MARKET OVERVIEW

The Middle East Residential Construction market presumes a substantial share under the entire construction industry, which is indeed inextricably linked to socio-economic dynamics, urban planning reforms, and the emphasis on framework-long housing. While short-term development trends and statistical projections have often been foregrounded, what is transpiring in this market needs to be critically examined in real depth, moving away from the cyclical and towards addressing the real, underlying transitions that are shaping the future of residential construction in this region.

The unfolding of the Middle East Residential Construction market will not be characterized simply by an increase in housing units on a population-pull basis. It will, instead, harbor an approach toward the redefinition of lifestyle, particularly with respect to regional disparities in land use, economic diversification, and resource allocation. Accordingly, this market will not simply be characterized by high-end villas or skyscrapers adorning the skyline but will undergo a transition to various types of housing that more closely respond to changing consumer behavior, regionalism, and spatial reconfiguration.

The Middle Eastern states will have the change in the residential construction landscape with a younger populace moving through various formative life events, such in Saudi Arabia, UAE, and Qatar. The shift would take some time as governments come up with housing policies and regulatory frameworks. It would change from landmark urban development to access-oriented, sustainable, and flexible approaches. What will replace the typical luxury housing model will be communities designed for functionality and future use flexibility.

Cultural recalibrations and environmental awareness forces will also start shaping the Middle East Residential Construction market. Most countries in the region already have sought to rethink relations of constructions to water management, energy, and environmental conditions. These will shift from secondary concerns to key design directives. Homes will no longer be built as standalone houses but rather integrate into larger systems, interconnected through digital infrastructure, smart energy grids, and shared community spaces. Housing units of tomorrow will enable remote working, decentralized education, and hybrid families, adapting to broader redefinitions of lifestyles now underway.

The ongoing changes in the housing sector will necessarily start addressing the needs of the underprivileged communities, peripheral geographies, and lower-income groups. Slowly, government agendas will start redirecting attention to inclusivity and sustainability. The Middle East Residential Construction market will not only respond to demographic needs but will also try to develop new residential narratives that will accept complexity in human living. These changes will not be controlled by investors alone but also by thinkers about the city, policy developers, and even the citizens themselves, so that they are all involved in making decisions and creating the change.

There no longer remains a segregation of profit and ethics-but it is only beginning to consider a place in-between. Time now more than ever, should redefine home in the Middle East with rigor and engagement. This with no doubt will be an active set of processes and never an operation conducted along a pre-described path. The dynamicity and multifaceted character intrinsic to the sector of residential construction are hence driven, in all attempts, to develop a contemporary meaning of homes and respond well to the needs of the people.

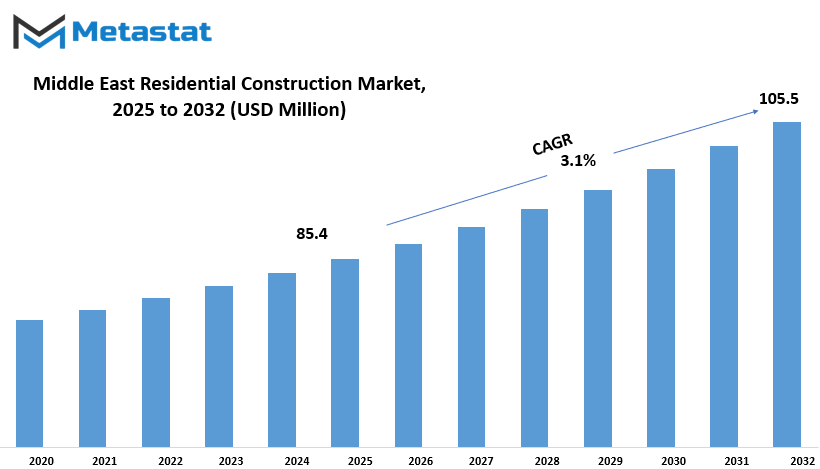

Middle East Residential Construction market is estimated to reach $105.5 Million by 2032; growing at a CAGR of 3.1% from 2025 to 2032.

GROWTH FACTORS

The Middle East Residential Construction Market with increasing demand for housing. Rapid urbanization is one of the vital factors escalating this market. More people flock to cities in search of better opportunities, thus necessitating more contemporary homes, apartments, and residential complexes. The countries in the region respond by enhancing their housing infrastructure to cope with this increasing demand. Besides, various government-led initiation programs such as Saudi Arabia's Vision 2030- a long-term strategy for redeveloping its housing infrastructure- are aiding in addressing these issues. Such programs focus on improving living standards and creating sustainable urban environments as the engine facilitating residential development.

Of course, there are always government schemes to boost what it terms "affordables," particularly for a younger population and low-income families, into more accessible home ownership: plans through which it strives to eliminate housing shortages and boost local construction activities. They also attract much support from public and private sectors to push forward the development of cities and towns into residential areas.

However, the market is also faced with a few hindrances. One of the hardest harbingers is the high cost of building materials. An increase in prices means bulk construction of homes must also cost more money, keeping developers under pressure and eventually delaying project completions. On top of that, there are problems relating to supply chains, such as delays in getting key materials and equipment, leading further to what builders consider a deviation from their original schedule. This causes frustration and adds costs to all parties concerned.

Another issue is the extremely tedious process of acquiring permits and compliance with a slew of regulatory requirements. Most of the time, a construction project has to go through a series of delays simply because approvals take longer than anticipated from the regulatory agencies. These bureaucratic hitches slow the pace of progress, and then create disincentives for potential investors, particularly for those companies looking to enter from abroad.

Nonetheless, there are still solid frontiers to be cultivated despite these hurdles. The smart and green housing movement opens up a brand-new arena for developers to build energy-efficient homes and the technology that modernizes living within them. Since the people have awakened to environmental issues and digital solutions, the demand for sustainable housing will most likely increase. This trend will invoke innovation and offer builders a unique opportunity to sell their different propositions.

MARKET SEGMENTATION

By Type

Currently, the Middle East residential construction market is witnessing steady growth due to rapid urbanization and population growth occurring all across the region. Countries like the United Arab Emirates, Saudi Arabia, and Qatar contend with constant demand for new housing development due to local needs and foreign investments.

Strong government initiatives aiming at offering improved living standards through affordable housing, which matches the increasing population, further underpin the market. As urban areas see further population influxes, the demand for well-planned residential projects rises, forcing developers to engage in the construction of varied housing types for different income groups and lifestyle choices.

The market is further divided into several key types of housing. Single-family homes form one of the largest segments at the value of $29.2 million. These homes are particularly popular with families seeking privacy and space for themselves, particularly in suburban areas. Multi-family homes and apartments represent another major segment, aiming to deliver smaller and more reasonable living choices, especially in congested city centers. Luxury residential schemes have captured attention, especially in the high-end cities where wealthy buyers are in search of discrete properties with premium facilities.

By Development Stage

The residential construction market of the Middle East has been continuously growing since times immemorial, spurred by many factors. The increase in housing demand has risen in this region due to population growth, urbanization, and changing lifestyles. Many nations have initiated mega housing projects meeting this demand and opening various opportunities for investors and developers. Government initiatives, in addition to easy financing options, have encouraged homebuyers and construction activities. These sustained thrusts have made residential construction one of the major components of the overall construction sector in the Middle East.

The market is segmented into new constructions, renovations, projects under construction, and planned developments by developmental stages. New constructions occupy a significant portion of the market, particularly in areas where new housing is a pressing need. Such projects usually concern the development of modern residential spaces with comfort and higher living standards. Renovations, on the other hand, arise out of the need to upgrade existing homes to contemporary design and safety standards. Many older buildings are considered for refurbishment with a view to enhancing their aesthetics, energy efficiency, and usability, thereby adding value to the property.

Under-construction projects are works in progress whereby homes are partly constructed. These projects are a continuous endeavor to meet ever-growing housing needs and frequently involve both the private and public sectors. Planned developments refer to future projects that are being designed or are in the approval process. These projects indicate the intention of the governments and developers to ensure a healthy supply of housing stock in the long term and to respond to future demand.

Issues faced by the residential construction market in the Middle East include increased costs for materials and shortages in labor; these challenges are, however, counteracted by high demand and sustained investment. Technology is also coming into play, with modern construction techniques fastening the building processes as well as improving the quality. Emphasis has now turned to sustainability, with many projects being carried out using designs that maximize energy conservation and environmentally friendly materials.

In summary, the residential construction market in the Middle East is dynamic and has potential for continued growth. Be it new constructions, renovations, under-construction projects, or planned developments-the focus seems to be on satisfying housing needs for a growing population while improving living conditions in the region. As long as the demand is robust, and developers keep changing with the new trends, the market seems to be on an upswing.

By End User

The Middle East Residential Construction Market shows a steady growth pattern, characterized by rising populations, urbanization, and demands for housing with modern touches. Factors supporting this range from government initiatives to enhance living standards and infrastructure. Many countries within the region heavily invest in residential projects to cater to citizens' needs and economic growth. This demand in turn affords opportunities for different parties within the market, each actively participating in the shaping of housing.

By end use, the market is segmented into homeowners, property developers and real estate firms, and state housing programs. Homeowners are constituted by individuals or families intending to build or buy homes for personal uses. Such a cluster is often influenced by parameters such as income levels, lifestyle changes, and demand for better living conditions. There is high demand for new housing that meets contemporary designs, energy efficiency, and better living experience in many parts of the Middle East, especially emerging cities. This impetus has caused an upswing in residential projects geared toward single-family homes, apartments, and gated communities.

An equal entity in the market is property developers and real estate firms, the companies responsible for planning, financing, and building large-scale residential projects. These firms generally tend to build housing complexes that appeal to either local buyers or international investors. They try to keep an equilibrium between cost, quality, and design to suit a more diverse clientele. In recent years, a major change is seen toward a mixed-use development where the residential area is combined with a commercial area, school, and healthcare facilities, thus making the whole community a more accessible and attractive living environment.

Government housing programs also constitute a force in the market. Several governments across the Gulf have launched housing initiatives for affordable housing targeted at low-and-middle-income families. Such programs are aimed at alleviating the housing shortage and supporting social stability by giving more people the opportunity of owning a home. Sometimes, the government collaborates with the private developers to fast-track the development and ensure that standards with respect to housing are maintained.

In a nutshell, the residential construction market in the Middle East is now expanding to address the needs of a growing and changing population. The market will keep evolving through contributions from homeowners, developers, and government programs, attempting to provide more varied housing options and thereby shaping the future of residential living across the region.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$85.4 million |

|

Market Size by 2032 |

$105.5 Million |

|

Growth Rate from 2025 to 2032 |

3.1% |

|

Base Year |

2024 |

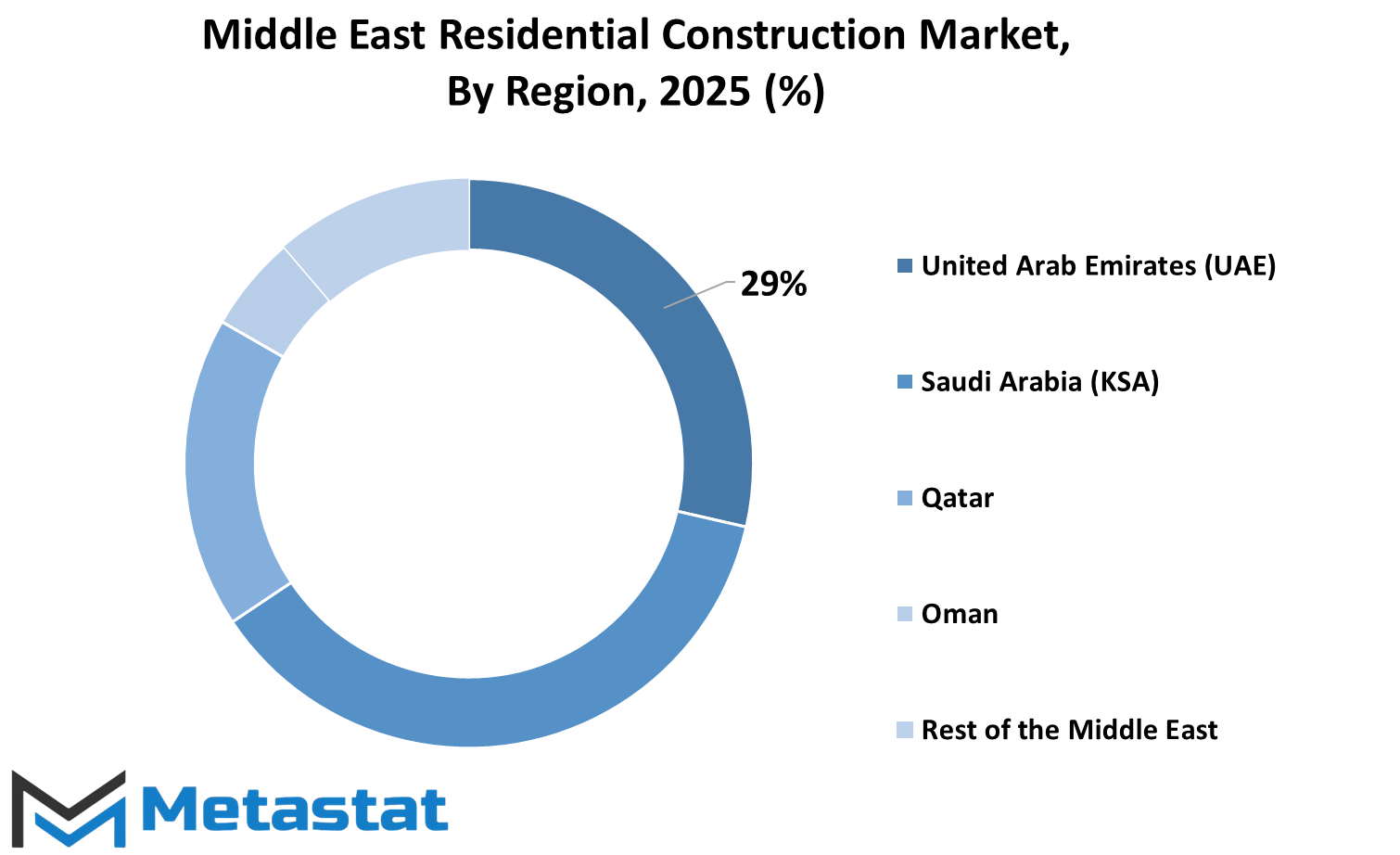

By Region

Urbanization, population growth, and government interventions to improve housing infrastructure have been the driver forces of steady growth for the Middle East residential construction market. In that they contribute in different ways to different markets, the region's countries expected to offer the greatest potential include the UAE, KSA, Qatar, and Oman. The current boom in residential schemes in Dubai and Abu Dhabi is mainly due to demand for luxury and affordable housing in the UAE. The contrary has happened when the government invested largely in infrastructure, mainly housing development that caters to the needs of shifting and growing population-even after having diversified the economy from oil.

Saudi Arabia is witnessing furthering achievements in residential construction, especially in line with its Vision 2030 plan. Keeping in view the promotion of homeownership for its citizens, huge housing projects have been executed. The construction market is also spearheaded by initiatives that build new urban areas and smart cities. They have a strong demand for modern and well-planned residential communities due to their young and growing population. Hence, the sector will continue to see steady activities.

Under its preparations for global events and commitment to improve living standards for its residents, Qatar has continued residential construction. Few but able to ensure this construction activities-the Qatari market continuing to be buoyant for its focus on quality housing and urban planning rather than just the numbers. Equally, housing projects are still under way in Oman, stressing affordable housing for its citizens. With councils putting a firm lid on housing availability, there have been modern residential communities, meaning some expansion for the market.

In broad terms, while some Middle Eastern countries enjoy much stability economically and in terms of construction activities, the development of the residential infrastructure continues in the rest of the region. Countries are resorting to celebrating sustainable and liveable environments, recognizing housing as a key component of long-term national development. Effectively, the two regions together comprise a market that is poised for further growth, driven by the need for better living conditions and sustained by strong government supporting policies. In summary, thereby the residential construction market in the Middle East is an embodiment of efforts made in the region to provide housing while addressing the quality of life for its citizens. Each country, each with its own front, contributes to the burgeoning of the market, leading to a vibrant, evolving sector awash with potential growth opportunities.

COMPETITIVE PLAYERS

The Middle East Residential Construction Market has witnessed a constant pace of development over the last ten years towards increasing urbanization, population, and raised government investments in housing projects by prominent country members. All countries in the region have focused on the expansion of residential infrastructure, especially for urban areas, for housing in accordance with growing geographical density. The expansion is not just in terms of luxury apartments or high-end villas but also affordable homes for middle-income families. With different housing schemes and incentives, the public sector has inexpensively boosted a lot of activities in construction development.

Energy diversification is an important factor in the increase of the aforementioned. By way of example, the United Arab Emirates and Saudi Arabia are increasingly lenient. They must produce other income sources outside oil and are opening the doors wide in real estate and construction. Their big investments have therefore led to a surge in new residential developments and, more recently, smart city and green homes. The desire for modern, energy-efficient homes has two objectives: the concerned handy environmental perspective and a long-term cost-saving attitude from homeowners

This transformation in consumer preference also affects the market. Many buyers aspire toward finding houses that guarantee more of a community experience complemented with schools, hospitals, and shopping areas. Nine out of ten developers are keenly looking forward to the establishment of a complete packaged house and neighborhood development focusing on delivering high-quality life standards to clients. There is a significant increase in the desire for gated communities and mixed-use developments, which gives an idea of how much value residents were placing on safety, convenience, and a sense of belonging.

Some key players in the residential construction industry include Emaar Properties, Al Habtoor Real Estate, Khansaheb Group, Albawani Group, El Seif Engineering Contracting Company, Nesma Co., United Development Company (UDC), Barwa Group, Ezdan Holding Group, Al Turki Group, Al Tasnim Enterprises LLC and Bahwan Engineering Group. They do have earned reputations for expert delivery on large-scale housing projects while reshaping the residential landscape through the Middle East.

The economy or, rather, the market is expected to boot itself and fly ahead in the coming years. There should not be too much blood in the construction sector in the first place since residential construction will really be the one considered into development plans with many projects going onsite and more underway. Sustainability and innovation, and most importantly, dissent, meet the housing needs of the expected far more populated and diverse region, and that should see this sector evolving quite a lot over the years.

Middle East Residential Construction Market Key Segments:

By Type

- Single-Family Homes

- Multi-Family Homes & Apartments

- Luxury Residential Projects

- Low-Income & Affordable Housing

- Smart & Sustainable Housing

By Development Stage

- New Constructions

- Renovations

- Under-Construction Projects

- Planned Developments

By End User

- Homeowners

- Property Developers & Real Estate Firms

- Government Housing Programs

By Region

- United Arab Emirates (UAE)

- Saudi Arabia (KSA)

- Qatar

- Oman

- Rest of the Middle East

Key Middle East Residential Construction Industry Players

- Emaar Properties

- Al Habtoor Real Estate

- Khansaheb Group

- Albawani Group

- El Seif Engineering Contracting Company

- Nesma Co.

- United Development Company (UDC)

- Barwa Group

- Ezdan Holding Group

- Al Turki Group

- Al Tasnim Enterprises LLC

- Bahwan Engineering Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252