MARKET OVERVIEW

The Global Net Promoter Score (NPS) market within the broader spectrum of customer experience management. This sector revolves around the assessment and analysis of customer loyalty and satisfaction, employing a metric that has become instrumental in gauging brand advocacy. The industry essentially thrives on unraveling the intricacies of customer sentiments and perceptions to derive actionable insights for businesses worldwide.

The Global NPS market operates on a foundation of simplicity, emphasizing a straightforward yet effective methodology. NPS measurement revolves around a single question – the likelihood of recommending a product, service, or brand to others. Respondents are categorized into three segments: promoters, passives, and detractors, based on their rating. This straightforward approach eliminates the need for convoluted surveys and provides a quick snapshot of customer loyalty.

The industry's significance lies in its ability to serve as a compass for businesses navigating the tumultuous waters of consumer sentiment. In a landscape defined by perpetual change, companies find solace in the stability offered by the NPS metric. The Global NPS market caters to a diverse array of sectors, ranging from retail and technology to healthcare and hospitality. Its universal applicability stems from the fundamental human aspect of recommending or dissuading others based on personal experiences.

One key aspect of the Global NPS market is its adaptability to various business models and sizes. From small enterprises to multinational corporations, the NPS metric scales seamlessly, offering a standardized yardstick for customer satisfaction. This adaptability underscores its role as a democratizing force in the realm of customer experience management.

An intriguing facet of the Global NPS market is its ability to transcend geographical boundaries. In an increasingly interconnected world, businesses no longer grapple with localized challenges alone. The NPS metric serves as a global language of customer satisfaction, allowing companies to benchmark their performance on a worldwide scale. This interconnectedness fosters healthy competition and encourages companies to strive for excellence in a global context.

In practical terms, the Global NPS market facilitates a continuous feedback loop, enabling organizations to iterate and improve their offerings. By identifying promoters and detractors, businesses gain actionable insights to enhance customer experience. This iterative process positions NPS as more than just a metric; it becomes a catalyst for organizational evolution.

As businesses grapple with the ever-changing landscape of consumer preferences, the Global NPS market emerges as a stalwart ally. Its simplicity, adaptability, and global relevance make it an indispensable tool for companies striving to not only understand their customers but also to thrive in an increasingly competitive marketplace. In a world where customer loyalty is a coveted currency, the NPS metric reigns supreme, shaping the strategies of businesses across diverse industries.

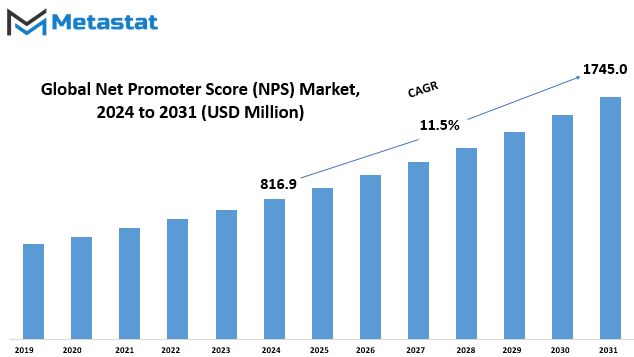

Global Net Promoter Score (NPS) market is estimated to reach $1745.0 Million by 2031; growing at a CAGR of 11.5% from 2024 to 2031.

GROWTH FACTORS

The Global Net Promoter Score (NPS) market experiences growth propelled by essential factors while encountering challenges that may hinder its progress. The market's upward trajectory is influenced significantly by specific growth factors, presenting a promising outlook. On the flip side, there exist obstacles that could potentially impede the market's expansion.

The driving forces behind the growth of the Global NPS market are pivotal in shaping its current positive trajectory. These factors contribute significantly to the market's advancement, underlining their importance. However, it is crucial to acknowledge the existence of certain challenges that stand as potential roadblocks to this growth.

While growth factors propel the market forward, it is essential to address potential hindrances. These challenges, though present, should not overshadow the positive aspects of the market's progression. The delicate balance between growth factors and challenges defines the dynamic landscape of the Global NPS market.

In navigating these challenges, opportunities emerge as beacons of hope for the market's continued development. Despite the hurdles, the market remains resilient, poised to capitalize on lucrative opportunities in the foreseeable future. The identification and pursuit of these opportunities become integral to sustaining and enhancing the market's overall performance.

The Global NPS market undergoes a continuous ebb and flow influenced by both growth factors and challenges. This intricate interplay shapes the market's trajectory, highlighting the importance of recognizing and navigating obstacles while leveraging opportunities for sustained growth.

MARKET SEGMENTATION

By Component

In the vast landscape of the global market for Net Promoter Score (NPS), the breakdown by component sheds light on the key players. Within this context, the Software segment holds significant weight, registering a value of 567.4 USD Million in the year 2023. This underlines the pivotal role that software plays in the NPS domain.

Parallelly, the Services segment emerges as a notable contender, boasting a valuation of 165.8 USD Million in 2023. This emphasizes the integral contribution of services to the overall NPS market, demonstrating a dynamic interplay between software and services components.

The segmentation by component not only provides a glimpse into the financial dimensions but also unravels the intricate dynamics at play within the NPS market. It highlights the dual forces of software and services, each making distinct contributions to the thriving ecosystem of NPS solutions.

This nuanced understanding of the NPS market’s composition enables stakeholders to navigate the competitive landscape with a comprehensive grasp of the software and services facets, crucial for strategic decision-making in this evolving market.

By Enterprise Size

In the expansive landscape of the Global Net Promoter Score (NPS) market, the segmentation by enterprise size plays a pivotal role in delineating its diverse facets. This market, a dynamic arena where businesses gauge customer loyalty and satisfaction, is categorized into two primary segments based on enterprise size.

The Small and Medium Enterprises (SMEs) segment occupies a significant space within this market ecosystem. In the financial tapestry of 2023, this segment commanded a valuation of 216.7 USD Million. These enterprises, often characterized by their nimbleness and adaptability, form a substantial part of the NPS market, navigating the intricacies of customer relations with a distinct approach.

Conversely, the Large Enterprises segment stands as a formidable force within the NPS market landscape. In the fiscal year 2023, it registered a valuation of 516.6 USD Million, underscoring its substantial influence. Large enterprises, known for their expansive operations and significant market presence, contribute significantly to the broader canvas of NPS dynamics.

Understanding the distinct values attributed to these two segments provides a nuanced insight into the trajectory of the NPS market. The SMEs, with their agility, cater to specific market niches, while the Large Enterprises, with their robust structures, navigate the challenges of customer satisfaction on a broader scale. Together, these segments shape the contours of the NPS market, reflecting the diverse strategies employed by businesses to measure and enhance customer loyalty.

By End-User

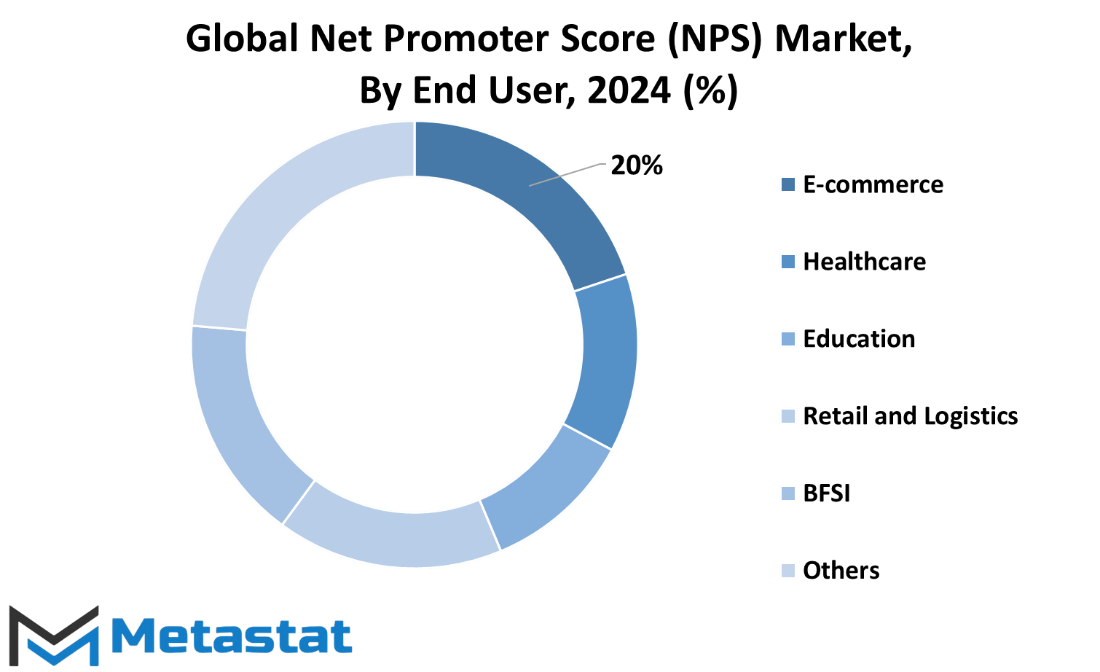

The Global Net Promoter Score (NPS) market, various industries play a pivotal role in shaping its trajectory. The market’s segmentation based on end-user industries reveals a diverse panorama, encompassing E-commerce, Healthcare, Education, Retail and Logistics, BFSI, and Other sectors.

E-commerce stands out as a significant participant, harnessing the power of NPS to gauge customer satisfaction and loyalty. The online retail realm relies on NPS insights to enhance user experiences and fortify brand allegiance.

Healthcare, another key player in this market, leverages NPS to measure patient satisfaction and optimize healthcare services. Understanding the pulse of patients aids in refining medical processes and elevating the overall quality of healthcare delivery.

Education, a vital facet, utilizes NPS as a yardstick to evaluate student satisfaction and engagement. This approach contributes to the continuous improvement of educational institutions and the learning experiences they provide.

The Retail and Logistics sector, intertwined in the dynamics of consumer interactions, employs NPS to decipher customer sentiments. This strategic application of NPS assists in tailoring services to meet consumer expectations, fostering a positive and enduring customer-provider relationship.

BFSI (Banking, Financial Services, and Insurance) embraces NPS to gauge client satisfaction in the intricate world of financial transactions. This aids in refining services, instilling trust, and bolstering customer loyalty in a competitive financial landscape.

The category of Others encompasses a spectrum of industries that also harness the capabilities of NPS. This inclusive segment represents various sectors benefiting from NPS insights to enhance customer relationships and overall performance.

The division of the Global NPS market based on end-user industries provides a nuanced understanding of how diverse sectors integrate NPS methodologies. Each industry, with its unique characteristics, contributes to the comprehensive tapestry of the market, emphasizing the universal applicability and impact of Net Promoter Score across a myriad of sectors.

REGIONAL ANALYSIS

The global market for Net Promoter Score (NPS) is categorized by geographical regions, including North America and Europe. NPS serves as a metric to measure customer satisfaction and loyalty, influencing businesses worldwide.

The North American segment of the NPS market holds significant importance, reflecting the diverse business landscape and consumer behaviors across the continent. Companies in North America utilize NPS as a valuable tool to gauge customer sentiments and refine their strategies for enhanced customer satisfaction.

Moving on to Europe, the NPS market within this region plays a crucial role in shaping customer-centric approaches for businesses. European companies, much like their North American counterparts, leverage NPS insights to adapt and improve their products or services based on customer feedback.

The dynamic nature of the global NPS market underscores its impact on businesses striving to meet customer expectations. The strategic deployment of NPS across continents emphasizes its universal relevance in optimizing customer experiences and fostering long-term loyalty. As companies worldwide recognize the value of NPS, its influence continues to grow, creating a ripple effect that transcends geographical boundaries.

COMPETITIVE PLAYERS

In the expansive arena of the Global Net Promoter Score (NPS) market, various companies vie for prominence. Among the notable players in the NPS industry are Qualtrics, LLC, Zonka Technologies Pvt Ltd, SurveySparrow Inc., Survicate sp. z o.o., InMoment, Medallia Inc., Customer Gauge, NICE Satmetrix, Verint Systems Inc., Nice Reply, s.r.o., AskNicely, and Zykrr. These entities form a competitive landscape, each contributing to the dynamic and evolving nature of the NPS sector.

The competitive dynamics within this market are shaped by the activities and strategies of these key players. Companies like Qualtrics, LLC, and Zonka Technologies Pvt Ltd bring their unique approaches and solutions to the table, influencing the overall direction of the NPS industry. SurveySparrow Inc., Survicate sp. z o.o., and InMoment, with their distinct offerings, contribute to the diversity that characterizes the market.

Medallia Inc., Customer Gauge, and NICE Satmetrix play pivotal roles in shaping customer experience measurement, while Verint Systems Inc., Nice Reply, s.r.o., AskNicely, and Zykrr contribute to the multifaceted nature of feedback systems and customer engagement strategies within the NPS domain.

Understanding the competitive players in the NPS industry is crucial for comprehending the market dynamics. Each entity brings its strengths and innovations, creating a mosaic that reflects the ongoing evolution of the Net Promoter Score landscape. As these key players continue to navigate the competitive arena, their contributions collectively shape the narrative of customer satisfaction measurement, providing businesses with insights essential for enhancing their overall performance and customer relationships.

Net Promoter Score (NPS) Market Key Segments:

By Component

- Software

- Services

By Enterprise Size

- SMEs

- Large Enterprises

By End-User Industry

- E-commerce

- Healthcare

- Education

- Retail and Logistics

- BFSI

- Others

Key Global Net Promoter Score (NPS) Industry Players

- Qualtrics, LLC

- Zonka Technologies Pvt Ltd

- SurveySparrow Inc.

- Survicate sp. z o.o.

- InMoment

- Medallia Inc.

- Customer Gauge

- NICE Satmetrix

- Verint Systems Inc.

- Nice Reply, s.r.o.

- AskNicely

- Zykrr

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383