MARKET OVERVIEW

The Global Mentoring Software market was shaping the policies through which organizations nurture talent and grow individuals with structured mentoring programs. Industries started to deem knowledge transfer and employee development important, meaning that the use of digital mentoring solutions was becoming a key component of their corporate strategy. From learning to engagement and finally into retention, companies in different sectors are implementing these platforms to provide structured guidance. The evolution of this technology is characterized by moving from old-style mentoring experiences into a new age, wherein AI platforms provide dynamic interaction experiences that change based on the personal career path journey of the mentee.

Finance, health, and technology are already using mentoring software to close skill gaps and ensure that professionals are well-supported in their career advancement. As the organizations in the world spread, so does the need for scalable mentoring solutions. Companies that have a presence in different locations require seamless communication systems with real-time monitoring of mentorship progress. These functionalities provide software to pair mentors with mentees based on skill sets, objectives, and interests and thus enable a structured approach to learning and career advancement. The integration of AI further fine-tunes these matches to improve the efficiency and effectiveness of the mentoring process.

Most of the reasons for mentoring software adoption revolve around the growing need to support remote and now hybrid work models. Organizations are no longer confined to office spaces, and virtual mentorships are becoming a need. Employees need their guidance from industry experts, and companies must ensure that knowledge-sharing, for whatever reason, remains undisturbed by geographical barriers. With mentoring software, structured interactions can happen over video calls, chat functionalities, and progress-tracking features so that mentees can seek insights and career advice anywhere and anytime. This kind of flexibility fosters new professional development strategies while rendering mentoring accessible to a more diverse workforce.

As more corporate institutions see and experience the expected strategic advantage of organized mentoring programs, the functionalities of this software are continuously evolving. Future developments will probably include deeper AI-driven analytics, predictive mentoring models, and automated performance tracking, enhancing the mentoring experience even further. As technology advances, specific software solutions will continue becoming highly configurative, ensuring that mentorship always remains critical for employees' career growth and satisfaction. The Global Mentoring Software market will only become more dynamic as corporations and institutions prioritize mentorship as a means of talent development, leadership cultivation, and knowledge transfer.

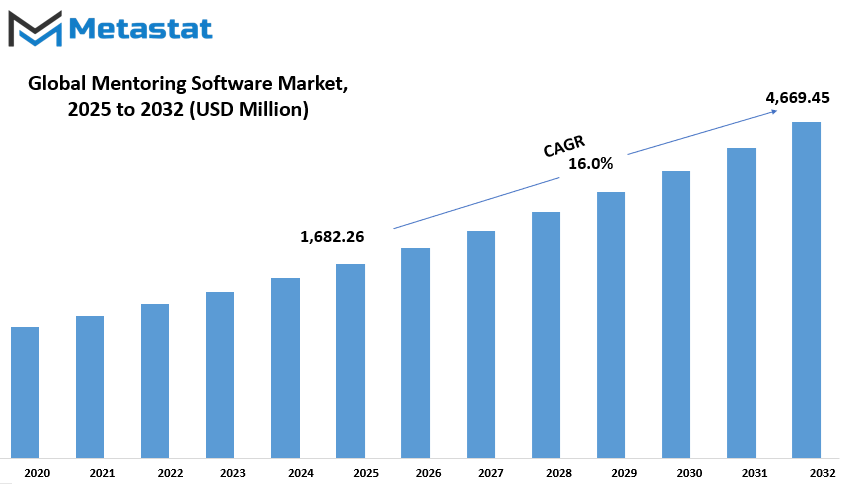

Global Mentoring Software market is estimated to reach $4,669.45 Million by 2032; growing at a CAGR of 16.0% from 2025 to 2032.

GROWTH FACTORS

The Global Mentoring Software market is also receiving a significant fillip from educational institutions. Universities and colleges have been using these platforms to connect students to alumni and industry professionals, thus attempting to create networks that would in turn support career guidance, skill development, and job placement. With the integration of mentorship software in academic settings, students are now equipped with the knowledge and insights that facilitate their smooth transition into the corporate world.

Today organizations understand the importance of mentorship programs for the personal and professional development of their employees, therefore investing in structured mentoring software. Through such software, companies get an all-inclusive mentorship solution to improving their workforce skills, engagement, and overall productivity through matching mentors and mentees based on expertise, career goals, and learning preferences. Such technological advancements have led to a reality where it is possible to offer even AI-driven recommendations, track progress ,and real-time feedback by mentoring software that further makes the whole process more effective and scalable for users.

Employee development has become one of the key factors that attract many organizations toward coaching software. As said organizations understand that when employees perform well they feel more satisfied with their work, investments in these overall areas hold. Well-thought-out mentorship training pathways will assist employees with career and leadership dilemmas, the input of motivational signals, and will also help them become more productive in their work. Employees value a company that makes them feel cared for in their careers, and such companies tend to have more retention rates. Digital programs have made it affordable to develop flexible programs to suit different employee needs regardless of geolocation or time constraints.

AI-dimensional technologies have yet added to revolutionizing this field, as they ensure that the right pairing is achieved between a mentor and mentee. Based on the analysis of user preferences, skills, and career aspirations, machine learning algorithms find the best suitable match such that the quality of interaction between the mentor and mentee will be productive. AI-supported chatbots and virtual assistants also give instant advice and feedback, making this kind of mentoring even easier to access. These tools help design a mentoring experience that is more structured and impactful by measuring participation, setting goals, and tracking areas of improvement.

Adoption of mentoring software is not without its share of complications. Implementation costs tend to be prohibitively high, which makes many small businesses shy away from venturing into the adoption of such a software solution. Justifying spending on an advanced mentoring system is a hurdle that many enterprises face with budget constraints, as most companies do not have a great budget allocated in the area of mentoring. Others have to deal with employee resistance to digital mentoring altogether. Some employees don't want to point into online or digital mentoring offered by their own organizations. Personal relationships and personal discussions often seem more reliable in developing trust and engagement. Convincing them can happen if companies advertise the benefits of virtual mentoring such as flexibility, access, and personalization in learning.

When looking beyond, integration of AI and data analytics to the mentoring platforms offers an exciting opportunity for the market. AI and data analytics provide user experience enhancements through customized learning paths, engagement tracking, and predictive capabilities. Any organization able to use the above capabilities will have a better experience refining its mentoring programs. As more organizations continue investing in employee development, the market for mentoring software is expected to grow with innovative solutions that serve the changing needs of organizations and individuals.

MARKET SEGMENTATION

By Type

The global mentoring software market is exceptional because, even currently, companies continue to recognize the benefits of structured mentoring programs. The onslaught of organizations and schools taking mentoring software into consideration for grooming and enhancing career development and achieving employee engagement in the building of leading-edge pipeline talent. These platforms provide mentorship operations and make them easy and accessible for the entire company workforce. The digitization phenomenon has been another expansion force for adopting mentoring software by companies with features such as remote mentoring, auto-matching, and tracking of progress. An elaborate approach to mentoring that both the companies offer mentorship via structured formats, thus ensuring guided learning experiences for both parties.

The myriad forms of mentoring programs that fall under mentoring software meet the specific organizational requirements within the organizations. For example, diversity mentoring is worth $593.07 million and is said to be critical in building bridges among people through diverse backgrounds and experiences. Flash mentoring is short-term mentoring during which a mentee can learn from industry experts through a series of brief, targeted interactions. Hi-potential mentoring is for holding workers taking the future leadership track, giving them all the insight and exposure they need to advance their careers. Mentoring by professional associations provides access for its members to establish contacts for career development within individual industries. Reverse mentoring is based on the idea of knowledge exchange between senior professionals and younger employees who can offer perspectives on innovations, technology, and modern workplace culture.

The growth of Employee Development and Retention has spurred the demand for mentoring software. Internal structure concerning mentorship programs increases job satisfaction and productivity and improves relationships among employees in the workplace. The hybrid and remote-style working model refers to the new shift of employees in traditional offices and promotes digital mentorship solutions through which everyone can work despite geographical distance. Also, companies use this platform to benchmark the gaps in skills, improve leadership Talent development, and address the factors around knowledge transfer within their workforce.

As the market goes on, developmental advancements in artificial intelligence and data analytics are also likely to improve the ability of mentoring software. Automated mentor-mentee matching, real-time progress tracking, and predictive-fit analytics are expected to improve mentoring effectiveness. Integration with existing HR and learning management systems will seamlessly incorporate mentorship into employee development strategies. Therefore, organizations that invest in such technologies will be better positioned to attract, retain, and engage talent for their competitive future success.

By Deployment Type

The Global Mentoring Software market is on the rise as organizations pursue structured solutions for their employee development and knowledge-sharing programs. Under this market, platforms are built for connecting mentors and mentees providing toolsets for goal-setting, progress tracking, and communication. Companies across various industry domains have embraced mentoring solutions to increase workforce engagement, leadership training, and skill enhancement. With the trends of digital transformation, the demand for effective mentoring software is also growing, making it a core element in corporate training and career development strategies.

By deployment type, the market is classified into cloud and on-premises solutions. Cloud solutions are more flexible, scalable, and remotely accessible and are hence favored by companies that operate with distributed teams. These solutions relieve some of the burdens of infrastructure management and ensure automatic updates so users are always using the latest features and security improvements. On the contrary, companies concerned about their data management and control select the on-premises model, especially those that operate under serious regulatory restrictions. This deployment allows companies to host and oversee their mentoring software in their own IT infrastructure, thus enabling more customization and adherence to internal policies.

Gen Z employees have been entering the workforce and seeking mentoring software to help organizations retain talent and upskill employees while fostering a culture of continuous learning. Such organizations understand that structured mentorships lead to employee satisfaction and productivity, which can affect the business bottom line. The platforms promote diversity and inclusion by granting equal access to mentorship opportunities so that individuals from all backgrounds receive the guidance and support necessary for career advancement.

The Global Mentoring Software market continues to reinvent itself as organizations put money in technology for better employee engagement and development. The choice for either a cloud or an on-premise solution considers security requirements, IT capabilities, and respect of an organization's preferences. The mentoring software offering, as it matures, will continue to be an innovative space providing solutions that enhance the user experience, automation, and integration with other workplace tools. Their role in fostering professional development and encapsulating knowledge-sharing networks makes these platforms a prime asset in the current corporate climate.

By Organization Size

The Global Mentoring Software market is expected to get massive growth just like structured mentorship programs gain value in companies all over the world. All organizations acknowledge mentoring for its potential to improve the growth, retention, and productivity of employees. Organizations use different technologies to enhance how easy and efficient the application of Mentor Process is. Mentorship software tries to encourage the method of communication, goal tracking, and performance measurements so that organizations can offer structured learning and development opportunity for both mentor and mentee.

In the contemporary and fierce business scenario, skill upgradation and lifelong learning have become unavoidable. Very large-sized Cos, employing large workforce associates, highly require organized mentorship programs for employees who are at various points in their careers. These organizations usually have formal training structures, and the use of mentoring software gives them a way to implement scalable mentorship projects in line with their larger organizational goals. Through integration between the mentoring program and the company's existing learning management systems, large companies can therefore regularly guide employees while effectively monitoring their progress.

Mentoring software is also finding its way into small and medium enterprises (SMEs). Unlike large organizations, SMEs might not have dedicated training departments or extensive resources for employee development programs. However, with the right mentoring software, they can implement cost-effective mentoring programs that facilitate skill development and professional growth. Companies can use it to match their mentors to mentees based on skills, experience, and learning objectives, thus allowing SMEs to take a more structured approach to knowledge-sharing within their organizations.

And the software is not just for corporations. Mentoring software is now also being put to use in educational institutions, nonprofit organizations, and governmental agencies. Supporting students in finding and connecting with experienced professionals who can offer career guidance and insight into the industry is what educational settings achieve quite well through mentoring software. This holds especially true for the nonprofits and governmental agencies that greatly depend on driving leadership development and community engagement through mentorship. They use software as a huge advantage that helps keep these programs well managed and tracked.

As technology progresses, so, too, does mentoring software, incorporating advanced elements such as AI-enhanced matching of mentors and mentees, real-time feedback provisions, and analytical performance auditing. Such developments keep mentoring programs, pertinent to contemporary dynamics, evolving away from either relevance or stagnation in addressing organizations' requirements. As businesses now put emphasis on employee development, their increasing demand for mentoring software will also make it a key component in workforce strategies for the future.

By End-User Industry

The international atmosphere for the encouraging global mentoring software market has scaled up with the realization by sectors and institutions about the planned mentoring programs of entering into the real ground of skill development and professional growth. This mentoring software is intended for mentoring purposes by providing communication channels, setting of goals, and tracking progress. As a consequence, mentoring software has become a requirement for active engagement, productivity, and ultimately, career chances as industries prioritize workforce development.

The software is being implemented primarily in the field of education. Schools, universities, and training institutions are using mentoring platforms to help students in career planning, academic success, and skill development. The platform gives the students definite guidance in connecting with mentors who may guide them regarding various career paths and industry expectations. Santé has similar needs for mentoring software in training medical professionals through complicated procedures and continuous learning opportunities. Because of constant advancements in healthcare and the need for professionals to stay updated, mentorship helps fill these gaps and makes medical staff more efficient.

The Information Technology (IT) sector applied mentoring software for training employees in technical skills, coding practices, and project management. Rapid advances of technology bring IT professionals to benefit from mentoring programs that focus on continuous learning and career development. The banking, financial services, and insurance (BFSI) industry also finds working mentoring software of significant importance. Financial institutions use these platforms to train employees on topics such as regulatory compliance, financial analysis, and customer relationship management. New hires are paired with experienced professionals, offering an avenue to transfer knowledge that eliminates errors and advances service delivery.

Mentoring software has significant applications in the manufacturing sector by means of skills upgrading on workers in new machinery, safety protocols, and production techniques. Through automation and smart manufacturing works, the transitioning operations call for structured mentoring so that employees cope up with new changing technologies. Companies that use mentoring software ensure their workforce is ready and production levels maintained in ever-evolving industrial environments.

Thus, the spread of mentoring software among these sectors promises growth in professional stature and organizational viability. With structured guidance, such software enhances learning experiences, bridges skill gaps, and builds better career opportunities. Therefore, as organizations increasingly see the importance of mentorship for employee engagement and performance enhancement, one can expect a higher demand for mentoring software as an integral component of workforce development strategies.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,682.26 million |

|

Market Size by 2032 |

$4,669.45 Million |

|

Growth Rate from 2025 to 2032 |

16.0% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Mentoring Software market has ever since foreseen incalculable opportunities for structured guidance and professional development. Companies are investing in digital mentoring solutions for employee engagement, developing their careers, and producing leadership. These platforms allow a structured way for employees and seasoned mentors to come together and share knowledge and build skills. With the growing emphasis among organizations on the professional development of their workforce, the demand for such solutions will continue to grow.

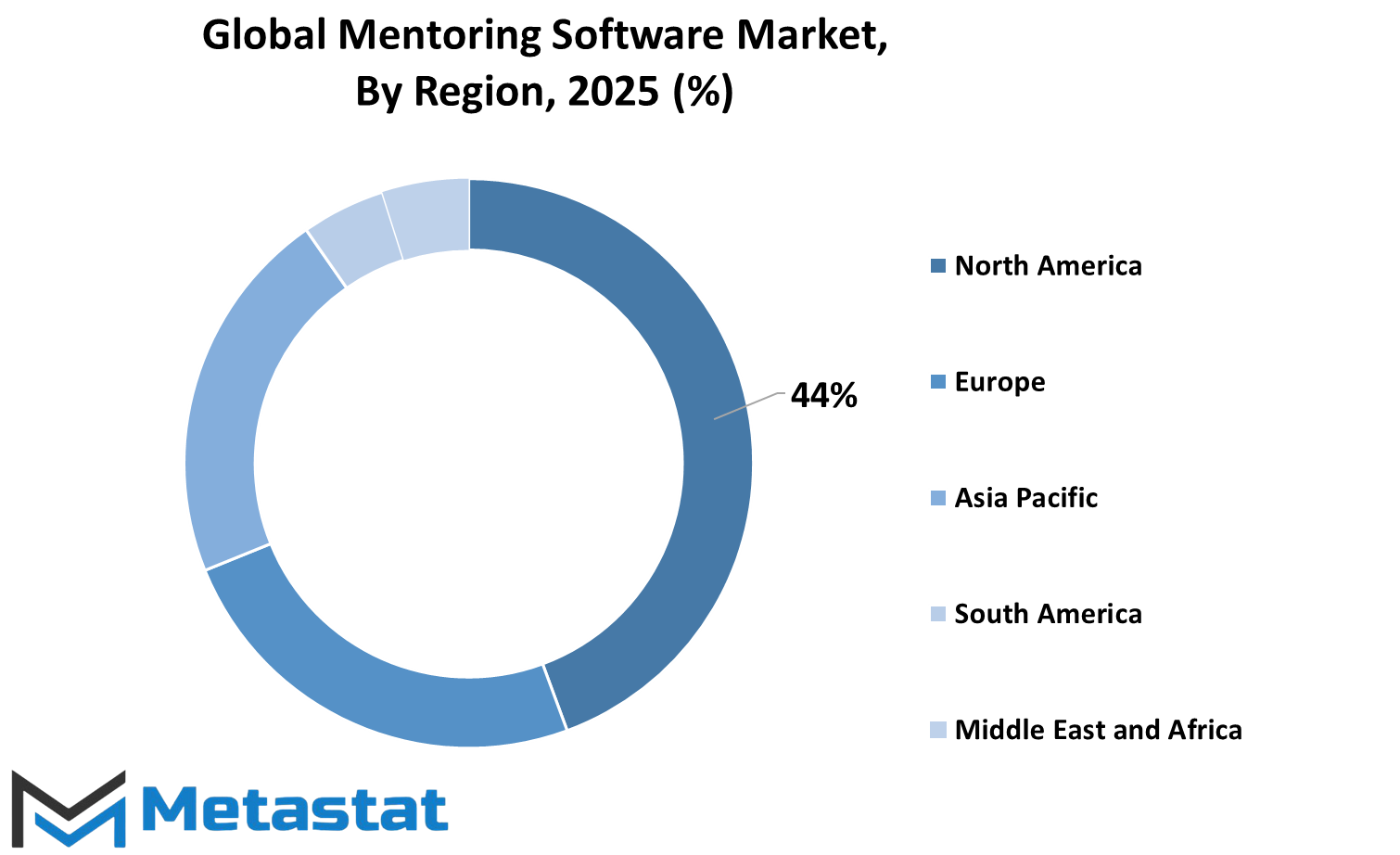

For geographical segmentation, the market is divided on a regional basis and towards each region's growth pattern and adoption rates. Presently, North America occupies a substantial market share, and the United States, Canada, and Mexico should be contributing to the growth of the market. In these countries, massive corporate enterprise actions and technological advancements lead to fast adoption. Europe, on the other hand, is also playing an important role with the UK, Germany, France, and Italy pouring digital mentoring tools into workforce productivity. In this region, companies have targeted skill enhancement and leadership development as key drivers behind demand for mentoring platforms.

Asia-Pacific is still an important region growing fast. Countries like India, China, Japan, and South Korea are seeing increasing investments in digital learning solutions. Organizations in these countries value mentorship for career development and employee retention, thereby leading to a wider adoption of mentoring software. These solutions are entering the South American market in Brazil and Argentina at a slow pace within corporate and educational sectors. Adoption is slow on a comparative basis with other regions, but increasing awareness of the mentoring benefits will boost demand.

Through the Middle East & Africa, mentoring software adoption is taking place, with some GCC countries, Egypt, and South Africa showing interest in digital mentoring solutions. Organizations in these regions use technology for the development of employee skills and leadership principles, thereby contributing to the market growth. Demand for mentoring software will increase as businesses worldwide focus on professional skills development and knowledge transfer. Companies adopting these solutions would undoubtedly benefit in driving a well-guided and skilled workforce for a competitive advantage.

COMPETITIVE PLAYERS

The Global Mentoring Software market will witness growth due to the realization of structured mentorship as a key element in the employee's development and career growth journey. Companies seek to adopt digital solutions for their mentoring programs to ensure accessibility and efficiency. These software bridge the gap between mentors and mentees, monitoring progress and measuring the effects of the mentoring program on organizations and educational institutions. The surge in demand for remote learning and professional development tools has fast-tracked the application of mentoring software, making it a huge part of talent development strategies in various verticals.

Mentoring software is a useful support system for nurturing professional growth by availing assistance to mentees along a personalized development path. It helps organizations to facilitate structured mentorships so that employees can receive career advice, skills development opportunities, and networking connections. Such features include automated matching of mentors with mentees, tracking of goals and interacting with support, thereby aiding organizations to make mentorship more systematic and effective. With a keen focus on data-driven solutions for enhancing talent development, organizations have found added value through mentoring software, which also reports activity levels and measures the effectiveness of employee improvement programs.

Key players in the Global Market are engaged in continuous innovations to meet user requirements and expand their offerings. Among the main companies providing advanced mentoring platforms to meet corporate and educational needs are Together (US) Inc., Qooper Mentoring, and MentorcliQ. Other key players are Chronus LLC, PushFar Ltd., and Mentorink, who provide AI matching and analytics to create access to mentorship. Mentornity LLC, Guider, and Wisdom Share focus on making scalable mentorship programs with various industry applications. In addition, MentorCloud Inc., Almabase, Inc., and Orbiit are working toward affordable solutions that can be easily integrated into existing learning and development ecosystems.

Emphasis on employing retention and career development will further cause organizations to invest in mentoring software. Definite results will include enhanced job satisfaction, increased productivity, and succession opportunities stemming from effective mentorship programs. The growing demand for virtual mentorship is propelled by hybrid work and remote work schemes. Coupled with this demand, companies are expected to integrate mentoring software with other HR and learning management systems into a more complete employee development framework. With technological innovation and changing workplace requirements, the Global Mentoring Software market is set to expand with more advanced and streamlined solutions for mentoring and career growth.

Mentoring Software Market Key Segments:

By Type

- Diversity Mentoring

- Flash Mentoring

- Hi-Potential Mentoring

- Professional Association Mentoring

- Reverse Mentoring

By Deployment Type

- Cloud-Based

- On-Premises

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By End-User Industry

- Education

- Healthcare

- Information Technology (IT)

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

Key Global Mentoring Software Industry Players

- Together (US) Inc.

- Qooper Mentoring

- MentorcliQ

- Chronus LLC

- PushFar Ltd.

- Mentorink

- Mentornity LLC

- Guider

- Wisdom Share

- MentorCloud Inc

- Almabase, Inc.

- Orbiit

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383