MARKET OVERVIEW

The Global Nitrogen Generator market and its industry will be used in the future industrial operations of the various sectors. Production of high-purity nitrogen gas on-site is fundamental for nitrogen generators as that avoids supply from external suppliers or storage systems. With techniques such as Pressure Swing Adsorption (PSA), Membrane technology, and Cryogenic processes, businesses can manufacture nitrogen gas effectively and at a low cost in response to the growing demand for on-demand and in-situ nitrogen production. Further integration of the industry is expected to be seen into various sectors like pharmaceuticals, food and beverage, electronics, chemicals, and manufacturing.

These industries require nitrogen for inerting, blanketing, preservation, and as part and parcel of their manufacturing process. The rising requirements of these industries for nitrogen would increase the demand for the sophisticated equipment and technologies devised to exactly meet the demands of production by providing quality and reliable nitrogen gas at a variety of levels. With improved scalability, the markets of these industries will still search for ways to make the next new products or services developed meet the requirements on technologies and quality.

This industry will find new inventions which make their operation more economical, reduce their expenditure in terms of energy usage, and make the operation of systems for nitrogen generation safer than before.

As businesses look to expand different industries and expand capacity for production, this demand for nitrogen generation will be sustained as it will be considered a critical component of business operations to reduce risk while maintaining constant gas availability. Customized production of nitrogen would become a standard in businesses like electronics, wherein nitrogen is applied in controlled environments as part of their manufacturing process. Oil and gas sectors that use nitrogen for pressure testing, purging, and stimulation of wells would also need such an escalating commodity. This will create an enormous market for custom-built nitrogen generation systems that would fill very specific requirements.

Future developments in the Global Nitrogen Generator market will include smart technology. Automation, IoT, and more advanced monitoring systems will track the processes in real-time to generate nitrogen. Efficiency, safety, and remote control over the nitrogen production systems will be increased. These new developments would most probably interest the industries seeking ways to reduce cost, energy usage, and performance operation.

There is expected demand for nitrogen generators in the food and beverage industry as time goes by. Nitrogen prolongs the shelf life of products through maintaining a controlled atmosphere, hindering oxidation, and promoting product freshness. As a result of the global food industry's growth, mainly from developing countries, demand for nitrogen generators will be even more pronounced because producers aim to keep pace with growing consumers' demands for preserved high-quality goods.

The Global Nitrogen Generator market is going to experience huge growth based on technological development, the growing industrial demand, and the changing requirements of the market. The industry will continue to innovate new, more efficient methods of nitrogen generation with a focus on reliable, safe, and cost-effective solutions. With better customization and widespread adoption across industries due to advancing technologies, the Global Nitrogen Generator market will solidify its role as an integral component of the current industrial activities worldwide.

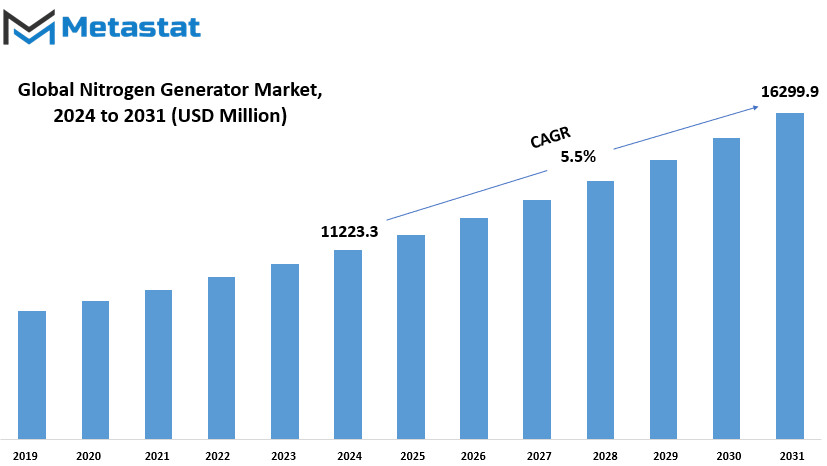

Global Nitrogen Generator market is estimated to reach $16299.9 Million by 2031; growing at a CAGR of 5.5% from 2024 to 2031.

GROWTH FACTORS

A nitrogen generator has significant market growth in the global space, which is attributed to a number of factors. The most significant driver behind this growth is the growing industrial demand for nitrogen. With increasing amounts of nitrogen being used in industries all over the world for different applications, there is also a need for efficient and reliable systems of nitrogen generation. Nitrogen is extensively used in the packaging of food products, chemical processing, and in the pharmaceutical industry and for many other purposes where it is required continuously to ensure supply of this vital gas. This expansion of nitrogen usage in numerous sectors will act as a fueler for the growth of the nitrogen generator market over the next few years. Improvements in the nitrogen generation systems also play an important role in stimulating growth for the market.

These systems have become more efficient and cost-effective over time and easier to maintain. New technologies, such as PSA technology and membrane nitrogen generators, have improved the reliability and performance of these systems, making them more attractive to a wider range of industries. These will continuously grow to make nitrogen generators efficient, thereby spreading them extensively in various fields. With such market growth, however, there are some drawbacks to the usage of these nitrogen generators.

The installation and subsequent maintenance costs involved with this system are comparatively very high. Nitrogen generators will cause problems with many businesses that, although they want to benefit from the gases, still cannot afford to incur all the costs necessary to get and maintain a nitrogen generator. This hampers the widespread adoption of the generator, especially for small to medium-sized enterprises, due to low production capacities and budgets. Other challenges are related to operating nitrogen generation systems with the regulatory standards and compliance issues. Various regions have different safety and environmental regulations that manufacturers need to adhere to, which can be a time-consuming and costly affair. These can deter the growth of the market because companies will need to ensure their complex regulatory landscape, coupled with safety and efficiency of their operations.

However, there are significant opportunities on the horizon. The promising prospect is the growing adoption of nitrogen generators in emerging economies. As industrialization advances in these regions, demand for nitrogen will increase, and this presents a massive opportunity for nitrogen generator manufacturers.

MARKET SEGMENTATION

By Type

The three major classes of nitrogen generators are Pressure Swing Adsorption (PSA) Nitrogen Generators, Membrane Nitrogen Generators, and Cryogenic Nitrogen Generators. Every form has the function of providing nitrogen in different applications, although it works on different principles and supports various applications.

The most commonly used method of on-site production of nitrogen is Pressure Swing Adsorption (PSA) Nitrogen Generators. They work based on the principle known as adsorption where they use carbon molecular sieves among others to separate nitrogen from air. The PSA system cycles in and out of high and low pressure. That cycle causes the nitrogen to separate and the other gases get rejected. Generators are also utilized in food packaging, electronics production, and in laboratory applications to name a few of those industries where the constant requirement for a consistent supply of nitrogen is essential.

Membrane Nitrogen Generators operate by membrane separation. Gases pass at different rates through a membrane. This allows oxygen, carbon dioxide, and other gases to travel faster through the membrane compared to the rate at which nitrogen moves through it. Membrane generators are simpler and generally more compact than PSA systems. They are often used in smaller operations where purity requirements are not as high, such as in certain medical or automotive applications. Cryogenic Nitrogen Generators are applied for larger applications where more nitrogen volume is required.

This process involves cooling air to a very low temperature. It causes gases to liquefy. Liquid air is separated into various components, one of which is nitrogen. Cryogenic generators are best used in industries like petrochemical production or steel manufacturing. These industries use large volumes of nitrogen and, typically, at very high purities. Cryogenic systems are more complex and power-intensive than PSA and membrane systems, and thus do not fit small-scale production. Each different variety of the generator has advantages in terms of user requirements. Solutions depending on the scale, whether small with very high purity or industrial processes, exist for generating nitrogen.

By Capacity

The market is segmented by capacity into four: Up to 1,000 SCFH, 1,000–5,000 SCFH, 5,000–10,000 SCFH, and Above 10,000 SCFH. This will then establish how the supply and demand function with each range of capacity. For example, products of Up to 1,000 SCFH are typically small in size and used for applications requiring a lower flow rate. They are mainly applied in small-scale industries or certain residential applications that do not need much output.

In the case of 1,000 to 5,000 SCFH, medium-sized applications are found. They can best fit an organization requiring a mid-size flow rate. Such products usually tend to fall into a category where wider use is achieved. Such applications can be employed for most industrial processes which call for flow rates that are neither excessively low nor excessive.

The 5,000–10,000 SCFH category is meant for industries and businesses that require more. These products are designed to handle more significant operations, providing larger flow rates for heavy-duty processes that require efficiency and a higher volume of output. This capacity range is often indispensable in sectors like manufacturing, chemical processing, and greater commercial activities.

Above 10,000 SCFH products are those that are highly designed to serve massive industrial purposes. These are mainly created for businesses and industries where heavy volumes of gas or air are demanded for complex or high output processes. Usually, these products can be found in industries like power plants, large-scale factories, and other major enterprises where large volumes are a critical factor.

With regard to their use, the use varies for each category; since flow rate is dependent upon necessity, businesses can decide what kind of product fits which. This categorization further assists in targeting proper consumers and ensures that its designed products meet the industrial need, from small business entities up to large industrial premises. All these categories will keep businesses from acting or deciding without knowledge.

By End-Users

The nitrogen generators market is segmented based on end-users, and the various industries in this sector are categorized as the largest share in the entire market. The food and beverage industry is a major one, which accounted for 3,112.9 million USD in 2023. This segment made up 29.2% of the total market for nitrogen generators in that year. It is expected to grow at a compound annual growth rate of 5.91% from 2024-2031 and is likely to attain 4,930 million USD by 2031. Increasing the requirements for nitrogen in food packaging, preservation, and production are expected to influence the growth of the nitrogen market. Other significant industries for the nitrogen generator market are the chemical and petrochemical industries. They rely on the gas for many applications, including creating an inert atmosphere during chemical reactions and preventing oxidation in other processing. The electronics industry also uses the gas, especially in manufacturing components where any specified environment needs to be controlled in order to maintain the quality of the product and ensure it lasts long.

The medical and pharmaceutical industries constitute another significant use. This industry uses nitrogen for applications such as cryogenics, plus packaging to preserve the integrity of highly sensitive medical products and medications. The automobile industry makes use of nitrogen for inflating tires which helps in better performance as well as safety of a tire.

Another main industry related to the applications of a nitrogen generator is packaging, especially food packaging. Nitrogen displaces oxygen and increases shelf life, keeping packaged goods fresh for a longer time. Other industries also get a mention in market reports and add to the share of the market of the nitrogen generator, though this could be a smaller share compared to others.

The nitrogen generator industry, from food and beverage to medical, electronics, and automotive, is diversified in its portfolio. It is these industries which are continuously on the growth path and are likely to propel the demand for the nitrogen generators, supporting the advancements and growing market value in the coming years.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$11223.3 million |

|

Market Size by 2031 |

$16299.9 Million |

|

Growth Rate from 2024 to 2031 |

5.5% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

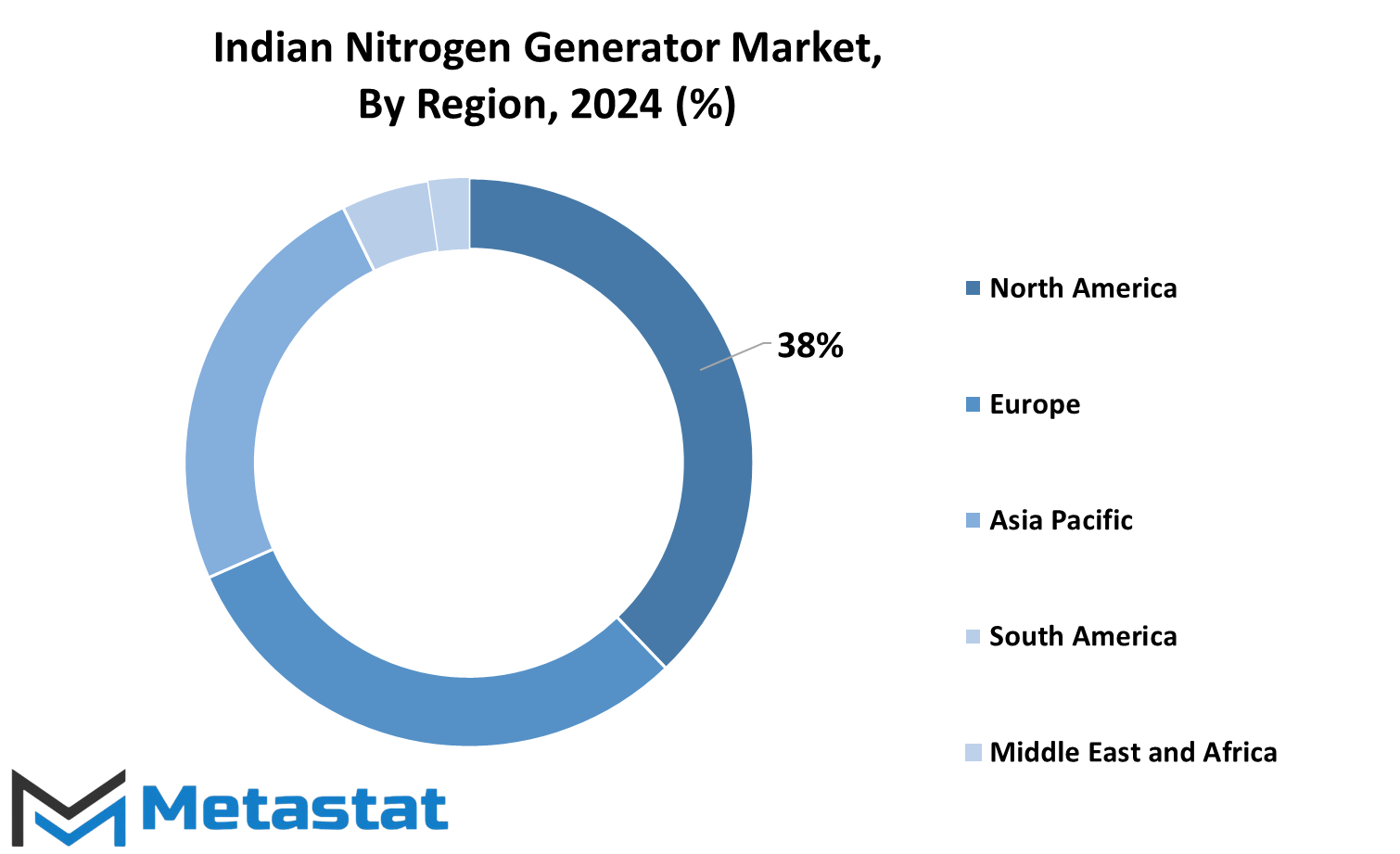

REGIONAL ANALYSIS

The global nitrogen generator market is further segmented into multiple regions having different characteristics. Those are North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America also encompasses the United States, Canada, and Mexico with varying demand for the generator among key markets. In Europe, the market is segmented into countries as the UK, Germany, France, Italy, and the rest of it as the Rest of Europe. Asia-Pacific is a large region by population and industrial growth and is split into India, China, Japan, South Korea, and the rest of Asia-Pacific, which includes all other countries. The South America region consists of the major markets Brazil and Argentina, and other countries in the continent are clubbed together as the Rest of South America.

This region is booming in terms of industrial demand, thereby pushing the demand for nitrogen generators. The Middle East & Africa region comprises the GCC countries, Egypt, South Africa, and the rest of the Middle East & Africa. Challenges and opportunities differ in each region and involve the aspects of industrial growth, energy demand, and technological development of each region. These form a significant part of the dynamics of the global market.

The demand for nitrogen generators is determined by the industries and the local economy in each region, along with the advancement in technology. Since the markets are growing and changing constantly, knowledge about the geographic segmentation would be significant for businesses to tailor strategies for every region. The structure of the market will remain one of the critical factors in shaping its future with such needs as local industrial applications and responses to regional growth trends.

COMPETITIVE PLAYERS

The key companies which shape the Nitrogen Generator industry and have a very significant role in its development and growth are Atlas Copco Group, Parker-Hannifin Corporation, Air Products and Chemicals, Inc., Linde PLC, and Air Liquide S.A. These companies are recognized for innovation and strong presence in the market, providing advance solutions to industries that depend on nitrogen generation.

Other major companies in the list include Hitachi, Ltd., Ingersoll Rand Inc., and Peak Scientific Instruments. These companies contribute significantly to the progress of this industry by offering quality products and services. These firms have reputations for supplying reliable nitrogen generation systems for several applications, from laboratories to industrial facilities.

South-Tek Systems, LLC, On Site Gas Systems, Inc., and Generon are also leading companies in this industry. They provide tailored nitrogen generation solutions for business clients who are looking for cost-effective and efficient systems. Oxymat A/S is another leader in the industry that offers nitrogen solutions with a focus on energy efficiency, which has become an important consideration for businesses that are shifting towards more environmentally friendly practices.

These companies are important in the growth of the nitrogen generator market, as they serve to meet the demand for on-site gas generation solutions. As industries around the world continue to require reliable sources of nitrogen for many applications, the competition between these key players will drive further advancements in technology and efficiency. Their innovation and commitment to providing high-performance nitrogen systems will be crucial in the future of the industry.

Nitrogen Generator Market Key Segments:

By Type

- Pressure Swing Adsorption (PSA) Nitrogen Generators

- Membrane Nitrogen Generators

- Cryogenic Nitrogen Generators

By Capacity

- Up to 1,000 SCFH

- 1,000–5,000 SCFH

- 5,000–10,000 SCFH

- Above 10,000 SCFH

By End-Users

- Food and Beverage Industry

- Chemical and Petrochemical Industry

- Electronics Industry

- Medical and Pharmaceutical Industry

- Automotive Industry

- Packaging Industry

- Others

Key Global Nitrogen Generator Industry Players

- Atlas Copco Group

- Parker-Hannifin Corporation

- Air Products and Chemicals, Inc.

- Linde PLC

- Air Liquide S.A.

- Hitachi, Ltd.

- Ingersoll Rand Inc.

- Peak Scientific Instruments

- South-Tek Systems, LLC

- On Site Gas Systems, Inc.

- Generon

- Oxymat A/S

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252