MARKET OVERVIEW

The global managed services market is a highly interesting business category under the more encompassing technology industry covering an incredibly broad range of services and solutions provided for the outsourcing of management of a myriad of IT functions and processes. Thus, it forms a very complex industry that spans across all different kinds of requirements for businesses from across the world.

The global managed services market involves outsourcing support and maintenance services for the IT infrastructure, applications, and systems. Included in these are network monitoring, security management, data backup and recovery, cloud computing, help desk support, and many more. These companies work towards freeing core business objectives from the burden of managing their clients' IT systems.

A couple of the biggest factors driving growth in the global managed services market is increasing complexity and sophistication of IT environments within organizations. As organizations have begun to rely ever more on technology for operations, a significant need arose for expert management and support services. This is one area where MSPs come into their own, bringing a level of specialist knowledge and resources needed to manage and optimize IT infrastructure and applications efficiently.

Another motivator is the increased interest in digital transformation programs. They require managed services to bring about modernization of their IT infrastructure and leverage newly developed technologies such as cloud computing, IoT, and AI. This often does not have the right in-house resources and competencies to be implemented properly. The managed service providers present customized choices and strategic guidance to allow organizations to grapple with the intricacies of digital transformation.

The global managed services market caters to a variety of industries. These include healthcare, finance, manufacturing, retail, and telecommunication, to name a few. Each industry poses unique challenges and demands, and there is a requirement for customized managed services offerings for specific needs and compliance regulations.

The global managed services market is one of the most dynamic sectors in the technological industry, which offers a great deal of IT management solutions outside the business world. Service providers play an important role in making the future of IT management, providing solutions to IT environments with the growing complexity they face, creating digital transformation opportunities, and filling the various demands of industries and SMEs.

Additionally, growth in adoption among small and medium-sized enterprises also has boosted the market. Since SMEs are not like the big organizations who have in-house IT capabilities and resources, SMEs make good customers for outsourced IT management. Managed service providers provide low-cost scalable services where SMEs get enterprise-grade technology by not spending significant upfront capital outlays.

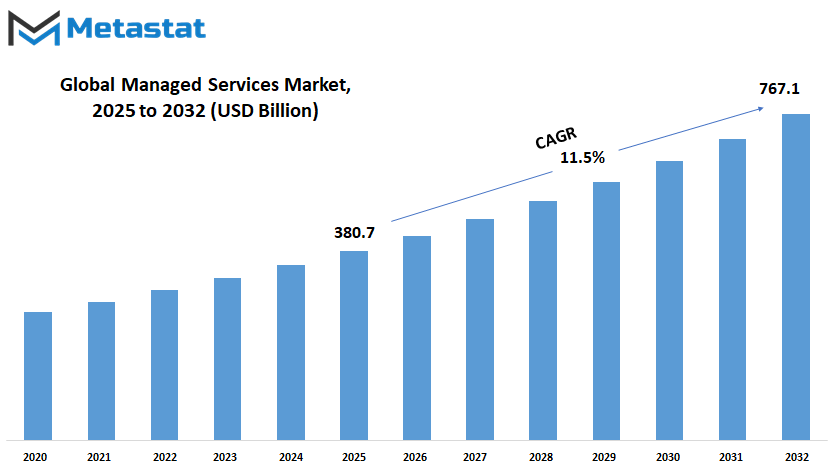

Global managed services market is estimated to reach $767.1 Million by 2032; growing at a CAGR of 11.5% from 2025 to 2032.

GROWTH FACTORS

Many aspects contribute to the rapid growth of the global managed services market. The following are the biggest drivers: There is an increase in the level of complexity relating to IT infrastructure within organizations as firms expand to devise innovation, where their demand for IT escalates to very much complexity; most of them cannot have on their own due to this requirement and hence seek managed service providers to bridge such gaps to be assured of running it.

The other strong trend driver for the Managed Services market is the cost cut and operational efficiency trend. In this type of competitive scenario as today, companies have always been trying to streamline operations and optimize available resources. It is quite possible that organizations can escape this by outsourcing non-core functions, in this case, IT management.

But, at the same time, with problems comes a treasure of managed services development and innovation opportunities. The adoption rate of cloud-based solutions has increased greatly, which, in turn, provides the potential for managed service providers to be able to provide more holistic, scalable service capabilities. It is, by far, more flexible and agile as well as being less expensive in comparison to the rest that keep such options at the top demand from companies wishing to modernize their IT infrastructure and consequently be more effective in their operations.

Many such benefits have arisen from the concept of outsourcing IT services; still, several concerning aspects and limitations accompany this process. One such very important concern that has arisen recently in this regard relates to data security and privacy. Delegation of such important functions of IT service providers has further aroused certain apprehensions of sensitive information exposure and failure in meeting the necessary data regulations. Service provider dependence is another important challenge with service quality and flexibility issues. Organizations may not be able to align their services with their business needs and change. This organization faces a disruption in case of service outages or changes with the providers.

The global managed services market is driven by a combination of drivers, restraints, and opportunities. On the one hand, the increasing complexity of IT infrastructure and the desire for cost reduction drive demand for managed services. On the other hand, concerns over data security and dependence on service providers present challenges. The opportunity for managed services providers is the ability to deliver innovative and scalable solutions that cater to the changing needs of organizations in this fast-changing business environment.

MARKET SEGMENTATION

By Deployment

It encompasses a huge global managed services market in terms of range and scope to cater to varied needs of various-sized businesses regarding the streamlining of operations, thus improving business efficiency. However, the major aspect of its deployment is those two primary ones in this market-On-premise and Cloud.

On-premise deployment includes the traditional approach wherein the structure and software reside within the confines of the company's premises. With such deployment, businesses gain control over the system, hence customizing or fitting the application based on its particular needs would be possible. Conversely, a large amount of hardware, along with software license investments, requires expert personnel in case of its repair or upgrade, is required by on-premise solutions. However, due to serious data security compliance and full-fledged control of IT environment problems, many businesses also consider on-premise deployment as their solution of choice.

Both deployment options have strengths and weaknesses; the choice between on-premise and cloud-based managed services usually goes down to budget, IT capability, and organizational goals. Small and medium-sized enterprises, which have limited resource and technical capacity, may be attracted to the cloud solution, which is relatively affordable with ease of application. On the other hand, large enterprises, characterized by more complex IT requirements, need hard security structures.

It is totally imperative for businesses to understand their needs and goals in choosing the right form of deployment for their managed services. Of course, this means that despite the cloud being flexible and cost-effective, it is not the best choice for all. Since on-premise remains a traditional and very viable option today, this becomes a feasible option for companies which may have some compliance requirements or even ones that have legacy systems that are not easy to migrate to the cloud.

In recent times, however, cloud deployment has gained immense popularity because of its flexibility, scalability, and cost-effectiveness. Businesses can gain access to computing resources and software applications over the internet with cloud-based managed services, doing away with on-site infrastructure. It has many advantages like low capital expenditure, pay-as-you-go pricing models, and scaling up or down of resources according to demand. It frees up the internal IT teams from maintenance, update, and security issues to focus on strategic initiatives rather than routine tasks.

The Deployment segment of the global managed services market is an important consideration in understanding how businesses use technology for growth and innovation. Whether it is on-premise or cloud-based, every organization must analyze the pros and cons of each deployment model so that they can make the right decision necessary to meet the strategic objectives and operational needs.

By Type

The global managed services market is defined as all the various services that help businesses run their IT infrastructures and services. There are devised various types of managed services for the benefit of various businesses with varied business requirements in a number of different industries.

Among the most leading Global Managed Services sectors is that of Managed Data Center services. Such services cover data center infrastructure management, which relates to the external managing and maintenance of servers, storage, and network equipment, thereby ensuring a firm can attain reliable, secure, and scalable data center operations with little to no capital invested.

Managed Security services is another major part of the market. Businesses of all sizes are at risk in today's cyber space due to a number of threats for cybersecurity. Managed Security services provides proactive monitoring, threat detection, and incident response that will protect businesses from cyber attacks, data breaches, and many other security vulnerabilities.

Managed Infrastructure Services would involve the management and maintenance of IT infrastructure components such as servers, storage, and virtualization technologies. The outsourcing of infrastructure management to Managed Service providers can help businesses possibly minimize operational overheads and optimize the use of resources in order to promote better IT efficiency.

Managed Mobility services fill in the widening gap of mobile device management and support. With the proliferation of mobile devices across the workplaces, businesses need solutions to manage and secure mobile endpoints, applications, and data. Managed Mobility services include provisioning, security management, and application deployments that support mobile workforce productivity and safeguard data.

Managed Communications is very important for internal and external easy, efficient organization-wide communication and collaboration. It offers voice, video, and messaging through cloud-based services. Through these services, businesses are enabled to have their communication requirements outsourced from them by the Managed Communications provider in order to have better productivity and streamlined workflows with connected distributed teams.

Managed Network services optimize and maintain performance and reliability of enterprise networks. Services also include designing and implementing, then monitoring and managing a network toward achieving the utmost network availability with maximum security in it. Thus, organizations diminish the chance of being caught with dead networks, widen their capacities to carry out further moves, and even embrace the prospects of digital transformation presently gaining momentum.

The global managed services market provides a comprehensive range of services that will help the businesses optimize their IT operations, enhance security, and accelerate digital transformation. With managed services in the areas of Data Center, Security, Communications, Network, Infrastructure, and Mobility, it will be possible for the businesses to stay agile, competitive, and resilient in this rapidly changing business landscape.

By Enterprise Size

This includes all the various services companies around the world offer. The types of services provided for enterprises are broadly categorized as Small and Medium Enterprises and Large Enterprises.

This market in 2023 was 118.9 USD Billion for Small and Medium Enterprises. This describes the levels of business operation as being smaller compared to a large-scale enterprise operation. These are highly important enterprises in any economy; they act as significant job generators as well as drivers for innovation. Often requiring managed services, SMEs run on a narrow band of activities about their IT infrastructure, security, and all that is necessary to conduct business; and managed services provide them with expert knowledge and other tools which an enterprise need not have within and hence facilitate such business houses to continue carrying out business on core operations with technical services outsourced.

Today, the business landscape is very dynamic, and so organizations of all kinds appreciate the need to use managed services in order to continue innovating and staying competitive. The externalization of non-core functions to capable service providers will allow companies to focus on innovation and strategic initiatives that catalyze growth. Managed services will also provide companies with access to the latest technologies and best practices in order to keep them ahead in this constantly changing digital landscape.

Therefore, the market will see more consumption of managed services for the next foreseeable period with further growing momentum for large and small businesses due to continuous growth of digitization along with efficient requirements from enterprises and customers toward the service for managing infrastructure IT, security issues, or cloud-based requirements. In essence, the global managed services market caters to all sizes of enterprises, providing them with the tools and support they need to thrive in today’s competitive environment.

In the same year, the Large Enterprises segment of the global managed services market was valued at 181 USD Billion. Large enterprises are typically large operations with vast customer bases that cover a large number of regions or industries. Large companies typically have very complex IT challenges that require sophisticated solutions and continuous monitoring. Managed services allow large enterprises to be flexible and scalable to adapt to the changing needs of the business, ensuring that operations are seamless and downtime is minimized.

SMEs and large enterprises can benefit in several ways from managed services. It streamlines the operations, makes them more efficient, and less expensive by delegating tasks to providers who are specialized in specific tasks. Moreover, managed services providers provide proactive maintenance and round-the-clock support so that service delivery is not interrupted, and issues are resolved quickly.

By End-user Vertical

The global managed services market is a vast arena, comprising various sectors where businesses seek external assistance in managing their IT infrastructure and services. These services cater to a wide range of industries, each with its unique needs and challenges.

Similarly, the Government sector plays a crucial role in the market, with a valuation of 53.1 USD Billion in 2023. Government agencies require robust IT infrastructure and services to fulfill their responsibilities efficiently. Managed Services providers offer solutions tailored to the unique needs of governmental organizations, ensuring smooth operations and data security.

The Healthcare industry, valued at 47.4 USD Billion in 2023, is another significant player in the global managed services market. With the increasing digitization of medical records and the need for compliance with stringent regulations like HIPAA, healthcare providers turn to Managed Services to manage their IT systems securely.

One significant division within the global managed services market is based on end-user verticals. These verticals represent different sectors of the economy, each with its specific characteristics and demands. Among these verticals are Banking, Financial Services, and Insurance (BFSI), Government, Healthcare, IT & Telecom, Manufacturing, Media & Entertainment, Retail, and Others.

The BFSI sector, encompassing banking, insurance, and other financial services, stands as a pillar in the global economy. In 2023, the BFSI segment accounted for a substantial portion of the global managed services market, with a valuation of 52.9 USD Billion. Given the critical nature of financial transactions and data security in this sector, the demand for Managed Services is notably high.

The IT & Telecom sector, being inherently technology-driven, relies heavily on Managed Services to maintain their networks, servers, and applications. With a dynamic landscape and constant advancements in technology, businesses in this sector require agile and scalable IT solutions, making Managed Services an attractive option.

Manufacturing companies also benefit from Managed Services, leveraging them to optimize their operations, enhance supply chain management, and improve efficiency. Media & Entertainment, Retail, and Other sectors also find value in Managed Services, albeit with their unique requirements and challenges.

The global managed services market is multifaceted, catering to the diverse needs of various industries. By offering specialized solutions tailored to different end-user verticals, Managed Services providers play a crucial role in enhancing operational efficiency, ensuring data security, and driving business growth across sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$380.7 Billion |

|

Market Size by 2032 |

$767.1 Billion |

|

Growth Rate from 2024 to 2031 |

11.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

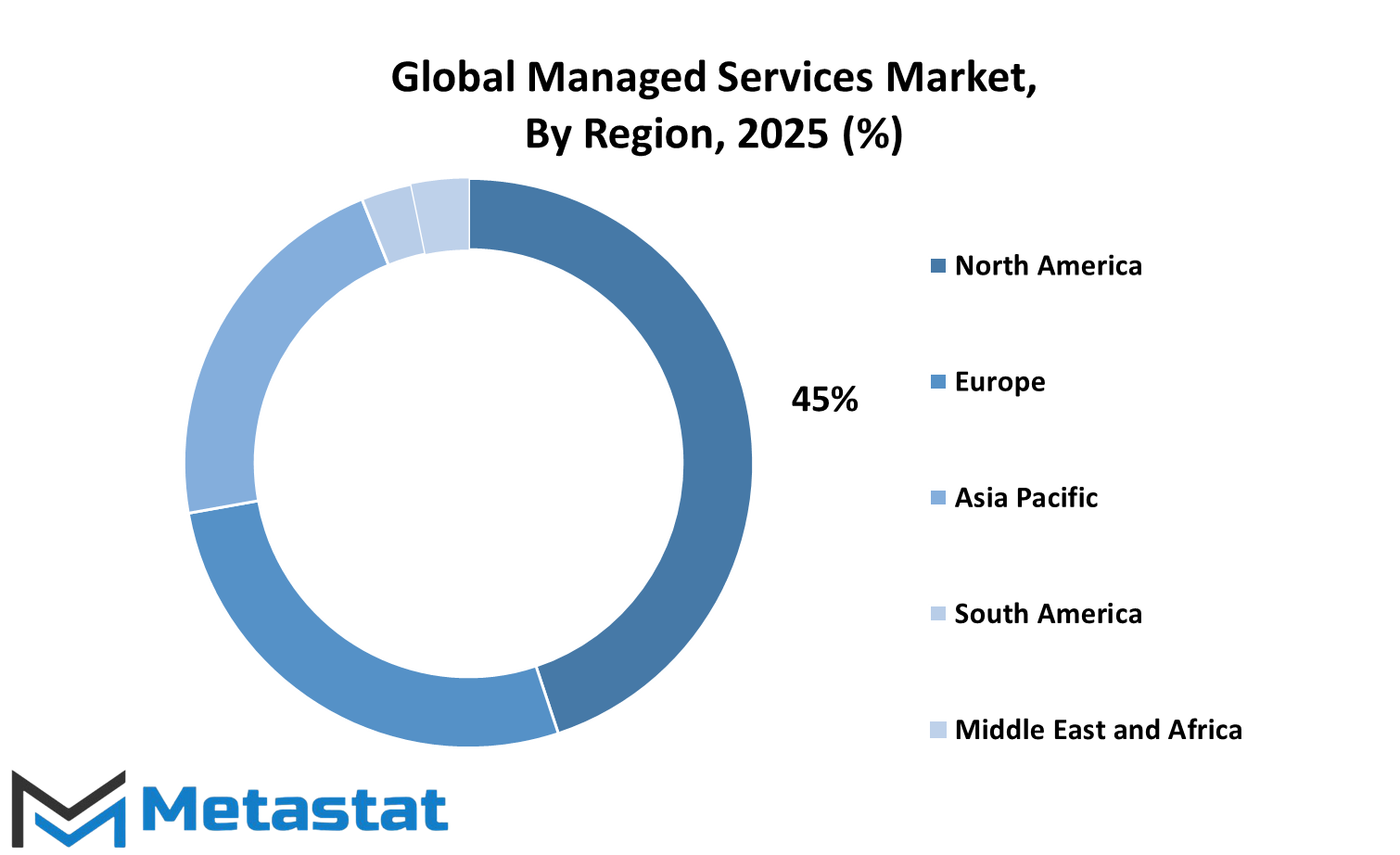

The global managed services market is a vast landscape, divided into different regions for better understanding and analysis. These regions include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Understanding the dynamics within each region is crucial for comprehending the overall market trends and opportunities.

North America stands unique in the global managed services market. Advanced technological infrastructure and the adoption of managed services in many industries have captivated a major share of the market in North America. Other contributing factors leading to growth in the adoption of Managed Services include an efficient management of IT, cybersecurity, and outsourcing of non-core functions through specialized service providers.

South America is an emerging market for Managed Services, with its own set of challenges and opportunities. Brazil and Argentina are some of the countries that are gaining momentum in terms of Managed Services adoption, largely due to cost-effective IT solutions and support services. Economic instability and political uncertainty in some South American countries present obstacles to market growth.

The Middle East & Africa region also holds promise for Managed Services providers. Organizations within the region increasingly rely on digital transformation and IT modernization initiatives; as such, more are turning towards Managed Services in streamlining their business processes and gaining more productivity. Leading countries in terms of adoption are the United Arab Emirates, Saudi Arabia, and South Africa.

Europe is the second-largest market for Managed Services after North America. The region has a strong presence of established players and a robust IT ecosystem. Managed Services in Europe cater to a wide range of industries, including banking, healthcare, manufacturing, and retail. Increasing digitalization initiatives and focus on enhancing operational efficiency are creating demand for Managed Services across European countries.

Asia-Pacific is quickly emerging as a burgeoning market for Managed Services. Expansion in economies like China, India, and Southeast Asia has massive opportunities for providers of Managed Service. Factors driving demand for Managed Services in the Asia-Pacific region are proliferation of mobile devices, cloud adoption, and the general thrust for digital transformation. Added to this are the dynamic nature of the region's business and changing regulatory climate.

Regional analysis, therefore, represents a critical segment in the knowledge of the global managed services market environment. Regional opportunities and threats are different with each region depending on the drivers such as the technological advancements taking place, economic scenarios, and policies. The key stakeholders can find better strategies if they dig into the regional dynamics while tapping into different growth prospects which the managed services market offers throughout the world.

COMPETITIVE PLAYERS

The global managed services market is witnessing intense competition with several key players vying for dominance. These players are integral to the industry's landscape, each bringing unique strengths and offerings to the table.

Among the prominent contenders in the Managed Services arena are Accenture plc, Amazon Web Services, Inc., Aryaka Networks, Inc., AT&T Inc., Atera Networks Ltd., Atos SE, BMC Software, Inc., Broadcom Inc., Capgemini SE, Cisco Systems, Inc., DXC Technology Company, Fujitsu Ltd., HCL Technologies Limited, HP Development Company, L.P., IBM Corporation, Lenovo Group Ltd, Microsoft Corporation, NTT DATA Corporation, and Tata Communication Services Limited, along with Telefonaktiebolaget LM Ericsson.

Accenture plc stands out for its comprehensive suite of managed services, catering to various sectors globally. Amazon Web Services, Inc., a giant in cloud computing, offers a range of managed services to facilitate smooth operations for businesses of all sizes. Aryaka Networks, Inc. specializes in providing managed SD-WAN solutions, ensuring secure and optimized connectivity for enterprises.

AT&T Inc. is a significant player, leveraging its vast network infrastructure to deliver managed services ranging from network security to communication solutions. Atera Networks Ltd. is known for its user-friendly MSP platform, empowering IT professionals to manage and monitor systems efficiently. Atos SE excels in digital transformation services, offering managed solutions that align with clients' strategic objectives.

BMC Software, Inc. is renowned for its innovative IT solutions, including managed services for optimizing performance and reducing downtime. Broadcom Inc., with its diverse portfolio, caters to various industries with tailored managed services. Capgemini SE is a global leader in consulting, technology, and outsourcing services, providing end-to-end managed solutions to drive business growth.

Cisco Systems, Inc. is a key player in networking and cybersecurity, offering managed services to safeguard organizations against evolving threats. DXC Technology Company specializes in IT consulting and managed services, helping businesses navigate digital transformation effectively. Fujitsu Ltd. is known for its reliable IT infrastructure services, including managed hosting and cloud solutions.

HCL Technologies Limited offers a wide range of managed services, leveraging its expertise in IT and engineering services. HP Development Company, L.P. provides managed print services, enhancing productivity and cost efficiency for businesses worldwide. IBM Corporation is a prominent player, offering managed services spanning IT infrastructure, cloud computing, and cybersecurity.

Lenovo Group Ltd focuses on managed services tailored to the needs of modern enterprises, including device management and security solutions. Microsoft Corporation is a dominant force in the managed services market, offering a comprehensive suite of cloud-based solutions and managed services. NTT DATA Corporation delivers end-to-end managed services, leveraging its global presence and technological prowess.

Tata Communication Services Limited provides managed networking solutions, enabling seamless connectivity for businesses across geographies. Telefonaktiebolaget LM Ericsson specializes in managed services for telecom operators, facilitating network optimization and service innovation. These competitive players collectively drive innovation and efficiency in the global managed services market, catering to diverse needs and ensuring business continuity in an increasingly digital world.

Managed Services Market Key Segments:

By Deployment

- On-premise

- Cloud

By Type

- Managed Data Center

- Managed Security

- Managed Communications

- Managed Network

- Managed Infrastructure

- Managed Mobility

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By End-user Vertical

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail

- Others

Key Global Managed Services Industry Players

- Accenture plc

- Amazon Web Services, Inc.

- Aryaka Networks, Inc.

- AT&T Inc.

- Atera Networks Ltd.

- Atos SE

- BMC Software, Inc.

- Broadcom Inc.

- Capgemini SE

- Cisco Systems, Inc.

- DXC Technology Company

- Fujitsu Ltd.

- HCL Technologies Limited

- HP Development Company, L.P.

- IBM Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252