MARKET OVERVIEW

In modern transportation, the Global E-Bike Battery Swapping Station market emerges as a revolutionary force, shaping the trajectory of sustainable mobility. This innovative market is not merely a trend but a transformative solution that addresses the pressing challenges associated with electric bikes and their conventional charging methods.

The Global E-Bike Battery Swapping Station market embodies the essence of convenience and efficiency in the realm of electric-powered bicycles. Unlike traditional charging systems, which often entail prolonged waiting periods, battery swapping stations offer a seamless and rapid solution to the energy needs of e-bikes. This novel approach eliminates the intricacies of lengthy charging times, providing riders with a swift and hassle-free alternative.

The significance of the E-Bike Battery Swapping Station market extends beyond the mere facilitation of quick energy replenishment. It caters to the growing demand for sustainable urban mobility solutions, aligning with global efforts to reduce carbon footprints and promote eco-friendly commuting options. This market reflects a pivotal shift in the way we perceive and embrace electric transportation, emphasizing not only efficiency but also environmental consciousness.

In practical terms, the Global E-Bike Battery Swapping Station market addresses the challenges posed by the limited range and extended charging times of electric bicycles. By strategically deploying swapping stations across urban landscapes, the market ensures that e-bike users can easily access a network of charging points, minimizing concerns related to battery life and range anxiety. This approach enhances the appeal of e-bikes and contributes to the wider adoption of sustainable transportation alternatives.

Moreover, the market fosters a sense of community and collaboration among e-bike enthusiasts. The swapping stations become hubs where riders converge, creating a social ecosystem around shared values of sustainability and technological innovation. This sense of camaraderie further strengthens the appeal of electric biking, transforming it into a lifestyle choice that goes beyond mere transportation.

The Global E-Bike Battery Swapping Station market is not just a fleeting trend; it represents a paradigm shift in the way we envision urban mobility. As cities grapple with the challenges of congestion, pollution, and the need for efficient transportation, the market emerges as a beacon of hope, offering a scalable and sustainable solution. Its impact is not confined to the present but extends into the future, where electric biking becomes synonymous with a cleaner, greener, and more connected urban environment.

The Global E-Bike Battery Swapping Station market stands at the forefront of the ongoing revolution in sustainable transportation. Its influence is not limited to the mechanics of charging; it encapsulates a broader vision of urban mobility that is efficient, environmentally conscious, and community centric. As we witness the rise of this transformative market, it becomes evident that the future of commuting is not just electric but also characterized by the seamless integration of technology and sustainability.

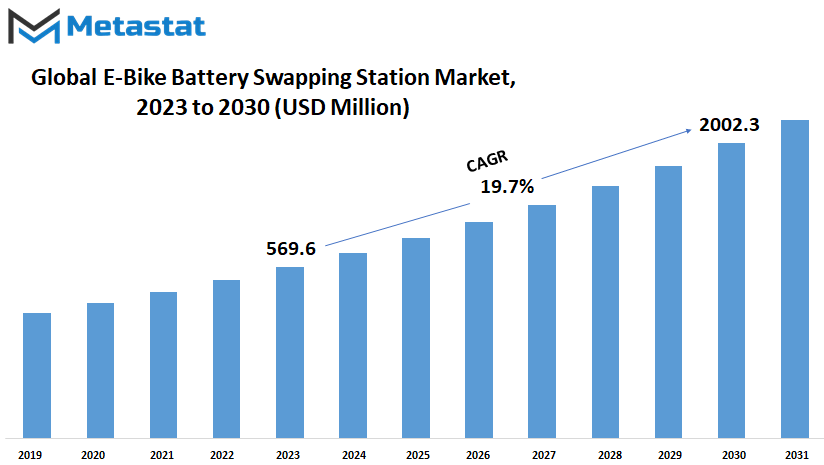

Global E-Bike Battery Swapping Station market is estimated to reach $2002.3 Million by 2030; growing at a CAGR of 19.7% from 2023 to 2030.

GROWTH FACTORS

The Global E-Bike Battery Swapping Station market exhibits a promising trajectory fueled by several key growth factors. Primarily, the rising adoption of e-bikes as an eco-friendly and cost-effective mode of transportation acts as a significant driver for the market. The growing awareness regarding environmental sustainability and the need for energy-efficient commuting options contribute to the increasing demand for e-bikes and, consequently, the battery swapping stations that support them.

Moreover, the surge in urbanization and the associated traffic congestion issues amplify the appeal of e-bikes, further propelling the demand for battery swapping infrastructure. As urban areas grapple with traffic woes and a push toward greener alternatives gains momentum, the market benefits from the increasing popularity of e-bikes as a viable solution.

However, like any burgeoning market, challenges loom on the horizon. The high initial setup costs and the need for a robust infrastructure network represent potential hurdles. Overcoming these challenges necessitates strategic planning and investment to establish a widespread and efficient battery swapping station network.

Additionally, concerns related to battery disposal and environmental impact pose another set of challenges. The industry must address these apprehensions through responsible recycling initiatives and eco-friendly disposal methods to sustain long-term growth.

Despite these challenges, the market remains resilient, poised for substantial growth. Government initiatives promoting electric mobility and offering incentives for the development of charging infrastructure create a favorable regulatory environment. This not only supports the existing market players but also attracts new entrants, fostering healthy competition and innovation.

Looking ahead, the market foresees lucrative opportunities, particularly in technological advancements. Innovations in battery technology, such as enhanced energy storage and faster charging capabilities, promise to reshape the landscape. These advancements not only address current challenges but also open doors to new possibilities, making e-bike battery swapping stations even more appealing to consumers.

The Global E-Bike Battery Swapping Station market's growth is underpinned by the increasing adoption of e-bikes as a sustainable transportation alternative. While challenges exist, strategic planning, investment, and technological innovations provide avenues for overcoming them. The market's future appears promising, driven by supportive government policies and a growing preference for green commuting solutions. As the industry continues to evolve, the potential for providing efficient and sustainable battery swapping solutions to a widening consumer base remains a focal point for market players and investors alike.

MARKET SEGMENTATION

By Type

In the expansive landscape of the Global E-Bike Battery Swapping Station market, the segmentation by type serves as a fundamental classification, allowing us to discern the varied approaches adopted within this dynamic market.

Two primary types define the landscape are Manual and Automated. The Manual segment involves a hands-on, user-driven approach, where individuals actively engage in the battery-swapping process. This type emphasizes user involvement and control, providing a more interactive experience.

On the other side of the spectrum, we have the Automated segment. Here, technology takes center stage, automating the battery-swapping process. Users experience a more hands-free approach, relying on automated systems to swiftly and efficiently replace e-bike batteries. This type caters to those seeking a seamless and less involved experience in managing their e-bike power needs.

Both Manual and Automated types cater to the diverse preferences and requirements within the e-bike community. The Manual option appeals to those who value a hands-on, user-centric experience, while the Automated alternative attracts individuals seeking a more streamlined and technologically-driven process.

This segmentation not only reflects the diverse user preferences but also addresses the practical considerations of efficiency and convenience. As the market continues to evolve, these distinct types play a crucial role in accommodating the varied needs of e-bike users, ensuring that the e-bike battery swapping experience aligns with individual preferences and technological expectations.

By Vehicles Type

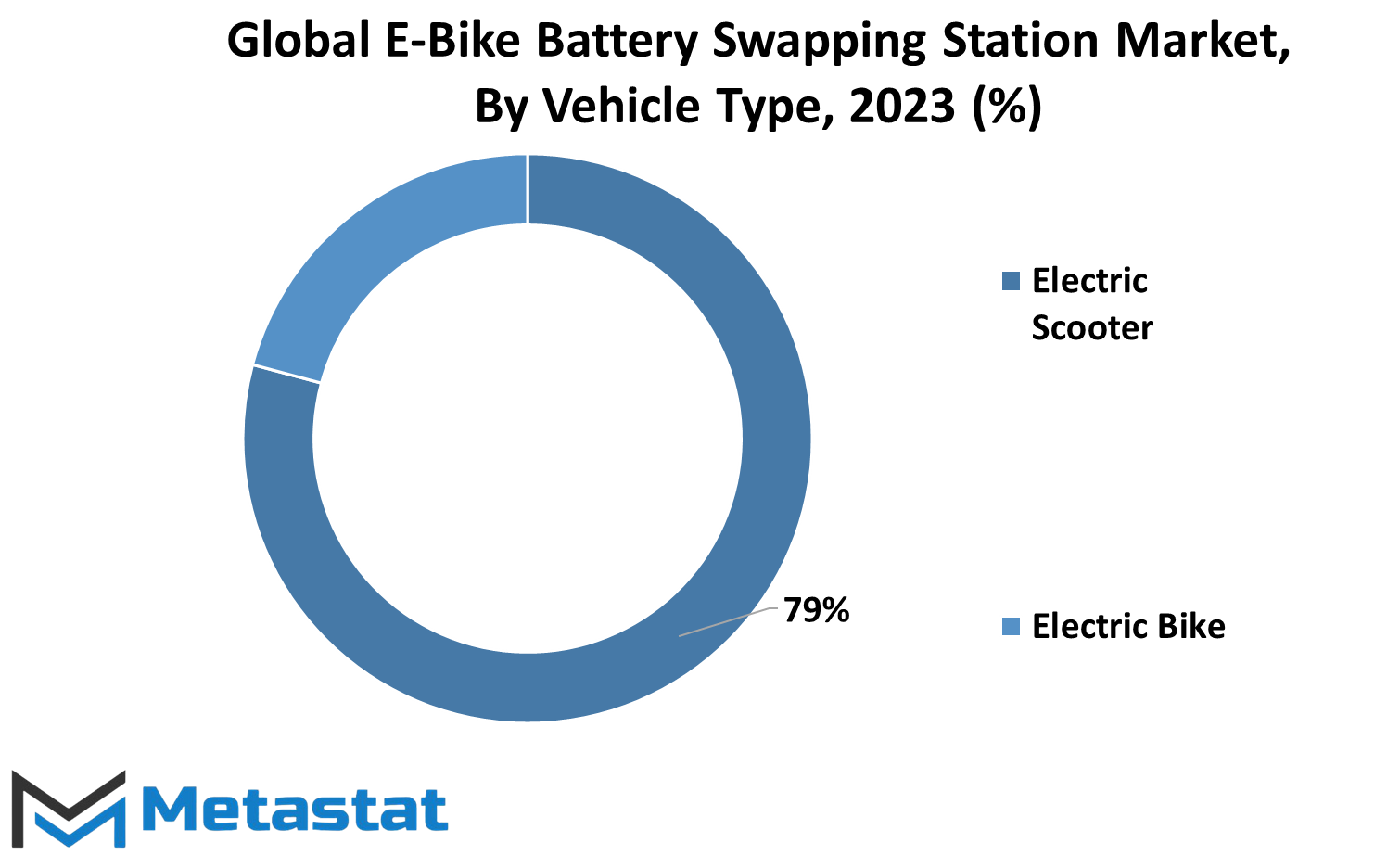

In the Global E-Bike Battery Swapping Station market, one discernible categorization emerges through the lens of Vehicles Type. This division is instrumental in understanding the diverse applications of battery swapping technology within the realm of electric mobility.

The market is distinctly segmented into Electric Scooter and Electric Bike, encapsulating the primary vehicles that utilize e-bike battery swapping stations. Electric Scooters, a prevalent choice in urban commuting, benefit from the efficiency and convenience of battery swapping. This segment reflects the increasing popularity of electric scooters as a sustainable and practical mode of transport in congested city environments.

On the other hand, Electric Bikes constitute another significant segment within the market. These e-bikes, equipped with electric propulsion, cater to a broader range of users, from urban commuters to recreational cyclists. The integration of battery swapping stations aligns with the evolving needs of e-bike users, ensuring a seamless and swift exchange of depleted batteries for a fully charged one.

This division based on Vehicles Type underscores the versatility of battery swapping technology across various electric mobility platforms. It caters not only to the compact and nimble electric scooters navigating urban streets but also to the broader and more diverse category of electric bikes, appealing to a spectrum of users with varied mobility requirements.

The categorization by Vehicles Type provides a clear lens through which we can comprehend the targeted applications of battery swapping stations. It speaks to the practicality and adaptability of this technology in meeting the changing needs of both electric scooters and electric bikes, contributing to the ongoing paradigm shift towards sustainable and efficient urban mobility solutions.

By Battery Type

In the Global E-Bike Battery Swapping Station market, the classification by battery type is a pivotal factor shaping its dynamics. The market distinguishes itself through the varying types of batteries, each contributing uniquely to the overall landscape.

Lithium-ion, a prominent player in this market, stands out for its prevalence and efficiency. Known for its high energy density and longer lifespan compared to traditional alternatives, lithium-ion batteries dominate the scene, offering a reliable and long-lasting power source for e-bikes. This dominance is reflected in their widespread usage, emphasizing the market's inclination towards technological advancements.

In contrast, Lead Acid batteries hold their ground as a durable and cost-effective option. Although traditionally associated with older technologies, they continue to find relevance, particularly in markets where cost considerations weigh heavily. Their robustness and affordability make them a preferred choice in certain segments of the e-bike market, showcasing the diversity of battery options available.

The category labeled as Others encompasses a range of battery types, contributing to the market’s adaptability and responsiveness to varied consumer needs. These may include emerging technologies or niche battery types that cater to specific requirements within the e-bike ecosystem. This category, marked by its diversity, underscores the market’s flexibility and its ability to incorporate evolving technologies.

The market’s segmentation based on battery type is not merely a classification but a reflection of the dynamic choices available to consumers and manufacturers. It highlights the coexistence of established and emerging technologies, demonstrating the e-bike industry’s responsiveness to diverse consumer preferences and needs. The global market, through this nuanced classification, paints a vivid picture of a landscape where different battery types play integral roles, each contributing uniquely to the vibrant tapestry of the e-bike battery swapping station market.

REGIONAL ANALYSIS

The Global E-Bike Battery Swapping Station market's regional analysis provides a comprehensive view of how this market is shaping up across different parts of the world. Understanding the regional dynamics is crucial in grasping the nuances of the market and tailoring strategies to regional needs.

Asia-Pacific emerges as a powerhouse in the E-Bike Battery Swapping Station market, holding a substantial share. The region's rapid urbanization and increasing environmental awareness have spurred the adoption of e-bikes, driving the demand for battery swapping stations. Countries like China and India, with their large populations and burgeoning urban centers, play a significant role in this regional dominance.

Europe, known for its progressive stance on sustainable transportation, follows closely. The European market is driven by a growing inclination towards eco-friendly commuting options. Governments in this region actively support green initiatives, providing a favorable environment for the E-Bike Battery Swapping Station market to thrive.

North America, while not as dominant as Asia-Pacific and Europe, is witnessing a steady rise in the adoption of e-bikes and associated infrastructure. The cultural shift towards healthier and more sustainable lifestyles contributes to the growth of the E-Bike Battery Swapping Station market in this region.

The Middle East and Africa exhibit a more gradual uptake, influenced by factors such as economic development and cultural preferences. However, as awareness of the benefits of e-bikes and their infrastructure spreads, these regions are expected to contribute to the market's global landscape.

The regional analysis of the Global E-Bike Battery Swapping Station market reveals a varied landscape shaped by factors like urbanization, environmental consciousness, and governmental support. Each region brings a unique set of opportunities and challenges to the table, emphasizing the importance of a nuanced and region-specific approach in navigating the global market.

COMPETITIVE PLAYERS

Key players operating in the E-Bike Battery Swapping Station industry include Nio Inc., Aulton New Energy Automotive Technology Co., Ltd., Sun Mobility Private Ltd., Gogoro Inc., Shenzhen Immotor Technology Co., Ltd, Ample Inc., Swobbee GmbH, Lithion Power Private Limited, Zynch, Esmito Solutions Pvt Ltd

E-Bike Battery Swapping Station Market Key Segments:

By Type

- Manual

- Automated

By Vehicles Type

- Electric Scooter

- Electric Bike

By Battery Type

- Lithium Ion

- Lead Acid

- Others

Key Global E-Bike Battery Swapping Station Industry Players

- Nio Inc.

- Aulton New Energy Automotive Technology Co., Ltd.

- Sun Mobility Private Ltd.

- Gogoro Inc.

- Shenzhen Immotor Technology Co., Ltd

- Ample Inc.

- Swobbee GmbH

- Lithion Power Private Limited

- Zynch

- Esmito Solutions Pvt Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383