Global Automotive Bumpers Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global automotive bumpers market has completely changed from a mere metal guard to a sophisticated system that showcases the automotive industry's overall shift. Initially, bumpers were only able to protect the car body from very light impacts and therefore were only used for this purpose. They were quite bulky, very rigid, and mainly composed of steel. In the 20th century, when car ownership reached its peak, manufacturers began experimenting with new materials and new shapes which combined safety and the public's love for design. The 1970s marked a revolutionary stage when North America and Europe mainly the government imposed safety regulations that forced manufacturers to look for better impact absorption mechanisms, thus marking the invention of energy-absorbing structures and standard testing procedures as innovations.

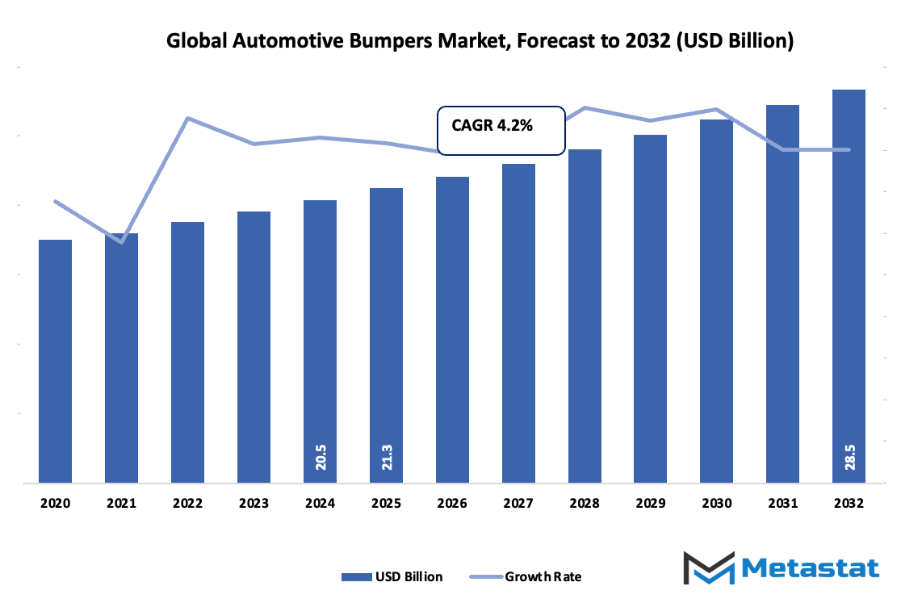

- The global automotive bumpers market is predicted to be worth about USD 21.3 billion by 2025, that is with a compound annual growth rate (CAGR) of 4.2% expected to last through 2032, and the total possible scenario reaching even USD 28.5 billion.

- The passenger cars' share is almost 69.6% of the total global market and the sector is constantly developing through deep research and further application of the technologies.

- The growing market forces are: The demand for bumpers resulting from increasing automobile production and sales worldwide., Using lightweight materials to reduce fuel consumption is becoming more and more widespread.

- The market opportunities are: The force of the electric and self-driving cars market would be a major reason for the bumper design innovativeness through the latest technology.

- A major takeaway from the study is that the market value is going to increase tremendously over the next ten years, hence, the existence of a huge growth opportunity.

The 1980s and 1990s era mainly saw the extensive use and introduction of plastic and composite bumpers which eventually took over the traditional metal ones. The light weight of materials and improved fuel economies were among the main factors that drove this change. The changeover not only enhanced the aesthetic side but at the same time improved the aerodynamic feature. The bumper was the one invention of the automobile industry, which the rest of the world had to recognize, that made the car its original personality besides being protective parts. The global automotive bumpers market had begun to reflect the styling trends more closely by merging safety and aesthetics through the incorporation of sensors, air intake systems, and lighting features.

The new era of bumper innovations is said to be powered by electric vehicles and automated technologies. The original equipment manufacturers (OEMs) are working on systems that will in the future make it possible to smoothen radar, lidar, and camera sensors effortlessly into the bumper without compromising on design and performance. Besides, the life cycle of bumpers has now started to revolve around sustainability and recyclability. Recycled plastics and modular components are some of the options that are attracting the interest of the manufacturers for future production. Moreover, legislation pertaining to pedestrian safety and vehicle repair is going to have an even greater impact on the design of bumpers in the near future.

The global automotive bumpers market which once was a simple utility tool has today transformed into a multifaceted safety and design component that is still developing albeit at a slower pace compared to the changes in the vehicle technology, manufacturing, and environmental responsibility. The historical development of this market has been one of continuous change and it is cycles—the triad of design, regulation, and innovation is the one that const.

Market Segments

The global automotive bumpers market is mainly classified based on Vehicle Type, Material, Positioning, Sales Channel.

By Vehicle Type is further segmented into:

- Passenger cars: Passenger cars are the primary vehicles in the global automotive bumpers market, which means they also have the biggest share. The combination of the world's population growth, urban spread, and the craving for personal transport upgraded the passenger car demand a notch higher. The bumpers of this category not only assure safety but also give a good look to the car. The idea is to come up with the bumpers' aesthetic and functional needs through its design and material hence the auto manufacturers are striving for it.

- Commercial Vehicles: The contribution of commercial vehicles to the global automotive bumpers market is significant, this is mainly due to the fact that they are indispensable in logistics, transportation, and construction. Sturdy bumpers that can handle the frequent impact and heavy-duty usage are what these vehicles need at all times. For aesthetics, the drivers in this segment are durability and performance. The advancements in materials are a major help for the manufacturers in coming up with stronger bumpers that not only enhance vehicle safety but also reduce maintenance costs.

- EVs: The electric vehicle segment is taking a larger slice of the global automotive bumpers market as the demand for electric mobility is burgeoning. Lightweight bumpers are a must for EVs to keep the battery life longer and the energy consumption lesser. The manufacturers are shifting to novel materials that can give a perfect balance of strength and lightness, thus providing safety along with performance. The government incentives for the adoption of electric vehicles are a driving factor for this segment's growth as well.

- Others: The global automotive bumpers market is also influenced by vehicle types including off-road vehicles, luxury sports cars, and customized vehicles. These types of vehicles always require personalized bumpers depending on the needs such as durability, flexibility, or air-flow design. This segment's growth, though, is mainly due to continuous innovation and rare vehicle structure adaptation.

By Material the market is divided into:

- Metals: Metals have been and still are, the most important materials used in the global automotive bumpers market due to their sturdiness and excellent impact absorption properties. Steel and aluminum are the two metals mostly chosen for their durability and anti-corrosion traits. Heavy-duty vehicles and models where impact protection is a major concern are fitted with metal bumpers. Nevertheless, the trend towards light-weight substitutes has led to a slight decline in their market share in the recent years.

- Composite plastics: Composite plastics are becoming more and more accepted in the world of automotive bumpers for being light-weight, cheaper, and versatile materials. Besides, these materials enable the manufacturers to sculpt very intricate pieces while up to a certain extent improving fuel efficiency because of the vehicle's lighter weight. Furthermore, plastic bumpers are easy to fix and recycle; hence, they are considered to be a sustainable option for carmakers around the globe.

- Fibers: Fiber-based materials such as carbon fiber and fiberglass are taking more space in the global automotive bumpers market and are mostly used for luxury and performance cars. Such materials deliver very high strength with very low weight and thus eventually the safety and efficiency are both improved. The gaining acceptance of high-quality fibers is in sync with the trend of better material performance and environment-friendly solutions.

By Positioning the market is further divided into:

- Rear End Bumpers: Rear end bumpers hold a crucial role in the global automotive bumpers market as they protect vehicles from collisions and parking damage. The design of these bumpers focuses on energy absorption and easy replacement. Rear bumpers are also increasingly equipped with sensors and cameras that assist in parking and reversing.

- Front End Bumpers: Front end bumpers form another key section of the global automotive bumpers market as they are the first line of defense in most collisions. The emphasis in this segment is on impact absorption, pedestrian safety, and aerodynamic design. Integration of sensors and radar for advanced driver-assistance systems is also enhancing demand.

By Sales Channel the global automotive bumpers market is divided as:

- OEM: Original Equipment Manufacturers (OEM) dominate the global automotive bumpers market as they provide bumpers directly fitted to new vehicles. OEMs ensure product quality, design accuracy, and compliance with safety standards. The increasing production of vehicles worldwide keeps OEM demand strong, with many automakers collaborating closely with bumper manufacturers.

- Aftermarket: The aftermarket segment plays a growing role in the global automotive bumpers market as consumers look for replacement parts and upgrades. Aftermarket bumpers are available in various designs and materials to suit different needs. Rising accident rates and interest in vehicle customization drive the demand in this segment, offering opportunities for both local and international suppliers.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$21.3 Million |

|

Market Size by 2032 |

$28.5 Million |

|

Growth Rate from 2025 to 2032 |

4.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

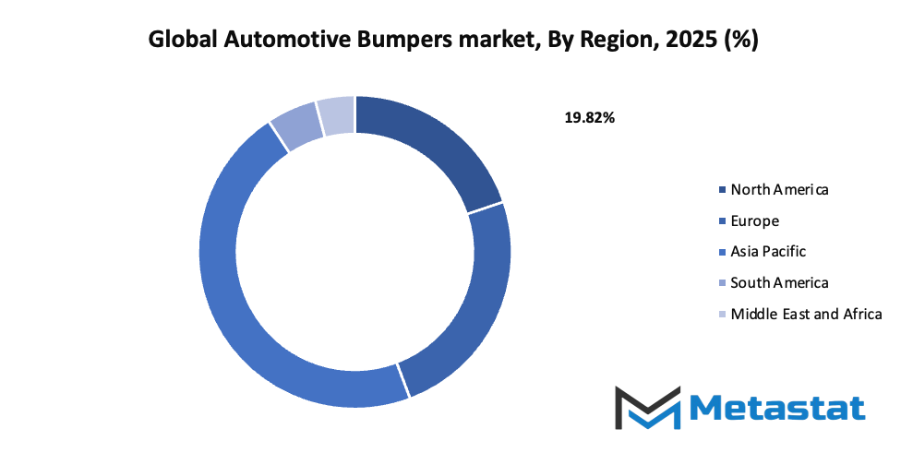

By Region:

- Based on geography, the global automotive bumpers market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Rising vehicle production and sales globally boosting bumper demand: The global automotive bumpers market is growing steadily as vehicle production and sales continue to increase worldwide. The rise in personal and commercial vehicle ownership is directly contributing to the higher demand for bumpers, which are essential for both safety and aesthetics. As consumers show more interest in new and upgraded vehicles, manufacturers are focusing on producing durable, efficient, and visually appealing bumpers to meet market expectations. This trend has also encouraged suppliers to enhance production capacity and adopt better materials and technologies to support the growing automotive industry.

Growing adoption of lightweight materials for improved fuel efficiency: The shift toward lightweight materials such as aluminum, thermoplastics, and composites is shaping the global automotive bumpers market. These materials help reduce vehicle weight, leading to better fuel efficiency and lower emissions. Automakers are prioritizing this approach to meet environmental standards and consumer preference for sustainable transportation options. The demand for bumpers made from these advanced materials is increasing because they offer strength, flexibility, and energy absorption in collisions. As a result, manufacturers are investing in innovative production methods to improve quality and reduce costs while maintaining safety and performance standards.

Challenges and Opportunities

High cost of advanced materials and manufacturing technologies: One of the main challenges facing the global automotive bumpers market is the high cost of advanced materials and modern manufacturing technologies. Producing lightweight and high-performance bumpers often requires expensive materials and specialized equipment. This raises overall production expenses and impacts profit margins, especially for small and mid-sized manufacturers. Additionally, balancing affordability with quality and safety standards remains difficult. Despite these obstacles, ongoing research and process optimization are expected to help reduce costs over time, allowing wider adoption of innovative bumper designs.

Stringent safety and environmental regulations increasing design complexity: Safety and environmental regulations across various regions are becoming more demanding, increasing the complexity of bumper design. Manufacturers must ensure that bumpers meet crash safety standards, pedestrian protection requirements, and recycling regulations. Compliance with these rules requires continuous redesigning and testing, which extends development timelines and adds cost. However, these challenges are also driving technological innovation, leading to safer and more sustainable bumper systems. As automakers aim to align with global standards, design advancements are becoming a key factor in maintaining competitiveness.

Opportunities

Increasing demand for electric and autonomous vehicles driving innovative bumper designs: The growing popularity of electric and autonomous vehicles presents major opportunities for the global automotive bumpers market. These vehicles require specialized bumper systems that support sensors, cameras, and advanced driver assistance technologies. Manufacturers are exploring new materials and smart designs to integrate these components without compromising safety or aesthetics. The shift toward electric mobility also promotes the use of recyclable and energy-efficient materials. This transformation is expected to create fresh opportunities for suppliers and designers to develop bumpers that meet the changing needs of future vehicles.

Competitive Landscape & Strategic Insights

The global automotive bumpers market shows strong competition among both established international companies and fast-growing regional manufacturers. Major players such as Fab Fours, Inc., Faurecia SA, Flex-N-Gate Corporation, Forvia SE, Futaba Industrial Co., Ltd., Hyundai Mobis Co., Ltd., Jiangnan Mould & Plastic Technology Co., Ltd., Magna International, Inc., Motherson Sumi Systems Limited, NTF (India) Private Ltd., Plastic Omnium S.A., SMP Deutschland GmbH, Toray Industries, Inc., Toyoda Gosei Co., Ltd., Toyota Boshoku Corporation, Venture Otto SA (Pty) Ltd., and Yanfeng Automotive Trim Systems Co., Ltd. are leading participants shaping the market structure. These organizations focus on constant innovation and cost efficiency to gain an advantage in both developed and emerging markets.

The competition mainly depends on product quality, material strength, lightweight design, and alignment with environmental standards. Global manufacturers continue to invest in research and development to introduce bumpers made from advanced composites that provide durability and improved safety. The increasing preference for electric and hybrid vehicles encourages suppliers to develop lighter and energy-efficient bumper systems. In addition, companies are forming strategic partnerships and mergers to enhance production capacity and expand their distribution networks.

Regional companies are also gaining attention due to their ability to provide affordable solutions tailored to local requirements. Government regulations on vehicle safety and emission control further push manufacturers to adopt sustainable production methods and recyclable materials. The rising demand for customized and premium vehicle parts supports the introduction of high-performance bumpers with aesthetic appeal.

Market size is forecast to rise from USD 21.3 million in 2025 to over USD 28.5 million by 2032. Automotive Bumpers will maintain dominance but face growing competition from emerging formats.

Technological advancement, combined with the growing emphasis on safety and design, will continue to influence market direction. Continuous innovation, efficient manufacturing processes, and strategic alliances will determine success in this competitive environment, allowing manufacturers to secure long-term market presence and profitability.

Report Coverage

This research report categorizes the global automotive bumpers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive bumpers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive bumpers market.

Automotive Bumpers Market Key Segments:

By Vehicle Type

- Passenger cars

- Commercial Vehicles

- EVs

- Others

By Material

- Metals

- Composite plastics

- Fibers

By Positioning

- Rear End Bumpers

- Front End Bumpers

By Sales Channel

- OEM

- Aftermarket

Key Global Automotive Bumpers Industry Players

- Fab fours, Inc.

- Faurecia SA

- Flex-n-gate corporation

- Forvia SE

- Futaba industrial co., ltd.

- Hyundai mobis co., ltd.

- Jiangnan mould & plastic technology co., ltd.

- Magna international, Inc.

- Motherson Sumi Systems Limited

- Ntf (india) private ltd

- Plastic Omnium S.A.

- SMP Deutschland GmbH

- Toray industries, Inc.

- Toyoda Gosei Co., Ltd.

- Toyota boshoku corporation

- Venture otto SA (pty) ltd.

- Yanfeng Automotive Trim Systems Co., Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252