MARKET OVERVIEW

The global military battery market is among the most dynamic and significant components of any modern defense system and is used to empower equipment, ranging from communications devices to vehicles and weapon systems. The industry is going to register considerable change through technological advancement and increased demand for cleaner, more efficient, and more reliable energy sources. As military operations become more reliant on highly developed technologies, so will the need for tough and adaptable battery solutions that can manage a variety of hostile environments. The more sophisticated the military equipment, the more such special batteries are deserved: tougher, longer-living, and higher-energy-density solutions. Demand for such special-purpose batteries will drive the innovation process within global military battery markets towards advanced battery technologies meeting the specific needs of contemporary military forces.

Lithium-ion batteries are therefore the most likely to dominate a huge share in the Global Military Battery market in future. They have some very advantageous properties: their weight is relatively low, and their energy density is sufficiently high for many military applications. As technology continues to advance further, these batteries will come out with increased efficiency and better energy storage, faster re-charge times, thus enabling military forces to operate for a longer time and more effectively.

The Global Military Battery market will also ride on the growth of solid-state battery technology. Over other traditional types of batteries, these have more energy density and possess better safety features, making them usable in many applications. As research in this area continues to develop, the potential of solid-state batteries to be a part of military-based power systems will make them a mainstay for assured military-related energy solutions across various military applications.

Another important dimension of the Global Military Battery market is the shift toward a sustainable manufacturing model and molds with regard to environmental impacts. As the world gets more conscious and seized of the need to bring down carbon footprints and cut down on maximum avoidable environmental damages, the military sector too would focus on developing ecologically neutral battery solutions. This will propel the existing state of innovation in the market that already requests batteries for military applications which will align with objectives for global sustainability.

Integration of artificial intelligence and the Internet of Things in the art of warfare will further be instrumental in directing the course of the Global Military Battery market. These technologies need reliable and effective power sources to function in ways that can be most effective, thereby increasing demand for such advanced battery solutions. This, in turn, shall require that manufacturers come up with batteries that can support growing complexity and sophistication in military technologies.

The Global Military Battery market will be very critical to ensure that military forces have power for their needs, basing on the fact that military strategies and technologies are advancing highly. Ongoing research and development investment will continue, besides collaboration with military organizations by the industry's business leaders to devise applicable innovative solutions to the peculiar demands of modern warfare.

In the future, the Global Military Battery Market will further intensify manufacturing battery technologies that are state-of-the-art for superior performance and reliability than others in competition. In such a backdrop, innovation will lead to a whole range of battery solutions catering to the niche needs of military forces around the world. As the industry manages to push ahead with finding future scenarios for military operation landscapes, the need to make sure that necessary power is available to military forces for protection and defense is going to be an essential contribution.

The Global Military Battery market is expected to grow and transform significantly in the coming years. These factors will ensure even further development of the industry, while adherence to sustainability and further digitizing of military operations with AI and IoT technology will develop more in the future to make indispensable power solutions for the emerging modern military forces. It will play an important market role in supporting the operational capabilities of military forces worldwide as manufacturers continue to innovate and create new battery technologies.

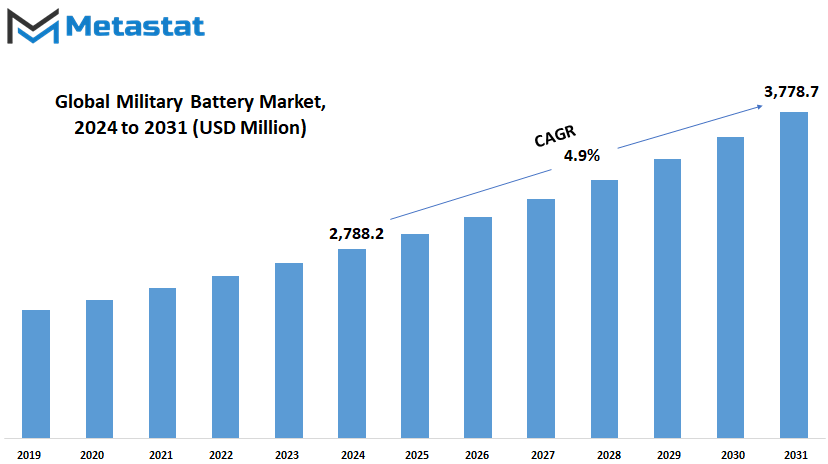

Global Military Battery market is estimated to reach $3,778.7 Million by 2031; growing at a CAGR of 4.9% from 2024 to 2031.

GROWTH FACTORS

The Global Military Battery market is projected to witness huge growth, driven by some strong motivators. Of these, the chief drivers are increases in defense budgets across the globe. Most countries invest heavily in programs of military modernization for enhancing their defense capabilities, thereby fueling demand for advanced military batteries. As the focus for the development of more efficient and mighty military equipment increases, so is the need for more reliable and high-performance batteries.

Another major trend driving the growth of the Global Military Battery market is increasing applications in portable and unmanned systems. Modern military operations are highly dependent on technology that requires portable power sources, such as drones, robotics, and other unmanned systems. These systems form part of the military strategy and deliver capabilities that did not exist before. These technologies will keep demanding supporting batteries at a higher level over time, moving the market forward.

However, the growth of the Global Military Battery market is bound by some restraints. Some major challenges that exist in this arena pertain to expensive production processes and intricate manufacturing procedures. Advanced military-grade batteries are extremely costly to develop and require loads of investment in research and development. Moreover, tight regulatory and safety requirements over military equipment further complicate the manufacturing procedure, which may elongate the development time and fielding time of a product.

Despite these challenges, developments in battery technology also create various opportunities for the growth of the Global Military Battery market. Much potential can be derived from innovation if researchers and manufacturers focus on developing high energy density and a longer lifespan. Advances in technology will allow military batteries to have increased performance, while the size and weight of battery systems are reduced, thus making a military battery system more efficient and versatile. These improvements will be very useful in a number of ways, especially in portable and unmanned systems where weight and size may be most important.

These technological developments in military battery storage solutions are, therefore, likely to facilitate the growth in demand within the global military battery market during the next few years, with the help of more efficient and potent battery solutions. In large part, these two emergent properties—longer-lasting and more reliable power sources—are going to drive the success of military operations in the future. In a view to modernize militaries and to develop new technologies in the defense sector, prospects remain bright for advanced military batteries. Demand will drive further investment and innovation in the market and open up new opportunities and growth prospects.

While there are a few challenges in the global military battery market, the growth factors and the opportunities that exist with technological developments and a rise in military spending are likely to make the future bright. Further, as the market continues to grow, it would aid technological evolution for modern military operations, thereby helping to increase the global defense capabilities.

MARKET SEGMENTATION

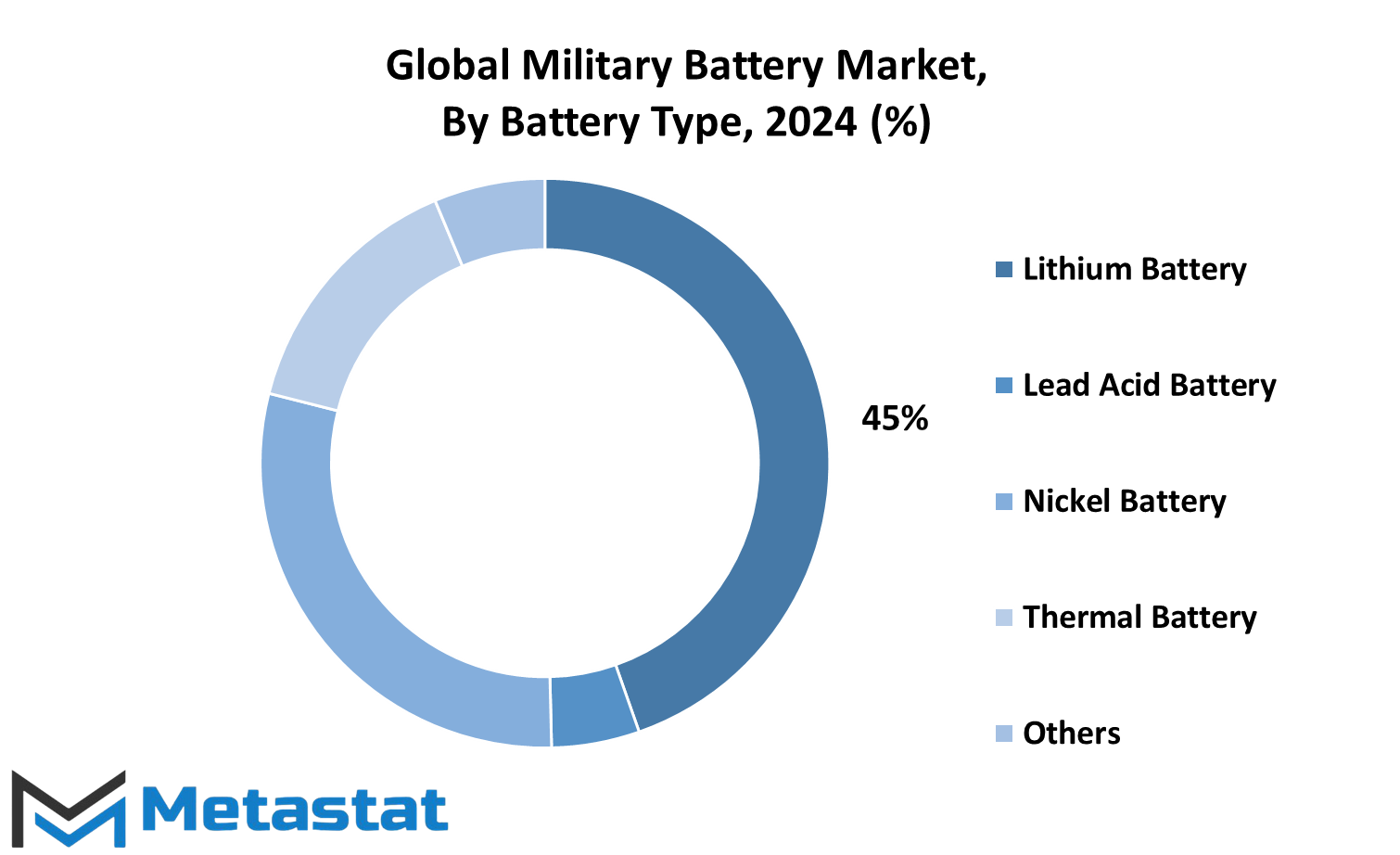

By Battery Type

With the changing times of technological developments and defense strategies, the global military battery market is ever ready to expand. Increased development and fielding of sophisticated defense systems call for increased investment in reliable, efficient power sources. Military operations are getting more and more dependent on advanced electronic systems; hence, demand for high-performance batteries is going to rise accordingly. This market will be driven by innovations in battery technology, along with shifts in geopolitical landscapes necessitating modernized military capabilities. A further segmentation of the military power sources into a future scenario, based on battery type, would help in comprehending and pinpointing how these developments would drive the future of military power sources.

Lead-acid batteries have held a historic monopoly over military applications because they are both reliable and inexpensive. With rising demands for lighter and more energy-dense solutions, the limelight is sure to shift to lithium batteries. Such batteries have higher energy efficiency and larger lifetimes that make them very suitable for modern military equipment, which requires sustained power over extended periods. Their ability to resist unfriendly environmental conditions and deliver consistent performance makes them indispensable in the future global military battery market.

Another field in which nickel batteries will be very important is in those applications in which one needs a battery with good energy density and high strength, besides also having good resistance to extremely high and low temperatures. This battery is rugged, and this characteristic will be more important when military operations are conducted with high frequency in different terrains. Continuous research and development of nickel battery technology will make possible new versions that can sustain high energy requirements for modern military systems.

With the ability to provide high power in very short bursts, thermal batteries will continue to be crucial for applications such as missile systems and other high-demand weaponry. Application of these kinds of batteries in missile systems and other high-demand weaponry will thus remain very strong amid changing market scenarios toward more sophisticated weaponry across varied geographies. Given that the emphasis is on improving their efficiency and making them less environmentally harmful, hence aligning with broader trends toward “greening” military force practices.

Other battery types will also show up as viable options, impelled by continuous research into new materials and technologies. The integration of cutting-edge technology—like solid-state batteries—into this could have a market-changing impact with never-before energy density and safety. As these innovations become more commercially viable, they will reshape the global military battery market by opening up new avenues to power future military systems.

By Type

The Global Military Battery market will undergo significant changes through the years with innovation in technology and diverging needs of the defense sector. This market is split into two key divisions: Rechargeable and Non-Rechargeable Batteries. Both of these segments are going to contribute to creating a different form of the military in the coming times.

Rechargeable batteries will capture the most significant market share due to their cost-effectiveness and environmental benefits in the long run. They are irreplaceable in a modern military installation where high energy density and reliable sources of power become paramount. Rechargeable batteries, including lithium-ion and nickel-metal hydride types, designed to provide higher performance, are now being introduced into advanced military hardware. These batteries will continue to evolve; improvement in energy storage capacity and charging efficiency will be at the core of research and development.

On the other hand, non-rechargeable batteries will still be of immense importance in certain military uses. Being a single-use, highly reliable power source, non-rechargeable batteries find extensive use in many applications. For example, in remote sensors and emergency beacons where recharging is impractical, non-rechargeable batteries made from primary lithium and alkaline have high energy density and are characterized by a long shelf life, hence able to be used under harsh conditions. Development in non-rechargeable batteries will be oriented to their exploitability and performance when working in extreme conditions.

Noticeably, the Global Military Battery market will also refute advanced technologies such as solid-state batteries and next-generation energy storage solutions. Improved innovations will surmount existing limitations to the battery domain, such as improved safety features and limited energy density. In particular, solid-state batteries would be most revolutionary to the market, given their higher energy densities and better safety features than other conventional types of batteries.

In the near future, military forces will be turning ever more to advanced battery technologies to support applications ranging from portable electronics and communication systems to unmanned vehicles and advanced weaponry. The evolution of batteries will certainly follow the increased demand for more efficient, reliable, and long-lasting power sources within military operations.

By Capacity

On the basis of capacity, the military battery market can be categorized into three key segments: Below 12V, 12 to 24V, and Above 24V. They are categorized according to different operational and technological requirements. Batteries Below 12V are used in smaller or portable devices and equipment—that is, in applications of lower power. These batteries become very important in field conditions by keeping communication devices, personal gear, and other small-scale equipment running.

The 12-24V capacity range still holds a huge share of the market, powering more demanding applications. This includes the batteries for medium-sized equipment such as tactical vehicles, portable power supplies, and communication systems. Such batteries have a good balance of output power versus size and are therefore appropriate for the bulk of military uses that need a hardwired power source without mobility compromise.

Those exceeding 24V are targeted at high-power applications and large equipment: power systems of armored vehicles, drones, and advanced weaponry. Military operations already increasingly rely on advanced technology and high-performance equipment; thus, demand for these high-capacity batteries is bound to rise. A tremendous amount of power is demanded from batteries in this segment, yet they shall be sturdy and reliable in unforgiving environments.

In the future, the Global Military Battery market will continue to progress with the invention of better batteries having increased energy density, charging efficiency, and cycle life. Solid-state batteries and improvements in lithium-ion technology shall help immensely in catering to the future requirements of soldiers. Such developments in this area will enhance military batteries’ performance and reliability to serve next-generation technologies as well as current ones.

As military operations evolve, so does the demand for versatile and high-performance batteries. With the technological development and increasing requirement for reliable sources of power in many military applications, the global military battery market is expected to grow. Increasing investment in research and development will be witnessed for more efficient and durable battery solutions that will further help perform military operations in the near future.

By End User

The future market will be characterized by diversified applications, with various end-users driving the demand for specialized batteries. A big part of this sector is foreseen to be occupied by drones and UAVs. For long missions and effectiveness in operations, such devices will require batteries with high energy density and a correspondingly long life. The improvements made in this sector of battery technology will most probably be oriented toward increasing the ability of energy storage while bringing down battery weight, which will impact directly on UAV performance and endurance.

One more critical segment of the Global Military Battery market is that of soldier-wearable or soldier-carried devices. With modern-day soldiers increasingly relying on electronic equipment, such as advanced communication devices, advanced navigation gadgets, and surveillance gadgets, the batteries powering these devices must be strong and effective. The future development will most likely look more into batteries that deliver long-life service, have quicker charging time, and demonstrate a better capacity for resisting hostile environments in order to be able to fall back on equipment in any given situation for soldiers.

Hybrid systems and electrical aircraft will also fuel demand for fresh battery solutions. This drive toward greener, more efficient technologies in aviation will be supported with the requirement for batteries in this field that support high energy demands without jeopardizing safety and performance standards. The future of battery technology in this respect will be quite critical to fulfill military aviation needs of tomorrow.

Otherwise, marine UAVs and unmanned underwater vehicles are likely to constitute high growth as well. Underwater and surface vessels have specialized batteries that will function efficiently in extreme conditions. Developments will be made in the future on enhancing the durability of the batteries and increasing energy efficiency to power such missions while prolonging time and augmenting the operational features of the marine UAVs and UUVs.

The Global Military Battery market will continue to show growth as technological advancements in efficient, durable, and high-performance batteries are developed. In the future, the market will be influenced by innovations that will respond to the special requirements of different military applications, so that defense forces obtain the most reliable and advanced energy solutions available.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$2,788.2 million |

|

Market Size by 2031 |

$3,778.7 Million |

|

Growth Rate from 2024 to 2031 |

4.9% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

From a regional point of view, the global Military Battery market has been delineated into five distinct regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. All these regions have unique characteristics and growth prospects.

North America is driven by the United States, Canada, and Mexico. It is expected that the United States will continue to lead the market due to its huge defense budget and continuous process of military technology modernization. The initiative by Canada to upgrade its defense capabilities and the growing budget by Mexico on military infrastructure would further boost the market growth. These nations are likely to be at the forefront of adopting and integrating the latest battery technologies to meet their defense requirements.

Steady growth will also come from European countries, including the United Kingdom, Germany, France, Italy, and the rest. The UK and Germany have established defense industries and a commitment to the modernization of military equipment. France and Italy will eventually catch up through investments in new technologies and refurbishment or upgrading of existing systems. The rest of Europe will also contribute to this growth but at a slower rate than these leaders. Rapidly, the European market will also turn more towards energy efficiency and reliability in military batteries.

The Asia-Pacific region, which includes India, China, Japan, South Korea, and the rest of Asia-Pacific, would also experience considerable expansion in this sector. It is probable that China and India will be big contributors, given their huge defense budgets and rapidly advancing military technologies. Japan and South Korea will also be key contributors driven by their attempts to keep on modernizing respective systems of defense and amalgamating advanced solutions in the development of batteries. Other countries in the Asia-Pacific region will grow at a slow rate since investment in military battery technology varies.

South America will show a more moderate growth with Brazil, Argentina, and the rest of the region. Brazil and Argentina take the lead with their strategic investments in defense and military capability buildup; the latter is at a discrepant pace for the remaining South Americans due to varying levels of investment and development.

The Middle East & Africa will grow because of the focus of countries in the region on increasing their defense capabilities. GCC countries, such as Saudi Arabia and UAE, will add to the bulk of growth since they are some of the biggest spenders on defense and have modernization programs lined up. Military battery technology will also be adopted by Egypt and South Africa, although at a different pace than in the GCC countries. The rest of Middle East & Africa will develop gradually, characterized by uneven growth and investment.

Overall, with technological evolution and increasing defense spending in various regions of the world, the Military Battery market will change accordingly with diversified growth trajectories and innovative opportunities.

COMPETITIVE PLAYERS

The Global Military Battery market is bound to register tremendous growth with the industry continuing to evolve. With growing investments by nations and defense organizations in new technologies, the requirement for advanced and reliable military batteries is bound to rise. There are a number of competitive players in the market, each of which has been contributing to the sector with quite a number of ingenious solutions.

The key participants in the global military battery market involve Arotech Corporation, BAE Systems PLC, and Bren-Tronics, Inc. These companies have very strong product portfolios and are engaged extensively in the development of new batteries for military use. For example, Arotech Corporation works with high-performance battery systems designed for stringent military applications. BAE Systems PLC is a front-runner in defense technology, applying its expertise to deliver batteries that excel in operational capabilities for defense equipment. Bren-Tronics, Inc. manufactures sturdy and dependable batteries with which militaries around the world match their highest standards.

The other key market players are BST Systems, Inc., BYD Co. Ltd., and Cell-Con, Inc. BST Systems delivers next-generation battery solutions to meet prolonged mission demands and challenging environments. BYD Co. Ltd. is also one of the key market participants globally in offering new energy battery technologies that ensure enhanced energy efficiency and operational reliability. Cell-Con, Inc. also contributes to the market by delivering quality batteries designed for various military applications.

Apart from these, Concorde, Denchi Power, and EaglePicher Technologies, LLC, are in dominant positions in the Global Military Battery market. Concorde provides high-capacity, long-life cells. On the other hand, Denchi Power designs state-of-the-art battery solutions to meet military and defense applications' most demanding requirements. EaglePicher Technologies, LLC offers a complete line of battery solutions to support military missions worldwide.

Other key players in the marketplace will be Ecobat Technologies Limited, ENERSYS, and Exide Technologies, LLC. Ecobat Technologies Limited will be known for their "green" battery solutions while ENERSYS and Exide Technologies, LLC provide a complete portfolio of highly reliable battery systems for military applications.

General Dynamics, Kokam, and Lincad Limited also contribute to the sector through their innovative ways of designing and manufacturing batteries. General Dynamics provides high-performance military system functionality with its high-performance batteries, while Kokam and Lincad Limited engage in advanced technologies for such batteries to be both reliable and efficient in critical situations.

Finally, the other key players in the Global Military Battery market are Mathews Associates, Navitas Systems LLC, Saft, Teledyne Battery Products, and Ultralife Corporation. Military battery technologies are developed and diversified by these companies through their varied capabilities.

These players will be very instrumental in driving innovations and meeting the growing demands that characterize modern military operations as the Global Military Battery market continues to develop. Their contribution will therefore be essential to developing military battery technology in the future so that armed forces are well-equipped with the most reliable and advanced energy solutions available.

Military Battery Market Key Segments:

By Battery Type

- Lead Acid Batteries

- Lithium Batteries

- Nickel Batteries

- Thermal Batteries

- Others

By Type

- Rechargeable

- Non-Rechargeable

By Capacity

- Below 12V

- 12 to 24V

- Above 24V

By End User

- Drones and UAVs

- Soldier Wearable or Soldier Carried Devices

- E-Aviation

- Marine UAVs and UUVs

Key Global Military Battery Industry Players

- Arotech Corporation

- BAE Systems PLC

- Bren-Tronics, Inc.

- BST Systems, Inc.

- BYD Co. Ltd.

- Cell-Con, Inc.

- Concorde

- Denchi Power

- EaglePicher Technologies, LLC

- Ecobat Technologies Limited

- ENERSYS

- Exide Technologies, LLC

- General Dynamics

- Kokam

- Lincad Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383