emission systems.

Competition remains strong as recognized names continue to protect brand reputation through research programs and routine improvements. Lubegard, Torco Race Fuels, VP Racing Fuels, Inc., BOOSTane, STP, Royal Purple, LLC, Lucas Oil Products, Inc., Liqui Moly GmbH, Gumout, Rislone, Nitrous Formula Products PTY LTD, Innospec Inc., and Cestoil Chemical Inc. stand among the most active forces within the market. Each organization follows its own strategy, whether through expanded distribution networks, attention to cleaner formulas, or partnerships with automotive service centers. A broad selection of blends encourages steady comparisons among consumers, helping the market remain dynamic without relying on a single dominant supplier.

Growing awareness of engine care encourages fresh attention toward octane-enhancing additives. Many consumers seek solutions that support longer engine life, reduced knocking, and more consistent fuel burn during demanding conditions. Regulatory pressure across transportation sectors also pushes producers to focus on cleaner burn characteristics, guiding new research toward formulas with lower environmental impact. Marketing campaigns often highlight transparent testing data, giving buyers clearer expectations regarding performance gains. Broader acceptance of premium fuels supports interest in booster products as many users look for alternatives that offer noticeable benefits without a major jump in fuel costs.

Overall market movement suggests steady growth during the coming years as both global brands and smaller regional producers continue to introduce improved additives, respond to new regulations, and maintain strong engagement with automotive communities.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1715.2 million in 2025 to over USD 2755.2 million by 2032. Octane Boosters will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global octane boosters market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global octane boosters market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global octane boosters market.

Octane Boosters Market Key Segments:

By Product Type

- Fuel Additives

- Octane Boosters

- Performance Enhancers

- Liquid Additives

- Others

By Distribution Channel

- Online Retail

- Automotive Specialty Stores

- Gas Stations

- Others

By Application

- Automotive

- Motorcycles

- Racing Cars

- Others

Key Global Octane Boosters Industry Players

- Lubegard

- Torco Race Fuels

- VP Racing Fuels, Inc.

- BOOSTane

- STP

- Royal Purple, LLC

- Lucas Oil Products, Inc.

- Liqui Moly GmbH

- Gumout

- Rislone

- Nitrous Formula Products PTY LTD

- Innospec Inc.

- Cestoil Chemical Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383