MARKET OVERVIEW

The north america emr for military and aerospace market will undergo serious reorganization as technology expansion and defense policy continually come into alignment. This industry, founded on electromagnetic radiation technologies utilized by the military and aerospace sectors, will transition into a phase where innovation will no longer merely help but redefine mission execution, threat sensing, and secure communications. Usage of electromagnetic spectrum (EMR) devices will no longer be limited to traditional defense initiatives, but instead, coming infrastructure will expand the boundaries of EMR implementation within multi-dimensional environments.

The North American market is likely to see more concerted cooperation between military and aerospace officials and non-government entrepreneurs. As concern about secure navigation, satellite integrity, and tactical data transmission continues to grow, governments will increasingly rely on adaptive technology. Rather than evolve independent systems, the future is interoperable platforms wherein EMR solutions will be integrated into the infrastructure of terrestrial and space-based systems. Not only will this integration enable tactical advantage, it will also introduce new levels of situational awareness across a variety of defense domains.

EMR applications will continue to evolve into even more miniature, scalable, and software-centric solutions. These next-generation systems will be non-hardware-dependent but algorithmic-optimization-highly driven. Artificial intelligence and machine learning will power signal interpretation, allowing for higher accuracy of engagement without increased physical loadouts on aircraft or ground platforms. In the north america emr for military and aerospace market, this trend will increase defense research laboratory, aerospace firm, and technology-startup-based synergy.

Operational needs will dictate the development of EMR technologies in the future. Standard radar and communications technology will not be sufficient in a situation where an adversary employs signal jamming, cyber-jamming, or stealth technology. Thus, EMR adaptive technologies will be developed to counter and respond to erratic electronic environments. The technology will allow command centers and tactical forces to regain control even in electromagnetic denial operations.

With military and space missions reaching farther into outer space, the north america emr for military and aerospace market will stretch further away from Earth's atmosphere. Space-based EMR capabilities will be the enablers of extended connectivity, early warning systems, and real-time threat assessment across vast distances. EMR tools will be the digital nervous system of aerospace operations in the future, informing decisions from lift-off to orbital defense strategy.

Furthermore, as defense plans evolve to include newer domains such as cyber and space, EMR technologies will serve as the interface between non-kinetic and kinetic action. Future missions will depend on the ability to act across multiple domains simultaneously, and EMR-enabled systems will enable that type of coordination and response.

In the next few years, the north america emr for military and aerospace market will not just change it will redefine what operational readiness will need to stand for to defense and aerospace industry players. This transformation will be characterized not by how fast the industry grows, but by how much it incorporates EMR technologies into the fabric of next-generation warfare and aerospace operations.

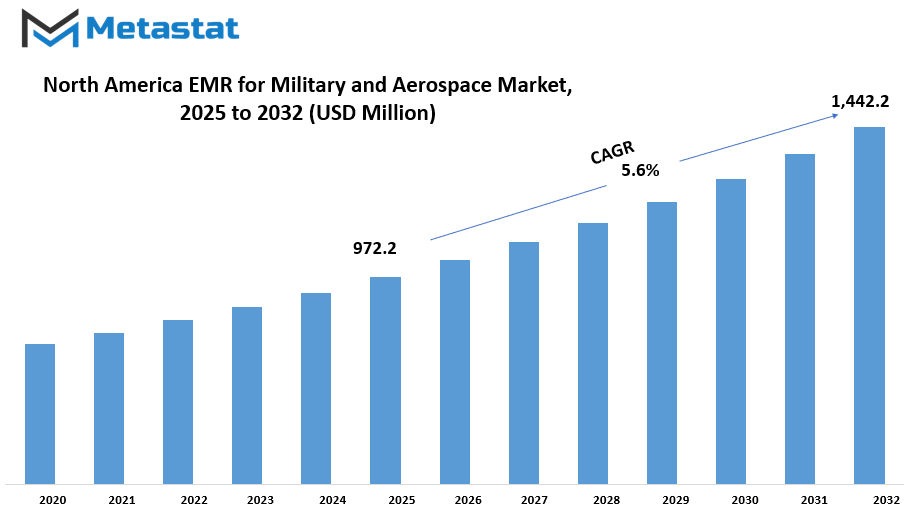

North America emr for military and aerospace market is estimated to reach $1,442.2 Million by 2032; growing at a CAGR of 5.6% from 2025 to 2032.

GROWTH FACTORS

The north america emr for military and aerospace market is growing steadily because of some extremely compelling reasons. One of the primary reasons is the rise in the defense budget of the region. With countries like the United States placing major emphasis on national security and readiness, there is an incentive to spend on better, better technology. This has given rise to an increased demand for advanced electromagnetic radiation (EMR) systems to facilitate modern military operations. These systems aid in electronic warfare, radar, surveillance, and communication making them an essential part of modern defense strategies.

The advent of the other primary driver is the growing need for secure and dependable communication systems. With the current scenario, in which cyber attacks are growing and are even becoming more advanced in nature, having reliable communications on missions is of utmost importance. Technologies such as EMRs offer jam-resistant lines and immunity to interference or jamming, hence are a perfect fit for military and aerospace applications. In the threat of data loss and communication failure hanging over them every moment, efforts are being made towards technologies that guarantee information security and operate seamless operations.

The market does pose some challenges, however. Among the biggest is the huge amount of money that goes into making and putting these systems in place. Advanced EMR technology involves huge research, costly materials, and qualified staff. Everything adds to the cost, making it harder for some projects to go ahead, especially when there is a struggle financially. This slows down the manner in which the technology is put into practice. In addition to that, there are strict guidelines and regulations that these systems must comply with. Regulatory approvals are time-consuming and may involve modifying current systems, and thus it becomes even more challenging for companies to implement their solutions rapidly.

In spite of all these challenges, there are robust opportunities in the future. The growing demand for combining artificial intelligence (AI) and the Internet of Things (IoT) with EMR systems offers an innovative new path. AI can turn these systems smart, and IoT offers an overlay of connectivity that could assist in coordinating and improving efficiency. Additionally, as different military bases and defense platforms are being modernized, there's an obvious opportunity to implement next-generation EMR solutions. These upgrades offer a chance to start new systems from the ground up, making them effective and future-proof. With the progress being made, the industry is likely to expand in the coming years.

MARKET SEGMENTATION

By Type

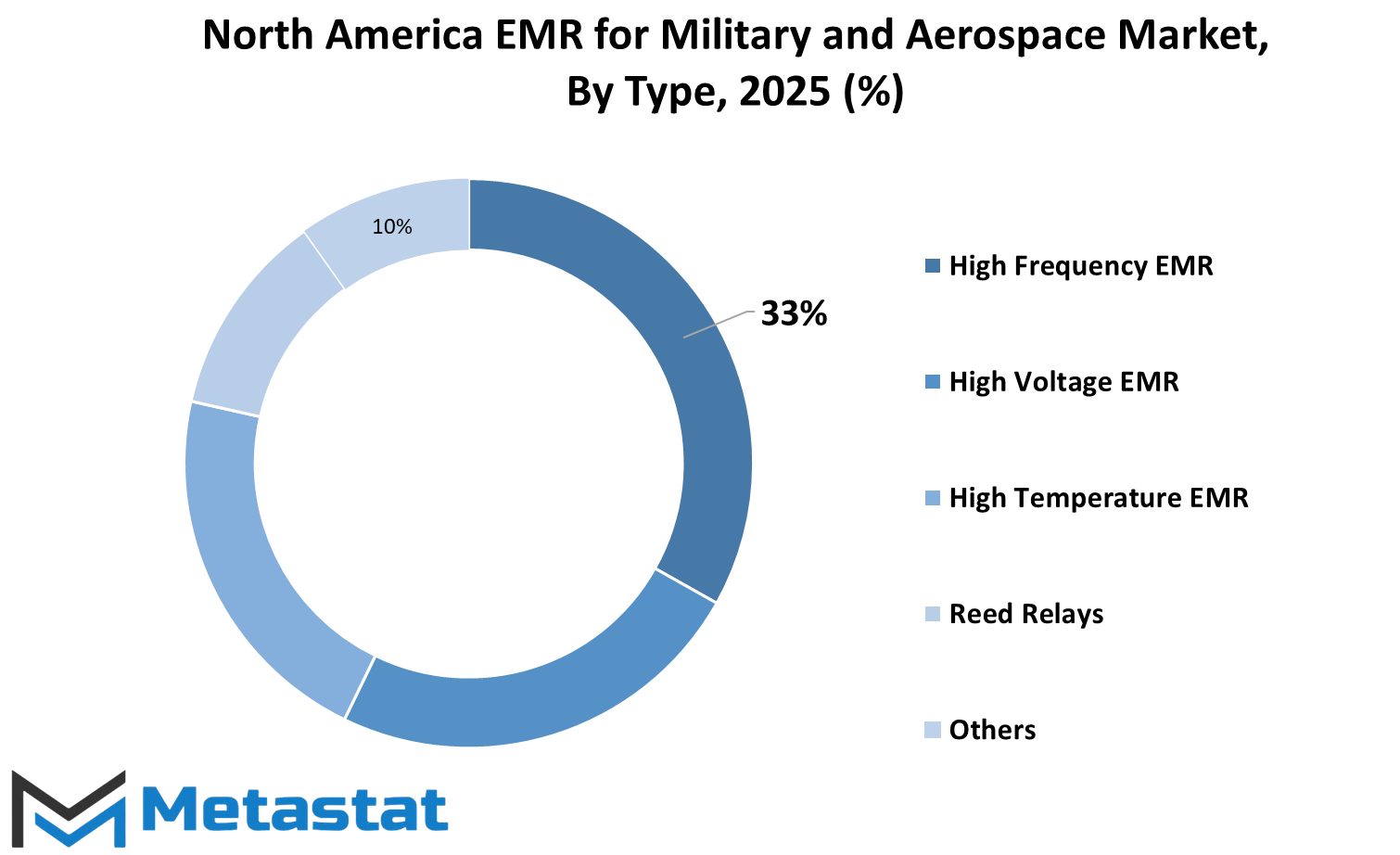

The north america emr for military and aerospace marketplace is experiencing constant growth with the increasing requirement of high-overall performance and reliable components in protection and aerospace applications. The marketplace includes numerous forms of Electromechanical Relays (EMRs), every serving a particular motive in performing important functions. These are further sub-categorised into High Frequency EMR, High Voltage EMR, High Temperature EMR, Reed Relays, and others. Among them, High Frequency EMRs are the biggest phase that is valued at $322.4 million. They are particularly used where there's a need for regular sign transmission at excessive speeds, which includes in radar structures and stable communications systems. Their capability to interchange at excessive speeds even as minimizing sign loss makes them the choice in this use.

High Voltage EMRs also are vital, particularly in systems wherein factors need to face up to and manipulate powerful electrical currents. They are used in plane and military automobile power distribution, in which protection and reliability are non-negotiable. High Temperature EMRs are designed to function beneath extremely high temperatures, for this reason they may be used in aircraft engines, space exploration, and in barren region environments where the temperature is tough to govern. Their strength and consistent performance ensure systems operate flawlessly under extreme stress.

Reed Relays, nevertheless, are valued for their compactness and rapid switching time. They are commonly used in test instruments and sensor circuits in aerospace and military use. Their ability to function at low power consumption and precise control allows engineers to build compact, efficient systems without compromising performance.

The "others" segment is application-specific or bespoke relays that are not among the main listed categories but do contribute to the market growth. These can include hybrid designs or relays configured to meet the shifting requirements of modern defense systems.

In general, the Military and Aerospace EMR market in North America continues to progress with the increasing use of electronic systems on all platforms. From communications management to flight systems control or ensuring vehicle safety, every use of EMR is essential. With further technology developments and the necessity of increasingly powerful, lighter, and more efficient systems, only demand for dependable relay components will grow. Performance, reliability, and safety will be the focus, ensuring that these relays can perform mission-critical applications with unwavering reliability.

By Application

The north america emr for military and aerospace market will witness steady growth with increasing demand for technology in the majority of defense systems. EMR is critical for the functioning and reliability of the majority of systems used in military and aerospace environments. With increasing technological advancements, the use of EMR will be more vital in environments that require precision, velocity, and secured transmission.

Through application, the market has been divided under avionics, weapon systems, communication systems, power distribution systems, radar systems, and others. Avionics, being all electronic systems used in aircraft, greatly rely on EMR to function properly. The systems span everything from flight control and navigation to weather monitoring and detection. As airplanes evolve, there will be an increasing demand for powerful and effective EMR solutions. Weapon systems also depend on EMR for accurate targeting, guidance, and control. Such systems require accurate data transmission and reception, especially during high-pressure combat when timing and reliability can make all the difference.

Communication systems are yet another critical field where EMR finds its significance. Secure and high-speed communication links are required for military and space operations, especially while operating in far-flung or hostile regions. EMR allows such systems to offer instant information with minimal possibility of interference or interception. The increasing significance of cybersecurity in communication systems will further drive the adoption of EMR technology.

Power distribution systems employed in military and aerospace equipment must be very efficient and dependable. EMR solutions provide control of the power distribution within complex machinery so that it functions well even when things get challenging. Radar systems also depend on EMR to detect and track objects. Detection of potential threats through to traversing terrain, radar systems need clear and uninterrupted signals for proper functioning. With radar technology making advancements in sensitivity and accuracy, additional EMR support will become a necessity.

Finally, there are additional upcoming uses in the "others" category such as unmanned aerial vehicles (UAVs), electronic countermeasures, and surveillance systems, all of which are aided by EMR usage. As new defense technologies and tactics are brought to market, custom EMR applications will become more necessary. The North America market will likely be leading in adoption due to its high defense spending, ongoing innovation, and obsession with keeping ahead of the technology curve.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$972.2 million |

|

Market Size by 2032 |

$1,442.2 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

COMPETITIVE PLAYERS

The north america emr for military and aerospace market includes a variety of prominent players that are major entities in the market. Such important players engage in growing, producing, and offering electromagnetic relays (EMRs) for diverse navy and aerospace uses. A few of the prominent entities on this context encompass American Zettler, Inc., Coto Technology, Inc., Littelfuse, Inc., and National Instruments Corporation. All those agencies own positive proprietary products and technology that help meet the disturbing necessities of army and aerospace systems.

American Zettler, Inc. Is devoted to reliable electromagnetic relays for high-performance packages below harsh situations. Coto Technology, Inc. Produces cutting-edge products that will be inclined to focus on precision and performance. Littelfuse, Inc. Has a vast variety of protection and manage additives utilized for protection and reliability packages in venture-essential structures. National Instruments Corporation is concerned with current size and automation technology that have a propensity to be integrated with EMR answers to enhance device overall performance.

Some of the opposite outstanding agencies include NTE Electronics, Inc., Omron Americas, and Panasonic Corporation of North America. NTE Electronics gives components that are designed to bear excessive environments, that is crucial inside the military and space sectors. Omron Americas boasts diverse relays and control devices whose reliability and overall performance are exceptionally recognized. NTE Electronics provides components designed to survive extreme environments, which is critical in military and space uses.

Phoenix Contact USA Inc. and Rockwell Automation, Inc. are also noteworthy. Phoenix Contact specializes in high-quality connection technology and automation products supporting EMR applications. Rockwell Automation boasts extensive industrial automation products and services that often include or follow EMRs. Schneider Electric USA, Inc., and TE Connectivity Ltd. provide the additional knowledge in electrical management and connectivity necessary to integrate EMRs successfully.

Finally, Kelco Industries, Teledyne Defense Electronics, and Leach International Corporation make their contribution to the market with top-of-the-line defense electronics and relay production. Their products are designed to meet rigid military and aerospace specifications for safety, reliability, and highest performance.

Together, these companies shape the north america emr for military and aerospace market by providing essential components sustaining the complex and demanding needs of the industry. Their constant innovation and commitment will drive the growth and reliability of EMR applications in military and aerospace systems.

North America EMR for Military and Aerospace Market Key Segments:

By Type

- High Frequency EMR

- High Voltage EMR

- High Temperature EMR

- Reed Relays

- Others

By Application

- Avionics

- Weapons Systems

- Communication Systems

- Power Distribution Systems

- Radar Systems

- Others

Key North America EMR for Military and Aerospace Industry Players

- American Zettler, Inc.

- Coto Technology, Inc.

- Littelfuse, Inc.

- National Instruments Corporation

- NTE Electronics, Inc.

- Omron Americas

- Panasonic Corporation of North America

- Phoenix Contact USA Inc.

- Rockwell Automation, Inc.

- Schneider Electric USA, Inc.

- TE Connectivity Ltd.

- Kelco Industries

- Teledyne Defense Electronics

- Leach International Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252